Behind Russia GDP’s 3.5% expansion in 2023 are uncontrolled growth of expenditures, high inflation, distortions in the labor market. Problems will only multiply in the future, as I argue in a @ForeignAffairs piece. THREAD 1/

foreignaffairs.com/russian-federa…

foreignaffairs.com/russian-federa…

2/ Putin faces an impossible trilemma. He must fund the war against Ukraine, maintain the Russian populace’s living standards, and safeguard macroeconomic stability. Achieving all three goals is impossible

3/ For now, high oil&gas revenues, competent financial management by the Russian authorities, and laxed enforcement of Western sanctions play to the Kremlin’s advantage, but they mask growing imbalances in the economy 👇

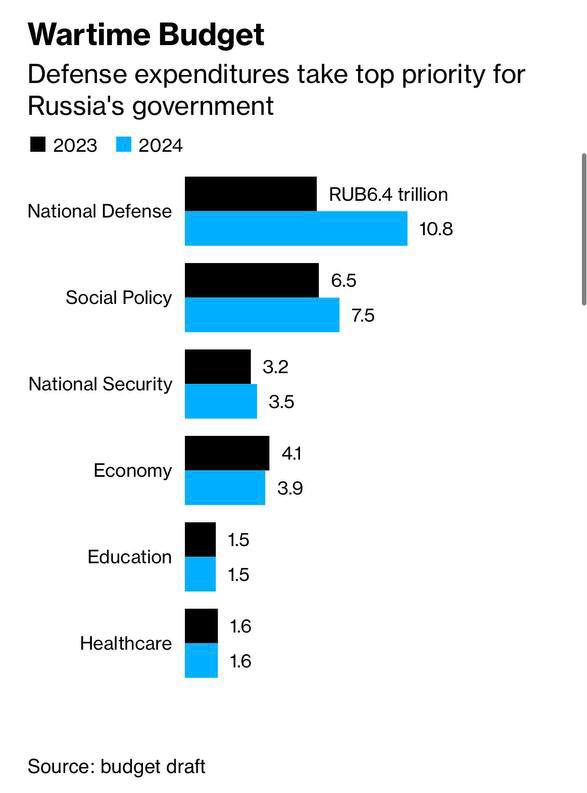

4/Military spending eclipsed social spending—less than 5% of GDP—for the first time in history. $18b state investment to 4 annexed regions of 🇺🇦 ↗️ interregional inequality. 🇷🇺 manufacturing has been transformed, with civilian industries dwarfed by the military-industrial complex

5/ Defense enterprises operate at fever pitch now. Any surge in demand will likely force prices to rise due to the sector’s inability to increase supply. This pushes up wages. For the time being this allows the Kremlin to maintain a pretense of normalcy, but with high inflation

6/The interplay between mil spending, labor shortages& rising wages has created an illusion of prosperity that is unlikely to last. ↗️ wages and state payments => consumption. Putin’s directive to secure availability of consumer goods => imports, discouraging domestic production

7/ The Kremlin’s way to fuel growth by subsidized loans to people and businesses undermine macroeconomic stability. The amount of such loans has exceeded $130 bln (7% of GDP). The mortgage sector is the main liability, as 70% of new credit accounts for soft-loans programs

8/ 🇷🇺 have also become unsustainably reliant on war-related payments. If the war is to end, it will become difficult for many people to service their loans, especially in the face of rising prices. See @WSJ dispatch by @chelseydulaney @georgikantchev

wsj.com/world/russia/r…

wsj.com/world/russia/r…

9/ The interest rate in Russia is 16% now. Businesses and households still continue to borrow, indicating high inflation expectations. @bank_of_russia is unlikely to return the rate to single digits any time soon

10/ Beyond the near-prohibitive cost of borrowing, for the Kremlin, high interest rates constitute an image problem, undermining Putin’s narrative about the stability of the Russian economy. A healthy economy, after all, does not need a double-digit key rate

11/ Volatility of the ruble is also a problem. Left at the mercy of trade flows, the ruble has oscillated between 50 and 100 RUR/$ over just 2 years. A three-digit $ exchange rate not only stokes inflation; it triggers public concern

12/ The authorities cannot remove the main reason for the ruble’s weakening, as they heavily rely on imports. What the Kremlin can do is control over capital flows and manual regulation of prices, triggering cascade of negative effect if the Kremlin uses these tools

13/ Control of prices works here and now, but they do not help against inflation and have negative effects in the long term. Any restriction of supply distorts market mechanisms and signals. More on that in this @FT piece by @NastyaStognei @courtney_ft

ft.com/content/b3206a…

ft.com/content/b3206a…

14/ So far, the situation looks stable in the short term:

gold and yuan reserves allow to finance ext.debt;

🇷🇺low prewar debt-to-GDP means the debt is unlikely to become a risk in upcoming years; turning to domestic market to finance the war is still an option

gold and yuan reserves allow to finance ext.debt;

🇷🇺low prewar debt-to-GDP means the debt is unlikely to become a risk in upcoming years; turning to domestic market to finance the war is still an option

15/ Still, the war has already taken a toll on pillars of policy crucial for macro stability, including the budget rule, freedom of capital flows, and—to some extent—the independence of the central bank. Most of wounds cannot be healed without ending the war and the sanctions

17/ With the war unlikely to end soon, the financial and economic costs will mount and are likely to bite Russia several years from now. My detailed account in @ForeignAffairs: foreignaffairs.com/russian-federa…

• • •

Missing some Tweet in this thread? You can try to

force a refresh