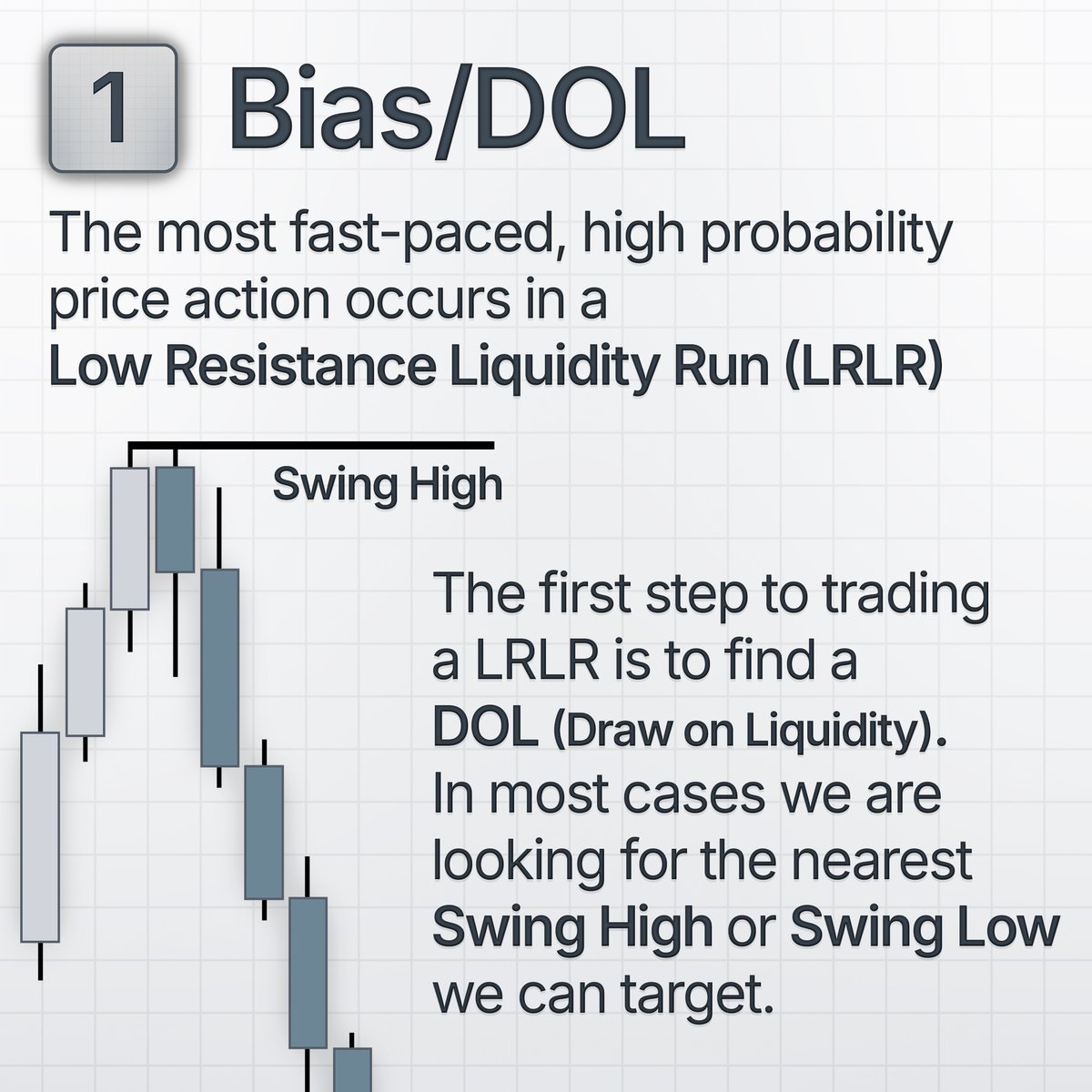

1 - The first step is to identify our Bias. We need to identify a direction we want to trade in as well as a DOL/Target.

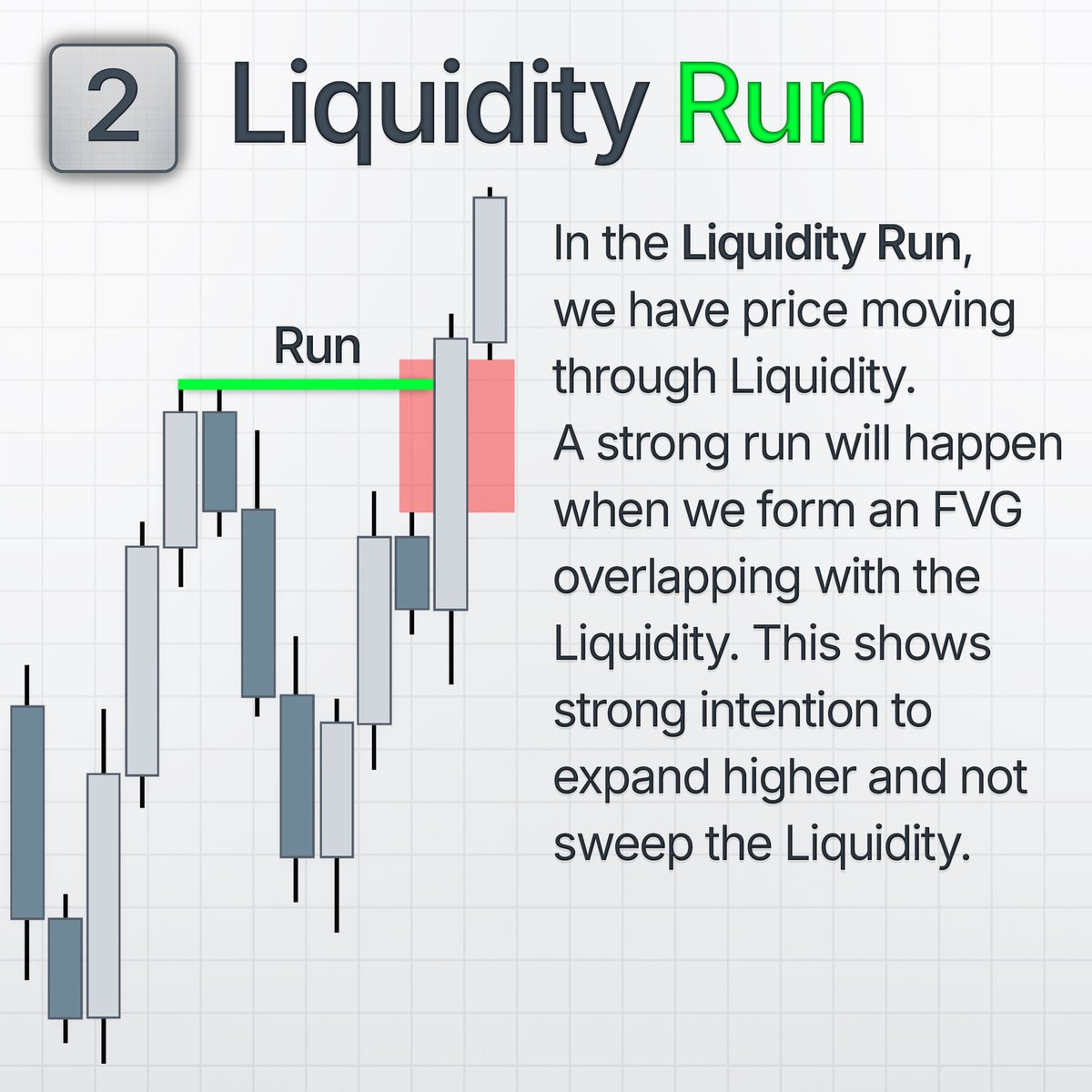

2 - Once we have our Bias we wait for an FVG to form in the direction of our Bias. We will later use this FVG to find an entry.

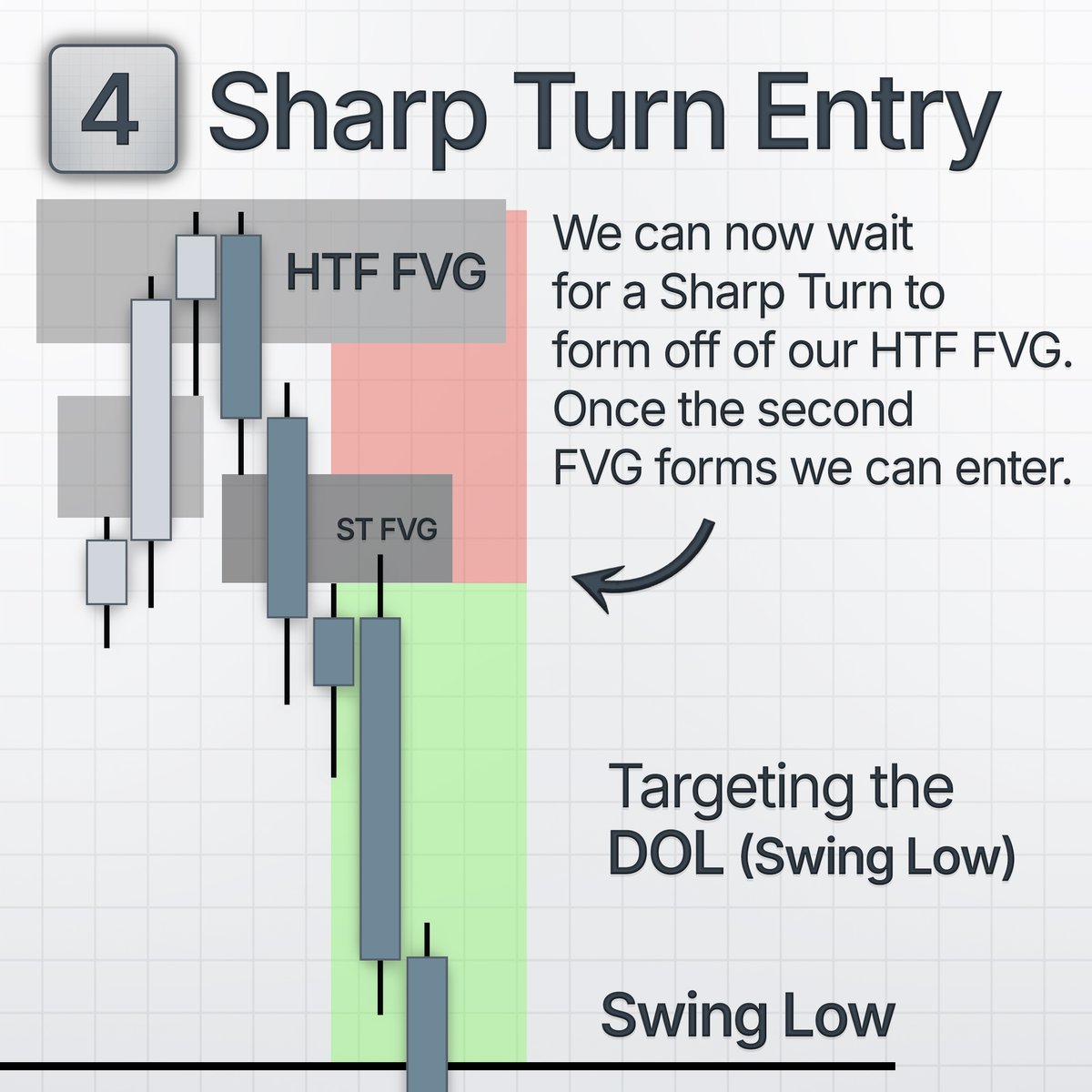

3 - Once we have identified our FVG we need to align our timeframes. Depending on what timeframe our higher timeframe FVG is on, will dictate on what timeframe we will look for a Sharp Turn Entry.

4 - Once we have our HTF FVG and our Entry Timeframe we can look for a Sharp Turn to form. The Sharp Turn is identified by an FVG into the HTF FVG and then an FVG out of the HTF FVG. We can then enter on the second FVG.

5 - Lastly we need to know where to place our Stop Loss. When just starting out with ST Entries it is best to place your Stop Loss at the Swing High or the bodies of the Swing High.

6 - Using these 5 steps you have everything you need to identify Sharp Turns and use them to get trade entries.

Full Video👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh