1/ I lost -$700k in a single trade... and I was lucky.

In 2021, it was known as the Widowmaker Trade. The single reason for all the blowups (3AC, Blockfi, Silvergate, FTX).

I even sent an email & had a call about the systemic risk, but the market was pumping, so who cared? Me

In 2021, it was known as the Widowmaker Trade. The single reason for all the blowups (3AC, Blockfi, Silvergate, FTX).

I even sent an email & had a call about the systemic risk, but the market was pumping, so who cared? Me

2/ This is the perspective of an insider that went through this hellhole of a trade, and survived.

At the very end, the trade was net down -38%.. which was probably the best performing fund in the trade.

Some were down >-1,000% their original investmt, and FORCED to repay.

At the very end, the trade was net down -38%.. which was probably the best performing fund in the trade.

Some were down >-1,000% their original investmt, and FORCED to repay.

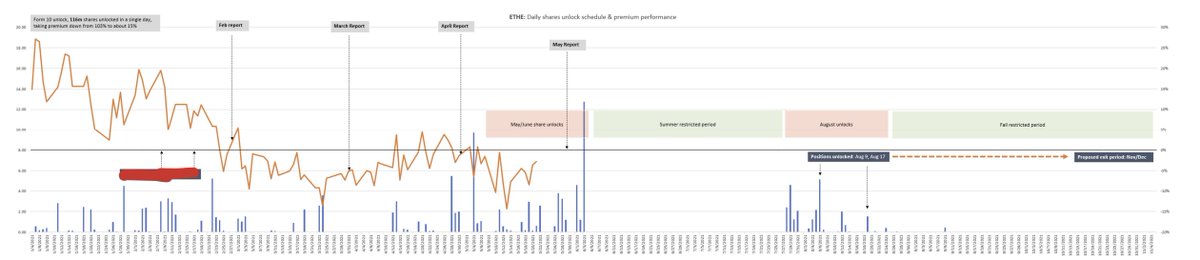

3/ The chart above shows 2 metrics:

The 1) premium or discount, 2) and the shares unlocked.

This is particularly interesting today, because a lot of the unlocks you see this week came from this period where money was locked 2-3 years ago.

It's why the ETF market dumps

The 1) premium or discount, 2) and the shares unlocked.

This is particularly interesting today, because a lot of the unlocks you see this week came from this period where money was locked 2-3 years ago.

It's why the ETF market dumps

4/ So let's start from the very beginning. What the fuck was this trade?

It was well known in the institutional crypto world: Jump, Jane, DRW, etc.

It was this anomaly where GBTC was valued a lot HIGHER than the Bitcoins than it held.

Every 1 BTC was worth 1.3 BTC... huh?

It was well known in the institutional crypto world: Jump, Jane, DRW, etc.

It was this anomaly where GBTC was valued a lot HIGHER than the Bitcoins than it held.

Every 1 BTC was worth 1.3 BTC... huh?

5/ This was because BTC was "hard" to access for a lot of folks

You want BTC? Instead of coinbase, they just bought GBTC shares. So it was a demand vs supply imbalance.

How do we make money here? Well, you give Grayscale a BTC, and then you get back GBTC after 1 year.

You want BTC? Instead of coinbase, they just bought GBTC shares. So it was a demand vs supply imbalance.

How do we make money here? Well, you give Grayscale a BTC, and then you get back GBTC after 1 year.

6/ And then you SELL the GBTC in the equities world.

So if GBTC is a +30% premium.. you make a "free" +30% on top of your BTC.

Of course, as I said, it's a 1 year wait... but the premium had NEVER BEEN NEGATIVE ONCE

And sometimes, the premium went NUTS, like +800% premium

So if GBTC is a +30% premium.. you make a "free" +30% on top of your BTC.

Of course, as I said, it's a 1 year wait... but the premium had NEVER BEEN NEGATIVE ONCE

And sometimes, the premium went NUTS, like +800% premium

7/ So we (& a lot of other people) decided - we should do this trade.

It looks decent enough - we've heard some folks make decent returns on it (15-20x after 1 year).

Most importantly, the duration got cut from 1 year -> 6 months for ETHE (known as a Form 10 update)

It looks decent enough - we've heard some folks make decent returns on it (15-20x after 1 year).

Most importantly, the duration got cut from 1 year -> 6 months for ETHE (known as a Form 10 update)

8/ This is how the trade worked to be "hedged" so you just made USD returns.

> Have $1m in cash

> Deposit that cash, borrow $3m in BTC (Blockfi)

> Deposit $3m in BTC in Grayscale

> Wait 6 months

> ????

> Profit!

So pretty much 30% premium * 3.0 borrow = +90% (less interest)

> Have $1m in cash

> Deposit that cash, borrow $3m in BTC (Blockfi)

> Deposit $3m in BTC in Grayscale

> Wait 6 months

> ????

> Profit!

So pretty much 30% premium * 3.0 borrow = +90% (less interest)

8.1/ 3x the principal was very low compared to the market. We heard that the average on this trade was 5-20x! Jane, Jump, crypto funds, DRW, 3AC.

Yeah crazy, a 5% down payment? Cuz of muh twitter presence? What diligence was this?

We did 3x, one of the lower rates.

Yeah crazy, a 5% down payment? Cuz of muh twitter presence? What diligence was this?

We did 3x, one of the lower rates.

9/ In 2021, I remember everyone asking me "wow Blockfi has high yield! Should I deposit?

In 2021, I remember Wow BTC/ETH are PUMPING! Why did that happen? From $300 ETH to $2000 ETH

>They were both related.

>They both were fueled by the Widowmaker Trade

In 2021, I remember Wow BTC/ETH are PUMPING! Why did that happen? From $300 ETH to $2000 ETH

>They were both related.

>They both were fueled by the Widowmaker Trade

10/ We only did ETHE, and 1-month into the trade.... It happened for the 1st time.

The premium.. was a discount. Remember that math before? Let's switch 1 math symbol....

+30% premium * 3.0 borrow = +90% (less interest)

-30% premium * 3.0 borrow = -90% (less interest)

Fuck.

The premium.. was a discount. Remember that math before? Let's switch 1 math symbol....

+30% premium * 3.0 borrow = +90% (less interest)

-30% premium * 3.0 borrow = -90% (less interest)

Fuck.

11/ FEB '21

Life turned to a living hell. I knew I shoulda stuck with MEVing. I even sold my ETH at $300 for this shit trade

What should have been a very automated trade turned into a verystressedone.

The discount wasnt high yet (-1%) in Feb 2021.. but it was just starting.

Life turned to a living hell. I knew I shoulda stuck with MEVing. I even sold my ETH at $300 for this shit trade

What should have been a very automated trade turned into a verystressedone.

The discount wasnt high yet (-1%) in Feb 2021.. but it was just starting.

12/ The real issue, actually, was actually the interest cost.

Because remember you are borrowing against your cash (this is the undercollateralized)

So not only are you in a loss, but you are now paying interest. You also paying in BTC/ETH interest.

Because remember you are borrowing against your cash (this is the undercollateralized)

So not only are you in a loss, but you are now paying interest. You also paying in BTC/ETH interest.

13/ I called every lender/counterparty who we we were dealing with and BEGGED to get some interest relief. They knew we were (and everyone else in the trade) in the red.

The worst part of all.. ETH was PUMPING. So as ETH went up.. the interest went up too.

The worst part of all.. ETH was PUMPING. So as ETH went up.. the interest went up too.

14/ APRIL '21:

Over the next few months, we got -6% interest -> -4.25% interest payment, on a 3x position (so about -13% total).

We also PREPAID the interest to hedge against the ever pumping ETH-denominated interest cost.

Over the next few months, we got -6% interest -> -4.25% interest payment, on a 3x position (so about -13% total).

We also PREPAID the interest to hedge against the ever pumping ETH-denominated interest cost.

15/ The wait was fucking brutal.

At least we paid for the interest already, and solved that problem.. but now was the bigger issue.

Everyone was making money in DeFi and celebrating.. and we were just glimpsing at our seemingly inevitable demise come summer.

At least we paid for the interest already, and solved that problem.. but now was the bigger issue.

Everyone was making money in DeFi and celebrating.. and we were just glimpsing at our seemingly inevitable demise come summer.

15.1/ May '21 Update: fuck, fuck, fuck. what else can we do?

We even did thse NASDAQ to ETH correlation analyses. WHY IS IT NEGATIVE!!?

We even did thse NASDAQ to ETH correlation analyses. WHY IS IT NEGATIVE!!?

16/ We even tried to figure out how to convert the fucking shares.

So why did the premium turn to a discount?

It was really just a ton of products/knowledge. Folks realized that they should just buy on coinbase, and not with their IRA via GBTC (everyone was online post-covid)

So why did the premium turn to a discount?

It was really just a ton of products/knowledge. Folks realized that they should just buy on coinbase, and not with their IRA via GBTC (everyone was online post-covid)

17/ As shown in the 1st post, we emailed and warned and warned, but nothing mattered.

Everyone was making money, but a lot of people were NOT making money... The very people who originally caused the omega pump

Everyone was making money, but a lot of people were NOT making money... The very people who originally caused the omega pump

18/ Well the day fucking came. My buddy and I got on Tradestation.

The discount? About -4-8%

"Hey why dont we stay in the trade?" an investor asked. "I think it comes back, we're gonna stay in" I heard another fund say.

NO WAY!!! GTFO ASAP!!!

The discount? About -4-8%

"Hey why dont we stay in the trade?" an investor asked. "I think it comes back, we're gonna stay in" I heard another fund say.

NO WAY!!! GTFO ASAP!!!

19/ Every day it vested, we got on, and we sold every share we could.

Unlock, transfer, dump it, telegram msg sale, mark to market disc.

Unlock, transfer, dump it, telegram msg sale, mark to market disc.

Unlock, transfer, dump it, telegram msg sale, mark to market disc.

Unlock, transfer, dump it, telegram msg sale, mark to market disc.

Unlock, transfer, dump it, telegram msg sale, mark to market disc.

Unlock, transfer, dump it, telegram msg sale, mark to market disc.

20/ The market absorbed our ETHE shares quite well. Who tf was buying this? Didnt matter, we got out at -4% discount.

Why didnt we hold? Well I sure as hell aint paying interest?

Then one of the lenders comes back to us.. so hey you wanna try doing this "basis trade"?

Why didnt we hold? Well I sure as hell aint paying interest?

Then one of the lenders comes back to us.. so hey you wanna try doing this "basis trade"?

21/ NO. This fund is done. We arent doing this again. We booked the loss at a total of -38%.

Now that was when the discount was 4-8%

Where did the discount hit at the bottom? -55%

NEGATIVE FIFTY FIVE PERCENT.

Now that was when the discount was 4-8%

Where did the discount hit at the bottom? -55%

NEGATIVE FIFTY FIVE PERCENT.

22/ What would have happened if we kept on going?

>Interest would have piled up (100%)

>ETH could have gone higher (another 10x)

>WE could have borrowed 10x borrow

>The discount could have been -50% (10x current).

>Now multiply that by -1.0

-50% * 10x * 10x - 100%

BANKRUPTCY

>Interest would have piled up (100%)

>ETH could have gone higher (another 10x)

>WE could have borrowed 10x borrow

>The discount could have been -50% (10x current).

>Now multiply that by -1.0

-50% * 10x * 10x - 100%

BANKRUPTCY

23/ We walked away from the SPV.

We got out fast, and tried to minimize damages. We even paid for all the internal things (audit, NAV, etc) out of our own pocket.

We didnt use client money (Blockfi, FTX)

We didnt screw our friends (3AC)

We didnt hide it (all other blowups)

We got out fast, and tried to minimize damages. We even paid for all the internal things (audit, NAV, etc) out of our own pocket.

We didnt use client money (Blockfi, FTX)

We didnt screw our friends (3AC)

We didnt hide it (all other blowups)

24/ In the market today, we are seeing $35bn of GBTC being sold.

It's really the last thing left of the 2020-2021 cycle. It's come full circle. The market is slowly absorbing all this toxic baggage.. but many of the (insti) grifters are gone

It's really the last thing left of the 2020-2021 cycle. It's come full circle. The market is slowly absorbing all this toxic baggage.. but many of the (insti) grifters are gone

25/ No FTX. No overloaded leverage. No systemic risk.

Folks complain about the lack of innovation this cycle.. but I just see an open, innocent plain.

You know what would have solved this? If we just had a fucking redeemable ETF in 2021.

NONE of this would have happened

Folks complain about the lack of innovation this cycle.. but I just see an open, innocent plain.

You know what would have solved this? If we just had a fucking redeemable ETF in 2021.

NONE of this would have happened

26/ hopefully the recently shared story by @cobie and why the $35bn dump makes a bit more sense now.

It's just baggage by a bunch of funds who tried to make money but ultimately created the biggest systemic risk in the market that took down everyone.

It's just baggage by a bunch of funds who tried to make money but ultimately created the biggest systemic risk in the market that took down everyone.

• • •

Missing some Tweet in this thread? You can try to

force a refresh