Charlie Munger passed away today at the age of 99.

Warren Buffett once said "Charlie has the best 30-second mind in the world"

How did he think so quickly & precisely?

Mental Models

Let's take a look at 21 of Munger's best:

Warren Buffett once said "Charlie has the best 30-second mind in the world"

How did he think so quickly & precisely?

Mental Models

Let's take a look at 21 of Munger's best:

Mental Models are "structures that help us understand the world".

If you have a wide range of mental models you'll be well equipped to make good decisions.

If you have a wide range of mental models you'll be well equipped to make good decisions.

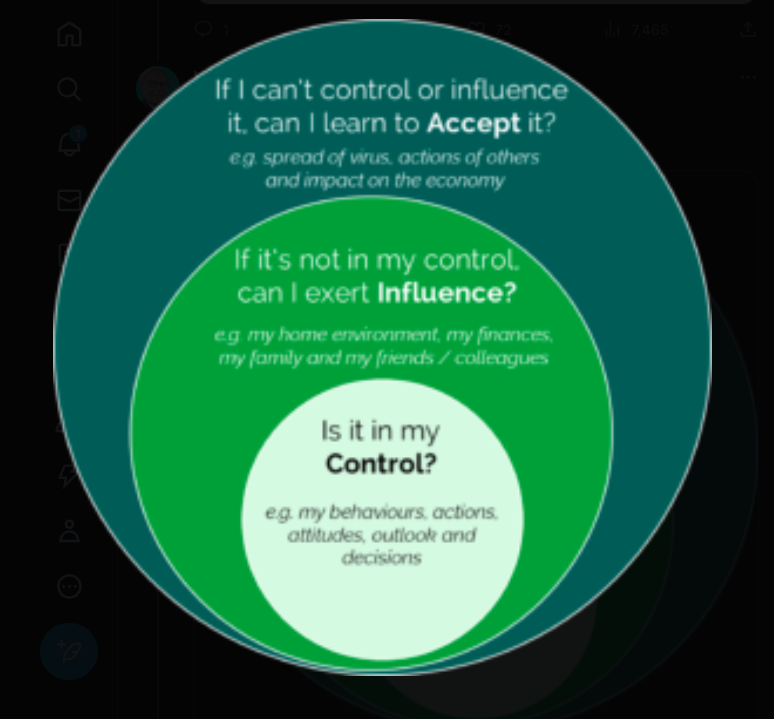

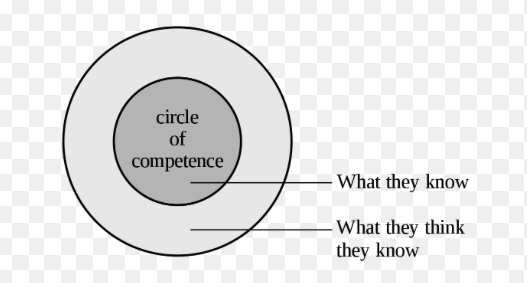

1. Circle of Competence

You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence.

You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence.

2. Inversion

When Charlie was a weatherman in the Air Corps he would ask himself "How can I kill these pilots" and avoided doing that.

Instead of looking at how a company will make you money, look at how it will lose you money.

When Charlie was a weatherman in the Air Corps he would ask himself "How can I kill these pilots" and avoided doing that.

Instead of looking at how a company will make you money, look at how it will lose you money.

3. Margin of Safety

It's leaving room for error.

If you are building a bridge to support 10 tonnes trucks, you should build it so it can support 20 tonnes because things can go wrong.

In investing if you think something is worth $1 you only want to pay 50c for it.

It's leaving room for error.

If you are building a bridge to support 10 tonnes trucks, you should build it so it can support 20 tonnes because things can go wrong.

In investing if you think something is worth $1 you only want to pay 50c for it.

4. The Law of Large Numbers

As you increase the sample size the more accurate the results will be.

Invest in a poor company once and you might get lucky. But keep on doing it and your luck will run out.

As you increase the sample size the more accurate the results will be.

Invest in a poor company once and you might get lucky. But keep on doing it and your luck will run out.

5. When The Odds Are In Your Favor Bet Big

“The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.”

— Charlie Munger

“The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.”

— Charlie Munger

6. Be a Swiss Army Knife

“To a man with a hammer, everything looks like a nail.”

― Mark Twain

Different problems require different tools.

“To a man with a hammer, everything looks like a nail.”

― Mark Twain

Different problems require different tools.

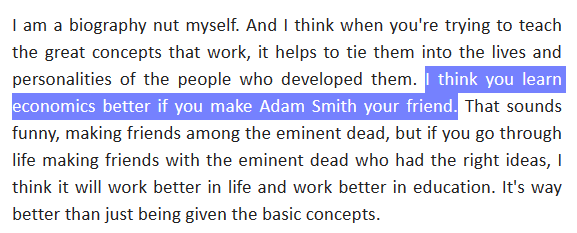

7. Makes Friends with the Eminent Dead

We can't speak to Benjamin Franklin or Albert Einstein anymore. But we can still learn from their writings.

"The man who does not read good books has no advantage over the man who can't read them."

- Mark Twain

We can't speak to Benjamin Franklin or Albert Einstein anymore. But we can still learn from their writings.

"The man who does not read good books has no advantage over the man who can't read them."

- Mark Twain

9. Crush Your Cherished Beliefs

It's okay to change your mind.

“It isn't the learning that's so hard. It's the unlearning.”

- Charlie Munger.

It's okay to change your mind.

“It isn't the learning that's so hard. It's the unlearning.”

- Charlie Munger.

10. Opportunity Cost

The decision to do x is the decision not to do y.

Investing $1,000 in Apple is the decision not to invest that $1,000 in Microsoft.

Investing is all about finding the best place to put your money.

The decision to do x is the decision not to do y.

Investing $1,000 in Apple is the decision not to invest that $1,000 in Microsoft.

Investing is all about finding the best place to put your money.

11. Survival of the Fittest

"Specialization is key" - Charlie Munger

The biggest markets may not be the most attractive because they have lots of competition.

Instead, find a niche and become the best at it.

Amazon started by selling books.

"Specialization is key" - Charlie Munger

The biggest markets may not be the most attractive because they have lots of competition.

Instead, find a niche and become the best at it.

Amazon started by selling books.

12.The Power of Incentives

Brokers are incentivized to get you to buy and sell stocks.

Managers are incentivized to make you think they run a good company.

Always consider the incentives that drive people.

Brokers are incentivized to get you to buy and sell stocks.

Managers are incentivized to make you think they run a good company.

Always consider the incentives that drive people.

13. Independent Thinking

Think for yourself. Don't just go along with the crowd.

"The stock investor is neither right nor wrong because others agreed or disagreed with him."

- Benjamin Graham

Think for yourself. Don't just go along with the crowd.

"The stock investor is neither right nor wrong because others agreed or disagreed with him."

- Benjamin Graham

14. Simplicity

In investing you aren't rewarded just for making more complex investments.

The simplest way to invest would be to dollar cost average into an index fund and that beats 90% of actively managed funds.

In investing you aren't rewarded just for making more complex investments.

The simplest way to invest would be to dollar cost average into an index fund and that beats 90% of actively managed funds.

15. Use Filters

Find the "good" companies by filtering out the "bad" ones.

Some filters you can apply:

- Remove companies with poor past growth.

- Remove companies outside of your circle of competence.

- Remove companies that are unlikely to outperform the broad market.

Find the "good" companies by filtering out the "bad" ones.

Some filters you can apply:

- Remove companies with poor past growth.

- Remove companies outside of your circle of competence.

- Remove companies that are unlikely to outperform the broad market.

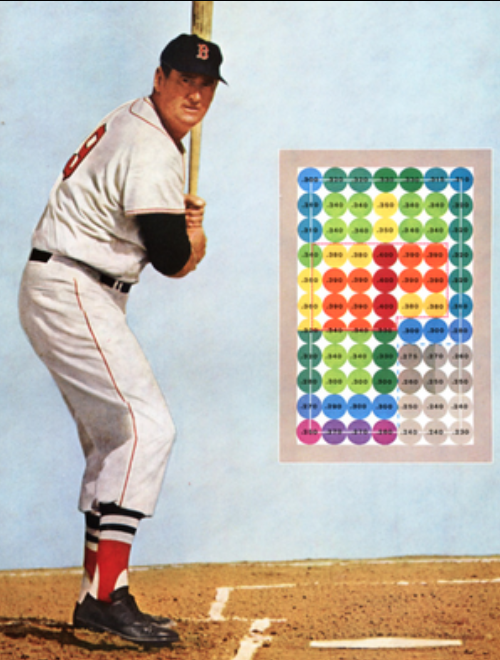

16. The Fat Pitch Strategy

Ted Williams was one of the best hitters in baseball history.

How did he do it?

He waited for good pitches.

In investing you don't need to buy every company. Instead, wait for the right opportunity to come along.

Ted Williams was one of the best hitters in baseball history.

How did he do it?

He waited for good pitches.

In investing you don't need to buy every company. Instead, wait for the right opportunity to come along.

17. Second Order Thinking

Think about the long term or indirect effects of decisions, not just the immediate ones.

1st order thinking: "This stock will grow its earnings. I'll buy it."

2nd order thinking "But earnings won't grow by as much as expected so I won't buy."

Think about the long term or indirect effects of decisions, not just the immediate ones.

1st order thinking: "This stock will grow its earnings. I'll buy it."

2nd order thinking "But earnings won't grow by as much as expected so I won't buy."

18. Lollapalooza Effect

2+2=5

"when there are multiple forces or factors moving in the same direction .... they don’t just add up; ... each force builds off of and strengthens the other, creating an explosive effect with huge results.

- Charlie Munger

2+2=5

"when there are multiple forces or factors moving in the same direction .... they don’t just add up; ... each force builds off of and strengthens the other, creating an explosive effect with huge results.

- Charlie Munger

19. Manage Expectations

Happiness is the result of the actual outcome vs the expected outcome.

If you expect every stock to double within a year you will be disappointed.

Happiness is the result of the actual outcome vs the expected outcome.

If you expect every stock to double within a year you will be disappointed.

21. The Iron Prescription

Munger dealt with his fair share of tragedies.

His son Teddy died at age 9 to Leukaemia.

And he went blind in one eye due to a failed surgery.

Munger dealt with his fair share of tragedies.

His son Teddy died at age 9 to Leukaemia.

And he went blind in one eye due to a failed surgery.

But he didn't let those things beat him.

“You should never, when facing some unbelievable tragedy, let one tragedy increase to two or three through your failure of will.”

- Charlie Munger

“You should never, when facing some unbelievable tragedy, let one tragedy increase to two or three through your failure of will.”

- Charlie Munger

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter