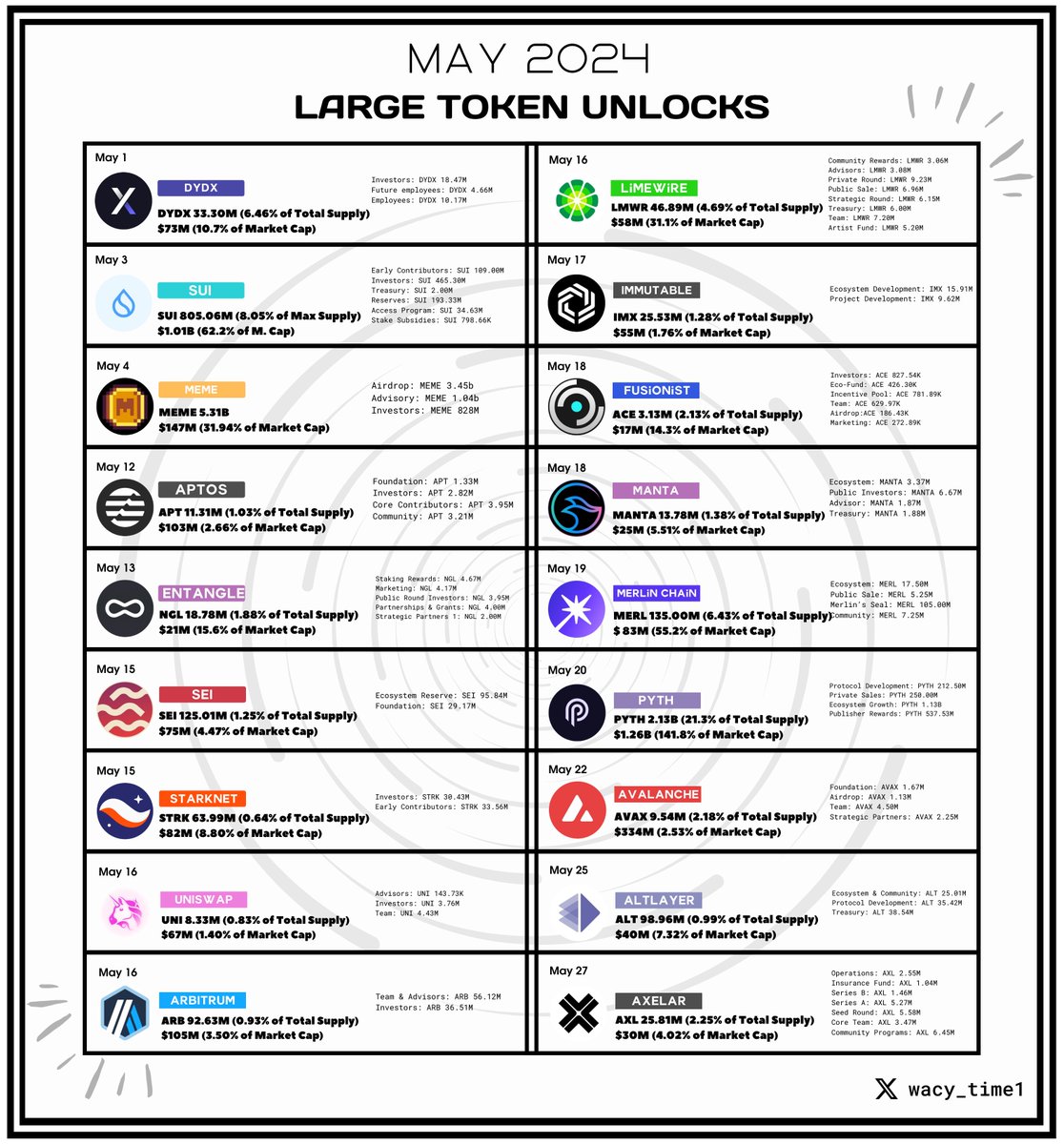

Large token unlocks in May 🧵:

The largest:

• $PYTH - $1.26B May 20

• $SUI - $1.01B May 3

• $AVAX - $334M May 22

• $MEME - $147M May 3

Others:

• $DYDX - $73M May 1

• $APT - $103M May 12

• $NGL - $21M May 13

• $SEI - $75M May 15

• $STRK - $82M May 15

• $UNI - $67M May 16

• $ARB - $105M May 16

• $LMWR - $58M May 16

• $IMX - $55M May 17

• $ACE - $17M May 18

• $MANTA - $25M May 18

• $MERL - $83M May 19

• $ALT - $40M May 25

• $AXL - $30M May 27

💡Some Insights ⬇️

The largest:

• $PYTH - $1.26B May 20

• $SUI - $1.01B May 3

• $AVAX - $334M May 22

• $MEME - $147M May 3

Others:

• $DYDX - $73M May 1

• $APT - $103M May 12

• $NGL - $21M May 13

• $SEI - $75M May 15

• $STRK - $82M May 15

• $UNI - $67M May 16

• $ARB - $105M May 16

• $LMWR - $58M May 16

• $IMX - $55M May 17

• $ACE - $17M May 18

• $MANTA - $25M May 18

• $MERL - $83M May 19

• $ALT - $40M May 25

• $AXL - $30M May 27

💡Some Insights ⬇️

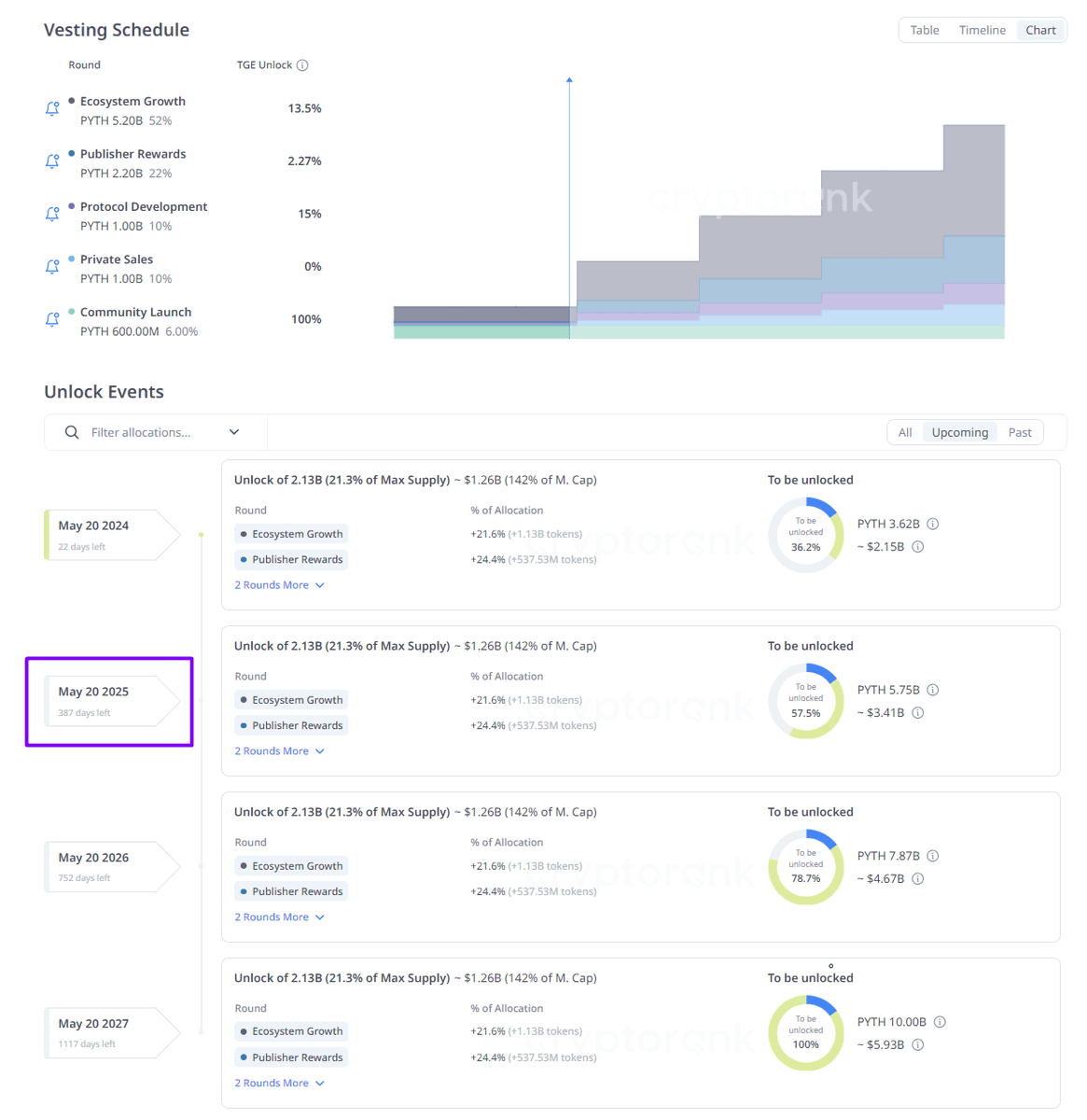

◢ @PythNetwork - $PYTH - $1.26B - May 20

$PYTH is shaping up to be one of the most intriguing unlocks in the month ahead.

A substantial 141% of the current market cap will be unlocked, with a focus on ecosystem development and rewards.

The $PYTH staking feature has already led to airdrops from various projects. If the price reacts to the unlock, it could present a favorable entry point for acquiring airdrops and profiting from the coin itself.

However, if there's an overall market drop beforehand, the unlock may not impact the price significantly.

My strategy would involve buying $PYTH and staking 50% of the tokens. Once the price doubles, I would sell the unstaked 50%, keeping the remaining coins in staking for additional income through airdrops.

This plan is based on the fact that $PYTH won't undergo its next unlock until 2025.

$PYTH is shaping up to be one of the most intriguing unlocks in the month ahead.

A substantial 141% of the current market cap will be unlocked, with a focus on ecosystem development and rewards.

The $PYTH staking feature has already led to airdrops from various projects. If the price reacts to the unlock, it could present a favorable entry point for acquiring airdrops and profiting from the coin itself.

However, if there's an overall market drop beforehand, the unlock may not impact the price significantly.

My strategy would involve buying $PYTH and staking 50% of the tokens. Once the price doubles, I would sell the unstaked 50%, keeping the remaining coins in staking for additional income through airdrops.

This plan is based on the fact that $PYTH won't undergo its next unlock until 2025.

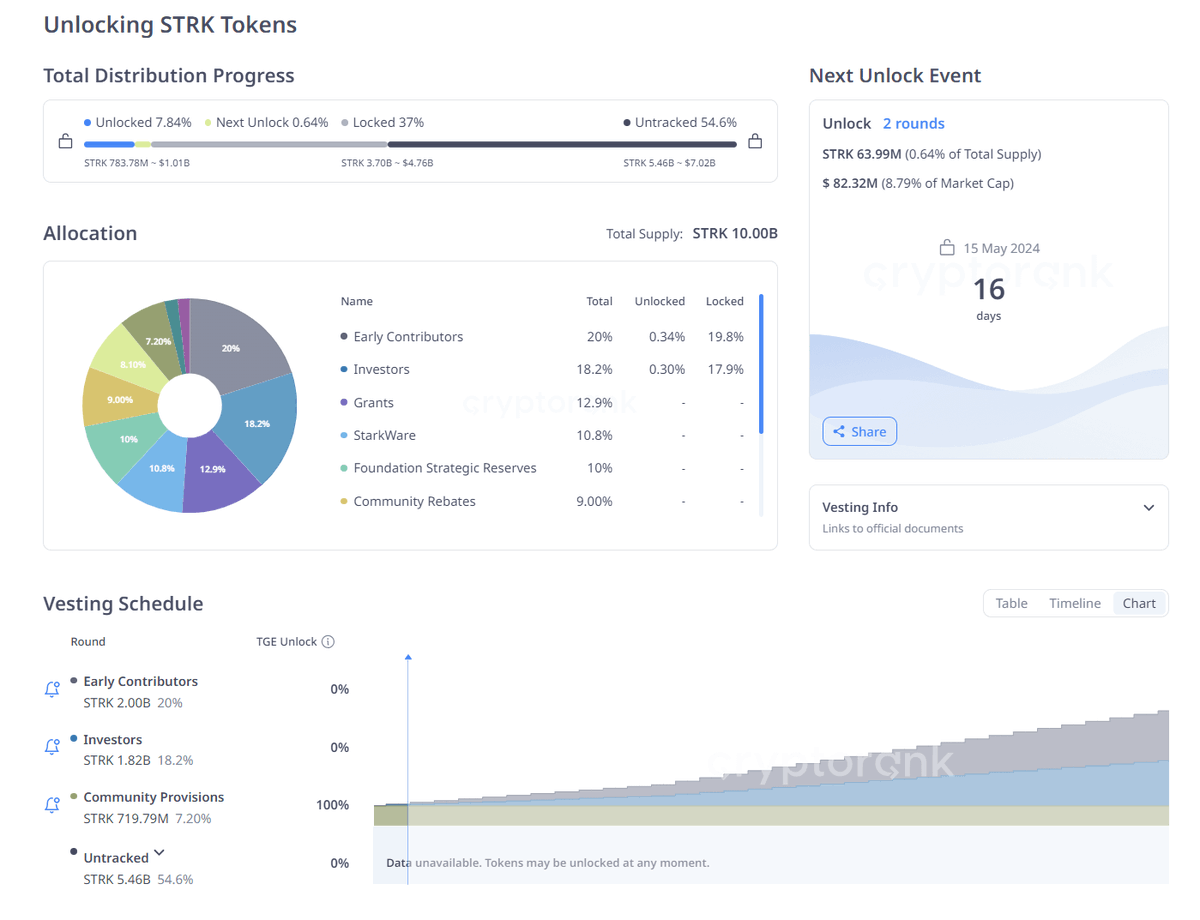

◢ @Starknet - $STRK - $82M - May 15

All tokens from the unlock will be allocated to investors and early contributors.

I anticipate that L1 and L2 blockchains will perform well during the alt season, as they are clearer for major retail, along with memes. Blockchain is blockchain.

I believe holding onto Starknet for the long term might not be advisable due to its massive FDV. It could be seen as an opportunity to enter the alt season with significant volume.

Expect price manipulation similar to what occurred with $APT.

All tokens from the unlock will be allocated to investors and early contributors.

I anticipate that L1 and L2 blockchains will perform well during the alt season, as they are clearer for major retail, along with memes. Blockchain is blockchain.

I believe holding onto Starknet for the long term might not be advisable due to its massive FDV. It could be seen as an opportunity to enter the alt season with significant volume.

Expect price manipulation similar to what occurred with $APT.

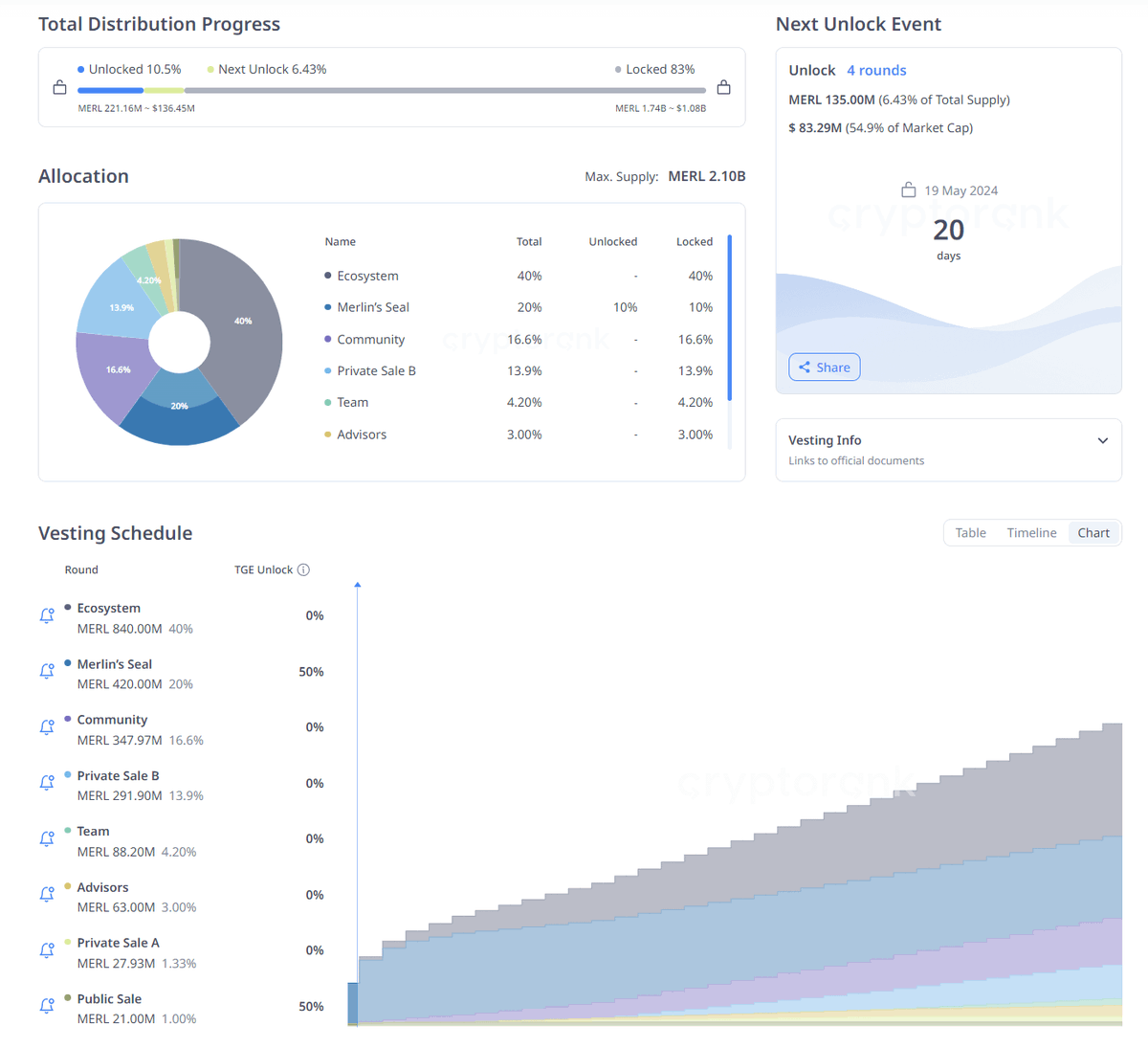

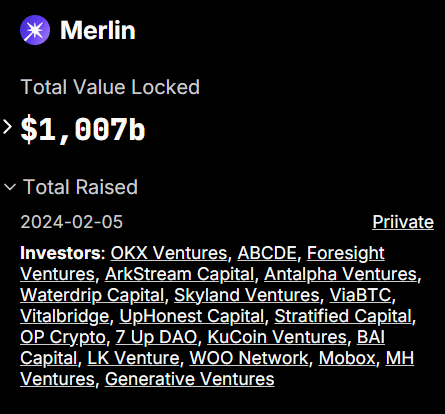

◢ @MerlinLayer2 - $MERL - $83M - May 19

I discussed earlier why Merlin is a good project and expressed my interest in buying its tokens at a more favorable price point.

Think $MERL has the potential to demonstrate power during the upcoming altcoin season due to:

- Huge TVL

- Strong backing from major investors

- Well-designed tokenomics featuring linear vesting

This project has the potential to be the next $STX.

Although the current price is on a sharp decline, this is a common occurrence. As I don't have any allocations or free tokens and I'm not an early investor.

If the price responds to the unlock, I may consider buying more aggressively.

I discussed earlier why Merlin is a good project and expressed my interest in buying its tokens at a more favorable price point.

Think $MERL has the potential to demonstrate power during the upcoming altcoin season due to:

- Huge TVL

- Strong backing from major investors

- Well-designed tokenomics featuring linear vesting

This project has the potential to be the next $STX.

Although the current price is on a sharp decline, this is a common occurrence. As I don't have any allocations or free tokens and I'm not an early investor.

If the price responds to the unlock, I may consider buying more aggressively.

Overall, the altseason seems imminent. We might be on the brink of a sudden shake-up to shed excess baggage, or the market could sharply pivot due to negative news, as is often the case.

➜

It's good to have positions in alts in case of a rapid increase and stablecoins in case of another drop.

➜

It's good to have positions in alts in case of a rapid increase and stablecoins in case of another drop.

https://twitter.com/wacy_time1/status/1784590540740157690

I hope you've found this thread helpful.

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can:

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can:

https://twitter.com/wacy_time1/status/1784650774821138847

• • •

Missing some Tweet in this thread? You can try to

force a refresh