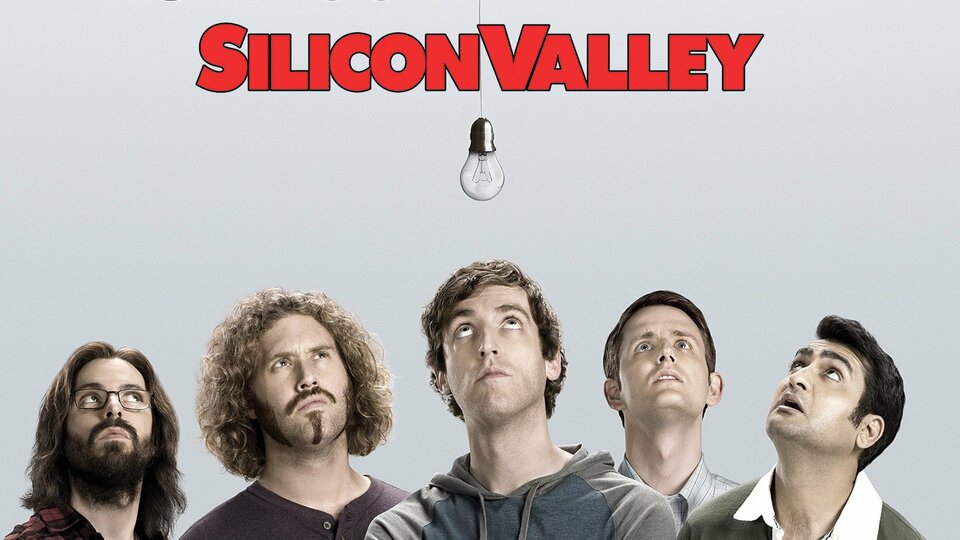

Gilfoyle makes over $6M/yr writing a newsletter about why tech newsletters are insufferable. He doesn't understand why it's so popular, and he spends his money investing in the least-popular YC hardware companies.

Erlich Bachman is back in SF. He ended up building the “WeWork of Asia” which went public and was briefly valued at $38 Billion in 2021. The company was quickly de-listed and he was fired as CEO. He’s back in the states raising money for Fluxx - which is “College Dorms: Reimagined.” Everyone calls it a scam.

Richard Hendricks is the co-founder and CEO of Hoomane - a wildly-hyped AI wearable bracelet that raised $300M pre-launch and just had a challenging first week in the market. He knows there's something there, and will spend the next several years battling tech giants to make it successful.

Jared Dunn lives in a large home in a bad part of East Palo Alto because his realtor told him it was “Palo Alto adjacent” and he was too polite to say no. He has recently returned to the bay area after 2 years at HBS. He and a classmate just started "DUNN-right HVAC" - a PE-backed holdco to roll up local HVAC companies and make them "tech enabled."

Dinesh is the CEO of SalesFarce - a $300B legacy tech company that desperately needed an "Indian CEO" even though he explained to the all-white board that he's actually Pakistani several times. He pulled home $248M in 2023 TC and is funding his side-project, which is a rocket company.

Big Head is a multi-billionaire and runs the #1 tech podcast in the world called “The Half-In Podcast” about how to make it big with minimal effort. He just made $1.7B selling his stake in the Dallas Mavericks, which he "didn't realize he even owned."

Russ Hanneman is a much-poorer co-host of 'The Half-In Podcast.' He lost over $900M from 2020-2023 betting on companies with a .ai domain that he didn't understand at 400x revenue multiples. He recently invested all of his remaining liquidity into his own brand "Tres Comas Nicotine Pouches" - which he promotes relentlessly on the podcast.

Jian Yang is back in Palo Alto and looking for a place to live after spending 7 years in Chinese Prison for convincing several senior communist officials to invest over $400M USD in an app called "SíFood" - which would help users identify common Spanish foods.

If you enjoyed this little tribute, give me a follow - and more importantly, please consider me as a writing intern if anyone decides to re-boot this show.

• • •

Missing some Tweet in this thread? You can try to

force a refresh