How to take profit (long tweet)

Re-posting this info, because it is important to survive in this space.

I keep getting lots of dm´s from people asking: ´tim, what is your take profit (tp) strategy, when do you cash out, how much % you take where´ etc. Apparently a lot of people are in nice profit, and lost what to do, so i took my time to really answer this So in this longer tweet, i will go deeper into this, discussing circumstances, the market, having a goal, intuition, and ´what to do with profit´.

Circumstances:

Taking profit not just depends on how much money you made, but firstly on your personal circumstances. Do you have debt? A mortgage? Unpaid bills etc? If you do, than you should take profit, and pay that off imo. If you don´t, you can leave money longer in the bullmarket, since you have more ´finacial breathing space´ so to speak. If this profit allows you to send your kids to university, take it. If none of that applies, you can take more risk in the cryptomarket, since it won´t affect your finances so much, hence you can risk taking profit when market is higher, knowing a lot can evaporate as well.

The market:

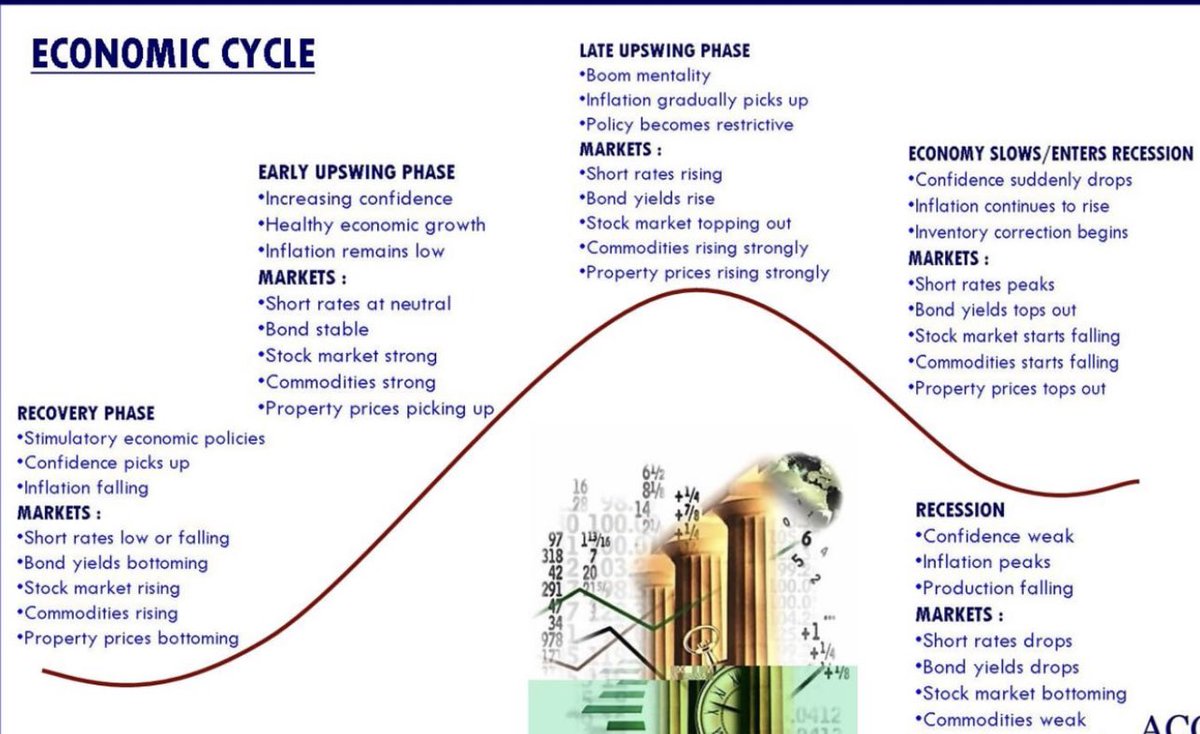

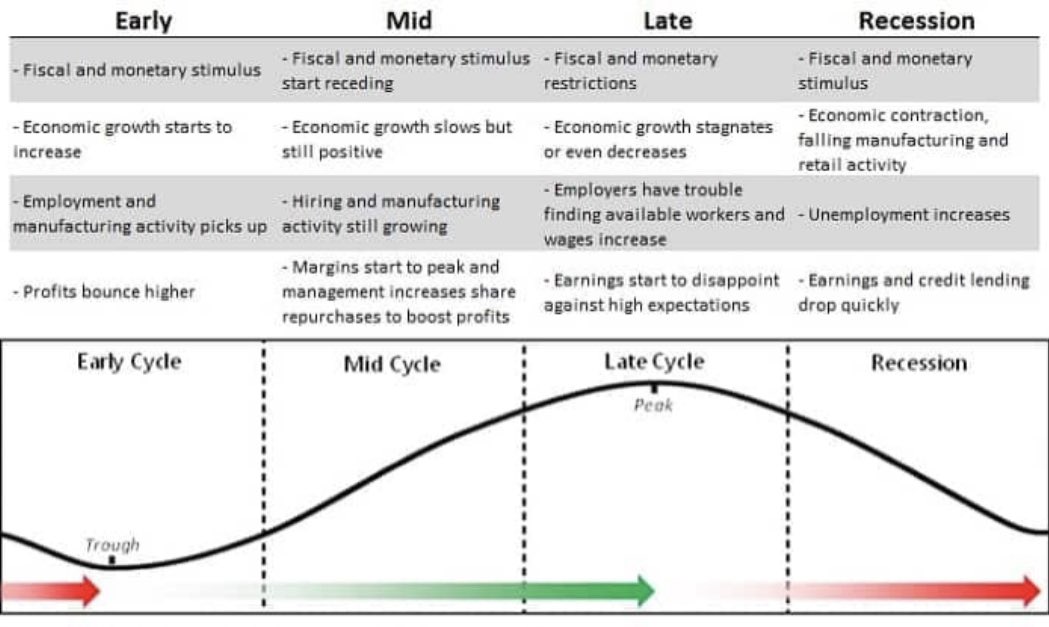

We are clearly in a bullrun. In a bullmarket, you take profit on the way up, in a bearmarket, you buy slowly when market bottoms or dca near the bottom.

1: you can take profit in %. so take 10% off, every time btc prices goes up 20% for example. depends on how much risk you want to take

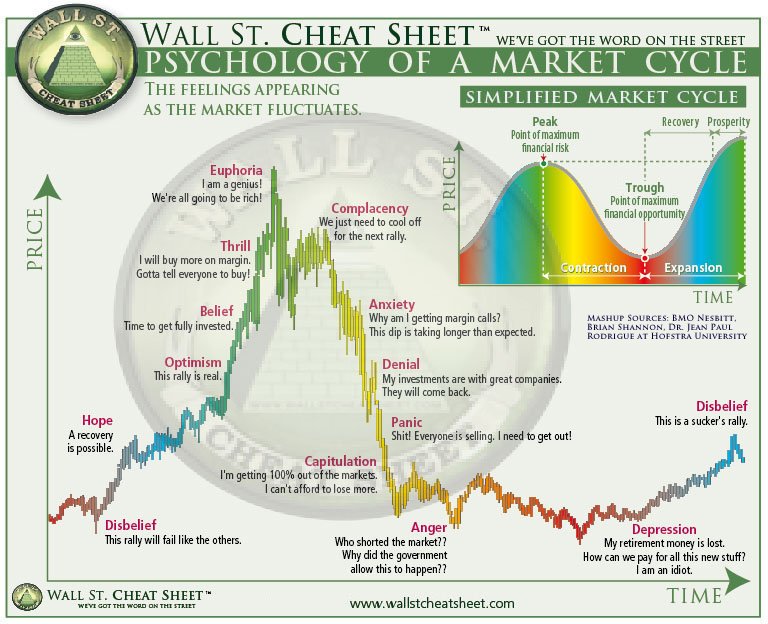

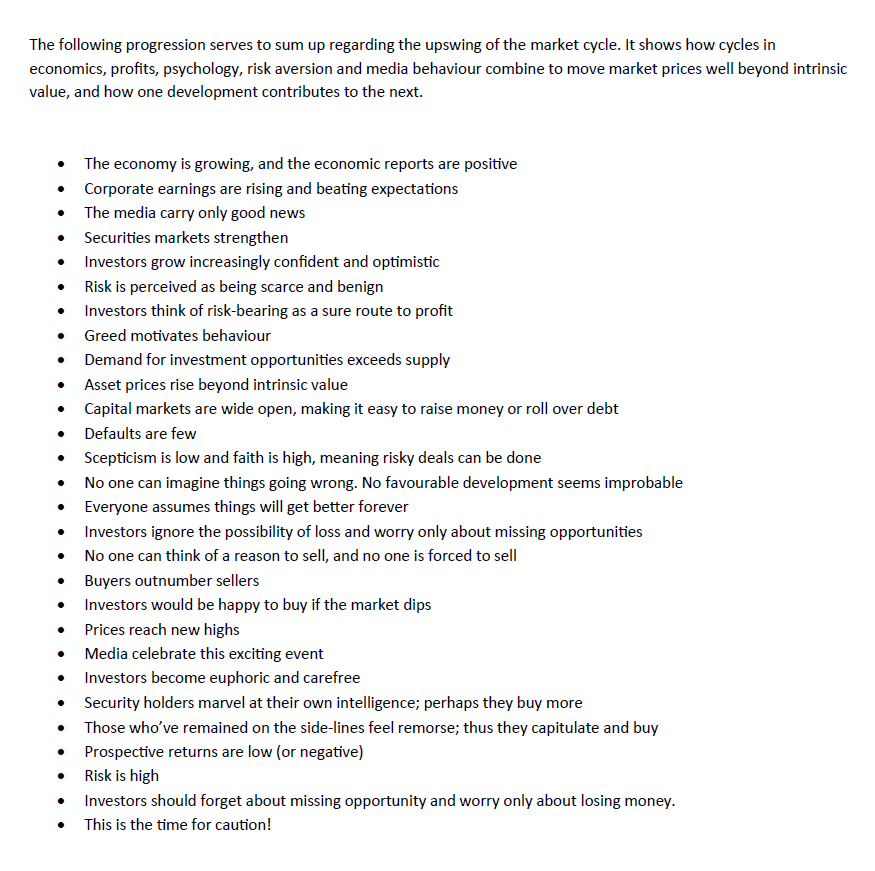

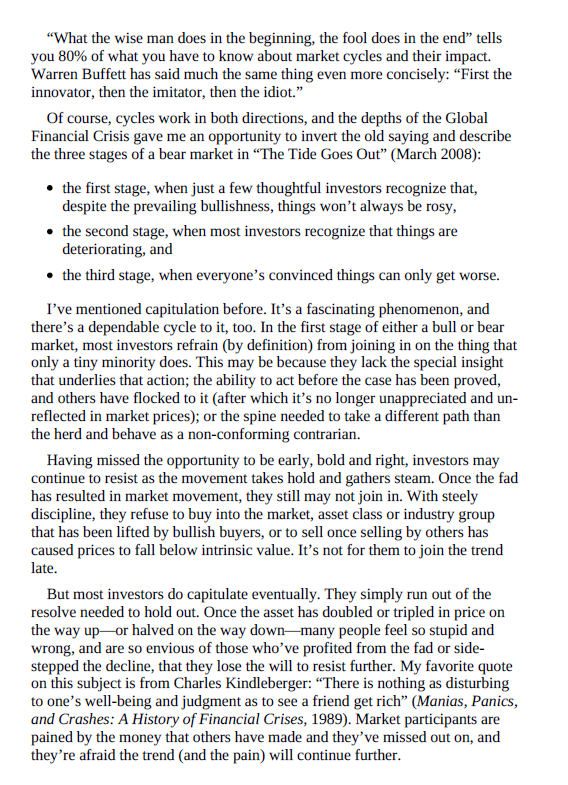

2: you can asses the ´cryptotwitter vibe´, is everyone going crazy, take more profit. Is everyone ultra bearish, buy more. Sounds easy, but super tough. You need real mental discipline for this

3: you can wait and let the bullmarket run its course, and sell it all in one go after the peak. How you know the peak has come? Well, you can wait until montly rsi is over 80, or you can wait until a clear top has formed, and sell a bit later. For example, last cycle i bought btc at 5k (after the bottom), and sold at 48k (after the 68k top), based on 50/200 ma crossing. I did not catch the bottom or peak, but most of it.

Having a $ goal:

Ok, so you reached your $ goal. What you do? Well you sell of course. Sounds easy, but why not. You wanted this, so do it, don´t let your mind trick you. Can you achieve your $ goal slowly on the way up, sure, take a certain % profit every time your bags go up 10% for example until you reached your goal. Once you reached it, you leave the rest in crypto, and sell higher, but at least you achieved your goal already

Intuition:

If you know your own mind well enough, you know when you get euphoric yourself, become aware of it, and use that ´feeling´ as a sell-indicator. Also, when you are scared, use that as a buy-indicator. This is not easy at all, takes years to learn imo, but personally this is my main way of making decisions. I have an article on how to use intuition on my blog, there you can read it Now if you actively follow the cryptomarket, you can use a combo of all above, and i do that as well. How is cryptotwitter, how are the Ta indicators, am i euphoric myself, what feels right etc. For example, arc went up a lot, so i took 10% off, than went parabolic, and took 25% again, felt right, and is fine. Do i regret not leaving that first 10% in for more profit, no, love taking profit.

What to do with profit:

You can put some in usdt, or usd, and buy the dip if you are good day-trader, i do that often. Or you can put it in btc, if you believe in its long term value. Or buy something that will generate you income, rental, business, etc. Or spend it, you earned this money! Buy what your dream is, invest in a garden, help people, buy a car, whatever you feel helps you become a better human being and more content. Remember a new bearmarket will come, when you want to buy cheaply again, so leaving a pile of USD is always smart. All the above is different for every person, since every person has unique circumstances, a different mind-set, or a different amount of money or goals, and every bullmarket is different. So there is no ´one recipe solution´ on how to take profit, it depends on all the above, and you have to figure out what feels right for you. If it feels right, you won´t regret it later on.

Hope this helps 😘

Re-posting this info, because it is important to survive in this space.

I keep getting lots of dm´s from people asking: ´tim, what is your take profit (tp) strategy, when do you cash out, how much % you take where´ etc. Apparently a lot of people are in nice profit, and lost what to do, so i took my time to really answer this So in this longer tweet, i will go deeper into this, discussing circumstances, the market, having a goal, intuition, and ´what to do with profit´.

Circumstances:

Taking profit not just depends on how much money you made, but firstly on your personal circumstances. Do you have debt? A mortgage? Unpaid bills etc? If you do, than you should take profit, and pay that off imo. If you don´t, you can leave money longer in the bullmarket, since you have more ´finacial breathing space´ so to speak. If this profit allows you to send your kids to university, take it. If none of that applies, you can take more risk in the cryptomarket, since it won´t affect your finances so much, hence you can risk taking profit when market is higher, knowing a lot can evaporate as well.

The market:

We are clearly in a bullrun. In a bullmarket, you take profit on the way up, in a bearmarket, you buy slowly when market bottoms or dca near the bottom.

1: you can take profit in %. so take 10% off, every time btc prices goes up 20% for example. depends on how much risk you want to take

2: you can asses the ´cryptotwitter vibe´, is everyone going crazy, take more profit. Is everyone ultra bearish, buy more. Sounds easy, but super tough. You need real mental discipline for this

3: you can wait and let the bullmarket run its course, and sell it all in one go after the peak. How you know the peak has come? Well, you can wait until montly rsi is over 80, or you can wait until a clear top has formed, and sell a bit later. For example, last cycle i bought btc at 5k (after the bottom), and sold at 48k (after the 68k top), based on 50/200 ma crossing. I did not catch the bottom or peak, but most of it.

Having a $ goal:

Ok, so you reached your $ goal. What you do? Well you sell of course. Sounds easy, but why not. You wanted this, so do it, don´t let your mind trick you. Can you achieve your $ goal slowly on the way up, sure, take a certain % profit every time your bags go up 10% for example until you reached your goal. Once you reached it, you leave the rest in crypto, and sell higher, but at least you achieved your goal already

Intuition:

If you know your own mind well enough, you know when you get euphoric yourself, become aware of it, and use that ´feeling´ as a sell-indicator. Also, when you are scared, use that as a buy-indicator. This is not easy at all, takes years to learn imo, but personally this is my main way of making decisions. I have an article on how to use intuition on my blog, there you can read it Now if you actively follow the cryptomarket, you can use a combo of all above, and i do that as well. How is cryptotwitter, how are the Ta indicators, am i euphoric myself, what feels right etc. For example, arc went up a lot, so i took 10% off, than went parabolic, and took 25% again, felt right, and is fine. Do i regret not leaving that first 10% in for more profit, no, love taking profit.

What to do with profit:

You can put some in usdt, or usd, and buy the dip if you are good day-trader, i do that often. Or you can put it in btc, if you believe in its long term value. Or buy something that will generate you income, rental, business, etc. Or spend it, you earned this money! Buy what your dream is, invest in a garden, help people, buy a car, whatever you feel helps you become a better human being and more content. Remember a new bearmarket will come, when you want to buy cheaply again, so leaving a pile of USD is always smart. All the above is different for every person, since every person has unique circumstances, a different mind-set, or a different amount of money or goals, and every bullmarket is different. So there is no ´one recipe solution´ on how to take profit, it depends on all the above, and you have to figure out what feels right for you. If it feels right, you won´t regret it later on.

Hope this helps 😘

• • •

Missing some Tweet in this thread? You can try to

force a refresh