How 20230930-DK-BUTTERFLY-1, INC. Rugpulled Virtu "virt-20230930"

〰️〰️〰️〰️〰️〰️〰️〰️〰️〰️〰️

Posted some of this before, just put it all together and added a couple things 🙂

〰️〰️〰️〰️〰️〰️〰️〰️〰️〰️〰️

Why was the Form 8-K for 20230930-DK-Butterfly-1, Inc dated Sep. 29th??

"The Confirmed Plan became effective (the “Effective Date”) on Friday, September 29, 2023"

What is the cut-off point for financial reporting for the quarter?

September 30 is cut-off point for financial reporting for that quarter. The actual work of preparing and filing reports comes after this date.

What happens when after that date?

Closing of Books.

The company's accounting team will finalize all financial transactions for the quarter and "close the books," which means ending all accounting records for that period.

What happened on the Effective Date?? Shares became null, void, & worthless.

ONE (LIBERTY) day before Virtu had to get ready to close their books, they effectively get RUGPULLED by

20230930-DK-BUTTERFLY-1, INC.

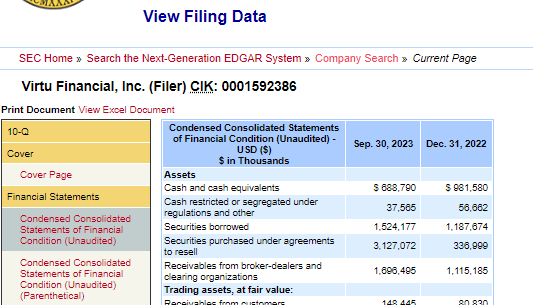

Why does the Virtu Financial, Inc latest

10-Q say it's Unaudited?

"Unaudited" means that the financial statements have not been formally reviewed by an independent external auditor. While the figures have been prepared by the company's internal accounting department and are presented in good faith, they have not gone through the comprehensive audit process that is typically conducted.

The lack of an audited 10-Q does not impede the filing of the audited 10-K.

The annual 10-K report is the one that requires a full audit and the inclusion of audited financial statements for the entire fiscal year.

They can get away with not auditing the 10-Q, but once it's time to file that annual Form 10-K... 😬

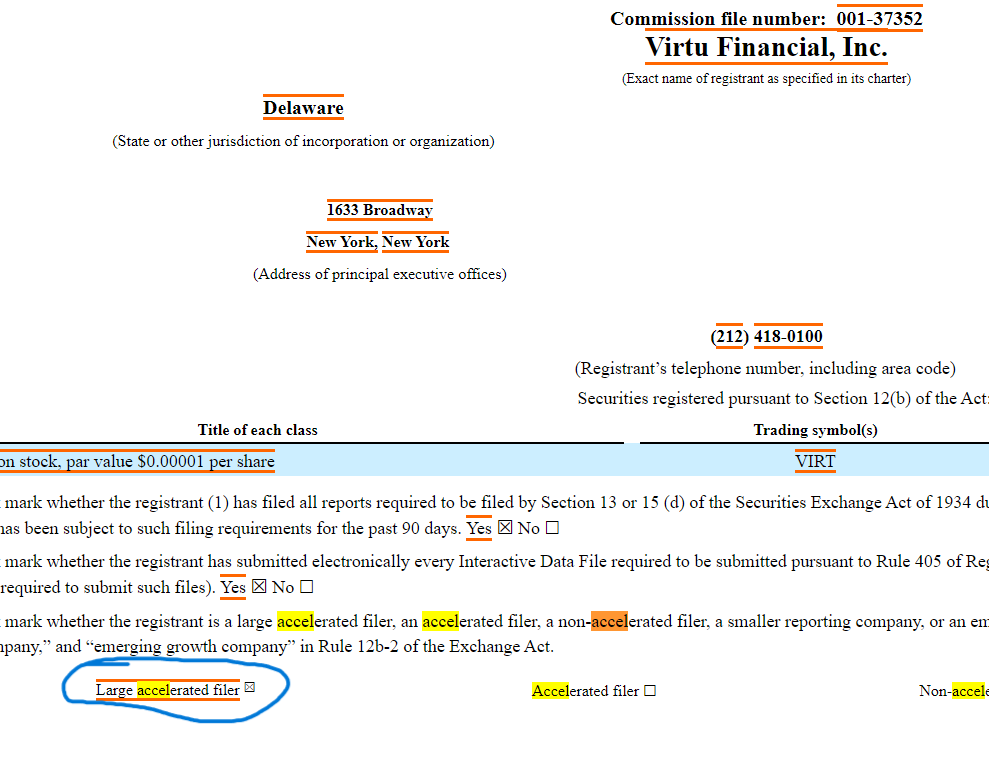

The SEC requires that the 10-K be filed within 60, 75, or 90 days after the fiscal year-end

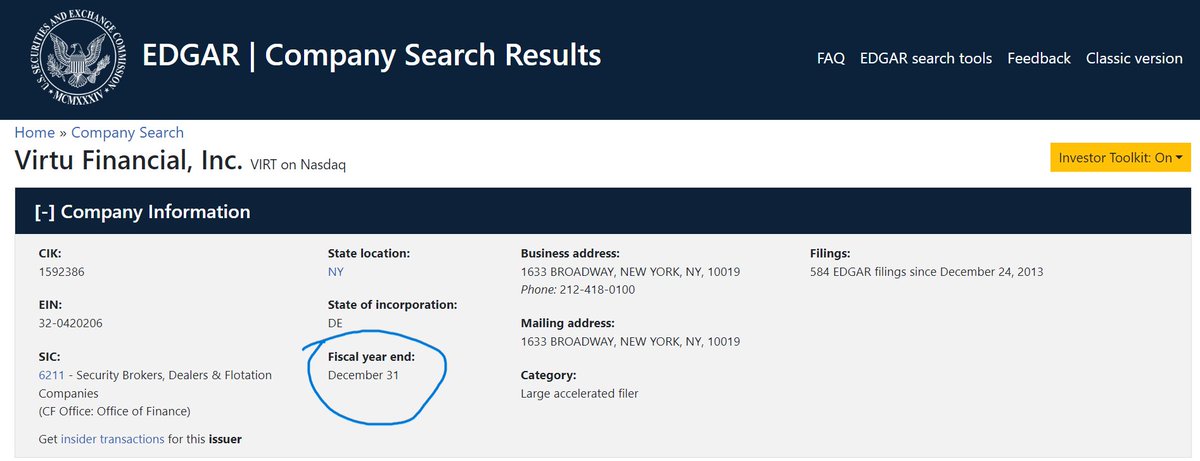

Virtu's Fiscal Year End: December 31, 2023

Large accelerated filers must file within 60 days, accelerated filers within 75 days

and all other filers within 90 days depending on the size of the company.

60 Days.

🕐

Which would mean

Thursday, February 29 2024

Virtu's 10-K is due

I have a feeling there will be another RUGPULL sometime before Feb. 29 🫠

"virt-20230930"

20230930-DK-Butterfly-1, Inc. Is an end of quarter date

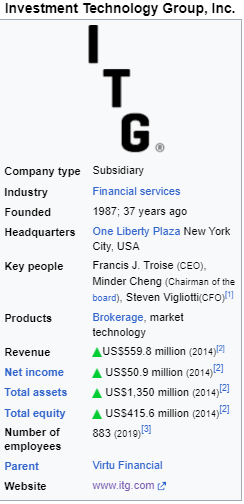

The ITG Posit Trade Exchange was the trading venue for BBBY/BBBYQ in the USA

The Parent Company of ITG is Virtu Financial

The address Is ONE LIBERTY Plaza

🦋

〰️〰️〰️〰️〰️〰️〰️〰️〰️〰️〰️

Posted some of this before, just put it all together and added a couple things 🙂

〰️〰️〰️〰️〰️〰️〰️〰️〰️〰️〰️

Why was the Form 8-K for 20230930-DK-Butterfly-1, Inc dated Sep. 29th??

"The Confirmed Plan became effective (the “Effective Date”) on Friday, September 29, 2023"

What is the cut-off point for financial reporting for the quarter?

September 30 is cut-off point for financial reporting for that quarter. The actual work of preparing and filing reports comes after this date.

What happens when after that date?

Closing of Books.

The company's accounting team will finalize all financial transactions for the quarter and "close the books," which means ending all accounting records for that period.

What happened on the Effective Date?? Shares became null, void, & worthless.

ONE (LIBERTY) day before Virtu had to get ready to close their books, they effectively get RUGPULLED by

20230930-DK-BUTTERFLY-1, INC.

Why does the Virtu Financial, Inc latest

10-Q say it's Unaudited?

"Unaudited" means that the financial statements have not been formally reviewed by an independent external auditor. While the figures have been prepared by the company's internal accounting department and are presented in good faith, they have not gone through the comprehensive audit process that is typically conducted.

The lack of an audited 10-Q does not impede the filing of the audited 10-K.

The annual 10-K report is the one that requires a full audit and the inclusion of audited financial statements for the entire fiscal year.

They can get away with not auditing the 10-Q, but once it's time to file that annual Form 10-K... 😬

The SEC requires that the 10-K be filed within 60, 75, or 90 days after the fiscal year-end

Virtu's Fiscal Year End: December 31, 2023

Large accelerated filers must file within 60 days, accelerated filers within 75 days

and all other filers within 90 days depending on the size of the company.

60 Days.

🕐

Which would mean

Thursday, February 29 2024

Virtu's 10-K is due

I have a feeling there will be another RUGPULL sometime before Feb. 29 🫠

"virt-20230930"

20230930-DK-Butterfly-1, Inc. Is an end of quarter date

The ITG Posit Trade Exchange was the trading venue for BBBY/BBBYQ in the USA

The Parent Company of ITG is Virtu Financial

The address Is ONE LIBERTY Plaza

🦋

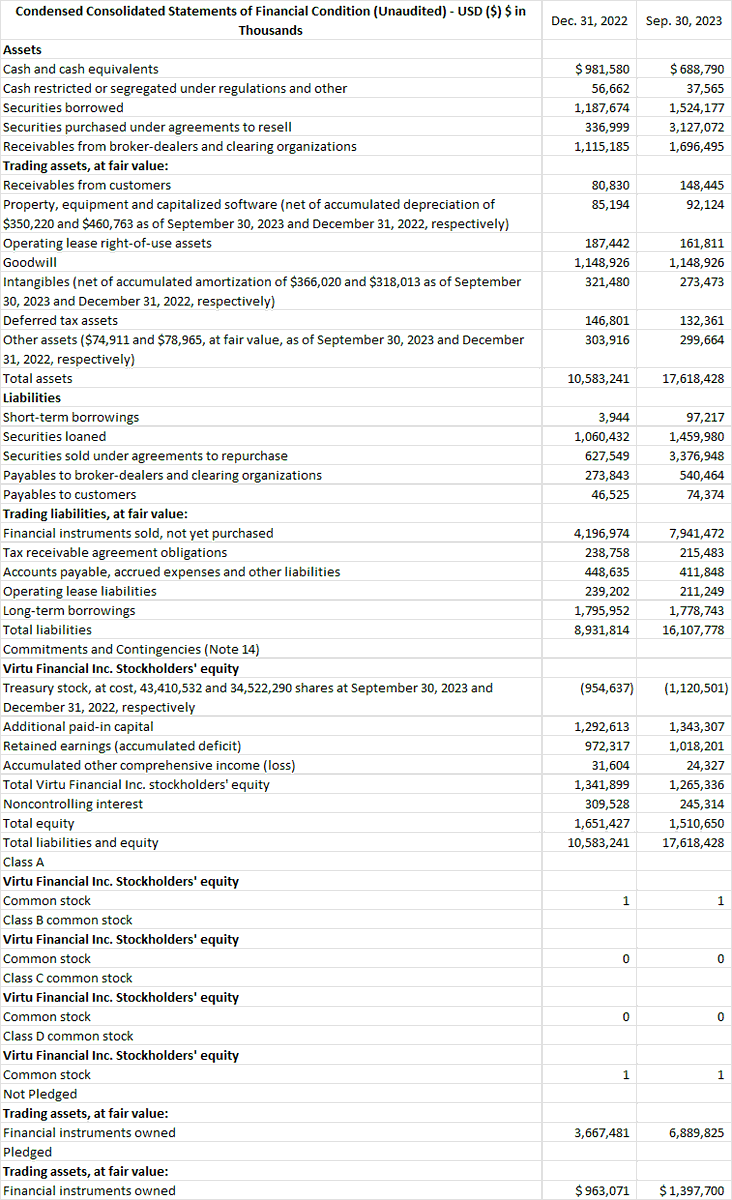

Condensed Consolidated Statements of Financial Condition 1 (Unaudited):

*These are the things I'm seeing that might raise concerns, appear unusual, or need for a closer examination-

Securities purchased under agreements to resell:

The increase from $336,999,000 to $3,127,072,000 in a nine-month period is highly unusual and may indicate an aggressive trading strategy or accounting issues.

Securities sold under agreements to repurchase:

Similarly, there is a significant increase $627,549,000 to $3,376,948,000 This could imply a substantial change in the company's leveraged positions.

Trading liabilities, at fair value (Financial instruments sold, not yet purchased):

The near doubling from $4,196,974,000 to $7,941,472,000 is alarming and could suggest a high level of speculative trading or a significant market event affecting the valuation of these instruments.

Total assets:

The total assets have shown a substantial increase from approximately $10,583,241,000 to $17,618,428,000

Total liabilities:

These have almost doubled from approximately $8,931,814,000 to $16,107,778,000 Such a significant change in the balance sheet size is unusual and warrants scrutiny.

Short-term borrowings:

The leap from $3,944,000 to $97,217,000 in short-term borrowings may indicate new borrowing or a reclassification from long-term debt, raising concerns about liquidity and short-term obligations.

Common Stock (Class A and D): The nominal value for the common stock classes remaining at $1 is peculiar.. as it doesn't typically change and is very low. This suggests that the stock might have a nominal par value which is not reflective of the underlying equity.

Trading assets, at fair value (Not Pledged): The financial instruments owned that are not pledged have nearly doubled from around $3,667,481,000 to $6,889,825,000

Discrepancies in trading assets:

The substantial growth in non-pledged trading assets from- $3,667,481,000 to $6,889,825,000 Pledged trading assets from $963,071,000 to $1,397,700,000 This could indicate a significant increase in the values of held securities, which also come with higher risk exposure.

These unusual and potentially alarming points indicate significant changes in the company’s financial condition within nine months. This is suggesting a need for substantial disclosure to justify the figures... especially in the context of the "SOX"🧦

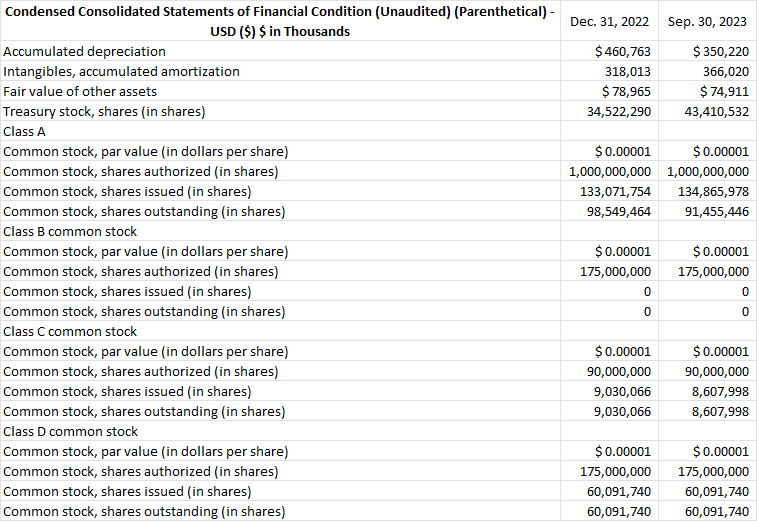

Condensed Consolidated Statements of Financial Condition 2 (Unaudited):

Asset Depreciation, Stock Dynamics, and Intangible Amortization.

Accumulated Depreciation Reduction:

It is unusual for accumulated depreciation to decrease as this typically increases over time as assets are used.

A decrease could indicate asset sales or write-offs, which should be explained in the notes to the financial statements.

Intangibles, Accumulated Amortization Increase:

The accumulated amortization of intangibles has increased, which is normal over time, but the increase should correlate to the amortization schedule of the intangible assets.

Treasury Stock Increase:

The significant increase in treasury stock, from 34,522,290 shares to 43,410,532 shares, could signal a large-scale buyback program.

This might be of concern if the buybacks are being financed with debt or if it significantly reduces the company's cash reserves.

Common Stock Par Value:

The par value of $0.00001 is extremely low and, while not inherently alarming, is atypical.

This could be a strategy to minimize the legal capital required by corporate laws or could be used to facilitate stock splits or dividends.

Class A Common Stock Decrease in Outstanding Shares:

The decrease in outstanding Class A shares from 98,549,464 to 91,455,446 could be due to a stock buyback or a conversion to another class of stock, which could impact shareholder voting rights and equity value distribution.

Class B Common Stock:

The fact that there are no issued or outstanding Class B common stock shares remains consistent, but it’s unusual to have a class of stock that exists in the charter but has never been issued.

Decrease in Class C Common Stock:

The decrease in outstanding Class C shares might be concerning if it indicates a conversion or buyback that could affect control dynamics within the company.

Stability in Class D Common Stock:

There is no change in Class D stock, which is not alarming but could be of interest if other classes are changing due to corporate actions.

No Issued or Outstanding Shares for Class B Common Stock:

It's unusual for a class of stock to be authorized but never issued, as this could imply potential future corporate actions that are not yet disclosed.

The company's assets are playing hide-and-seek with depreciation, and the intangibles are getting more 'intangible' by the day. 🫥

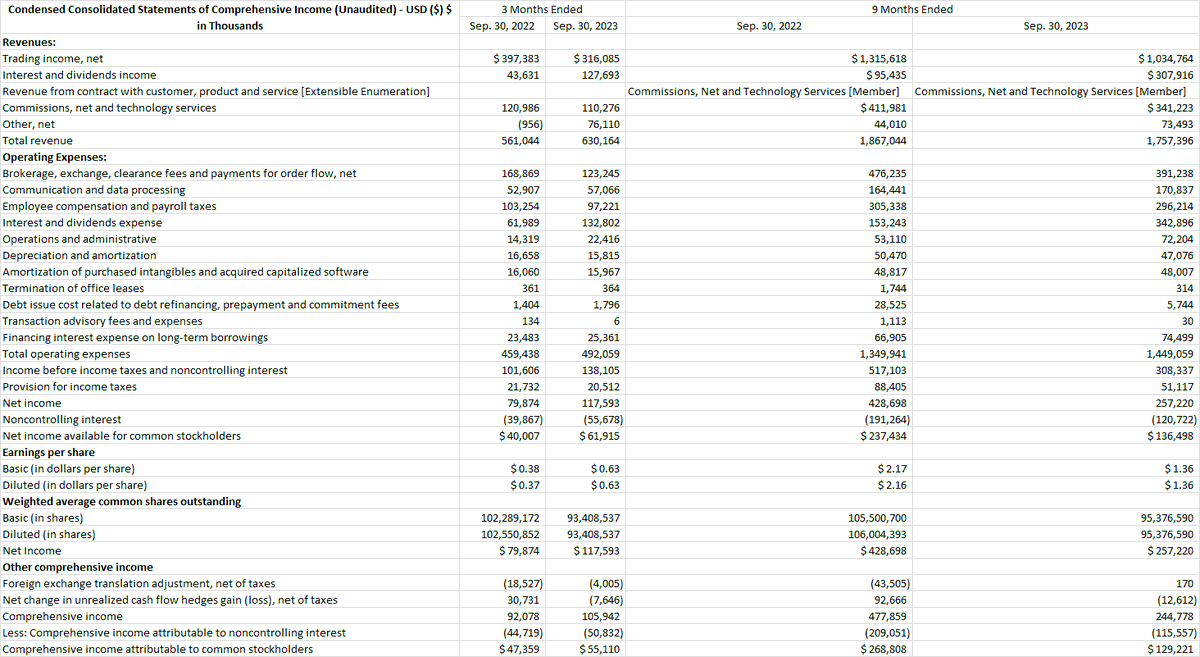

Condensed Consolidated Statements of Financial Condition 3 (Unaudited):

Significant Shifts in Income, Expenses, and Equity Dynamics.

Interest and Dividends Expense:

There is more than a doubling of this expense over the 9-month period, from $153,243,000 to $342,896,000. This is a substantial increase and could indicate higher debt levels or rising interest rates affecting the company.

Net Income Fluctuation:

While there is an increase in net income from $79,874,000 to $117,593,000 for the 3-month period ended September 30, 2022, and September 30, 2023, respectively, there is a decrease in net income from

$428,698,000 to $257,220,000 for the 9-month period ended on the same dates. This fluctuation might raise questions about the volatility of earnings.

Noncontrolling Interest:

There is a decrease in losses attributed to noncontrolling interest from $(191,264,000) to $(120,722,000) over the 9-month period. This suggests a change in the performance of subsidiaries or joint ventures which might require further scrutiny.

Comprehensive Income Decline:

Comprehensive income has decreased significantly over the 9-month period, from $477,859,000 to $244,778,000. This decline is noteworthy and could reflect underlying issues with the company's broader financial performance.

Foreign Exchange and Cash Flow Hedges:

The foreign exchange translation adjustment shows a change from a loss of $(43,505,000) to a gain of $170,000, and the cash flow hedges gain (loss) went from a gain of $92,666,000 to a loss of $(12,612,000). These items can be volatile but large swings could indicate significant foreign exchange or hedging risks.

Interest and Dividends Income Increase:

An increase in interest and dividends income from $95,435,000 to $307,916,000 over the 9-month period. This significant increase should be examined in the context of the company's investment activities and market interest rates.

Other Net Revenue:

There is a substantial change in 'Other, net' revenue from a negative $(956,000) to a positive $76,110,000 for the 3-month period ended September 30, 2022, and 2023, respectively. This could indicate a one-off event or transaction that significantly impacted other income.

Operating Expenses Variations:

While some operating expenses have decreased, others like 'Interest and dividends expense' and 'Operations and administrative' have increased notably. This could be indicative of changing business operations or cost structures.

Total Revenue vs. Total Operating Expenses:

There is a closing gap between total revenue and total operating expenses from the 9-month period ended September 30, 2022, to September 30, 2023 ($1,867,044,000 vs. $1,349,941,000 compared to $1,757,396,000 vs. $1,449,059,000). This suggests a shrinking margin which could be alarming for the company's future profitability.

Decrease in Weighted Average Common Shares Outstanding:

The decrease in the weighted average number of common shares outstanding from 105,500,700 to 95,376,590 suggests that the company may have bought back shares or undergone some other equity reduction, which could affect per-share calculations such as earnings per share (EPS).

Earnings Per Share (EPS):

The decrease in EPS from $2.17 to $1.36 for the basic and from $2.16 to $1.36 for the diluted over the 9-month period can be alarming as it reflects a decrease in profitability on a per-share basis.

These numbers would typically be scrutinized in accordance with the Sarbanes-Oxley Act's requirements for accurate financial reporting and internal controls.

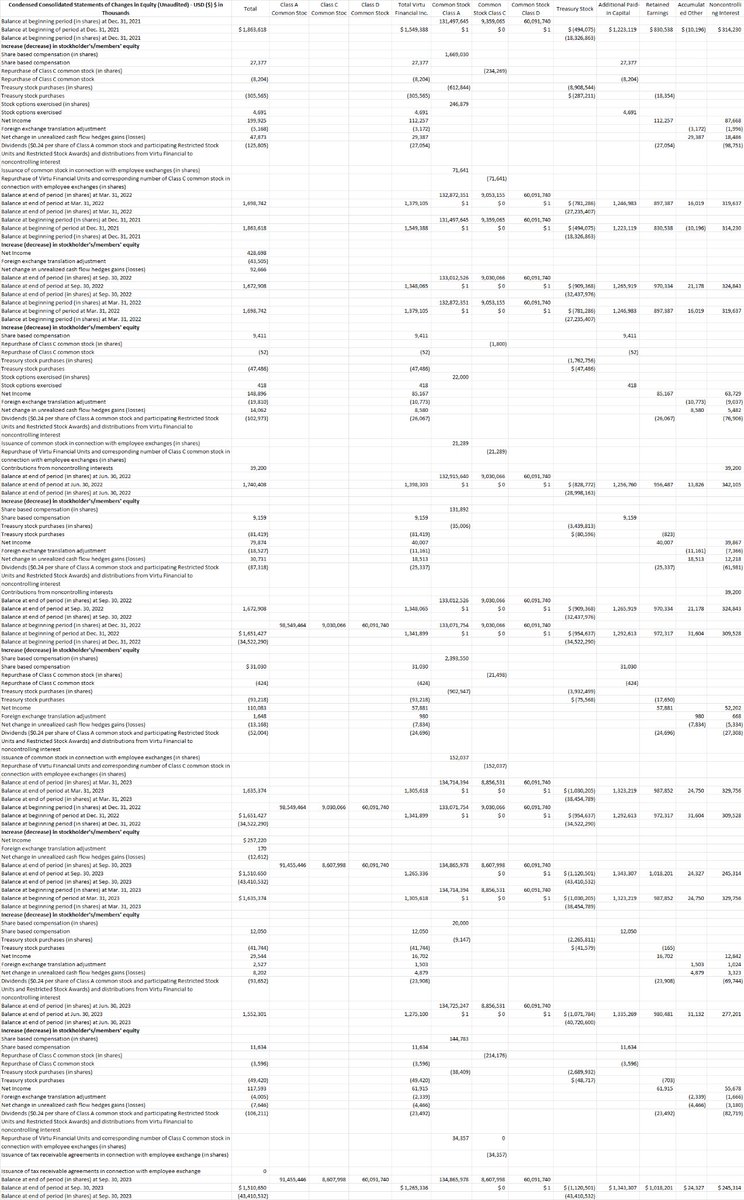

Condensed Consolidated Statements of Financial Condition 4 (Unaudited):

Didn't do calculations on this one, just observations.

Treasury Stock Purchases:

There are substantial increases in treasury stock, indicating the company is buying back its own shares. The scale of these buybacks could be considered unusual if it represents a significant portion of the company’s market capitalization or if it deviates from the company’s historical buyback patterns.

Net Income vs. Dividends and Distributions:

The company has been profitable, but it’s also paying out a considerable amount in dividends and distributions. It's worth checking if the dividends paid are in line with the company's dividend policy or if there is a large one-time distribution to noncontrolling interests.

Foreign Exchange Translation Adjustments:

There are foreign exchange translation adjustments that affect accumulated other comprehensive income (loss). Significant fluctuations here could be concerning if they represent a risk to the company's financial stability due to currency exposure.

Share-Based Compensation:

There is recurring share-based compensation, which is normal for many companies, but if the numbers are very large compared to the company's net income or if there's a significant change in the pattern, it might be worth exploring.

Fluctuations in Noncontrolling Interest: Contributions from noncontrolling interests and distributions to them can be typical in a corporate structure with multiple stakeholders. However, significant changes may reflect alterations in ownership structures or strategic partnerships.

Stability of Retained Earnings:

Retained earnings are increasing, which is typically a good sign. However, a decrease or a significant slowdown in the growth rate of retained earnings might be a red flag.

Consistency in Accumulated Other Comprehensive Income (Loss):

Substantial fluctuations in accumulated other comprehensive income (loss) may indicate the company's exposure to various forms of risk, such as foreign exchange or marketable securities.

Stagnant Common Stock Values:

The par value of the common stock classes does not change, which is expected, but a change here would be highly unusual.

Balance of Common Stock Classes:

It seems there's no issuance of new common stock, as the par value of Class A, Class C, and Class D common stock remains $1 throughout the periods. Any deviation here could be peculiar.

Issuance and Repurchase in Connection with Employee Exchanges:

There are entries related to the issuance of common stock and repurchase of Virtu Financial Units in connection with employee exchanges, which do not seem to affect the numerical balance. This might require further examination.

SOX soon🧦

sarbanes-oxley-act.com

*These are the things I'm seeing that might raise concerns, appear unusual, or need for a closer examination-

Securities purchased under agreements to resell:

The increase from $336,999,000 to $3,127,072,000 in a nine-month period is highly unusual and may indicate an aggressive trading strategy or accounting issues.

Securities sold under agreements to repurchase:

Similarly, there is a significant increase $627,549,000 to $3,376,948,000 This could imply a substantial change in the company's leveraged positions.

Trading liabilities, at fair value (Financial instruments sold, not yet purchased):

The near doubling from $4,196,974,000 to $7,941,472,000 is alarming and could suggest a high level of speculative trading or a significant market event affecting the valuation of these instruments.

Total assets:

The total assets have shown a substantial increase from approximately $10,583,241,000 to $17,618,428,000

Total liabilities:

These have almost doubled from approximately $8,931,814,000 to $16,107,778,000 Such a significant change in the balance sheet size is unusual and warrants scrutiny.

Short-term borrowings:

The leap from $3,944,000 to $97,217,000 in short-term borrowings may indicate new borrowing or a reclassification from long-term debt, raising concerns about liquidity and short-term obligations.

Common Stock (Class A and D): The nominal value for the common stock classes remaining at $1 is peculiar.. as it doesn't typically change and is very low. This suggests that the stock might have a nominal par value which is not reflective of the underlying equity.

Trading assets, at fair value (Not Pledged): The financial instruments owned that are not pledged have nearly doubled from around $3,667,481,000 to $6,889,825,000

Discrepancies in trading assets:

The substantial growth in non-pledged trading assets from- $3,667,481,000 to $6,889,825,000 Pledged trading assets from $963,071,000 to $1,397,700,000 This could indicate a significant increase in the values of held securities, which also come with higher risk exposure.

These unusual and potentially alarming points indicate significant changes in the company’s financial condition within nine months. This is suggesting a need for substantial disclosure to justify the figures... especially in the context of the "SOX"🧦

Condensed Consolidated Statements of Financial Condition 2 (Unaudited):

Asset Depreciation, Stock Dynamics, and Intangible Amortization.

Accumulated Depreciation Reduction:

It is unusual for accumulated depreciation to decrease as this typically increases over time as assets are used.

A decrease could indicate asset sales or write-offs, which should be explained in the notes to the financial statements.

Intangibles, Accumulated Amortization Increase:

The accumulated amortization of intangibles has increased, which is normal over time, but the increase should correlate to the amortization schedule of the intangible assets.

Treasury Stock Increase:

The significant increase in treasury stock, from 34,522,290 shares to 43,410,532 shares, could signal a large-scale buyback program.

This might be of concern if the buybacks are being financed with debt or if it significantly reduces the company's cash reserves.

Common Stock Par Value:

The par value of $0.00001 is extremely low and, while not inherently alarming, is atypical.

This could be a strategy to minimize the legal capital required by corporate laws or could be used to facilitate stock splits or dividends.

Class A Common Stock Decrease in Outstanding Shares:

The decrease in outstanding Class A shares from 98,549,464 to 91,455,446 could be due to a stock buyback or a conversion to another class of stock, which could impact shareholder voting rights and equity value distribution.

Class B Common Stock:

The fact that there are no issued or outstanding Class B common stock shares remains consistent, but it’s unusual to have a class of stock that exists in the charter but has never been issued.

Decrease in Class C Common Stock:

The decrease in outstanding Class C shares might be concerning if it indicates a conversion or buyback that could affect control dynamics within the company.

Stability in Class D Common Stock:

There is no change in Class D stock, which is not alarming but could be of interest if other classes are changing due to corporate actions.

No Issued or Outstanding Shares for Class B Common Stock:

It's unusual for a class of stock to be authorized but never issued, as this could imply potential future corporate actions that are not yet disclosed.

The company's assets are playing hide-and-seek with depreciation, and the intangibles are getting more 'intangible' by the day. 🫥

Condensed Consolidated Statements of Financial Condition 3 (Unaudited):

Significant Shifts in Income, Expenses, and Equity Dynamics.

Interest and Dividends Expense:

There is more than a doubling of this expense over the 9-month period, from $153,243,000 to $342,896,000. This is a substantial increase and could indicate higher debt levels or rising interest rates affecting the company.

Net Income Fluctuation:

While there is an increase in net income from $79,874,000 to $117,593,000 for the 3-month period ended September 30, 2022, and September 30, 2023, respectively, there is a decrease in net income from

$428,698,000 to $257,220,000 for the 9-month period ended on the same dates. This fluctuation might raise questions about the volatility of earnings.

Noncontrolling Interest:

There is a decrease in losses attributed to noncontrolling interest from $(191,264,000) to $(120,722,000) over the 9-month period. This suggests a change in the performance of subsidiaries or joint ventures which might require further scrutiny.

Comprehensive Income Decline:

Comprehensive income has decreased significantly over the 9-month period, from $477,859,000 to $244,778,000. This decline is noteworthy and could reflect underlying issues with the company's broader financial performance.

Foreign Exchange and Cash Flow Hedges:

The foreign exchange translation adjustment shows a change from a loss of $(43,505,000) to a gain of $170,000, and the cash flow hedges gain (loss) went from a gain of $92,666,000 to a loss of $(12,612,000). These items can be volatile but large swings could indicate significant foreign exchange or hedging risks.

Interest and Dividends Income Increase:

An increase in interest and dividends income from $95,435,000 to $307,916,000 over the 9-month period. This significant increase should be examined in the context of the company's investment activities and market interest rates.

Other Net Revenue:

There is a substantial change in 'Other, net' revenue from a negative $(956,000) to a positive $76,110,000 for the 3-month period ended September 30, 2022, and 2023, respectively. This could indicate a one-off event or transaction that significantly impacted other income.

Operating Expenses Variations:

While some operating expenses have decreased, others like 'Interest and dividends expense' and 'Operations and administrative' have increased notably. This could be indicative of changing business operations or cost structures.

Total Revenue vs. Total Operating Expenses:

There is a closing gap between total revenue and total operating expenses from the 9-month period ended September 30, 2022, to September 30, 2023 ($1,867,044,000 vs. $1,349,941,000 compared to $1,757,396,000 vs. $1,449,059,000). This suggests a shrinking margin which could be alarming for the company's future profitability.

Decrease in Weighted Average Common Shares Outstanding:

The decrease in the weighted average number of common shares outstanding from 105,500,700 to 95,376,590 suggests that the company may have bought back shares or undergone some other equity reduction, which could affect per-share calculations such as earnings per share (EPS).

Earnings Per Share (EPS):

The decrease in EPS from $2.17 to $1.36 for the basic and from $2.16 to $1.36 for the diluted over the 9-month period can be alarming as it reflects a decrease in profitability on a per-share basis.

These numbers would typically be scrutinized in accordance with the Sarbanes-Oxley Act's requirements for accurate financial reporting and internal controls.

Condensed Consolidated Statements of Financial Condition 4 (Unaudited):

Didn't do calculations on this one, just observations.

Treasury Stock Purchases:

There are substantial increases in treasury stock, indicating the company is buying back its own shares. The scale of these buybacks could be considered unusual if it represents a significant portion of the company’s market capitalization or if it deviates from the company’s historical buyback patterns.

Net Income vs. Dividends and Distributions:

The company has been profitable, but it’s also paying out a considerable amount in dividends and distributions. It's worth checking if the dividends paid are in line with the company's dividend policy or if there is a large one-time distribution to noncontrolling interests.

Foreign Exchange Translation Adjustments:

There are foreign exchange translation adjustments that affect accumulated other comprehensive income (loss). Significant fluctuations here could be concerning if they represent a risk to the company's financial stability due to currency exposure.

Share-Based Compensation:

There is recurring share-based compensation, which is normal for many companies, but if the numbers are very large compared to the company's net income or if there's a significant change in the pattern, it might be worth exploring.

Fluctuations in Noncontrolling Interest: Contributions from noncontrolling interests and distributions to them can be typical in a corporate structure with multiple stakeholders. However, significant changes may reflect alterations in ownership structures or strategic partnerships.

Stability of Retained Earnings:

Retained earnings are increasing, which is typically a good sign. However, a decrease or a significant slowdown in the growth rate of retained earnings might be a red flag.

Consistency in Accumulated Other Comprehensive Income (Loss):

Substantial fluctuations in accumulated other comprehensive income (loss) may indicate the company's exposure to various forms of risk, such as foreign exchange or marketable securities.

Stagnant Common Stock Values:

The par value of the common stock classes does not change, which is expected, but a change here would be highly unusual.

Balance of Common Stock Classes:

It seems there's no issuance of new common stock, as the par value of Class A, Class C, and Class D common stock remains $1 throughout the periods. Any deviation here could be peculiar.

Issuance and Repurchase in Connection with Employee Exchanges:

There are entries related to the issuance of common stock and repurchase of Virtu Financial Units in connection with employee exchanges, which do not seem to affect the numerical balance. This might require further examination.

SOX soon🧦

sarbanes-oxley-act.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh