🚨How British companies are bolstering Vladimir Putin’s war machine🚨

A depressing thread.

But an important one.

With some pretty shocking charts.

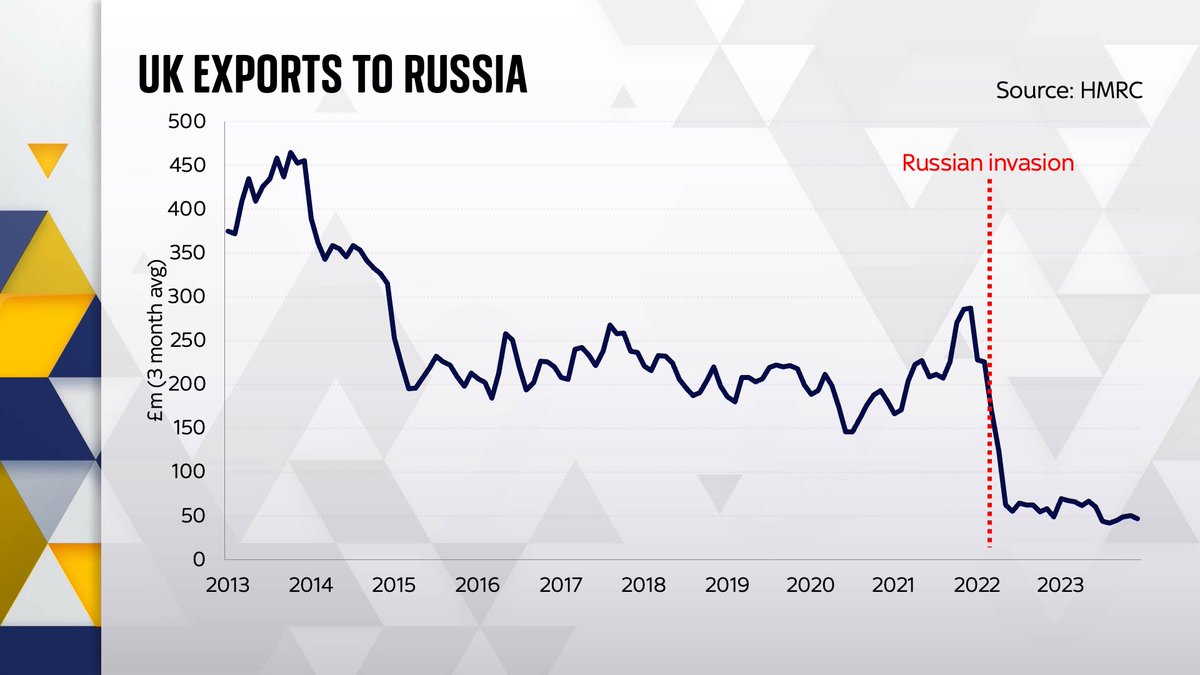

Let’s begin with the “official” picture. It suggests UK trade with Russia has collapsed since Feb 2022. Down by 74%…

A depressing thread.

But an important one.

With some pretty shocking charts.

Let’s begin with the “official” picture. It suggests UK trade with Russia has collapsed since Feb 2022. Down by 74%…

Now let's fill in the data.

Look how we're no longer exporting cars or heavy machinery to Russia. Because the govt is well aware this stuff could be repurposed into weapons. So the official line is that this is a big success story.

Looks like Russia's economy is being starved

Look how we're no longer exporting cars or heavy machinery to Russia. Because the govt is well aware this stuff could be repurposed into weapons. So the official line is that this is a big success story.

Looks like Russia's economy is being starved

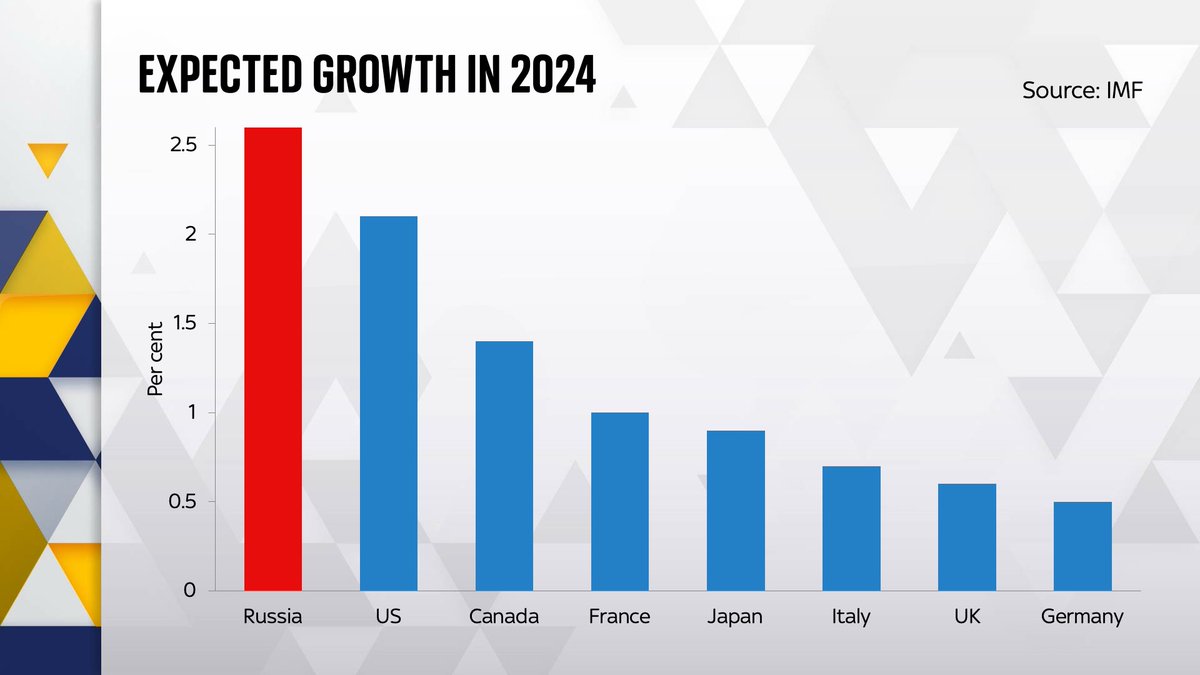

But clearly the Russian economy isn't doing as badly as all that. Indeed Russia is due to grow faster than any G7 nation this year 👇

And that's just the economy. Now look at the battlefield and Russia is looking v strong. No shortage of weapons/drones etc despite sanctions

Why?

And that's just the economy. Now look at the battlefield and Russia is looking v strong. No shortage of weapons/drones etc despite sanctions

Why?

Well let's imagine you're a Russian unit needing weapons. Imagine you rely on a certain input or tool from the UK. Back in the past you'd get it directly. But you can't anymore.

Here's one solution: set up a shell company in a friendly Caucasus state like Kyrgyzstan...

Here's one solution: set up a shell company in a friendly Caucasus state like Kyrgyzstan...

The genius of this is that there's no sanctions on these other neighbouring states. But once your goods arrive you can send them straight over to Russia.

They've been laundered.

Voila Russia gets its machinery which it can use to make weaponry etc, in spite of the sanctions.

They've been laundered.

Voila Russia gets its machinery which it can use to make weaponry etc, in spite of the sanctions.

Which raises a question: is this kind of thing actually happening? Well let's look at UK exports to Kyrgyzstan and ask the question: have they gone up since the outbreak of war? Well, have a look...

That's up by more than 1,100%.

And NB these aren't just ANY goods. They're precisely the machinery/car imports we can no longer send to Russia. All going to Kyrgyzstan. And then almost certainly onwards to Russia (tho the paper trail tends to end when goods leave UK)

And NB these aren't just ANY goods. They're precisely the machinery/car imports we can no longer send to Russia. All going to Kyrgyzstan. And then almost certainly onwards to Russia (tho the paper trail tends to end when goods leave UK)

It's a similar story in Armenia. And in many other Caucasus nations. A massive leap post invasion/sanctions...

Nor is this just a UK-specific story. Not in the slightest. If anything the volumes from Germany/Poland are worse.

@robin_j_brooks has been documenting this via EU figs for months. He's a must-follow for more on this extraordinarily under-reported story

@robin_j_brooks has been documenting this via EU figs for months. He's a must-follow for more on this extraordinarily under-reported story

https://twitter.com/robin_j_brooks/status/1660886006386622465?s=61&t=UkNyg41Nd8nA4NCqLU19TA

And there's more (I'm afraid).

Because the issue isn't just the surge in volumes of trade to these caucasus nations, but precisely WHAT kinds of things we've been exporting to these countries.

So, I've looked at those numbers.

And what emerges is even more disturbing...

Because the issue isn't just the surge in volumes of trade to these caucasus nations, but precisely WHAT kinds of things we've been exporting to these countries.

So, I've looked at those numbers.

And what emerges is even more disturbing...

Starting point is to note the EU & G7 partners have a list of what they call "Common High Priority Items".

It's 45 categories of goods we KNOW the Russians are important and repurposing into weapons.

Because we've found them on the battlefield... finance.ec.europa.eu/system/files/2…

It's 45 categories of goods we KNOW the Russians are important and repurposing into weapons.

Because we've found them on the battlefield... finance.ec.europa.eu/system/files/2…

Which raises a question: are these items among the stuff Britain is sending to these states (which anyone with an ounce of sense must know are being diverted ro Russia)?

The answer is yes.

Very much yes 🫥

The answer is yes.

Very much yes 🫥

Here's the chart specifically looking at these items.

The items we KNOW are being used to kill Ukrainians. What you see here 👇 is trade flows specifically of these banned items to these states (who then almost certainly send them straight to Russia).

That's a 500%+ increase.

The items we KNOW are being used to kill Ukrainians. What you see here 👇 is trade flows specifically of these banned items to these states (who then almost certainly send them straight to Russia).

That's a 500%+ increase.

Now let's look at the specific line items we're talking about here.

These are the main "banned" goods UK companies re sending to four Russian neighbours👇

Top one: "Parts of aeroplanes, helicopters or unmanned aircraft".

In other words, parts you can use to make/repair drones...

These are the main "banned" goods UK companies re sending to four Russian neighbours👇

Top one: "Parts of aeroplanes, helicopters or unmanned aircraft".

In other words, parts you can use to make/repair drones...

Few things:

1. The absolute numbers 👆are not massive.

But add up figs across EU (viz @robin_j_brooks) & it's MUCH bigger. & then consider stuff going via Turkey/China.

2. Real story is TREND.

3. Sorry I described Kyrgyzstan as a caucasus nation 🤦♂️It's Central Asia. Whoops!

1. The absolute numbers 👆are not massive.

But add up figs across EU (viz @robin_j_brooks) & it's MUCH bigger. & then consider stuff going via Turkey/China.

2. Real story is TREND.

3. Sorry I described Kyrgyzstan as a caucasus nation 🤦♂️It's Central Asia. Whoops!

Anyway.

Here's my full story on this shocking phenomenon👇

On how UK companies seem to be sending millions of pounds worth of supposedly banned equipment to Russia via the shadow economy.

Equipment which we know has been used to kill Ukrainians... Ugh news.sky.com/story/british-…

Here's my full story on this shocking phenomenon👇

On how UK companies seem to be sending millions of pounds worth of supposedly banned equipment to Russia via the shadow economy.

Equipment which we know has been used to kill Ukrainians... Ugh news.sky.com/story/british-…

Of course this is hardly the first time trade has trumped war. Consider the episode I wrote about in #MaterialWorld when Britain actually proposed buying binoculars off the Germans during WWI in exchange for rubber, so they could all carry on killing each other more efficiently…

https://twitter.com/edconwaysky/status/1678774833025548288

• • •

Missing some Tweet in this thread? You can try to

force a refresh