It is said that OPTION SELLING requires very huge capital to generate returns and manage risk.

But it is not TRUE!

A complete guide on how you can start Option Selling to generate active returns with less capital (Rs 1 Lakh) 🧵:

But it is not TRUE!

A complete guide on how you can start Option Selling to generate active returns with less capital (Rs 1 Lakh) 🧵:

First of all, option selling is a very risky business because you can lose the entire capital if the market goes against you.

So it's important to do technical analysis properly. Read everything about Technical Analysis from Zerodha Varsity.

zerodha.com/varsity/module…

So it's important to do technical analysis properly. Read everything about Technical Analysis from Zerodha Varsity.

zerodha.com/varsity/module…

Technical Analysis will give you good knowledge on chart reading, which will help you do in doing analysis and sit in the right direction.

Before starting with F&O trading, it's important to understand how it works and what all things happen?

Before starting with F&O trading, it's important to understand how it works and what all things happen?

This module of Zerodha Varsity will help you to get a basic understanding of Futures Trading. As of now, this is less important as we are focusing on option trading.

zerodha.com/varsity/module…

zerodha.com/varsity/module…

For options, Zerodha Varsity has explained all the basic things in a simple manner. You need not require joining any paid workshop or webinars.

This is module will help you to clear basics of options.

zerodha.com/varsity/module…

This is module will help you to clear basics of options.

zerodha.com/varsity/module…

This module on options is little advance as it talks of various strategies in option trading. All the important strategies are covered in this, which will help you further in your option selling.

zerodha.com/varsity/module…

zerodha.com/varsity/module…

Now we can expect that basic knowledge of option trading is completed and the most important part is live trading.

So whatever your analysis is bullish, bearish or sideways, never take a naked option selling position as you will burst your account if the market goes against you.

So whatever your analysis is bullish, bearish or sideways, never take a naked option selling position as you will burst your account if the market goes against you.

Focus on simple strategy don't complicate your position, don't do adjustment or don't do firefighting as it will make your option selling tedious with less capital. So simply focus on increasing your capital to a scale where you can do all that.

What are the strategies you can use depending on the technical analysis?

1. Bullish: Short Near Put Option and Buy Far Put Option to Hedge

2. Bearish: Short Near Call Option and Buy Far Call Option to Hedge

1. Bullish: Short Near Put Option and Buy Far Put Option to Hedge

2. Bearish: Short Near Call Option and Buy Far Call Option to Hedge

3. Sideways: Here you can have two strategies:

a. Iron Fly: Short ATM Call and Put option and hedging with far OTM call and put option.

b. Iron Condor: Short Near Call and Put option and hedging with far OTM call and put option.

These are the four strategies that you can use.

a. Iron Fly: Short ATM Call and Put option and hedging with far OTM call and put option.

b. Iron Condor: Short Near Call and Put option and hedging with far OTM call and put option.

These are the four strategies that you can use.

Now an important part of taking option trades is to analyse how the trades look like, what is the payoff, and what is the max risk?

So there are some free tools that will help you in this, so let's discuss that.

So there are some free tools that will help you in this, so let's discuss that.

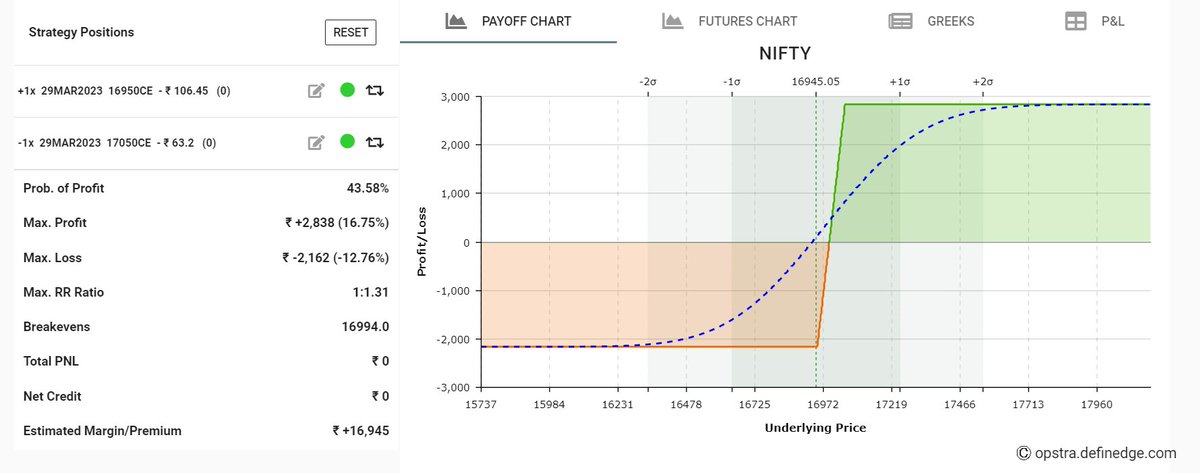

1/ Opstra:

It's an amazing website that can help you in analysing your option trade.

Let's explain this with an example. If I am bullish, then I will short a near put option buy far put to hedge the position.

Opstra interface is very simple to use.

It's an amazing website that can help you in analysing your option trade.

Let's explain this with an example. If I am bullish, then I will short a near put option buy far put to hedge the position.

Opstra interface is very simple to use.

For my bullish view, I am shorting 17600 PE and buying 17500 PE to hedge the position as seen from the image.

Now forget Risk:Reward in option selling as it will never be favourable, and probability of profit will offset that.

Now forget Risk:Reward in option selling as it will never be favourable, and probability of profit will offset that.

In this, you can see that the max profit is Rs 1,200 and max loss is Rs 3,800.

So in whatever direction goes, I will not lose more than Rs 3,800 in this trade.

Let's say you started option selling with Rs 1 Lakh. Then your max risk is 3.8% of the total capital.

So in whatever direction goes, I will not lose more than Rs 3,800 in this trade.

Let's say you started option selling with Rs 1 Lakh. Then your max risk is 3.8% of the total capital.

In option selling trades, always keep your max risk to 5% of the total capital. Don't risk more than that, otherwise it will be difficult for you to survive in the long run.

So buy your hedge position according to the risk and don't run behind profit.

So buy your hedge position according to the risk and don't run behind profit.

Similarly, if I am bullish, then I will short 17800 CE (near call) and buy 17900 CE (far call) to hedge the position.

For Iron Condor, I will short 17900 CE and 17500 PE and buy 18000 CE and 17400 PE to hedge the position.

For Iron Fly, I will short 17700 CE and 17700 PE and buy 17900 CE and 17500 PE to hedge the position.

So all my positions will be based on the view.

For Iron Fly, I will short 17700 CE and 17700 PE and buy 17900 CE and 17500 PE to hedge the position.

So all my positions will be based on the view.

Now, you know that your max risk will always be less than 5% of the total capital.

So how will you plan your exit?

Keep proper stoploss and target levels based on the chart. If that is hit, then exit your option trade and focus on new trade.

So how will you plan your exit?

Keep proper stoploss and target levels based on the chart. If that is hit, then exit your option trade and focus on new trade.

If both SL or Target is not hit, then your position will be have MTM in range of max loss to max profit which you can exit on the expiry day.

So always keep the risk in check and let the market reward you for whatever you deserve.

So always keep the risk in check and let the market reward you for whatever you deserve.

Second tool that you can use is Sensibull in Zerodha.

Simply create a basket order of your position and then click on Analyse.

Here you will get similar data which can help you to take decision.

These two tools are free, which you can also try.

Simply create a basket order of your position and then click on Analyse.

Here you will get similar data which can help you to take decision.

These two tools are free, which you can also try.

Benefit of hedge that you are taking:

1. It will eliminate unlimited risk factor in option selling.

2. Margin reduction in option selling otherwise for naked option selling more than Rs 1 lakh margin is needed.

1. It will eliminate unlimited risk factor in option selling.

2. Margin reduction in option selling otherwise for naked option selling more than Rs 1 lakh margin is needed.

That's all about how you can start selling options if you are a beginner. Small profits can end up in large profit in the long run because of compounding.

Don't go aggressive. Start with one lot and increase lot size on profit of every Rs 1 Lakh.

Don't go aggressive. Start with one lot and increase lot size on profit of every Rs 1 Lakh.

This thread has become a little big, so let's summarise all the pointers:

1. Focus on Basic Technical Analysis, Basic of Options and Option Strategies from Zerodha Varsity.

2. Create your view based on the technical analysis of index or stock.

1. Focus on Basic Technical Analysis, Basic of Options and Option Strategies from Zerodha Varsity.

2. Create your view based on the technical analysis of index or stock.

3. Check your position based on your analysis on Opstra or Sensibull.

4. Never risk more than 5% of your total capital in any trade.

5. Exit your position if Stoploss or Target is hit or at the end of the expiry.

6. Focus on small gains in the start and compound your capital.

4. Never risk more than 5% of your total capital in any trade.

5. Exit your position if Stoploss or Target is hit or at the end of the expiry.

6. Focus on small gains in the start and compound your capital.

• • •

Missing some Tweet in this thread? You can try to

force a refresh