As long as I am admitting my errors this week:

My good friend Jeff Cohen (@BCLAW prof. former prosecutor) persuaded me that I was wrong about a criticism of the @ManhattanDA case against Trump:

These purely internal records like paystubs could count for intent to defraud.

1/

My good friend Jeff Cohen (@BCLAW prof. former prosecutor) persuaded me that I was wrong about a criticism of the @ManhattanDA case against Trump:

These purely internal records like paystubs could count for intent to defraud.

1/

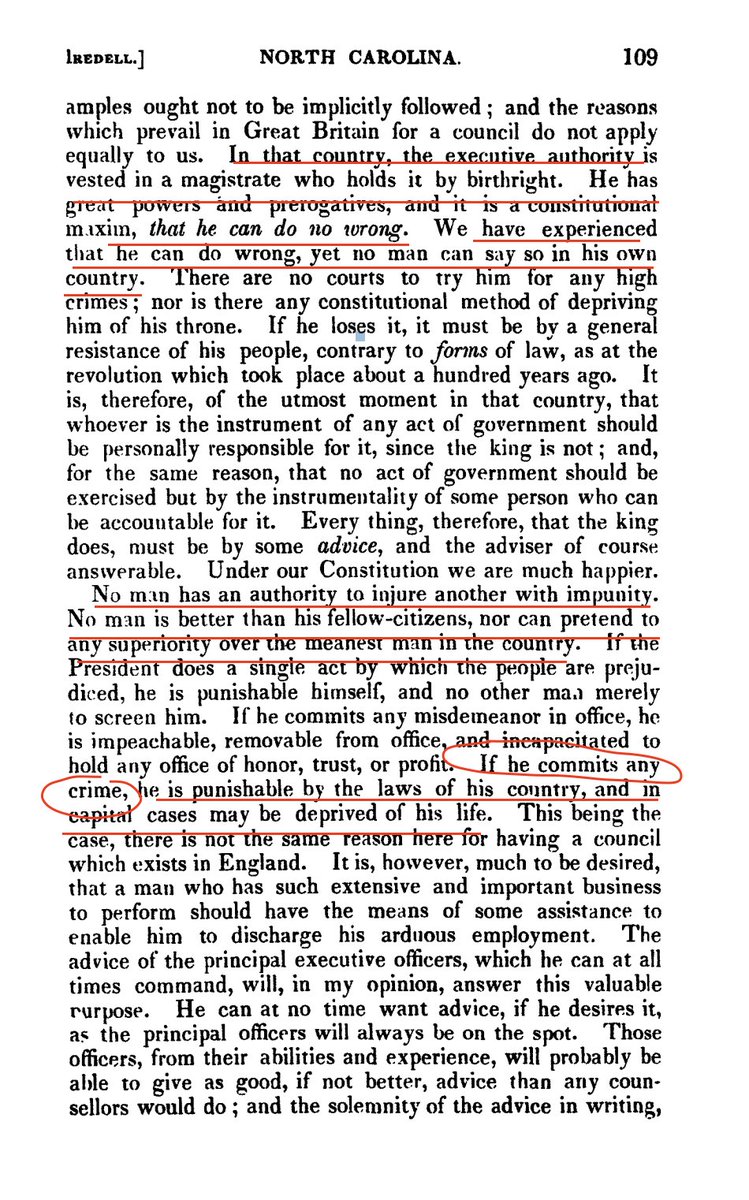

2/ Last April, I wrote in @nytimes:

"What, in practice, is the meaning of 'intent to defraud'? If a business record is internal, it is not obvious how a false filing could play a role in defrauding if other entities likely would not rely upon it and be deceived by it."

See below:

"What, in practice, is the meaning of 'intent to defraud'? If a business record is internal, it is not obvious how a false filing could play a role in defrauding if other entities likely would not rely upon it and be deceived by it."

See below:

@nytimes 3/ The statutes 175.05 & .10 require:

"falsifying business records...with intent to defraud."

A false tax return or FEC filing would defraud the govt, but I asked how a pay stub would defraud anyone if no one ever relies on it or even looks at it:

nytimes.com/2023/04/05/opi…

"falsifying business records...with intent to defraud."

A false tax return or FEC filing would defraud the govt, but I asked how a pay stub would defraud anyone if no one ever relies on it or even looks at it:

nytimes.com/2023/04/05/opi…

@nytimes 4/ @IChotiner in @NewYorker did a great job questioning me on this point. At the time, several colleagues & friends said my answers (below) clarified my point and were persuasive...

But now Jeff Cohen has persuaded me that I was wrong by reconstructing a timeline of fraud.

But now Jeff Cohen has persuaded me that I was wrong by reconstructing a timeline of fraud.

@nytimes @IChotiner @NewYorker 5/ Link to Isaac Chotiner @ichotiner's interview:

"Is the Trump Indictment a Legal Embarrassment?"

(Relevant screenshots in the thread immediately above)

newyorker.com/news/q-and-a/i…

"Is the Trump Indictment a Legal Embarrassment?"

(Relevant screenshots in the thread immediately above)

newyorker.com/news/q-and-a/i…

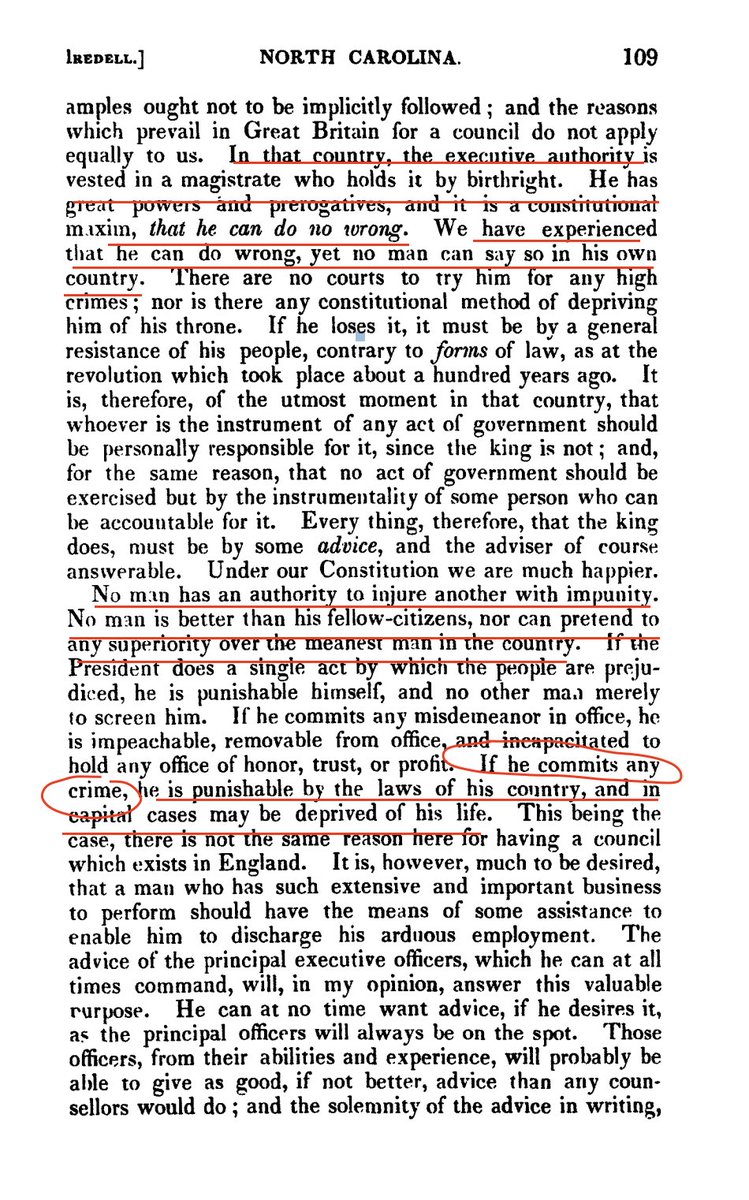

@nytimes @IChotiner @NewYorker 6/ This is Jeff Cohen's counterargument, and it is the first time I've heard it posed as a timeline of a long-term cover-up & litigation.

The fraud is not that any regulator would initially would look at pay stubs, invoices, and daily entries...

It's about later investigation.

The fraud is not that any regulator would initially would look at pay stubs, invoices, and daily entries...

It's about later investigation.

@nytimes @IChotiner @NewYorker 7/ Jeff Cohen says:

The invoices, pay stubs, and daily business entries were all recorded in Oct. 2016.

The (allegedly) false FEC filing was later, June 2017.

A) So the invoices etc. are not like the downstream "copy and paste" w/o intent to fraud, in my metaphor to @IChotiner

The invoices, pay stubs, and daily business entries were all recorded in Oct. 2016.

The (allegedly) false FEC filing was later, June 2017.

A) So the invoices etc. are not like the downstream "copy and paste" w/o intent to fraud, in my metaphor to @IChotiner

@nytimes @IChotiner @NewYorker 8/

B) This timeline is a chain of false records of a continuous fraud:

Trump started with false pay stubs, invoices, and daily bus entries as step 1 of the intent to defraud govt entities in 2016, then entered the false FEC report in 2017.

B) This timeline is a chain of false records of a continuous fraud:

Trump started with false pay stubs, invoices, and daily bus entries as step 1 of the intent to defraud govt entities in 2016, then entered the false FEC report in 2017.

@nytimes @IChotiner @NewYorker 9/ C) Though no one else initially relies on the false pay stubs, invoices, and daily entries, they were recorded falsely in order to create a consistent paper trail leading up to the false FEC filing.

Trump intended to defraud govt investigators, if allegations emerged later.

Trump intended to defraud govt investigators, if allegations emerged later.

@nytimes @IChotiner @NewYorker 10/ Investigators would look back at the pay stubs etc., not to rely on them initially, but to investigate a potential FEC crime:

Evidence of intent (mens rea, knowledge of an FEC legal problem) by showing business record inconsistencies.

This is intent to defraud the govt.

Evidence of intent (mens rea, knowledge of an FEC legal problem) by showing business record inconsistencies.

This is intent to defraud the govt.

@nytimes @IChotiner @NewYorker 11/ I still think there may be other problems. But I also think I was wrong on this core NY statutory criminal question, which leads me to re-assess my overall criticism of this case and the strength of Trump's selective prosecution defense.

@NormEisen @rgoodlaw @AWeissmann_

@NormEisen @rgoodlaw @AWeissmann_

@nytimes @IChotiner @NewYorker @NormEisen @rgoodlaw @AWeissmann_ 12/ So I was likely wrong on (at least 1 big part of) @AlvinBraggNYC's case v. Trump:

@alegalnerd @Jonesieman @RDEliason @lee_kovarsky @CBHessick @EricColumbus @rroiphe @DanielRAlonso @McDeereUSA @benprotess @petermshane @ProfMMurray @rickhasen @RickPildes @alanchen @GJackChin

@alegalnerd @Jonesieman @RDEliason @lee_kovarsky @CBHessick @EricColumbus @rroiphe @DanielRAlonso @McDeereUSA @benprotess @petermshane @ProfMMurray @rickhasen @RickPildes @alanchen @GJackChin

@nytimes @IChotiner @NewYorker @NormEisen @rgoodlaw @AWeissmann_ @AlvinBraggNYC @alegalnerd @Jonesieman @RDEliason @lee_kovarsky @CBHessick @EricColumbus @rroiphe @DanielRAlonso @McDeereUSA @benprotess @petermshane @ProfMMurray @rickhasen @RickPildes @AlanChen @GJackChin 13/ Someone asks if this is a correction or retraction. Not really. It's more of a subjective reassessment that @ManhattanDA's fraud case is far more valid & provable than I had argued.

@WRashbaum @Dahlialithwick @lawofruby @Teri_Kanefield @maggieNYT

@WRashbaum @Dahlialithwick @lawofruby @Teri_Kanefield @maggieNYT

14/ If someone else had made this timeline argument earlier and explained an intent to defraud later FEC investigators or prosecutors by fraudulently creating a consistent paper record, I apologize for missing it.

Believe me, I received (and responded) to MANY other criticisms.

Believe me, I received (and responded) to MANY other criticisms.

15/ Let me add that this also could solve NY jurisdictional problems:

If this is a valid case of defrauding the feds with a false paper trail, then I am open to the argument it counts as intent to defraud NY officials, who wd investigate a tax crime & find FEC fraud instead...

If this is a valid case of defrauding the feds with a false paper trail, then I am open to the argument it counts as intent to defraud NY officials, who wd investigate a tax crime & find FEC fraud instead...

16/ Even if some invoices or paystubs were recorded in 2017, it still coincides with Trump's June 2017 FEC filing, with the same intent of creating a fraudulent paper trail - again, not for any initial reliance, but as part of concealing the fraud mens rea from investigators.

17/

TL;dr:

"If it's not the crime, it's the cover up."

False business records to conceal the mens rea and defraud investigators attempting to enforce the law.

TL;dr:

"If it's not the crime, it's the cover up."

False business records to conceal the mens rea and defraud investigators attempting to enforce the law.

18/

fyi this was my other concession and confession of error this week:

My immediate optimism from the DC Circuit’s delayed but thorough, strong, and unanimous rejection of Trump’s immunity nonsense in the Jan 6 prosecution:

fyi this was my other concession and confession of error this week:

My immediate optimism from the DC Circuit’s delayed but thorough, strong, and unanimous rejection of Trump’s immunity nonsense in the Jan 6 prosecution:

https://twitter.com/jedshug/status/1763045960404386197

• • •

Missing some Tweet in this thread? You can try to

force a refresh