My first Airdrop was $UNI, & since then I've seen how airdrops have evolved

A thread on my honest take on the current state of Airdrop meta. How users are being milked in the name of free money:

• Forced lockups to increase TVL

• Endless farming seasons

& more: 🧵👇

1/44

A thread on my honest take on the current state of Airdrop meta. How users are being milked in the name of free money:

• Forced lockups to increase TVL

• Endless farming seasons

& more: 🧵👇

1/44

2/44

Not Larping, $UNI was actually my first airdrop and I've been seeing airdrops ever since.

so Keep reading to know my take on the current state of Airdrop meta

I'd appreciate your follow, likes & RTs. Also, feel free to share

Not Larping, $UNI was actually my first airdrop and I've been seeing airdrops ever since.

so Keep reading to know my take on the current state of Airdrop meta

I'd appreciate your follow, likes & RTs. Also, feel free to share

https://x.com/axel_bitblaze69/status/1306468190579388416?s=46&t=MpsMbNE2PDtDtDfKUQWooA

3/44

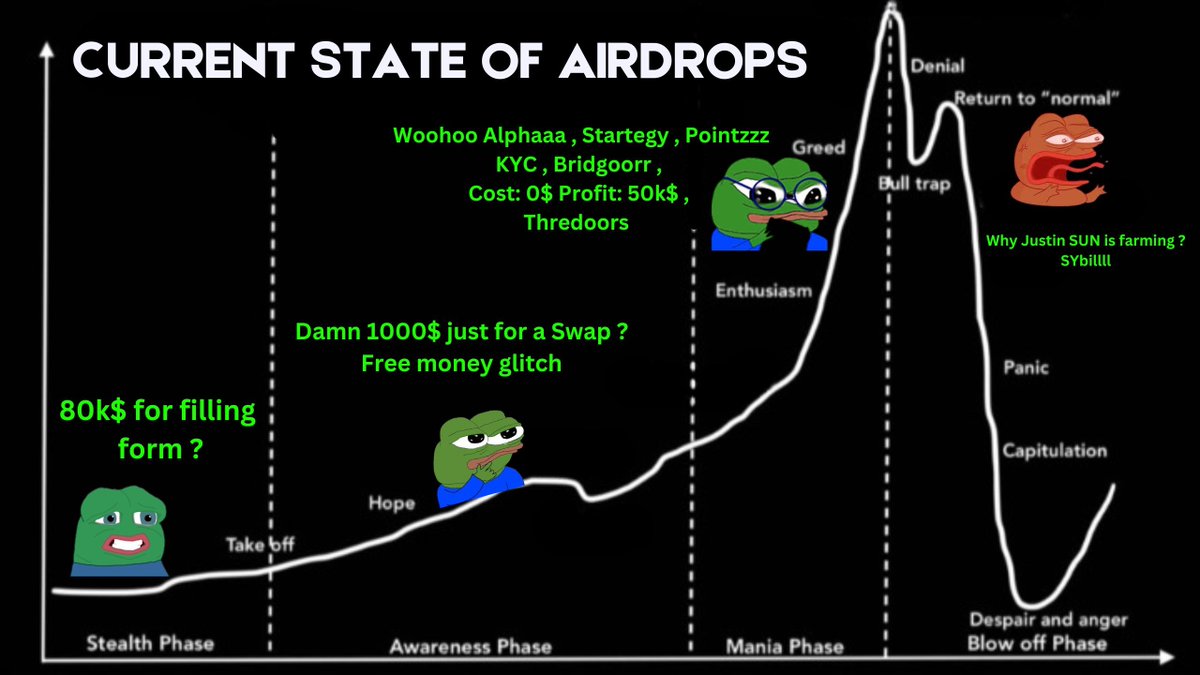

Current State of Airdrops:

Down the thread:

+ Airdrop is more of a psychological narrative thing

+ Current State of Airdrop

+ Point Meta: A death Spiral?

+ Sybil farm evolution

+ Which airdrops to hold and which not

Current State of Airdrops:

Down the thread:

+ Airdrop is more of a psychological narrative thing

+ Current State of Airdrop

+ Point Meta: A death Spiral?

+ Sybil farm evolution

+ Which airdrops to hold and which not

4/44

Okay, I've seen 2 Bull markets, and from my experience, this is how I feel airdrops evolved.

➝ In Bull Market or Pre-Airdrop Phases:

The criteria used to be simple.

Earlier airdrops were mostly done via filling forms or gleams or Bounty campaigns. For example, INV gave out $80k just for filling out a form.

Okay, I've seen 2 Bull markets, and from my experience, this is how I feel airdrops evolved.

➝ In Bull Market or Pre-Airdrop Phases:

The criteria used to be simple.

