John Quakes🤥 The Sophist 🎭🐍

This is my final response to this fake sophist's (latter-stage negative connotation) attacks, where I will show how he is more interested in winning an argument through clever but misleading reasoning rather than seeking the truth. @quakes99

1/12

This is my final response to this fake sophist's (latter-stage negative connotation) attacks, where I will show how he is more interested in winning an argument through clever but misleading reasoning rather than seeking the truth. @quakes99

1/12

2/12

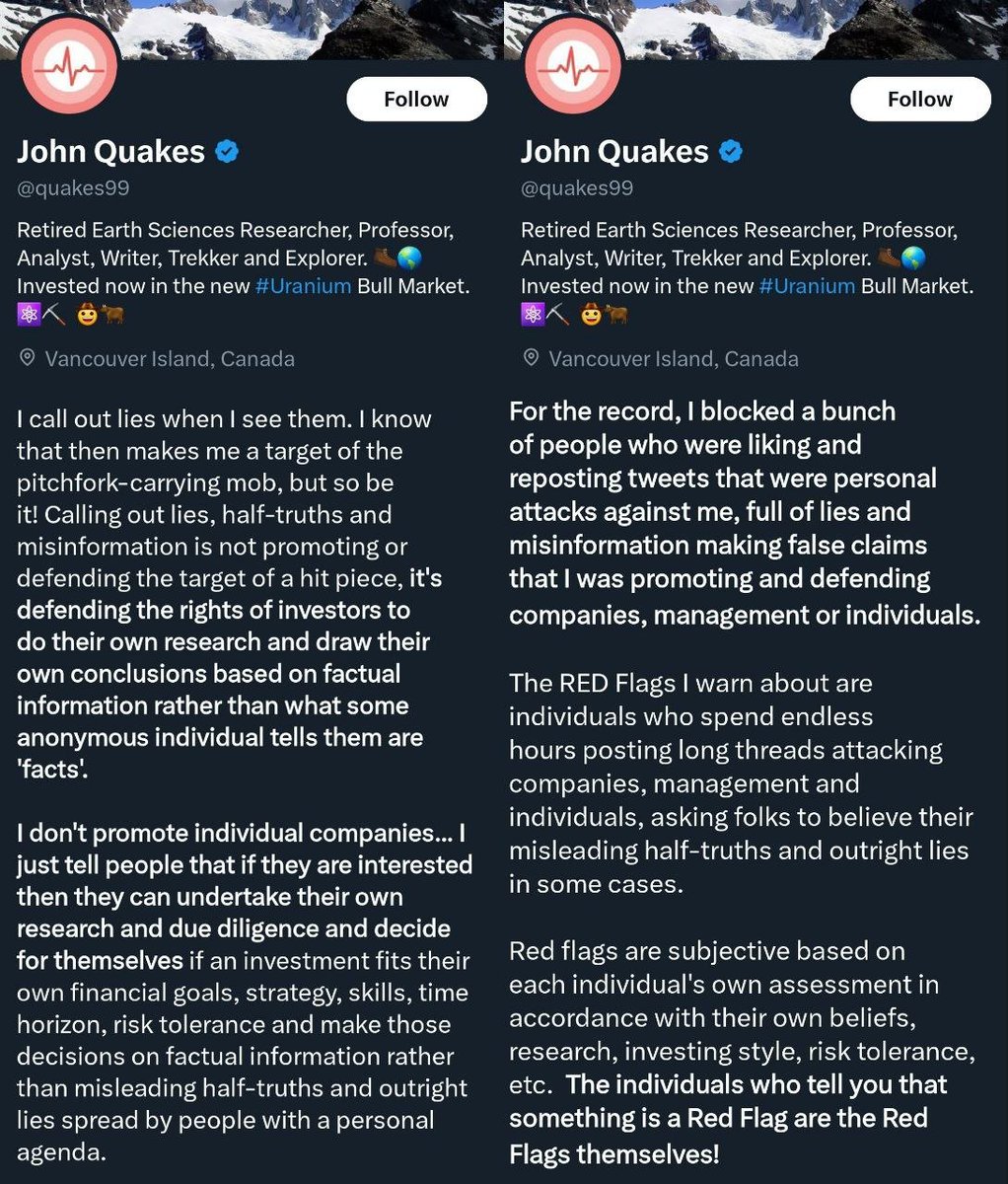

This is his latest attack on me, my research, and some other critically-minded #Utwit accounts that helped research and expose shady #uranium company management along the way. I will break this down and show how he employs his sophistry to mislead his followers. 🤥🐍

This is his latest attack on me, my research, and some other critically-minded #Utwit accounts that helped research and expose shady #uranium company management along the way. I will break this down and show how he employs his sophistry to mislead his followers. 🤥🐍

3/12

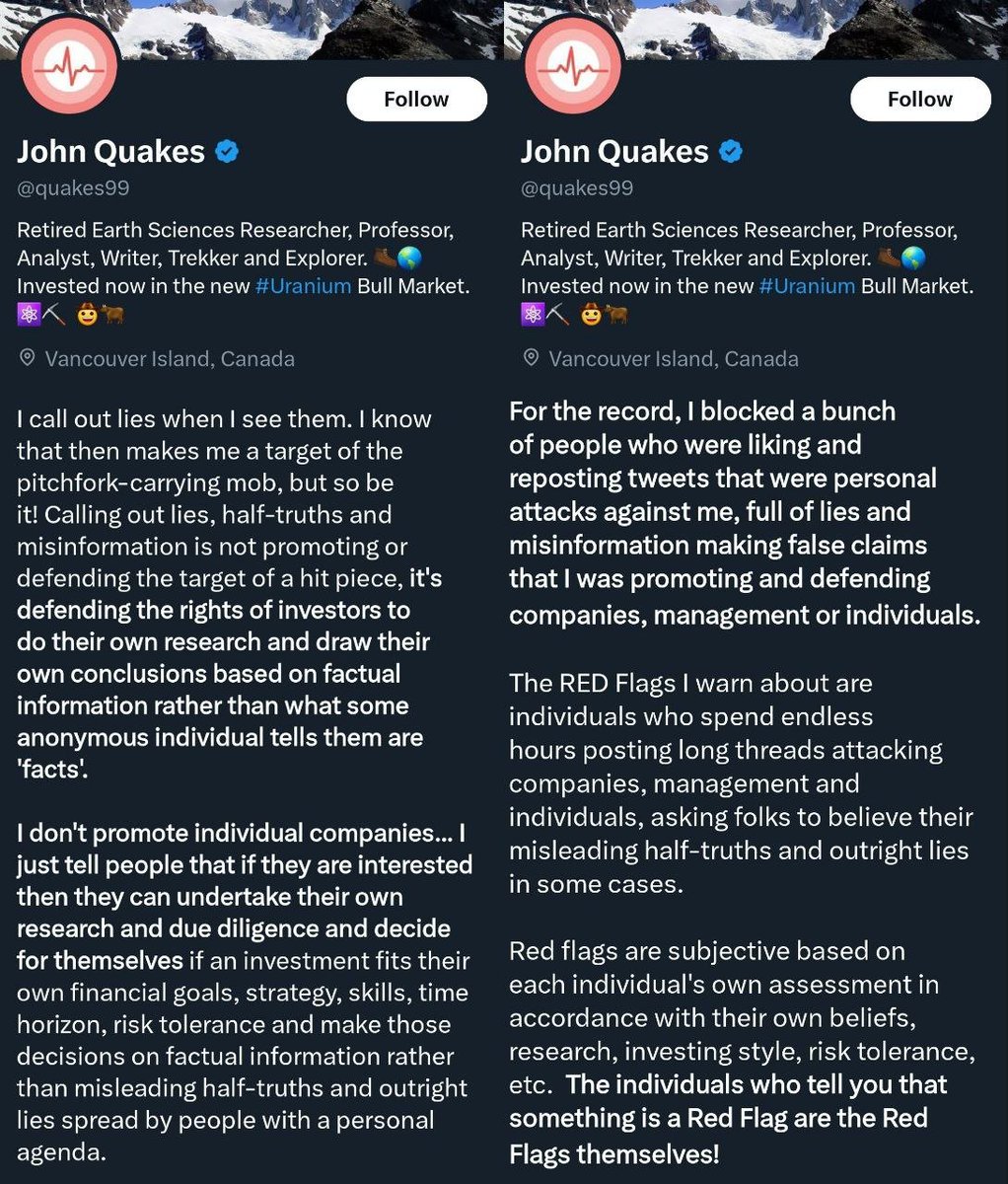

First of all, @quakess99 makes wide use of:

1. Ad Hominem Attacks

This is how he attacks my character (and those of other critically-minded #Utwit members) or motives instead of addressing the substance of the facts presented...

First of all, @quakess99 makes wide use of:

1. Ad Hominem Attacks

This is how he attacks my character (and those of other critically-minded #Utwit members) or motives instead of addressing the substance of the facts presented...

4/12

By calling my research a "hit piece" and labeling me a "predatory short seller that preys on poor retail investors" in previous attacks, he's attempted to discredit me personally rather than engage with the facts I've presented. Facts he never touched upon, of course...

By calling my research a "hit piece" and labeling me a "predatory short seller that preys on poor retail investors" in previous attacks, he's attempted to discredit me personally rather than engage with the facts I've presented. Facts he never touched upon, of course...

5/12

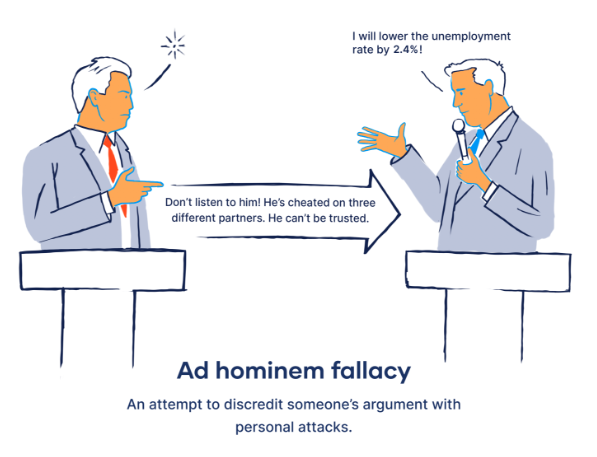

2. Straw Man Fallacy

This is how he misrepresents or oversimplifies my arguments to make them easier to attack. By focusing on #RSU option grant's tax implications, he's not addressing the main points of my argument but rather a side issue that is irrelevant to my points.

2. Straw Man Fallacy

This is how he misrepresents or oversimplifies my arguments to make them easier to attack. By focusing on #RSU option grant's tax implications, he's not addressing the main points of my argument but rather a side issue that is irrelevant to my points.

6/12

3. Deflection

Instead of responding to the specific accusations and evidence I've provided, @quakes99 deflects the issue to something else — in this case, the tax consequences of #RSU option grants, which is not the central issue of my research. It is irrelevant...

3. Deflection

Instead of responding to the specific accusations and evidence I've provided, @quakes99 deflects the issue to something else — in this case, the tax consequences of #RSU option grants, which is not the central issue of my research. It is irrelevant...

7/12

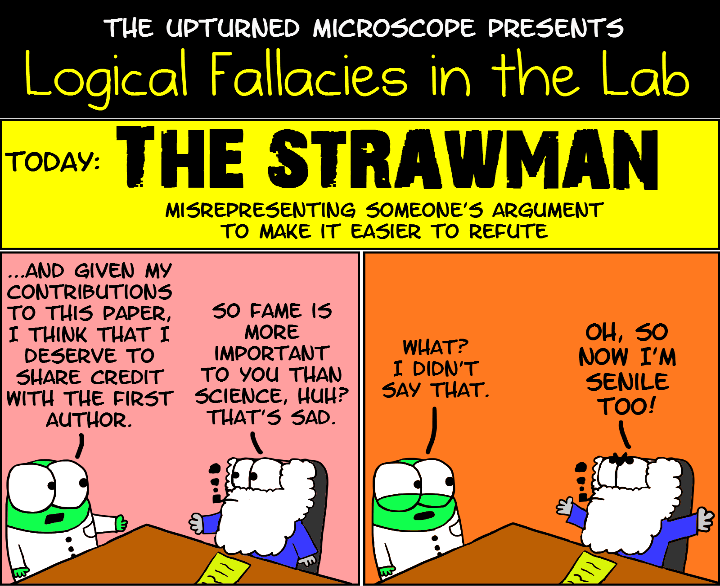

4. Appeal to Authority

@quakes99 is "The Professor", respected by 1,000s of #Utwitters. He implicitly relies on the fallacy of Appeal to Authority, where he uses his larger following & presumed reputation to give weight to his arguments over mine, regardless of the facts.

4. Appeal to Authority

@quakes99 is "The Professor", respected by 1,000s of #Utwitters. He implicitly relies on the fallacy of Appeal to Authority, where he uses his larger following & presumed reputation to give weight to his arguments over mine, regardless of the facts.

8/12

First, the tongue of @quakes99 the Sophist slanderer tries to murder my character through Ad Hominem + Appeal to Authority, while playing the hero at the same time: the defender of retail investors and, yes, I will show further on, of the companies involved...

First, the tongue of @quakes99 the Sophist slanderer tries to murder my character through Ad Hominem + Appeal to Authority, while playing the hero at the same time: the defender of retail investors and, yes, I will show further on, of the companies involved...

9/12

@quakes99 in a previous post response to my $FUU thread went on a seething-long rant, giving his followers a Google explanation on #RSUs taxation, which is an absolute Straw Man Fallacy, because he simplifies all my Misrepresentation of Facts proof and other🚩 I expose...

@quakes99 in a previous post response to my $FUU thread went on a seething-long rant, giving his followers a Google explanation on #RSUs taxation, which is an absolute Straw Man Fallacy, because he simplifies all my Misrepresentation of Facts proof and other🚩 I expose...

10/12

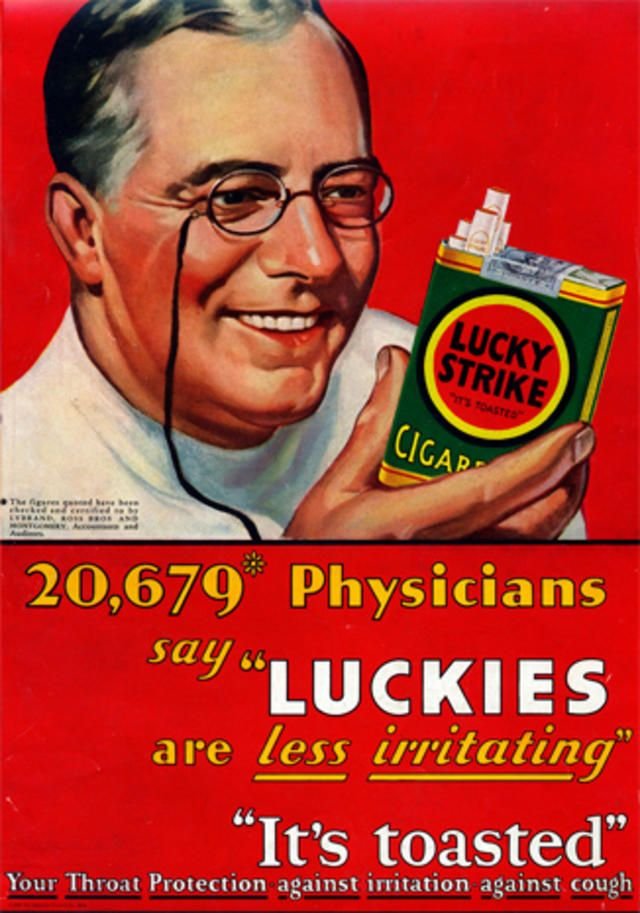

By calling my fact-based research a "hit piece with lies, half-truths, and misinformation", he is literally defending these shady companies. He is deflecting the facts from the real issues at hand. Only someone with an interest would take that much effort to do so...

By calling my fact-based research a "hit piece with lies, half-truths, and misinformation", he is literally defending these shady companies. He is deflecting the facts from the real issues at hand. Only someone with an interest would take that much effort to do so...

11/12

By stating, "The individuals who tell you that something is a🚩 are the🚩 themselves" he is once again committing an Ad Hominem attack to deflect his followers from the hard truths. "Do NOT listen to critical takes based on facts. Trust "The Professor" instead." 🐍

By stating, "The individuals who tell you that something is a🚩 are the🚩 themselves" he is once again committing an Ad Hominem attack to deflect his followers from the hard truths. "Do NOT listen to critical takes based on facts. Trust "The Professor" instead." 🐍

12/12

I could go on for HOURS on this matter and dissect @quakes99 sophistic tactics way further, but I won't waste any more energy on this Vancouver 🇨🇦 personality. If you still consider him to be unbiased and reliable, then you do your thing, sirs & ladies.

🐸✌️

END

I could go on for HOURS on this matter and dissect @quakes99 sophistic tactics way further, but I won't waste any more energy on this Vancouver 🇨🇦 personality. If you still consider him to be unbiased and reliable, then you do your thing, sirs & ladies.

🐸✌️

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh