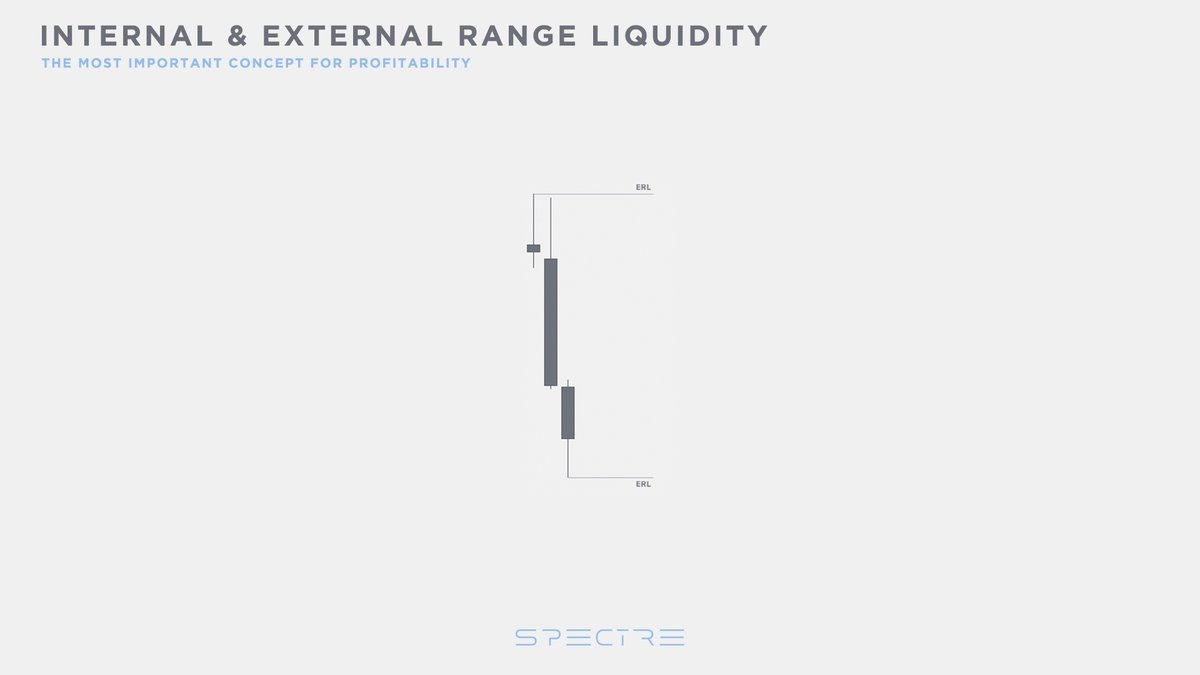

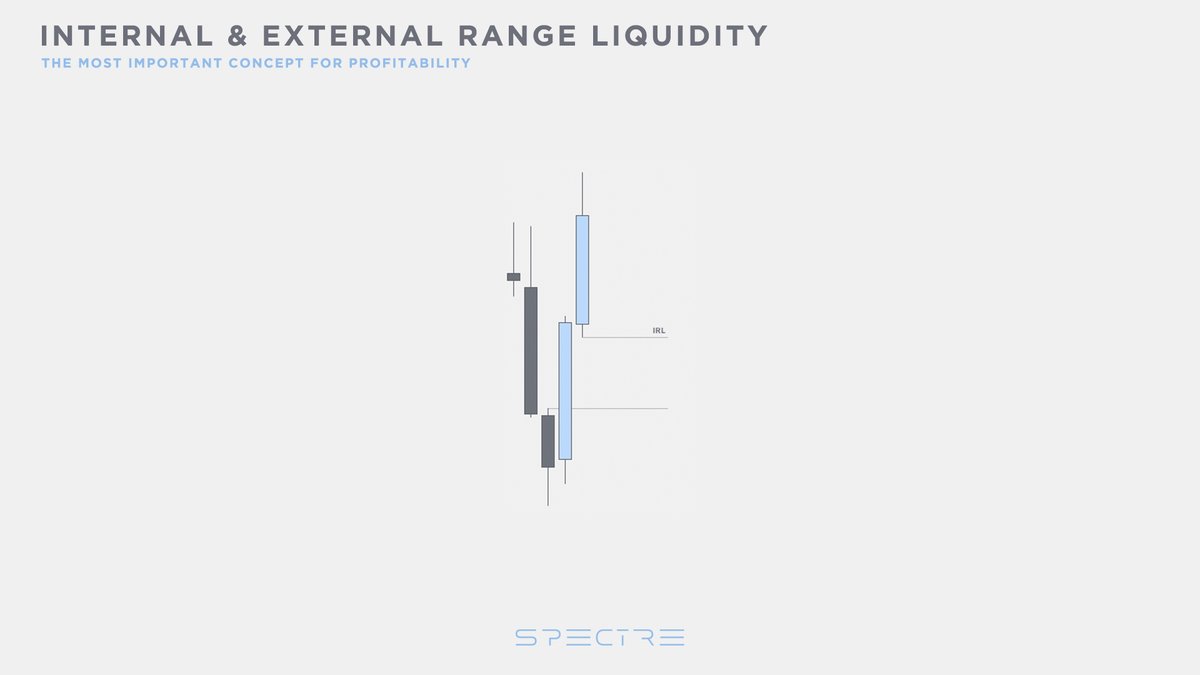

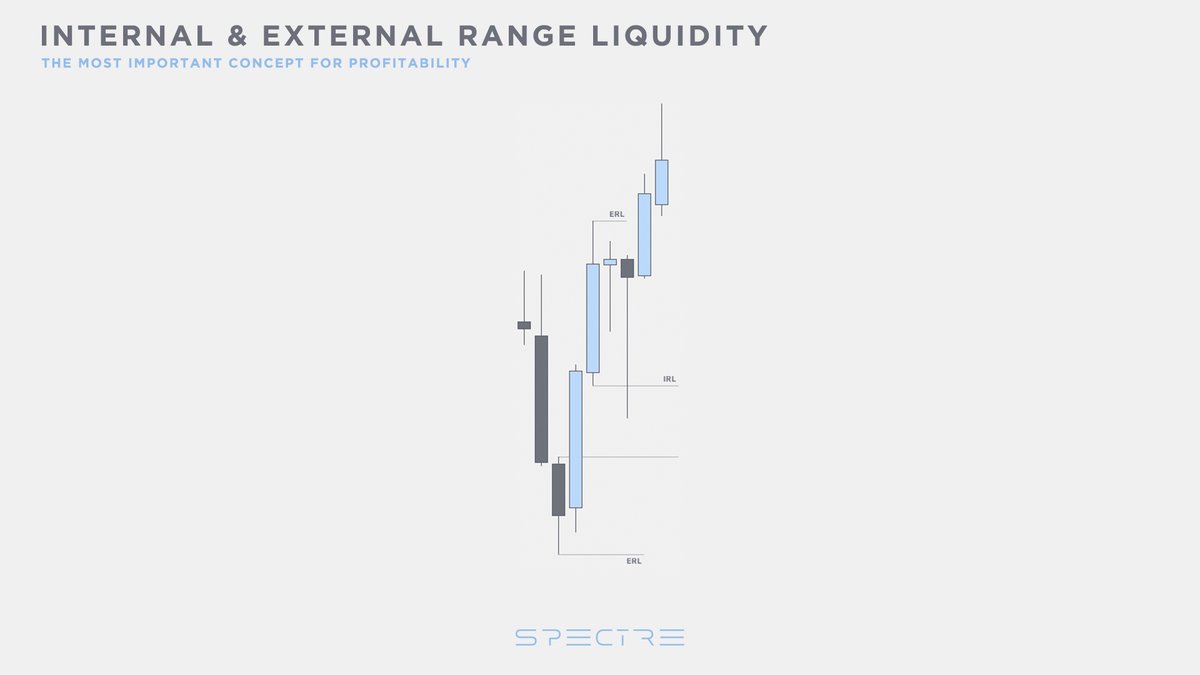

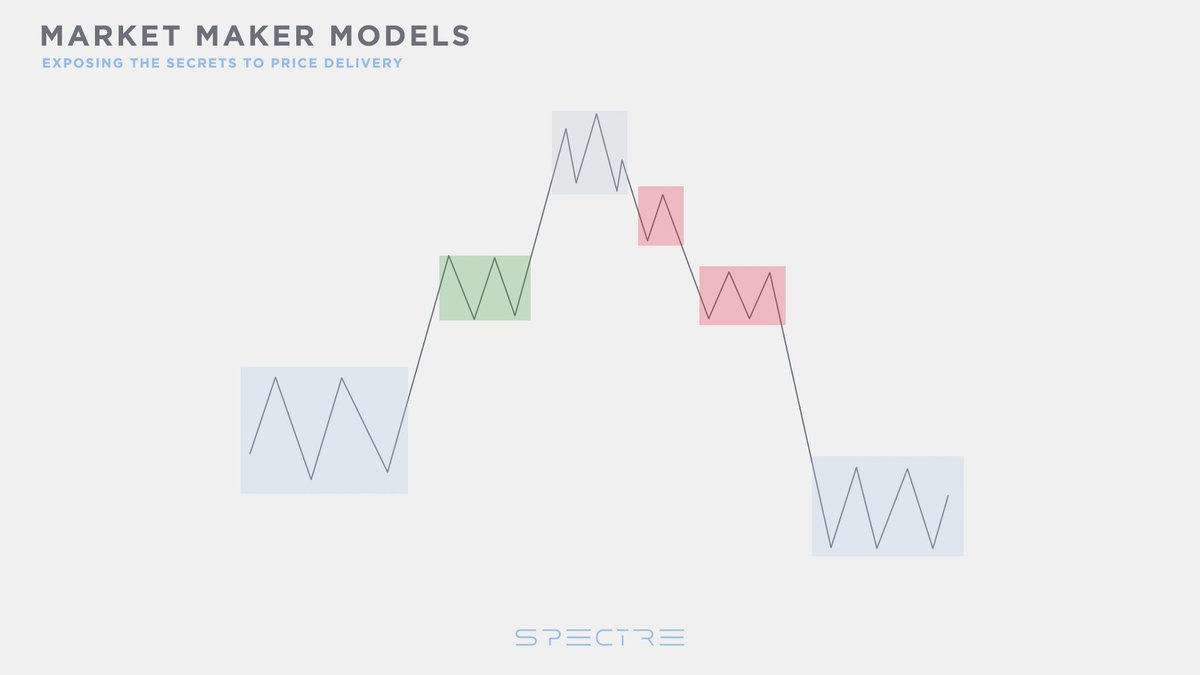

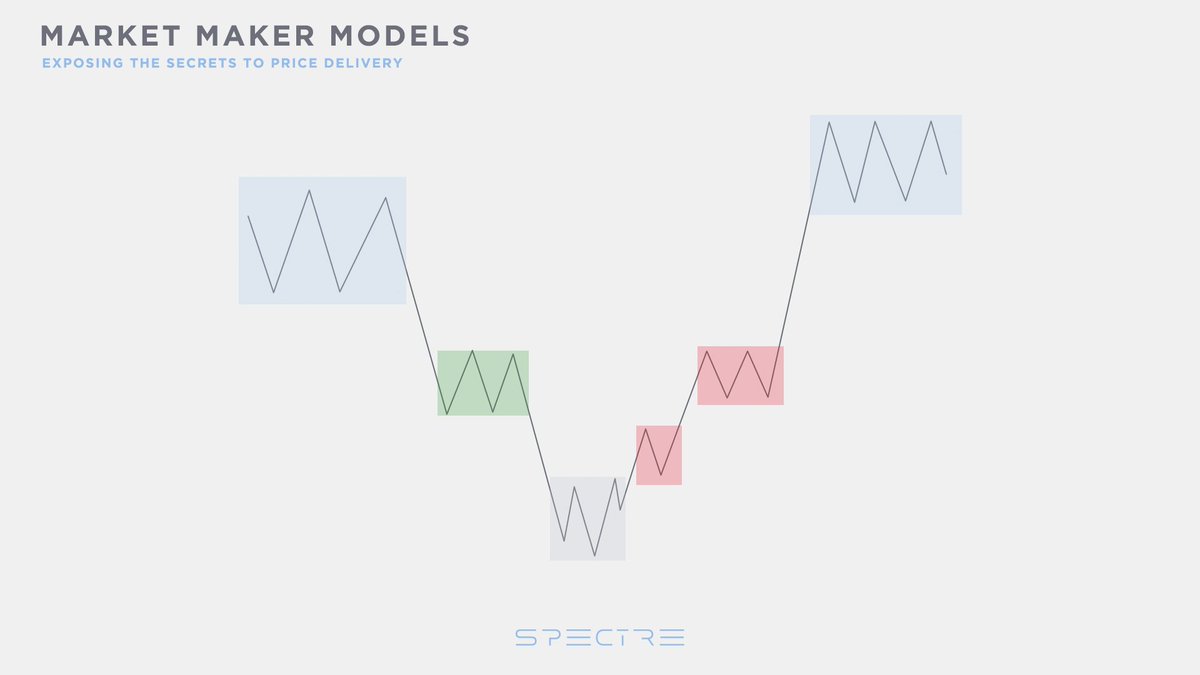

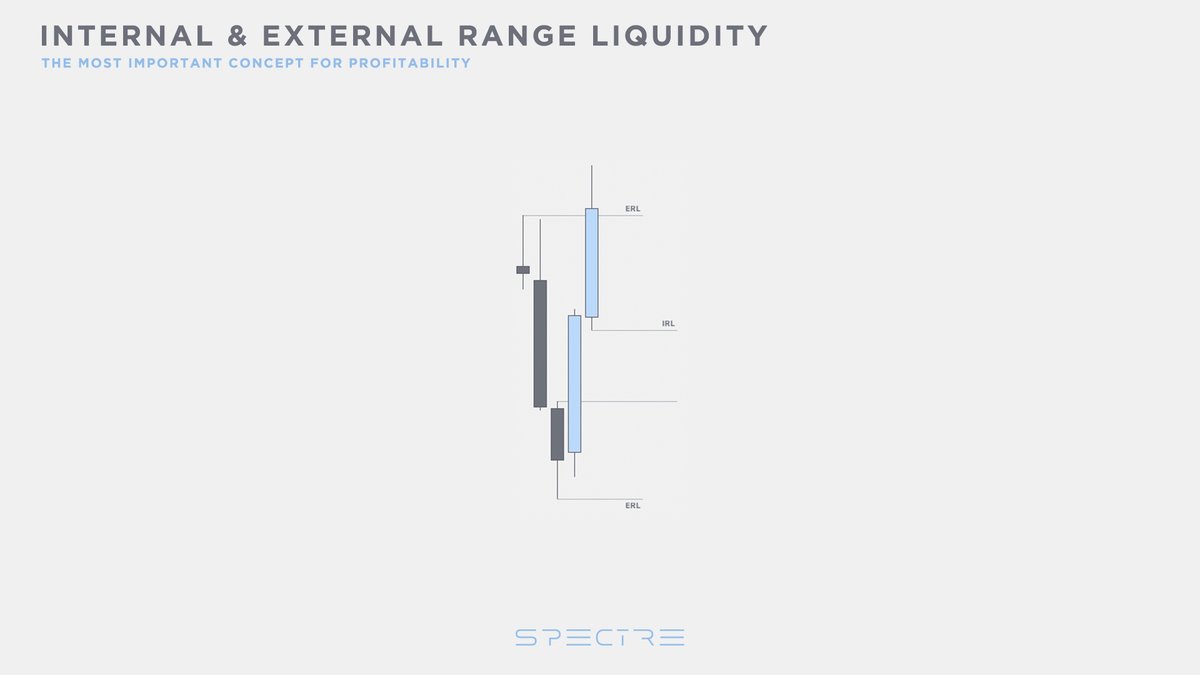

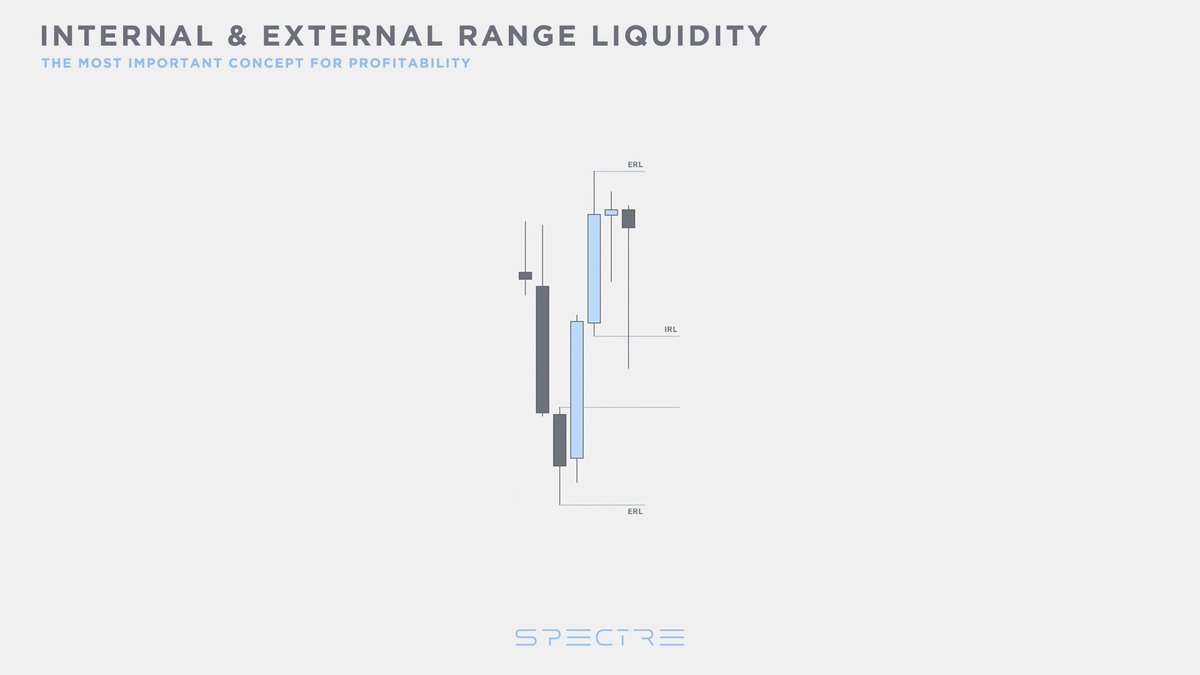

When price takes out an external range liquidity, you should anticipate a return into the range to target internal range liquidity.

Your new external range high now becomes the highest swing high of the range after the internal range liquidity was rebalanced.

Now you should anticipate external range liquidity to be your next target.

Internal ⇒ External.

Now you should anticipate external range liquidity to be your next target.

Internal ⇒ External.

Detailed video explanation 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh