1/ Kamino Liquidity is an automated LP product that delivers institutional-grade liquidity strategies to retail users - at the click of a button

Our Liquidity Vaults have revolutionized the UX for LPs in Solana DeFi🧵

Our Liquidity Vaults have revolutionized the UX for LPs in Solana DeFi🧵

2/ Kamino Vaults removes the friction from liquidity provision.

All Kamino vaults feature:

- Single-token deposits (Kamino swaps for you)

- One-click transactions (yes, with Ledgers too)

- Auto-compounding (never harvest LP fees & incentives again)

- Auto-rebalancing

All Kamino vaults feature:

- Single-token deposits (Kamino swaps for you)

- One-click transactions (yes, with Ledgers too)

- Auto-compounding (never harvest LP fees & incentives again)

- Auto-rebalancing

3/ Once a user deposits into a Kamino vault, they don't have to do anything else

Each Kamino vault has a vault "Strategy" that determines the LP ranges & rebalancing parameters. These strategies are fully automated, with the smart contract monitoring every vault for rebalances.

Each Kamino vault has a vault "Strategy" that determines the LP ranges & rebalancing parameters. These strategies are fully automated, with the smart contract monitoring every vault for rebalances.

4/ We've spent 18 months optimizing & creating new strategies, while building analytics so users can monitor vault performance

EVERY vault on Kamino has analytics, monitoring:

Vault performance vs either token's performance vs just holding both tokens. Check the interface here:

EVERY vault on Kamino has analytics, monitoring:

Vault performance vs either token's performance vs just holding both tokens. Check the interface here:

5/ But here's where we've changed the game completely:

In addition to strategy automation, Kamino now also tokenizes user positions into LP tokens (kTokens). And these tokens can now be used as collateral in Kamino Lend 👀

In addition to strategy automation, Kamino now also tokenizes user positions into LP tokens (kTokens). And these tokens can now be used as collateral in Kamino Lend 👀

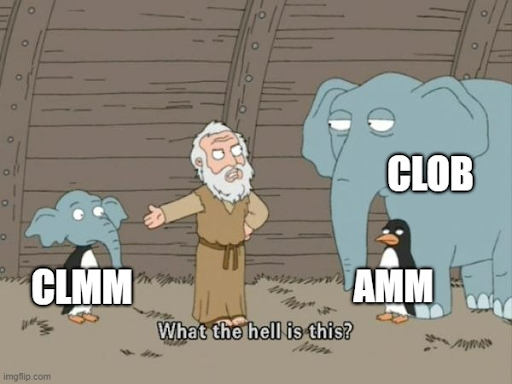

6/ This means, for the first time ever, various CLMM liquidity positions can be levered up. For example:

kJitoSOL-SOL can be deposited into Kamino Lend, and SOL can be borrowed against it. SOL can then be deposited back into the JitoSOL-SOL vault, increasing yield exposure.

kJitoSOL-SOL can be deposited into Kamino Lend, and SOL can be borrowed against it. SOL can then be deposited back into the JitoSOL-SOL vault, increasing yield exposure.

7/ Strategies like these are highly significant to the ecosystem as they make for much deeper liquidity across various key token pairs.

This, in turn, facilitates greater DeFi activity and larger token swaps, which are essential to ecosystem growth.

This, in turn, facilitates greater DeFi activity and larger token swaps, which are essential to ecosystem growth.

8/ Looping via Lending also comes with risks such as token depegs, which we outline in our docs:

Liquidity vaults also expose users to risks such as impermanent loss. We encourage ALL liquidity providers to read our vault docs: docs.kamino.finance/products/multi…

docs.kamino.finance/v/automated-li…

Liquidity vaults also expose users to risks such as impermanent loss. We encourage ALL liquidity providers to read our vault docs: docs.kamino.finance/products/multi…

docs.kamino.finance/v/automated-li…

9/ Join the Kamino Telegram, where we discuss all things liquidity, lending, and risk related: t.me/kamino2

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter