📓• Time & Price Theory | Protraction Profiles 🧵

pro·trac·tion

noun

1. Utilizing the London profile to characterize the NY intraday price action delivery program

• Classic Protraction

• Delayed Protraction

• Void Profile ~ Judas Swing

PDF Available here: drive.google.com/file/d/1HDJ6zO…

pro·trac·tion

noun

1. Utilizing the London profile to characterize the NY intraday price action delivery program

• Classic Protraction

• Delayed Protraction

• Void Profile ~ Judas Swing

PDF Available here: drive.google.com/file/d/1HDJ6zO…

Thank you everyone for the ongoing support; I recently reached 4000 followers and am very appreciate for each and eveyone of you 🙌

If you found this helpful please consider following (liking, resharing, commenting) & check out my YT channel for new videos every 2 days.

If you found this helpful please consider following (liking, resharing, commenting) & check out my YT channel for new videos every 2 days.

Concept credits:

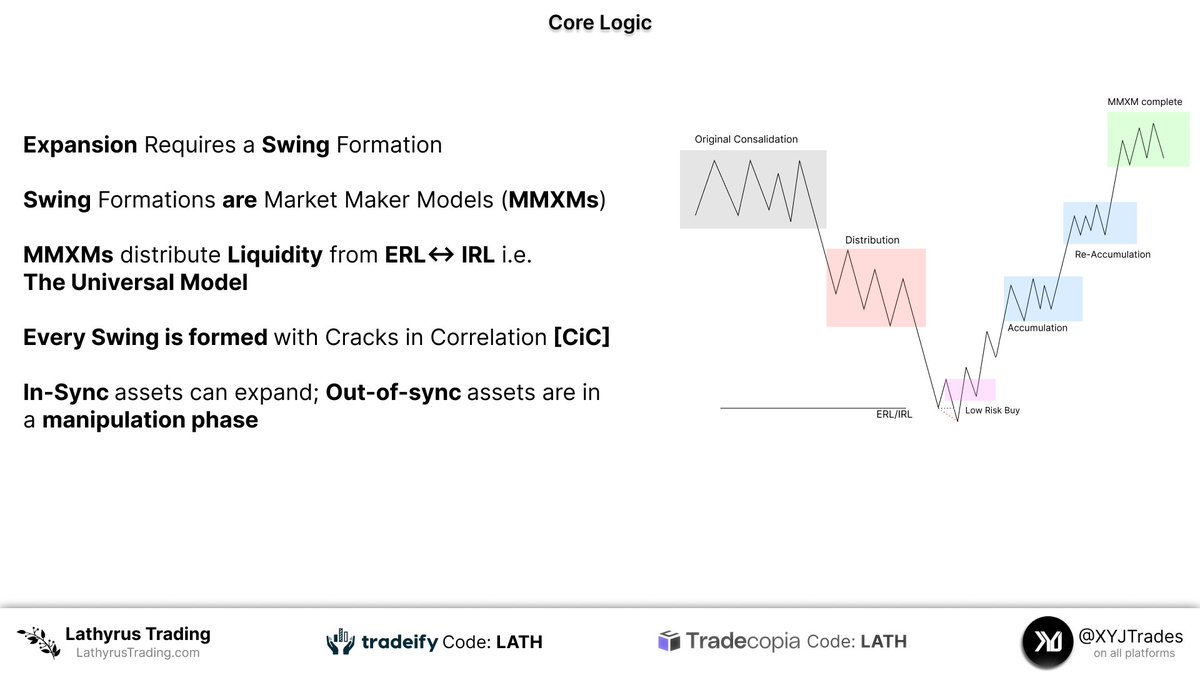

Although I most definitely tag him way too much credit is due to @theMMXMtrader for teaching us the intricacies of Market Maker Models

Also huge shoutout to @alextlaz his work is phenomenal as well building on tons of ICT content.

Cheers 🥂

Although I most definitely tag him way too much credit is due to @theMMXMtrader for teaching us the intricacies of Market Maker Models

Also huge shoutout to @alextlaz his work is phenomenal as well building on tons of ICT content.

Cheers 🥂

• • •

Missing some Tweet in this thread? You can try to

force a refresh