1/ *VERY* concerned about the quality & type of information coming to @BMA_Pensions members to allow them to make choices in regards to McCloud.

For members who chose to move to 2008 (so called "choice 2", we saw the first of this information last week - deep dive 🧵

Pls RT

For members who chose to move to 2008 (so called "choice 2", we saw the first of this information last week - deep dive 🧵

Pls RT

2/ OK first of all, lets rewind. Pre 2008 we were all in the 1995 section. For most members that had a fixed retirement age of 60, and gave us "80ths" of final salary. Work 40 years, get 40/80ths or 1/2 of your final salary. Simple. Back in the day contributions were 5% or 6%

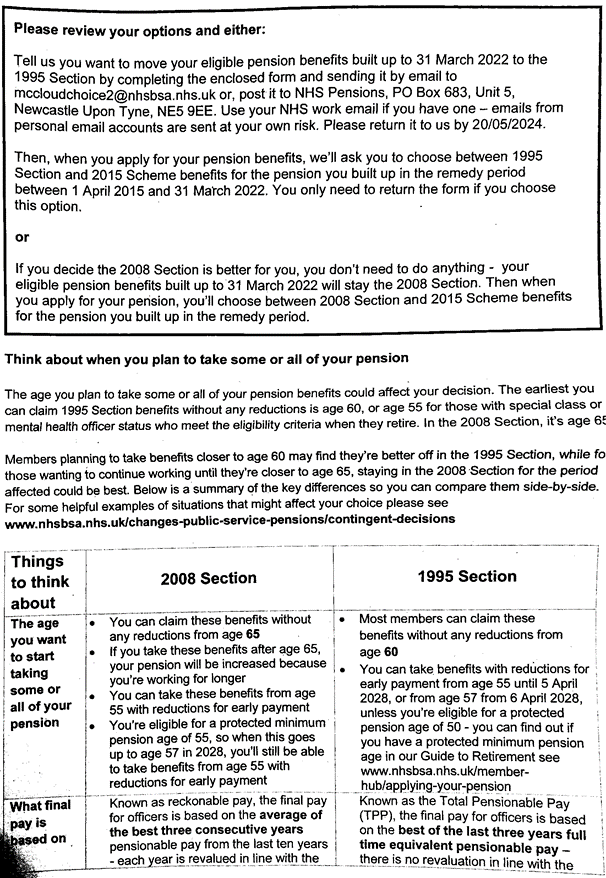

3/ As we all started to live longer, government felt this was unnafordable as we were spending longer in retirement. So they introduced the 2008 scheme

- 1/60th not 1/80ths

- Retire at 65 not 60

- So called "Reckonable" pay - based on best of 3yr in last 10, inflation adjusted

- 1/60th not 1/80ths

- Retire at 65 not 60

- So called "Reckonable" pay - based on best of 3yr in last 10, inflation adjusted

4/ This was so called "CHOICE 1"

And credit where credit is due, there was HIGH QUALITY information provided to members to help them make this important choice.... quality written information including PERSONALISED examples based on THEIR data, DVDs etc 👇

And credit where credit is due, there was HIGH QUALITY information provided to members to help them make this important choice.... quality written information including PERSONALISED examples based on THEIR data, DVDs etc 👇

5/ Lets take a good look 👀 This is what you got, a detailed 10 page PERSONALISED statement allowing you to take an informed choice

6/ In CHOICE 1 you got a detailed & personalised statement showing exactly how they computed your comparison, based on YOUR actual service & YOUR actual pay

7/ And then you were given a detailed breakdown of how your pension look would look with each choice at two ages (60 and 65) and with either scheme.

Usefully showed standard lump sums, crucially "equal lump sum" (so you can actually compare the pension) & max lump sum 👇

Usefully showed standard lump sums, crucially "equal lump sum" (so you can actually compare the pension) & max lump sum 👇

8/ They gave a detailed & useful guide to age of retirement showing clearly that generally those retiring before 63 better in 1995, after 64 in 2008, and very similar in between. There was also a detailed glossary

9/ In all, not a bad effort at all from @nhs_pensions - detailed, personalised info to make an #informedchoice

Remember also this was in a nicer world where noone had really heard of, let alone be caught out by the annual or lifetime allowance.

And inflation was more *STABLE*

Remember also this was in a nicer world where noone had really heard of, let alone be caught out by the annual or lifetime allowance.

And inflation was more *STABLE*

10/ Fast forward to October 2014, and we are in more uncertain times. Due to the incoming 2015 scheme we were given that chance again so called "CHOICE 2"

Were in austerity now, glossy 10 pages leaflets and DVDs have gone, & much small info letter

No individual forecast 👎

Were in austerity now, glossy 10 pages leaflets and DVDs have gone, & much small info letter

No individual forecast 👎

11/ But in the place of the individual forecast, they shifter the onus to members to work it out with a provided calculator (more error prone, they had the info👇& were provided an *OFFICIAL* calculator

12/ The calculator itself has long since been deleted but relicks of it continue to exist @waybackmachine but its clear there was an individual calculator to calculate outputs similar to choice 1, and decision trees, examples etc

Again, not a bad effort from @nhs_pensions

Again, not a bad effort from @nhs_pensions

13/ Now fast forward to 2024. Members have had to deal with the ordeal of McCloud and the turmoil & confusion it brings to members needing to make complex financial decisions.

Also for high earners, add in the *NIGHTMARE* of dealing with AA, tapered AA & LTA.

Also for high earners, add in the *NIGHTMARE* of dealing with AA, tapered AA & LTA.

14/ And also remember unlike in choice 1 & choice 2, when inflation was MUCH more stable, we now have to contend with VERY HIGH inflation & its impact not only on annual allowance calculation, but also on RECKONABLE pay 2008 which is COMPLICATED but uses inflation

15/ Now I dont want to get too bogged down into #reckonablepay, but suffice to say its VERY complicated but you need to be aware it comes with a degree of inflation protection, and that inflation protection *lasts 10 years* (bookmark this)

16/ So having been beaten & bruised from the illegal & discriminatory nature of the introduction of 2015 (leading to "McCloud"), nightmarish AA which is constantly changing, and latterly very high inflation.... you would assume government & @nhs_pensions would want to help ASAP

17/ My request to gvmnt was as follows (sorry a bit technical)

"Choice 1 came with a personal projection (from memory) and choice 2 came with a calculator. Both of those choices were in more certain times, when inflation was much more stable. Due to the 10 year look back element of reckonable pay in 2008, it will mean it is crucial to give a forecast using actual inflation for the recent prior period (i.e. with 10.1% & 6.7%; i.e. unlike the recent GAD partial retirement calculator which ignored known prior inflation and used 2% in all years) as these could majorly affect decision making for those considering retiring in the next 10 years where these periods of high inflation could seriously impact reckonable pay in a major way as inflation stabilises towards a baseline going forward."

"Choice 1 came with a personal projection (from memory) and choice 2 came with a calculator. Both of those choices were in more certain times, when inflation was much more stable. Due to the 10 year look back element of reckonable pay in 2008, it will mean it is crucial to give a forecast using actual inflation for the recent prior period (i.e. with 10.1% & 6.7%; i.e. unlike the recent GAD partial retirement calculator which ignored known prior inflation and used 2% in all years) as these could majorly affect decision making for those considering retiring in the next 10 years where these periods of high inflation could seriously impact reckonable pay in a major way as inflation stabilises towards a baseline going forward."

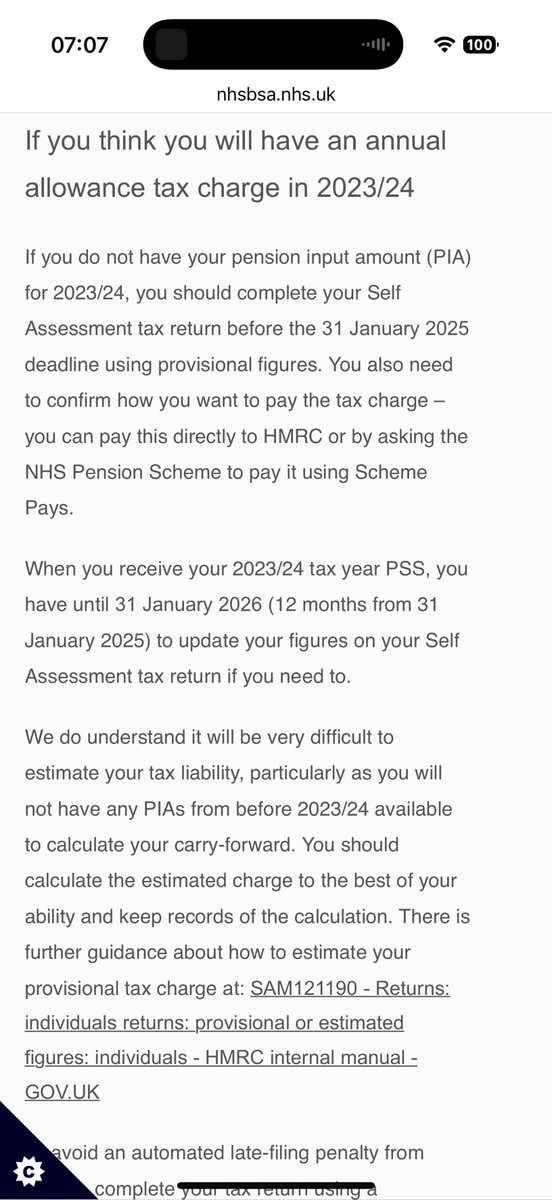

18/ Lets now see whats provided, and whether its good enough to make an #informeddecision

- No personalised information/forecast

- No link to a calculator (becuase there isnt one)

- No reference to AA/tax

- No mention of high inflation issues

- No mention of McCloud interaction

- No personalised information/forecast

- No link to a calculator (becuase there isnt one)

- No reference to AA/tax

- No mention of high inflation issues

- No mention of McCloud interaction

19/ And this is where it starts to go into dark comedy, telling you to go to your TRS for help

Do they actually realise that

(1) TRS is a seriously poor document

(2) Really wont help them make this decision - you really need to project being in either scheme, different ages

Do they actually realise that

(1) TRS is a seriously poor document

(2) Really wont help them make this decision - you really need to project being in either scheme, different ages

20/ I dont want to get sidetracked into the defects in TRS, Ive talked about them publicly & privately before, see here for more info 🧵

If you can read TRS & make an #informedchoice to reverse CHOICE2, you know a lot more about NHS pensions than me!

If you can read TRS & make an #informedchoice to reverse CHOICE2, you know a lot more about NHS pensions than me!

https://x.com/goldstone_tony/status/1554378313027801088?s=20

21/ So in @nhs_pensions defence, they have produced two very limited examples. But I'm concerned about them as well.

Firstly case studies arent that helpful, people need to know their *OWN* numbers. Ideally thats by way of a SCHEME PROVIDED forecast - see choice 1 above

Case👇

Firstly case studies arent that helpful, people need to know their *OWN* numbers. Ideally thats by way of a SCHEME PROVIDED forecast - see choice 1 above

Case👇

22/ But lets look at the scheme provided example. Meet Janet.

I've reversed engineered their example basically Janet

- earned £43,000 in 2008

- earned £43,000 in 2022

- earned £43,000 in all future years

- inflation is ZERO % in future/past (i.e. ignoring high inflation)

I've reversed engineered their example basically Janet

- earned £43,000 in 2008

- earned £43,000 in 2022

- earned £43,000 in all future years

- inflation is ZERO % in future/past (i.e. ignoring high inflation)

23/ Modelling on that (*HIGHLY IMPROBABLE*) scenario, I can get very similar numbers to @nhs_pensions "Janet"

24/ You'll note my version of NHS Pension model (based on unrealistic inflation) I have colour coded the pension forecast vs age

"Equalised" is the best way to compare pensions as the lump sum is the same, so you can see which pension is higher

Looks like initial choice 1📊👇

"Equalised" is the best way to compare pensions as the lump sum is the same, so you can see which pension is higher

Looks like initial choice 1📊👇

25/ But suffice to say, Im not impressed with their model. Because it ignores inflation.

A few years ago, you could almost safely ignore inflation as it hovered around 2%

But with Sept 22 CPI 10.1%, Sept 23 CPI 6.7%, this will have a MAJOR impact on reckonable pay for 10 yrs

A few years ago, you could almost safely ignore inflation as it hovered around 2%

But with Sept 22 CPI 10.1%, Sept 23 CPI 6.7%, this will have a MAJOR impact on reckonable pay for 10 yrs

26/ To my mind, the provided information goes *NOWHERE NEAR* what is needed to make an #informedchoice

The scheme need to, URGENTLY, up their ante. Members cannot be expected to make a complex & important financial decision based on that 👇

The scheme need to, URGENTLY, up their ante. Members cannot be expected to make a complex & important financial decision based on that 👇

27/ Obviously CHOICE2 reversal only involves small percentage of members, but many more will be impacted by other very complex decisions relating to AA tax, McCloud choices, "contingent decisions"- I hope this document is not indicitative of the quality of information coming

RT

RT

Addendum 1: the yellow highlight in Tweet 22/ should have commented that at age 66 there is also a a late retirement factor as above NPA. They do appear to have included it in the calculation as it’s close to my calcs in the following tweet. Similarly an early fact would only be applied if retiring before 65

Addendum 2: Ive updated graphic provided in tweet 24 so

- uses same colour scheme as useful chart provided by the scheme in choice 1

- shows %age change, so of some use to those having to make choice

- disclaimer about IGNORING inflation (read it, esp if retiring in <10yrs!)

- uses same colour scheme as useful chart provided by the scheme in choice 1

- shows %age change, so of some use to those having to make choice

- disclaimer about IGNORING inflation (read it, esp if retiring in <10yrs!)

IMPORTANT Addendum 3:

Crucial reason @nhs_pensions examples are wrong & highly unrealistic (esp if retiring in next 10 yrs) due to IGNORING recent high inflation causing reckonable pay in their example to be well above £43k

Its all about assumptions. #RUBBISHinRUBBISHout

Crucial reason @nhs_pensions examples are wrong & highly unrealistic (esp if retiring in next 10 yrs) due to IGNORING recent high inflation causing reckonable pay in their example to be well above £43k

Its all about assumptions. #RUBBISHinRUBBISHout

• • •

Missing some Tweet in this thread? You can try to

force a refresh