Thread

How I built my trading system from scratch ? Full credit goes to @PradeepBonde @Qullamaggie @RichardMoglen one thing I love most about Pradeep and Kris they want to teach you how to trade by doing deep study. I did my Deep study on market from 1999 to 2023

Read full🙏

How I built my trading system from scratch ? Full credit goes to @PradeepBonde @Qullamaggie @RichardMoglen one thing I love most about Pradeep and Kris they want to teach you how to trade by doing deep study. I did my Deep study on market from 1999 to 2023

Read full🙏

The Rule by @LarryDHite,

Miracle of love by Ram Dass, these two books completely changed my life. In this thread I'm sharing problems that I faced in trading and how I found solutions of these problems?

Long story short I started trading in 2020 not lying I want quick money 🤣

Miracle of love by Ram Dass, these two books completely changed my life. In this thread I'm sharing problems that I faced in trading and how I found solutions of these problems?

Long story short I started trading in 2020 not lying I want quick money 🤣

I did every mistake which is possible in trading , read newspaper , Test every style of trading dip buying, intraday long/short, breakout, pullback,Ep ,reversal,bounce on ema etc. but got no result account was going down day by day .

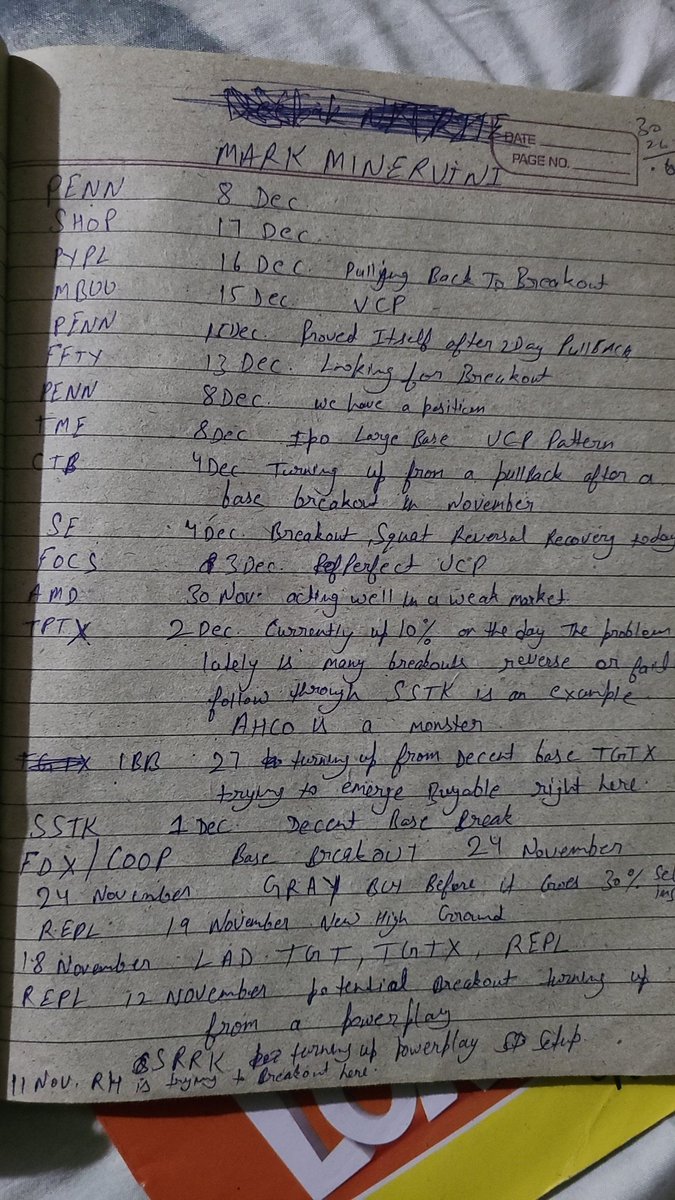

After that I read some William o Neil, Minervini, chris kacher,miachel covel, Jack D Schwager,Darvas books. Then I choose o neil style buy some strong techno-funda. RS rating , Group Rank stocks ,Stop-loss 8% but again same story no results.

Then I read every tweet of minervini and analyze every stock chart. After that I built some confidence and started buying breakouts with all money in one stock because I was trying to recover from loses as quickly as possible, but again got no results.

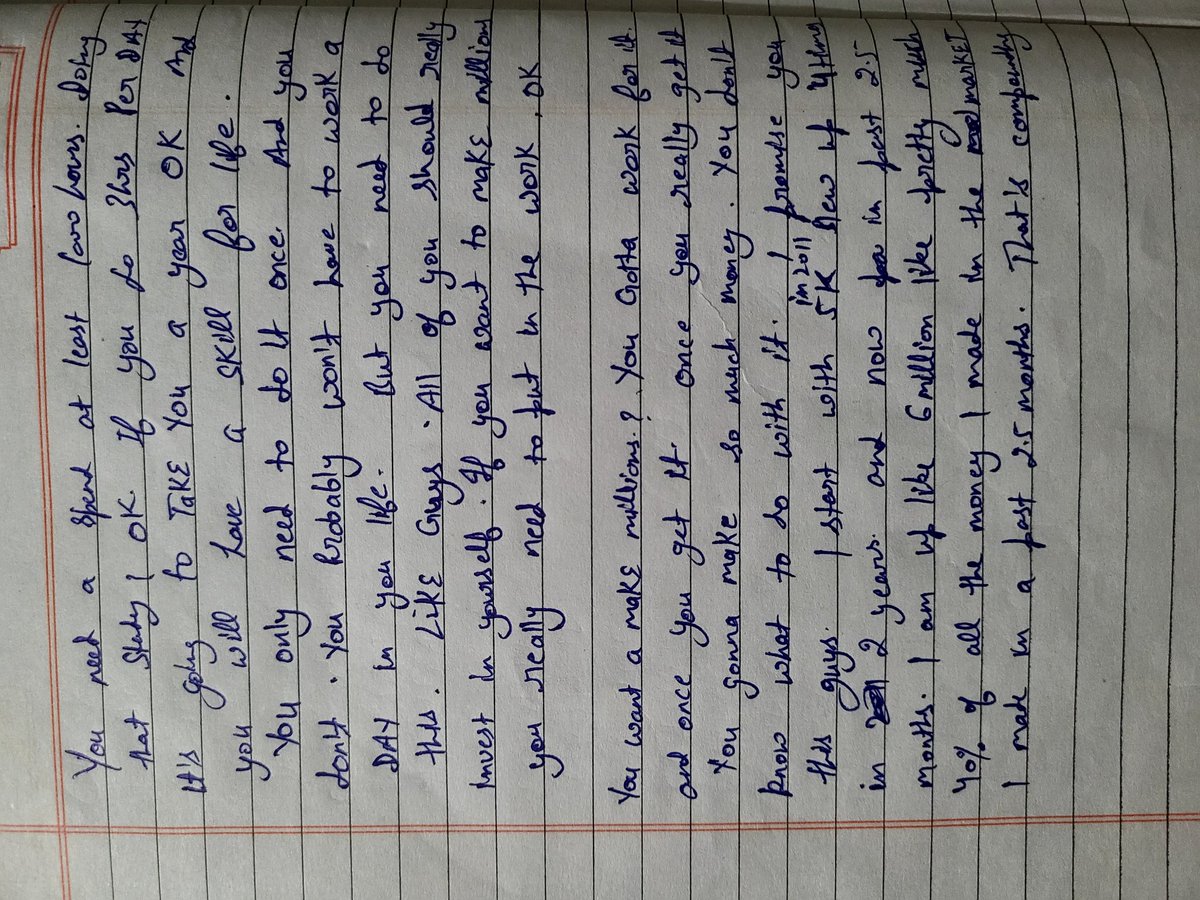

God knows how I found Qullamaggie on internet and started trading Ep, parabolic short in indian market 🤣 again same result loss going on . But then I realized I need deep studies if I want to make money from market. and then these words from Qullamaggie mouth changed my life

and I never look back again started diving deep in market . Every time I feel depressed I watch this clip again & again I still listen this everyday . same concept on stockbee blog you need to analyze 5000charts no shortcuts.

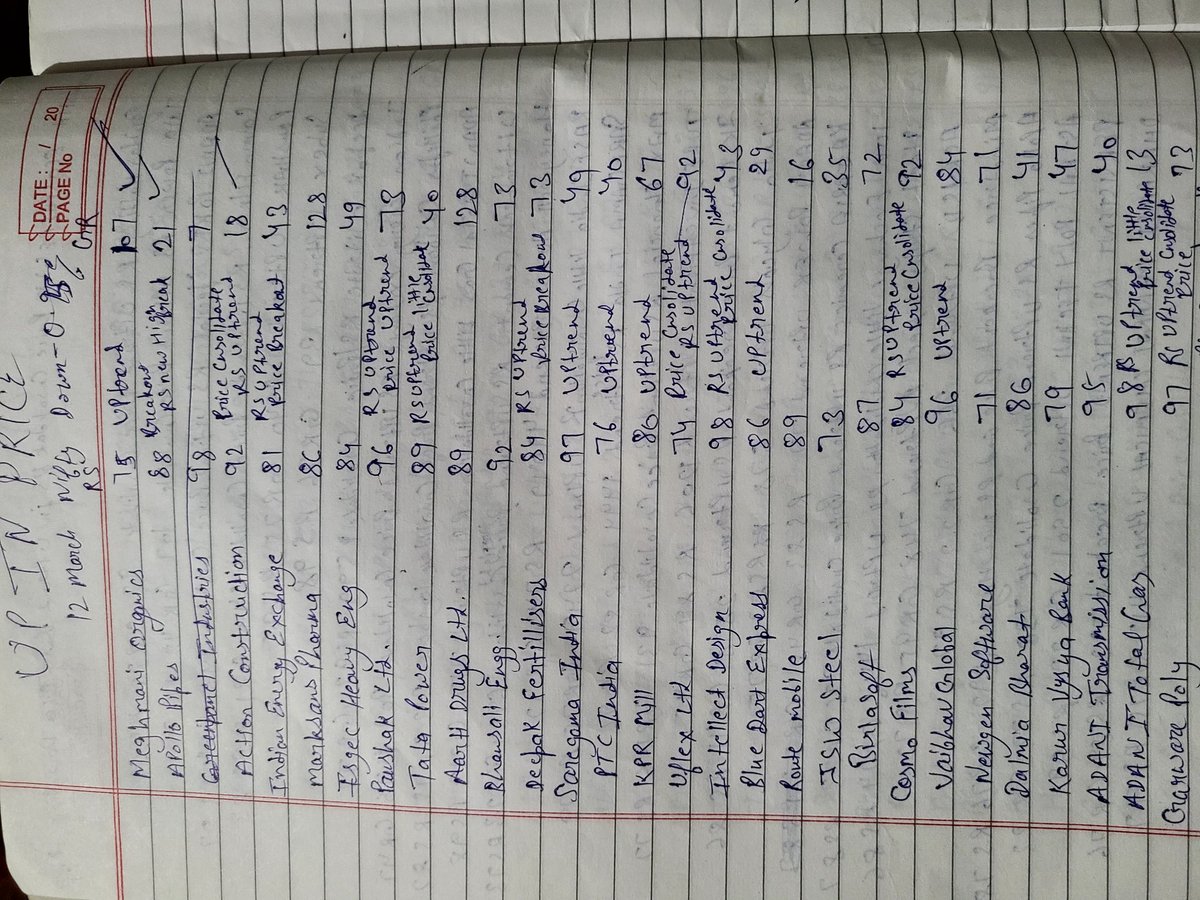

I built a chart database from 1999 to 2022 but again same problem not getting results I improved my trading little bit but not much. then again in very detail manner I analyze market from 2015 to 2022 . what's the story behind move /earnings / volume.

and I quickly realized o neil works doesn't work anymore . Now news story works in market . Ep /parabolic short doesn't works in indian market .

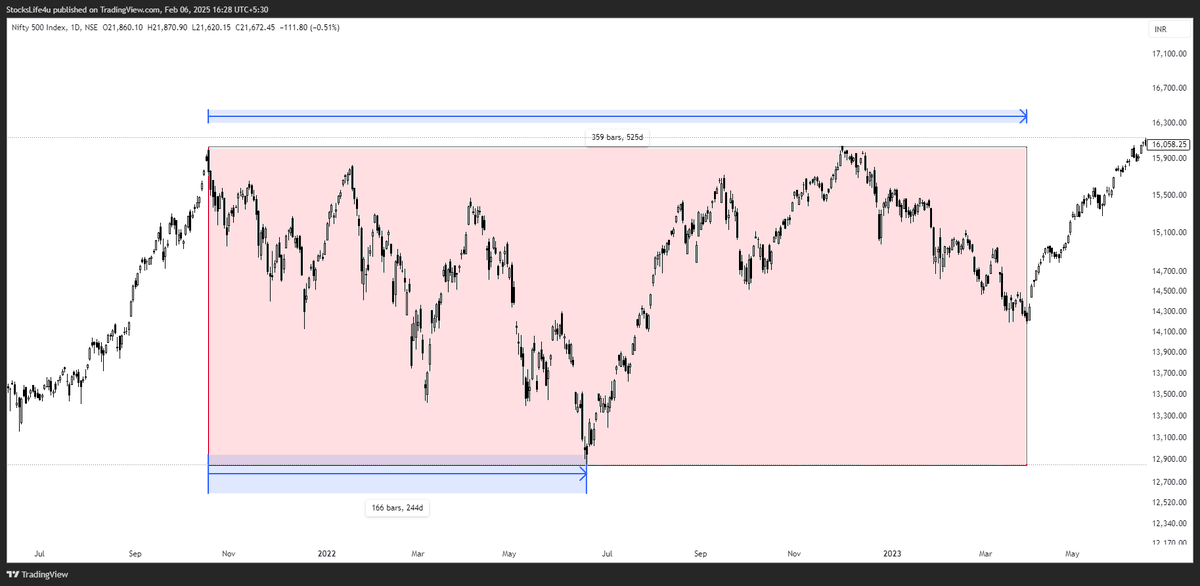

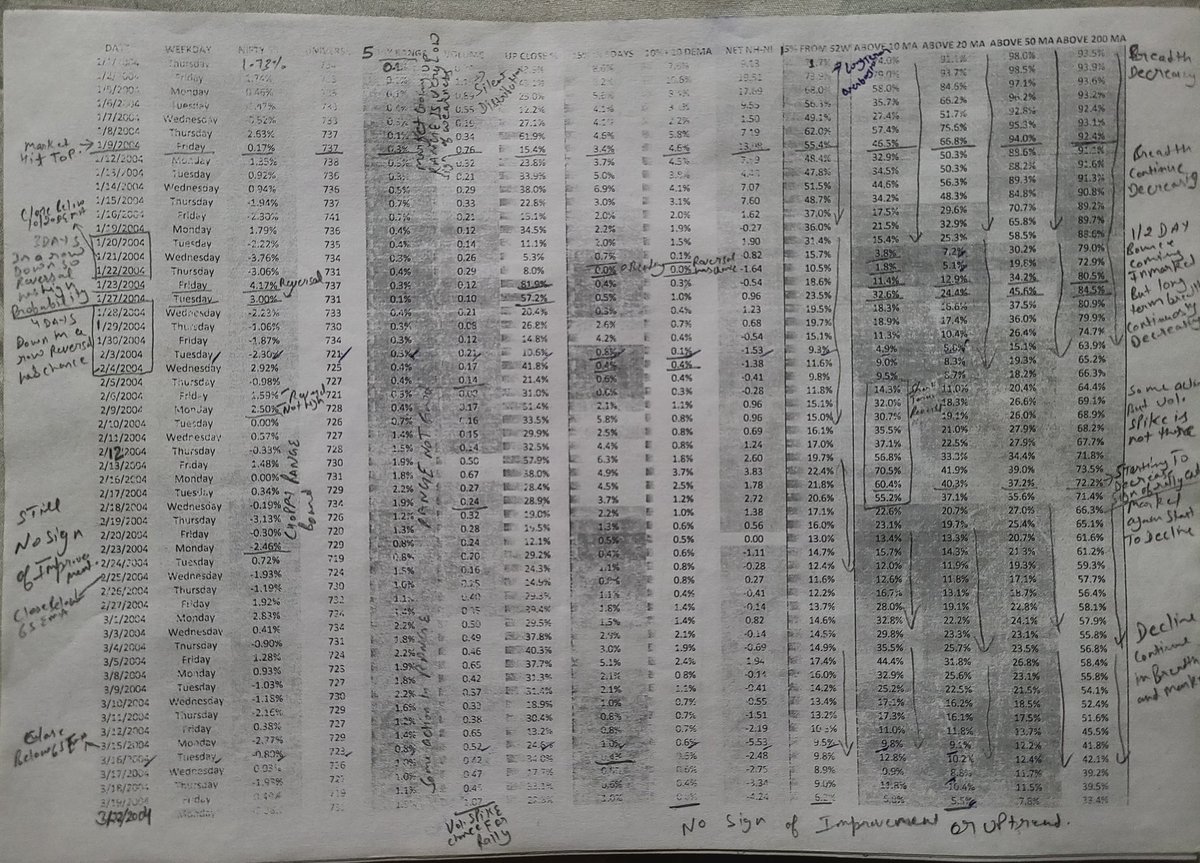

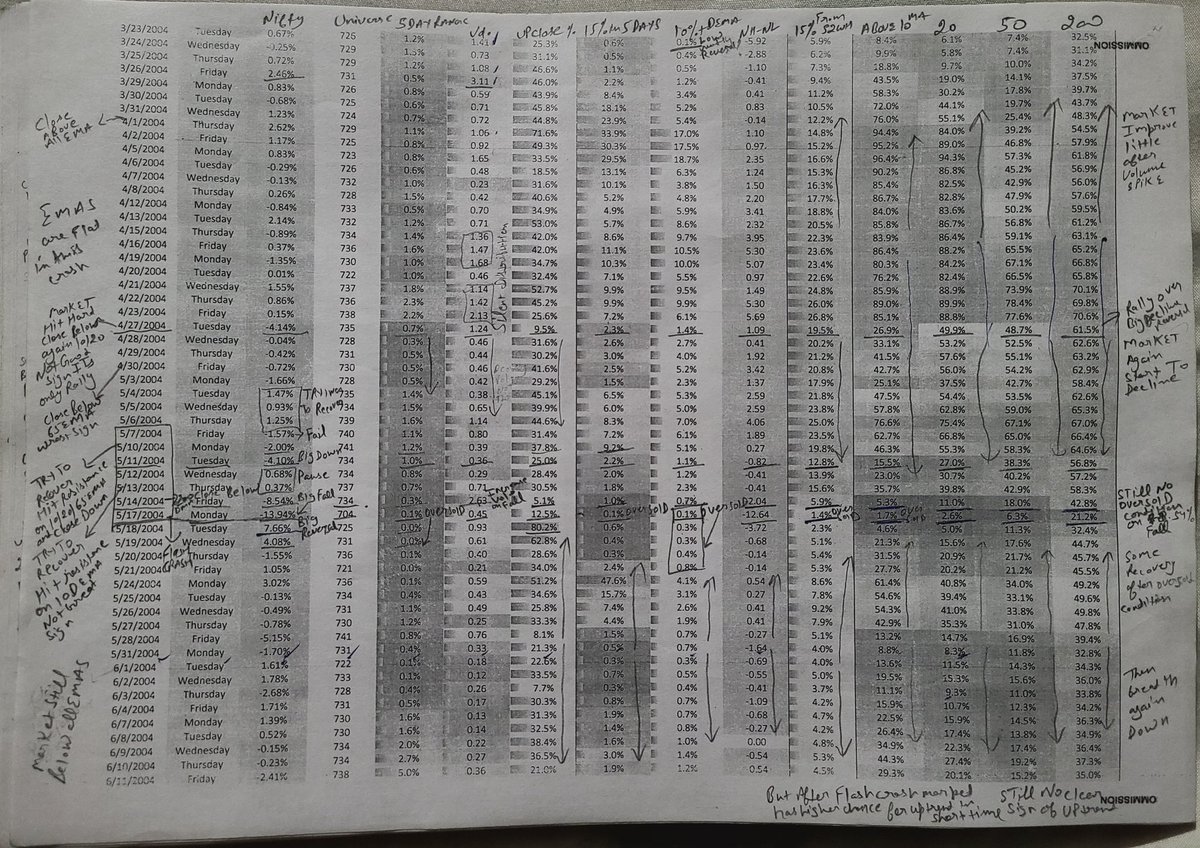

Now I'm getting results but lack of Situational awareness so then again I did this study when breakout works when not ?

https://twitter.com/itrendfollower/status/1700947026903503144?t=jHInFzS7zObJdyIJNHgUUg&s=19

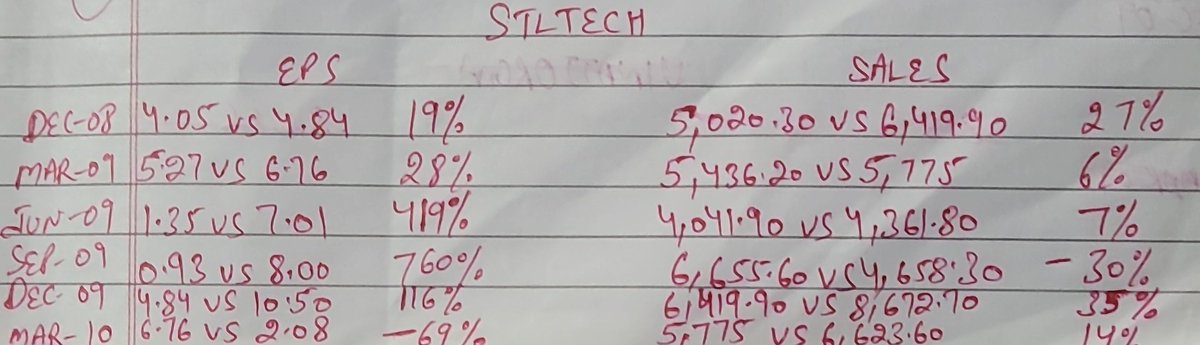

Again I started my Deep study from 1999 to 2014 analyze news,story ,calculate earnings manually. And realize it's same things over and over

Next problem is leaders vs laggard in sector . so again 🤣 I analyze lots of market cycles leaders have some common characteristics Gap up on High volume , highly Liquid ,news,story

Quality Breakouts problem - I'm focusing only on right side of the base and buying breakouts Stop-loss hitting day by day. and again I did study on chart and realize left side is also very important because if move on left side is not linear we can't expect good after breakout

Next problem is how to find emerging theme ? For this problem I use ivanhoff/stockbee concepts when lots of stock giving 4% breakout on high volume or hitting 1 month high from one sector that's means theme is emerging.

every week I study 15% Move in a week. from this I quickly examine which sector is leading. So now I have system-

How to find leading Theme?

Story matters more than earnings

When to buy breakouts?

now again where to put Stop-loss?

I use LOD , I'm not using it randomly

How to find leading Theme?

Story matters more than earnings

When to buy breakouts?

now again where to put Stop-loss?

I use LOD , I'm not using it randomly

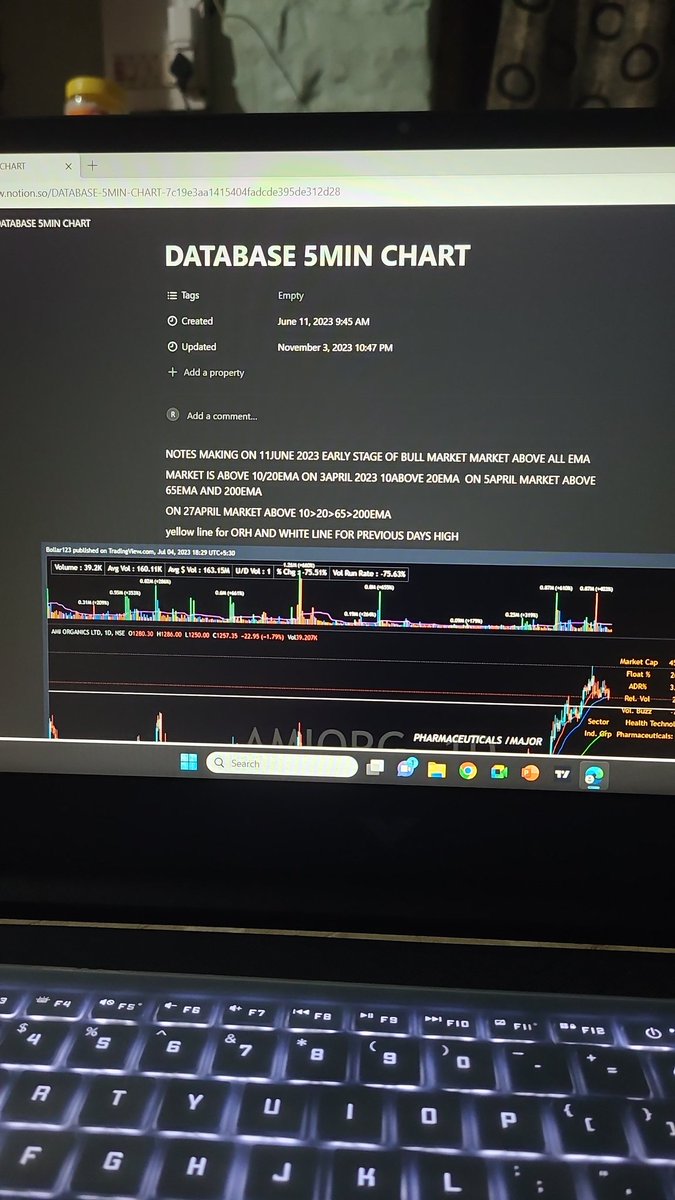

I also did deep dive on this and build 5min chart database on 1200 breakouts . and analyze strong breakouts never visit LOD again.

Risk management - No more than 1% of the total account on any one trade . sell half after 3days , ride with 20ema very simple no complication.

Risk management - No more than 1% of the total account on any one trade . sell half after 3days , ride with 20ema very simple no complication.

@swing_ka_sultan did a great job on market breadth sheet and after that I study very hard and built some long term overbought/oversold zone for our market . which I don't want to share with anyone. I did it manually.

Now its all about giving back to the community.youtube.com/@TheTrendFollo…

I also learn lots of concepts from these traders. @mwebster1971 52wk high

@RaiTrades HVE/HV1/HVIPO

RIP @KevinMarder his simplicity in trading and position sizing

@RaiTrades HVE/HV1/HVIPO

RIP @KevinMarder his simplicity in trading and position sizing

• • •

Missing some Tweet in this thread? You can try to

force a refresh