An order block is defined as “a change in the state of delivery.”

A change in the state of delivery (CSD) is when IPDA shifts from a buy program to a sell program, or vice versa.

A change in the state of delivery (CSD) is when IPDA shifts from a buy program to a sell program, or vice versa.

When price returns to an old level of institutional sponsorship, there will be a change in the state of delivery.

Displacement alongside order blocks hints that there is institutional sponsorship behind the move. It is the large orders of smart money participation that leave behind a “footprint.”

This is true institutional order flow, price should respect it. (assuming you are aligned with the current draw on liquidity)

Displacement alongside order blocks hints that there is institutional sponsorship behind the move. It is the large orders of smart money participation that leave behind a “footprint.”

This is true institutional order flow, price should respect it. (assuming you are aligned with the current draw on liquidity)

A bullish order block is a change in the state of delivery from a sell program to a buy program.

The lowest candle with a down close that has the most range between open to close and is near a “support” level.

This occurs at a HTF discount array.

The lowest candle with a down close that has the most range between open to close and is near a “support” level.

This occurs at a HTF discount array.

A bearish order block is a change in the state of delivery from a buy program to a sell program.

The highest candle with a up close that has the most range between open to close and is near a “resistance” level.

This occurs at a HTF premium array.

The highest candle with a up close that has the most range between open to close and is near a “resistance” level.

This occurs at a HTF premium array.

In my opinion, viewing order blocks is one of the easiest ways to identify the current state of orderflow.

If orderflow is bullish, discount order blocks will be respected by price.

If orderflow is bearish, premium order blocks will be respected by price.

If orderflow is bullish, discount order blocks will be respected by price.

If orderflow is bearish, premium order blocks will be respected by price.

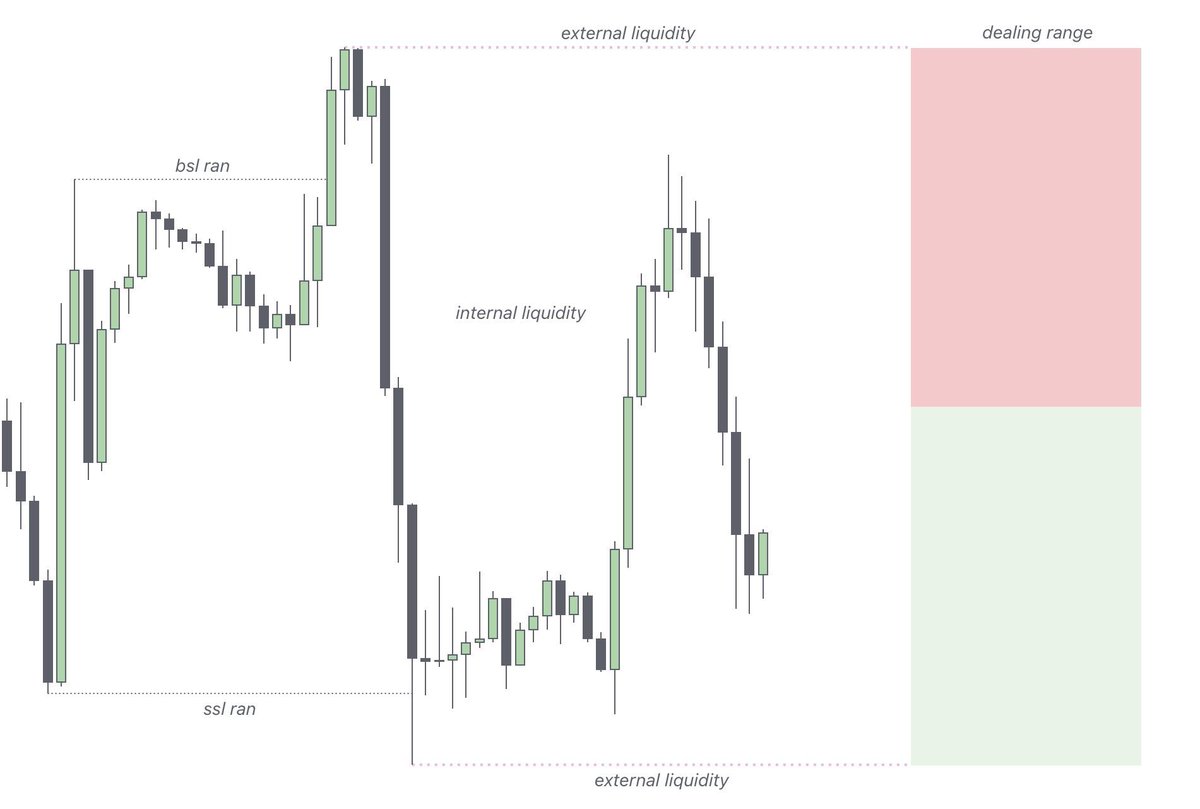

High probability order blocks

- Come off a HTF PDA

- Create a fair value gap

- Have a liquidity grab

- Create a break of structure

- Come off a HTF PDA

- Create a fair value gap

- Have a liquidity grab

- Create a break of structure

Now you may be wondering, how do I mark these order blocks?

When the wick is overlapping with a fair value gap, then mark the order block using the wick.

When the wick is overlapping with a fair value gap, then mark the order block using the wick.

When the wick is not overlapping with a fair value gap, then mark the order block using the body. This method of marking order blocks was shown to me by my friend & mentor Arjo.

“Wicks do the damage, bodies tell the story.”

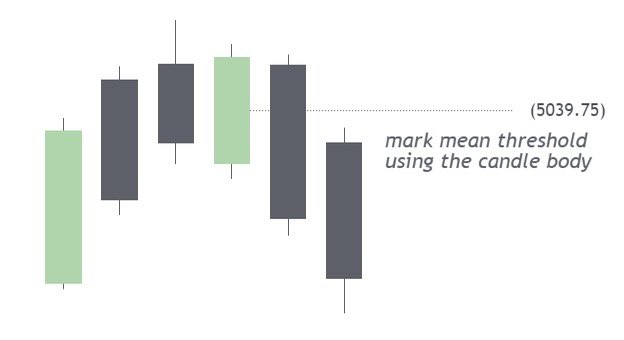

When looking to validate/invalidate order blocks, mean threshold is the early indicator. This would be a body candle close above/below mean threshold. We want to mark the mean threshold using a .5 fib and grabbing the candle body.

When looking to validate/invalidate order blocks, mean threshold is the early indicator. This would be a body candle close above/below mean threshold. We want to mark the mean threshold using a .5 fib and grabbing the candle body.

In this example, we wick into mean threshold and then respect it. This is an early indication that this order block will be respected by price.

However, in this example, we disrespect mean threshold and close above the order block. This is an invalidation of the bearish order block.

Anticipating where and when order blocks will form is an absolute game changer. Order block theory goes much deeper than just buying the last down close or up close candle.

To support or connect with me, please checkout my links below!! 💞

linktr.ee/tradingpatient…

linktr.ee/tradingpatient…

• • •

Missing some Tweet in this thread? You can try to

force a refresh