Yield curve dynamics are crucial to understand if you want to become a better macro investor.

And there is a lot going on under the surface now.

Thread.

1/

And there is a lot going on under the surface now.

Thread.

1/

Yield curve dynamics represent a crucial macro variable, as they inform us on today’s borrowing conditions and on the market future expectations for growth and inflation.

2/

2/

An inverted yield curve often leads towards a recession because it chokes real-economy agents off with tight credit conditions (high front-end yields) which are reflected in weak future growth and inflation expectations (lower long-dated yields).

3/

3/

A steep yield curve instead signals accessible borrowing costs (low front-end yields) feeding into expectations for solid growth and inflation down the road (high long-dated yields).

4/

4/

Rapid changes in the shape of the yield curve at different stages of the cycle are a key macro variable to understand and incorporate in your portfolio allocation process.

So, let's explore the 4 main yield curve regimes.

5/

So, let's explore the 4 main yield curve regimes.

5/

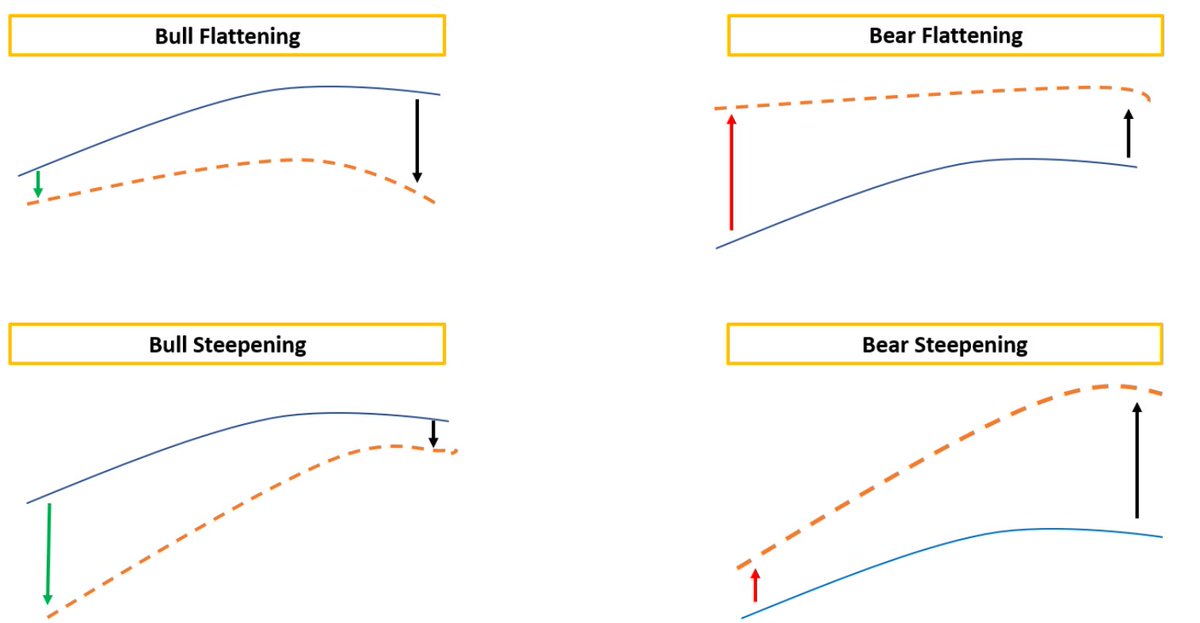

Bull Flattening = lower front-end yields, flatter curves.

Think of 2016: Fed Funds already basically at 0% and weak global growth.

Yields stay put at the front-end and could move lower only at the long-end, hence bull-flattening the curve.

6/

Think of 2016: Fed Funds already basically at 0% and weak global growth.

Yields stay put at the front-end and could move lower only at the long-end, hence bull-flattening the curve.

6/

Bull Steepening = lower front-end yields, steeper curves.

Late 2020, early 2021: the Fed was keeping rates pinned at 0% and stimulating via QE but the economy was flooded with fiscal stimulus and ready for reopening.

7/

Late 2020, early 2021: the Fed was keeping rates pinned at 0% and stimulating via QE but the economy was flooded with fiscal stimulus and ready for reopening.

7/

This tends to happen ahead of recessions: short-dated bonds start to price in meaningful Fed cuts in response to weak economic conditions, and they rally harder than long-end bonds.

A transition from a flat curve to a bull steepening is very troublesome for markets.

8/

A transition from a flat curve to a bull steepening is very troublesome for markets.

8/

Bear Flattening = higher front-end yields, flatter curves.

2022 was the bear flattening year: Powell raised rates aggressively to fight inflation, but he ended up choking the economy off.

9/

2022 was the bear flattening year: Powell raised rates aggressively to fight inflation, but he ended up choking the economy off.

9/

Bear Steepening = higher front-end yields, steeper curves.

This happened in Q3-23, leading long-end yields markedly higher as investors demanded more term premium to hold long duration bonds.

Unless growth is exceptionally strong, bear steepening are hard on equities.

10/

This happened in Q3-23, leading long-end yields markedly higher as investors demanded more term premium to hold long duration bonds.

Unless growth is exceptionally strong, bear steepening are hard on equities.

10/

Recently, the curve has been bear flattening.

Yes, markets have priced away a large number of cuts until early 2025 but they are assuming the Fed will be forced to deliver some of them later anyway.

For example: the inversion between March 2025 and March 2026 just reached new lows.

11/

Yes, markets have priced away a large number of cuts until early 2025 but they are assuming the Fed will be forced to deliver some of them later anyway.

For example: the inversion between March 2025 and March 2026 just reached new lows.

11/

The hawkish YTD repricing in bond markets has been contained by reshuffling some cuts down the curve.

This explains why such a repricing in bond markets doesn’t have strong repercussions on stock markets.

12/

This explains why such a repricing in bond markets doesn’t have strong repercussions on stock markets.

12/

Rapid changes in the shape of the yield curve when growth is at turning points are a key variable to consider for a successful asset allocation process.

Hence, it's important to keep watching the changes in the shape of the yield curve.

13/

Hence, it's important to keep watching the changes in the shape of the yield curve.

13/

Before you leave: I am working to the launch of my new macro fund!

If you are interested to discuss a potential allocation, reach out to me and I'll share more info.

Enjoy your weekend!

14/14

If you are interested to discuss a potential allocation, reach out to me and I'll share more info.

Enjoy your weekend!

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh