Clear signs that a LTF reversal may occur, including:

- Clears hourly liquidity

- Respecting the higher time frame POI

- Generates alluring internal liquidity

- Violates PD array for the opposing direction (FVG/Inversions/OB)

- Clears hourly liquidity

- Respecting the higher time frame POI

- Generates alluring internal liquidity

- Violates PD array for the opposing direction (FVG/Inversions/OB)

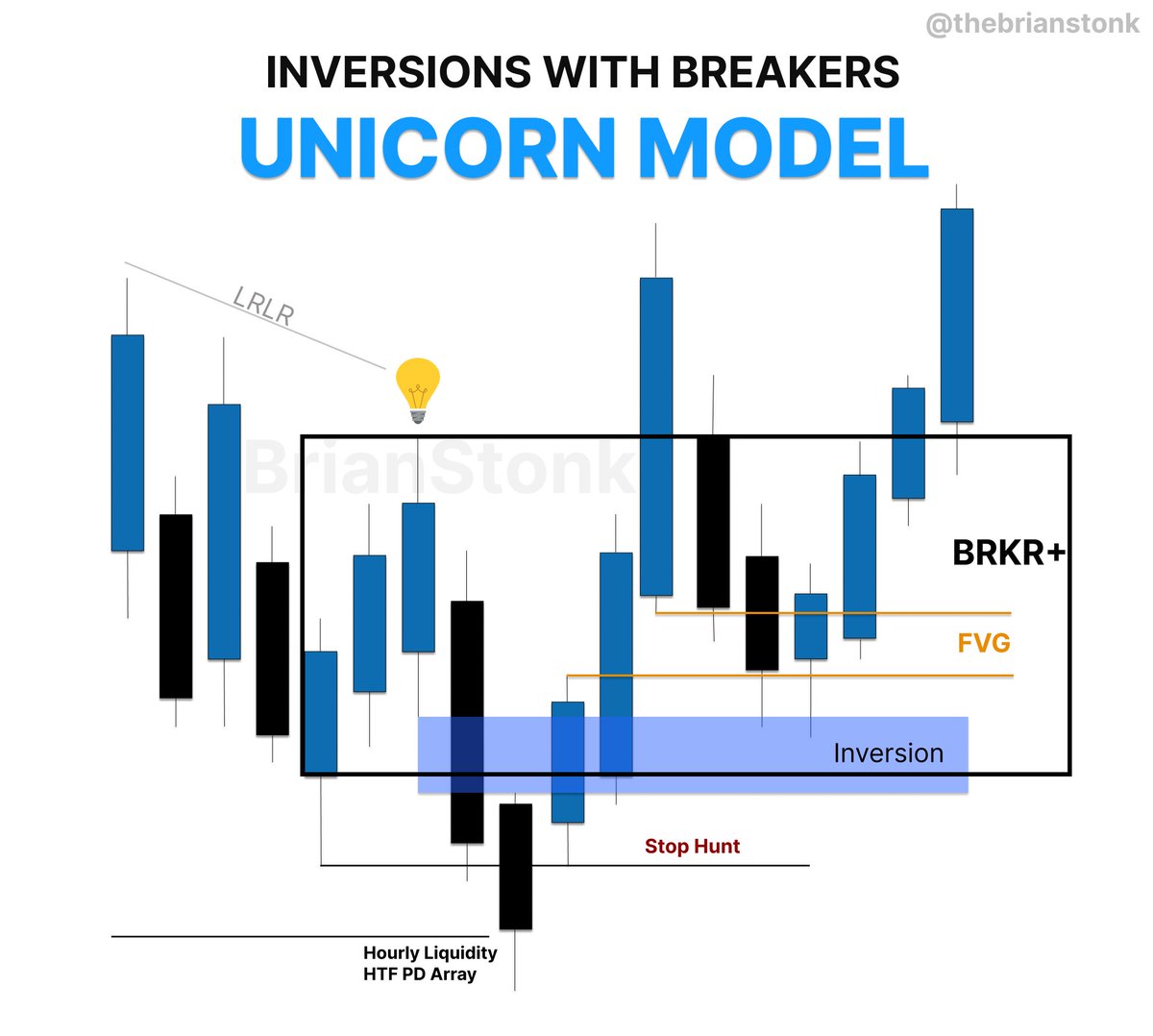

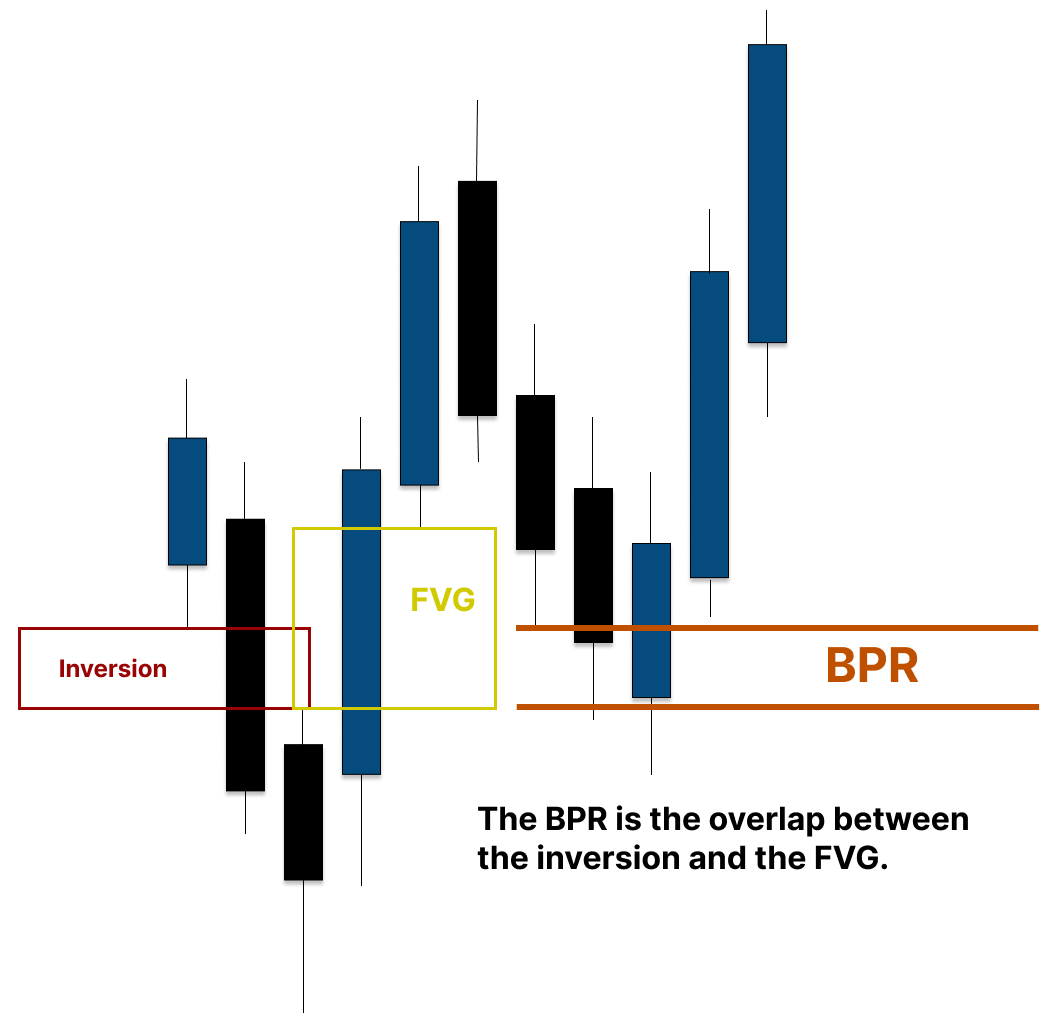

We can employ inversions as confirmation & entry points when we anticipate the formation of the breaker and an ensuing reversal.

Upon meeting reversal criteria and adhering to the flipped direction while violating the opposing PD array, a low-risk entry opportunity is created.

Upon meeting reversal criteria and adhering to the flipped direction while violating the opposing PD array, a low-risk entry opportunity is created.

When deconstructing a reversal, inversions present additional entry opportunities, prioritizing a secure delivery into internal liquidity, and potentially extending to external liquidity.

Internal Liquidity:

- LRLR (Trendline)

- Relative Equal High/Low (Smooth)

- Swing Point

Internal Liquidity:

- LRLR (Trendline)

- Relative Equal High/Low (Smooth)

- Swing Point

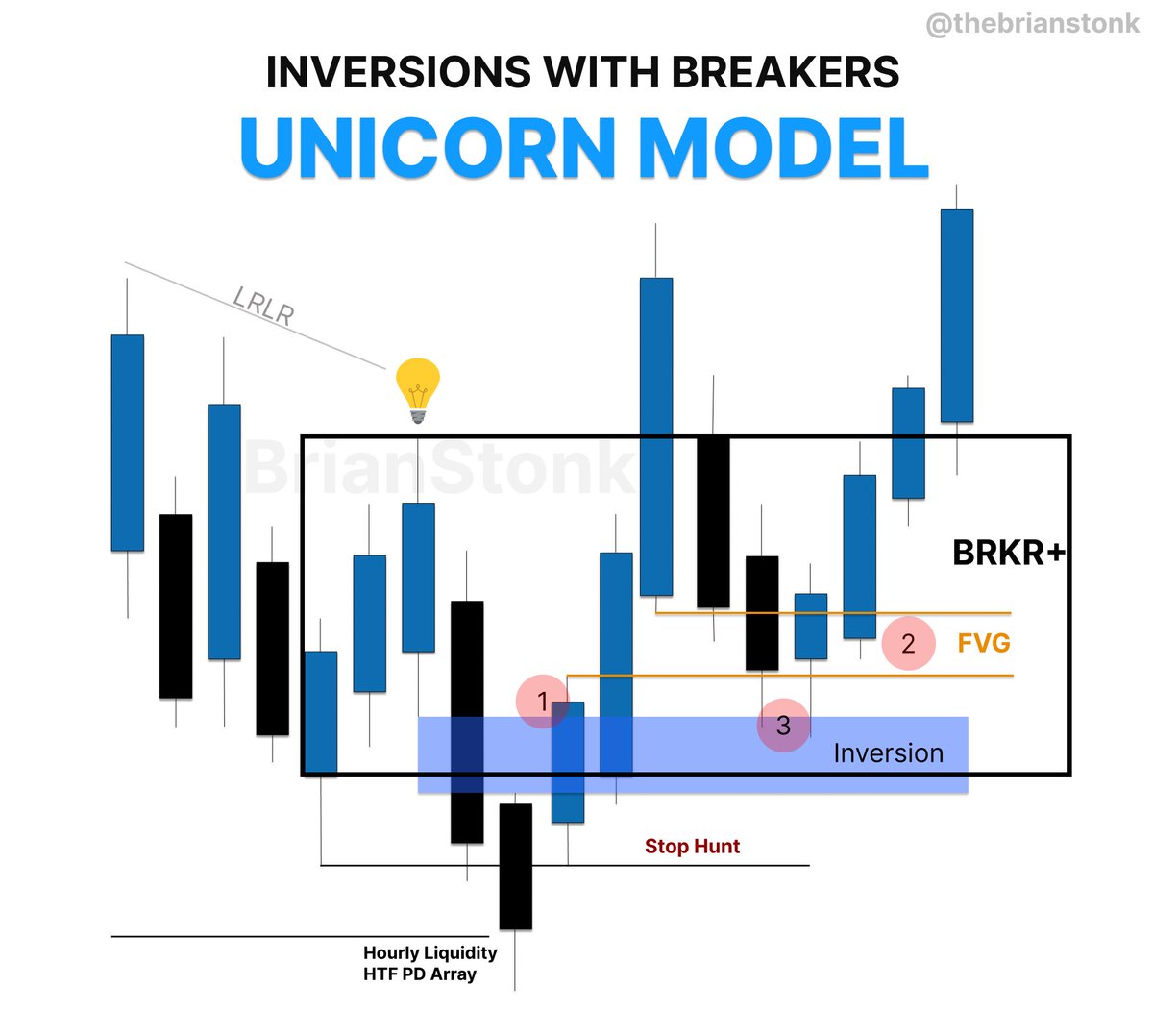

Implementing the inversion framework into our Unicorn model after meeting clear reversal criteria, we can concentrate on these three entry points:

1) Closing above the bearish FVG, which violates the PD array and transitions into an inversion, serves as an entry point (@DodgysDD strategy).

2) The formation of a breaker offers a traditional Unicorn entry opportunity.

3) The shift from a bearish FVG to a bullish inversion signals a retracement suitable for entry.

1) Closing above the bearish FVG, which violates the PD array and transitions into an inversion, serves as an entry point (@DodgysDD strategy).

2) The formation of a breaker offers a traditional Unicorn entry opportunity.

3) The shift from a bearish FVG to a bullish inversion signals a retracement suitable for entry.

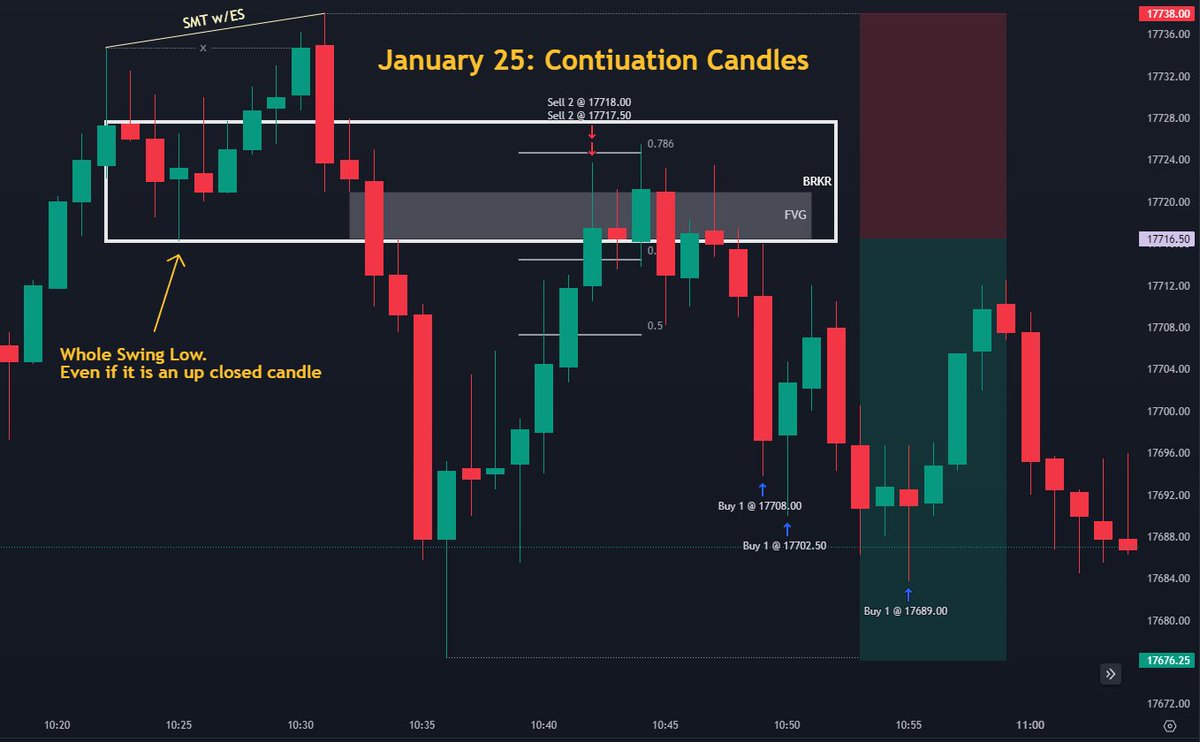

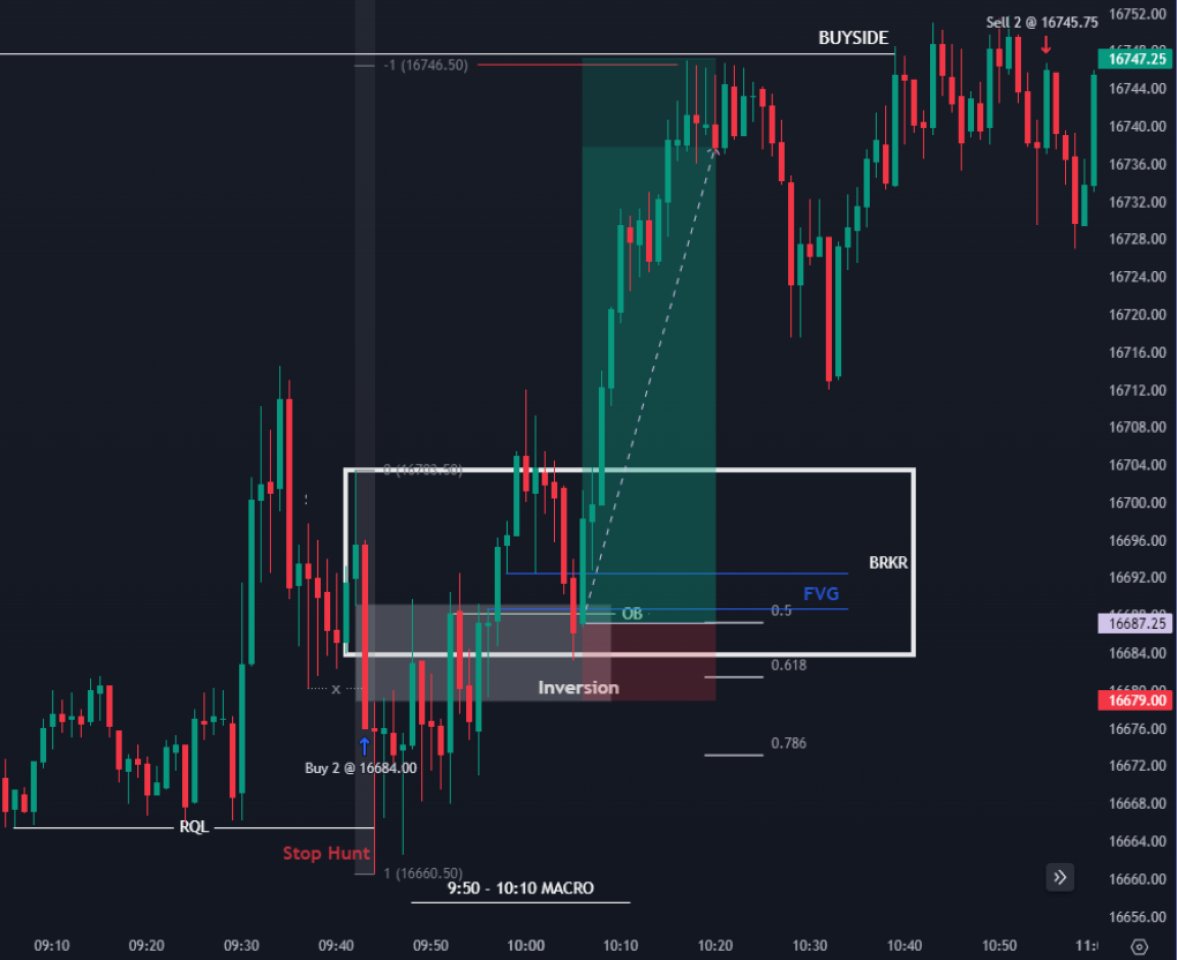

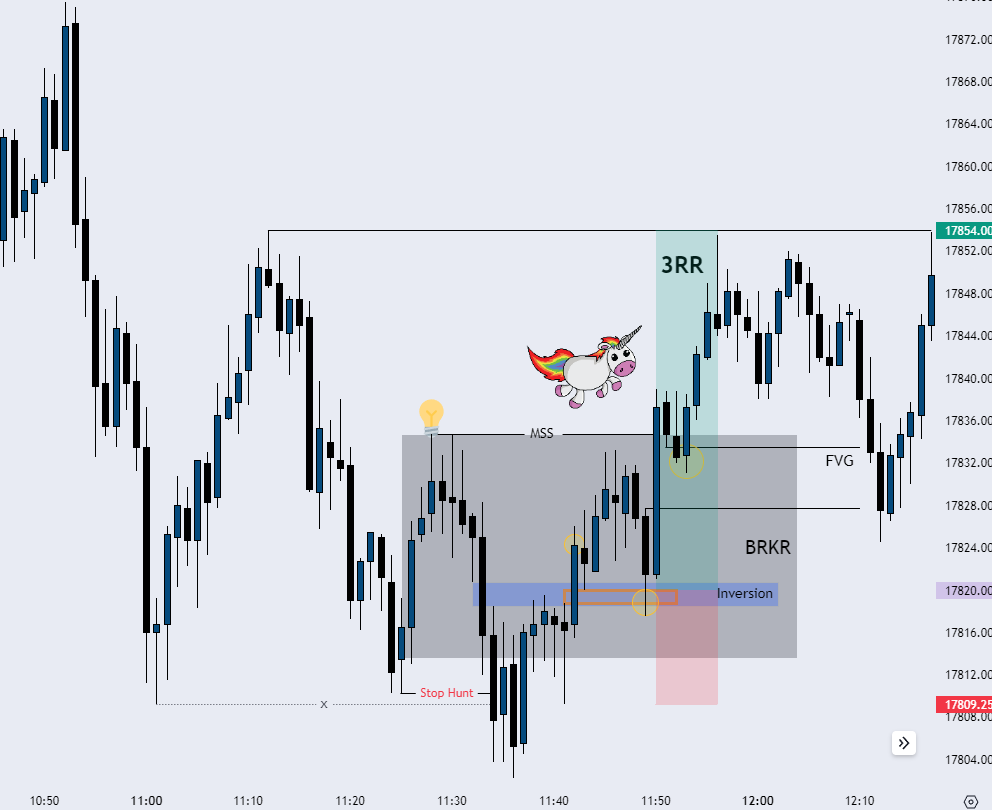

February 6th: Tuesday

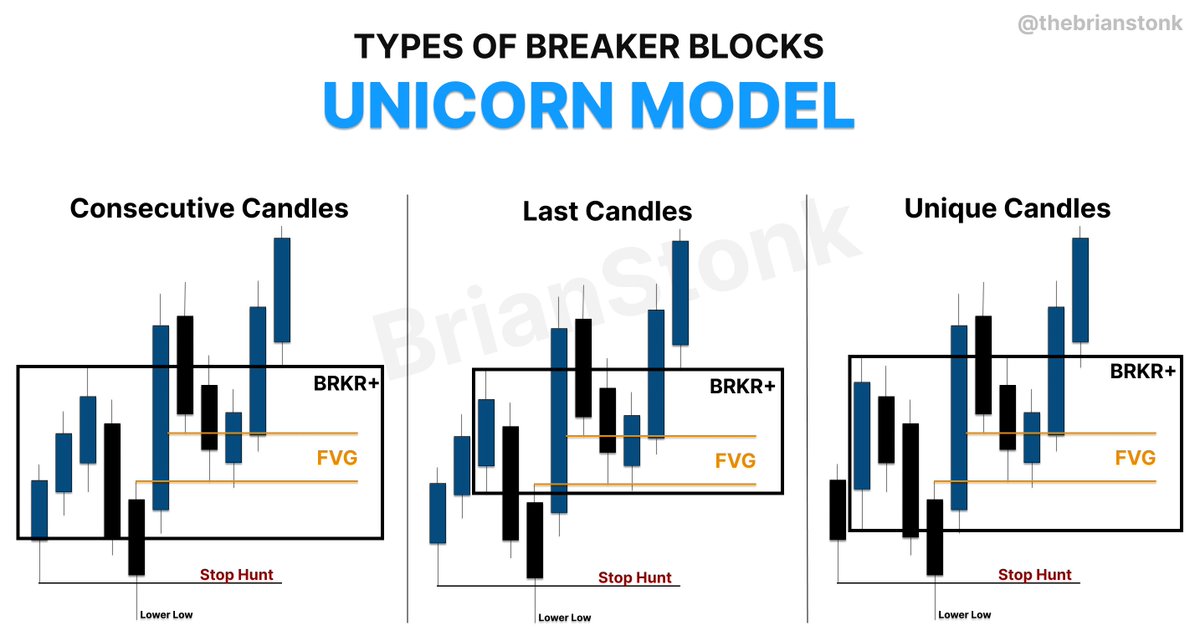

Consecutive candle breakers demonstrate displacement, effectively sweeping liquidity and initiating a reversal, supported by hourly FVG and the multiple failed drives.

Entry via inversion closure can effectively target internals (LRLR) and facilitate the formation of a bullish breaker block.

Classic unicorn entry into the FVG to target liquidity drawdown.

Stops may be placed at the bottom of the breaker or the bottom of the inversion, contingent upon the entry criteria

Consecutive candle breakers demonstrate displacement, effectively sweeping liquidity and initiating a reversal, supported by hourly FVG and the multiple failed drives.

Entry via inversion closure can effectively target internals (LRLR) and facilitate the formation of a bullish breaker block.

Classic unicorn entry into the FVG to target liquidity drawdown.

Stops may be placed at the bottom of the breaker or the bottom of the inversion, contingent upon the entry criteria

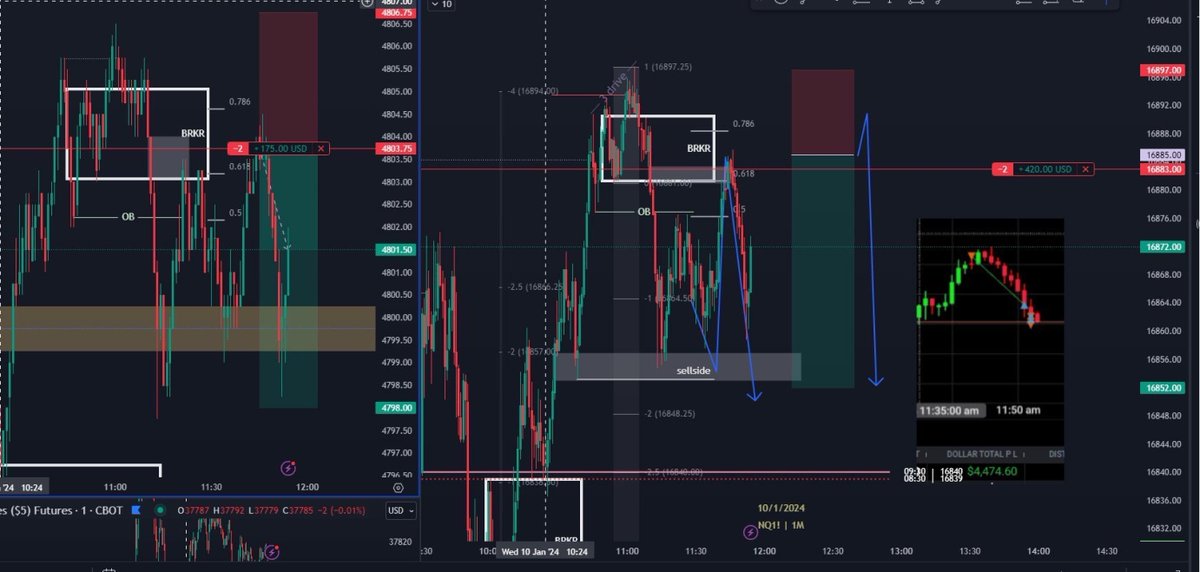

February 7th: Wednesday

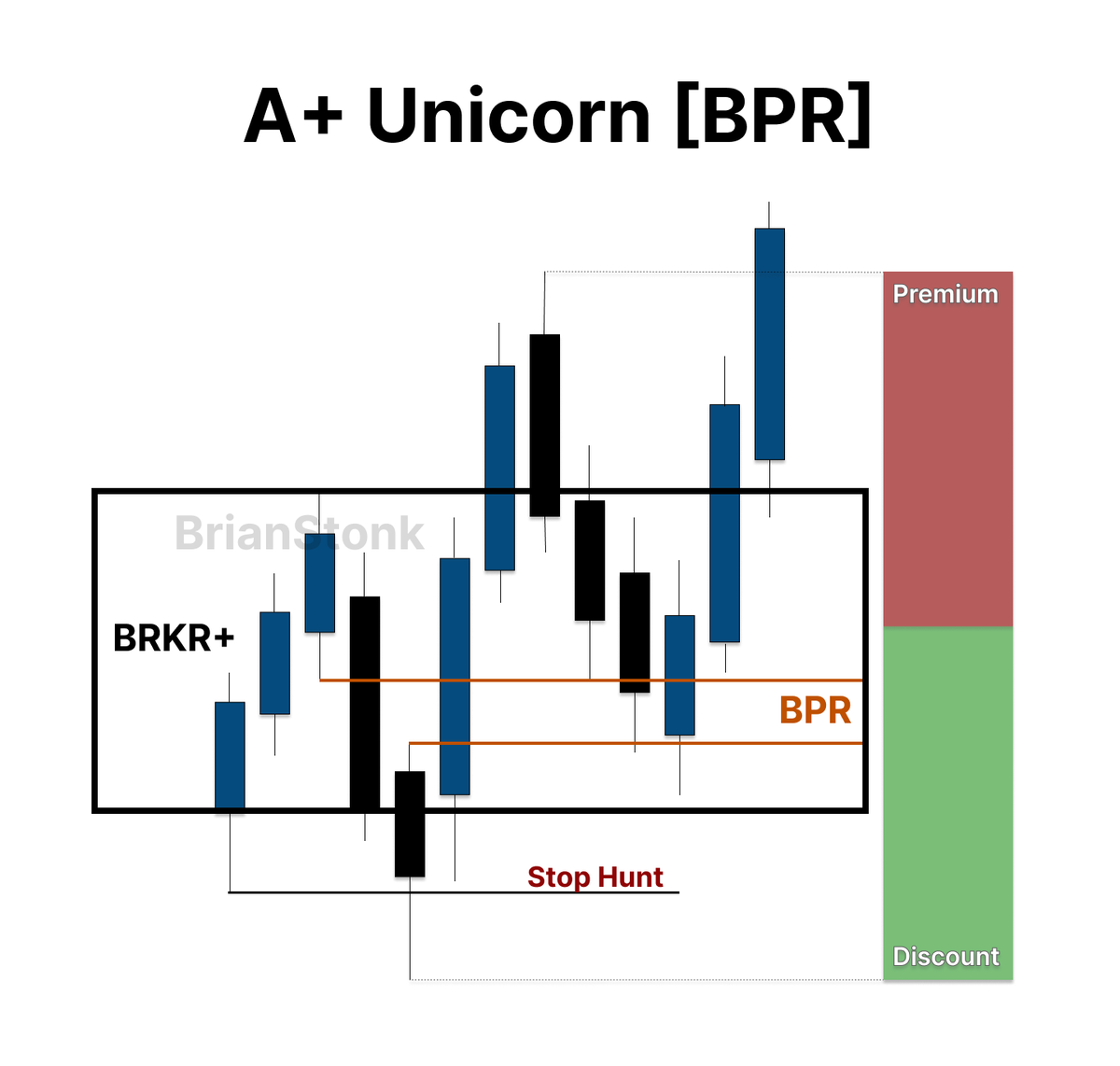

Consecutive candle breakers demonstrate displacement, effectively sweeping lows and initiating a reversal, supported by the higher time frame POI.

Entry via inversion closure can effectively target internals (RQH) and facilitate the formation of a bullish breaker block.

Retracement supported by inversions and the FVG creates a classic BPR unicorn entry model.

Stops at the bottom of the breaker or the swing low.

Consecutive candle breakers demonstrate displacement, effectively sweeping lows and initiating a reversal, supported by the higher time frame POI.

Entry via inversion closure can effectively target internals (RQH) and facilitate the formation of a bullish breaker block.

Retracement supported by inversions and the FVG creates a classic BPR unicorn entry model.

Stops at the bottom of the breaker or the swing low.

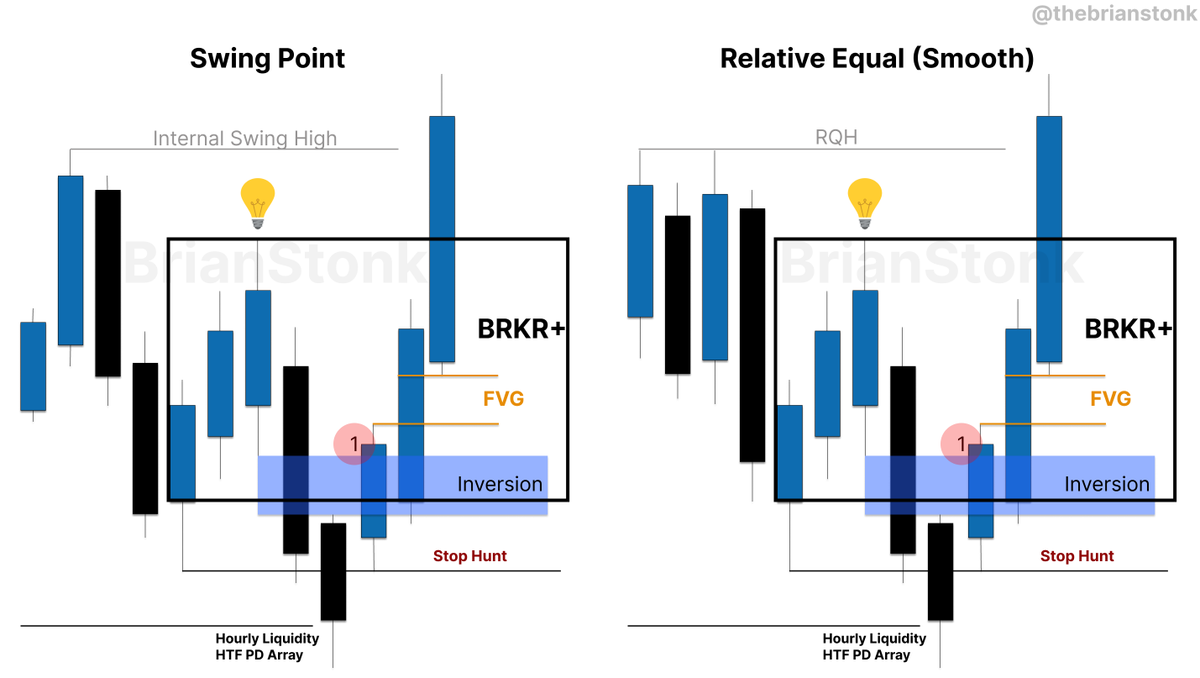

January 29th: Monday

Consecutive candle breakers demonstrate displacement, effectively sweeping all relative lows and initiating a reversal, supported by the hourly sell-side and the time macro.

Entry via inversion closure can effectively target internals (RQH) and facilitate the formation of a bullish breaker block.

Retracement supported by inversions and the FVG creates a classic BPR unicorn entry model.

Stop at the hunted lows.

Consecutive candle breakers demonstrate displacement, effectively sweeping all relative lows and initiating a reversal, supported by the hourly sell-side and the time macro.

Entry via inversion closure can effectively target internals (RQH) and facilitate the formation of a bullish breaker block.

Retracement supported by inversions and the FVG creates a classic BPR unicorn entry model.

Stop at the hunted lows.

That wraps up this comprehensive thread on deconstructing LTF reversal and integrating inversions into the Unicorn model.

Please conduct your own back/forward testing.

If you've reached this point, give a ❤️ to demonstrate your dedication, as many may not reach this point.

Please conduct your own back/forward testing.

If you've reached this point, give a ❤️ to demonstrate your dedication, as many may not reach this point.

• • •

Missing some Tweet in this thread? You can try to

force a refresh