$APLM DD THREAD

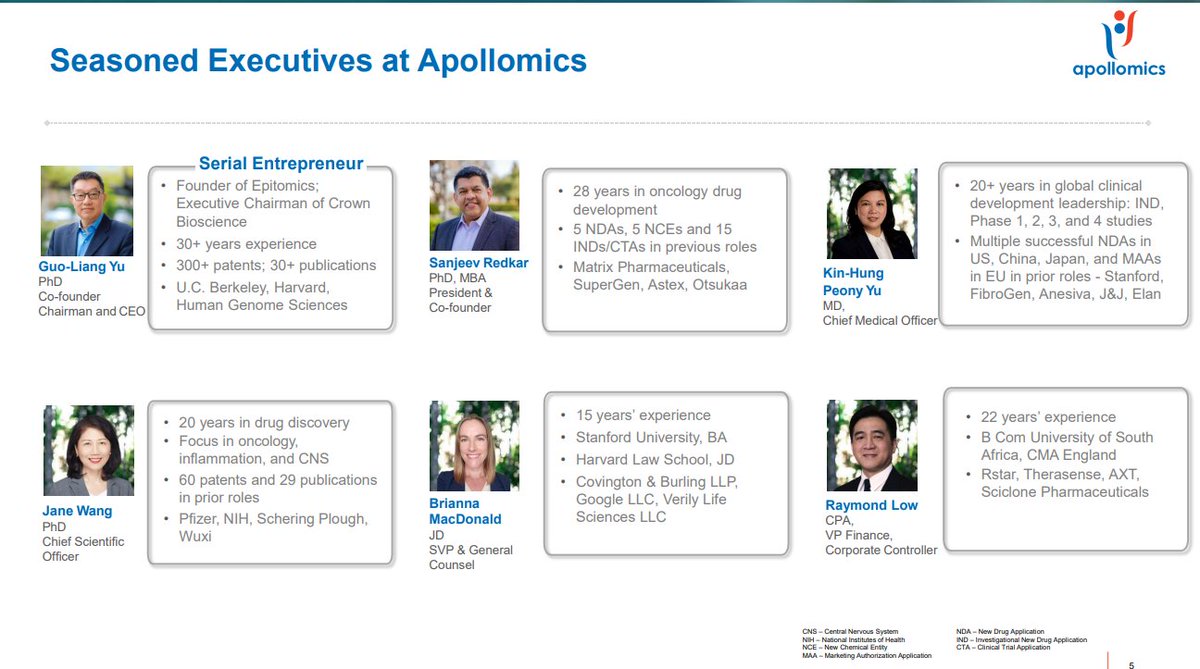

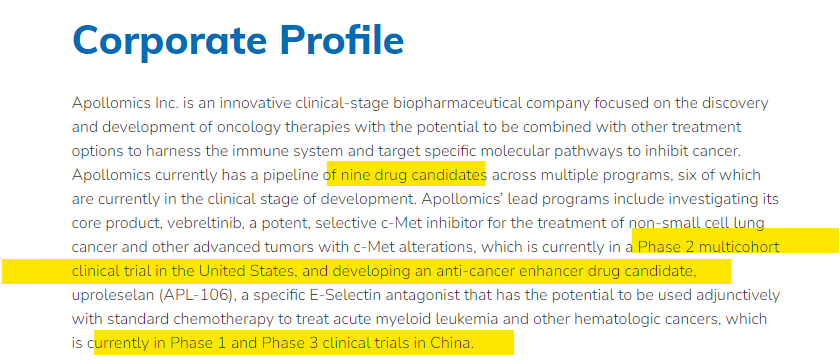

Apollomics is an innovative biotechnology company focusing on the discovery and development of oncology therapies with the potential to be combined with other treatment options to harness the immune system and target specific molecular pathways to inhibit cancer

Apollomics is an innovative biotechnology company focusing on the discovery and development of oncology therapies with the potential to be combined with other treatment options to harness the immune system and target specific molecular pathways to inhibit cancer

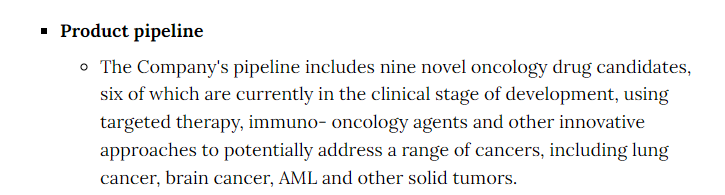

$APLM PIPELINE

With our presence in China and the U.S., together with our drug development know-how and our oncology expertise, we consider us an ideal partner for companies from the West interested in entering the fast-growing China market...

With our presence in China and the U.S., together with our drug development know-how and our oncology expertise, we consider us an ideal partner for companies from the West interested in entering the fast-growing China market...

$APLM "We have established numerous strategic collaborations to increase our pipeline of assets, explore new treatment areas, and advance our oncology programs to broaden the patient populations we serve."

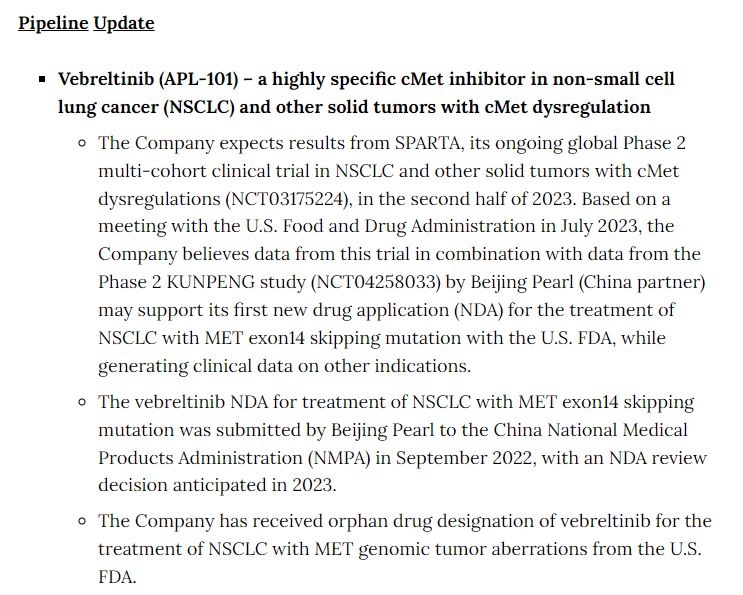

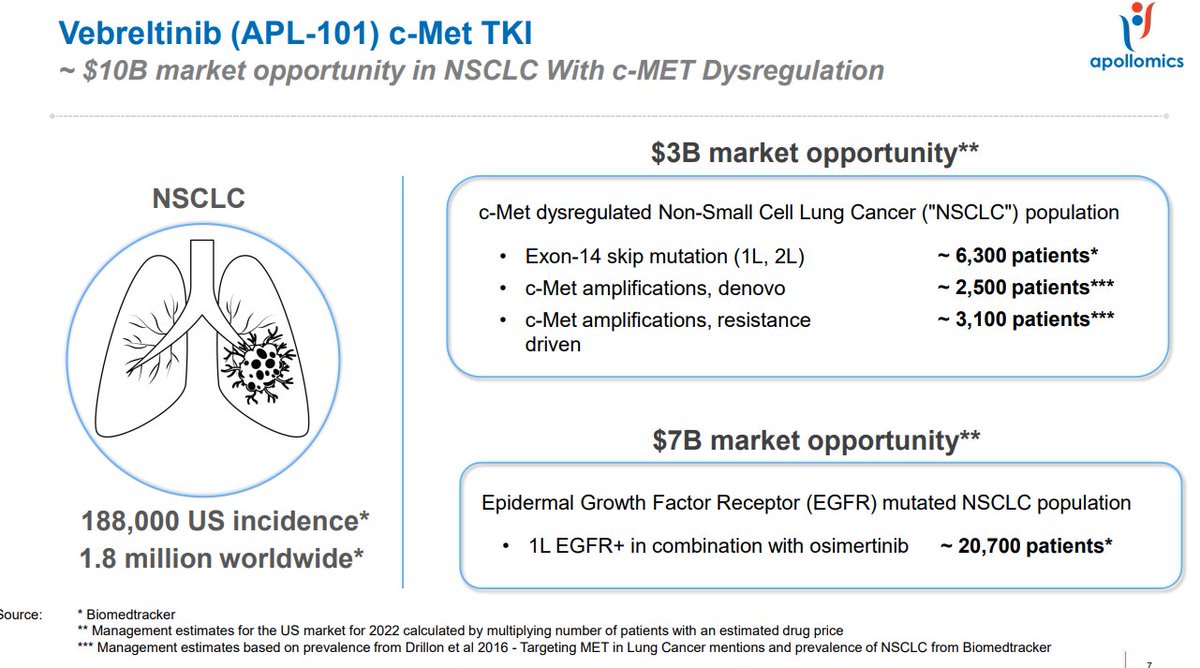

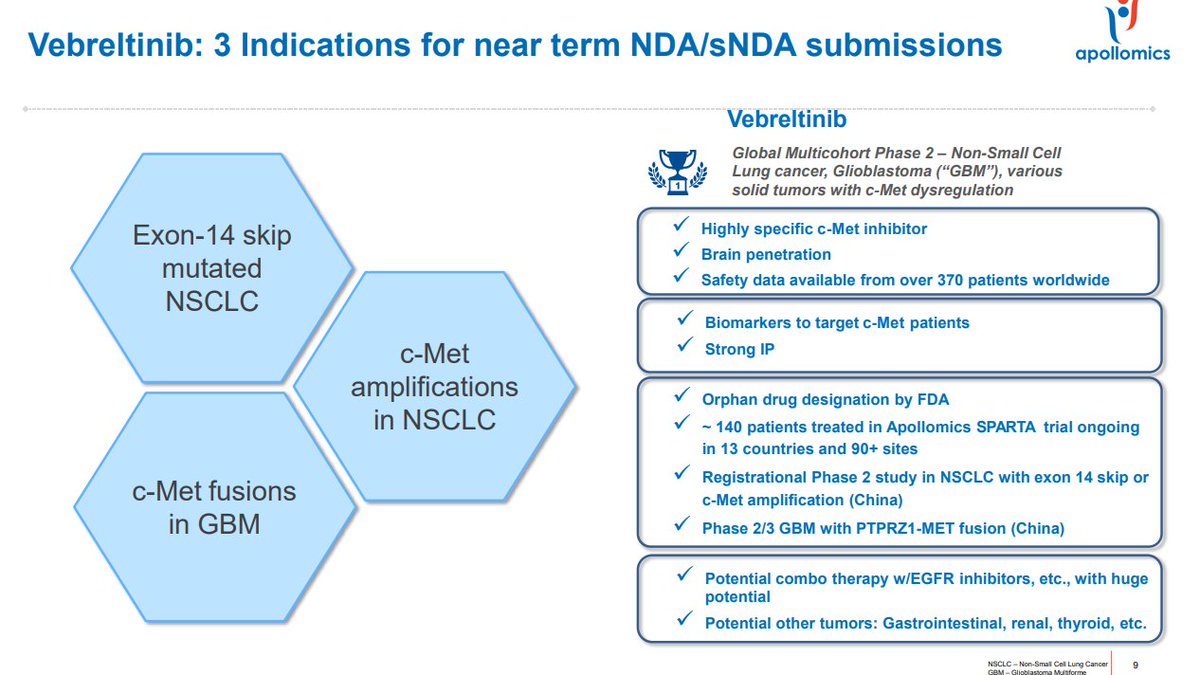

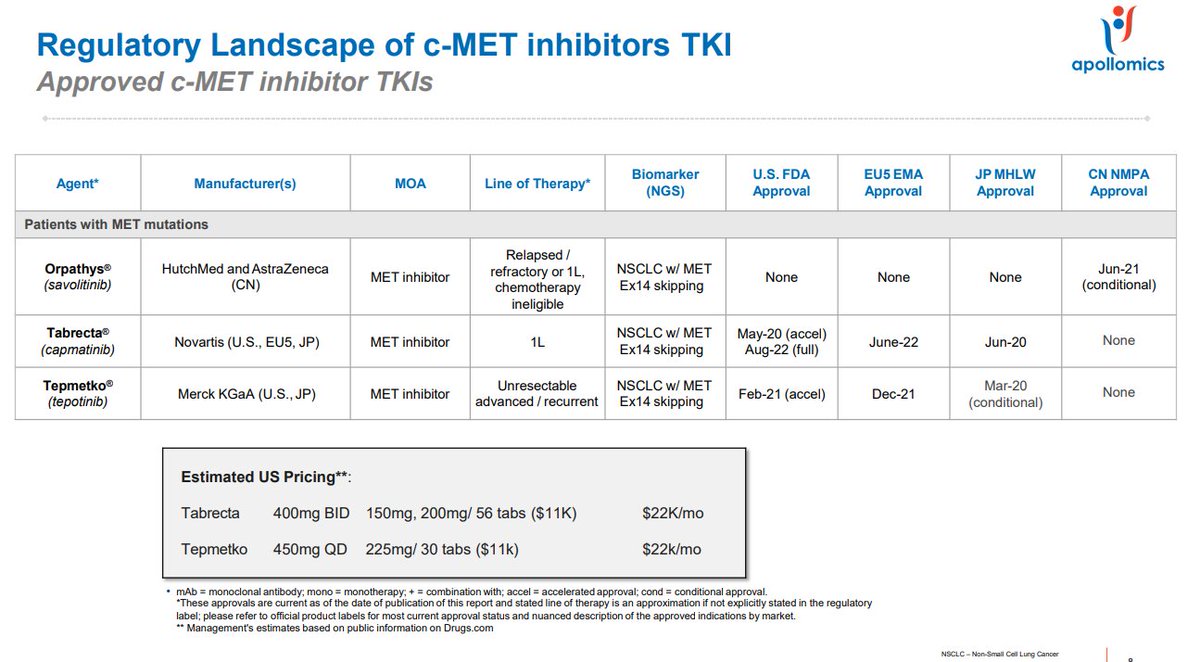

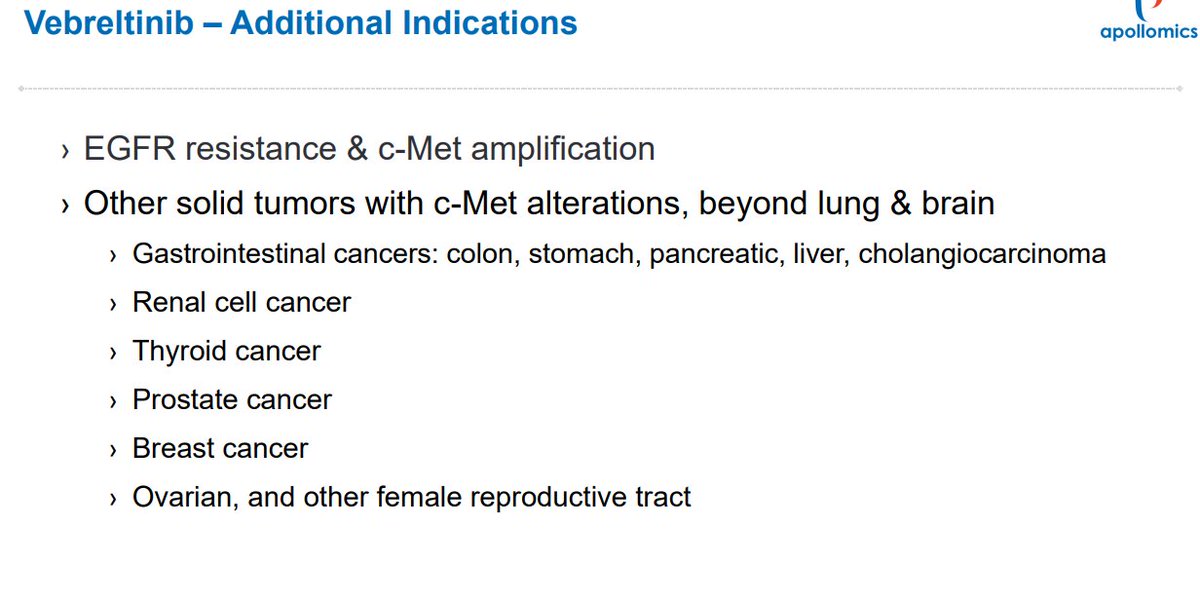

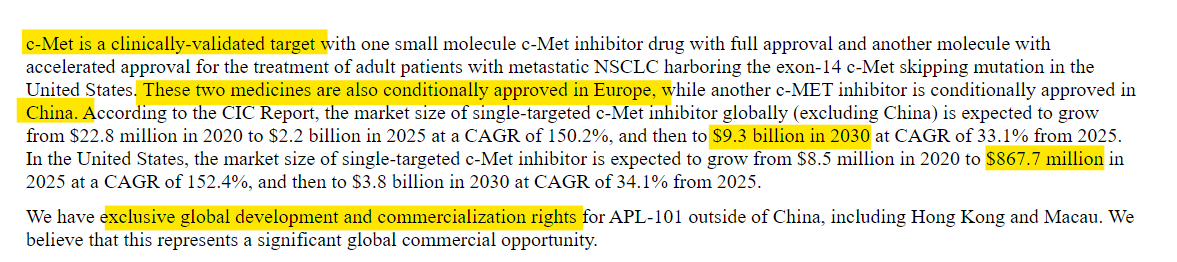

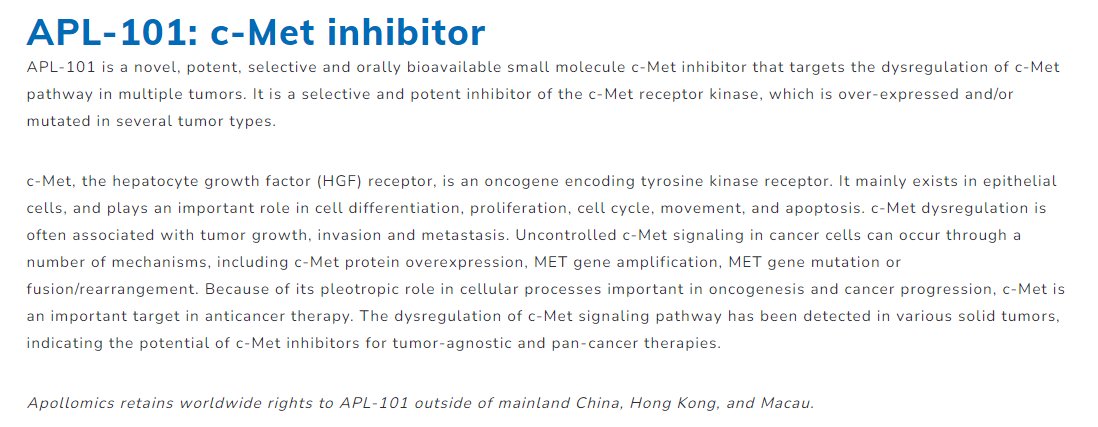

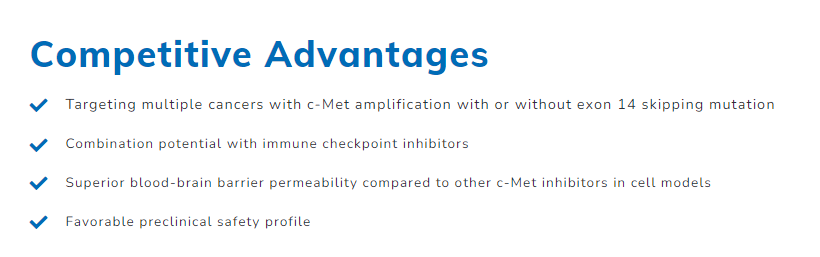

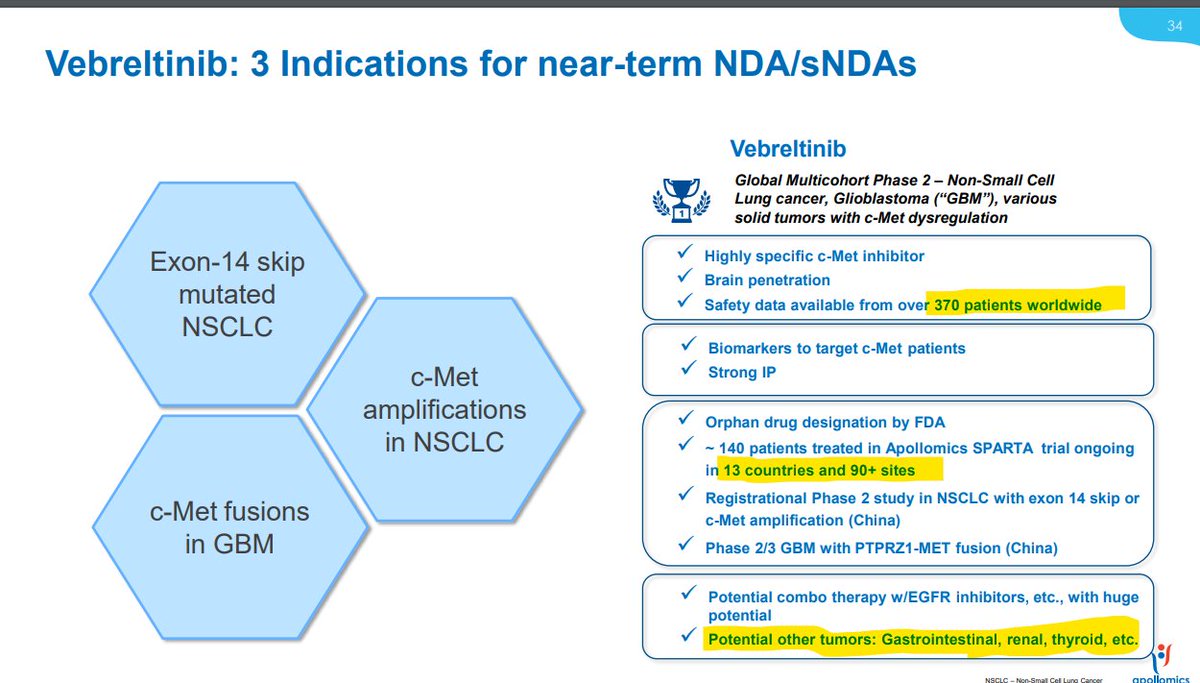

$APLM - APL-101 c-Met inhibitor.

Sparta Phase 2 Clinical Trial:

China Trials:

clinicaltrials.gov/study/NCT03175…

clinicaltrials.gov/study/NCT04258…

Sparta Phase 2 Clinical Trial:

China Trials:

clinicaltrials.gov/study/NCT03175…

clinicaltrials.gov/study/NCT04258…

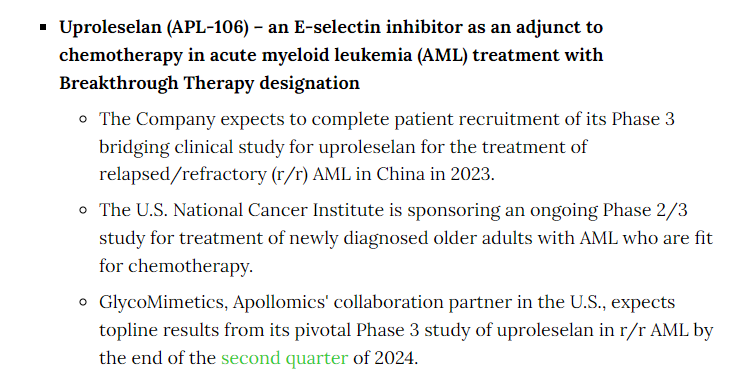

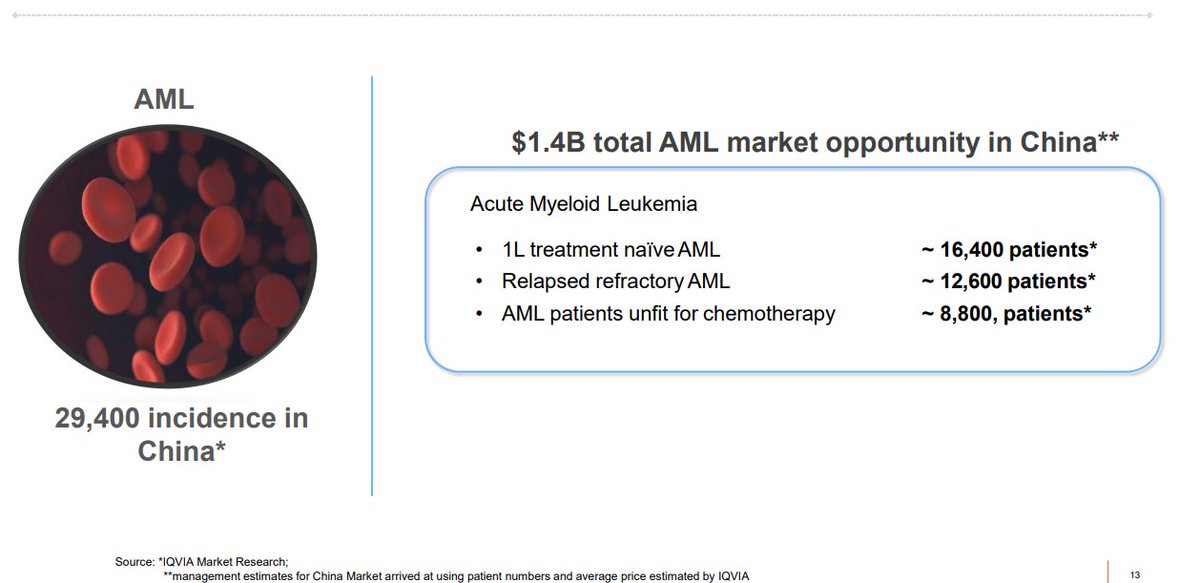

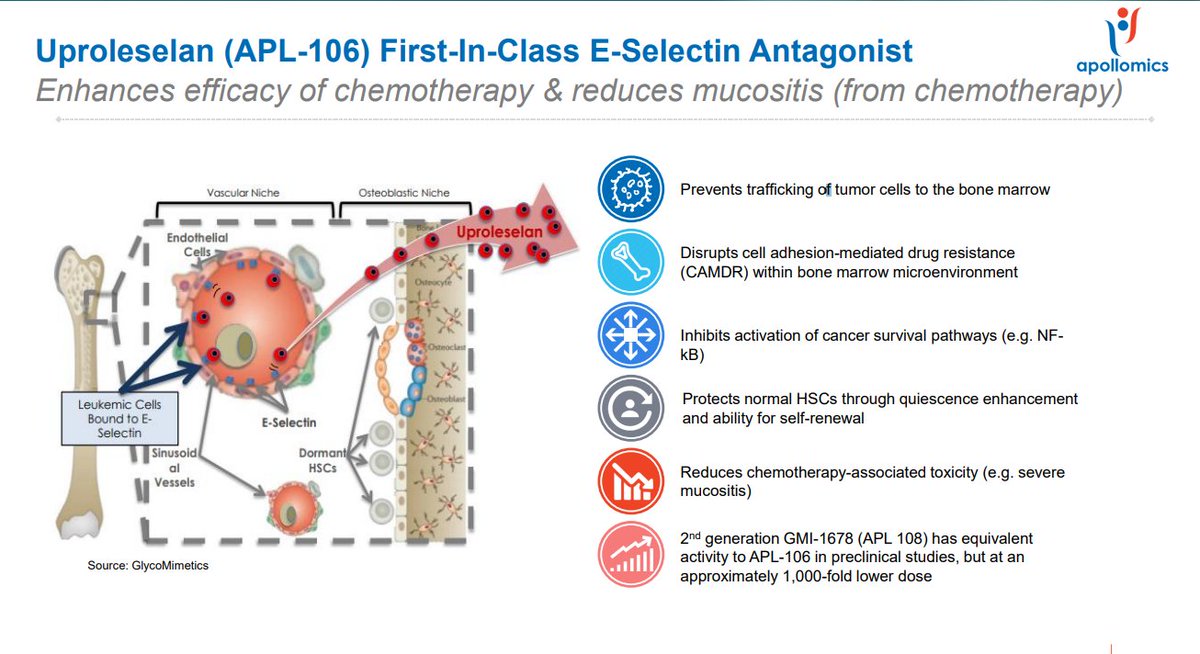

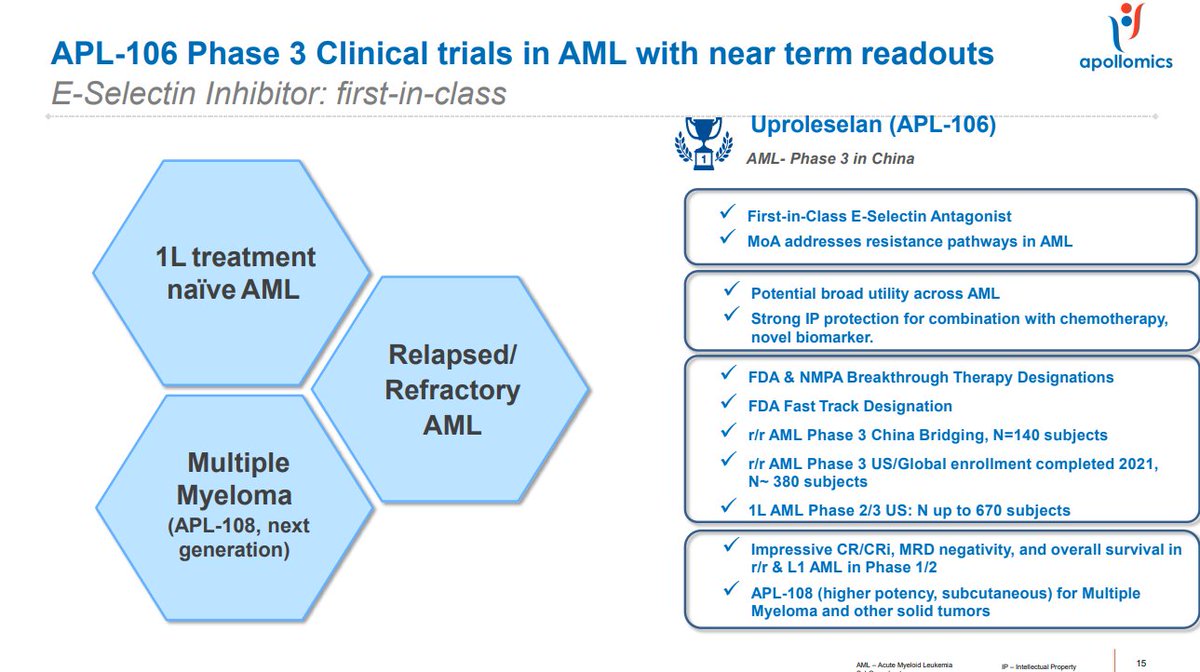

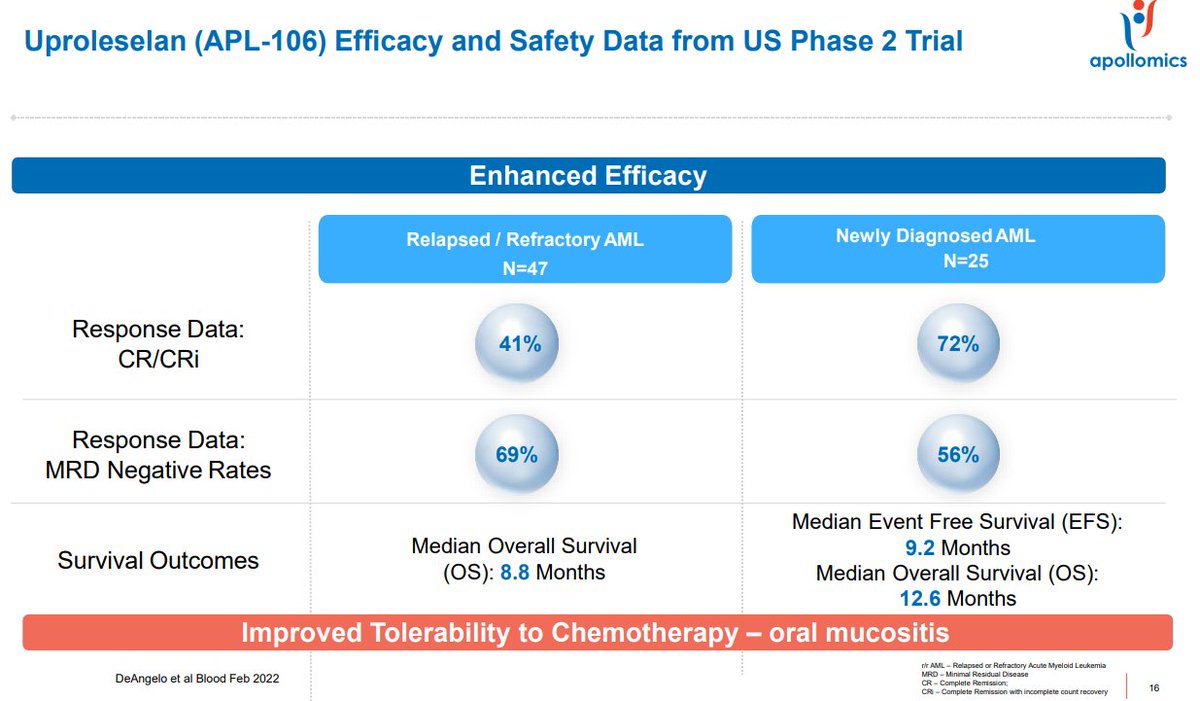

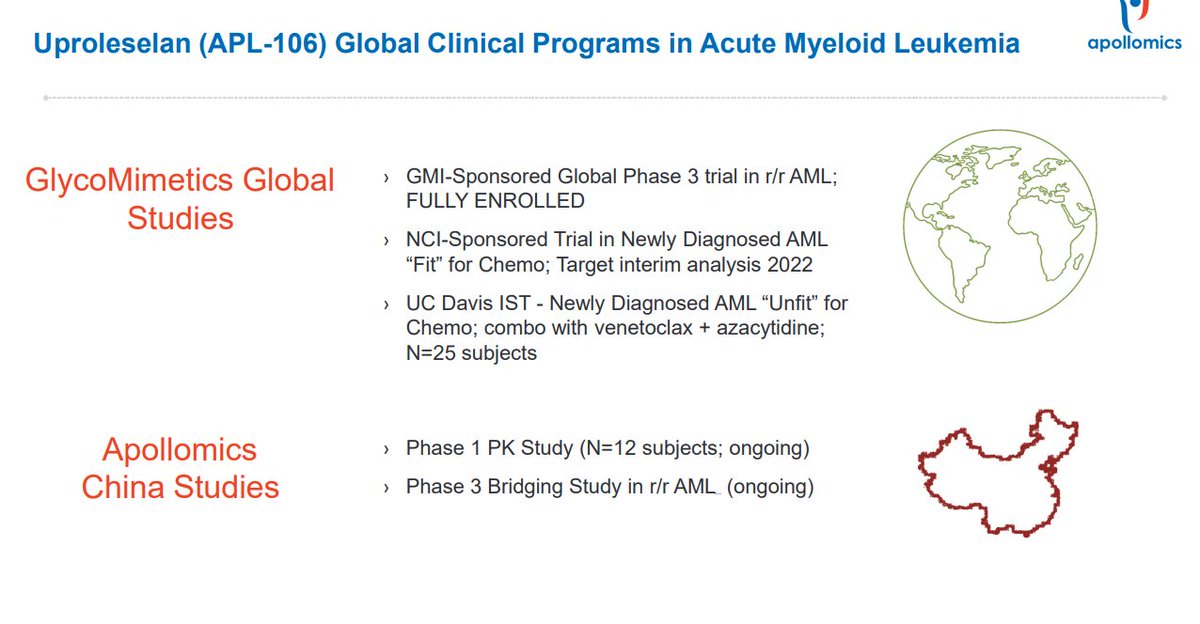

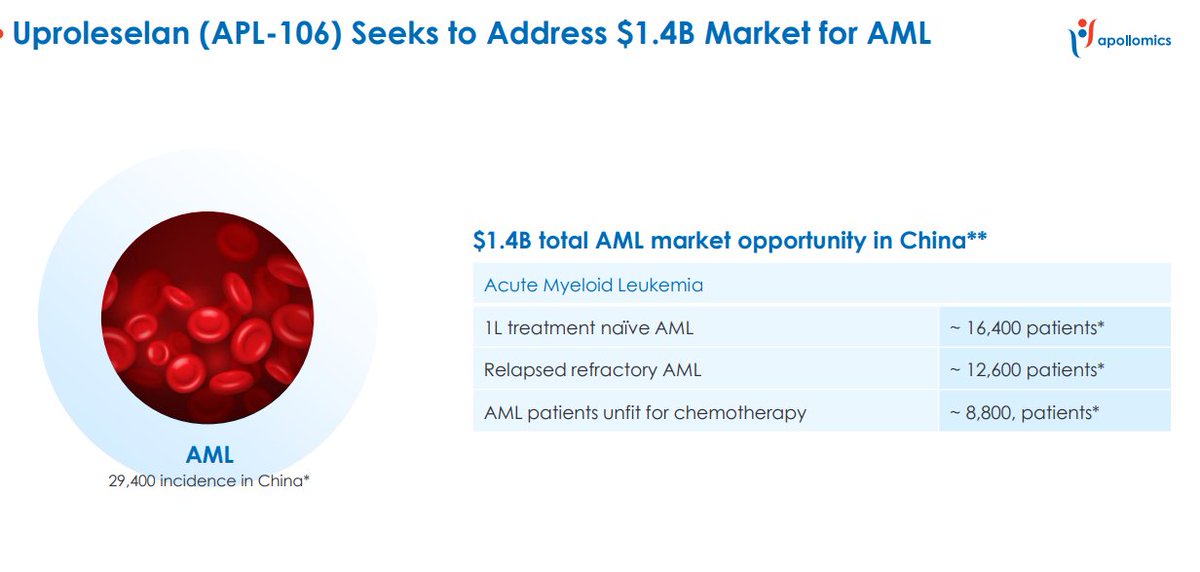

$APLM - APL-106: (uproleselan): E-Selectin

A Phase 3 Randomized, Double-Blinded Bridging Trial:

Phase 3 development program in AML.

clinicaltrials.gov/study/NCT05054…

clinicaltrials.gov/study/NCT03616…

clinicaltrials.gov/study/NCT03701…

A Phase 3 Randomized, Double-Blinded Bridging Trial:

Phase 3 development program in AML.

clinicaltrials.gov/study/NCT05054…

clinicaltrials.gov/study/NCT03616…

clinicaltrials.gov/study/NCT03701…

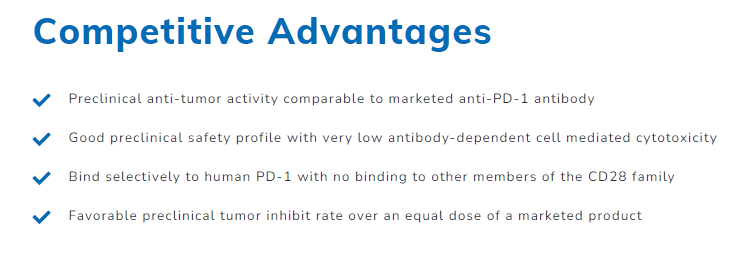

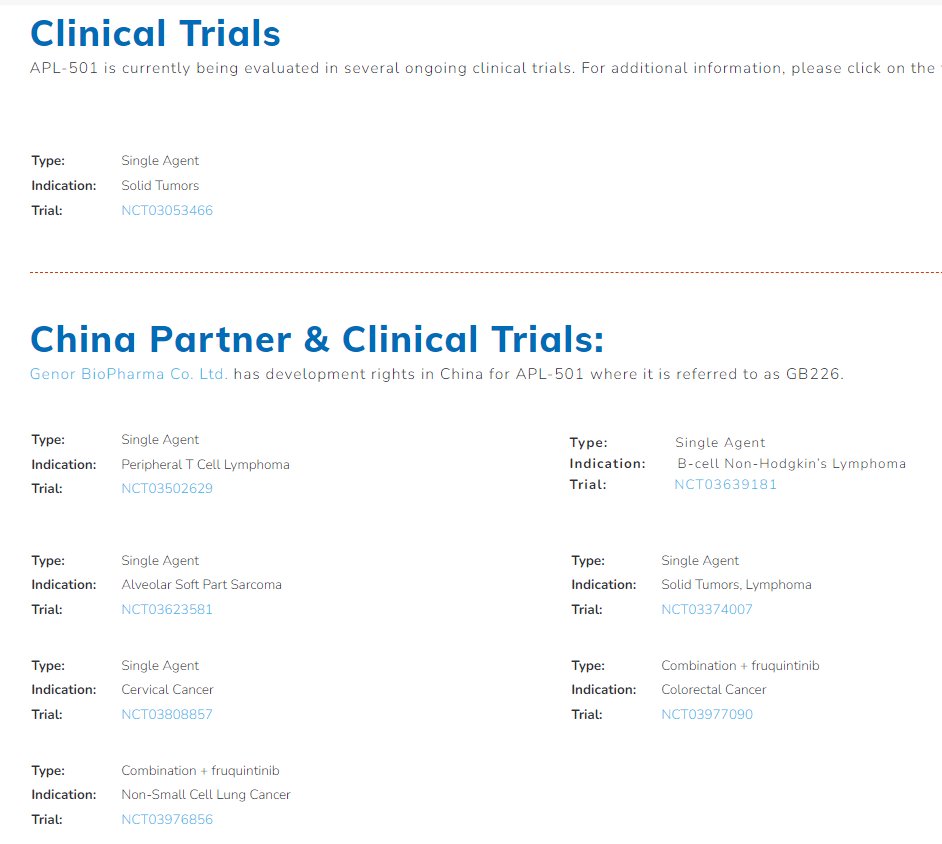

$APLM - APL-501: Anti Programmed Death-1

APL-501 is currently being evaluated in several ongoing clinical trials:

clinicaltrials.gov/study/NCT03053…

clinicaltrials.gov/study/NCT03977…

clinicaltrials.gov/study/NCT03808…

APL-501 is currently being evaluated in several ongoing clinical trials:

clinicaltrials.gov/study/NCT03053…

clinicaltrials.gov/study/NCT03977…

clinicaltrials.gov/study/NCT03808…

$APLM Began trading in March 2023.

announced the completion of its business combination with Maxpro Capital Acquisition Corp. (“Maxpro”, Nasdaq: JMAC). Apollomics’ Class A ordinary shares and public warrants.

ir.apollomicsinc.com/news-releases/…

announced the completion of its business combination with Maxpro Capital Acquisition Corp. (“Maxpro”, Nasdaq: JMAC). Apollomics’ Class A ordinary shares and public warrants.

ir.apollomicsinc.com/news-releases/…

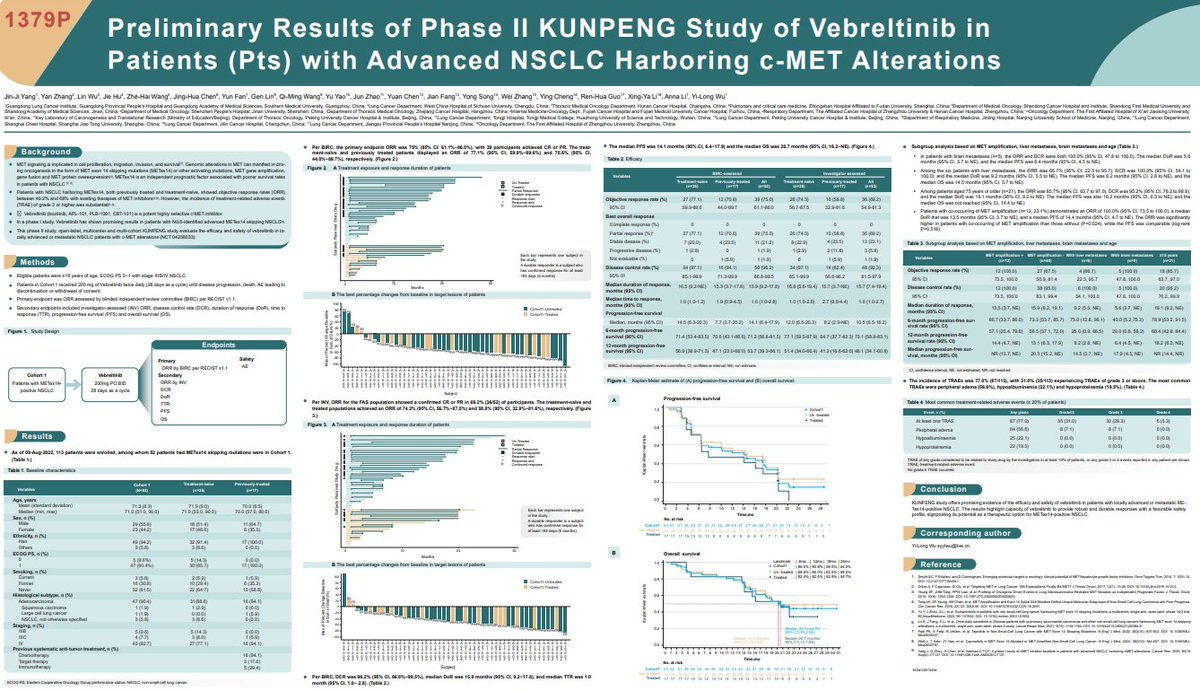

$APLM Apollomics Announces Efficacy of Vebreltinib in NSCLC Patients with MetEx14 Skipping Mutation Achieving an Overall Response Rate (ORR) of 75%

ir.apollomicsinc.com/news-releases/…

ir.apollomicsinc.com/news-releases/…

$APLM Apollomics Announces Report of Activity of Vebreltinib in Glioblastoma Multiforme (GBM) with PTPRZ-MET Fusion

REPORT:

ir.apollomicsinc.com/news-releases/…

ir.apollomicsinc.com/static-files/2…

REPORT:

ir.apollomicsinc.com/news-releases/…

ir.apollomicsinc.com/static-files/2…

$APLM Apollomics Announces Two New Cohorts in Global Phase 2 SPARTA Study of Vebreltinib in Non-Small Cell Lung Cancer and Other Solid Tumors with MET Dysregulation

ir.apollomicsinc.com/news-releases/…

ir.apollomicsinc.com/news-releases/…

$APLM Apollomics Announces the First Approval of Vebreltinib for MET Exon 14 Skip Non-Small Cell Lung Cancer

ir.apollomicsinc.com/news-releases/…

ir.apollomicsinc.com/news-releases/…

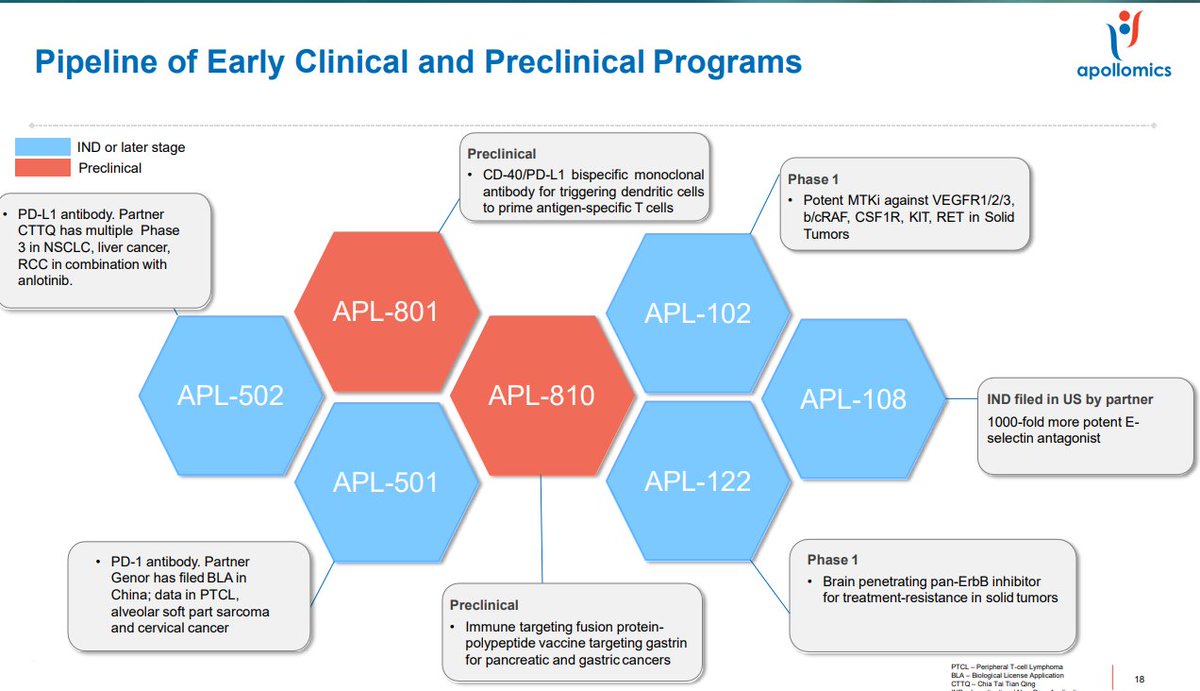

$APLM Apollomics currently has a pipeline of nine drug candidates across multiple programs, six of which are currently in the clinical stage of development.

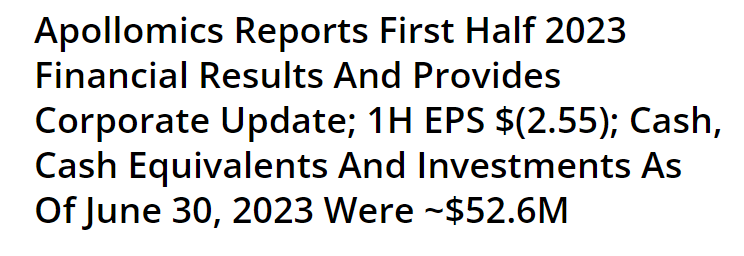

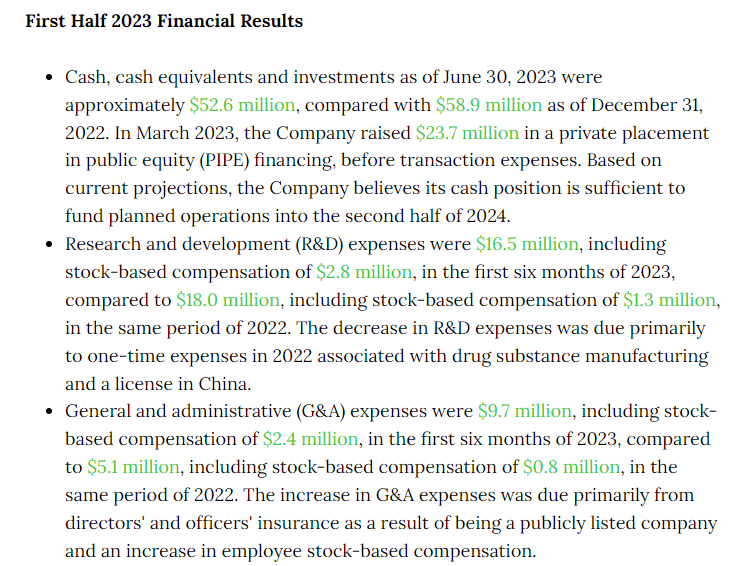

$APLM First half 2023 Financials.

"We remain on track to generate key clinical data across our pipeline later this year and into 2024, including for our two late-stage candidates, vebreltinib and uproleselan."

"We remain on track to generate key clinical data across our pipeline later this year and into 2024, including for our two late-stage candidates, vebreltinib and uproleselan."

$APLM - Approximately $52.6 million in cash, cash equivalents, and investments at June 30, 2023; Cash runway to mid-year 2024

$APLM MSQ CEO Webinar Series with Apollomics, May 2023.

$APLM Billy with the APLM Video today

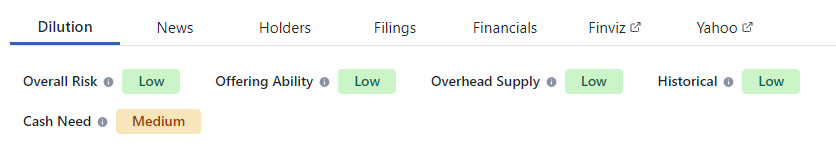

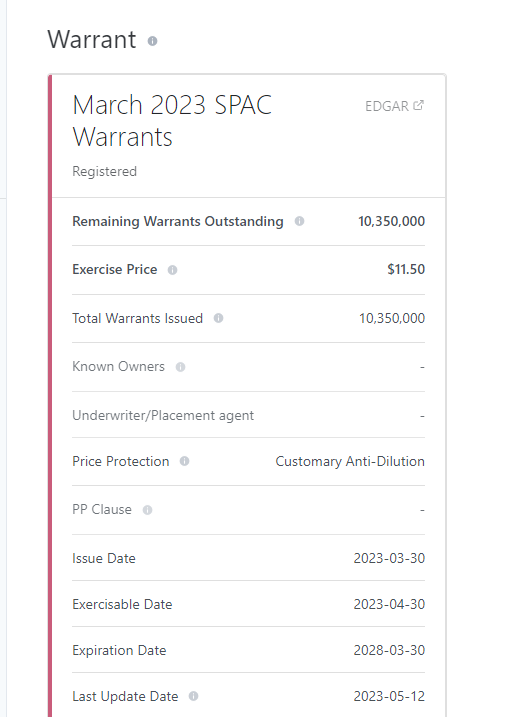

$APLM Major Bullish Point. Curtesy of Dilution Tracker. Every Indicator is marked LOW, except Cash needs, which they've already stated lasts until Mid 2024

But there's no other opening forms of dilution except for one 2023 Warrant that doesn't even exercise til $11.50

But there's no other opening forms of dilution except for one 2023 Warrant that doesn't even exercise til $11.50

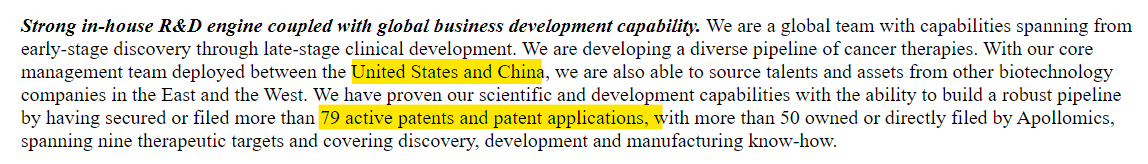

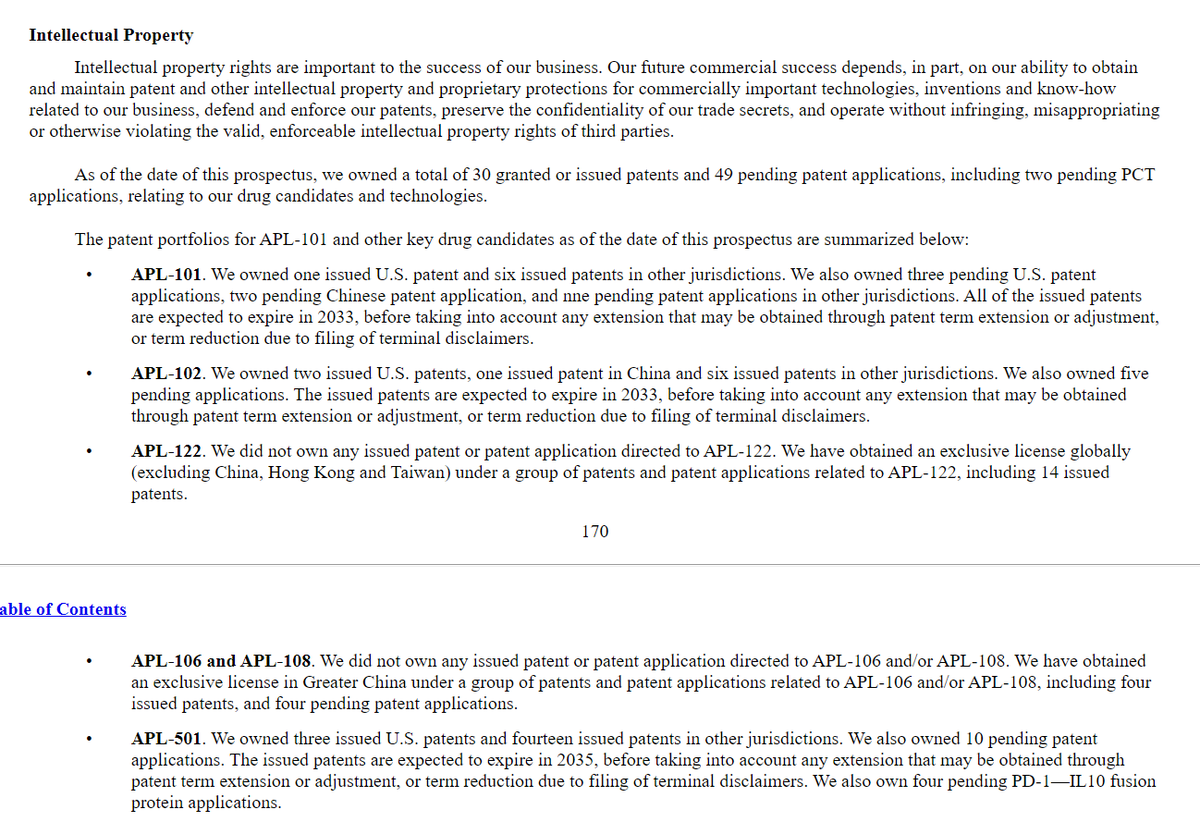

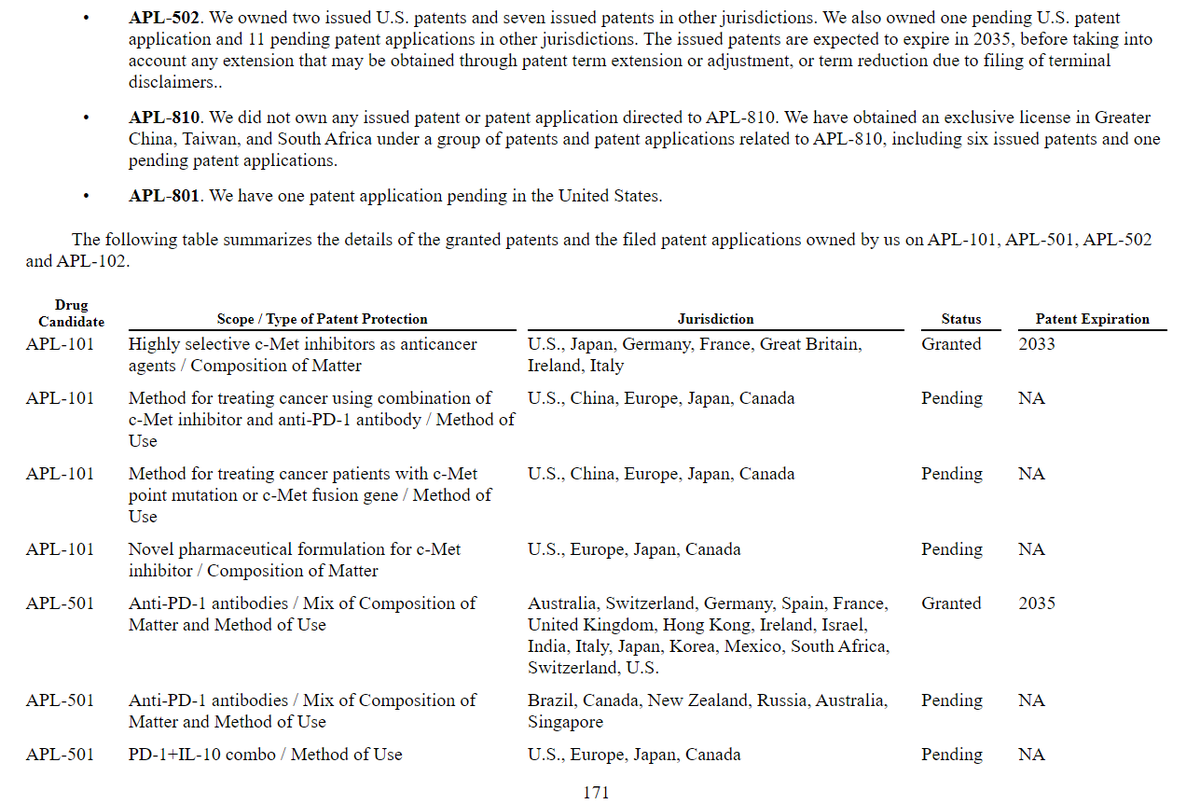

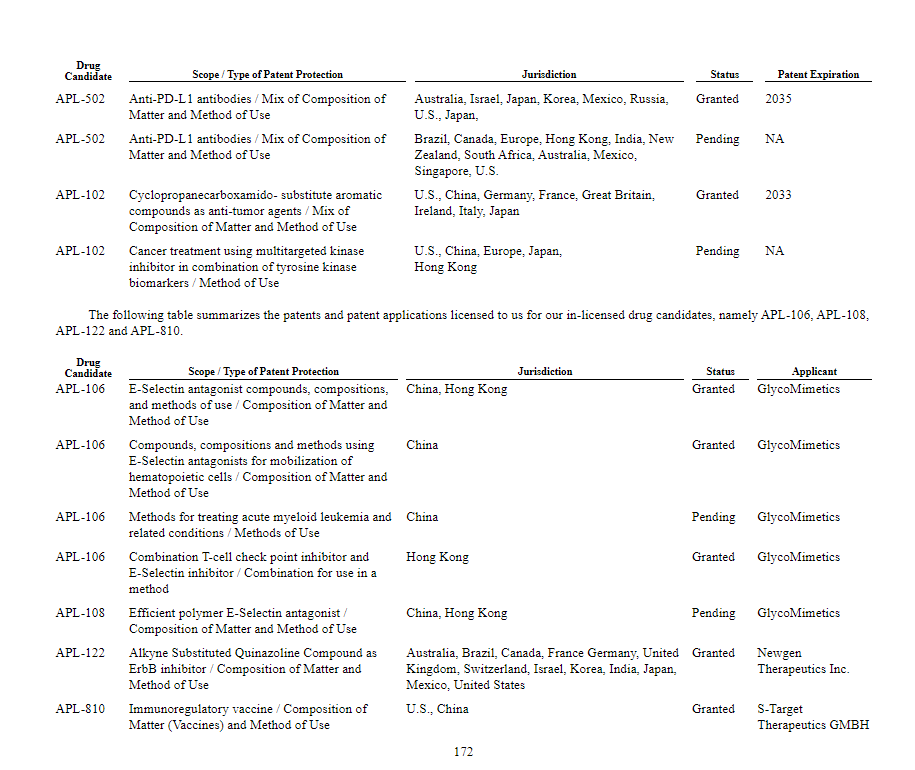

$APLM ... having secured or filed more than 79 active patents and patent applications, with more than 50 owned or directly filed by Apollomics, spanning nine therapeutic targets and covering discovery, development and manufacturing know-how.

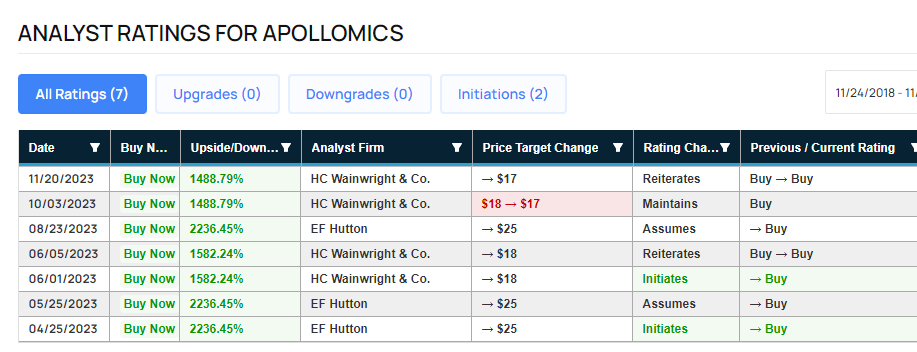

$APLM From their latest presentation at the HC Wainright Global Conference from September.

journey.ct.events/view/69cea170-…

journey.ct.events/view/69cea170-…

$APLM Cost to borrow at a staggering 700%+

Short Interest Value up 5000% over the last month.

Shares on Loan up over 600% over the past month.

Short Interest Value up 5000% over the last month.

Shares on Loan up over 600% over the past month.

$APLM Look at the history of this Stock. (weekly)

*Began trading in March of 2023 after a business combination

*Traded in the 10 range for quite a while, putting it at around a 1 B Market Cap. Peaked at 48/share

*RSI and MACD current at bottom and curling, so much space to run

*Began trading in March of 2023 after a business combination

*Traded in the 10 range for quite a while, putting it at around a 1 B Market Cap. Peaked at 48/share

*RSI and MACD current at bottom and curling, so much space to run

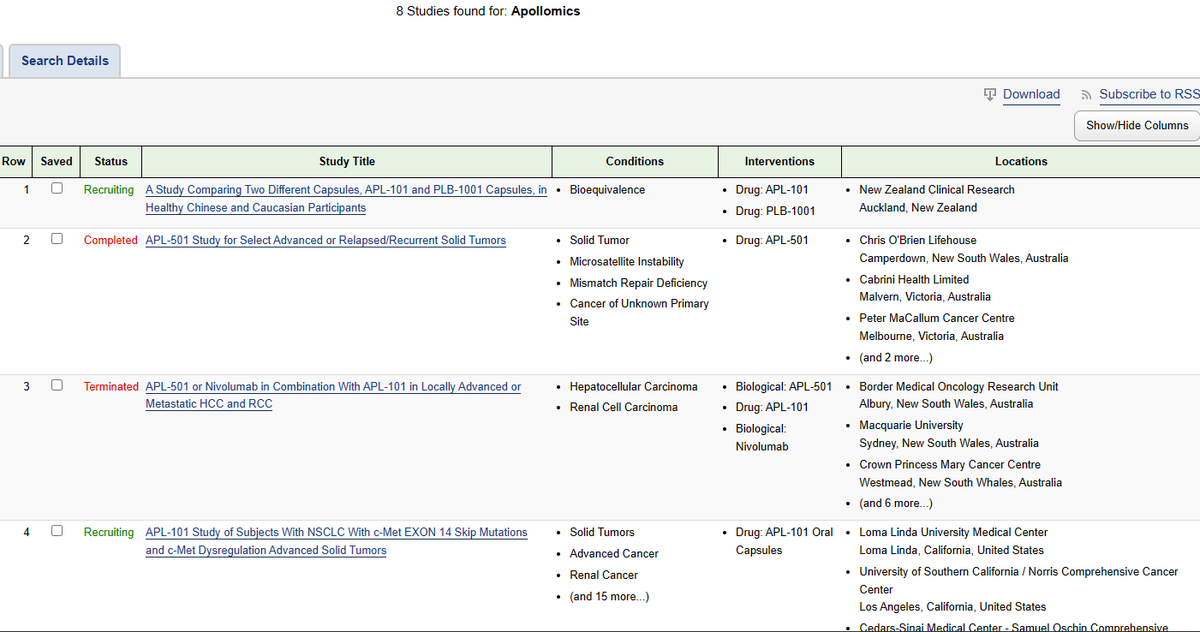

$APLM so many clinical trials going on that his company and their partners are doing. Check the government site yourself, this one is just the ones they are doing directly.

classic.clinicaltrials.gov/ct2/results?co…

classic.clinicaltrials.gov/ct2/results?co…

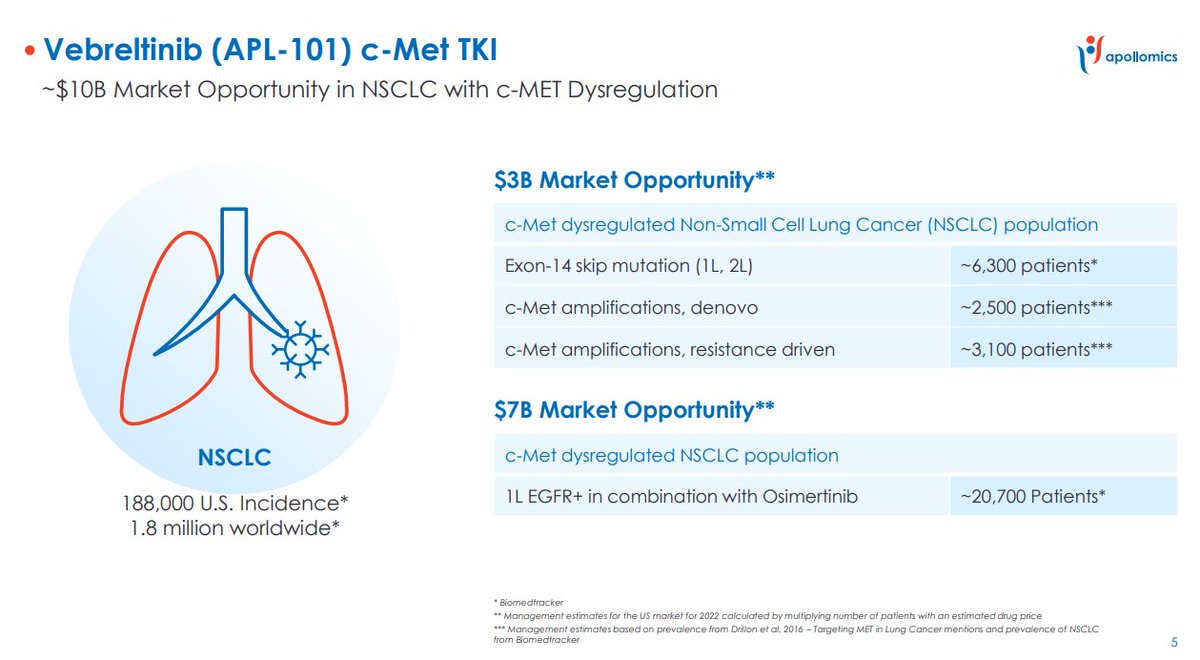

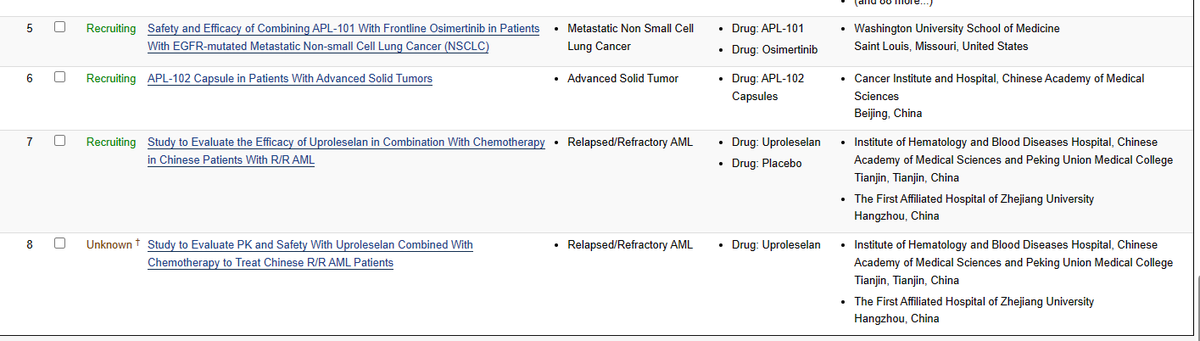

$APLM 10b market here...Vebreltinib

~ 140 patients treated in Apollomics SPARTA trial ongoing in 13 countries and 90+ sites

~ 140 patients treated in Apollomics SPARTA trial ongoing in 13 countries and 90+ sites

$APLM Reddit on it too! Upvote it and get it trending!

-

$ABUS $JDST $VXRT $LEJU $EMAN $TVIX $INPX $FUV $MRNA $HMHC $W $TRIP $JPM $SOHU $TSLA $STNE $NET $PENN $WFC $GRPN $ATTO $UAA $GSX $MAXR $SPG $ON $AYX $GENE $NE $LULU

reddit.com/r/pennystocks/…

-

$ABUS $JDST $VXRT $LEJU $EMAN $TVIX $INPX $FUV $MRNA $HMHC $W $TRIP $JPM $SOHU $TSLA $STNE $NET $PENN $WFC $GRPN $ATTO $UAA $GSX $MAXR $SPG $ON $AYX $GENE $NE $LULU

reddit.com/r/pennystocks/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh