$ENA is live! @ethena_labs is one of our highest conviction bets this cycle both @delphi_ventures and personally

I believe:

- sUSDe will offer the highest dollar yield in crypto at scale

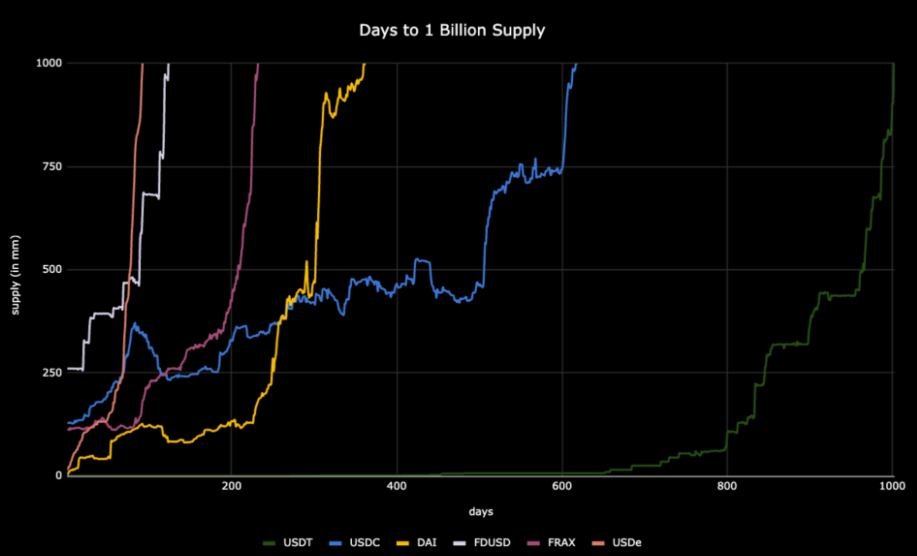

- USDe will become the largest stablecoin outside of USDC/USDT in 2024

- Ethena will become the highest revenue generating project in all of crypto

Thread on what Ethena is, why I'm excited, and the risks as I see them

I believe:

- sUSDe will offer the highest dollar yield in crypto at scale

- USDe will become the largest stablecoin outside of USDC/USDT in 2024

- Ethena will become the highest revenue generating project in all of crypto

Thread on what Ethena is, why I'm excited, and the risks as I see them

@ethena_labs @Delphi_Ventures This turned out pretty long, so if you want to read it in a cleaner format I published it on my Medium here:

Or if you prefer to listen, my partner @yan_liberman does a great job breaking it down here: medium.com/@zemacedo/ethe…

podcasts.apple.com/us/podcast/eth…

Or if you prefer to listen, my partner @yan_liberman does a great job breaking it down here: medium.com/@zemacedo/ethe…

podcasts.apple.com/us/podcast/eth…

@ethena_labs @Delphi_Ventures @yan_liberman 1/ Stablecoins are still undeniably one of crypto's killer apps

The market has repeatedly shown it wants yield on stables. The issue is generating it in an organic, sustainable way

Ethena is able to provide this yield with the byproduct being a stablecoin

The market has repeatedly shown it wants yield on stables. The issue is generating it in an organic, sustainable way

Ethena is able to provide this yield with the byproduct being a stablecoin

@ethena_labs @Delphi_Ventures @yan_liberman 2/ The stablecoin captures the yield while the capital used to mint the stablecoin generates it

@ethena_labs @Delphi_Ventures @yan_liberman 3/ Specifically, the capital used to back the stable is placed into a delta neutral exposure of Long Staked ETH and Short Eth perp, with both legs of the position typically providing a yield

sUSDE yield = stETH yield + funding rate (currently 35.4%)

sUSDE yield = stETH yield + funding rate (currently 35.4%)

@ethena_labs @Delphi_Ventures @yan_liberman 4/ This is an implementation of @CryptoHayes's original idea of a "synthetic USD"

While delta neutral positions like this have previously been attempted (e.g. UXD), they've never before been able to tap into centralised exchange liquidity

blog.bitmex.com/in-depth-creat…

While delta neutral positions like this have previously been attempted (e.g. UXD), they've never before been able to tap into centralised exchange liquidity

blog.bitmex.com/in-depth-creat…

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 5/ Before digging into the design and its risks, it’s worth providing a brief summary/history of stablecoin designs and where they fit into the stablecoin trilemma

There are 3 popular forms of stable coins: Overcollateralized, Fiat Backed, and Algorithmic

There are 3 popular forms of stable coins: Overcollateralized, Fiat Backed, and Algorithmic

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 6/ They each address various parts of the stablecoin trilemma (i.e. the inability to be simultaneously Decentralized, Stable, and Scalable/Capital Efficient) but ultimately fall short in addressing all 3

multicoin.capital/2018/01/17/an-…

multicoin.capital/2018/01/17/an-…

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 7/ Fiat Backed (USDC, USDT)

StabIlity: Authorised participants (i.e. market makers) can mint and redeem them to arb price and ensure they maintain peg

Scalability: They're 1:1 collateralised so they're scalable + capital efficient

StabIlity: Authorised participants (i.e. market makers) can mint and redeem them to arb price and ensure they maintain peg

Scalability: They're 1:1 collateralised so they're scalable + capital efficient

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 8/ Decentralisation: Highly centralised, meaning holders face both counterparty risk (bank solvency, asset seizure, etc) and censorship risk as legal entities can be coerced and bank accs frozen

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 9/ Overcollateralised (DAI)

Stability: Anyone can mint and redeem for underlying collateral and arbitrage the price, creating stability

Stability: Anyone can mint and redeem for underlying collateral and arbitrage the price, creating stability

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 10/

Scalability: Struggles since it mostly exists as a byproduct of the demand for leverage. This is made worse by the superiority of Aave and other products when it comes to this functionality

Scalability: Struggles since it mostly exists as a byproduct of the demand for leverage. This is made worse by the superiority of Aave and other products when it comes to this functionality

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 11/

Decentralisation: Highly decentralised when compared to alternatives, although there's some reliance on both centralised stablecoins and treasuries as collateral

Decentralisation: Highly decentralised when compared to alternatives, although there's some reliance on both centralised stablecoins and treasuries as collateral

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 12/ Algorithmic stablecoins (RIP)

Algorithmic stablecoins are highly capital efficient and scalable as they can be minted without exogenous collateral, and generally pass on some form of yield/rebasing to participants when demand exceeds supply

Algorithmic stablecoins are highly capital efficient and scalable as they can be minted without exogenous collateral, and generally pass on some form of yield/rebasing to participants when demand exceeds supply

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 13/They're also decentralised since they tend to rely only on crypto-native collateral

However, they fail miserably on stability as they're backed only by endogenous collateral, which leads eventual collapse via death spiral. Every algo stable ever tried has suffered this fate

However, they fail miserably on stability as they're backed only by endogenous collateral, which leads eventual collapse via death spiral. Every algo stable ever tried has suffered this fate

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 14/ Enter Ethena's USDe - In my view, USDe is the most scalable fully collateralised stablecoin ever created. It's not fully decentralised, nor can it ever be, but imo it nevertheless sits at a very interesting point on the tradeoff spectrum

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 15/ Stability: USDe is fully collateralised by a delta neutral position that consists of a long staked Eth spot position offset by a short Eth perp position. Authorised participants can redeem the stablecoin for the underlying collateral, which should lead to stability

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 16/ However, this is a new design and there are risks (more on this later)

It's unlikely to ever be as stable as fiat-backed stables, given redemption costs for those are free whereas USDe redemption cost will rely on liquidity conditions at the time (i.e. cost to unwind shorts)

It's unlikely to ever be as stable as fiat-backed stables, given redemption costs for those are free whereas USDe redemption cost will rely on liquidity conditions at the time (i.e. cost to unwind shorts)

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 17/ Scalability: This is where USDe really shines for two main reasons. Firstly, like fiat-backed stables, Ethena can be minted 1:1 with collateral

However, unlike fiat-backed stables, Ethena is able to generate meaningful organic yield at scale for its holders

However, unlike fiat-backed stables, Ethena is able to generate meaningful organic yield at scale for its holders

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 18/ Specifically, USDe can be staked into sUSDe to capture the protocol yield, which is a combination of stETH yield and funding rates (i.e. demand for leverage)

sUSDE yield = stETH yield + funding rate (currently 35.4%)

sUSDE yield = stETH yield + funding rate (currently 35.4%)

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 19/ Crucially, this yield is likely to be: a) scalable and b) counter-cyclical to treasury rates

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 20/ On scalability: Ethena effectively combines the two largest sources of "real yield" in crypto:

ETH staking: ~$3.5b/year

Perp basis funding: ~$35b/year in OI between ETH and BTC (coming this week), earning an avg of ~11% over last 3 years

ETH staking: ~$3.5b/year

Perp basis funding: ~$35b/year in OI between ETH and BTC (coming this week), earning an avg of ~11% over last 3 years

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 21/ This is likely to be much higher during a bull market as we've seen over the last 3 months where funding has averaged ~30%

This also doesn’t account for the additional staked ETH yield buffer

This also doesn’t account for the additional staked ETH yield buffer

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 22/ On counter-cyclicality: As treasury yields likely trend lower over time, demand for crypto leverage should go up as people go further out on the risk curve

Ethena's yields should remain high as treasury-backed competitors compress

Ethena's yields should remain high as treasury-backed competitors compress

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 23/ Decentralisation: Decentralisation is a multi-dimensional spectrum, and overall assessments will depend on how heavily you weight each of the dimensions

Personally, I'd say Ethena sits somewhere between fiat-backed and overcollateralised stables in terms of decentralisation

Personally, I'd say Ethena sits somewhere between fiat-backed and overcollateralised stables in terms of decentralisation

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 24/ It's more censorship-resistant than fiat-backed stables in that there's no dependence on traditional banking rails which ultimately rely on the fed and can be shut down overnight. @cryptohayes describes this well in his recent blog post

cryptohayes.medium.com/dust-on-crust-…

cryptohayes.medium.com/dust-on-crust-…

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 25/ However, it does face some counterparty risk with CEXes

Specifically, Ethena holds collateral off exchanges in MPC wallets with institutional grade custodians, which are then mirrored onto CEXes using Copper, Ceffu and Cobo

Specifically, Ethena holds collateral off exchanges in MPC wallets with institutional grade custodians, which are then mirrored onto CEXes using Copper, Ceffu and Cobo

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 26/ While this sounds bad, it's worth noting that settlement actually happens every 4-8hrs, reducing counterparty risk with exchanges to the accrued profit of the short leg of the trade between settlement periods

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 27/ More importantly, unlike overcollateralised stable which can be minted/redeemed permissionlessly on-chain, Ethena relies on calling an off-chain server to compute venue with the most efficient funding rate and mint USDe

This is a large centralisation vector

This is a large centralisation vector

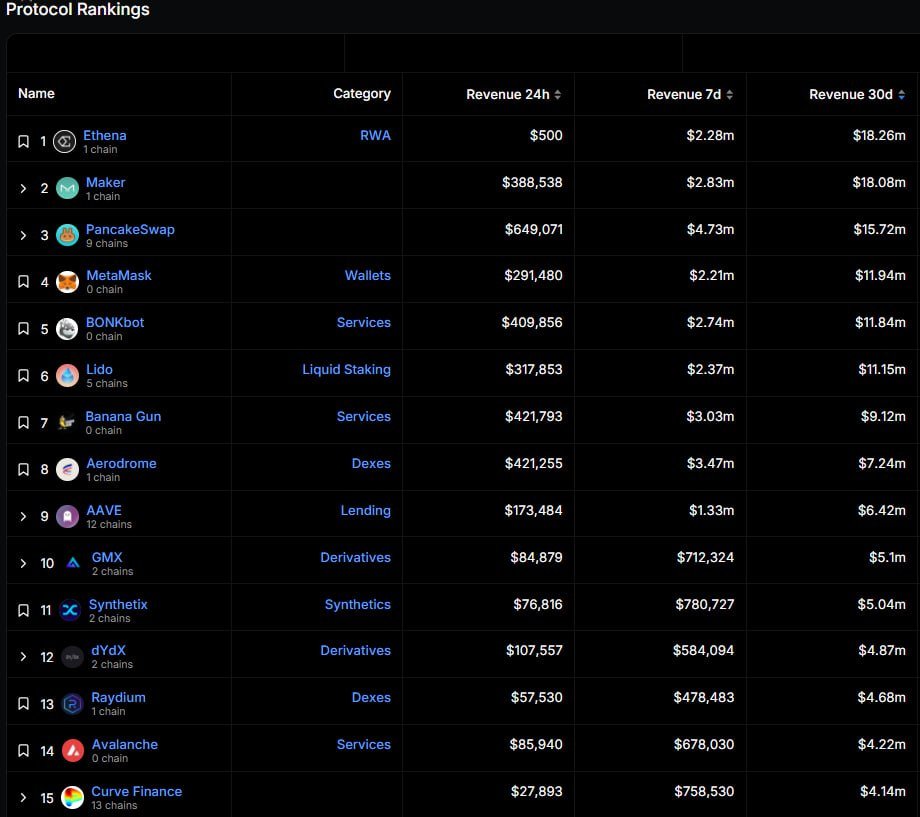

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 28/ Profitability:

Ethena has quickly become the highest revenue generating dApp in crypto, eclipsing all of DeFi and sitting behind only the largest L1s

Ethena's cashflow comes from a take rate on the total yield generated + yield on unstaked USDe.

Ethena has quickly become the highest revenue generating dApp in crypto, eclipsing all of DeFi and sitting behind only the largest L1s

Ethena's cashflow comes from a take rate on the total yield generated + yield on unstaked USDe.

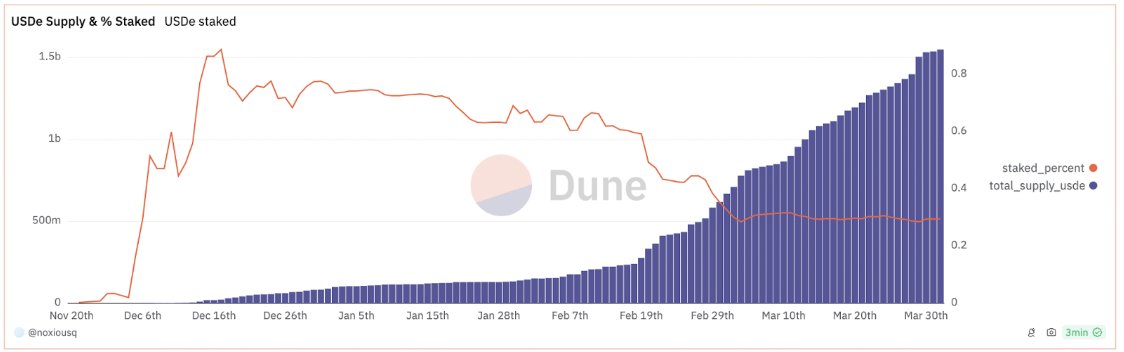

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 29/ Right now this is going to bootstrap the insurance fund, but eventually one could expect this to be distributed to $ENA stakers

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 30/ Assuming a 10% take rate, Ethena's protocol rev =

Total Yield * (1–90% * (1 — sUSDe Supply / USDe Supply))

It's worth noting that Ethena's profitability is higher right now due to the shard campaign, as the staking rate is only ~30% due to point incentives for locking USDe

Total Yield * (1–90% * (1 — sUSDe Supply / USDe Supply))

It's worth noting that Ethena's profitability is higher right now due to the shard campaign, as the staking rate is only ~30% due to point incentives for locking USDe

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 31/ This dynamic also highlights why it's so beneficial for USDE to succeed as a stablecoin. The more USDe is used a stablecoin, the less USDe is staked, and the more profitable Ethena is

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 32/ On risks:

The most common FUD I've seen people focus on is funding risk i.e. what happens if funding flips negative for prolonged periods? Will we see a UST-like unwind/blow-up?

In response to this, it's worth pointing out:

The most common FUD I've seen people focus on is funding risk i.e. what happens if funding flips negative for prolonged periods? Will we see a UST-like unwind/blow-up?

In response to this, it's worth pointing out:

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 33/

1) Funding has historically been highly positive

2) There's an insurance fund (IF) to cover periods of negative funding

1) Funding has historically been highly positive

2) There's an insurance fund (IF) to cover periods of negative funding

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 34/ 3) Most importantly, even in worst case scenarios where funding is negative for an unprecedented period of time and the IF is depleted, USDe is fully externally collateralised and has some level of "anti-reflexivity" built into the design, making it very different from UST

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 35/ 1) Historical funding

Funding has historically been positive, especially when accounting for the Eth staking yield buffer. Over the last 3 yrs:

- funding averaged positive ~8.5% on an OI weighted basis

- funding net of staked ETH yields has only been negative on 11% of days

Funding has historically been positive, especially when accounting for the Eth staking yield buffer. Over the last 3 yrs:

- funding averaged positive ~8.5% on an OI weighted basis

- funding net of staked ETH yields has only been negative on 11% of days

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes - max 13 consecutive days of negative funding vs 110 days positive

See these posts from Ethena contributors for some good data-driven analysis on this:

twitter.com/leptokurtic_/t…

See these posts from Ethena contributors for some good data-driven analysis on this:

https://twitter.com/ConorRyder/status/1759706195709849806

twitter.com/leptokurtic_/t…

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 36/ There also may be reason to believe funding stays structurally positive long-term

Some exchanges (Binance, Bybit) have positive baseline funding rates of 11%, meaning if funding is within a certain range it snaps back to 11% by default. These exchanges make up >50% of OI

Some exchanges (Binance, Bybit) have positive baseline funding rates of 11%, meaning if funding is within a certain range it snaps back to 11% by default. These exchanges make up >50% of OI

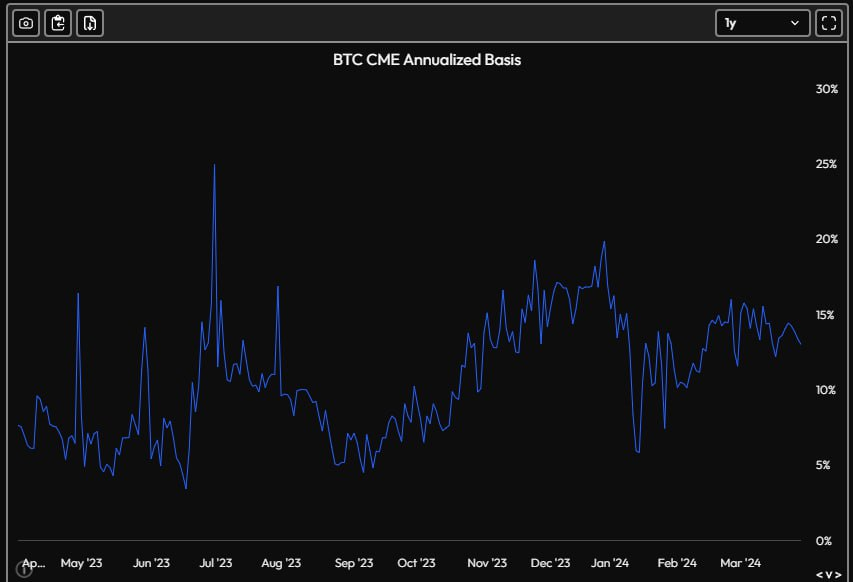

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 37/ Even when we look at TradFi, CME Bitcoin futures are bigger than Binance and are currently yielding ~15%. In general, futures yield basis is positive the vast majority of the time as a proxy for the cost of capital

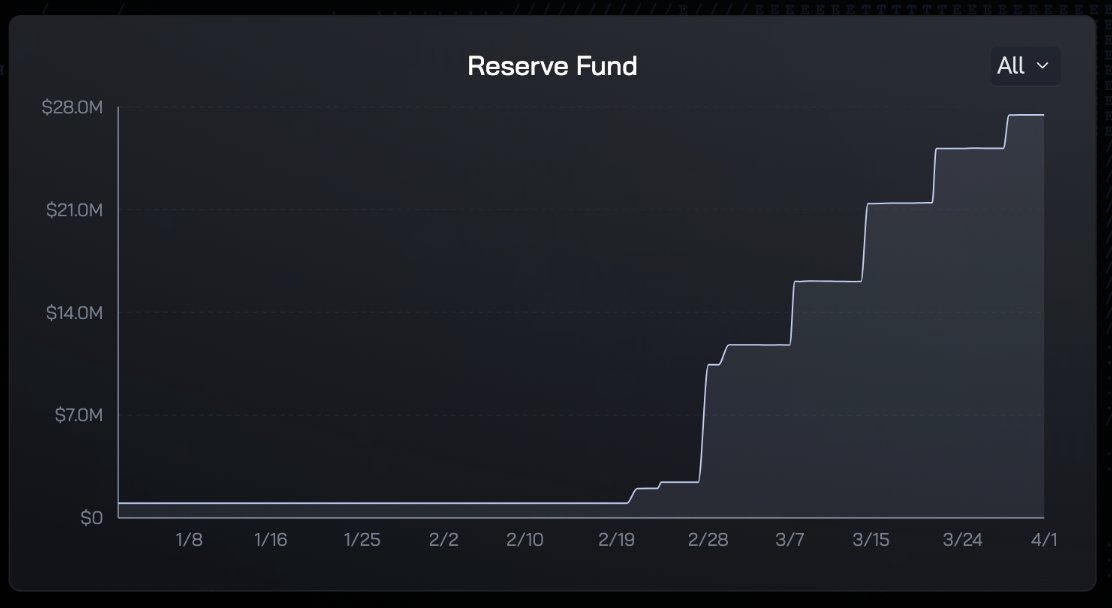

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 38/ 2) Insurance Fund

When funding does flip negative, there's an insurance fund in place which serves to subsidise sUSDE yield and ensure it's capped at 0 (i.e. never goes negative)

A % of protocol revenue will be redirected to the IF to ensure it grows organically over time

When funding does flip negative, there's an insurance fund in place which serves to subsidise sUSDE yield and ensure it's capped at 0 (i.e. never goes negative)

A % of protocol revenue will be redirected to the IF to ensure it grows organically over time

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 39/ The IF has been bootstrapped with a $10m contribution from Ethena Labs

It's sitting at $27m and currently all protocol revenue is being sent to there (~$3m/week at current run-rate)

etherscan.io/address/0x2b5a…

It's sitting at $27m and currently all protocol revenue is being sent to there (~$3m/week at current run-rate)

etherscan.io/address/0x2b5a…

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes 40/ Both Ethena team and @chaos_labs have done extensive research into figuring out the optimal size for the IF (links below)

Their recommendations came in at between $20m - $33m per $1b of USDE supply.

ethena-labs.gitbook.io/ethena-labs/re…

ethena-labs.gitbook.io/ethena-labs/so…

Their recommendations came in at between $20m - $33m per $1b of USDE supply.

ethena-labs.gitbook.io/ethena-labs/re…

ethena-labs.gitbook.io/ethena-labs/so…

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs 41/ 3) Anti-reflexivity

Now, let's assume a scenario where funding yields are negative and prolonged enough to drain the insurance fund

In this case, the principal balance of the stablecoin will slowly erode below $1 as funding payments are made from collateral balance

Now, let's assume a scenario where funding yields are negative and prolonged enough to drain the insurance fund

In this case, the principal balance of the stablecoin will slowly erode below $1 as funding payments are made from collateral balance

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs 42/ While this sounds bad, the risk here is very different from algostables in that collateral slowly erodes over time rather than rapidly and violently collapsing to 0

E.g. the max negative funding rate on Binance of -100% would imply a loss of 0.273% per day

E.g. the max negative funding rate on Binance of -100% would imply a loss of 0.273% per day

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs 43/ As Guy points out, this exogenous funding rate actually embeds "anti-reflexivity" or negative feedback loops into the design

Yield goes negative --> users redeem the stablecoin --> shorts are unwound --> funding mean reverts back above 0

Yield goes negative --> users redeem the stablecoin --> shorts are unwound --> funding mean reverts back above 0

https://twitter.com/leptokurtic_/status/1682781099376939008

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs 44/ Redemption of the stablecoin helps balance funding rates and bring the system back into equilibrium

This is the opposite of algostables where redemption tanks the price of the share token and creates the positive feedback loop which makes up the so-called "death spiral"

This is the opposite of algostables where redemption tanks the price of the share token and creates the positive feedback loop which makes up the so-called "death spiral"

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs 45/ Two additional things worth noting:

1) Any unwind will likely not happen suddenly when yields turn negative, but rather gradually as yields come down over time

Why hold USDeE if you can get the same yield from treasuries?

1) Any unwind will likely not happen suddenly when yields turn negative, but rather gradually as yields come down over time

Why hold USDeE if you can get the same yield from treasuries?

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs 46/ 2) the insurance fund is a design choice made to optimise UX for sUSDE holders by smoothing out yields and avoiding them having to worry about principal loss day to day

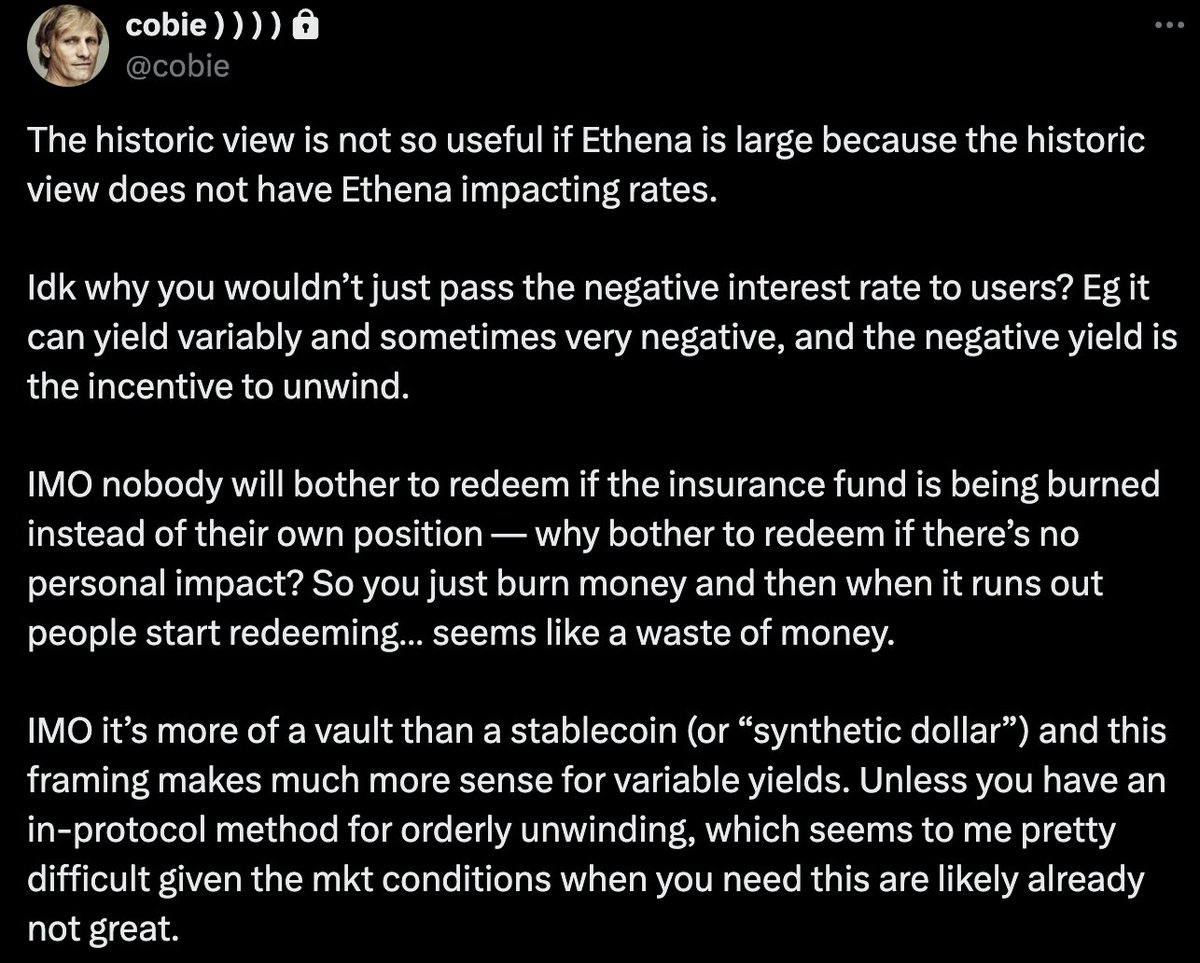

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs 47/ Ethena could instead choose to pass on negative yields to holders as @cobie suggests here, which would make the negative feedback loop even stronger by encouraging ppl to redeem quicker in response to changes in funding

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 48/ Other risks

While I don't think negative funding is a particularly big risk, there are definitely plenty of other risks to consider

Below is a (non-exhaustive) list of risks and mitigants as I see them:

While I don't think negative funding is a particularly big risk, there are definitely plenty of other risks to consider

Below is a (non-exhaustive) list of risks and mitigants as I see them:

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 49/ 1) Historical funding rate data doesn't include Ethena itself. If USDe gets sufficiently large vs overall OI, it could:

a) bring down average funding rates

b) exacerbate funding rate vol which could lead to violent unwinds, bad execution and potential USDe depegs

a) bring down average funding rates

b) exacerbate funding rate vol which could lead to violent unwinds, bad execution and potential USDe depegs

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 50/

Relatedly, stETH yields are also likely to continue come down over time, further hurting the economics and making the above problem worse

This is definitely a risk. A few mitigants:

Relatedly, stETH yields are also likely to continue come down over time, further hurting the economics and making the above problem worse

This is definitely a risk. A few mitigants:

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 51/

a) there's a 7 day delay on unstaking sUSDe which should help mitigate the magnitude of the panics as a lot of the supply will be staked and unable to be sold

a) there's a 7 day delay on unstaking sUSDe which should help mitigate the magnitude of the panics as a lot of the supply will be staked and unable to be sold

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 52/

b) even in the worst case this depeg shouldn't affect protocol solvency too severely, since the spread is passed on to the authorised participants redeeming. It would mainly harm the users redeeming at a loss and, more significantly, the protocols/users levering up on USDe

b) even in the worst case this depeg shouldn't affect protocol solvency too severely, since the spread is passed on to the authorised participants redeeming. It would mainly harm the users redeeming at a loss and, more significantly, the protocols/users levering up on USDe

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 53/ 2) LST collateral is relatively illiquid, and could get slashed and/or depeg. A sufficiently violent depeg could lead to Ethena getting liquidated and realising losses

However, given Ethena uses limited to no leverage, only an unprecedented depeg would cause liquidation

However, given Ethena uses limited to no leverage, only an unprecedented depeg would cause liquidation

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 54/ According to Ethena's own research, this would require a 41-65% depeg of the LST vs ETH, with the highest depeg ever being ~8% on stETH in 2022 (see worked example in link)

ethena-labs.gitbook.io/ethena-labs/so…

ethena-labs.gitbook.io/ethena-labs/so…

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 55/ Ethena also diversifies its LST exposure now which further mitigates this and only holds 22% of its collateral now in LSTs, with ETH making up 51% currently

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 56/ stETH yields of 3 / 4% become less relevant when funding is +30% in a bull market, so Ethena will likely hold more ETH in bull markets and more stETH in bear markets

3) Ethena has credit risk to CEXes on the short leg of the trade.

3) Ethena has credit risk to CEXes on the short leg of the trade.

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 57/ A counterparty blow-up means: a) Ethena ends up net long instead of delta neutral b) USDe depegs based on its pnl exposure to the specific counterparty

However, Ethena settles with CEXes every 4-8hrs, so they're only exposed to the difference between two settlement periods.

However, Ethena settles with CEXes every 4-8hrs, so they're only exposed to the difference between two settlement periods.

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 58/ While this could be large during a fast violent market move, it's not the same as being exposed to the entire notional amount

Also worth noting that all stablecoins have varying levels counterparty risk, as we found out w/ USDC last May

Also worth noting that all stablecoins have varying levels counterparty risk, as we found out w/ USDC last May

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 59/

4) USDE leverage - All the above risks can get amplified and systemic once we start adding in USDe looped leverage.

This will def lead to some panics, liquidation cascades and USDe depegs.

4) USDE leverage - All the above risks can get amplified and systemic once we start adding in USDe looped leverage.

This will def lead to some panics, liquidation cascades and USDe depegs.

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 60/

As mentioned above, this is likely to be more destructive to users and protocols that compose with USDe, rather than Ethena itself. However, in extreme cases it could also hurt Ethena

As mentioned above, this is likely to be more destructive to users and protocols that compose with USDe, rather than Ethena itself. However, in extreme cases it could also hurt Ethena

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 61/

5) Ethena Labs and associated multi-sigs have control of assets

Theoretically, they could take out leverage against them off-chain or otherwise encumber them

They could also get hit with an injuction and asked to freeze assets by regulators

5) Ethena Labs and associated multi-sigs have control of assets

Theoretically, they could take out leverage against them off-chain or otherwise encumber them

They could also get hit with an injuction and asked to freeze assets by regulators

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 62/ USDe holders have no legal rights and would have to fight this out in courts with no precedent to rely on

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 63/

7) Finally, there are also likely a lot of unknown unknowns.

Ethena is effectively operating as a tokenised hedge fund in the back-end. This stuff is hard, there are a lot of moving parts and ways that things could go wrong. Don't put in more than you can afford to lose

7) Finally, there are also likely a lot of unknown unknowns.

Ethena is effectively operating as a tokenised hedge fund in the back-end. This stuff is hard, there are a lot of moving parts and ways that things could go wrong. Don't put in more than you can afford to lose

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 64/ Everything in crypto has risks, as we've found out repeatedly the hard way. Imo, the important thing is to be as transparent as possible about the risks and allow individuals to make their own decisions

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 65/

I'd say the Ethena team has generally done a good job of this, with some of the most comprehensive documentation and risk disclosures I've seen for an early stage project

ethena-labs.gitbook.io/ethena-labs/so…

I'd say the Ethena team has generally done a good job of this, with some of the most comprehensive documentation and risk disclosures I've seen for an early stage project

ethena-labs.gitbook.io/ethena-labs/so…

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 66/ For my part, I have a lot of my personal stables in Ethena since before the shard campaign, bought a bunch of USDE/sUSDE Pendle YT, and also invested through Delphi Ventures

As you can probably tell by now, It's one of the projects i'm most excited for this cycle

As you can probably tell by now, It's one of the projects i'm most excited for this cycle

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 67/ I continue to think stablecoins are a $100b opportunity. Ethena strikes a very interesting point on the stablecoin tradeoff spectrum, and it'll be hard to compete with its yield at scale

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 68/

I also consider Guy one of the best founders we've backed, who in a little over a year has taken Ethena from an idea to the fastest growing dollar-denominated asset in crypto of all time w/ $1.5b TVL

I also consider Guy one of the best founders we've backed, who in a little over a year has taken Ethena from an idea to the fastest growing dollar-denominated asset in crypto of all time w/ $1.5b TVL

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie 69/ In this time, he's assembled a rockstar team to build out his vision, and surrounded himself with some of the best backers in the space (tier 1 CEXes, VCs, market-makers, etc)

Very excited to see what he can do over the next few years

Very excited to see what he can do over the next few years

@ethena_labs @Delphi_Ventures @yan_liberman @CryptoHayes @chaos_labs @cobie Thanks to @yan_liberman for helping me brainstorm this post and put it together, to @0xdef1, @yeak__ @ConorRyder for reviewing and @leptokurtic_ for answering all my dumb questions

• • •

Missing some Tweet in this thread? You can try to

force a refresh