Restore the company noyce and Moore built. Time to rebuild western manufacturing. Today is a day in that mission.

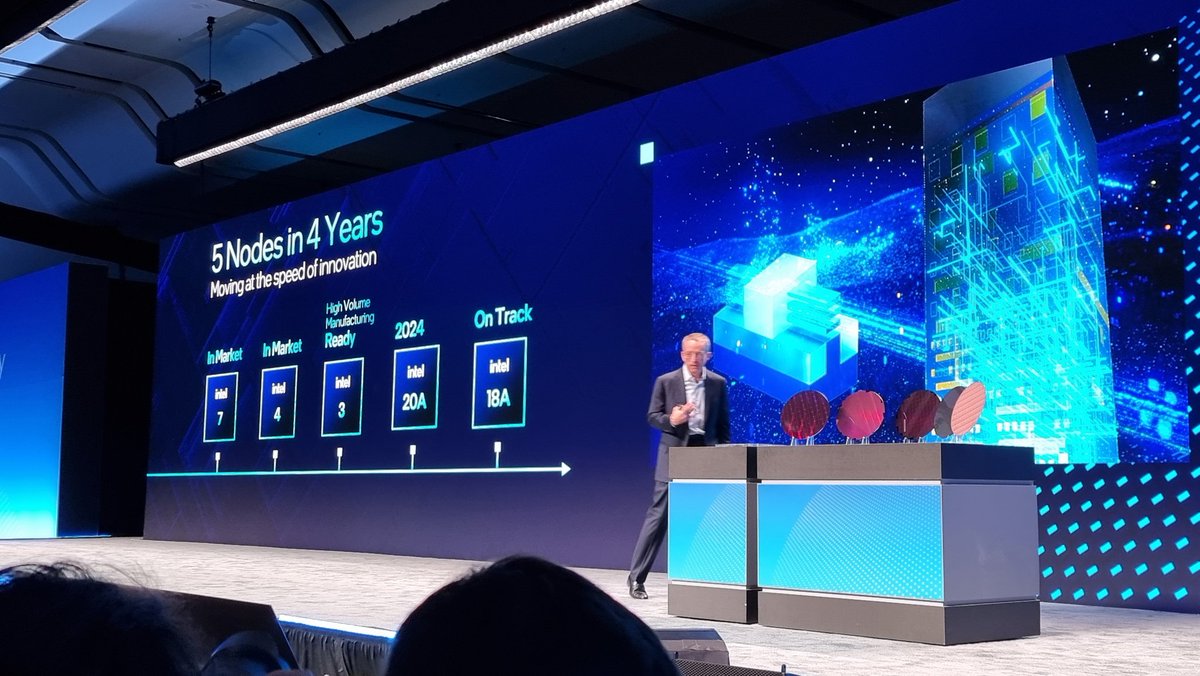

3 years ago, mixed response on foundry goals. Internally, Intel was Reinvigorated against the pessimism. The vision becomes real - Intel Foundry.

Foundry and products will be independent. Foundry will keep security, but products will drive the foundry volume. Interdependence

Chip design became boring, then AI happened. Explosion in perf, capabilities, power. Pushing every dept, going after 100% TAM. Intel is the world's first system foundry

Need to ensure consistent supply and supply chain for the next generation of world class silicon. Physics is driving to chiplets, rack level systems, packaging is vital. Systems foundry does it all, and available to customers to enable innovation

Former CEO and chairmen of synopsys, cadence, and Siemens on advisory board.

Intel to become world #2 foundry by 2030.

Intel to become world #2 foundry by 2030.

This goal is to move to this in the decade.

The volume of chips the bleeding edge of AI needs is mind blowing. It's a perfect convergence for Intel.

Is the chips act done? Do we need chips 2?

GF get 1.5b announced recently. Running fast to deploy chips 1. But there will have to be chips 2 if we want to lead the world.

GF get 1.5b announced recently. Running fast to deploy chips 1. But there will have to be chips 2 if we want to lead the world.

Very soon Intel chips grant to be announced. (didn't make it in time for the event)

Intel clearwater forest. Intel 20A with an Intel 3 base die. Foveros direct at sub 10 Micron, and emib

Mention of glass and optics. More details this afternoon

Intel is the clear leader in process and packaging and systems foundry. 15b total deal value in foundry today.

At Intel, it's the people who make the company. You don't need to be in Taiwan to build the world's leading semiconductors. We want to earn being your foundry supplier.

Stu came back to Intel 3 months after pat did

Tower and UMC allow Intel to load balance the factories. Rounds out the cost structure. Talks with tower about 40nm.

Optics enables chips on chips on chips on chips on chips on chips on chips on chips on chips.

Tasty!

Tasty!

@Arm Yes, Arm at an Intel event is a weird thing. But this is the IF BU, not product

@Arm Conversations started very soon after Rene took over Arm. Arm needs to be part of what Intel is doing. Arm announced new datacenter cores N3 V3 this morning (I'm still writing that up)

Fireside chat time with @MediaTek and @Broadcom. Guess who two of the biggest Intel foundry customers are

And that's a wrap! If anyone uses my photos, a link back would be greatly appreciated!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh