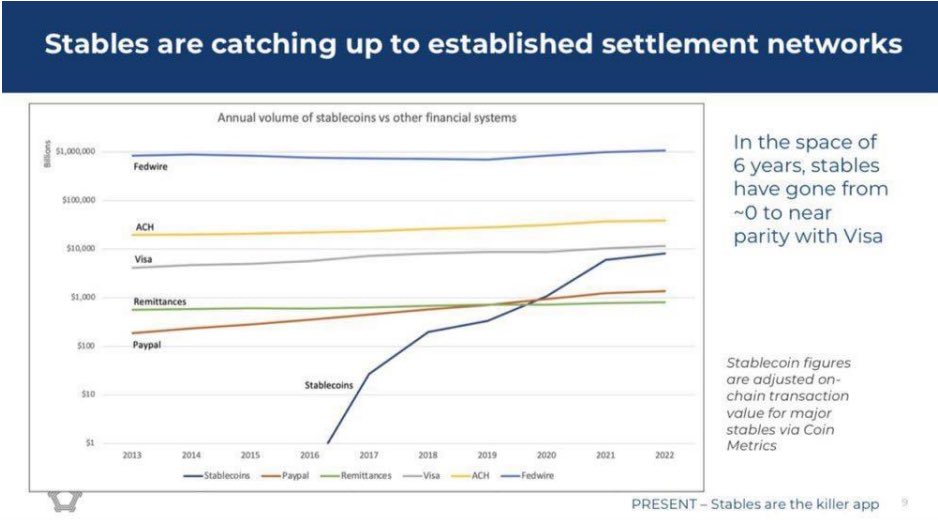

1/ After seeing this line chart created by @nic__carter showing stablecoin volume compared to established payment networks, we decided to partner with @AlliumLabs to create the Visa Onchain Analytics Dashboard as a public resource to take a closer look at stablecoin activity.

2/ The dashboard shows relevant metrics that our team closely tracks including stablecoin supply, transaction volume, and monthly active users for USDC, USDT, PYUSD, and USDP across five layer 1 blockchains and four layer 2s where stablecoins are issued

visaonchainanalytics.com

visaonchainanalytics.com

3/ We found there can be a lot of noise in stablecoin data given that they can be used across a range of use cases with transactions that can be initiated manually by an end user or programmatically through bots.

4/ Developers can create automated programs that perform activities such as arbitrage, liquidity provision, and market making that are vital for sustaining the DeFi ecosystem but don't resemble settlement in a traditional sense

5/ For example, we found that if a consumer converts $100 of USDC to PYUSD on Uniswap, this is counted as $200 of total stablecoin volume ($100 of USDC from the consumer's wallet to the Uniswap contract, and $100 of PYUSD from the contract to the consumers wallet).

We think it's more accurate to view this as $100 of volume which was the value that was moved by the consumer.

We think it's more accurate to view this as $100 of volume which was the value that was moved by the consumer.

6/ So we worked with @AlliumLabs to create an adjusted transaction volume methodology that combines a single directional volume filter that removes redundant internal transactions of a smart contract with an inorganic user filter that only counts volume from addresses that have made < 1k transactions and < $10M in volume over last 30 days to attempt to remove bot activity

7/ When this filter is applied, adjusted onchain stablecoin volume for the last 30 days is $265B instead of $2.65T. While this methodology is far from perfect, the remaining $265B we view as a more accurate estimate of settlement volume initiated by end users

8/ We are still early on our journey into onchain data so we'd love to hear from you. What could make this tool better? What are better methodologies to use? How are use cases for stablecoins evolving across the world and what can Visa do to further the awareness and discussion of onchain economic activity?

usa.visa.com/visa-everywher…

usa.visa.com/visa-everywher…

• • •

Missing some Tweet in this thread? You can try to

force a refresh