1/ Blobs unlock unprecedented scaling for L2s, but have huge gas spikes and price volatility. They lack financialization like hedging and fractionalization.

I've just quit my job at Apple to build blobspace derivatives & contribute to the ETH ecosystem:

mirror.xyz/0x1Ca8D5E43A19…

I've just quit my job at Apple to build blobspace derivatives & contribute to the ETH ecosystem:

mirror.xyz/0x1Ca8D5E43A19…

2/ The Dencun upgrade enabled record-high usage and 10x lower fees for L2s with blobs.

However, 10,000%+ gas spikes via Inscriptions soon highlighted their price volatility during high network demand. Future congestion events threaten more unpredictable costs for rollups.

However, 10,000%+ gas spikes via Inscriptions soon highlighted their price volatility during high network demand. Future congestion events threaten more unpredictable costs for rollups.

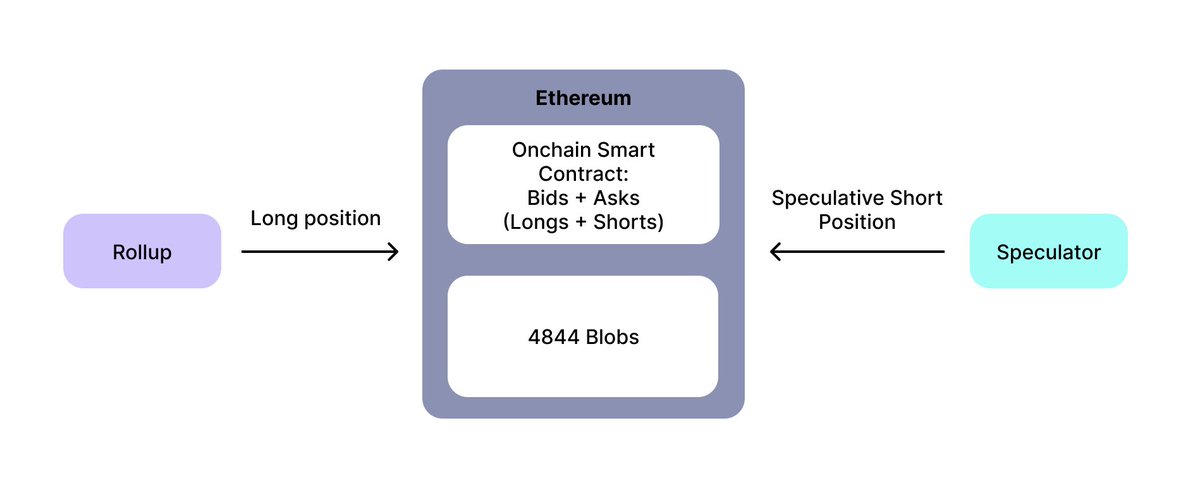

3/ Blobspace derivatives aim to hedge against these volatility challenges.

Similarly to trading of commodities futures, establishing derivatives markets for blob gas fees creates strategic trading opportunities for rollups (who pay premiums to de-risk their operational costs)

Similarly to trading of commodities futures, establishing derivatives markets for blob gas fees creates strategic trading opportunities for rollups (who pay premiums to de-risk their operational costs)

4/ Typically, gas markets suffer from lack of a natural seller. In this case, speculators in the community have long argued that the price for blobs should go down over time as bandwidth scales.

I expect that the market will be primarily speculators collecting premiums to start

I expect that the market will be primarily speculators collecting premiums to start

5/ So far, the biggest challenges to me are: (1) the burned base fee making the derivative unsuitable for the natural seller (validators), (2) enabling physical delivery, and (3) protecting against manipulation.

Some more reading on this here: mirror.xyz/0x03c29504CEcC…

Some more reading on this here: mirror.xyz/0x03c29504CEcC…

6/ Thanks to @barnabemonnot, @lrettig, @_prestwich, @ballsyalchemist, @0xSydney and @neelsalami for the collaboration & edits.

If you're interested in working on these problems, please reach out. I would love to collaborate and connect with other engineers working in the space.

If you're interested in working on these problems, please reach out. I would love to collaborate and connect with other engineers working in the space.

• • •

Missing some Tweet in this thread? You can try to

force a refresh