Over the past year Syncracy accumulated a large position in MKR.

We believe Maker could command a $40+ billion valuation this cycle given its vital role in financing Ethereum’s economy — a multi-billion dollar fee opportunity.

Our thesis on Maker in the Endgame Era.

1/

We believe Maker could command a $40+ billion valuation this cycle given its vital role in financing Ethereum’s economy — a multi-billion dollar fee opportunity.

Our thesis on Maker in the Endgame Era.

1/

Maker is the leading decentralized bank in the cryptoeconomy.

At ~2x 2025E revenue, we believe Maker is one of the best risk / reward opportunities today given its industry leading earnings, best-in-class unit economics, and growing market dominance.

syncracy.io/writing/makerd…

At ~2x 2025E revenue, we believe Maker is one of the best risk / reward opportunities today given its industry leading earnings, best-in-class unit economics, and growing market dominance.

syncracy.io/writing/makerd…

Maker is a leviathan amongst the leaders, capturing nearly 40% of all DeFi profits on Ethereum.

Its competitive advantage is centered around its currency Dai —the most widely used decentralized stablecoin in the industry with its deep liquidity, integrations, and track record.

Its competitive advantage is centered around its currency Dai —the most widely used decentralized stablecoin in the industry with its deep liquidity, integrations, and track record.

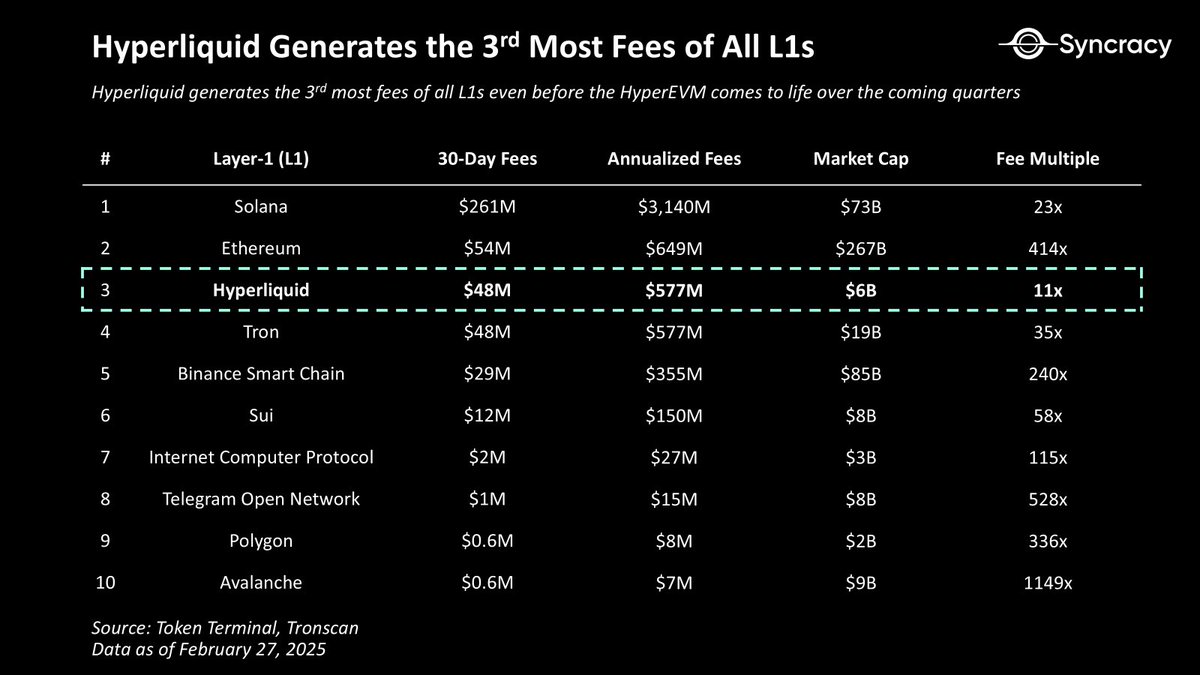

In fact, Maker is so dominant financially, it generates more fees than most L1s and L2s, which trade at orders of magnitude higher multiples than MKR.

Why then the discount?

Why then the discount?

Maker has historically been penalized for its conservatism.

However, its ongoing “Endgame” rollout could turn the tides as Maker evolves into a more scalable ecosystem of modular protocols.

With upcoming airdrops, as well as a project rebrand and token redenomination, Maker has the potential to become one of the biggest stories of the cycle as it executes on what may be the most ambitious roadmap in DeFi’s history.

However, its ongoing “Endgame” rollout could turn the tides as Maker evolves into a more scalable ecosystem of modular protocols.

With upcoming airdrops, as well as a project rebrand and token redenomination, Maker has the potential to become one of the biggest stories of the cycle as it executes on what may be the most ambitious roadmap in DeFi’s history.

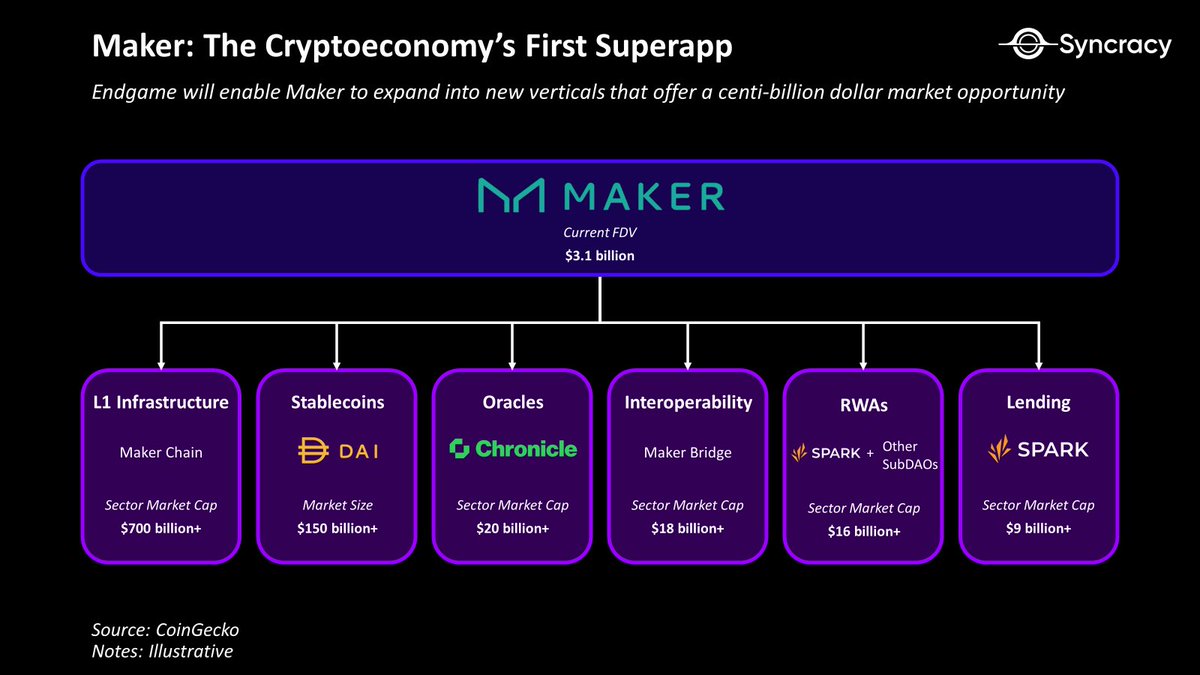

Endgame furthermore represents a massive TAM expansion as Maker transforms into the cryptoeconomy's first super-app .

As Maker rolls out a new bridge, a new chain, and a new RWA protocol amongst other exciting projects, we believe there is massive re-rate potential.

As Maker rolls out a new bridge, a new chain, and a new RWA protocol amongst other exciting projects, we believe there is massive re-rate potential.

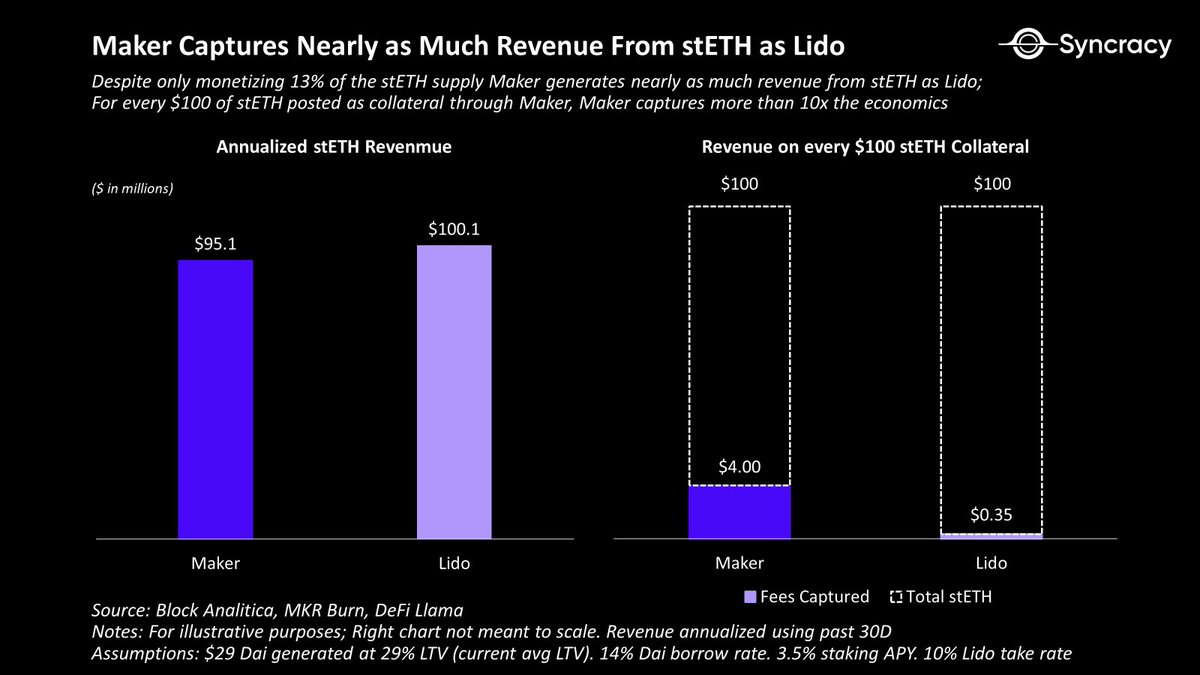

Most notably this cycle, Maker can play a critical role in the staking, restaking, and tokenized basis trading economies by providing the cheapest source of financing available onchain — the multi-billion dollar fee opportunity referenced above.

With its industry leading pricing power, Maker may very well capture more fees than the end protocols it’s financing, absorbing the lion’s share of DeFi profits this cycle.

With its industry leading pricing power, Maker may very well capture more fees than the end protocols it’s financing, absorbing the lion’s share of DeFi profits this cycle.

Already Maker generates as much revenue from the 13% of the stETH supply it lends against as Lido does on the entire stETH supply.

We expect the uses for liquid restaking tokens and tokenized basis trading positions (Ethena) will be similar, as will the disproportionate financial outcomes for Maker.

We expect the uses for liquid restaking tokens and tokenized basis trading positions (Ethena) will be similar, as will the disproportionate financial outcomes for Maker.

By passing a portion of these fees to Dai holders through the Dai Savings Rate (DSR), Maker can supercharge Dai’s growth, win the onchain economy, and gain share from centralized stablecoins.

Moreover, we believe Maker’s DSR has potential to become the savings backend for third party protocols including rollups, bridges and exchanges among other integrations.

Moreover, we believe Maker’s DSR has potential to become the savings backend for third party protocols including rollups, bridges and exchanges among other integrations.

With most of the old money out, and most of the new money bought into the Rune’s new vision, Maker is in as exciting a place as it's ever been.

The groundwork is laid for the next few years, providing Maker a legitimate shot to fulfill its ultimate goal of creating the holy grail of cryptocurrency — a monetary asset that is stable, scalable, and maximally resilient to corruption and failure.

syncracy.io/writing/makerd…

The groundwork is laid for the next few years, providing Maker a legitimate shot to fulfill its ultimate goal of creating the holy grail of cryptocurrency — a monetary asset that is stable, scalable, and maximally resilient to corruption and failure.

syncracy.io/writing/makerd…

Special thanks to @hexonaut, @pythianism, @jonmoore202, @seanlippel for the thoughtful feedback and discussion on the thesis.

Disclaimer: this post is for informational purposes only and should not be relied upon as investment advice. This post is not a recommendation for any security or investment.

• • •

Missing some Tweet in this thread? You can try to

force a refresh