🇨🇦BANK OF CANADA IS IN A BIND🔒

Canada’s economy is weakening quickly. Businesses are going bankrupt, unemployment is rising, and GDP per capita is abysmal.

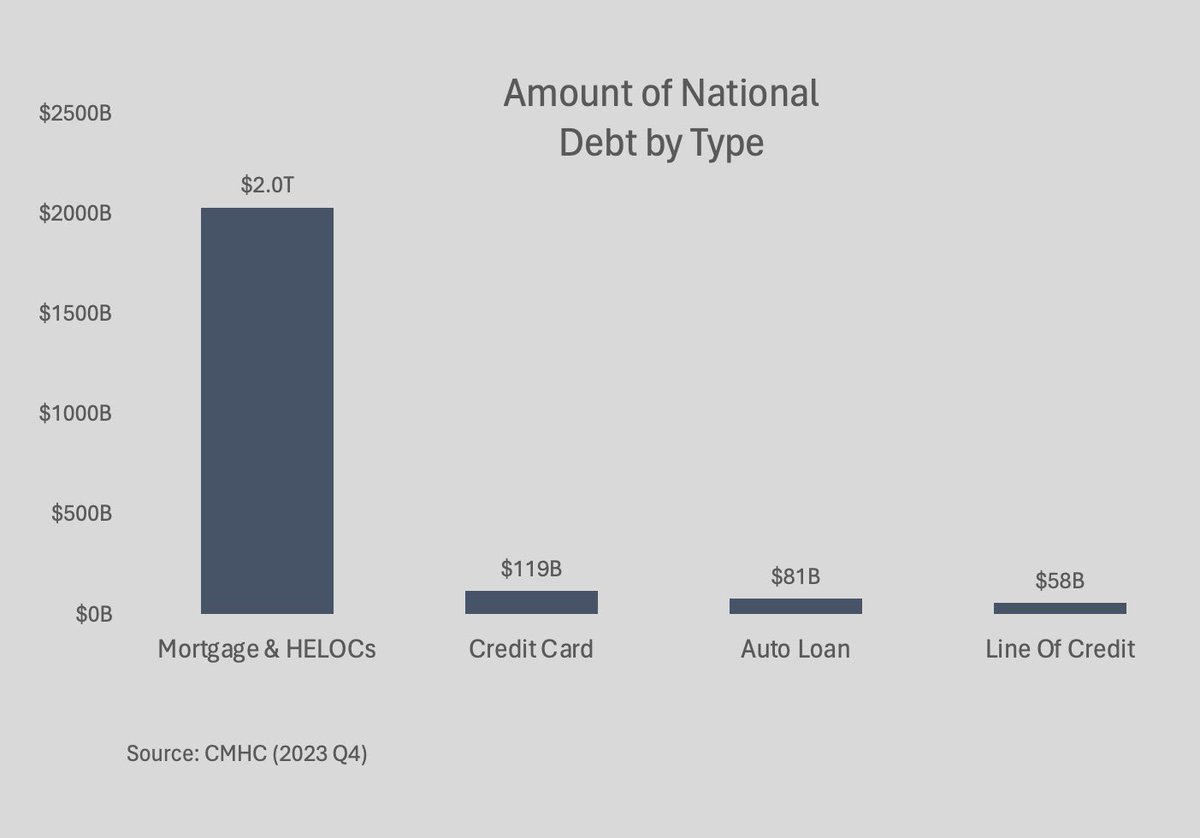

For 13 years BoC held rates at 2% (or less) so Canadians grew addicted to cheap debt and took on a lot of it. Now that we’re sitting at 5% rates it’s a shock to many people.

The debt accumulated by businesses, consumers, and the government is no longer feasible which is why many are calling for imminent rate cuts. Given the weakening economy I’m sure rate cuts are on the BoC’s mind but it’s not that simple.

If BoC cuts rates too soon we risk a second wave of inflation and a repeat of the 1970s.

Canada’s economy is weakening quickly. Businesses are going bankrupt, unemployment is rising, and GDP per capita is abysmal.

For 13 years BoC held rates at 2% (or less) so Canadians grew addicted to cheap debt and took on a lot of it. Now that we’re sitting at 5% rates it’s a shock to many people.

The debt accumulated by businesses, consumers, and the government is no longer feasible which is why many are calling for imminent rate cuts. Given the weakening economy I’m sure rate cuts are on the BoC’s mind but it’s not that simple.

If BoC cuts rates too soon we risk a second wave of inflation and a repeat of the 1970s.

1970s INFLATION CRISIS 📈

In the 1970s Canada experienced an inflation crisis which came in two waves.

WAVE 1:

From 1971 to 1974 inflation accelerated from 2.7% to 11% prompting the BoC to hike interest rates to >9%.

As a result, inflation fell to 7.5% by 1976.

With inflation falling, the BoC prematurely cut interest rates which only helped to fuel the second wave.

WAVE 2:

From 1976 to 1981 inflation jumped to 12.5% forcing the BoC to hike to a whopping 21.5% to finally contain inflation.

Many other countries experienced these inflation waves, including the US, so it’s not entirely the BoC’s fault. Fiscal expansion and external factors, like the surging price of oil, both played large roles but the BoC was an indisputable factor.

In the 1970s Canada experienced an inflation crisis which came in two waves.

WAVE 1:

From 1971 to 1974 inflation accelerated from 2.7% to 11% prompting the BoC to hike interest rates to >9%.

As a result, inflation fell to 7.5% by 1976.

With inflation falling, the BoC prematurely cut interest rates which only helped to fuel the second wave.

WAVE 2:

From 1976 to 1981 inflation jumped to 12.5% forcing the BoC to hike to a whopping 21.5% to finally contain inflation.

Many other countries experienced these inflation waves, including the US, so it’s not entirely the BoC’s fault. Fiscal expansion and external factors, like the surging price of oil, both played large roles but the BoC was an indisputable factor.

INTERNAL CONFLICTS 🍁

In Canada there is one main internal force working against the BoC in their fight with inflation - the government.

The federal government has welcomed a record amount of immigrants which exacerbated supply issues - the result is an increase in demand-pull inflation. The idea of mass immigration was to suppress wages and artificially prop up GDP, but we’re also seeing an expansion of the public sector to assist in the illusion of a strong economy.

Government at all 3 levels are also guilty of reckless deficit spending and amassed an unsustainable amount of debt in the process. With interest rates at higher levels the government is urging the BoC to cut rates to make their debt load more manageable.

The carbon tax is another inflationary pressure that not only increases the price of gas at the pumps, but also places additional operating costs on businesses. These businesses, in turn, increase the price of their products/services to offset the cost of the carbon tax.

These are all contributing factors to higher inflation and preventing BoC from cutting rates.

In Canada there is one main internal force working against the BoC in their fight with inflation - the government.

The federal government has welcomed a record amount of immigrants which exacerbated supply issues - the result is an increase in demand-pull inflation. The idea of mass immigration was to suppress wages and artificially prop up GDP, but we’re also seeing an expansion of the public sector to assist in the illusion of a strong economy.

Government at all 3 levels are also guilty of reckless deficit spending and amassed an unsustainable amount of debt in the process. With interest rates at higher levels the government is urging the BoC to cut rates to make their debt load more manageable.

The carbon tax is another inflationary pressure that not only increases the price of gas at the pumps, but also places additional operating costs on businesses. These businesses, in turn, increase the price of their products/services to offset the cost of the carbon tax.

These are all contributing factors to higher inflation and preventing BoC from cutting rates.

IMMIGRATION & PUBLIC SECTOR EXPANSION 🏫

Demand-pull inflation occurs when demand for goods and services exceeds supply in the economy - it’s often described as “too many dollars chasing too few goods”. This is exactly what we’re seeing today largely due to mass immigration.

Canada's population added 1.27 million people in 2023 alone, reaching a record high population of 40.77 million. This is the highest growth in over 65 years.

These immigrants essentially create demand out of thin air and put a strain on supplies. Some of them even exploit Canada’s welfare system, receiving government money and not contributing to society in any productive manner.

This amount of immigration is helping to prop up GDP, but the government is going one step further and expanding the public sector.

The size of the federal public service reached 274k employees in 2023 which is a 40% increase since 2015. Compensation for federal bureaucrats also increased by nearly 37% during this time. As a result, the public sector is also propping up our overall GDP.

This is bad for 2 reasons:

(1) a “strong” GDP signals the BoC to not cut rates; and

(2) this is not productive GDP so it doesn’t realistically indicate economic growth (see pics below).

So, not only is the government creating demand-pull inflation but they are also artificially propping up GDP to avoid a recession. These are two reasons the government is actually causing the BoC to keep rates higher for longer (even though they’re begging for rate cuts).

Demand-pull inflation occurs when demand for goods and services exceeds supply in the economy - it’s often described as “too many dollars chasing too few goods”. This is exactly what we’re seeing today largely due to mass immigration.

Canada's population added 1.27 million people in 2023 alone, reaching a record high population of 40.77 million. This is the highest growth in over 65 years.

These immigrants essentially create demand out of thin air and put a strain on supplies. Some of them even exploit Canada’s welfare system, receiving government money and not contributing to society in any productive manner.

This amount of immigration is helping to prop up GDP, but the government is going one step further and expanding the public sector.

The size of the federal public service reached 274k employees in 2023 which is a 40% increase since 2015. Compensation for federal bureaucrats also increased by nearly 37% during this time. As a result, the public sector is also propping up our overall GDP.

This is bad for 2 reasons:

(1) a “strong” GDP signals the BoC to not cut rates; and

(2) this is not productive GDP so it doesn’t realistically indicate economic growth (see pics below).

So, not only is the government creating demand-pull inflation but they are also artificially propping up GDP to avoid a recession. These are two reasons the government is actually causing the BoC to keep rates higher for longer (even though they’re begging for rate cuts).

GOVERNMENT DEBT PAYMENTS 💳

With unprecedented deficit spending our governments have contributed to high inflation and amassed record high debt doing so.

In Q3 2023 Canada’s general government (which includes all 3 levels) spent $24.7 billion on interest alone. That’s nearly $100 billion in interest annually.

Governments are now pressuring BoC to lower rates to help them manage this debt. Of course, we know from the 1970s that cutting too soon will result in a second wave of higher inflation.

This leaves the Canadian government vulnerable to sovereign default.

With unprecedented deficit spending our governments have contributed to high inflation and amassed record high debt doing so.

In Q3 2023 Canada’s general government (which includes all 3 levels) spent $24.7 billion on interest alone. That’s nearly $100 billion in interest annually.

Governments are now pressuring BoC to lower rates to help them manage this debt. Of course, we know from the 1970s that cutting too soon will result in a second wave of higher inflation.

This leaves the Canadian government vulnerable to sovereign default.

CARBON TAX ⛽️

The carbon tax is another unnecessary inflationary pressure. On April 1 the tax is set to increase 23% from $65 to $80 per tonne (and an additional $15 every year until 2030).

Not only does this increase the price of gas at the pumps but also puts an additional cost on businesses, at a time when businesses are struggling to stay afloat. In turn, these businesses will increase the price of their products to compensate for this additional cost.

The carbon tax is another unnecessary inflationary pressure. On April 1 the tax is set to increase 23% from $65 to $80 per tonne (and an additional $15 every year until 2030).

Not only does this increase the price of gas at the pumps but also puts an additional cost on businesses, at a time when businesses are struggling to stay afloat. In turn, these businesses will increase the price of their products to compensate for this additional cost.

EXTERNAL CONFLICTS 🌎

The BoC is at the mercy of the Fed - if the Fed doesn’t cut, the BoC can’t cut; not without collapsing the CAD and accepting a second round of inflation anyway. In the US right now inflation is sticky and the economy seems to be chugging along just fine, they’re in no rush to cut rates.

There is also the concern of oil prices, which was also a contributor to the inflation crisis in the 1970s.

So far in 2024 we have already seen oil prices rebound 17%. With geopolitical tensions between Russia/Ukraine, Israel/Gaza, China/Taiwan etc. there’s a good chance we see these conflicts affect the production and transportation of oil, driving the cost of oil up.

Russia's government recently ordered the reduction of oil output to 9 million barrels per day by the end of June. At the same time the US’s strategic petroleum reserve is dangerously low and they are starting to refill it, further reducing the supply.

Geopolitical tensions are likely to cause oil prices to surge and put further upward pressure on inflation.

The BoC is at the mercy of the Fed - if the Fed doesn’t cut, the BoC can’t cut; not without collapsing the CAD and accepting a second round of inflation anyway. In the US right now inflation is sticky and the economy seems to be chugging along just fine, they’re in no rush to cut rates.

There is also the concern of oil prices, which was also a contributor to the inflation crisis in the 1970s.

So far in 2024 we have already seen oil prices rebound 17%. With geopolitical tensions between Russia/Ukraine, Israel/Gaza, China/Taiwan etc. there’s a good chance we see these conflicts affect the production and transportation of oil, driving the cost of oil up.

Russia's government recently ordered the reduction of oil output to 9 million barrels per day by the end of June. At the same time the US’s strategic petroleum reserve is dangerously low and they are starting to refill it, further reducing the supply.

Geopolitical tensions are likely to cause oil prices to surge and put further upward pressure on inflation.

EN ROUTE TO STAGFLATION ⏳

Stagflation is when an economy faces both stagnant growth and high inflation at the same time - this leads to rising unemployment. This is where Canada is likely headed and the BoC can’t do anything about it anymore.

If the BoC cuts too soon, inflation will come roaring back which will only force them to raise rates even higher.

If the BoC doesn’t cut soon enough, businesses will continue to go bankrupt, unemployment will rise, and the housing market will take a massive hit.

Even with stagnant growth (or even contraction) in most sectors, the government will continue to expand and make every attempt to avoid a technical recession. High inflation could be inevitable given the external factors on the price of oil, in addition to the carbon tax which is specific to Canada. Unemployment is rising fast and will continue to increase as businesses fail to pay off their loans and are forced to close up shop.

It’s only a matter of time before Canada has to face the music.

Stagflation is when an economy faces both stagnant growth and high inflation at the same time - this leads to rising unemployment. This is where Canada is likely headed and the BoC can’t do anything about it anymore.

If the BoC cuts too soon, inflation will come roaring back which will only force them to raise rates even higher.

If the BoC doesn’t cut soon enough, businesses will continue to go bankrupt, unemployment will rise, and the housing market will take a massive hit.

Even with stagnant growth (or even contraction) in most sectors, the government will continue to expand and make every attempt to avoid a technical recession. High inflation could be inevitable given the external factors on the price of oil, in addition to the carbon tax which is specific to Canada. Unemployment is rising fast and will continue to increase as businesses fail to pay off their loans and are forced to close up shop.

It’s only a matter of time before Canada has to face the music.

• • •

Missing some Tweet in this thread? You can try to

force a refresh