What we learned about Jump in the Terraform Labs trial

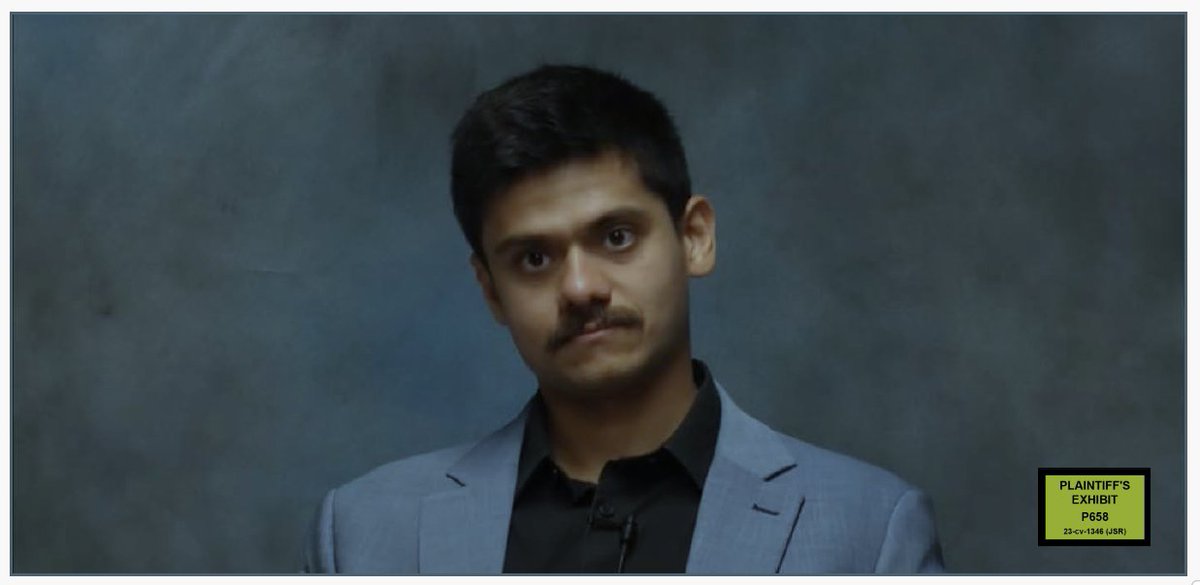

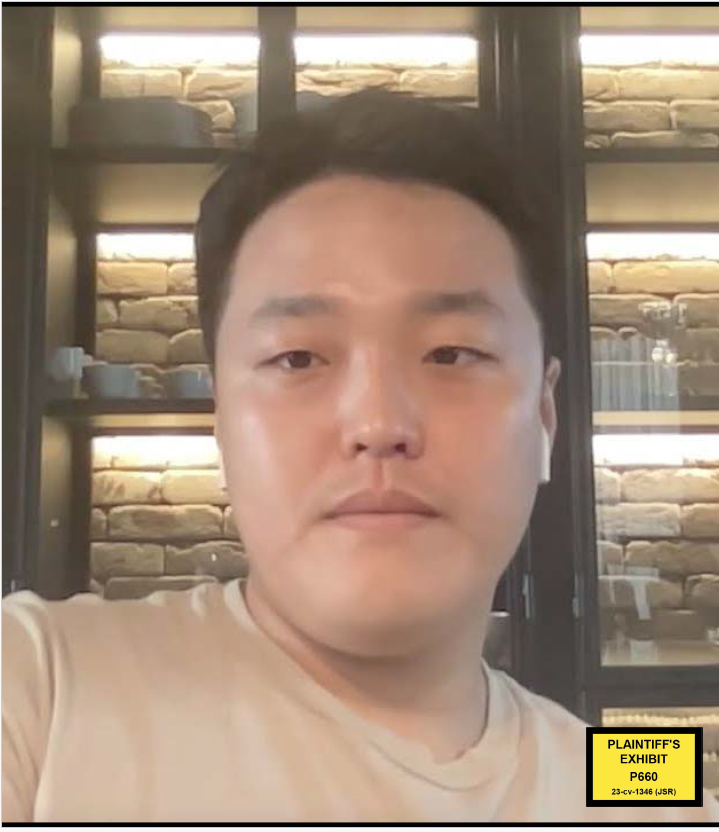

1/ Secretive HFT giant Jump Trading was a big backer of Do Kwon’s Terra/Luna project. Exhibits released by @SECGov show that Kwon formed a tight relationship with this guy: Jump Crypto president Kanav Kariya

1/ Secretive HFT giant Jump Trading was a big backer of Do Kwon’s Terra/Luna project. Exhibits released by @SECGov show that Kwon formed a tight relationship with this guy: Jump Crypto president Kanav Kariya

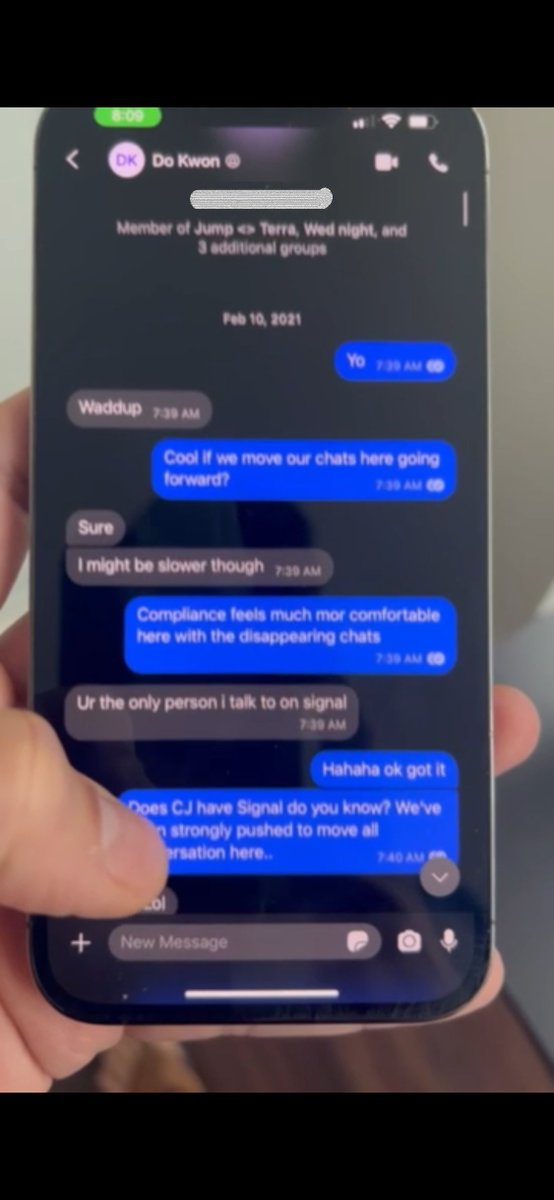

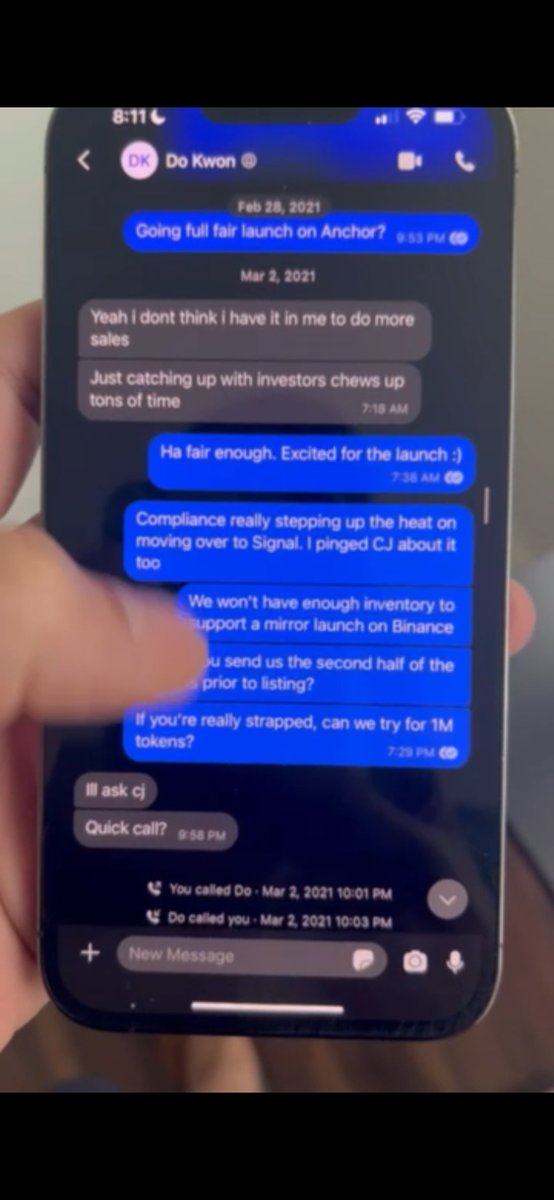

2/ In chats with Do Kwon made public by @SECGov, Kanav insisted they communicate via Signal, saying Jump was pushing for it. “Compliance feels much mor comfortable here with the disappearing chats,” Kanav said. (BTW it doesn’t seem he actually set his chats to disappear)

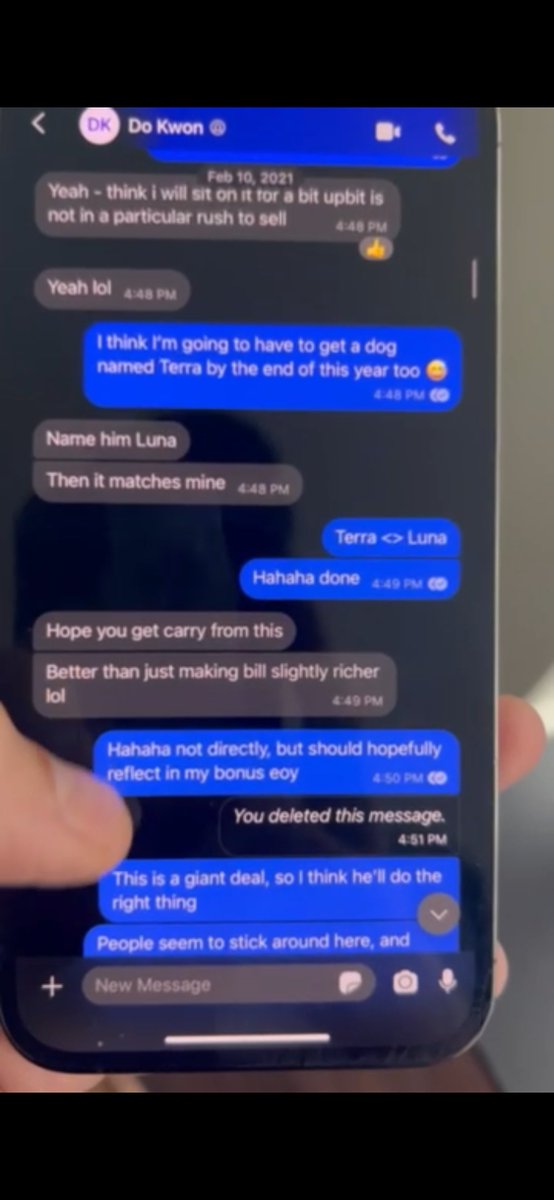

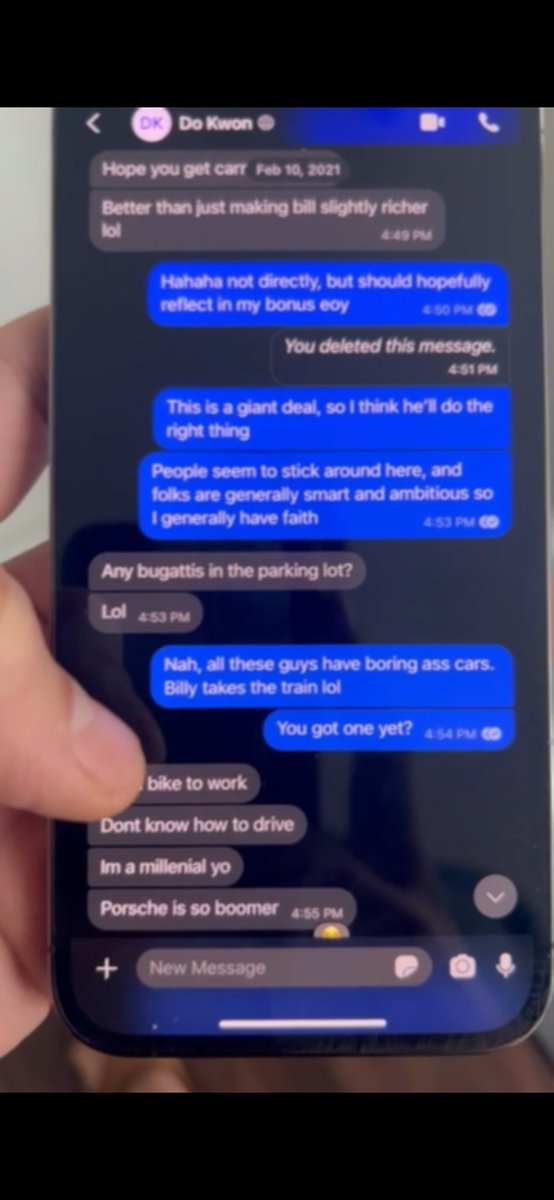

@SECGov 3/ On Feb 10, 2021, Kanav joked to Do that he would get a dog named Terra. Later Do asked whether there were Bugattis in the Jump parking lot. Kanav replied: "No, all these guys have boring ass cars."

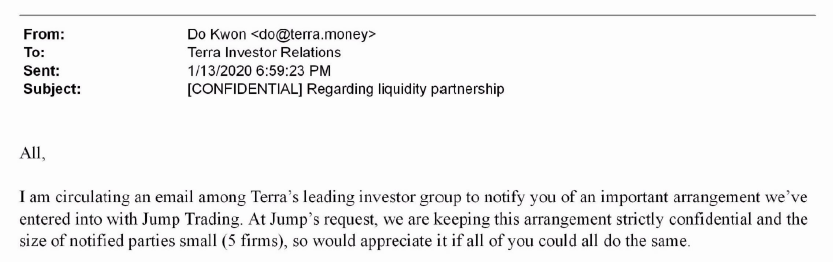

@SECGov 4/ Jump agreed to provide liquidity for UST and Luna, an important deal for Kwon. He told his lead investors about it in Jan 2020, adding that it was “strictly confidential.” In return, Jump got Luna call options that would become extremely profitable later, as Luna took off

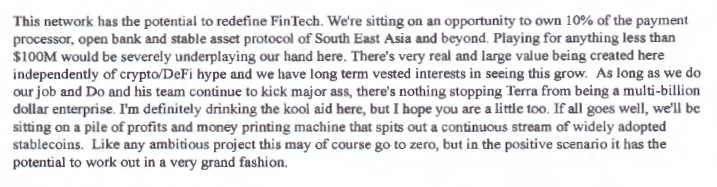

@SECGov 5/ Over at Jump, Kanav was pumped about the growing partnership with Terra. In Sept 2020 he wrote to colleagues: “If all goes well, we'll be sitting on a pile of profits and money printing machine that spits out a continuous stream of widely adopted stablecoins"

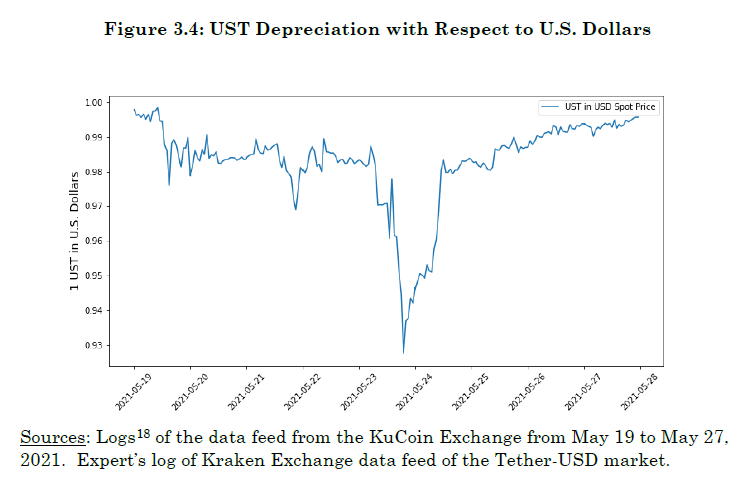

@SECGov 6/ Jump’s commitment was put to the test when UST fell below $1 in May 2021. (For clarity, this was a year before UST depegged disastrously, wiping out some $40 billion.) The question before Jump was: would it come to the rescue of @stablekwon’s project?

@SECGov @stablekwon 7/ The jury learned about what happened next from James Hunsaker, a former Jump employee turned SEC whistleblower. Hunsaker is now a co-founder of Monad Labs, a blockchain startup that recently raised $225 million in one of this year’s biggest crypto VC deals

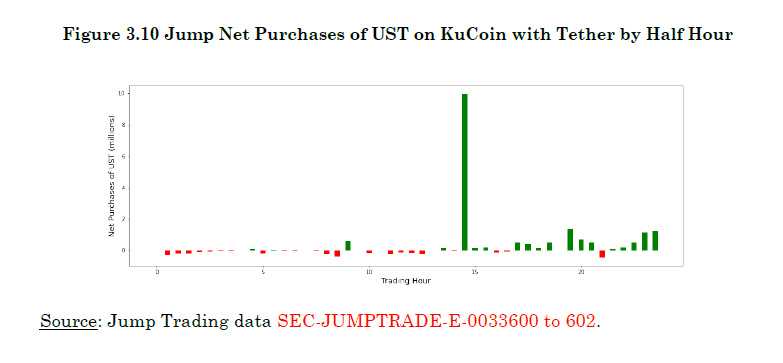

@SECGov @stablekwon 8/ Hunsaker testified that he was on a Zoom with Jump Crypto people when Kanav popped up to say “I spoke to Do, he's going to vest us”. After that, Jump began trading aggressively to defend UST’s peg. Here's the moment when Jump ramped up purchases of UST on Kucoin on 5/23/2021

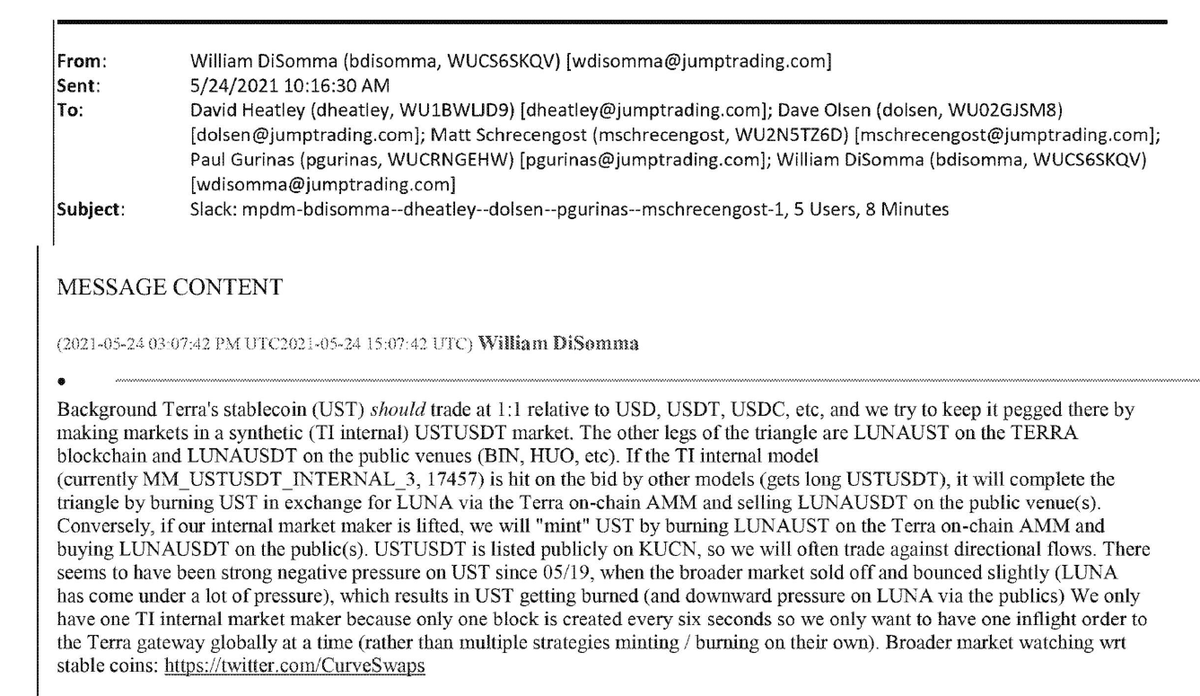

@SECGov @stablekwon 9/ Jump cofounder Bill DiSomma (pictured here) gave the OK to risk “a couple hundred million dollars” to save UST, saying it was important for Jump’s credibility in crypto, Hunsaker testified. DiSomma “ran the team” at Jump Crypto while Kanav was the public face, Hunsaker said

@SECGov @stablekwon 10/ On 5/24/2021, DiSomma briefed fellow execs from Jump Trading (not Jump Crypto) about efforts to restore the UST peg. Recipients included his fellow Jump co-founder and co-owner Paul Gurinas, Jump COO Matt Schrecengost, and Jump president Dave Olsen

@SECGov @stablekwon 11/ Olsen said: “Yep…seems like the prop to Do was well-timed.” DiSomma responded: “We bracing for another sell storm.”

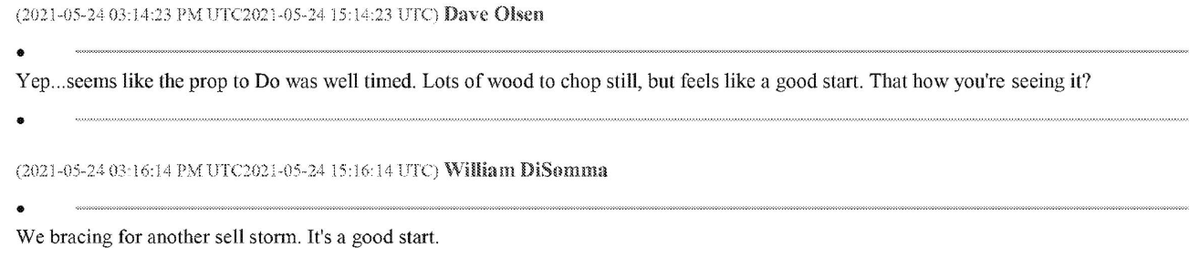

@SECGov @stablekwon 12/ Internally, Terraform Labs people recognized Jump’s role in rescuing UST. “Do said if Jump hadn’t stepped in we actually might’ve been fucked lol,” TFL’s PR guy, Brian Curran, later wrote to business development lead Jeff Kuan. “they saved our ass,” Kuan replied

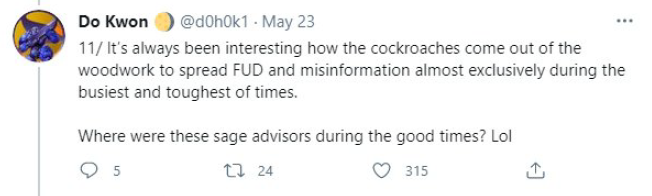

@SECGov @stablekwon 13/ But in external communications, such as this postmortem tweet thread, Terraform Labs didn’t mention Jump’s role in restoring the peg. Its messaging focused instead on UST’s algorithmic self-healing nature. Curran testified that Do told him not to mention Jump’s role

@SECGov @stablekwon 14/ Meanwhile Kwon took the opportunity to dunk on critics, as he often did on Twitter in those days.

@SECGov @stablekwon 15/ The SEC argued that Terraform Labs’ failure to disclose Jump’s role was a material omission that constituted securities fraud. The jury agreed. TFL’s disclosures around the May 2021 depeg are also part of the SDNY criminal indictment against Do Kwon

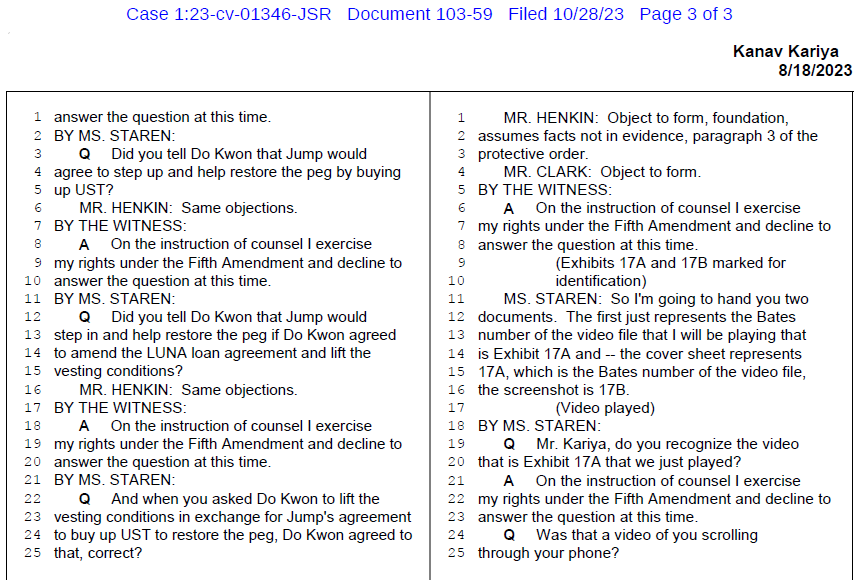

@SECGov @stablekwon 16/ It’s worth noting that Jump has not been accused of wrongdoing. Neither have Kanav Kariya nor Bill DiSomma. But both men pleaded the Fifth Amendment when @SECGov conducted depositions with them as part of the Terraform Labs case

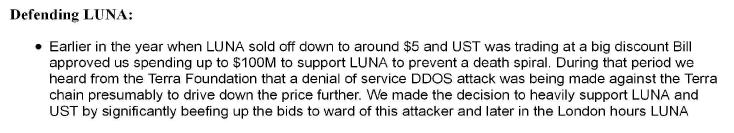

@SECGov @stablekwon 17/ In Oct 2021, a Jump employee described the team’s effort to prevent a death spiral in Terra/Luna as one of its big accomplishments for the year. Interestingly, the employee described what happened with UST that May as a “DDOS attack” against the Terra blockchain

18/ This is the same email, continued. “Bill was pleased with how we handled this,” the employee wrote.

• • •

Missing some Tweet in this thread? You can try to

force a refresh