On the heels of California’s new $20 minimum wage for fast-food workers, my co-author Max Risch of Carnegie Mellon University and I are posting our new working paper on the impact of minimum wage increases on independent businesses. [1/14]

nirupamarao.org/_files/ugd/ed3…

nirupamarao.org/_files/ugd/ed3…

To track impacts on these independent firms and their workers, we construct novel panel data by matching the universe of tax returns of U.S. independent businesses (pass-through firms) to the individual income tax returns of each of their workers and owners over a 10-year period. [2/14]

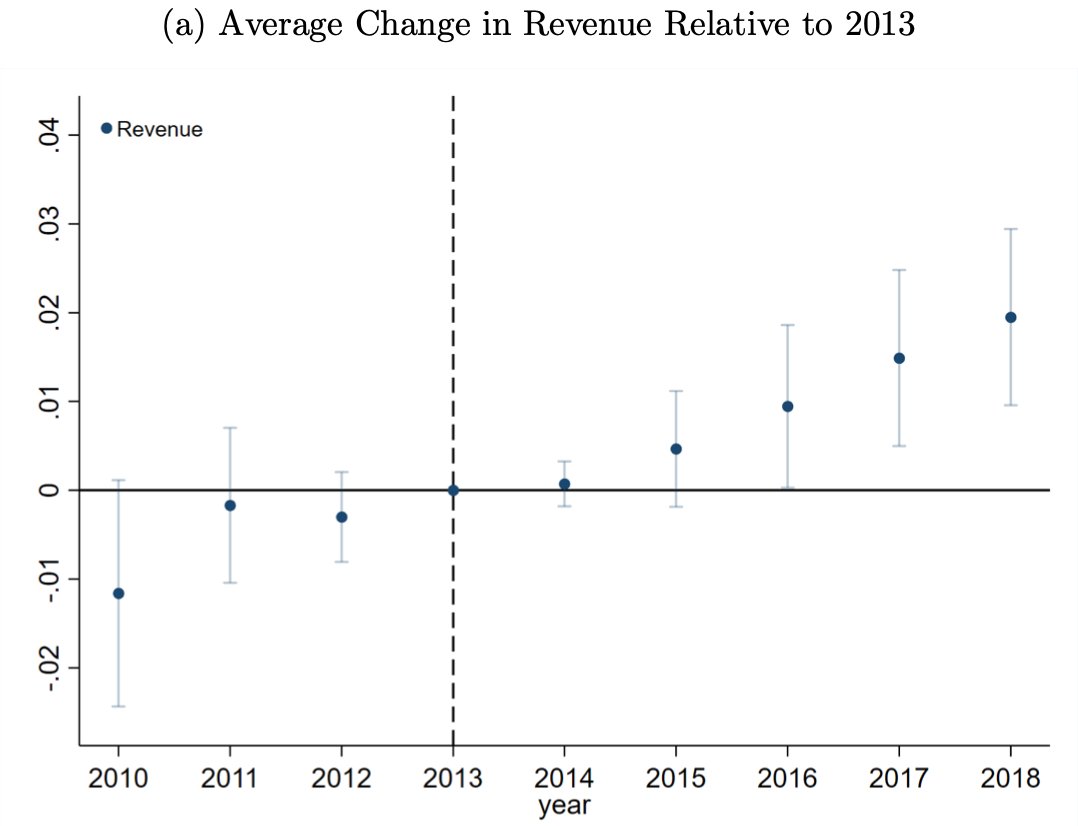

Despite concerns that minimum wage increases hit independent firms particularly hard, we find that the vast majority of independent retailers and restaurants are able to finance minimum wage increases with new revenues. [3/14]

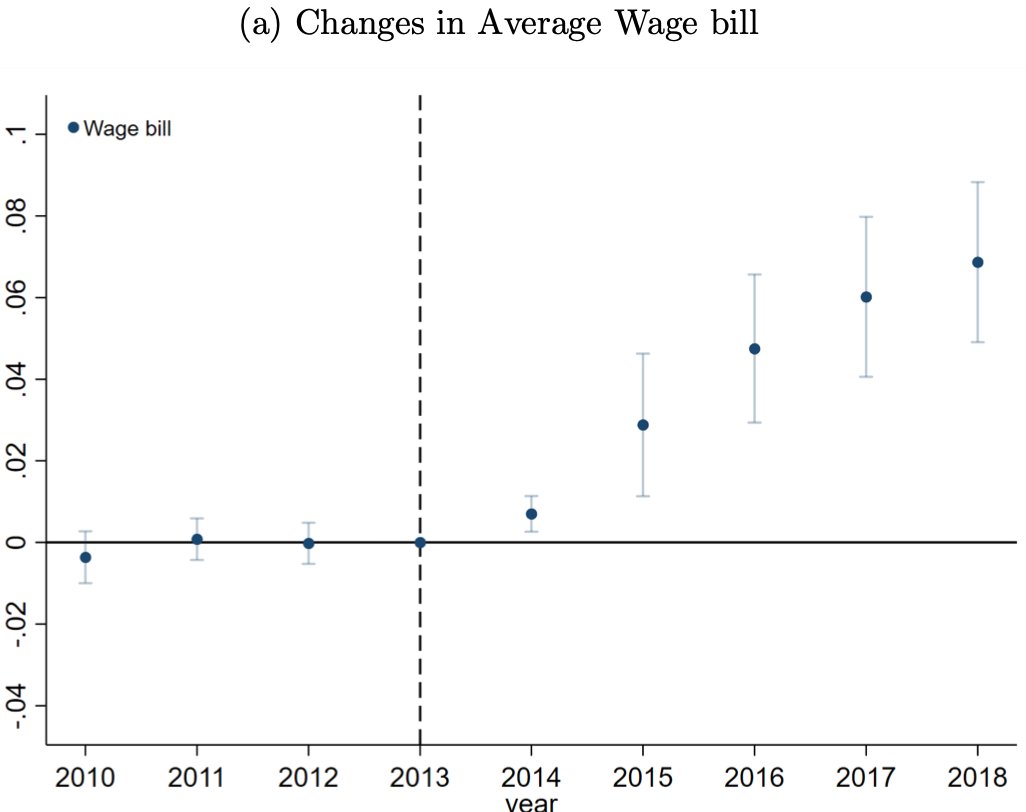

The six state minimum wage increases we examine are substantial – on average they raised minimum wages by more than 30%, and led to a 7% increase in wage bills. [4/14]

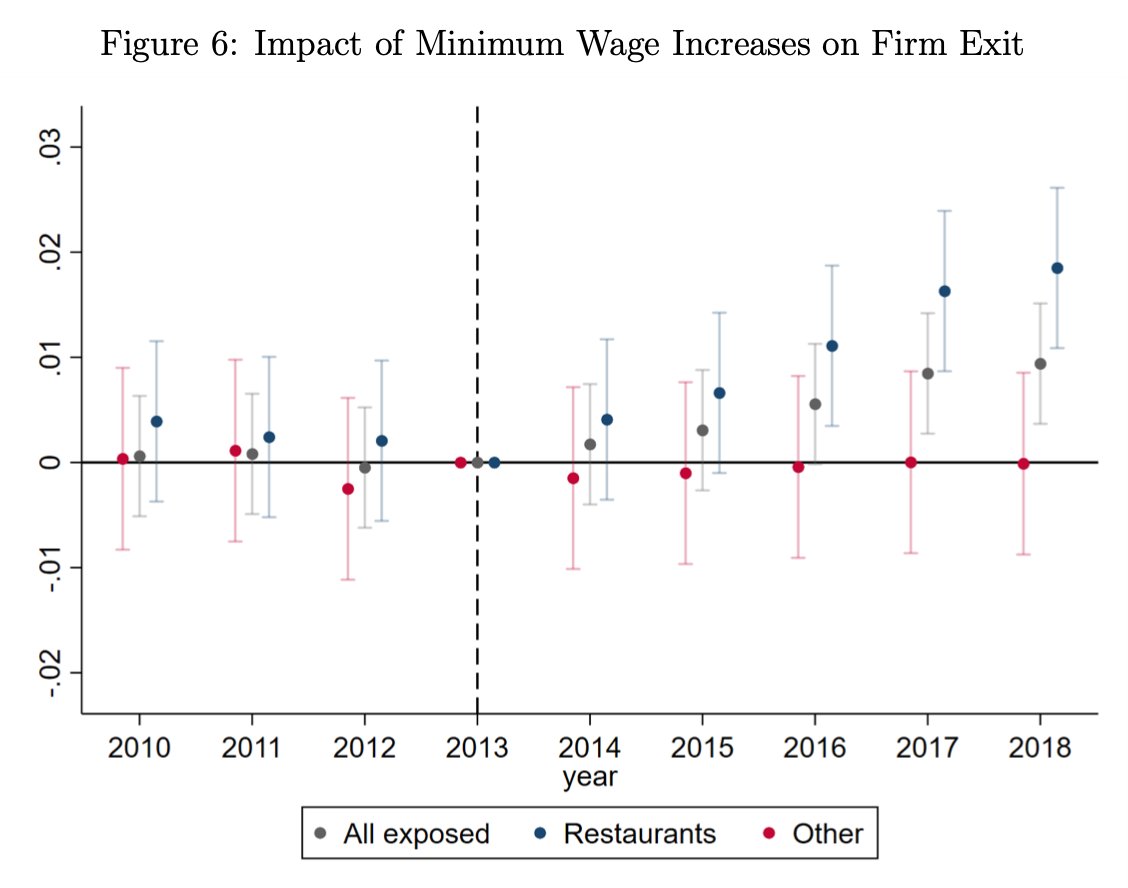

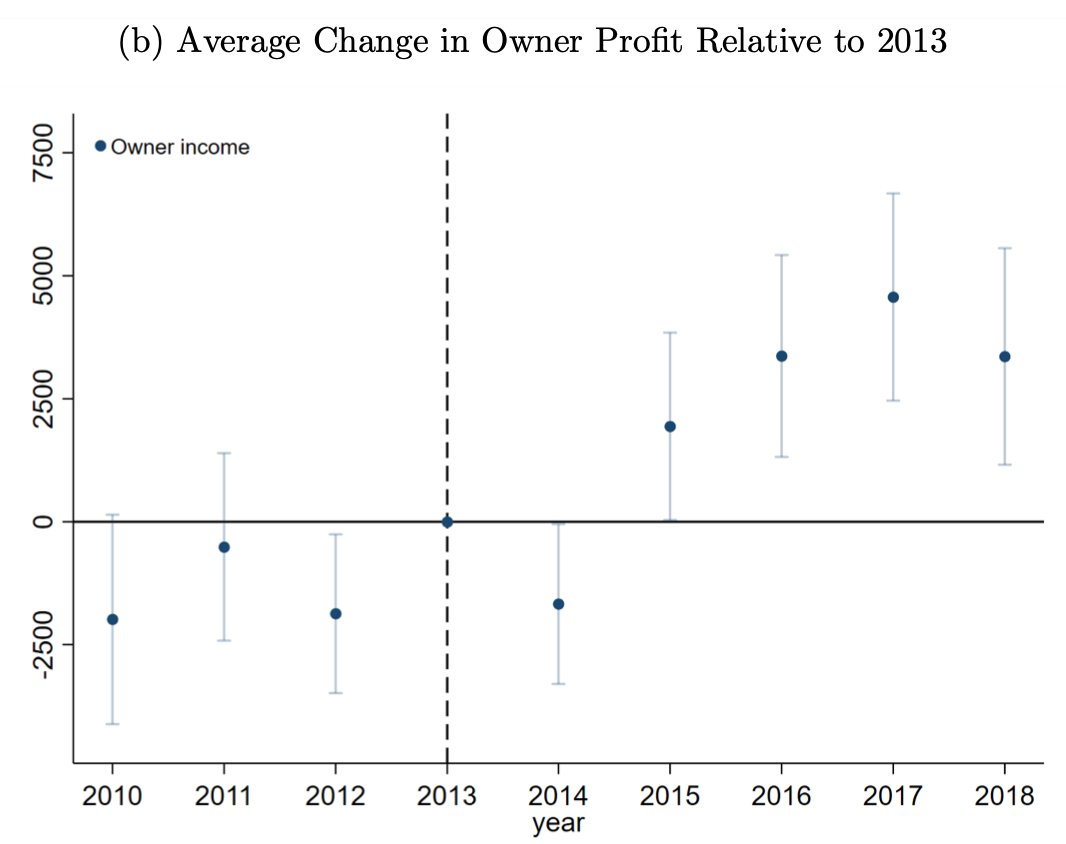

Larger, more productive restaurants also benefit from higher retention rates and boost spending on non-labor production inputs, suggesting their output may rise while their weaker counterparts close. Surviving restaurants in fact see higher profits following the minimum wage. [6/14]

While profit increases after a cost shock are surprising, gains to survivors only arise in markets where weaker firms exit. This pattern is consistent with a simple framework where exits shift sales to more productive firms, and helps explain the small employment impacts we (and others) find in the short run. [7/14]

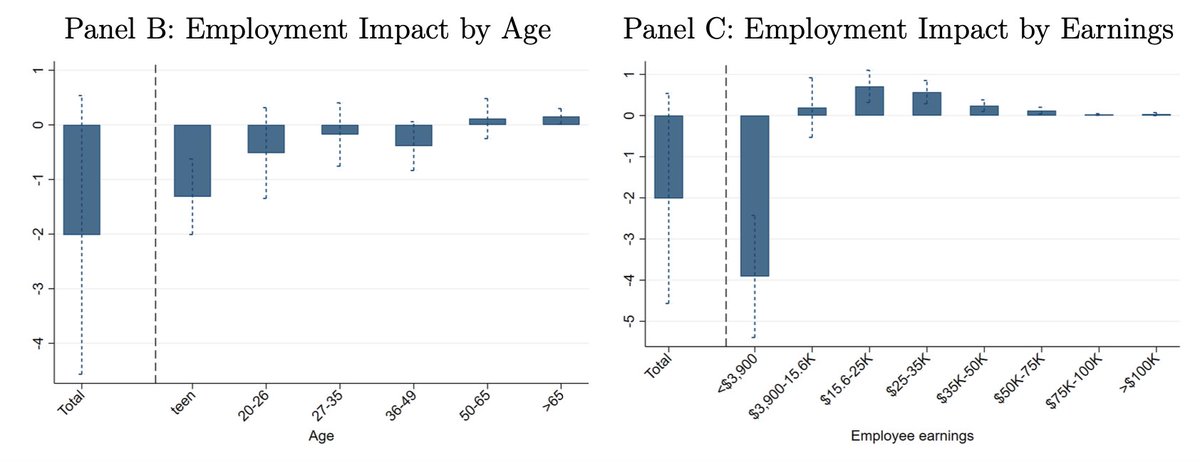

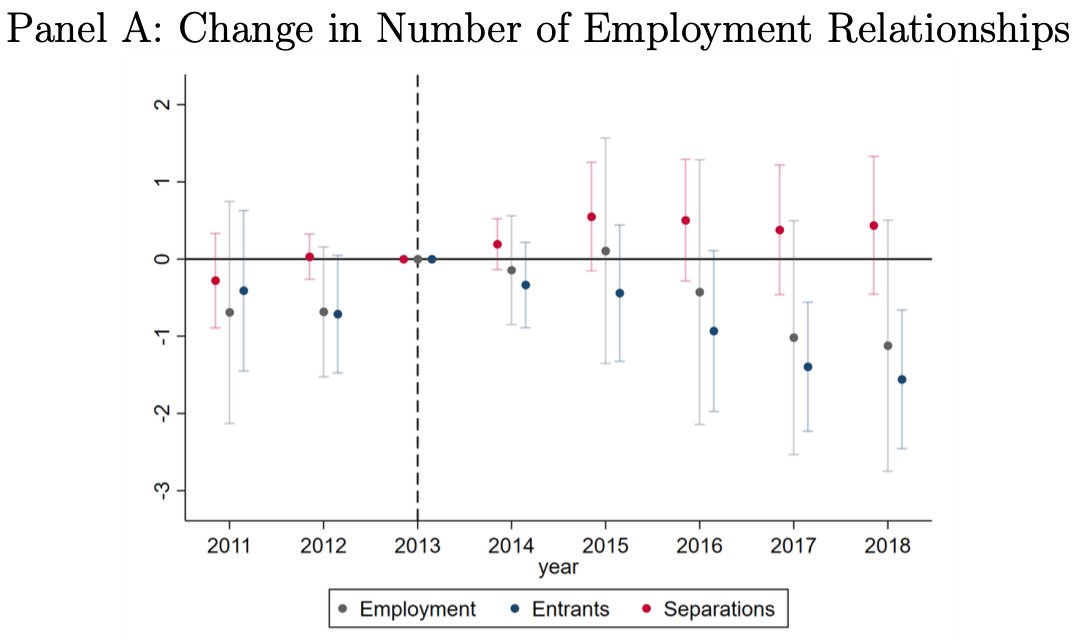

Speaking of employment impacts we find that restaurants do pull back on hiring (but do not engage in layoffs), reducing their total number of W-2 relationships by roughly one. [8/14]

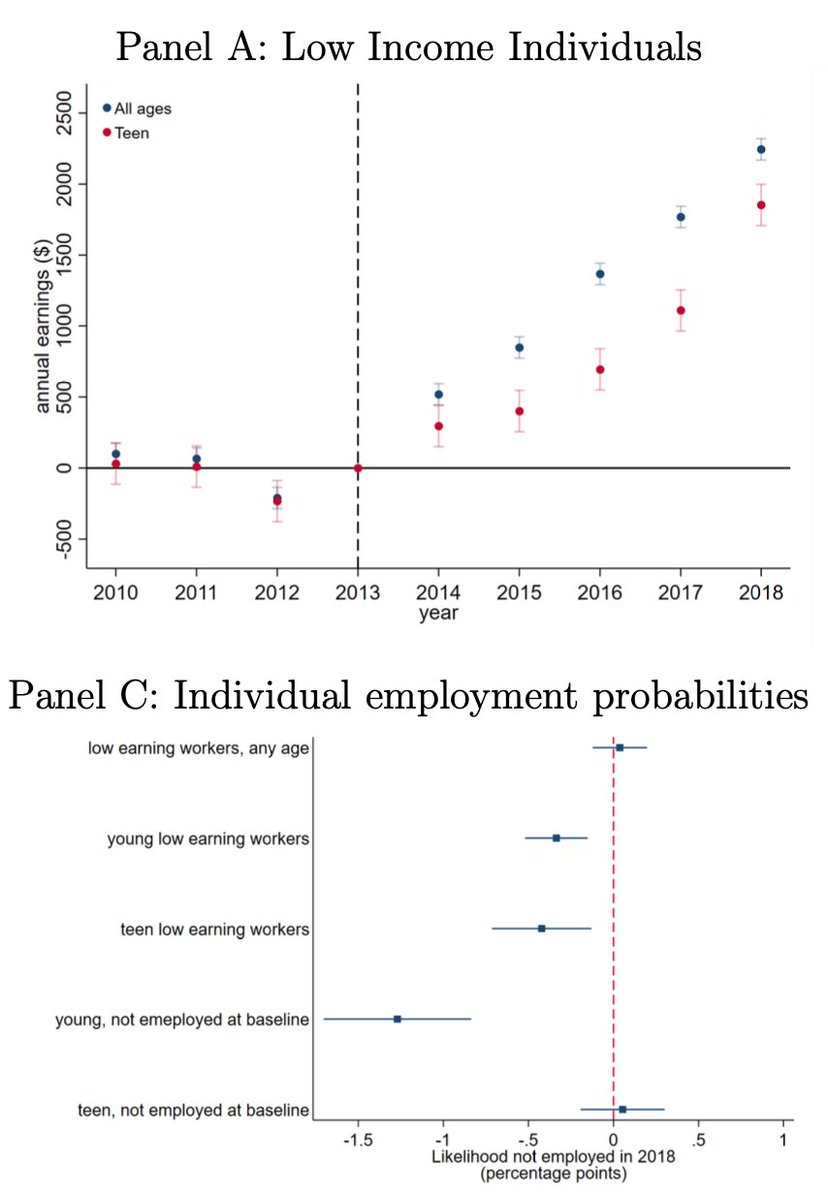

For the young and low-earning workers most likely to be impacted by minimum wage policies, we find that their average earnings increase and they are slightly more likely rather than less likely to be employed in the years after a minimum wage increase. [10/14]

Finally, following the owners of exiting firms, we find they are less likely to own businesses going forward, but see no change in their incomes largely because policy-induced exiters substitute away from potentially risky or less profitable business ownership. [11/14]

Ultimately, we show that higher wage floors raise the incomes of low-earning workers with the costs borne in part by the small share of owners whose firms shutter, and largely by consumers who finance the revenue increases that offset added wage costs and leave most business owners no worse off. [12/14]

In the restaurant industry where minimum wages bite most sharply, exit rates rise. But rather than shuttering otherwise healthy businesses, raising the minimum wage winnows the productivity distribution of restaurants, rendering the industry more efficient. [13/14]

In this way, through exit and entry, the minimum wage shapes the productivity distribution of restaurants in a manner akin to how the emergence of new technologies (Collard-Wexler and De Loecker, 2015), exposure to international trade (Melitz, 2003), and recessions (Osotimehin and Pappadà, 2017) can shift the productivity distribution in an industry. [14/14]

• • •

Missing some Tweet in this thread? You can try to

force a refresh