GMERICA: Saving Humanity, part 7

This post is just my opinion, and I am not a financial advisor. Do your own research.

This is part of a series, see part 6 for context:

Several months ago, I went silent for a period.

I had realized that bad actors were weaponizing the due diligence to be used against the Activist Affiliates, or the good guys that are trying to save humanity.

These bad actors setup a honeypot to lure unsuspecting investors to share their insights, research, and more on public forums which would then be used to short their investment, and meddle in the plans of the good guys.

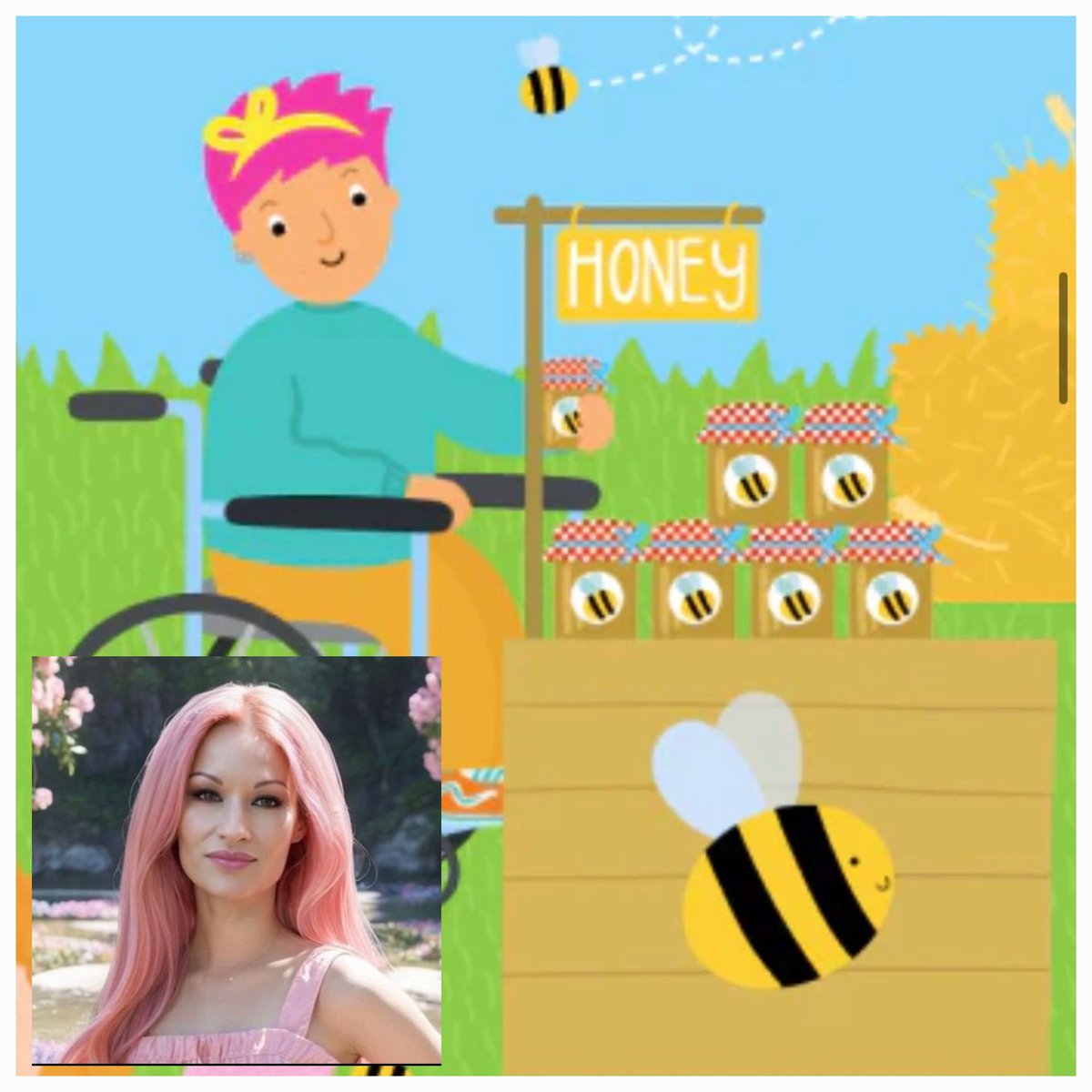

Ryan Cohen, an Activist Investor, Affiliate, and chairman of GameStop is well-aware and that's why he wrote a children's book that is available at

In Teddy books volume 2, he illustrated a pink haired lady who ran a honeypot: Platinum Sparkles of Reddit's popular GameStop forum r/Superstonk.

Now what I am about to show you will confirm that and much, much more.

This post will make you question things and maybe you will even hate me.

But it will be an eye-opener, for sure.

It's time to go under the surface and find out what lies beneath.

There's an entire swamp that must be drained.

And sunlight is the best disinfectant.

There will be no TLDR shorting of this post and I will not failure-to-deliver.

Brace yourself, the best is yet to come.

🕳️……………..🐇

$BBBYQ $GME

#GMERICA 🇺🇸

Teddy.com

This post is just my opinion, and I am not a financial advisor. Do your own research.

This is part of a series, see part 6 for context:

Several months ago, I went silent for a period.

I had realized that bad actors were weaponizing the due diligence to be used against the Activist Affiliates, or the good guys that are trying to save humanity.

These bad actors setup a honeypot to lure unsuspecting investors to share their insights, research, and more on public forums which would then be used to short their investment, and meddle in the plans of the good guys.

Ryan Cohen, an Activist Investor, Affiliate, and chairman of GameStop is well-aware and that's why he wrote a children's book that is available at

In Teddy books volume 2, he illustrated a pink haired lady who ran a honeypot: Platinum Sparkles of Reddit's popular GameStop forum r/Superstonk.

Now what I am about to show you will confirm that and much, much more.

This post will make you question things and maybe you will even hate me.

But it will be an eye-opener, for sure.

It's time to go under the surface and find out what lies beneath.

There's an entire swamp that must be drained.

And sunlight is the best disinfectant.

There will be no TLDR shorting of this post and I will not failure-to-deliver.

Brace yourself, the best is yet to come.

🕳️……………..🐇

$BBBYQ $GME

#GMERICA 🇺🇸

https://x.com/edwinbarnesc/status/1740642928861876229?s=20

Teddy.com

No Cell, No Sell

3 years ago, I bought a stock that I liked.

I held on excitedly as it ripped past $400.

I thought I'd be rich enough to retire my parents who had worked their entire lives.

Sadly, the stock price crashed because they turned off the buy button.

I was shocked, confused, and in utter disbelief.

I remember staring at my brokerage account, then refreshing and thinking it might have glitched.

I kept swiping on my phone, hoping it would change, but reality crept in and confusion turned to outrage.

"There's no way they were gonna get away with this!" or so I thought.

Congress held televised courts, and they questioned:

Keith Gill, or better known by his Reddit username DeepFuckingValue.

Robinhood, the retail broker that turned off the buy button.

Ken Griffin, CEO of Citadel Securities, the market maker that colluded with Robinhood.

Yet, nothing happened.

Nobody went to jail for stealing BILLIONS of dollars from hard-working household retail investors.

It was just smoke and mirrors, and it made my blood boil.

The game was rigged and the referees were in on it.

I vowed then and there that I would hold for justice.

"No Cell, No Sell."

Since they took away the buy button, that just meant delaying the inevitable.

I knew, that one day, MOASS - the Mother of All Short Squeezes would come so until then, I made a promise to keep buying more.

In my frustration and lack of understanding in the stock market, I committed myself to learning it.

Countless hours were invested into studying market mechanics, researching, and occasionally writing due diligence.

At first, I was terrible and was even berated by a well-known DD writer for asking a question once.

Still, I vowed to keep going, keep digging, and sharing whatever I came across with the community.

The more I read, the more I realized, that the American Dream was a lie.

I watched every day as my favorite stock was shorted, mercilessly.

When company earnings were beat, the stock price dropped.

When good news came out, the stock price dropped.

When anything positive came out, the stock price dropped.

The buy vs. sell ratio reported on Fidelity consistently held a 70-80% buy rating.

Yet the stock price kept falling, so how was it even possible?

Because supply and demand did not exist.

There was no such thing as price discovery.

And infinite liquidity, is just money laundering into the hands of a select few.

I found myself in The Matrix and questioned the very existence of my reality.

I loss sleep and loss weight because I couldn't stop thinking about it.

If you fill gas at the pump, who sets the price?

The stock market. 🕳️…….🐇

If you've ever seen "market price" on a restaurant menu, who sets the price?

The stock market. 🕳️…….🐇

If you buy groceries at the store, who sets the price on meat and produce?

The stock market. 🕳️…….🐇

If you pay rent or mortgage, electric, and gas utilities, who sets the price?

The stock market.

The stock market.

And the stock market. 🕳️…….🐇

It controls everything.

So if the stock market controls everything, then it also controls quality of life.

But if the stock market is fake, then so is everything else.

This discovery was unsettling, and it tormented me.

GameStop revealed a crack in the matrix: their infinite money glitch.

What was the point of working if they could just print money?

That's when I realized I was a slave, a cog in their machine.

They don't need money, they just want to enslave humanity.

I was bitter for months because I was in so much shock, denial, anger and more.

I went through the 7 stages of grief but finally reached acceptance.

I continued to question everything.

Thus I began a long journey towards answering One question:

If the stock market were to end one day, then..

What would replace it, who would build it, and how would it come to be?

This formed the basis of my thinking which took form in my writing as GMERICA.

In the darkest of times, I was always reminded by something that gave me hope:

"MOASS is tomorrow."

Like a hero's journey, I embarked, I discovered, and I found.

It has been 3 years, but I am happy to say, this discovery has now been realized.

But before I show you, I have to warn you:

“The Matrix is a system, Neo. That system is our enemy. But when you're inside, you look around, what do you see? Businessmen, teachers, lawyers, carpenters. The very minds of the people we are trying to save. But until we do, these people are still a part of that system and that makes them our enemy. You have to understand, most of these people are not ready to be unplugged. And many of them are so inured, so hopelessly dependent on the system, that they will fight to protect it." -Morpheus

Inured - that's an interesting word, and it means accustomed to abuse kind of like Stockholm syndrome.

Are you prepared to see what happens if you follow the white rabbit? 🕳️…….🐇

Will you accept the truth or will you defend the matrix?

Your thoughts are not yours.

They were programmed into you by mainstream media, by gatekeepers, and through years upon years of conditioning so that you may react, behave, and respond to certain things like:

China.

Russia.

Middle East.

And Donald Trump.

Did you react or feel some type of way from reading that list?

It is called predictive programming, a byproduct-symptom of The Matrix.

And it isn't your fault.

Perhaps you aren't ready.

You can choose to swallow this hard truth and proceed to the next post, or stop and pretend you never saw it.

I will let you decide, if you want to Free your mind.

🕳️…….🐇

3 years ago, I bought a stock that I liked.

I held on excitedly as it ripped past $400.

I thought I'd be rich enough to retire my parents who had worked their entire lives.

Sadly, the stock price crashed because they turned off the buy button.

I was shocked, confused, and in utter disbelief.

I remember staring at my brokerage account, then refreshing and thinking it might have glitched.

I kept swiping on my phone, hoping it would change, but reality crept in and confusion turned to outrage.

"There's no way they were gonna get away with this!" or so I thought.

Congress held televised courts, and they questioned:

Keith Gill, or better known by his Reddit username DeepFuckingValue.

Robinhood, the retail broker that turned off the buy button.

Ken Griffin, CEO of Citadel Securities, the market maker that colluded with Robinhood.

Yet, nothing happened.

Nobody went to jail for stealing BILLIONS of dollars from hard-working household retail investors.

It was just smoke and mirrors, and it made my blood boil.

The game was rigged and the referees were in on it.

I vowed then and there that I would hold for justice.

"No Cell, No Sell."

Since they took away the buy button, that just meant delaying the inevitable.

I knew, that one day, MOASS - the Mother of All Short Squeezes would come so until then, I made a promise to keep buying more.

In my frustration and lack of understanding in the stock market, I committed myself to learning it.

Countless hours were invested into studying market mechanics, researching, and occasionally writing due diligence.

At first, I was terrible and was even berated by a well-known DD writer for asking a question once.

Still, I vowed to keep going, keep digging, and sharing whatever I came across with the community.

The more I read, the more I realized, that the American Dream was a lie.

I watched every day as my favorite stock was shorted, mercilessly.

When company earnings were beat, the stock price dropped.

When good news came out, the stock price dropped.

When anything positive came out, the stock price dropped.

The buy vs. sell ratio reported on Fidelity consistently held a 70-80% buy rating.

Yet the stock price kept falling, so how was it even possible?

Because supply and demand did not exist.

There was no such thing as price discovery.

And infinite liquidity, is just money laundering into the hands of a select few.

I found myself in The Matrix and questioned the very existence of my reality.

I loss sleep and loss weight because I couldn't stop thinking about it.

If you fill gas at the pump, who sets the price?

The stock market. 🕳️…….🐇

If you've ever seen "market price" on a restaurant menu, who sets the price?

The stock market. 🕳️…….🐇

If you buy groceries at the store, who sets the price on meat and produce?

The stock market. 🕳️…….🐇

If you pay rent or mortgage, electric, and gas utilities, who sets the price?

The stock market.

The stock market.

And the stock market. 🕳️…….🐇

It controls everything.

So if the stock market controls everything, then it also controls quality of life.

But if the stock market is fake, then so is everything else.

This discovery was unsettling, and it tormented me.

GameStop revealed a crack in the matrix: their infinite money glitch.

What was the point of working if they could just print money?

That's when I realized I was a slave, a cog in their machine.

They don't need money, they just want to enslave humanity.

I was bitter for months because I was in so much shock, denial, anger and more.

I went through the 7 stages of grief but finally reached acceptance.

I continued to question everything.

Thus I began a long journey towards answering One question:

If the stock market were to end one day, then..

What would replace it, who would build it, and how would it come to be?

This formed the basis of my thinking which took form in my writing as GMERICA.

In the darkest of times, I was always reminded by something that gave me hope:

"MOASS is tomorrow."

Like a hero's journey, I embarked, I discovered, and I found.

It has been 3 years, but I am happy to say, this discovery has now been realized.

But before I show you, I have to warn you:

“The Matrix is a system, Neo. That system is our enemy. But when you're inside, you look around, what do you see? Businessmen, teachers, lawyers, carpenters. The very minds of the people we are trying to save. But until we do, these people are still a part of that system and that makes them our enemy. You have to understand, most of these people are not ready to be unplugged. And many of them are so inured, so hopelessly dependent on the system, that they will fight to protect it." -Morpheus

Inured - that's an interesting word, and it means accustomed to abuse kind of like Stockholm syndrome.

Are you prepared to see what happens if you follow the white rabbit? 🕳️…….🐇

Will you accept the truth or will you defend the matrix?

Your thoughts are not yours.

They were programmed into you by mainstream media, by gatekeepers, and through years upon years of conditioning so that you may react, behave, and respond to certain things like:

China.

Russia.

Middle East.

And Donald Trump.

Did you react or feel some type of way from reading that list?

It is called predictive programming, a byproduct-symptom of The Matrix.

And it isn't your fault.

Perhaps you aren't ready.

You can choose to swallow this hard truth and proceed to the next post, or stop and pretend you never saw it.

I will let you decide, if you want to Free your mind.

🕳️…….🐇

Sunlight Is The Best Disinfectant

Throughout this saga, there have been many bad actors and they are still among us.

They continue to hold positions of authority, on manufactured credibility, and propped up reputation.

These bad actors continue to rub shoulders with respected community members and some knowingly participate, while others turn a blind eye.

Now, I have tried to avoid this, but I see that without addressing it then this community cannot unite.

I only offer supporting evidence from my discoveries.

Remember, you chose to continue and pursue the truth so I will deliver.

However, I will say one thing: it will bring peace of mind for many to see where certain allegiance is placed.

To start, Reddit is a swamp that must be drained.

The Humiliation brought on by Jeffrey Epstein, convicted pedophile, and his list of pedophiles which names many prominent figures is at the center of what's wrong with the world today.

Epstein is directly related to the stock market and explains why your favorite stock has been naked shorted into a cellar box. (This will make sense in a moment)

For those out of the loop, Epstein was an intelligence agent working for Israel's MOSSAD (with direct ties to CIA) and he ran blackmail operations on the world' elites, royalty, celebrities, presidents, and Congress, involving kidnapped children for sex trafficking.

This is all public information now.

Ghislaine Maxwell was Epstein's handler and she was the real one pulling the strings. She learned from her father, Robert Maxwell, who ran a media empire and was a super-spy for MOSSAD.

In a detailed post, it was discovered that Ghislaine Maxwell ran an account on Reddit where she controlled a majority of all popular sub-Reddits under the moniker u/MaxwellHill.

She was also the first user in Reddit history to reach 1 million karma and not by accident.

Here's the sauce:

This explains for the popular GameStop forum r/Superstonk, the moderators like Platnum Sparkles, and Satori bot that collects information about unsuspecting investors, due diligence, and market sentiment.

The data collected is then sent to the shorting hedge funds to anticipate what retail investors will do, on any given day, and at any time.

The early moderators of Superstonk let slip that they were involved in some intelligence circles, which now makes sense (see the Highlight post on my X profile).

Superstonk is a honeypot and Ryan Cohen has illustrated that in books.

In GMERICA part 6, I revealed how Fidelity shorted GameStop and knew exactly when to turn it off.

Strange, right?

They always know when to short your stock, because retail investors provide the information via honey pot.

And do you recall the endless stock option posts that would pump before each hype date?

I used to defend stock options and even played some of those until I figured it out myself, but no more.

They pump, monitor Reddit, then rug pull and generate liquidity to keep shorting.

What makes it worse is when retail investors do not direct register shares, because every buy order for a share that is placed through a broker generates a phantom share, or commonly known as a synthetic share.

These synthetic shares are estimated to be in the billions for $GME and $BBBYQ, and the process enables failure-to-deliver shares, continuous net settlement can-kicking, and merciless naked shorting.

Their goal is to never close their short position, and to drive a company into bankruptcy thus cellar box.

Basically, retail is helping short its own investment unless they enter the Direct Registration System with Book-Entry form (learn ).

That is a fact, and why the SEC has officially confirmed shares held at brokerage are in street name which basically means you don't actually own your shares until you DRS.

At some point, you must have wondered, if they were shorting your beloved stock and making profit then where was the money going?

It's easy, just follow the money.

Or look at it this way, where do hedge funds get their money?

Last I recall, Michael Jordan was forced to sell his stake in Charlotte Hornets basketball team because Gabe Plotkin, using Jordan's money, mismanaged it trying to short GameStop with $7 Billion in total losses.

And how about all those tracked flights that Ken Griffin took to the lands of sovereign wealth and oligarchs?

Celebrities, politicians, billionaires, sovereign wealth funds, and Epstein.

It is all connected to GameStop, but more specifically, shorting companies into a cellar box.

Now the tides have turned with Bed Bath & Beyond, the ultimate anti-cellar boxing and reverse uno squeeze play.

In part 6, I showed evidence of a mounting RICO case that is being backed by the Department of Justice. In a RICO case, anyone found guilty, including co-conspirators like shills will forfeit their shares and face the crime.

Talking about shills, there was a fake DD writer named Neelay Das that rose to prominence on r/BBBY and is currently attempting to stall Bed Bath & Beyond from emerging out of chapter 11 courts.

What's interesting about Neelay Das is that he worked for Aricent/Altran which merged with Capgemini, a member of World Economic Forum or WEF, the same folks that said you'll own nothing and be happy.

That information about Neelay Das is available from his public profile on LinkedIn (although he might scrub it after this).

Time and again, these fake DD writers and shill agents have worked ruthlessly across Reddit in all major stock forums that Ryan Cohen has invested into by controlling narrative, shaping public opinions, and turning the community against each other.

Needless to say, they even attempted to recruit me, and on more than one occasion.

Last time was through Dr Eyeball, the current moderator of r/BBBY, a shill infested swamp for Bed Bath & Beyond discussion.

Dr Eyeball made a power move to control all Bed Bath & Beyond sub-Reddits, because he is motivated to gather data to report back to his shorting hedge fund friends on how to counter the Activist Affiliates.

Neelay Das used parts from my due diligence in his court battle against Bed Bath & Beyond, and now it's logged in the court dockets.

Dr Eyeball has coerced several Reddit users that were moderators of r/Teddy, r/Bobbystock, and many more to give up control to him.

Dr Eyeball has been very deliberate about his desire to control, consolidate, and manipulate.

This has led to the deletion of the popular BBBY sub-Reddit r/PPSeedsShow since the sub was a rogue forum board not under the direct control of a shill operative.

Upon deleting r/PPSeedsShow they have invited ex-members to r/Teddy which is now under control of Dr Eyeball.

Which begs the question: who supported the move to r/Teddy?

That should reveal a lot, and Pulte knows, which means Ryan Cohen knows.

Nothing is what it seems, initially.

The Storm is coming.

Are you buckled up?

🕳️….🐇

Teddy.com

whyDRS.org

Throughout this saga, there have been many bad actors and they are still among us.

They continue to hold positions of authority, on manufactured credibility, and propped up reputation.

These bad actors continue to rub shoulders with respected community members and some knowingly participate, while others turn a blind eye.

Now, I have tried to avoid this, but I see that without addressing it then this community cannot unite.

I only offer supporting evidence from my discoveries.

Remember, you chose to continue and pursue the truth so I will deliver.

However, I will say one thing: it will bring peace of mind for many to see where certain allegiance is placed.

To start, Reddit is a swamp that must be drained.

The Humiliation brought on by Jeffrey Epstein, convicted pedophile, and his list of pedophiles which names many prominent figures is at the center of what's wrong with the world today.

Epstein is directly related to the stock market and explains why your favorite stock has been naked shorted into a cellar box. (This will make sense in a moment)

For those out of the loop, Epstein was an intelligence agent working for Israel's MOSSAD (with direct ties to CIA) and he ran blackmail operations on the world' elites, royalty, celebrities, presidents, and Congress, involving kidnapped children for sex trafficking.

This is all public information now.

Ghislaine Maxwell was Epstein's handler and she was the real one pulling the strings. She learned from her father, Robert Maxwell, who ran a media empire and was a super-spy for MOSSAD.

In a detailed post, it was discovered that Ghislaine Maxwell ran an account on Reddit where she controlled a majority of all popular sub-Reddits under the moniker u/MaxwellHill.

She was also the first user in Reddit history to reach 1 million karma and not by accident.

Here's the sauce:

This explains for the popular GameStop forum r/Superstonk, the moderators like Platnum Sparkles, and Satori bot that collects information about unsuspecting investors, due diligence, and market sentiment.

The data collected is then sent to the shorting hedge funds to anticipate what retail investors will do, on any given day, and at any time.

The early moderators of Superstonk let slip that they were involved in some intelligence circles, which now makes sense (see the Highlight post on my X profile).

Superstonk is a honeypot and Ryan Cohen has illustrated that in books.

In GMERICA part 6, I revealed how Fidelity shorted GameStop and knew exactly when to turn it off.

Strange, right?

They always know when to short your stock, because retail investors provide the information via honey pot.

And do you recall the endless stock option posts that would pump before each hype date?

I used to defend stock options and even played some of those until I figured it out myself, but no more.

They pump, monitor Reddit, then rug pull and generate liquidity to keep shorting.

What makes it worse is when retail investors do not direct register shares, because every buy order for a share that is placed through a broker generates a phantom share, or commonly known as a synthetic share.

These synthetic shares are estimated to be in the billions for $GME and $BBBYQ, and the process enables failure-to-deliver shares, continuous net settlement can-kicking, and merciless naked shorting.

Their goal is to never close their short position, and to drive a company into bankruptcy thus cellar box.

Basically, retail is helping short its own investment unless they enter the Direct Registration System with Book-Entry form (learn ).

That is a fact, and why the SEC has officially confirmed shares held at brokerage are in street name which basically means you don't actually own your shares until you DRS.

At some point, you must have wondered, if they were shorting your beloved stock and making profit then where was the money going?

It's easy, just follow the money.

Or look at it this way, where do hedge funds get their money?

Last I recall, Michael Jordan was forced to sell his stake in Charlotte Hornets basketball team because Gabe Plotkin, using Jordan's money, mismanaged it trying to short GameStop with $7 Billion in total losses.

And how about all those tracked flights that Ken Griffin took to the lands of sovereign wealth and oligarchs?

Celebrities, politicians, billionaires, sovereign wealth funds, and Epstein.

It is all connected to GameStop, but more specifically, shorting companies into a cellar box.

Now the tides have turned with Bed Bath & Beyond, the ultimate anti-cellar boxing and reverse uno squeeze play.

In part 6, I showed evidence of a mounting RICO case that is being backed by the Department of Justice. In a RICO case, anyone found guilty, including co-conspirators like shills will forfeit their shares and face the crime.

Talking about shills, there was a fake DD writer named Neelay Das that rose to prominence on r/BBBY and is currently attempting to stall Bed Bath & Beyond from emerging out of chapter 11 courts.

What's interesting about Neelay Das is that he worked for Aricent/Altran which merged with Capgemini, a member of World Economic Forum or WEF, the same folks that said you'll own nothing and be happy.

That information about Neelay Das is available from his public profile on LinkedIn (although he might scrub it after this).

Time and again, these fake DD writers and shill agents have worked ruthlessly across Reddit in all major stock forums that Ryan Cohen has invested into by controlling narrative, shaping public opinions, and turning the community against each other.

Needless to say, they even attempted to recruit me, and on more than one occasion.

Last time was through Dr Eyeball, the current moderator of r/BBBY, a shill infested swamp for Bed Bath & Beyond discussion.

Dr Eyeball made a power move to control all Bed Bath & Beyond sub-Reddits, because he is motivated to gather data to report back to his shorting hedge fund friends on how to counter the Activist Affiliates.

Neelay Das used parts from my due diligence in his court battle against Bed Bath & Beyond, and now it's logged in the court dockets.

Dr Eyeball has coerced several Reddit users that were moderators of r/Teddy, r/Bobbystock, and many more to give up control to him.

Dr Eyeball has been very deliberate about his desire to control, consolidate, and manipulate.

This has led to the deletion of the popular BBBY sub-Reddit r/PPSeedsShow since the sub was a rogue forum board not under the direct control of a shill operative.

Upon deleting r/PPSeedsShow they have invited ex-members to r/Teddy which is now under control of Dr Eyeball.

Which begs the question: who supported the move to r/Teddy?

That should reveal a lot, and Pulte knows, which means Ryan Cohen knows.

Nothing is what it seems, initially.

The Storm is coming.

Are you buckled up?

🕳️….🐇

https://x.com/SamParkerSenate/status/1742933840585502810?s=20

Teddy.com

whyDRS.org

The Best Is Yet To Come

Throughout this saga, there have been memes, clues, and symbols.

So many symbols.

If you go back and review tweets by Ryan Cohen or read through books, then you will find them.

It's all there.

You can then trace them on EDGAR for SEC company filings and discover the work in-progress by the Activist Affiliates, a team including Ryan Cohen that wants to save humanity.

I began writing about GMERICA on October 16, 2022 after receiving 10x platinum awards on a comment I made on r/Superstonk where moderators were actively censoring discussion about $GME and $BBBY.

Here's that comment:

Someone wanted me to look into the connection between those 2 companies, so I did.

The following day, Ryan Cohen tweeted a picture of himself with Carl Icahn, the OG Activist Investor.

Following that tweet, my research intensified and the very first post of GMERICA went live.

On November 23, 2022, Ryan Cohen tweeted an illustrated picture of Teddy, which is Ryan Cohen's late father, and about Teddy making thanksgiving great again.

That tweet was unique because the illustration used was not from inside Teddy books, instead it was custom-made for Ryan Cohen to tweet.

That's how I was able to first discover Bed Bath & Beyond connections to Proskauer Rose, Icahn Enterprises, Sixth Street ($BBBYQ DIP Agent), Hudson Bay Capital, and many more.

"Every detail matters" -Ryan Cohen, interview.

One discovery led to another clue involving GameStop and Bed Bath & Beyond.

It was all interconnected because of a children's book called Teddy, and Ryan Cohen.

I have detailed my discoveries in a series labeled under GMERICA in chronological order as information became available (see my profile pinned post).

Now, let's turn it up and start with social trading brokerage, eToro.

On April 14, 2023, then-CEO Sue Gove of Bed Bath & Beyond conducted a live interview with an eToro representative.

Here's the interview:

What was odd about that interview was that Bed Bath & Beyond had just received a delisting notice from NASDAQ, the CEO was out giving interviews like it was a good thing, and the interview required approval of the SEC.

None of it made sense at the time. (But will, in just a moment)

As it turns out, there was a SPAC that wanted to take eToro public in 2022 and it was initiated by Betsy Z. Cohen, a SPAC Queen and highly successful business tycoon in banking, real estate, oil & gas, and more.

In 1974, she was the first female bank CEO in Pennsylvania and one of the nation’s first female bank CEOs. She received a bank charter and started Jefferson Bank which was later sold, then she moved on to create another bank called The Bancorp which now funds many of her enterprises, SPACs, and other businesses.

If anyone knows how to setup a bank, it's Betsy Cohen.

Furthermore, she also invested into PayPal by providing banking solutions via Bancorp and supported PayPal in offering peer-to-peer (P2P) payments, or sending money to a friend.

Worth mentioning: Elon Musk and Peter Thiel founded PayPal by combining with to create it. After selling PayPal to Ebay in 2002, the two went their separate ways. However, Elon retained and has replaced Twitter with it. Elon has always wanted to make X the everything app and soon he will.

Moving on, Betsy Cohen has provided much needed banking services to financial technology or FinTech companies so she's very familiar with digital payment infrastructure and borderless payment gateways.

Betsy has a son and his name is Daniel G. Cohen and together they took Perella Weinberg Partners (PWP) public via a SPAC IPO on June 25, 2021. PWP is a global financial services firm focused on investment banking advisory services.

Perella Weinberg acted as GameStop's financial advisor in 2018 when the company was exploring a possible sale and was evaluated by Apollo Global Management (cellar boxers) and Sycamore Partners (identified as an Interested Party in $BBBYQ chapter 11).

Furthermore, PWP has worked with Carl Icahn during Clorox takeover in 2011 and with Jefferies, the investment bank.

Daniel Cohen is a board member on Perella Weinberg which means he is likely aware of $GME getting cellar boxed since the events that follow happened to line up with January 2021's "fake squeeze" or known as the sneeze event.

Betsy and Daniel Cohen are a family in business together, including Betsy's husband Edward Cohen and other son, Jonathan Cohen.

They've created multiple holding companies, which include Cohen & Company, Cohen Circle, Resource America, and Atlas Energy Group.

Cohen & Company, Inc. is a publicly traded company listed on the NYSE as $COHN. It is an asset management business which means it buys debt and collects money from interest payments.

They also focus on capital markets through their subsidiary JVB Financial Group LLC, a lender for securities and debt financing like mortgage-backed securities, collateralized debt obligations (CDOs), U.S. government bonds, and much more.

On the other hand, Cohen Circle is a venture capital firm that invests into financial service companies including Payoneer, a global payment processing company focused on borderless payments.

Prior to becoming a venture capital firm, Cohen Circle was a leading SPAC firm that took many companies public via SPAC IPOs and reverse-mergers like Perella Weinberg Partners, and almost did it for eToro but held-off.

As for the other company, Resource America, that is a real estate holding company that purchases distressed properties at a great value buy.

Inside Resource America, there is a senior manager named Alan F. Feldman, he was the VP of Lazard.

If you recall in my prior DD writings, Lazard created the Dealer Manager Agreement (DMA) in October 2022 which secretly binds all the Activist Affiliates together and is the stalking horse bidder that has acquired buybuyBABY from Bed Bath & Beyond under chapter 11 as of September 29, 2023, but has yet to announce publicly.

Read about the DMA here:

And lastly, there is Atlas Energy Group, run by Edward and Jonathan Cohen. The company acquires land rights for oil & gas and they have identified Marcellus Shale, a type of sedimentary rock that houses natural gas in the Appalachian Basin.

What's interesting about Atlas is that it holds energy rights and properties in Virginia, which cohencidentally matches an investment in the same location by Ryan Cohen via RC Ventures LLC, in an oil & gas company called CoJax Oil & Gas.

If you are confused as to why I mention: banking, real estate, oil & gas -- is because these are the pre-requisites to create a megacorp holding company like Carl Icahn's $IEP and is a glimpse of the future, Teddy corporation.

Forming a mega corporation, or officially structured as a Master Limited Partnership (MLP) is extremely difficult since there are strict SEC requirements, tax laws, and federal regulations according to Investopedia.

In an MLP, there are (1) Limited Partners, or public investors that receive units instead of stocks, and (2) General Partners who are the owners that manage day-to-day operations.

The general partners receive compensation based on the business performance, which basically means they don't eat unless everyone else eats.

"MLPs are considered low-risk, long-term investments, providing a slow but steady income stream," and that translates into: we're going to be rich like Coca-Cola, Quincy, Florida rich (look it up).

This explains why Carl Icahn takes his compensation in units and not cash during dividend payouts. He puts his money where his mouth is, so Hindenburg Research: Go Fuck Yourself.

Since an MLP's publicly traded units are not stock shares, those who invest in MLPs are commonly referred to as unitholders, rather than shareholders.

(I'd like to refer to these future unithodlers as GMERICANs, if I may.)

On a related note: Ryan Cohen once tweeted, "No overpaid execs in the metaverse" and I-cahn see what he meant by that.

There will be investors (limited partners) and business operators (general partners) running each company and division under Teddy megacorp.

"Work is so sexy" -Ryan CohenTeddy.com

archive.is/E0cyJ

GMEdd.com

X.com

Confinity.com

X.com

Throughout this saga, there have been memes, clues, and symbols.

So many symbols.

If you go back and review tweets by Ryan Cohen or read through books, then you will find them.

It's all there.

You can then trace them on EDGAR for SEC company filings and discover the work in-progress by the Activist Affiliates, a team including Ryan Cohen that wants to save humanity.

I began writing about GMERICA on October 16, 2022 after receiving 10x platinum awards on a comment I made on r/Superstonk where moderators were actively censoring discussion about $GME and $BBBY.

Here's that comment:

Someone wanted me to look into the connection between those 2 companies, so I did.

The following day, Ryan Cohen tweeted a picture of himself with Carl Icahn, the OG Activist Investor.

Following that tweet, my research intensified and the very first post of GMERICA went live.

On November 23, 2022, Ryan Cohen tweeted an illustrated picture of Teddy, which is Ryan Cohen's late father, and about Teddy making thanksgiving great again.

That tweet was unique because the illustration used was not from inside Teddy books, instead it was custom-made for Ryan Cohen to tweet.

That's how I was able to first discover Bed Bath & Beyond connections to Proskauer Rose, Icahn Enterprises, Sixth Street ($BBBYQ DIP Agent), Hudson Bay Capital, and many more.

"Every detail matters" -Ryan Cohen, interview.

One discovery led to another clue involving GameStop and Bed Bath & Beyond.

It was all interconnected because of a children's book called Teddy, and Ryan Cohen.

I have detailed my discoveries in a series labeled under GMERICA in chronological order as information became available (see my profile pinned post).

Now, let's turn it up and start with social trading brokerage, eToro.

On April 14, 2023, then-CEO Sue Gove of Bed Bath & Beyond conducted a live interview with an eToro representative.

Here's the interview:

What was odd about that interview was that Bed Bath & Beyond had just received a delisting notice from NASDAQ, the CEO was out giving interviews like it was a good thing, and the interview required approval of the SEC.

None of it made sense at the time. (But will, in just a moment)

As it turns out, there was a SPAC that wanted to take eToro public in 2022 and it was initiated by Betsy Z. Cohen, a SPAC Queen and highly successful business tycoon in banking, real estate, oil & gas, and more.

In 1974, she was the first female bank CEO in Pennsylvania and one of the nation’s first female bank CEOs. She received a bank charter and started Jefferson Bank which was later sold, then she moved on to create another bank called The Bancorp which now funds many of her enterprises, SPACs, and other businesses.

If anyone knows how to setup a bank, it's Betsy Cohen.

Furthermore, she also invested into PayPal by providing banking solutions via Bancorp and supported PayPal in offering peer-to-peer (P2P) payments, or sending money to a friend.

Worth mentioning: Elon Musk and Peter Thiel founded PayPal by combining with to create it. After selling PayPal to Ebay in 2002, the two went their separate ways. However, Elon retained and has replaced Twitter with it. Elon has always wanted to make X the everything app and soon he will.

Moving on, Betsy Cohen has provided much needed banking services to financial technology or FinTech companies so she's very familiar with digital payment infrastructure and borderless payment gateways.

Betsy has a son and his name is Daniel G. Cohen and together they took Perella Weinberg Partners (PWP) public via a SPAC IPO on June 25, 2021. PWP is a global financial services firm focused on investment banking advisory services.

Perella Weinberg acted as GameStop's financial advisor in 2018 when the company was exploring a possible sale and was evaluated by Apollo Global Management (cellar boxers) and Sycamore Partners (identified as an Interested Party in $BBBYQ chapter 11).

Furthermore, PWP has worked with Carl Icahn during Clorox takeover in 2011 and with Jefferies, the investment bank.

Daniel Cohen is a board member on Perella Weinberg which means he is likely aware of $GME getting cellar boxed since the events that follow happened to line up with January 2021's "fake squeeze" or known as the sneeze event.

Betsy and Daniel Cohen are a family in business together, including Betsy's husband Edward Cohen and other son, Jonathan Cohen.

They've created multiple holding companies, which include Cohen & Company, Cohen Circle, Resource America, and Atlas Energy Group.

Cohen & Company, Inc. is a publicly traded company listed on the NYSE as $COHN. It is an asset management business which means it buys debt and collects money from interest payments.

They also focus on capital markets through their subsidiary JVB Financial Group LLC, a lender for securities and debt financing like mortgage-backed securities, collateralized debt obligations (CDOs), U.S. government bonds, and much more.

On the other hand, Cohen Circle is a venture capital firm that invests into financial service companies including Payoneer, a global payment processing company focused on borderless payments.

Prior to becoming a venture capital firm, Cohen Circle was a leading SPAC firm that took many companies public via SPAC IPOs and reverse-mergers like Perella Weinberg Partners, and almost did it for eToro but held-off.

As for the other company, Resource America, that is a real estate holding company that purchases distressed properties at a great value buy.

Inside Resource America, there is a senior manager named Alan F. Feldman, he was the VP of Lazard.

If you recall in my prior DD writings, Lazard created the Dealer Manager Agreement (DMA) in October 2022 which secretly binds all the Activist Affiliates together and is the stalking horse bidder that has acquired buybuyBABY from Bed Bath & Beyond under chapter 11 as of September 29, 2023, but has yet to announce publicly.

Read about the DMA here:

And lastly, there is Atlas Energy Group, run by Edward and Jonathan Cohen. The company acquires land rights for oil & gas and they have identified Marcellus Shale, a type of sedimentary rock that houses natural gas in the Appalachian Basin.

What's interesting about Atlas is that it holds energy rights and properties in Virginia, which cohencidentally matches an investment in the same location by Ryan Cohen via RC Ventures LLC, in an oil & gas company called CoJax Oil & Gas.

If you are confused as to why I mention: banking, real estate, oil & gas -- is because these are the pre-requisites to create a megacorp holding company like Carl Icahn's $IEP and is a glimpse of the future, Teddy corporation.

Forming a mega corporation, or officially structured as a Master Limited Partnership (MLP) is extremely difficult since there are strict SEC requirements, tax laws, and federal regulations according to Investopedia.

In an MLP, there are (1) Limited Partners, or public investors that receive units instead of stocks, and (2) General Partners who are the owners that manage day-to-day operations.

The general partners receive compensation based on the business performance, which basically means they don't eat unless everyone else eats.

"MLPs are considered low-risk, long-term investments, providing a slow but steady income stream," and that translates into: we're going to be rich like Coca-Cola, Quincy, Florida rich (look it up).

This explains why Carl Icahn takes his compensation in units and not cash during dividend payouts. He puts his money where his mouth is, so Hindenburg Research: Go Fuck Yourself.

Since an MLP's publicly traded units are not stock shares, those who invest in MLPs are commonly referred to as unitholders, rather than shareholders.

(I'd like to refer to these future unithodlers as GMERICANs, if I may.)

On a related note: Ryan Cohen once tweeted, "No overpaid execs in the metaverse" and I-cahn see what he meant by that.

There will be investors (limited partners) and business operators (general partners) running each company and division under Teddy megacorp.

"Work is so sexy" -Ryan CohenTeddy.com

archive.is/E0cyJ

GMEdd.com

X.com

Confinity.com

X.com

https://twitter.com/edwinbarnesc/status/1736631819272077581?s=20

Teddy Mega Corp

(This is a direct continuation from previous post)

$IEP or Icahn Enterprises is a megacorp holding company that controls multiple companies across multiple industries in real estate, energy, transportation, pharmaceutical, etc. and issues "units" as a form of shares.

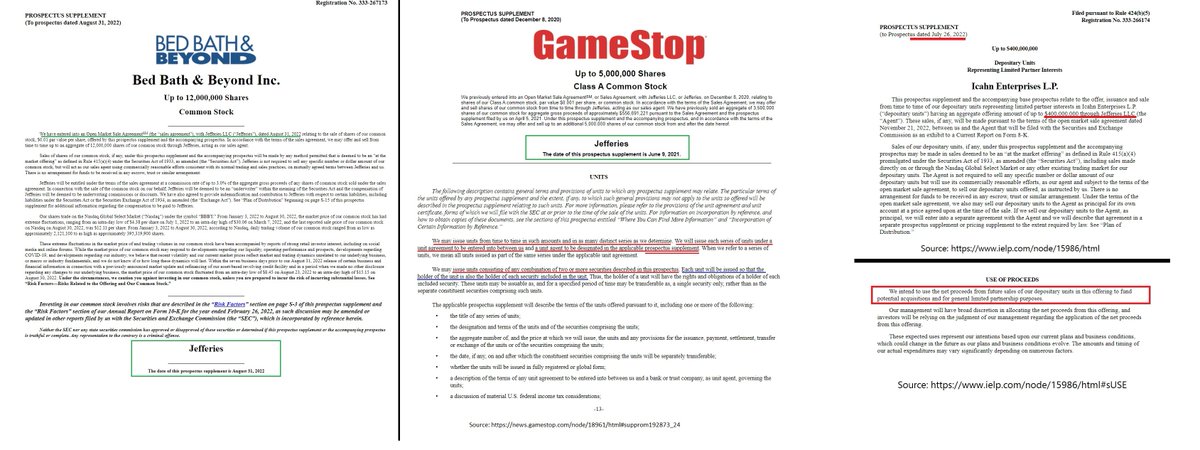

$IEP has worked directly with Jefferies, an investment bank and provided the $400M loan to save Bed Bath & Beyond in August 2022 via Sixth Street Partners, according to the prospectus filed under pre-chapter 11 $BBBY and there is a matching entry in $IEP's company filings of the same time period.

If you recall in the Dealer Manager Agreement, or DMA DD, I discovered how units were also mentioned in GameStop's SEC filing from 2020 and is being handled by Jefferies.

In GMERICA part 6, I revealed that units were also mentioned in DK-BUTTERFLY-1 INC., the shell company holding former Bed Bath & Beyond's assets and is also involved with Jefferies too.

All of these companies: $IEP, $GME, $BBBYQ - share Jefferies as the investment bank for handling units, as stated in respective company SEC filings.

On June 3, 2021, DeepFuckingValue under @TheRoaringKitty tweeted, "when the world slips you a Jefferey…"

In hindsight, it seems kind of obvious now, but DFV already knew. Time travelers, I tell ya, maybe DFV knows John Titor.

Ryan Cohen, the Activist Affiliates, and together with the family in business, Cohen & Company have laid the groundwork for Teddy, a megacorp that will own and/or control multiple companies that have undergone chapter 11 restructuring including Sears, Blockbuster, Toys R' Us, and many more.

Teddy = Godzilla, Ryan Cohen once tweeted.

What's more is Marcus Lemonis and his involvement with $BYON or Beyond, formerly Overstock.

For those out of the loop: Overstock acquired the intellectual property rights to use the brand name "Bed Bath & Beyond," but not the company Bed Bath & Beyond Inc., there is a difference.

After Overstock acquired the BBBY brand name, it re-branded into and now owns the brands of and , but not fur long.

In case you thought I forgot about Epstein, here is a statement listed on Bed Bath & Beyond's website:

Cellar boxing, driving companies into bankruptcy, and sex trafficking children - it's all about the money.

The dirty money that funds politicians, that fund wars, and creates destruction, chaos, and death.

You could almost say some people just want to destroy humanity, meanwhile a few want to save it.

Now back to the story line: Marcus Lemonis was appointed to $BYON by John A. Thaler of JAT Capital, who was an investor in Overstock during the Overstock short wars (2007-2015) while Patrick Bryne was CEO.

Thaler is also quite fond of Elon Musk based on his tweets. And as many know, Tesla Motors $TSLA was also a target of shorts during that same period.

Thaler's X profile was created on October 2022, an interesting timeline that matches the Dealer Manager Agreement that was created in the same period too.

Therefore, I believe JAT Capital is directly involved with the Activist Affiliates based on his dealings and appointment of Marcus Lemonis to chairman of the board at $BYON.

How else can you explain Bed Bath & Beyond giving away their name to Overstock/Beyond?

Fortunately, no guessing is required and I'll explain in a moment.

JAT Capital was formerly Hampton Road Office which has a history with Leucadia National Corporation and Jefferies.

In August 2012, Jefferies led the bailout with $400M for Knight Capital Group (KCG Holdings) during a flash crash that was caused by a computer glitch.

KCG was a market maker that provided liquidity and buy-ask spreads in the early 2000s with 17.3% market share on NYSE and 16.9% on NASDAQ until its own demise, according to Wikipedia.

After Jefferies acquired KCG, it wasn't doing very well, and soon needed help too.

Leucadia bought Jefferies in 2012 but later in 2020, Jefferies Financial Group $JEF became the parent company to Leucadia, which has now turned Leucadia into a subsidiary and the asset management division of Jefferies.

Furthermore, Leucadia is a diversified holding company engaged through its consolidated subsidiaries in a variety of businesses, including investment banking and capital markets, beef processing, manufacturing, energy projects, asset management and real estate.

It is another megacorp and Leucadia is known by some as a miniature Berkshire.

"I challenge Warren Buffet to a thumb war." -Ryan Cohen

Marcus Lemonis recently tweeted that Overstock will make a return which confirms the Reverse Uno thesis and will set-off a series of events ushered by a RICO case due to securities fraud that cellar boxed Bed Bath & Beyond into bankruptcy.

In part 6, I discovered how 2 separate transactions took place in September 2023. The first transaction involved selling off the subsidiary company buybuyBABY to L Catterton, an Activist Affiliate, global conglomerate, and partner to Arnault Group that owns $LVMH (Louis Vuitton Moet Hennessey). And second transaction is about the parent company Bed Bath & Beyond and securities fraud.

Bed Bath & Beyond Inc. converted into 20230930-DK-BUTTERFLY-1, INC., a special purpose vehicle after finalizing chapter 11 restructuring but has yet to emerge.

What Is a Special Purpose Vehicle (SPV)?

According to Investopedia: a special purpose vehicle, also called a special purpose entity (SPE), is a subsidiary created by a parent company to isolate financial risk. Its legal status as a separate company makes its obligations secure even if the parent company goes bankrupt. For this reason, a special purpose vehicle is sometimes called a bankruptcy-remote entity.

Basically, Bed Bath & Beyond Inc. converted into DK-BUTTERFLY-1 INC. and carved-out buybuyBABY and transferred it to another undisclosed SPV. (More on this later)

The parent company Bed Bath & Beyond will revert back hence "Reverse Uno" after the Plan Administrator in chapter 11 presses RICO charges on securities fraud committed by the Depository Trust Corporation (DTC), a company that holds all records of stock shares in existence.

That's right, RICO - Racketeer Influenced and Corrupt Organizations Act.

It was used to shut down and arrest the mafia and will be used to 69Dick these shorting hedge funds, claw back overpaid executives like Mark Tritton, and reach far up the ass of these co-conspirators that have robbed household investors of their retirement savings, pension funds, and livelihood.

These chain of events will trigger the Plan Administrator, Michael Goldberg, expert lawyer with experience recovering damages from the likes of Madoff Ponzi to pursue a RICO prosecution with a team of elite federal prosecutors and the backing of the Department of Justice.

Following that event, $BYON will revert back to Overstock $OSTK and Bed Bath & Beyond will be re-listed since its ticker $BBBY has been preserved, as stated in court dockets.

However, instead of returning to NASDAQ, $BBBY will list on the NYSE stock market.

With the crown jewel and subsidiary company buybuyBABY rescued from Bed Bath & Beyond's chapter 11, it will then reverse-merge with a SPAC and IPO into Teddy.

"Why would you ever want to sell?" -DeepFuckingValue

Teddy Mega Corp is coming and it has the financial backing and support from multiple megacorps including:

⚡$IEP Icahn Enterprises

⚡$COHN Cohen & Company

⚡$LVMH Arnault Group & L Catterton, global conglomerate

⚡$JEF Jefferies Financial Group

⚡And Leucadia "miniature Berkshire"

This is like Voltron meets Godzilla and the finale will be legendary.

Now, to uncover a big piece of the puzzle.

🕳️.🐇Beyond.com

Overstock.com

BedBathandBeyond.com

(This is a direct continuation from previous post)

$IEP or Icahn Enterprises is a megacorp holding company that controls multiple companies across multiple industries in real estate, energy, transportation, pharmaceutical, etc. and issues "units" as a form of shares.

$IEP has worked directly with Jefferies, an investment bank and provided the $400M loan to save Bed Bath & Beyond in August 2022 via Sixth Street Partners, according to the prospectus filed under pre-chapter 11 $BBBY and there is a matching entry in $IEP's company filings of the same time period.

If you recall in the Dealer Manager Agreement, or DMA DD, I discovered how units were also mentioned in GameStop's SEC filing from 2020 and is being handled by Jefferies.

In GMERICA part 6, I revealed that units were also mentioned in DK-BUTTERFLY-1 INC., the shell company holding former Bed Bath & Beyond's assets and is also involved with Jefferies too.

All of these companies: $IEP, $GME, $BBBYQ - share Jefferies as the investment bank for handling units, as stated in respective company SEC filings.

On June 3, 2021, DeepFuckingValue under @TheRoaringKitty tweeted, "when the world slips you a Jefferey…"

In hindsight, it seems kind of obvious now, but DFV already knew. Time travelers, I tell ya, maybe DFV knows John Titor.

Ryan Cohen, the Activist Affiliates, and together with the family in business, Cohen & Company have laid the groundwork for Teddy, a megacorp that will own and/or control multiple companies that have undergone chapter 11 restructuring including Sears, Blockbuster, Toys R' Us, and many more.

Teddy = Godzilla, Ryan Cohen once tweeted.

What's more is Marcus Lemonis and his involvement with $BYON or Beyond, formerly Overstock.

For those out of the loop: Overstock acquired the intellectual property rights to use the brand name "Bed Bath & Beyond," but not the company Bed Bath & Beyond Inc., there is a difference.

After Overstock acquired the BBBY brand name, it re-branded into and now owns the brands of and , but not fur long.

In case you thought I forgot about Epstein, here is a statement listed on Bed Bath & Beyond's website:

Cellar boxing, driving companies into bankruptcy, and sex trafficking children - it's all about the money.

The dirty money that funds politicians, that fund wars, and creates destruction, chaos, and death.

You could almost say some people just want to destroy humanity, meanwhile a few want to save it.

Now back to the story line: Marcus Lemonis was appointed to $BYON by John A. Thaler of JAT Capital, who was an investor in Overstock during the Overstock short wars (2007-2015) while Patrick Bryne was CEO.

Thaler is also quite fond of Elon Musk based on his tweets. And as many know, Tesla Motors $TSLA was also a target of shorts during that same period.

Thaler's X profile was created on October 2022, an interesting timeline that matches the Dealer Manager Agreement that was created in the same period too.

Therefore, I believe JAT Capital is directly involved with the Activist Affiliates based on his dealings and appointment of Marcus Lemonis to chairman of the board at $BYON.

How else can you explain Bed Bath & Beyond giving away their name to Overstock/Beyond?

Fortunately, no guessing is required and I'll explain in a moment.

JAT Capital was formerly Hampton Road Office which has a history with Leucadia National Corporation and Jefferies.

In August 2012, Jefferies led the bailout with $400M for Knight Capital Group (KCG Holdings) during a flash crash that was caused by a computer glitch.

KCG was a market maker that provided liquidity and buy-ask spreads in the early 2000s with 17.3% market share on NYSE and 16.9% on NASDAQ until its own demise, according to Wikipedia.

After Jefferies acquired KCG, it wasn't doing very well, and soon needed help too.

Leucadia bought Jefferies in 2012 but later in 2020, Jefferies Financial Group $JEF became the parent company to Leucadia, which has now turned Leucadia into a subsidiary and the asset management division of Jefferies.

Furthermore, Leucadia is a diversified holding company engaged through its consolidated subsidiaries in a variety of businesses, including investment banking and capital markets, beef processing, manufacturing, energy projects, asset management and real estate.

It is another megacorp and Leucadia is known by some as a miniature Berkshire.

"I challenge Warren Buffet to a thumb war." -Ryan Cohen

Marcus Lemonis recently tweeted that Overstock will make a return which confirms the Reverse Uno thesis and will set-off a series of events ushered by a RICO case due to securities fraud that cellar boxed Bed Bath & Beyond into bankruptcy.

In part 6, I discovered how 2 separate transactions took place in September 2023. The first transaction involved selling off the subsidiary company buybuyBABY to L Catterton, an Activist Affiliate, global conglomerate, and partner to Arnault Group that owns $LVMH (Louis Vuitton Moet Hennessey). And second transaction is about the parent company Bed Bath & Beyond and securities fraud.

Bed Bath & Beyond Inc. converted into 20230930-DK-BUTTERFLY-1, INC., a special purpose vehicle after finalizing chapter 11 restructuring but has yet to emerge.

What Is a Special Purpose Vehicle (SPV)?

According to Investopedia: a special purpose vehicle, also called a special purpose entity (SPE), is a subsidiary created by a parent company to isolate financial risk. Its legal status as a separate company makes its obligations secure even if the parent company goes bankrupt. For this reason, a special purpose vehicle is sometimes called a bankruptcy-remote entity.

Basically, Bed Bath & Beyond Inc. converted into DK-BUTTERFLY-1 INC. and carved-out buybuyBABY and transferred it to another undisclosed SPV. (More on this later)

The parent company Bed Bath & Beyond will revert back hence "Reverse Uno" after the Plan Administrator in chapter 11 presses RICO charges on securities fraud committed by the Depository Trust Corporation (DTC), a company that holds all records of stock shares in existence.

That's right, RICO - Racketeer Influenced and Corrupt Organizations Act.

It was used to shut down and arrest the mafia and will be used to 69Dick these shorting hedge funds, claw back overpaid executives like Mark Tritton, and reach far up the ass of these co-conspirators that have robbed household investors of their retirement savings, pension funds, and livelihood.

These chain of events will trigger the Plan Administrator, Michael Goldberg, expert lawyer with experience recovering damages from the likes of Madoff Ponzi to pursue a RICO prosecution with a team of elite federal prosecutors and the backing of the Department of Justice.

Following that event, $BYON will revert back to Overstock $OSTK and Bed Bath & Beyond will be re-listed since its ticker $BBBY has been preserved, as stated in court dockets.

However, instead of returning to NASDAQ, $BBBY will list on the NYSE stock market.

With the crown jewel and subsidiary company buybuyBABY rescued from Bed Bath & Beyond's chapter 11, it will then reverse-merge with a SPAC and IPO into Teddy.

"Why would you ever want to sell?" -DeepFuckingValue

Teddy Mega Corp is coming and it has the financial backing and support from multiple megacorps including:

⚡$IEP Icahn Enterprises

⚡$COHN Cohen & Company

⚡$LVMH Arnault Group & L Catterton, global conglomerate

⚡$JEF Jefferies Financial Group

⚡And Leucadia "miniature Berkshire"

This is like Voltron meets Godzilla and the finale will be legendary.

Now, to uncover a big piece of the puzzle.

🕳️.🐇Beyond.com

Overstock.com

BedBathandBeyond.com

The Missing Link

The plan to create Teddy as a megacorp has been in the making for years.

Few understand this.

In this saga, it begins with a rescue plan to save buybuyBABY and the spotlight is on Sue Gove, then-CEO of Bed Bath & Beyond.

Sue Gove started as a board member of $BBBY in 2019 and received her restricted stock units (RSUs) by approval of the board of directors on July 25, 2019, months before CEO-plant Mark Tritton joined on November 2019.

Prior to joining Bed Bath & Beyond, Tritton worked at Target and before that, at Boston Consulting Group (BCG), known for assisting shorting hedge funds in cellar boxing and by planting CEOs into public companies for sabotage.

Ryan Cohen recently tweeted about Target and has shared numerous tweets denouncing overpaid executives and demanding that when CEOs leave a company in shambles then they should return any compensation received.

I believe the shorting hedge funds, co-conspirators like BCG, and their cellar boxing playbook was discovered by the Activist Affiliates long ago and their movements were being tracked along with CEO-plants. (More on this in a moment)

Sue Gove had the business acumen, expertise, and financial understanding as a $BBBY board member which likely tipped her off that something nefarious was going on after Mark Tritton became CEO.

According to LinkedIn, Sue Gove's work experience included Chief Financial Officer at Zales for 25 years and Senior Advisor at law firm Marsal & Alvarez.

Marsal & Alvarez was retained to go over historical financial records during Bed Bath & Beyond chapter 11 proceedings. Probably, cohencidence.

In my last DD, part 6, I covered how the events that forced Bed Bath & Beyond into chapter 11 were initiated by CEO Mark Tritton and CFO Gustavo Arnal via accelerated stock buybacks that were meant to be spread out over 3 years but completed in half the time.

The accelerated buybacks depleted the company cash reserves and were exacerbated by unnecessary debt that Tritton loaded up on the company which only helped bring it to its knees.

The perfect cellar box plan executed, or so they thought.

When Ryan Cohen made his proxy bid on Bed Bath & Beyond in March 2022, the first thing he did was form a Strategic Committee and appointed Sue Gove as the chair to unlock the full value and sale of buybuyBABY, the crown jewel and subsidiary of $BBBY.

Now, what's interesting is that Bed Bath & Beyond hired a mergers & acquisition specialist to their team in 2021 and his name is Rajat Prakash.

He became the VP Treasurer at $BBBY and his LinkedIn profile revealed a track-record of 20 years in M&A.

Before Prakash joined Bed Bath & Beyond, he was Head of Corporate Development & Treasury with Sears Holding Corporation for nearly 13 years.

Billionaire Eddie Lampert was the CEO and chairman of Sears between 2013-2019 before declaring bankruptcy, and like Patrick Bryne of Overstock, had to deal with shorting hedge funds too in the same time period.

Unfortunately, Sears did not survive naked shorting brought on by cellar boxing, however, Overstock managed to escape by issuing an NFT dividend that squeezed the shorts using tZERO blockchain which saw $OSTK explode from $7.24/share to $124.65, a 17.2X increase over several months.

The reason I bring up bankrupt companies like Sears is because the company still exists on paper and the stock ticker is still active although there are no physical stores operating.

In the $GME community, many of these bankrupt companies were referred to as "Zombie stocks" because every now and then, for no other reason, the stock price would skyrocket.

As it turns out, many of these Zombie stocks like Sears, Toys R' Us, and Blockbuster are locked together in a meme basket due to Total Return Swaps, which was discovered by criand, a Pomeranian ape and due diligence writer on Reddit.

Swaps enable shorts to use Zombie stocks as leverage to short and suppress the price action of companies like $GME from skyrocketing even with Fidelity reporting heavy buy orders on a daily basis.

Naked shorting is a tactic used to cellar box with the sole intent to bankrupt a company and never have to close the position.

Now, these Zombie stocks have risen and are being acquired by an activist investor group hell-bent on righting the wrong that has been done.

And that begins with launching a RICO case to prosecute overpaid executives and initiate a Reverse Uno squeeze by forcing shorts to close in a Voltron meets Godzilla-style Super Mega Corp merger to launch Teddy.

It's time for the Game-Stop.

If all of this sounds a bit confusing then just think about this name, "Activist Affiliates."

It is a combination of Activist Investors like Ryan Cohen and a group of Affiliates with shared interests.

That shared interest means striking back at these shorting hedge funds that have destroyed beloved American brands and American companies through abusive naked shorting and cellar boxing into forced bankruptcy.

This includes destruction of wealth, loss of jobs, and crushing the hopes and dreams of millions of households investors in these companies, over decades.

The Activist Affiliates is the GMERICAN dream team, if you ask me.

Although I coined the term "Activist Affiliates," it was actually already written in the letters that RC Ventures LLC sent to the board of directors at GameStop and Bed Bath & Beyond in his proxy bids to clean-house.

And guess who delivered those letters?

It was Ryan Nebel of Olshan Frome Wolosky which I covered in previous due diligence writing.

Ryan Nebel also filed the trademark for TEDDY and included a screenshot that was going to become more than just a book store.

Here, see for yourself:

On a related note: began as a bookstore similar to , which means once Teddy megacorp forms then it will eclipse Amazon and become the king of ecommerce. Jeff Bezos once said to employees, "One day, Amazon will fail but our job is to delay it as long as possible." Looks like Bezos saw the writing on the wall when he sent that memo in 2018 because I believe that's when the Teddy plan began.

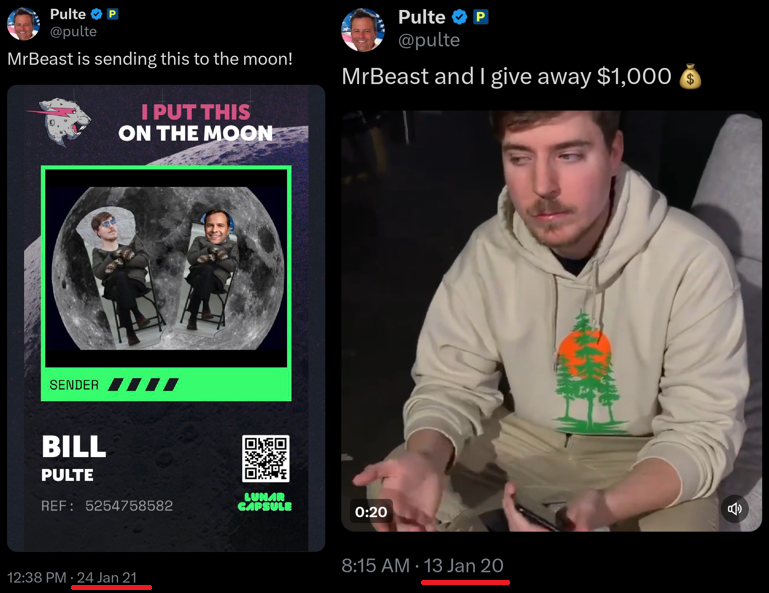

Olshan is the premier activist investor law firm which also represents William "Bill" J. Pulte, grandson of billionaire founder of Pulte Homes, which Pulte has confirmed during a live stream PPShow.

From the show, @Pulte said: "Ryan [Cohen] and I share the same attorney. It's a very well-known shareholder activist attorney. Two gentlemen. Two attorneys. We have the same attorneys. And these guys are pros. These attorneys are pros."

Ryan Cohen and Bill Pulte share the exact same lawyers who are Ryan Nebel and Steve Wolosky, the same two lawyers who helped Ryan Cohen proxy bid for $GME and $BBBY.

Again, on another live PPShow where I was a guest, Pulte dropped in and confirmed that he knows the Icahn family intimately, and that they even came to his wedding.

Furthermore, Pulte claims that Brett Icahn, son of Carl Icahn, is actually controlling the megacorp $IEP on behalf of his father Carl Icahn.

This confirms a prior DD I wrote about the Activist Affiliates and Brett Icahn's $IEP succession plan which includes delivering Teddy within 7 years, so until then, he has to work for free and without compensation or salary.

If Brett completes the task then he becomes chairman of Icahn Enterprises $IEP and receives a one-time lump sum payment.

Brett Icahn is kind of like Ryan Cohen, the only other chairman that I know who works for free.

Read about Brett Icahn and his succession plan, here:

Now, Pulte is at center of the current movement because he is the missing link that connects to everyone, especially the Activist Affiliates and other very prominent figures.

One of those figures is Mr. Beast.

Mr. Beast is the #1 YouTube creator, earning nearly $100M a year through his content production company, business ventures, and more.

He's a talented, smart guy, and is involved with the Activist Affiliates and Pulte.

Pulte and Mr. Beast are philanthropists who enjoy giving away money, in fact, they have collaborated many times in the past according to historical tweets from Pulte.

Recently, Pulte tweeted a video showing Mr. Beast sitting next to him so you could say they have a very close relationship.

As I said, this plan has been in the making, for a very long time.

Shall we see how deep this relationship goes?

It's going to be wild.

🕳️🐇Teddy.com

archive.is/WvDTv

Amazon.com

Teddy.com

archive.ph/NsQOd

The plan to create Teddy as a megacorp has been in the making for years.

Few understand this.

In this saga, it begins with a rescue plan to save buybuyBABY and the spotlight is on Sue Gove, then-CEO of Bed Bath & Beyond.

Sue Gove started as a board member of $BBBY in 2019 and received her restricted stock units (RSUs) by approval of the board of directors on July 25, 2019, months before CEO-plant Mark Tritton joined on November 2019.

Prior to joining Bed Bath & Beyond, Tritton worked at Target and before that, at Boston Consulting Group (BCG), known for assisting shorting hedge funds in cellar boxing and by planting CEOs into public companies for sabotage.

Ryan Cohen recently tweeted about Target and has shared numerous tweets denouncing overpaid executives and demanding that when CEOs leave a company in shambles then they should return any compensation received.

I believe the shorting hedge funds, co-conspirators like BCG, and their cellar boxing playbook was discovered by the Activist Affiliates long ago and their movements were being tracked along with CEO-plants. (More on this in a moment)

Sue Gove had the business acumen, expertise, and financial understanding as a $BBBY board member which likely tipped her off that something nefarious was going on after Mark Tritton became CEO.

According to LinkedIn, Sue Gove's work experience included Chief Financial Officer at Zales for 25 years and Senior Advisor at law firm Marsal & Alvarez.

Marsal & Alvarez was retained to go over historical financial records during Bed Bath & Beyond chapter 11 proceedings. Probably, cohencidence.

In my last DD, part 6, I covered how the events that forced Bed Bath & Beyond into chapter 11 were initiated by CEO Mark Tritton and CFO Gustavo Arnal via accelerated stock buybacks that were meant to be spread out over 3 years but completed in half the time.

The accelerated buybacks depleted the company cash reserves and were exacerbated by unnecessary debt that Tritton loaded up on the company which only helped bring it to its knees.

The perfect cellar box plan executed, or so they thought.

When Ryan Cohen made his proxy bid on Bed Bath & Beyond in March 2022, the first thing he did was form a Strategic Committee and appointed Sue Gove as the chair to unlock the full value and sale of buybuyBABY, the crown jewel and subsidiary of $BBBY.

Now, what's interesting is that Bed Bath & Beyond hired a mergers & acquisition specialist to their team in 2021 and his name is Rajat Prakash.

He became the VP Treasurer at $BBBY and his LinkedIn profile revealed a track-record of 20 years in M&A.

Before Prakash joined Bed Bath & Beyond, he was Head of Corporate Development & Treasury with Sears Holding Corporation for nearly 13 years.

Billionaire Eddie Lampert was the CEO and chairman of Sears between 2013-2019 before declaring bankruptcy, and like Patrick Bryne of Overstock, had to deal with shorting hedge funds too in the same time period.

Unfortunately, Sears did not survive naked shorting brought on by cellar boxing, however, Overstock managed to escape by issuing an NFT dividend that squeezed the shorts using tZERO blockchain which saw $OSTK explode from $7.24/share to $124.65, a 17.2X increase over several months.

The reason I bring up bankrupt companies like Sears is because the company still exists on paper and the stock ticker is still active although there are no physical stores operating.

In the $GME community, many of these bankrupt companies were referred to as "Zombie stocks" because every now and then, for no other reason, the stock price would skyrocket.

As it turns out, many of these Zombie stocks like Sears, Toys R' Us, and Blockbuster are locked together in a meme basket due to Total Return Swaps, which was discovered by criand, a Pomeranian ape and due diligence writer on Reddit.

Swaps enable shorts to use Zombie stocks as leverage to short and suppress the price action of companies like $GME from skyrocketing even with Fidelity reporting heavy buy orders on a daily basis.

Naked shorting is a tactic used to cellar box with the sole intent to bankrupt a company and never have to close the position.

Now, these Zombie stocks have risen and are being acquired by an activist investor group hell-bent on righting the wrong that has been done.

And that begins with launching a RICO case to prosecute overpaid executives and initiate a Reverse Uno squeeze by forcing shorts to close in a Voltron meets Godzilla-style Super Mega Corp merger to launch Teddy.

It's time for the Game-Stop.

If all of this sounds a bit confusing then just think about this name, "Activist Affiliates."

It is a combination of Activist Investors like Ryan Cohen and a group of Affiliates with shared interests.

That shared interest means striking back at these shorting hedge funds that have destroyed beloved American brands and American companies through abusive naked shorting and cellar boxing into forced bankruptcy.

This includes destruction of wealth, loss of jobs, and crushing the hopes and dreams of millions of households investors in these companies, over decades.

The Activist Affiliates is the GMERICAN dream team, if you ask me.

Although I coined the term "Activist Affiliates," it was actually already written in the letters that RC Ventures LLC sent to the board of directors at GameStop and Bed Bath & Beyond in his proxy bids to clean-house.

And guess who delivered those letters?

It was Ryan Nebel of Olshan Frome Wolosky which I covered in previous due diligence writing.

Ryan Nebel also filed the trademark for TEDDY and included a screenshot that was going to become more than just a book store.

Here, see for yourself:

On a related note: began as a bookstore similar to , which means once Teddy megacorp forms then it will eclipse Amazon and become the king of ecommerce. Jeff Bezos once said to employees, "One day, Amazon will fail but our job is to delay it as long as possible." Looks like Bezos saw the writing on the wall when he sent that memo in 2018 because I believe that's when the Teddy plan began.

Olshan is the premier activist investor law firm which also represents William "Bill" J. Pulte, grandson of billionaire founder of Pulte Homes, which Pulte has confirmed during a live stream PPShow.

From the show, @Pulte said: "Ryan [Cohen] and I share the same attorney. It's a very well-known shareholder activist attorney. Two gentlemen. Two attorneys. We have the same attorneys. And these guys are pros. These attorneys are pros."

Ryan Cohen and Bill Pulte share the exact same lawyers who are Ryan Nebel and Steve Wolosky, the same two lawyers who helped Ryan Cohen proxy bid for $GME and $BBBY.

Again, on another live PPShow where I was a guest, Pulte dropped in and confirmed that he knows the Icahn family intimately, and that they even came to his wedding.

Furthermore, Pulte claims that Brett Icahn, son of Carl Icahn, is actually controlling the megacorp $IEP on behalf of his father Carl Icahn.

This confirms a prior DD I wrote about the Activist Affiliates and Brett Icahn's $IEP succession plan which includes delivering Teddy within 7 years, so until then, he has to work for free and without compensation or salary.

If Brett completes the task then he becomes chairman of Icahn Enterprises $IEP and receives a one-time lump sum payment.

Brett Icahn is kind of like Ryan Cohen, the only other chairman that I know who works for free.

Read about Brett Icahn and his succession plan, here:

Now, Pulte is at center of the current movement because he is the missing link that connects to everyone, especially the Activist Affiliates and other very prominent figures.

One of those figures is Mr. Beast.

Mr. Beast is the #1 YouTube creator, earning nearly $100M a year through his content production company, business ventures, and more.

He's a talented, smart guy, and is involved with the Activist Affiliates and Pulte.

Pulte and Mr. Beast are philanthropists who enjoy giving away money, in fact, they have collaborated many times in the past according to historical tweets from Pulte.

Recently, Pulte tweeted a video showing Mr. Beast sitting next to him so you could say they have a very close relationship.

As I said, this plan has been in the making, for a very long time.

Shall we see how deep this relationship goes?

It's going to be wild.

🕳️🐇Teddy.com

archive.is/WvDTv

Amazon.com

Teddy.com