this was not a black swan event.

and it’s barely a tail event. at this point, LST depegs are run-of-the-mill, happening every couple of weeks.

in this thread I cover what happened, why good trades go bad, and how LST risk management should be approached.

1/10

and it’s barely a tail event. at this point, LST depegs are run-of-the-mill, happening every couple of weeks.

in this thread I cover what happened, why good trades go bad, and how LST risk management should be approached.

1/10

ezETH is @RenzoProtocol's liquid restaking token (LRT) for eigenlayer.

it's also a magnet for points, allowing farmers to stack incentives. renzo experienced hockey-stick growth from zero to $3B in TVL in just 4 months.

it's also a magnet for points, allowing farmers to stack incentives. renzo experienced hockey-stick growth from zero to $3B in TVL in just 4 months.

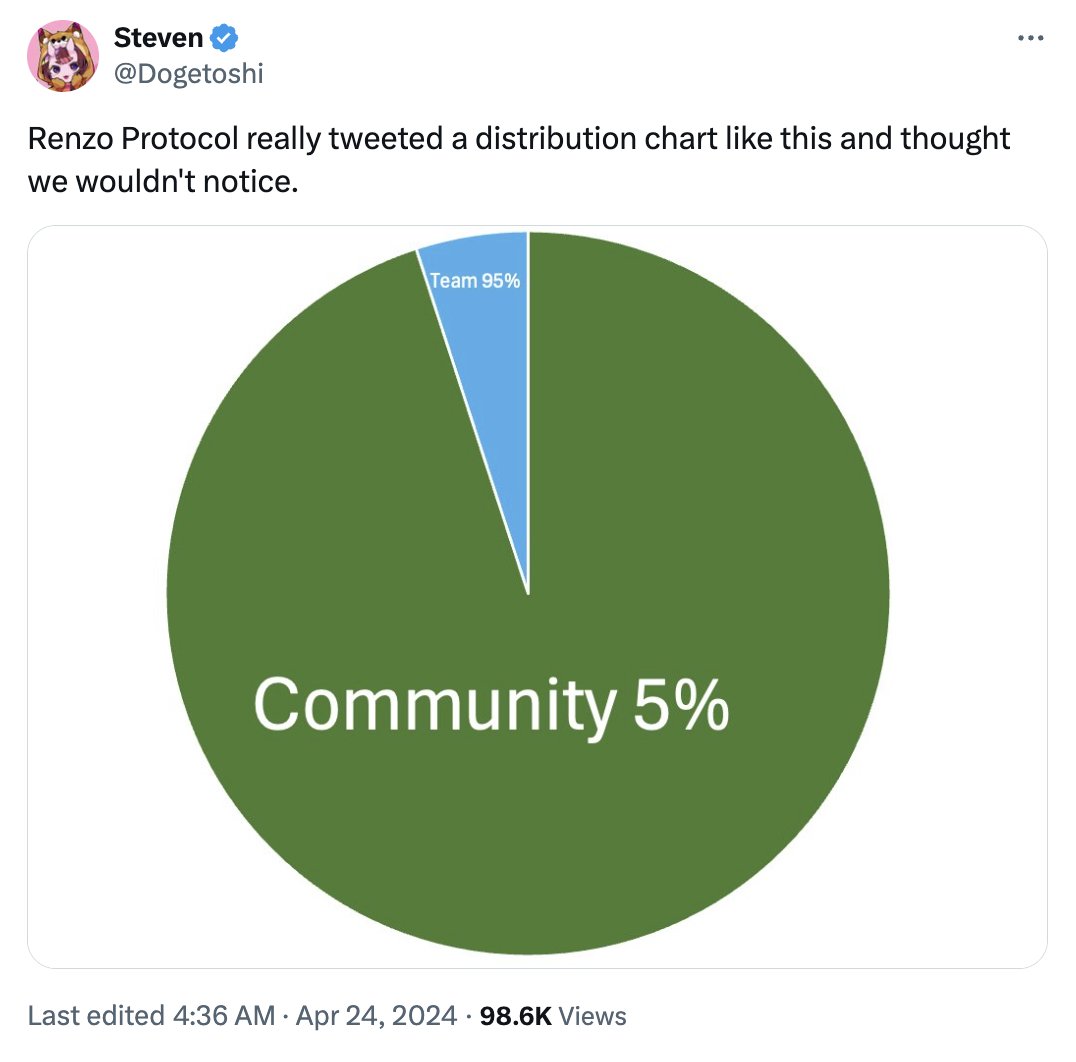

ezETH depegged due to the market's strong negative reaction to their tokenomics announcement.

since ezETH is not redeemable yet, there is no low-risk arbitrage to restore the peg.

since ezETH is not redeemable yet, there is no low-risk arbitrage to restore the peg.

tens of millions of dollars worth of ezETH were sold off, with cascading liquidations.

pictured are liquidations on @GearboxProtocol and a sharp drop in ezETH TVL on @MorphoLabs.

pictured are liquidations on @GearboxProtocol and a sharp drop in ezETH TVL on @MorphoLabs.

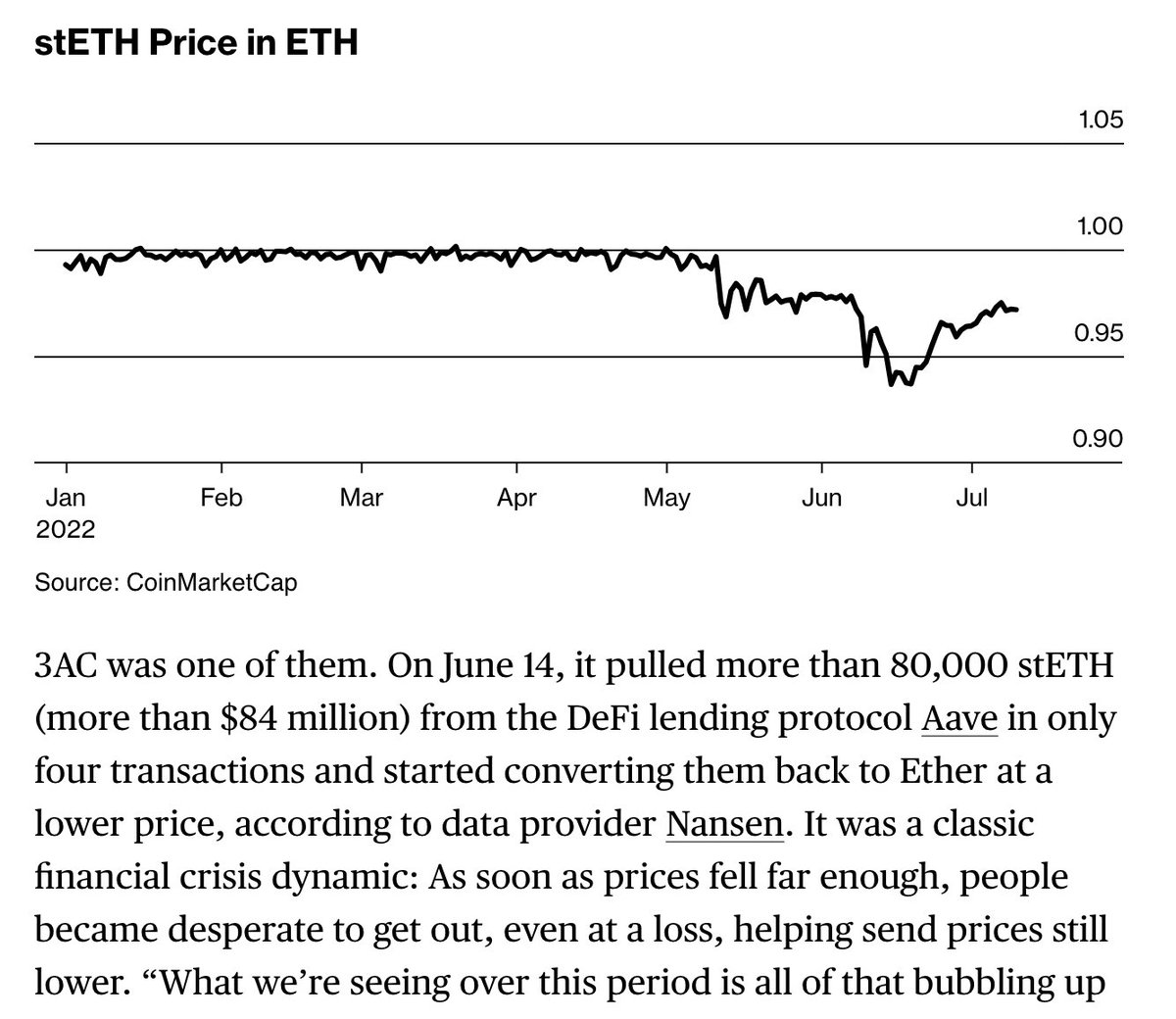

but there's nothing new under the sun, and we all know that history rhymes.

a similar event happened in 2022 with stETH which led to 3AC's collapse, contributing to a domino effect that completely reshaped the crypto landscape.

a similar event happened in 2022 with stETH which led to 3AC's collapse, contributing to a domino effect that completely reshaped the crypto landscape.

this also happened many times on solana (on a much smaller scale).

in december 2023, mSOL depegged due to an $8M sale of mSOL by a whale.

and just last week, multiple LSTs depegged, causing wrongful liquidations and bad debt on @marginfi.

@solendprotocol avoided both of these.

in december 2023, mSOL depegged due to an $8M sale of mSOL by a whale.

and just last week, multiple LSTs depegged, causing wrongful liquidations and bad debt on @marginfi.

@solendprotocol avoided both of these.

the approach solend uses to price LSTs prevents most issues like this. I won't get into details here since it's a complex and controversial issue, but I did a podcast with @Lightspeedpodhq that explores it in depth

https://x.com/Lightspeedpodhq/status/1737845748136640624

btw it's worth noting that marginfi was extremely critical of solend's approach, then got hit by the exact same problem months after stirring up a big storm. (lol get rekt)

kamino instead followed suit, and joined solend in smooth sailing.

kamino instead followed suit, and joined solend in smooth sailing.

the approach only works with SOL LSTs, however. ezETH isn't redeemable for probably a few more months so it's impossible to tell whether a depeg is a legitimate debasement or just caused by a fickle market. meanwhile, solana LSTs are redeemable at the end of epochs every 2 days.

unfortunately there's no silver bullet. it just boils down to setting safe parameters and using safe leverage.

it sucks to lose market share to competitors going down the risk curve, but it's more important to keep funds safe.

and you can't win if you don't survive.

10/10

it sucks to lose market share to competitors going down the risk curve, but it's more important to keep funds safe.

and you can't win if you don't survive.

10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh