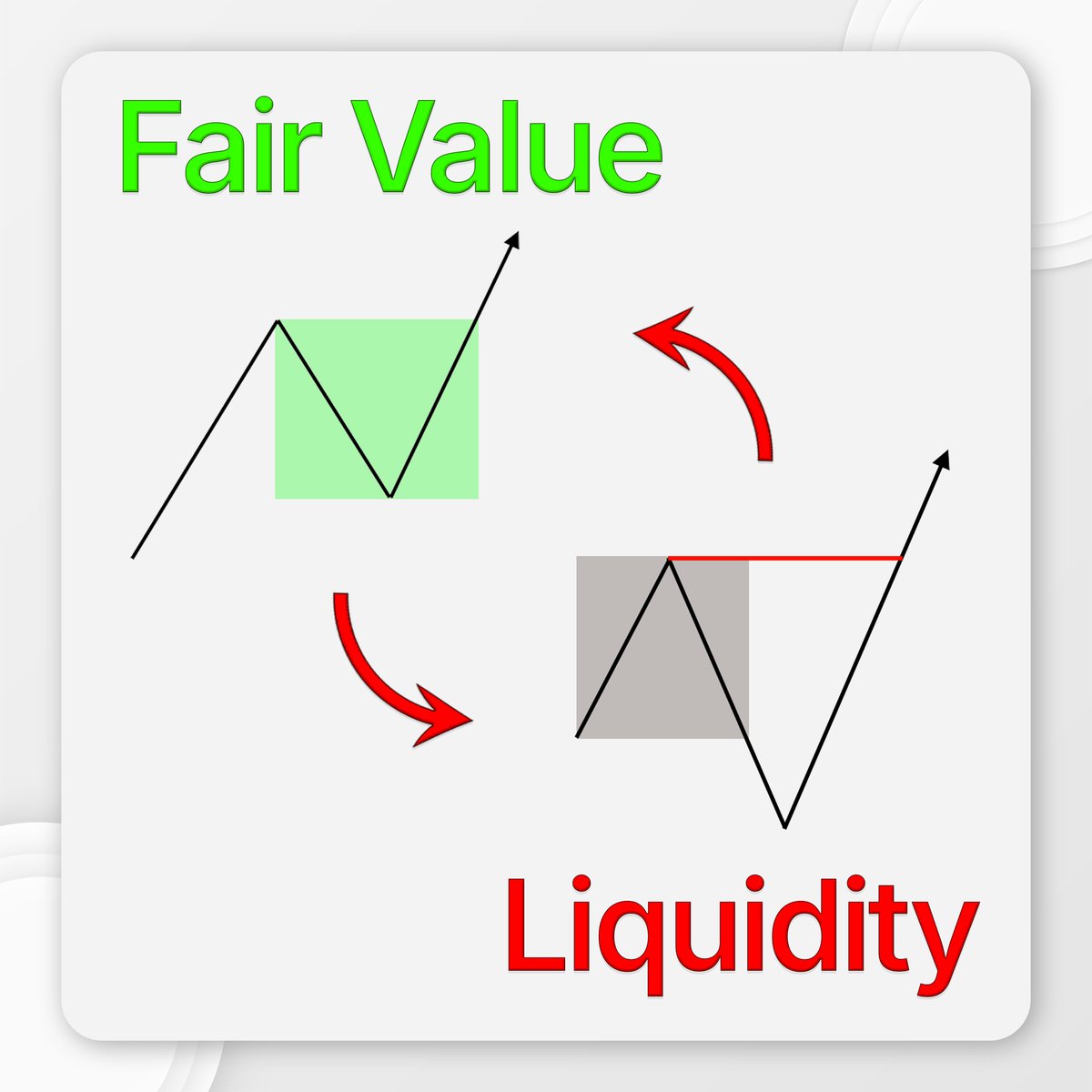

4 - However there is a 4th, less known FVG that is a different version of the 2nd FVG (The Expansion FVG). This FVG is the "Sneaky" Breakaway Gap that often many traders miss.

5 - In order to understand the Sneaky Breakaway Gap we must first understand Candle Science. This will help explain what the large wick of the 3rd FVG candle is actually telling us.

6 - We now understand then that the long wick actually represents lower timeframe FVGs that are being respected and thus price will likely not trade back into the FVG before we reach the DOL/Target.

7 - By understanding these 4 types of FVGs you can give yourself the highest chances of finding a high probability FVG to trade off of.

Full Video 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh