1/ Youtuber @MKBHD recently tested Fisker's latest EV and called it the "worst car I've ever reviewed."

The video has picked up 4.3 million views since he posted it and even reached execs at the company.

But things got really weird when Fisker responded. Let's get into it.

The video has picked up 4.3 million views since he posted it and even reached execs at the company.

But things got really weird when Fisker responded. Let's get into it.

2/ Brownlee had initially asked Fisker to give him a vehicle to review, but they kept delaying.

Tired of jumping through hoops, he found a car dealer willing to let him borrow one.

Tired of jumping through hoops, he found a car dealer willing to let him borrow one.

3/ When Fisker found out Brownlee sourced a car from a dealer, it asked that he delay his review until a software update came through.

Brownlee refused, saying "It's not really in my policy to wait on promised future software updates."

Brownlee refused, saying "It's not really in my policy to wait on promised future software updates."

4/ He continued with the review, posting it to his account on February 17.

In it, he notes "a lot of weird" choices—including unlabeled buttons, sunroof solar panels you can't monitor, and software glitches with the keyfob, cameras, and more.

In it, he notes "a lot of weird" choices—including unlabeled buttons, sunroof solar panels you can't monitor, and software glitches with the keyfob, cameras, and more.

5/ Brownlee did give credit to the car's handsome physical design.

But he followed that up by saying "You could give me this car and I wouldn't want to drive it," so the pros were obviously not enough to make up for the cons.

But he followed that up by saying "You could give me this car and I wouldn't want to drive it," so the pros were obviously not enough to make up for the cons.

6/ Fisker had a truly bizarre response.

A Fisker senior engineer called the dealership that loaned Brownlee the car to try to do damage control.

A Fisker senior engineer called the dealership that loaned Brownlee the car to try to do damage control.

7/ Unaware that they were being recorded, the rep let some things slip.

They admitted that even after the car's new update, Fisker's software "still got some holes in it."

The video recording of the call has 3.6+ million views on TikTok.

They admitted that even after the car's new update, Fisker's software "still got some holes in it."

The video recording of the call has 3.6+ million views on TikTok.

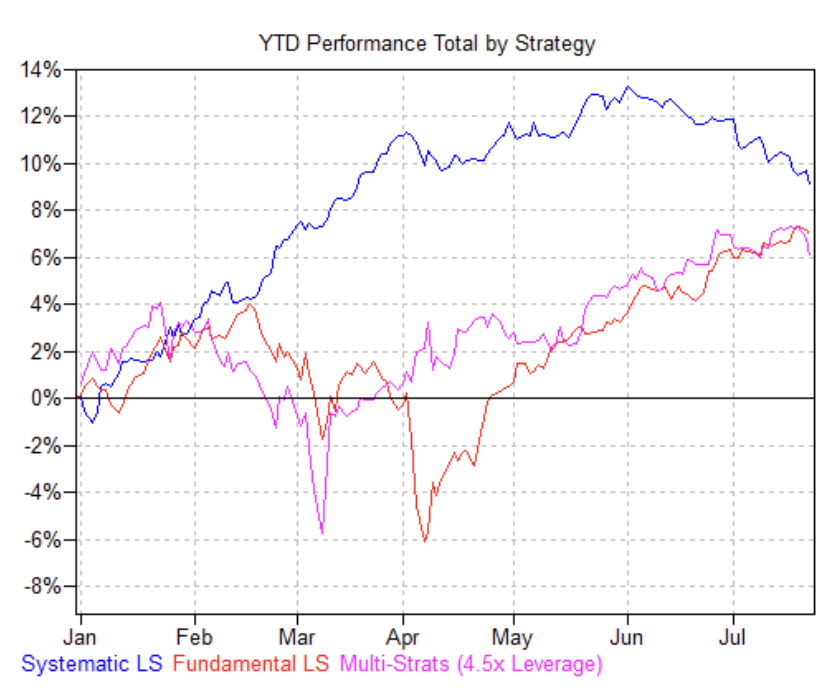

8/ Fisker's stock has tanked ~50% since Brownlee's video went live.

More people subscribe to Brownlee's YouTube channel than to the New York Times, Washington Post, Wall Street Journal, and USA Today combined.

More people subscribe to Brownlee's YouTube channel than to the New York Times, Washington Post, Wall Street Journal, and USA Today combined.

9/ It's another example of just how influential social media reviewers have become in the product space.

Separately, Fisker announced last week that it may not have money to survive the year.

Separately, Fisker announced last week that it may not have money to survive the year.

10/ If you enjoyed this thread, follow us @MorningBrew

We post business breakdowns like this 3x a week.

We post business breakdowns like this 3x a week.

Read more here: morningbrew.com/daily/stories/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh