What is a cash flow statement?

It shows you how much cash goes in and out of a business in a certain time period

You can't pay your bills with "earnings", you can only pay them with cash.

Let's dive deeper:

It shows you how much cash goes in and out of a business in a certain time period

You can't pay your bills with "earnings", you can only pay them with cash.

Let's dive deeper:

"Earnings" can more easily be manipulated by clever accounting

It is very hard to be deceitful when it comes to the in- and outflows of cash.

"EBITDA is an opinion, cash is a fact"

It is very hard to be deceitful when it comes to the in- and outflows of cash.

"EBITDA is an opinion, cash is a fact"

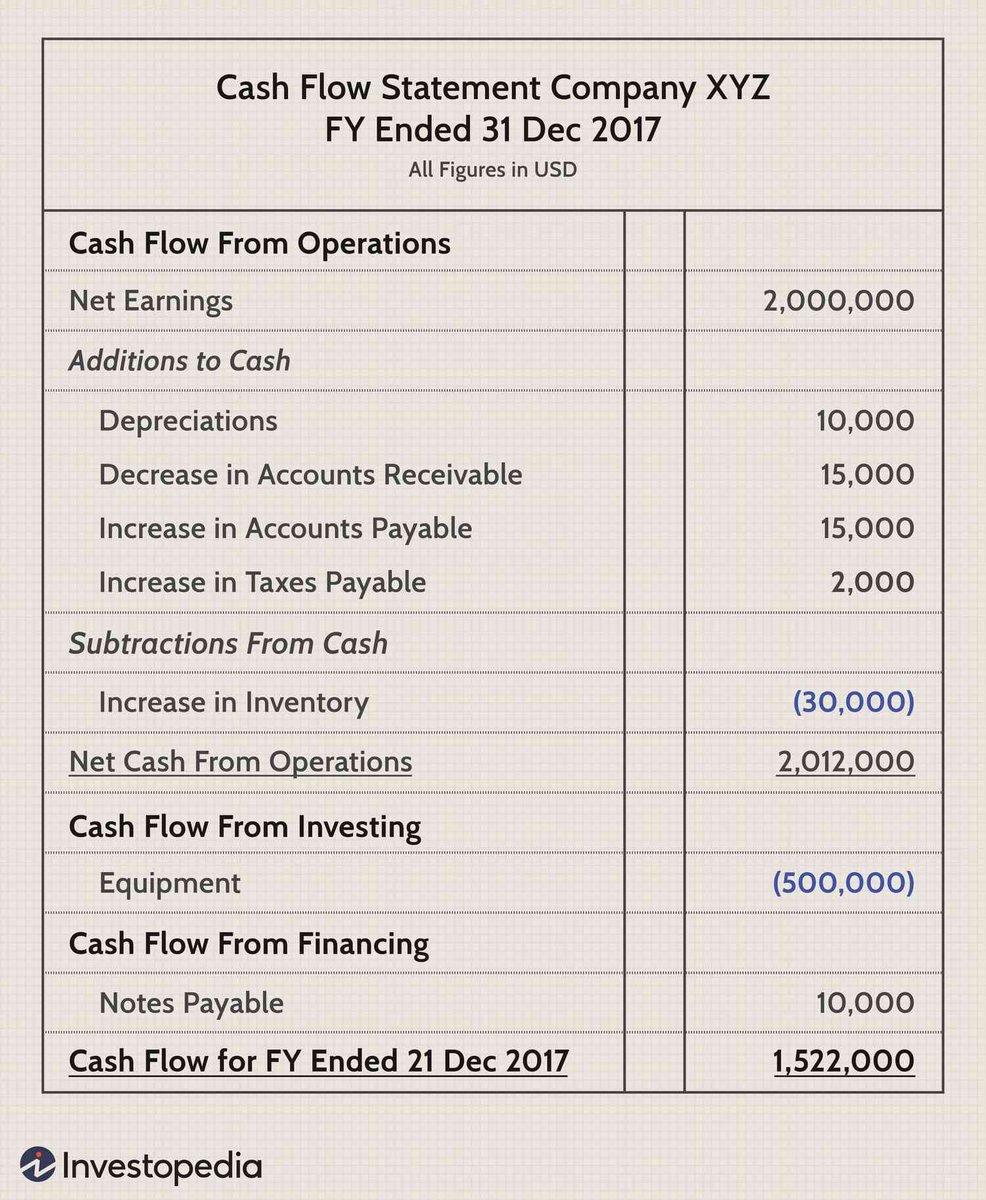

The cash flow statement consists of 3 key elements:

• Operating cash flow

• Investing cash flow

• Financing cash flow

All 3 are important to understand the ins and outs of the business

• Operating cash flow

• Investing cash flow

• Financing cash flow

All 3 are important to understand the ins and outs of the business

Operating Cash Flow

This section shows what the business generates from its normal operating activities.

For example: Apple's operating activities are to sell its iPhones and Macs.

This section shows what the business generates from its normal operating activities.

For example: Apple's operating activities are to sell its iPhones and Macs.

The cash from operations is similar to net income, but it adds back non-cash items that net income includes.

Examples: Depreciation and amortization, Non-cash adjustments, Changes in Working Capital

Examples: Depreciation and amortization, Non-cash adjustments, Changes in Working Capital

Note: OCF also adds Stock-based compensation back in, as it is not a cash expense. This is however not a good thing IMO, as SBC will dilute you as a shareholder.

This means that you will end up owning less % of the business, and therefore there is a real cost to investors.

This means that you will end up owning less % of the business, and therefore there is a real cost to investors.

Working capital is the capital a business keeps to meet short-term obligations.

Working capital consists of accounts receivables, plus inventory, minus accounts payable:

Working capital consists of accounts receivables, plus inventory, minus accounts payable:

• Accounts receivables is the money the customer owes the business

• Inventory is the total value of the product the business has not yet sold

• Accounts payable is what the business owes its suppliers

• Inventory is the total value of the product the business has not yet sold

• Accounts payable is what the business owes its suppliers

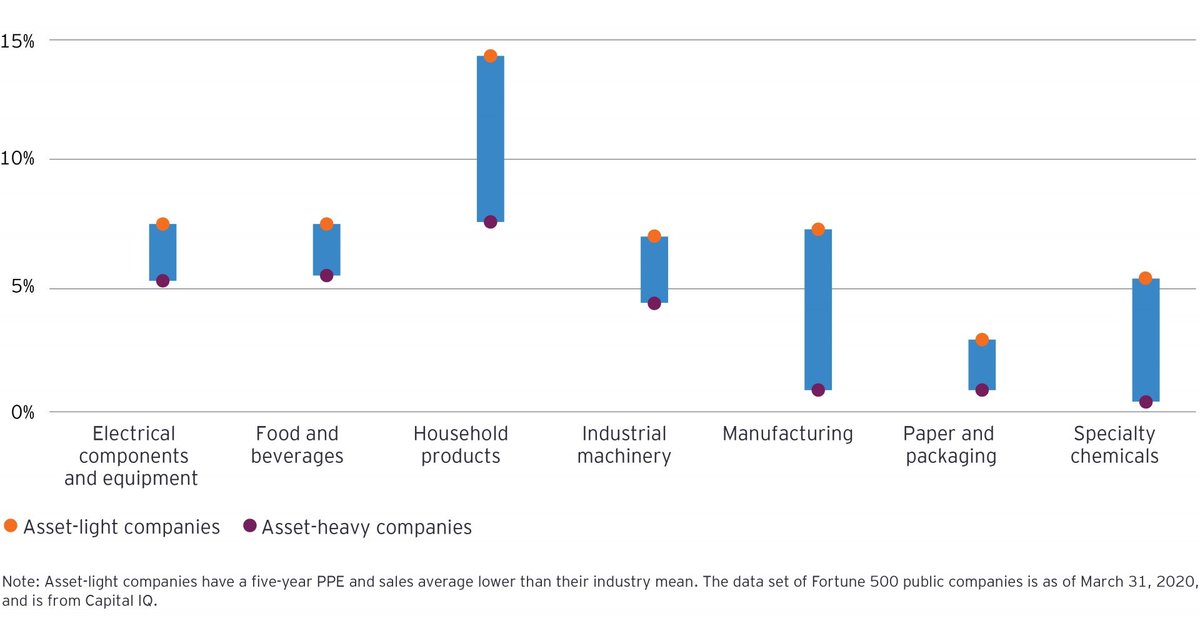

Low levels of working capital are good as it indicates that the business is managing its money efficiently and has control over its inventory.

Low working capital requirements for a business also mean it requires low levels of capital to operate, which is a plus.

Low working capital requirements for a business also mean it requires low levels of capital to operate, which is a plus.

Changes in Working Capital

You will often see this on the cash flow statement

It means that there is a change from the prior year in one of the following elements:

1. Accounts receivable

2. Accounts Payable

3. Inventory

You will often see this on the cash flow statement

It means that there is a change from the prior year in one of the following elements:

1. Accounts receivable

2. Accounts Payable

3. Inventory

Accounts receivable is negative = Accounts receivables have increased since the previous period

This means that customers owe the business more this period, than the previous period.

This can be a negative sign, but it depends on the context.

This means that customers owe the business more this period, than the previous period.

This can be a negative sign, but it depends on the context.

Accounts payable is positive = Accounts payable increase since the previous period

This means that the business is not paying its short-term obligations to its suppliers as quickly as in the previous period

This allows the business to keep the cash for a bit longer

This means that the business is not paying its short-term obligations to its suppliers as quickly as in the previous period

This allows the business to keep the cash for a bit longer

Inventory shows a positive number = Inventory is higher than the previous period

This can mean that the business is unable to sell its product, in certain industries this is a bad sign.

As a general rule, we want to see stable inventory levels

This can mean that the business is unable to sell its product, in certain industries this is a bad sign.

As a general rule, we want to see stable inventory levels

The formula for cash flow from operations is:

Net Income + non-cash charges + / - changes in working capital

Net Income + non-cash charges + / - changes in working capital

Cash flow from investing activities

This section gives an overview of the company's investment-related cash in- and outflows

There are 3 key elements:

1. CapEx

2. M&A

3. Marketable securities

This section gives an overview of the company's investment-related cash in- and outflows

There are 3 key elements:

1. CapEx

2. M&A

3. Marketable securities

•Capital Expenditure is the cash a company needs to maintain its ongoing operations. This can be costs related to equipment, buildings, and licenses.

•M&As are the cash used to acquire other businesses.

•Marketable securities are buys & sells made in stocks by the company.

•M&As are the cash used to acquire other businesses.

•Marketable securities are buys & sells made in stocks by the company.

The formula for cash flow from investments:

Sale of marketable securities + divestments - capital expenditure - M&As - buys of marketable securities

Sale of marketable securities + divestments - capital expenditure - M&As - buys of marketable securities

Cash from Financing Activities

This section shows the cash movement between the shareholders and the bondholders of the business.

From this section, we can learn how the business is being financed.

This section shows the cash movement between the shareholders and the bondholders of the business.

From this section, we can learn how the business is being financed.

There are 3 key elements:

1. Borrowing & repayment of debt

2. Issuing stock and stock buybacks

3. Dividends

1. Borrowing & repayment of debt

2. Issuing stock and stock buybacks

3. Dividends

The formula for cash flow from financing:

Debt issuance + issuance of new stock - dividends - debt repayment - share buybacks

Debt issuance + issuance of new stock - dividends - debt repayment - share buybacks

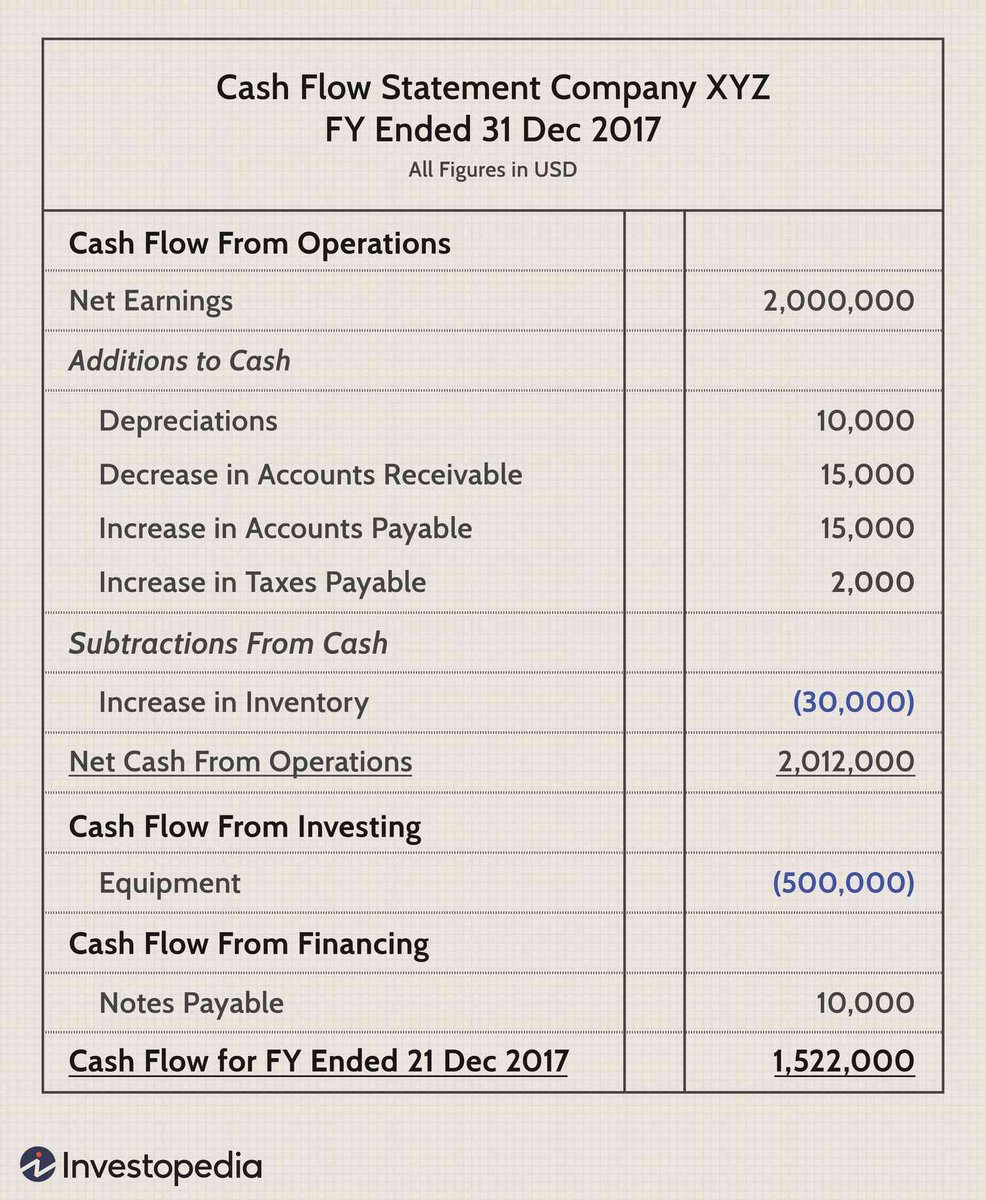

Cash and cash equivalents by the end of the period

The final section of the cash flow statement shows the balance of cash from the last period.

This will show a positive number if the cash balance is up from the prior period.

The final section of the cash flow statement shows the balance of cash from the last period.

This will show a positive number if the cash balance is up from the prior period.

From our example cash flow statement, the cash flow in that given year is $1.522.000

The only negative elements are an increase of $30.000 in inventory and a $500.000 investment in equipment.

We also want to know if that investment is a maintenance or a growth investment.

The only negative elements are an increase of $30.000 in inventory and a $500.000 investment in equipment.

We also want to know if that investment is a maintenance or a growth investment.

If you enjoy my content, be kind and:

1. Follow me @InvestInAssets for more of these

2. RT the tweet below to share this thread with your audience

3. Subscribe to my Newsletter and free resources: linktr.ee/investinassets

1. Follow me @InvestInAssets for more of these

2. RT the tweet below to share this thread with your audience

3. Subscribe to my Newsletter and free resources: linktr.ee/investinassets

https://twitter.com/1558861445902786560/status/1741052457684173098

• • •

Missing some Tweet in this thread? You can try to

force a refresh