views

BlackRock Entering RWA Sector

The RWA sector is expecting rapid growth.

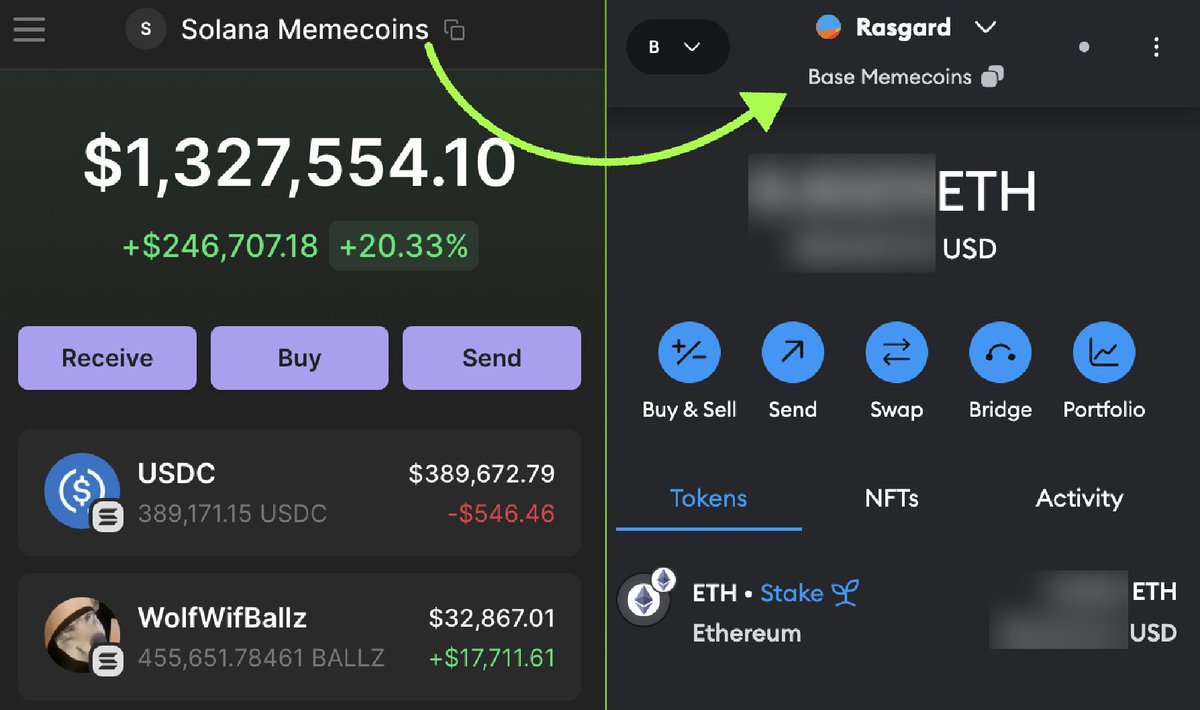

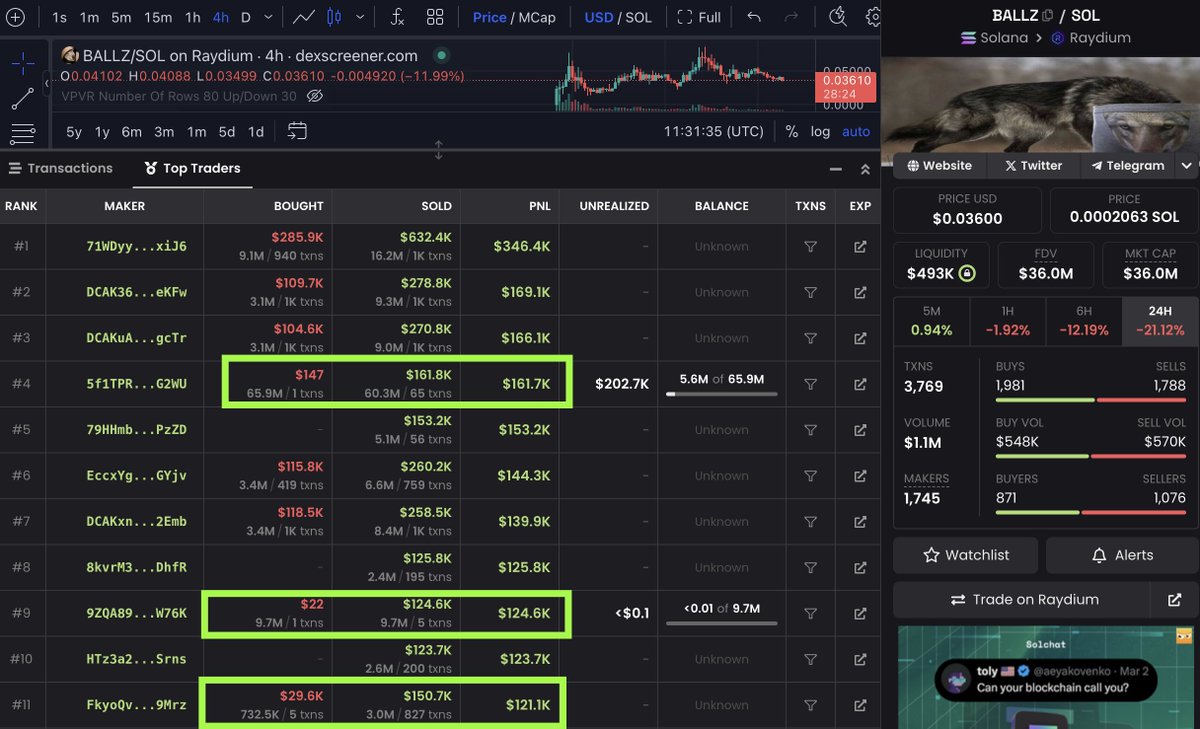

If you missed $SOL meme season - here is a great opportunity to find coins with 10-100x potential.

Check out these promising RWA projects 🧵🔽

The RWA sector is expecting rapid growth.

If you missed $SOL meme season - here is a great opportunity to find coins with 10-100x potential.

Check out these promising RWA projects 🧵🔽

Bookmark this thread for future reference

This Thread consists of next parts:

• What is RWA?

• Why RWA Narrative is expecting rapid growth?

• Top 23 RWA Projects

Let's dive 👇

This Thread consists of next parts:

• What is RWA?

• Why RWA Narrative is expecting rapid growth?

• Top 23 RWA Projects

Let's dive 👇

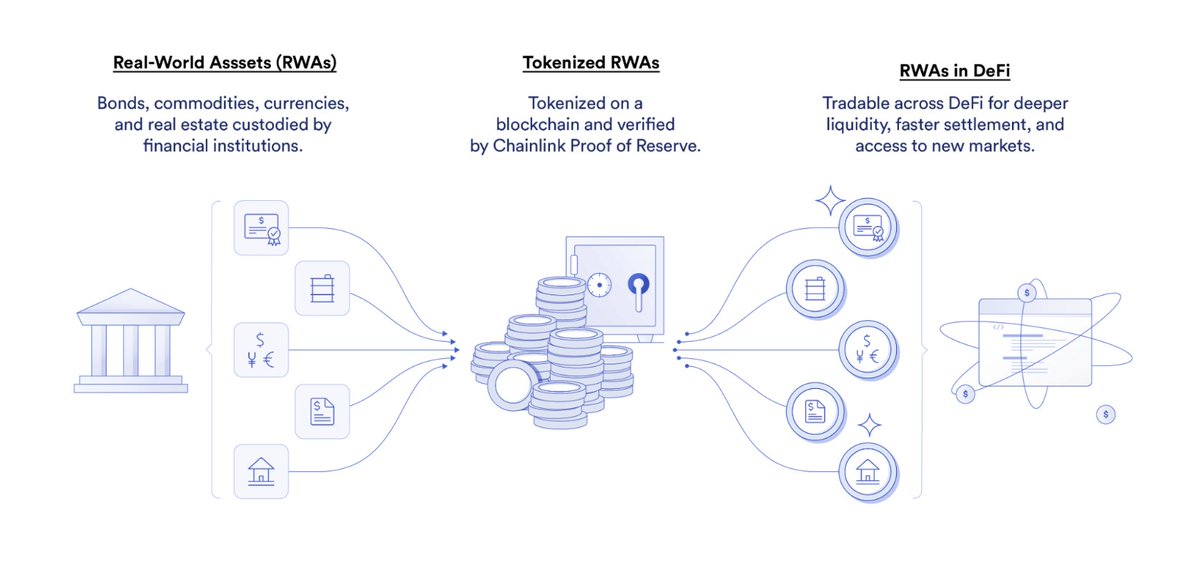

What is RWA?

RWA is an abbreviator of Real World Assets Tokenization

Tokenizing real-world assets involves representing the ownership rights of assets as onchain tokens.

Benefits of Asset Tokenization:

• Liquidity (easier to buy/sell)

• Accessibility (everyone could buy/sell)

• Transparency (easier to track and audit)

• Composability (of the DeFi ecosystem)

RWA is an abbreviator of Real World Assets Tokenization

Tokenizing real-world assets involves representing the ownership rights of assets as onchain tokens.

Benefits of Asset Tokenization:

• Liquidity (easier to buy/sell)

• Accessibility (everyone could buy/sell)

• Transparency (easier to track and audit)

• Composability (of the DeFi ecosystem)

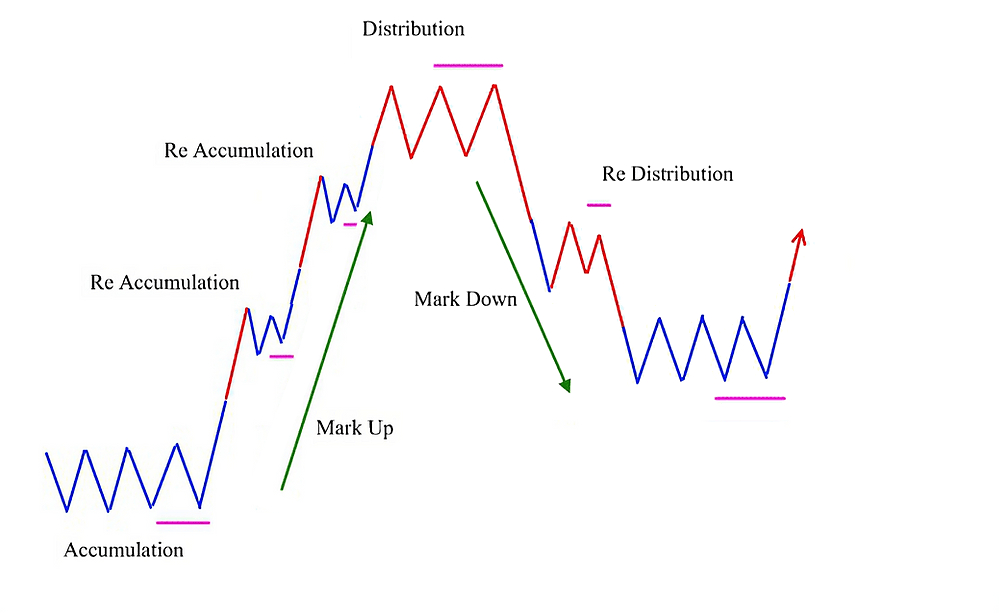

BlackRock has launched first Tokenized Fund on Ethereum.

Financial instituions are betting big on Tokenization.

This is why the RWA sector is expecting rapid growth.

Financial instituions are betting big on Tokenization.

This is why the RWA sector is expecting rapid growth.

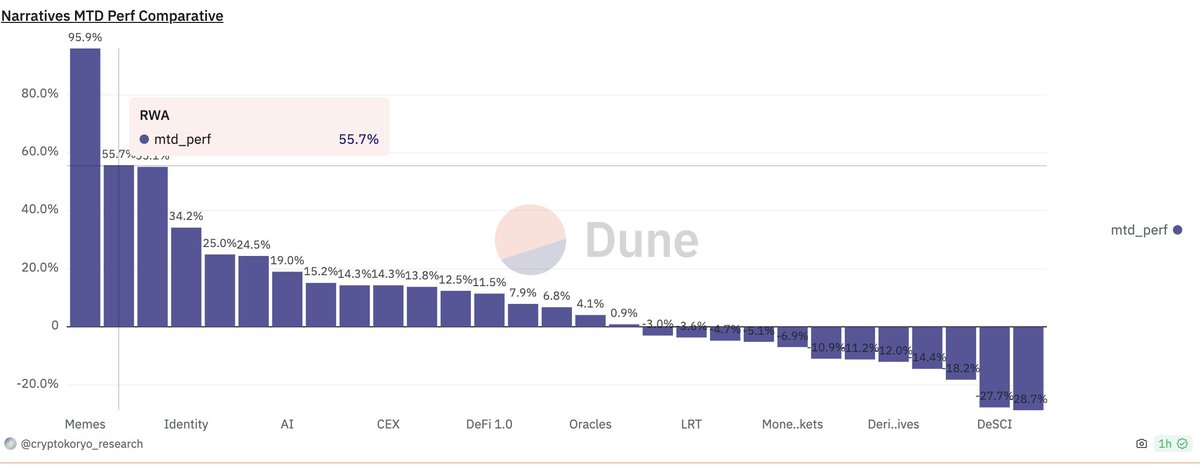

People are also showing interest in the RWA narrative,

making it the second most popular narrative after Memecoins in this cycle.

making it the second most popular narrative after Memecoins in this cycle.

The most promising projects of the RWA narrative 👇

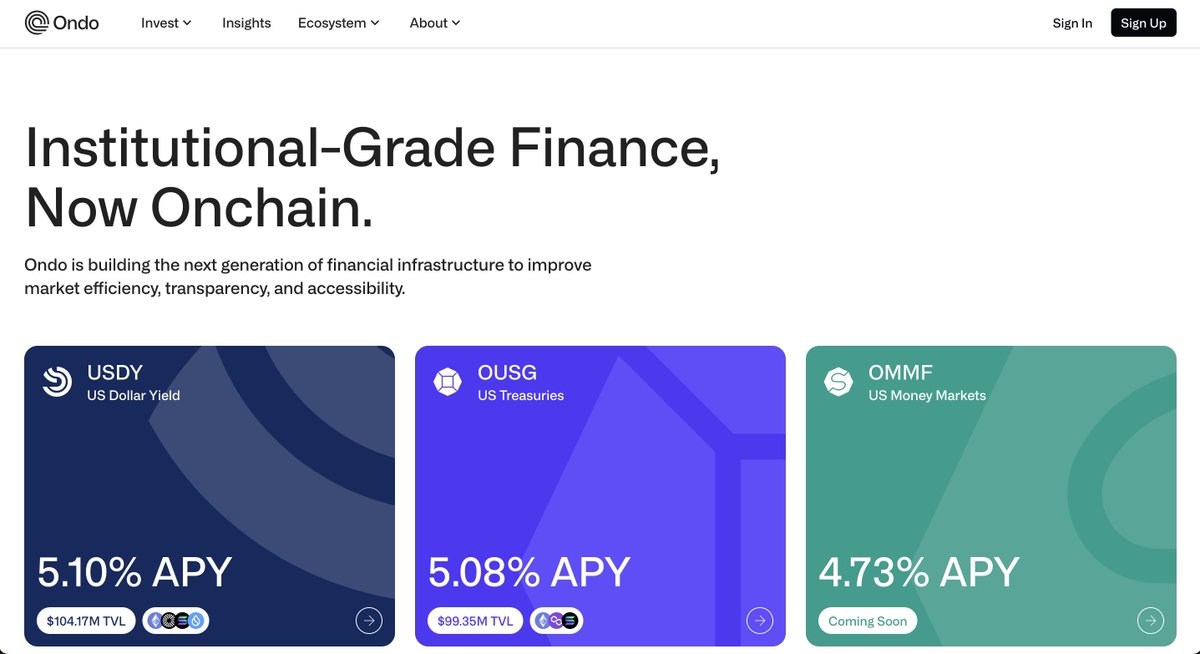

$ONDO | @OndoFinance

Mcap: $1B

Next generation of financial infrastructure to improve market efficiency, transparency, and accessibility.

Mcap: $1B

Next generation of financial infrastructure to improve market efficiency, transparency, and accessibility.

$OM | @MANTRA_Chain

Mcap: $450M

The first RWA Layer 1 Blockchain, capable of adherence and enforcement of real world regulatory requirements.

Mcap: $450M

The first RWA Layer 1 Blockchain, capable of adherence and enforcement of real world regulatory requirements.

$CTC | @Creditcoin

Mcap: $304M

The multichain credit protocol powering Real-World Assets

Mcap: $304M

The multichain credit protocol powering Real-World Assets

$DMTR | @dimitratech

Mcap: $103M

Dimitra is committed to developing an all-in-one agricultural platform that caters to farmers across the globe.

Mcap: $103M

Dimitra is committed to developing an all-in-one agricultural platform that caters to farmers across the globe.

$NXRA | @Nexera_Official

Mcap: $153M

Nexera is at the forefront and playing a crucial role in the tokenization of RWAs with our compliant infrastructure reshaping the next era of digital finance.

Mcap: $153M

Nexera is at the forefront and playing a crucial role in the tokenization of RWAs with our compliant infrastructure reshaping the next era of digital finance.

$GFI | @goldfinch_fi

Mcap: $60M

Goldfinch is a decentralized credit protocol that allows anyone to be a lender, not just banks

Mcap: $60M

Goldfinch is a decentralized credit protocol that allows anyone to be a lender, not just banks

$DUSK | @DuskFoundation

Mcap: $168M

Dusk is a permissionless, ZK-friendly L1 blockchain protocol focused on Compliance and Privacy to tokenize RWA

Mcap: $168M

Dusk is a permissionless, ZK-friendly L1 blockchain protocol focused on Compliance and Privacy to tokenize RWA

$LTO | @TheLTONetwork

Mcap: $76M

Layer-1 Blockchain for Real World Assets

Mcap: $76M

Layer-1 Blockchain for Real World Assets

$BOSON | @BosonProtocol

Mcap: $66M

Web3's decentralized Commerce Layer. Sell physical products as NFTs.

Mcap: $66M

Web3's decentralized Commerce Layer. Sell physical products as NFTs.

$SMT | @SwarmMarkets

Mcap: $22M

Blockchain-based finance for trading real world assets (RWAs).

Mcap: $22M

Blockchain-based finance for trading real world assets (RWAs).

$GB | @grandbase_fi

Mcap: $36M

GRAND BASE on $BASE is a decentralized market for spot synthetic RWAs designed to provide exposure to RWAs without holding the actual underlying asset.

Mcap: $36M

GRAND BASE on $BASE is a decentralized market for spot synthetic RWAs designed to provide exposure to RWAs without holding the actual underlying asset.

$CBY | @Carbify_io

Mcap: $22M

Earn money by planting trees.

Mcap: $22M

Earn money by planting trees.

$RWA | @xendfinance

Mcap: $17M

The first universal framework and blockchain for worldwide assets tokenization and on-chain management.

Mcap: $17M

The first universal framework and blockchain for worldwide assets tokenization and on-chain management.

$MBD | @MBDFinancials

Mcap: $2M

MBD Financials: Unconventional, Decentralized Financial District in the Photorealistic Metaverse.

Mcap: $2M

MBD Financials: Unconventional, Decentralized Financial District in the Photorealistic Metaverse.

$CREDI | @credefi_finance

Mcap: $15M

Credefi bridges the EU's financing gap by connecting crypto lenders with SME borrowers.

Mcap: $15M

Credefi bridges the EU's financing gap by connecting crypto lenders with SME borrowers.

$UBXS | @Bixosinc

Mcap: $9M

Empower businesses and individuals to take full advantage of the limitless potential of blockchain technology, and to make it accessible and usable for everyone.

Mcap: $9M

Empower businesses and individuals to take full advantage of the limitless potential of blockchain technology, and to make it accessible and usable for everyone.

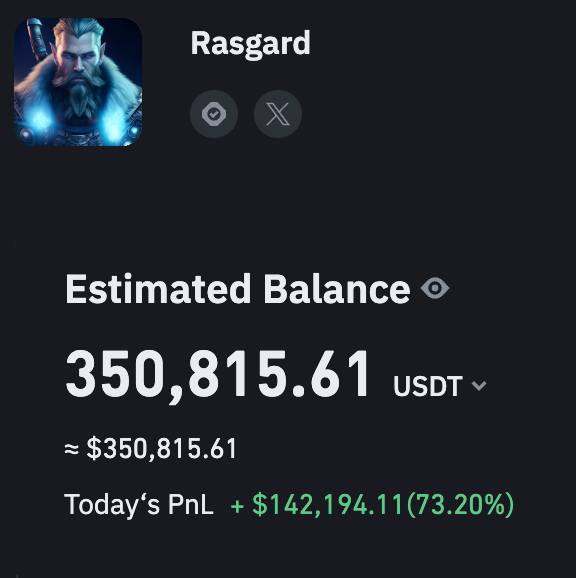

Join my Channel, where I'll share next projects

t.me/rasgardValhalla

t.me/rasgardValhalla

Follow me @rasgard_lodbrok

I hope you found this thread helpful.

Like, retweet the first tweet:

I hope you found this thread helpful.

Like, retweet the first tweet:

https://x.com/rasgard_lodbrok/status/1771631619608096857?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh