"TATA SONS And Upper Layer NBFC Listing Obligations "

– A Potential Value Unlocking 🔑 ,

– Or An Attempt Adhere To The RBI Norms And Avoid Listing

Will This Multi-billion Dollar

Rally Of Tata Group Stocks

Continue ?

Read The Full Thread 👇

– A Potential Value Unlocking 🔑 ,

– Or An Attempt Adhere To The RBI Norms And Avoid Listing

Will This Multi-billion Dollar

Rally Of Tata Group Stocks

Continue ?

Read The Full Thread 👇

First Let's Understand What Is Tata Sons ?

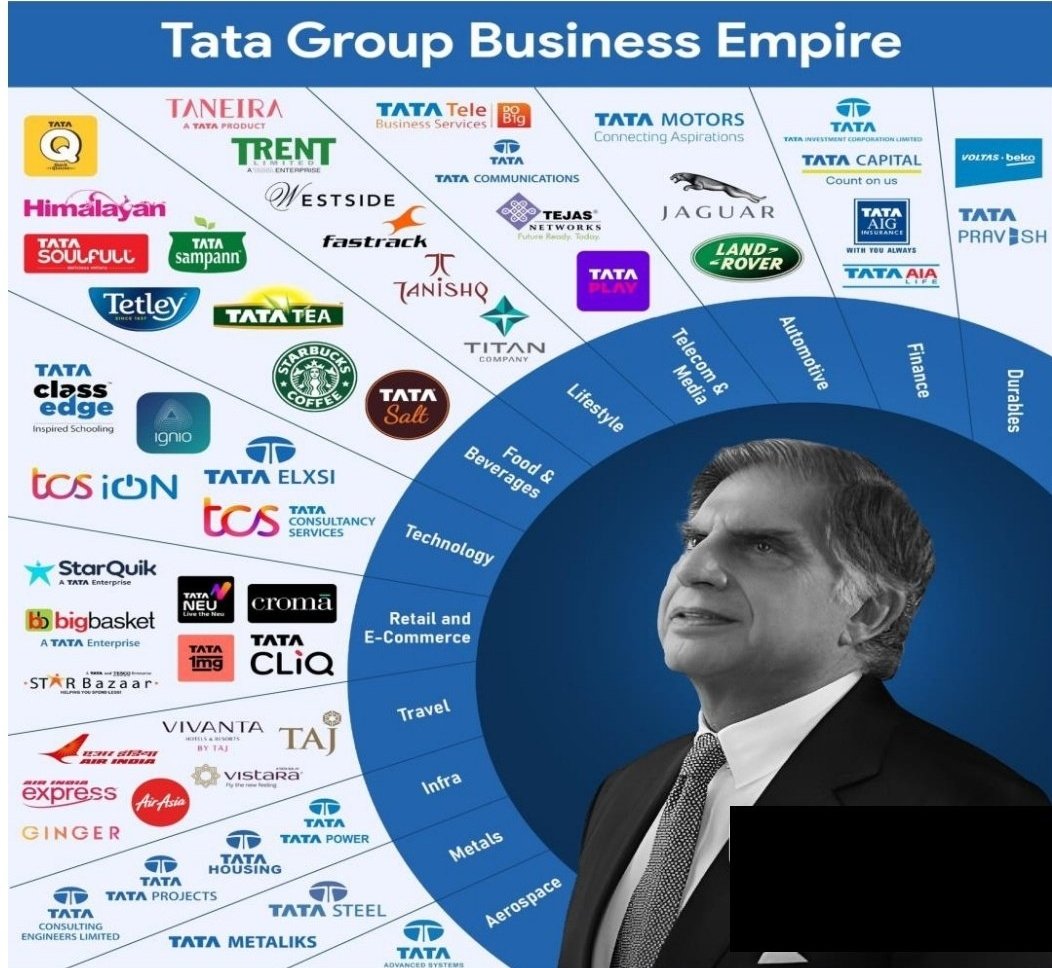

1.Tata Sons Pvt. Ltd. is The Parent Company Of The Salt To Semiconductor Conglomerate

2. It Holds the Bulk of Shareholding In The Tata Group Of Companies Including Their Land Holdings, Tea Estates and Steel Plants

1.Tata Sons Pvt. Ltd. is The Parent Company Of The Salt To Semiconductor Conglomerate

2. It Holds the Bulk of Shareholding In The Tata Group Of Companies Including Their Land Holdings, Tea Estates and Steel Plants

The Entity Derives Its Revenue From Dividends From These Companies And Brand Loyalty Fees

3. It Is Also A Holding Company Of Around

100+ Companies

It owns stakes into Unlisted Entities Like

The Tata Trusts Own 66% Stake In The Company

3. It Is Also A Holding Company Of Around

100+ Companies

It owns stakes into Unlisted Entities Like

The Tata Trusts Own 66% Stake In The Company

What Is The Valuation of

Tata Sons ?

➡️ Tata Sons' Listed Investments are worth about ~Rs16.5 lac cr, while its unlisted investments are valued around ~3 lac crore. Considering their ventures into semiconductors and EV batteries, the value of the Unlisted Investments

Tata Sons ?

➡️ Tata Sons' Listed Investments are worth about ~Rs16.5 lac cr, while its unlisted investments are valued around ~3 lac crore. Considering their ventures into semiconductors and EV batteries, the value of the Unlisted Investments

2.Holding Companies Trade At An Approx Discount of 40-50%

Hence The Value Of Tata Sons Can Be Around

10.5 Lakh Crore Considering A Discount of 45%

This Are All Approx Calculations

Real Worth Can Be Much Higher

Why Tata Sons Is Said To Comply The NBFC-UL Listing Obligations ?

Hence The Value Of Tata Sons Can Be Around

10.5 Lakh Crore Considering A Discount of 45%

This Are All Approx Calculations

Real Worth Can Be Much Higher

Why Tata Sons Is Said To Comply The NBFC-UL Listing Obligations ?

➡️In Sep 22 , RBI Announced A List of 16 NBFCs Falling Under The Tag of "NBFC-UL" , From These Tata Sons Was Expected To Get Listed Till Sep-25

It was Identified As "Core Investment Company(CIC)"

It was Identified As "Core Investment Company(CIC)"

Is Tata Sons IPO Hitting The Dalal Street ?

➡️The Answer Of This Question is Highly Controversial ,

First Let's Understand If Yes , How Much Value It Could Be ,

– As Per Rules , It Is Compulsory For A Company To Dilute Atleast 5% Equity in The IPO i.e Around 55000 cr

➡️The Answer Of This Question is Highly Controversial ,

First Let's Understand If Yes , How Much Value It Could Be ,

– As Per Rules , It Is Compulsory For A Company To Dilute Atleast 5% Equity in The IPO i.e Around 55000 cr

–So If This IPO Comes , it will be Undoubtedly The Largest IPO Till Date

But Wait ✋️ ,

Tata Sons Can Avoid The Listing By Exploring The Restructuring of Its Balance Sheet. If it reorganises debt by repaying borrowing or transfers the holding in Tata Capital to another entity

But Wait ✋️ ,

Tata Sons Can Avoid The Listing By Exploring The Restructuring of Its Balance Sheet. If it reorganises debt by repaying borrowing or transfers the holding in Tata Capital to another entity

Tata Sons may get deregistered as a core investment company(CIC) and upper-layer NBFC And Avoid Listing

If Tata Sons Comes Up With An IPO

Positive :

1.Few Listed Tata Group Companies Own Stake in Their Parent Entity Including TaMo& Tata Chem -3% Each , Tata Power-2% & IHCL-1%

If Tata Sons Comes Up With An IPO

Positive :

1.Few Listed Tata Group Companies Own Stake in Their Parent Entity Including TaMo& Tata Chem -3% Each , Tata Power-2% & IHCL-1%

This Can Unlock Large Value In The Above Entities , Especially Tata Chemicals Benefitting The Highest

Negative :

If The IPO is Escaped ,

The Multi Billion Dollar Rally in The Tata Group Companies May End

And Investors Have To Wait More For This Multi-billion Dollar Listing

Negative :

If The IPO is Escaped ,

The Multi Billion Dollar Rally in The Tata Group Companies May End

And Investors Have To Wait More For This Multi-billion Dollar Listing

What's Your Opinion On Whole Of This Event ,

Do Comment 👇

Do Like👍 And Retweet 🔂 , If You Had A Very Small Knowledge Increment From Our Attempt To Clear The Confusion Among Retailers

But 2 More Entities In The 16 NBFC-UL List Getting Listed Till

Sep-25 for sure

Stay Tuned🤝

Do Comment 👇

Do Like👍 And Retweet 🔂 , If You Had A Very Small Knowledge Increment From Our Attempt To Clear The Confusion Among Retailers

But 2 More Entities In The 16 NBFC-UL List Getting Listed Till

Sep-25 for sure

Stay Tuned🤝

• • •

Missing some Tweet in this thread? You can try to

force a refresh