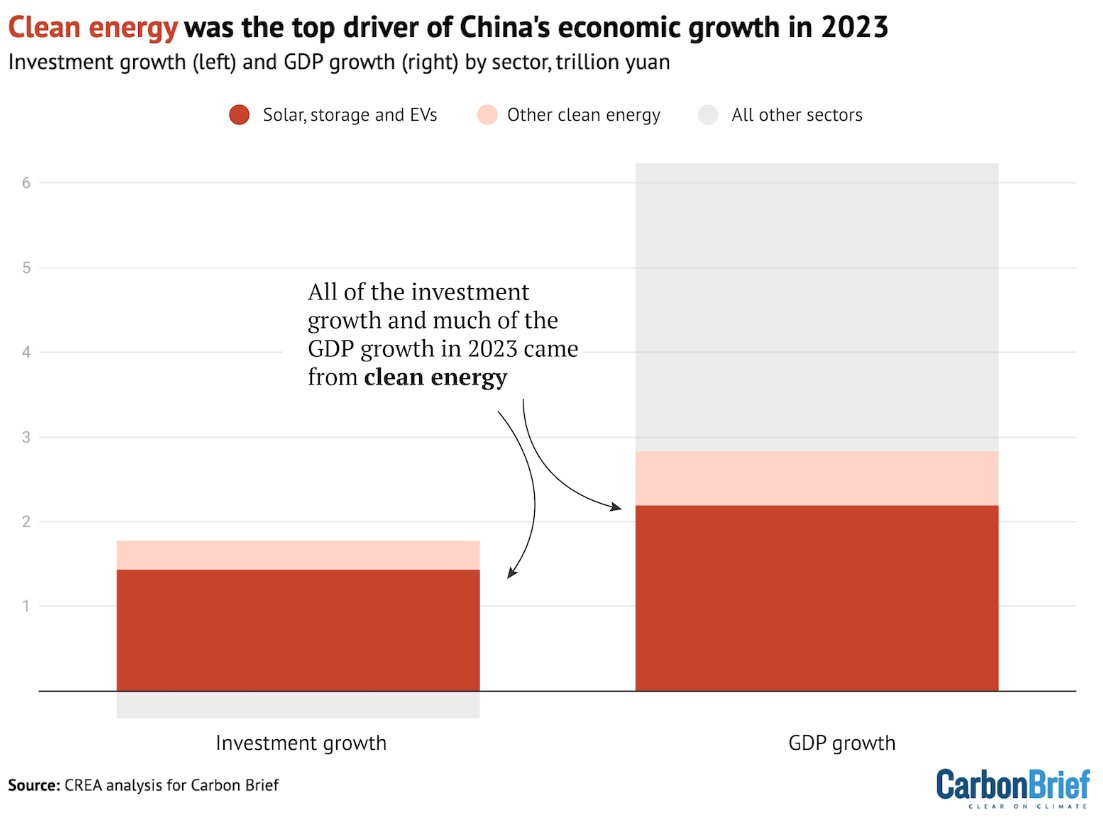

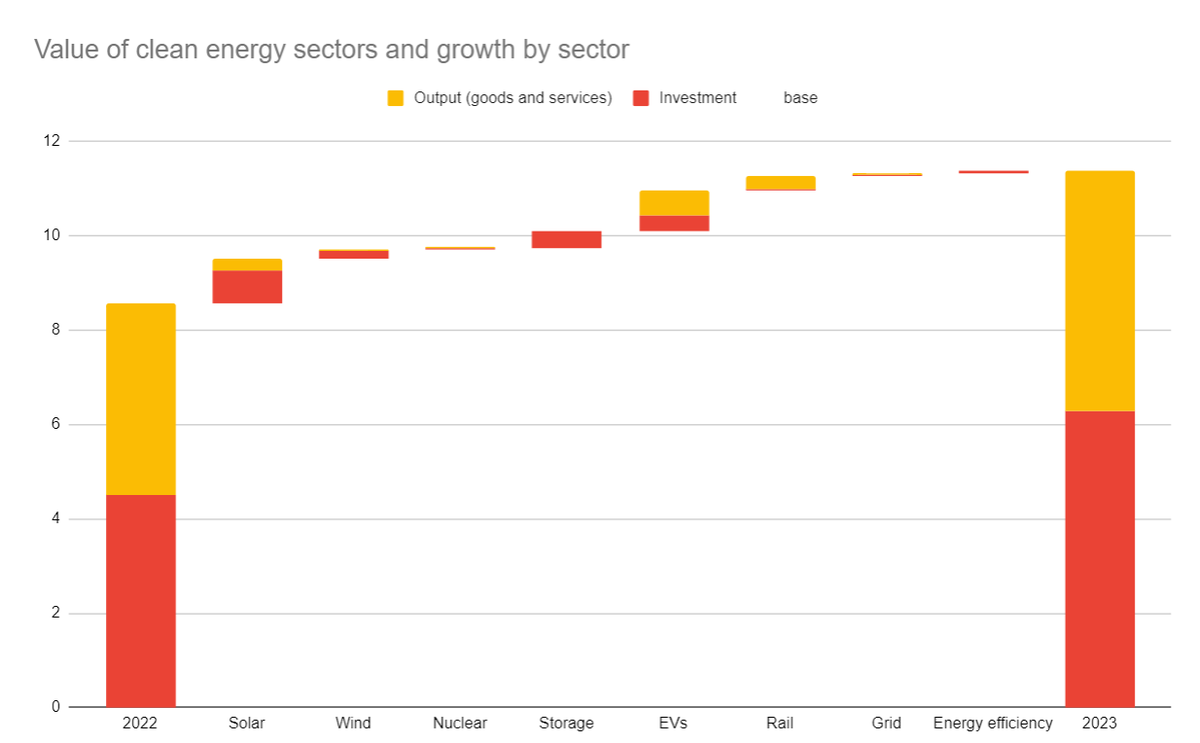

NEW: China’s unprecedented clean energy investment boom was the main driver of the country's economic growth in 2023. Without clean energy sectors, the country’s GDP would have grown by only 3% instead of 5.2%, missing the government’s target by a wide margin.

China’s investment in clean energy increased 40% on year, and rose to 5% of the country’s GDP, at 6.3tn yuan ($890bn). The investment spending is roughly equal to the GDP of Switzerland or Turkey. Investment in clean energy was responsible for all net growth in investment.

Including the value of production of goods and services, clean energy sectors contributed 9% of China’s GDP, up 30% year-on-year.

In one year, China:

*added >300 GW of solar manufacturing

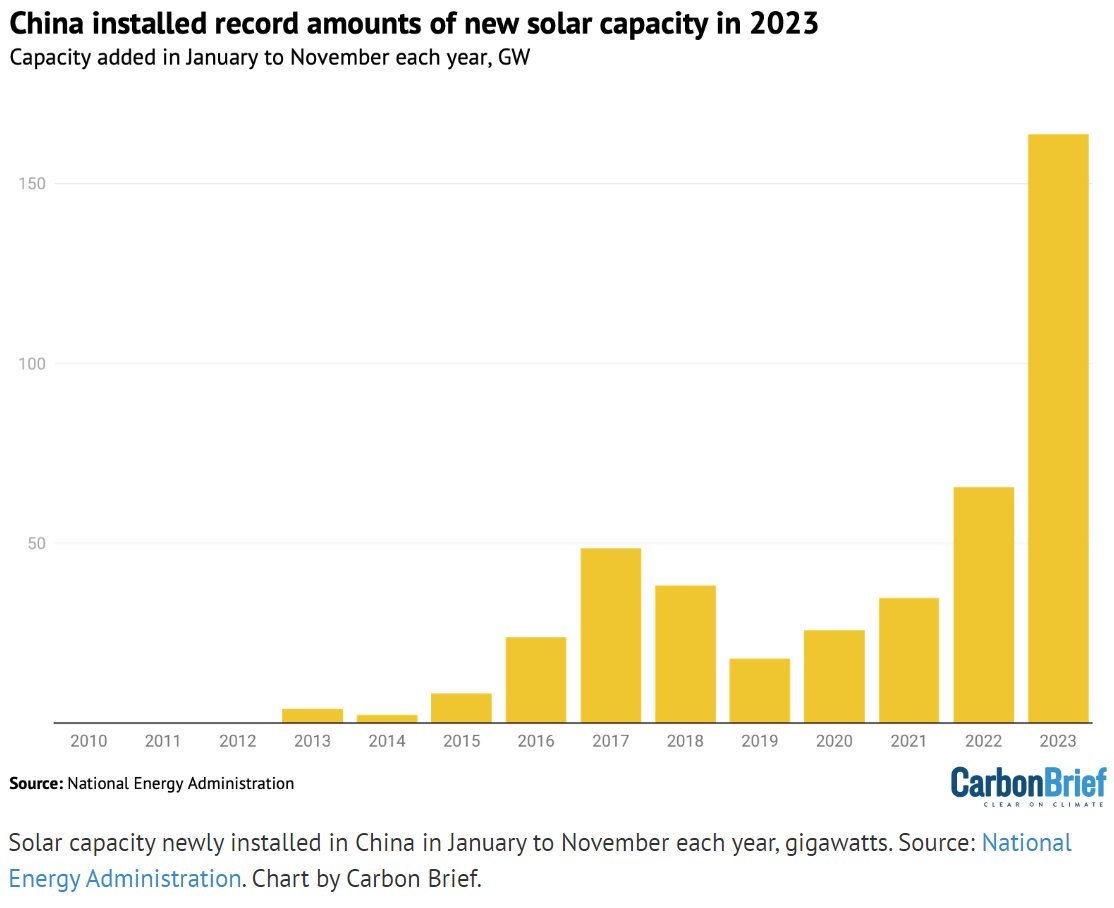

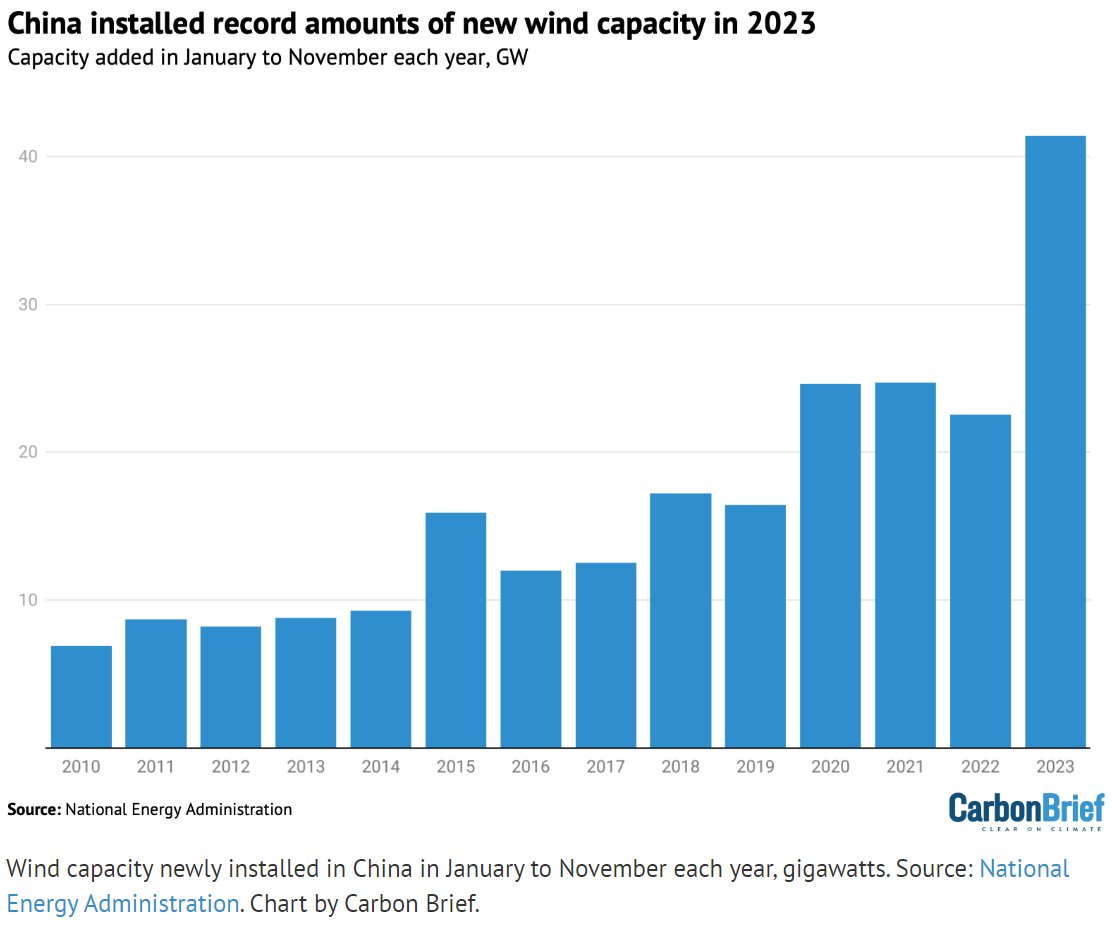

*added >200 GW solar and >60GW of wind power

*added batterymaking capacity equal to 16 Tesla Gigafactories

*started building 50 GW of pumped hydro

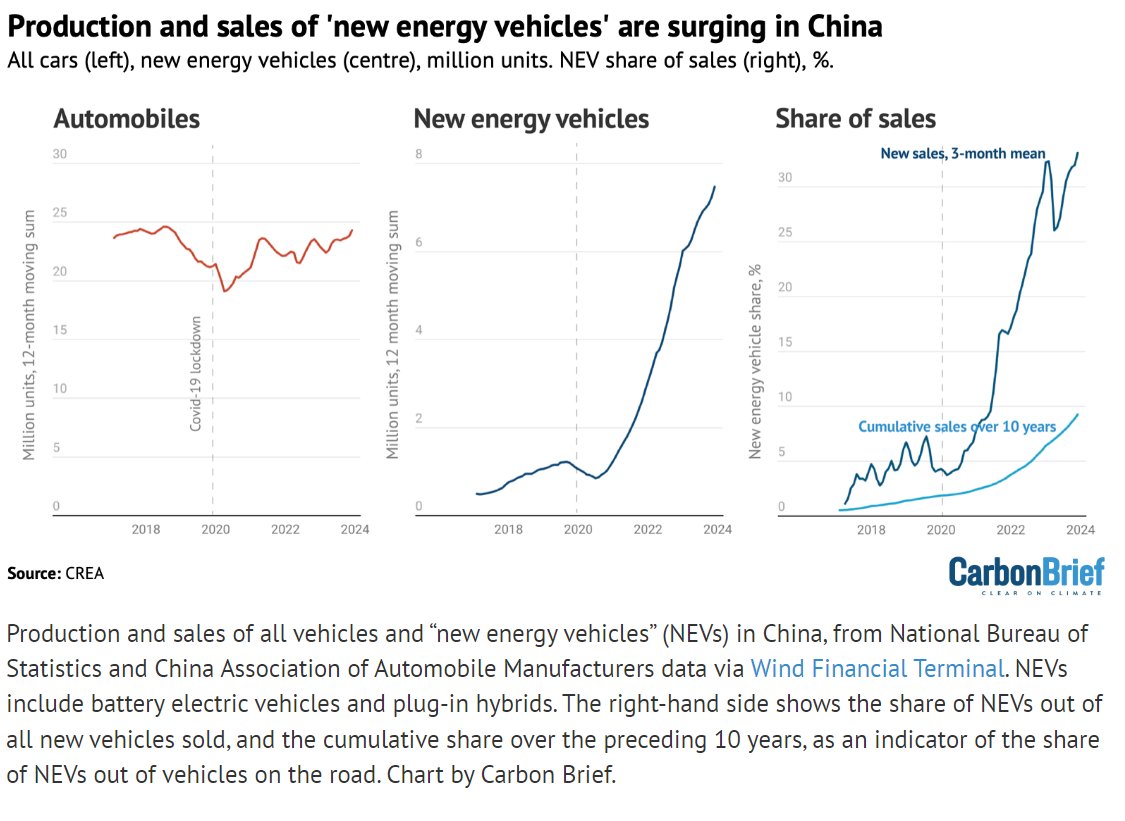

*produced 9.5mn EVs (vs 7.2mn in 2022)

*approved 10 new nuclear reactors

*added >300 GW of solar manufacturing

*added >200 GW solar and >60GW of wind power

*added batterymaking capacity equal to 16 Tesla Gigafactories

*started building 50 GW of pumped hydro

*produced 9.5mn EVs (vs 7.2mn in 2022)

*approved 10 new nuclear reactors

The largest contributors to growth were solar power, EVs, energy storage and rail transportation, which all saw strong growth both in investment and in production of goods and services.

All in all, we estimated the value of economic activity in 22 different areas. The full article has the link to a spreadsheet with the references and the basis for the calculations.

carbonbrief.org/analysis-clean…

carbonbrief.org/analysis-clean…

The clean energy boom marks a major pivot in China’s macroeconomic strategy, with the real estate sector contracting and investment shifting into manufacturing - primarily clean energy manufacturing. Local governments, state-owned enterprises and private capital all shifted.

This pivot was only possible because clean energy and industrial policy had built the foundation and scaled up these sectors, priming them for rapid growth. The real estate slump coincided with demand pull from clean energy technologies that had become economically competitive.

What are the implications of this clean energy boom?

1) With the accelerated deployment of clean energy, particularly solar, China’s emissions are much closer to peaking.

1) With the accelerated deployment of clean energy, particularly solar, China’s emissions are much closer to peaking.

2) The clean energy industry has become a key part of China’s macroeconomic strategy, in addition to energy and industrial policy. After this huge bet on manufacturing, the government has an interest in making sure the demand is there, putting the transition on a firmer basis.

3) China now has a major stake in the success of clean energy in the rest of the world and in building up export markets - expect intensified efforts to finance and develop clean energy projects overseas.

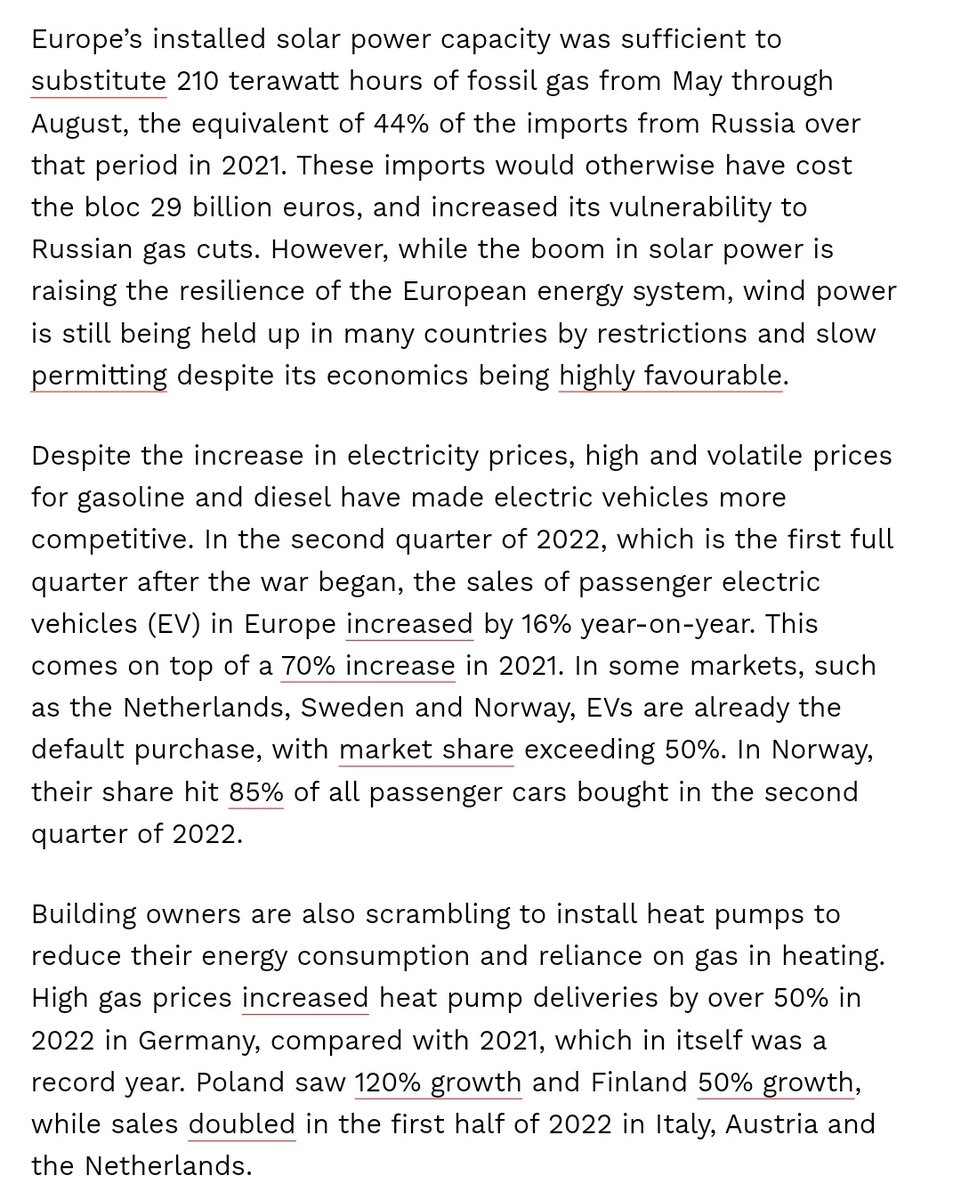

4) Global emissions trajectories have been upended. China’s supply boom pushed down the prices of solar panels by 42% and batteries by 50% year-on-year. This, in turn, has encouraged much faster take-up of clean-energy technologies.

4, cont'd) The IEA projects that if global deployment of solar power and grid-connected batteries follows the expansion of manufacturing capacity, then global power-sector coal use and carbon dioxide emissions could be a sizable 15% lower than in the base case by 2030.

5) The manufacturing boom also cements China’s dominant position in supply chains. Other countries face a choice of benefiting from the low-cost supply, or paying the cost of building new supply chains. Such efforts would further increase supply and push down global prices.

6) The clean energy boom has given a new lease of life to China’s investment-led economic model. There are however limits to how much capital the sector can absorb so eventually, the economic model will has to be transformed to rely less on investment as a growth driver.

Read the full article here:

carbonbrief.org/analysis-clean…

carbonbrief.org/analysis-clean…

• • •

Missing some Tweet in this thread? You can try to

force a refresh