Earlier airdrops were mostly done via filling forms or gleams or Bounty campaigns. For example, INV gave out $80k just for filling out a form.

5/44

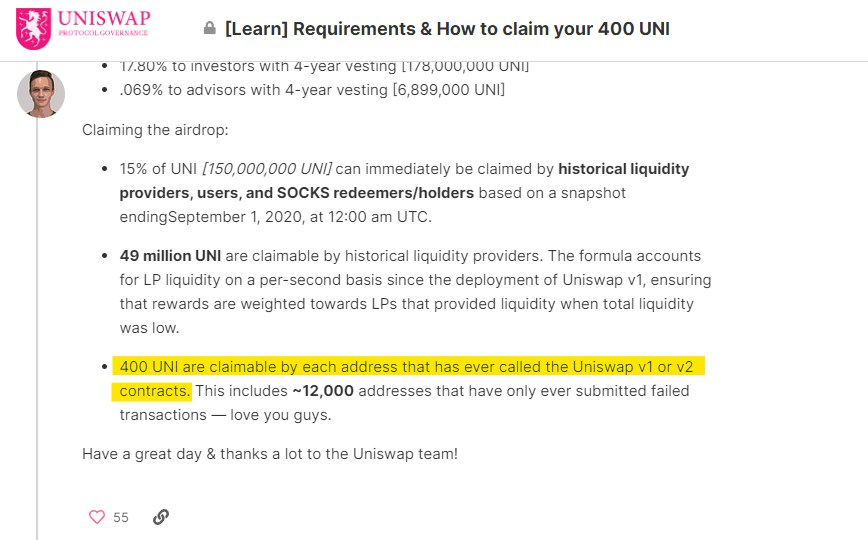

Then there came one big retro drop $UNI with a simplest criteria which made sense:

UNI chads needed just 1 transaction with Uniswap contract.

(They literally had just a merkle tree as an airdrop claimer which checked if you had a transaction or not - no BS Sybil filter and such.)

Then there came one big retro drop $UNI with a simplest criteria which made sense:

UNI chads needed just 1 transaction with Uniswap contract.

(They literally had just a merkle tree as an airdrop claimer which checked if you had a transaction or not - no BS Sybil filter and such.)

6/44

The reason was simple:

Nobody cared much as it was a bull market.

Liquidity was sky-high, people were making good money off trading. Another reason was less exposure to DeFi; people were mostly using centralized exchanges for trading.

The reason was simple:

Nobody cared much as it was a bull market.

Liquidity was sky-high, people were making good money off trading. Another reason was less exposure to DeFi; people were mostly using centralized exchanges for trading.

7/44

➜ Back to Current State of Airdrops:

- Endless farming seasons

- Lock your Money for our TVL

- Volume, unique days, and random multipliers

You see how criteria changed with time?

Well, this one follows the same Psychological Cycle of Narrative. Let me explain you.

➜ Back to Current State of Airdrops:

- Endless farming seasons

- Lock your Money for our TVL

- Volume, unique days, and random multipliers

You see how criteria changed with time?

Well, this one follows the same Psychological Cycle of Narrative. Let me explain you.

8/44

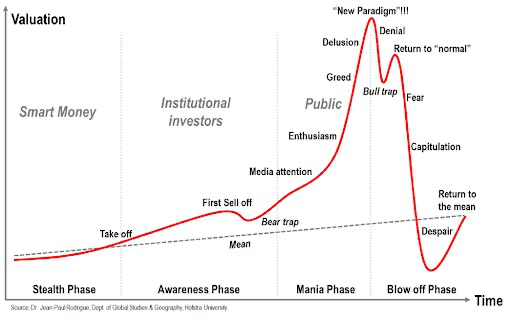

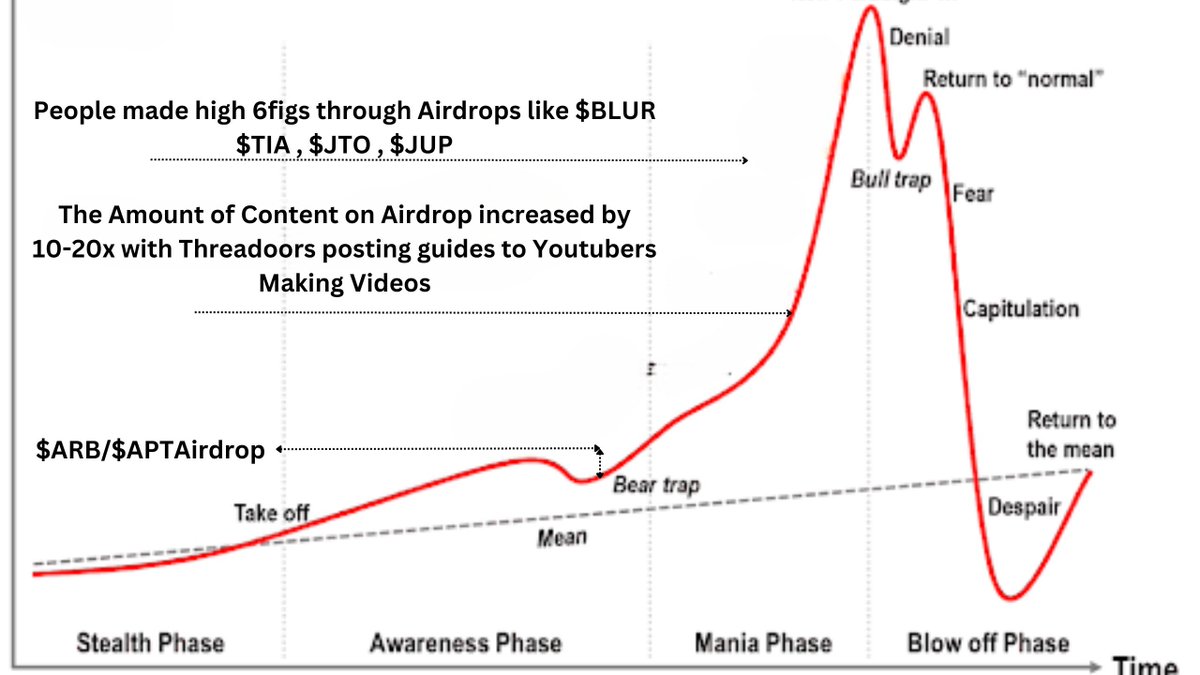

➔ The Same Psychological Cycle of Narratives:

I see such narratives play out every single time with different names but similar psychology.

Say you were here in the 2017 ICO Boom; I played that Narrative, so I can relate to it.

➔ The Same Psychological Cycle of Narratives:

I see such narratives play out every single time with different names but similar psychology.

Say you were here in the 2017 ICO Boom; I played that Narrative, so I can relate to it.

9/44

➛ Stealth Phase:

Initially, there were good IDOs, people were making money, but awareness was limited. The smart money was already involved.

This one is " The DAO " phase which raised 150M . See below video

Replicate the same Psychology for the Airdrop Narrative:

➛ Stealth Phase:

Initially, there were good IDOs, people were making money, but awareness was limited. The smart money was already involved.

This one is " The DAO " phase which raised 150M . See below video

Replicate the same Psychology for the Airdrop Narrative:

10/44

In the beginning, there were good airdrops like $UNI, $DYDX, etc., and the smart money profited, but not everyone, as there was little awareness or guidance about airdrops.

• It was a peak bull market where no one cared about farming airdrops as they were literally making multiples every single day.

In the beginning, there were good airdrops like $UNI, $DYDX, etc., and the smart money profited, but not everyone, as there was little awareness or guidance about airdrops.

• It was a peak bull market where no one cared about farming airdrops as they were literally making multiples every single day.

11/44

➛ Phase 2: Awareness

Then, it slowed down for some time in this phase.

I heard people saying, "Yeah, ICOs are a thing, people made money, but ah, it's too difficult for me to get into and understand."

There was friction, and people were less educated about how to get involved.

➛ Phase 2: Awareness

Then, it slowed down for some time in this phase.

I heard people saying, "Yeah, ICOs are a thing, people made money, but ah, it's too difficult for me to get into and understand."

There was friction, and people were less educated about how to get involved.

12/44

For Airdrops:

This was during the "Bear Market" where things were slow, airdrops like $ENS and others were happening, but the hype was missing.

YouTube channels stopped covering the next 100x GEM, lol.

For Airdrops:

This was during the "Bear Market" where things were slow, airdrops like $ENS and others were happening, but the hype was missing.

YouTube channels stopped covering the next 100x GEM, lol.

13/44

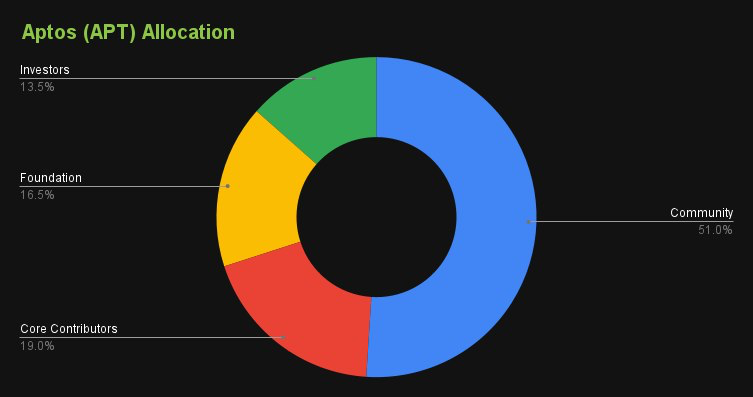

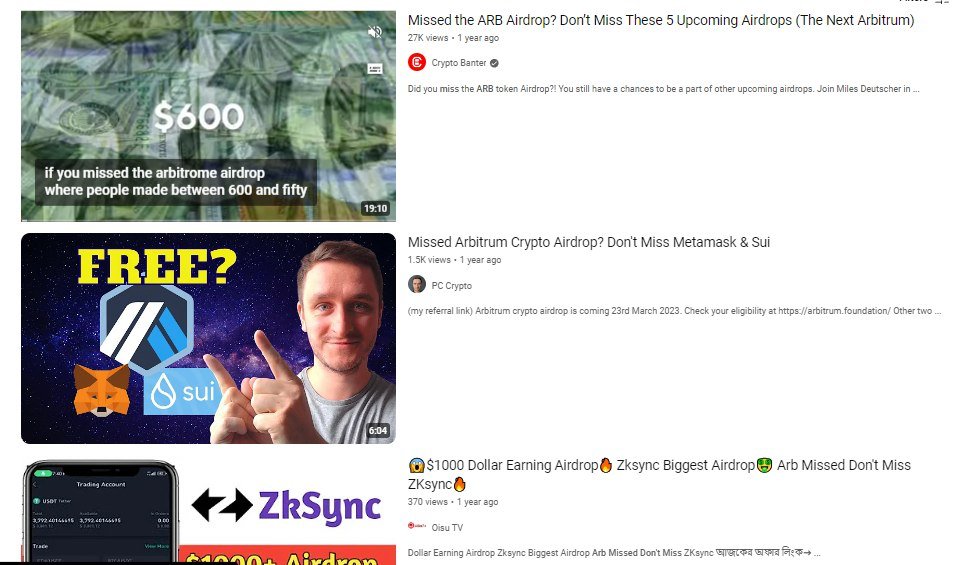

➥ The hype got restored by the Aptos and Arbitrum airdrops.

In the peak bear market, people were getting thousands of dollars for doing easy tasks, and that ignited the airdrop saga.

Threads and YouTubers started popping up with "Missed Aptos, don't miss ARB," "Missed ARB, don't miss XYZ."

➥ The hype got restored by the Aptos and Arbitrum airdrops.

In the peak bear market, people were getting thousands of dollars for doing easy tasks, and that ignited the airdrop saga.

Threads and YouTubers started popping up with "Missed Aptos, don't miss ARB," "Missed ARB, don't miss XYZ."

14/44

➛ Phase 3: The Mania Phase:

The ICO boom happened. People were like, "Fook it, let me throw money here, oh there's a YouTube tutorial, let me follow."

People made good money, even those who didn't have much knowledge. I heard people saying, "Printing money from thin air," "Free money."

➛ Phase 3: The Mania Phase:

The ICO boom happened. People were like, "Fook it, let me throw money here, oh there's a YouTube tutorial, let me follow."

People made good money, even those who didn't have much knowledge. I heard people saying, "Printing money from thin air," "Free money."

15/44

➥ Same for Airdrops:

We saw the rise in Airdrops from the Cosmos ecosystem to Solana and beyond, printing thousands of dollars from thin air.

The amount of awareness/hype and threads covering Airdrops increased by more than 10-20x, lol.

➥ Same for Airdrops:

We saw the rise in Airdrops from the Cosmos ecosystem to Solana and beyond, printing thousands of dollars from thin air.

The amount of awareness/hype and threads covering Airdrops increased by more than 10-20x, lol.

16/44

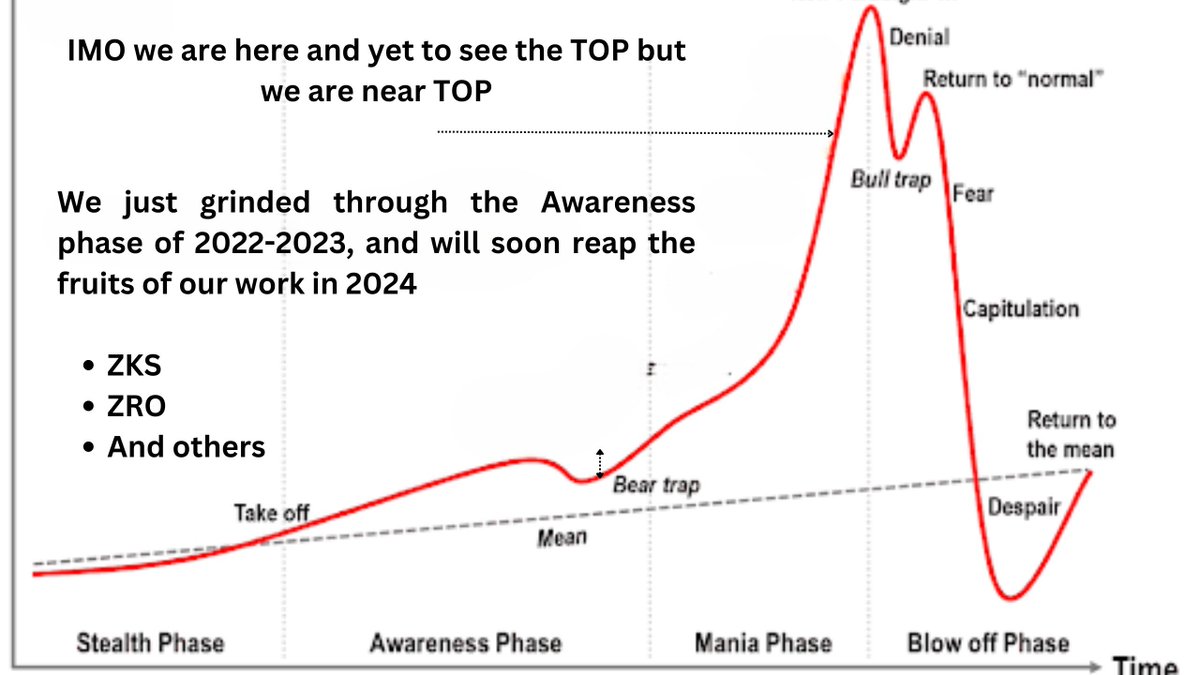

➛ Phase 4: The Endgame

That hype got topped out soon, as daily X amounts of projects were coming out with their Moonsheets.

That's where people got greedy with the hype, and the projects used that hype to scam people and Rug.

And ICOs are dead now, kind of.

➛ Phase 4: The Endgame

That hype got topped out soon, as daily X amounts of projects were coming out with their Moonsheets.

That's where people got greedy with the hype, and the projects used that hype to scam people and Rug.

And ICOs are dead now, kind of.

17/44

For Airdrops:

We are close to being topped out.

See, the final and major ones like Zksync, Layerzero, are yet to drop and will be done in the coming months.

You're already seeing those absurd criteria and projects literally working as a VC printoor.

For Airdrops:

We are close to being topped out.

See, the final and major ones like Zksync, Layerzero, are yet to drop and will be done in the coming months.

You're already seeing those absurd criteria and projects literally working as a VC printoor.

18/44

They will turn it into generational wealth for some, and a new peak FOMO will arise of "Missed this" and "Missed That."

New projects with similar tactics will try to milk you.

That's where you know things will be at their peak for some time, and you don't need to farm everything at its full potential.

They will turn it into generational wealth for some, and a new peak FOMO will arise of "Missed this" and "Missed That."

New projects with similar tactics will try to milk you.

That's where you know things will be at their peak for some time, and you don't need to farm everything at its full potential.

19/44

📌 Okay, More Talk on current Airdrop Meta:

Projects and VCs saw this hype opportunity here and started a coordinated marketing tactic to keep their money printer on:

- Onboard VCs at Lower FDV

- Build a Hype around airdrop ~ raised xyz backed by VCs

- Once TVL goes brrr, Raise another round

- Launch at higher FDVs

- Dump on retail

📌 Okay, More Talk on current Airdrop Meta:

Projects and VCs saw this hype opportunity here and started a coordinated marketing tactic to keep their money printer on:

- Onboard VCs at Lower FDV

- Build a Hype around airdrop ~ raised xyz backed by VCs

- Once TVL goes brrr, Raise another round

- Launch at higher FDVs

- Dump on retail

20/44

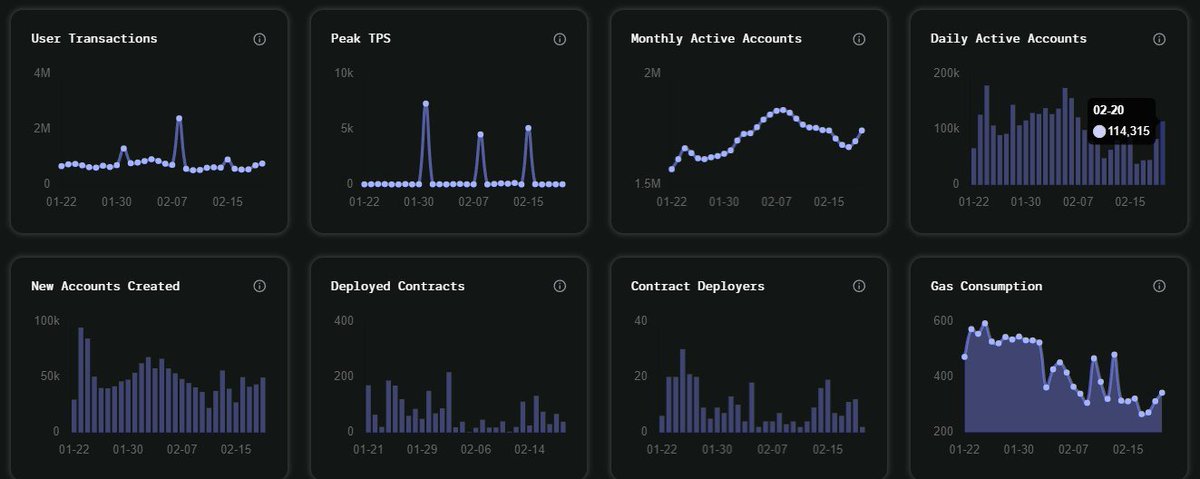

📌 A Death Spiral of Point Meta of Airdrops:

I see this whole thing as a Domino Effect.

How this plays out is: Projects get extra greedy with that airdrop hype and start an endless cycle of Seasons 1, 2, 3, 4... 69.

Why? To pump those TVL numbers up.

📌 A Death Spiral of Point Meta of Airdrops:

I see this whole thing as a Domino Effect.

How this plays out is: Projects get extra greedy with that airdrop hype and start an endless cycle of Seasons 1, 2, 3, 4... 69.

Why? To pump those TVL numbers up.

21/44

➙ Now, due to this, the size of wallets and farmers gets increased.

As every single day passes, the number of farmers and their families increases exponentially.

Thanks to Threadoors and, of course, the project Marketing teams and Interns.

For eg : $PRCL with extra Season

➙ Now, due to this, the size of wallets and farmers gets increased.

As every single day passes, the number of farmers and their families increases exponentially.

Thanks to Threadoors and, of course, the project Marketing teams and Interns.

For eg : $PRCL with extra Season

22/44

➔ A bit of Context on: More users and less airdrop:

When you speculate when a snapshot is taken, it's not like the project decides on a random day. They have these numbers:

1. %supply to be allocated for airdrop

2. What FDV to launch at .

➔ A bit of Context on: More users and less airdrop:

When you speculate when a snapshot is taken, it's not like the project decides on a random day. They have these numbers:

1. %supply to be allocated for airdrop

2. What FDV to launch at .

23/44

Depending on this,

They have an idea of how many users to let in. And what kind of criteria will make it fit the amount of users

See, this was not the case with those OG airdrops like Uniswap: It was just a simple merkle tree which checked if the user interacted with contract or not

Depending on this,

They have an idea of how many users to let in. And what kind of criteria will make it fit the amount of users

See, this was not the case with those OG airdrops like Uniswap: It was just a simple merkle tree which checked if the user interacted with contract or not

24/44

➔ Sorry, now back to where we were: More users -> Less amount of airdrop in $ value.

Now, with these TVL boosts, they raise another round.

But at this point, the farmers size has already been increased to a new level. We call this thing "overfarmed."

➔ Sorry, now back to where we were: More users -> Less amount of airdrop in $ value.

Now, with these TVL boosts, they raise another round.

But at this point, the farmers size has already been increased to a new level. We call this thing "overfarmed."

25/44

➔ Let's not forget the Whales farming with all these Hype

Imagine this Scenario:

↦ Day 1, no project hype:

You deposit $100 - you are early, you are in the top 1000 users.

↦ Day 69, hype goes brrr:

Justin Sun and familia deposit thousands of ETH - your rank drops to 69k, your points are peanuts in front of these whales.

➔ Let's not forget the Whales farming with all these Hype

Imagine this Scenario:

↦ Day 1, no project hype:

You deposit $100 - you are early, you are in the top 1000 users.

↦ Day 69, hype goes brrr:

Justin Sun and familia deposit thousands of ETH - your rank drops to 69k, your points are peanuts in front of these whales.

26/44

For the Context , Here are 3 wallets of Justin Sun :

- 0x176f - 2.8M $EIGEN tokens

- 0xdc3f - 778k $EIGEN tokens

- 0x79ac - 693k $EIGEN tokens

And Let's not forget the $ETHFI incident of throwing ETH at last few hours and grabbing a huge Pie of $ETHFI airdrop

For the Context , Here are 3 wallets of Justin Sun :

- 0x176f - 2.8M $EIGEN tokens

- 0xdc3f - 778k $EIGEN tokens

- 0x79ac - 693k $EIGEN tokens

And Let's not forget the $ETHFI incident of throwing ETH at last few hours and grabbing a huge Pie of $ETHFI airdrop

27/44

But they won't cart you out completely because 80% of the airdrop farmers are not whales and are just like you and me, lol.

And if they kick you out , they know the CT will be filled with blood and FUD lol

So they go for a tiered airdrop way for the lower ones.

But they won't cart you out completely because 80% of the airdrop farmers are not whales and are just like you and me, lol.

And if they kick you out , they know the CT will be filled with blood and FUD lol

So they go for a tiered airdrop way for the lower ones.

28/44

➔ We have seen this in all the recent Point based airdrops:

1. Renzo - Linear for top, tier for bottom

2. Tensor - Linear for top, tier for bottom

3. Etherfi - Linear for top, tier for bottom

➔ We have seen this in all the recent Point based airdrops:

1. Renzo - Linear for top, tier for bottom

2. Tensor - Linear for top, tier for bottom

3. Etherfi - Linear for top, tier for bottom

29/44

➜ Cycle 4: The Forced Saga of Valuations:

Now that the Point distribution has gone out of hand and those Low tier allocations are done, the next dilemma is, will the Airdrop be worth it?

To make it a decent size, they are bound to list at Higher Valuations.

➜ Cycle 4: The Forced Saga of Valuations:

Now that the Point distribution has gone out of hand and those Low tier allocations are done, the next dilemma is, will the Airdrop be worth it?

To make it a decent size, they are bound to list at Higher Valuations.

30/44

➥ For two reasons:

1. VCs Printer shouldn't stop

2. The low-tier farmoors should get a decent amount of airdrop in $$ value, or they will FUD the hell out of you since they consist of 90% of users on your platform and ruin the post-TGE price action

➥ For two reasons:

1. VCs Printer shouldn't stop

2. The low-tier farmoors should get a decent amount of airdrop in $$ value, or they will FUD the hell out of you since they consist of 90% of users on your platform and ruin the post-TGE price action

31/44

In most cases, VCs get a good exit at higher valuations and the angry farmers still get rekt and send it to zero with FUD.

This all affects on post listing :

> Low tier people happy - Price Action Good

> Low tier people angry - Price Action Bad

In most cases, VCs get a good exit at higher valuations and the angry farmers still get rekt and send it to zero with FUD.

This all affects on post listing :

> Low tier people happy - Price Action Good

> Low tier people angry - Price Action Bad

32/44

Let me show you 3-4 good and different examples:

1. STRK:

There was lot going around in case of STRK . From doing TGE in 2022 bypassing those Cliffs for VCs and taking back that decision .

Airdrop Hunters Disappointment on criteria

30B $FDV was way high

Let me show you 3-4 good and different examples:

1. STRK:

There was lot going around in case of STRK . From doing TGE in 2022 bypassing those Cliffs for VCs and taking back that decision .

Airdrop Hunters Disappointment on criteria

30B $FDV was way high

https://x.com/lookonchain/status/1760489819275395490

33/44

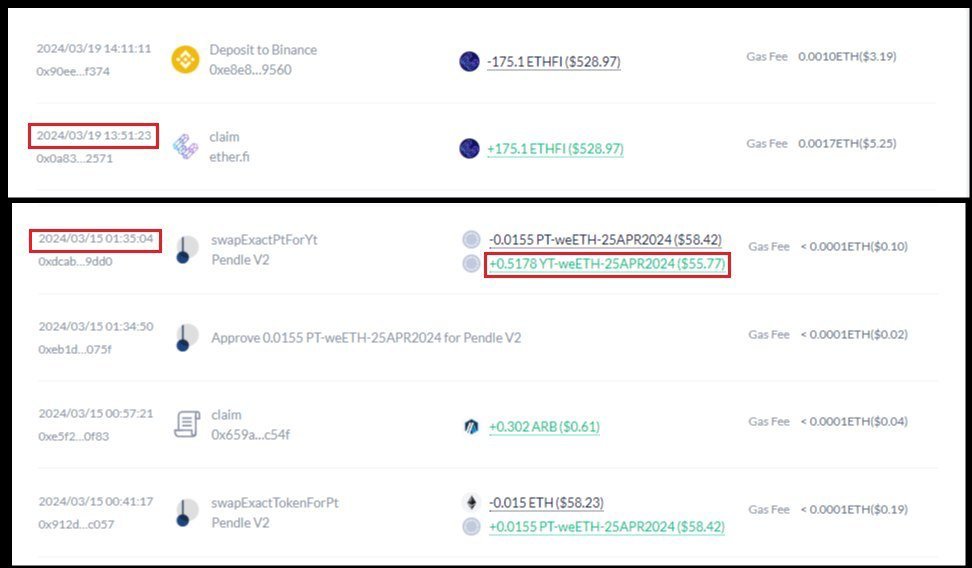

2. ETHERFI:

They did messed up with all those Justin Sun FUD and a really low tier alloc of 35 tokens initially

After that they rectify it and made it to 175 tokens .

> Low tier peeps happy and price action was good from $2.8 to $8

2. ETHERFI:

They did messed up with all those Justin Sun FUD and a really low tier alloc of 35 tokens initially

After that they rectify it and made it to 175 tokens .

> Low tier peeps happy and price action was good from $2.8 to $8

34/44

3. $ENA:

VCs made money raised at 300M valuation , Launched at 9B

Good thing was they were clear from the start and ended the point farming during the exact time didn't stretched it and token performed well.

> Token performed well since they didn't milked people

3. $ENA:

VCs made money raised at 300M valuation , Launched at 9B

Good thing was they were clear from the start and ended the point farming during the exact time didn't stretched it and token performed well.

> Token performed well since they didn't milked people

35/44

4. $SEI: VCs printer, farmers were milked and given peanuts, got dumped post-listing.

5. Wormhole: $W VCs printer with higher FDV, dumped post listing

4. $SEI: VCs printer, farmers were milked and given peanuts, got dumped post-listing.

5. Wormhole: $W VCs printer with higher FDV, dumped post listing

https://x.com/Axel_bitblaze69/status/1779102343570837755

36/44

➜ So, if you want to know which shiny token to bid?

See if the low tier people are happy? Not just the few top tier ones.

If not? Wait for the dump it will happen.

Buy it around 40-50% corrections and bid because even scams and hated projects pump to in bull.

Why? Don't ask me, lol, this one getting longer.

➜ So, if you want to know which shiny token to bid?

See if the low tier people are happy? Not just the few top tier ones.

If not? Wait for the dump it will happen.

Buy it around 40-50% corrections and bid because even scams and hated projects pump to in bull.

Why? Don't ask me, lol, this one getting longer.

37/44

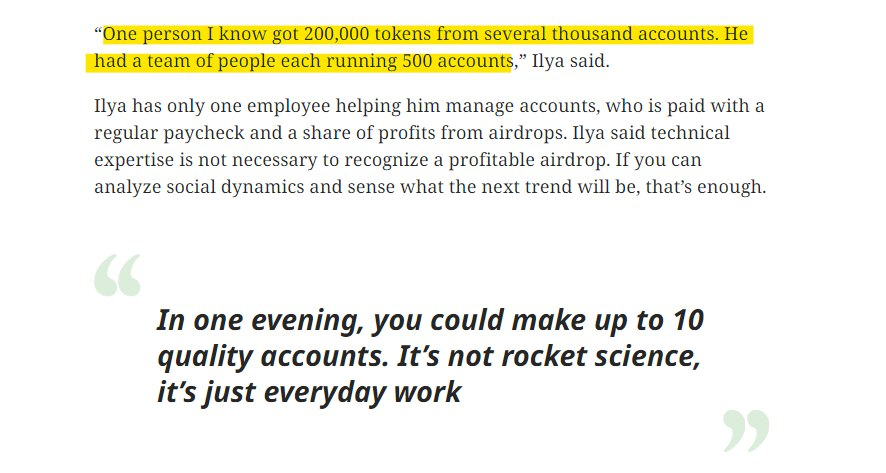

➔ Cycle 5: Rise to Sybil Farms.

Let me explain: When there is a minimum tier system, it is easy for all those Sybil Factories to milk the hell out of this.

There are literally factories and offices out there farming these airdrops on a large scale. And they won't even target the higher allocations.

➔ Cycle 5: Rise to Sybil Farms.

Let me explain: When there is a minimum tier system, it is easy for all those Sybil Factories to milk the hell out of this.

There are literally factories and offices out there farming these airdrops on a large scale. And they won't even target the higher allocations.

38/44

↦ But is it worth it?

YES! Look at Etherfi, look at Tensor, look at ARB.

For example: Let's say you aimed for low tier alloc for $ETHFI

I got a low tier alloc of 175 ETHFI on my burner wallet, what I did was bought the 50$ worth of Pendle YT just before the 4hr closing time

↦ But is it worth it?

YES! Look at Etherfi, look at Tensor, look at ARB.

For example: Let's say you aimed for low tier alloc for $ETHFI

I got a low tier alloc of 175 ETHFI on my burner wallet, what I did was bought the 50$ worth of Pendle YT just before the 4hr closing time

39/44

One wallet just 4 hrs ago and got 175 tokens, what if I did 50 wallets lol

With just 2500$ (less than 1E) you could have spinned 50 wallets (50$ per wallet) that's 8750 tokens ~ 43k$ ez

You know, sybiling the lower tier is always been the most profitable start, lol.

One wallet just 4 hrs ago and got 175 tokens, what if I did 50 wallets lol

With just 2500$ (less than 1E) you could have spinned 50 wallets (50$ per wallet) that's 8750 tokens ~ 43k$ ez

You know, sybiling the lower tier is always been the most profitable start, lol.

40/44

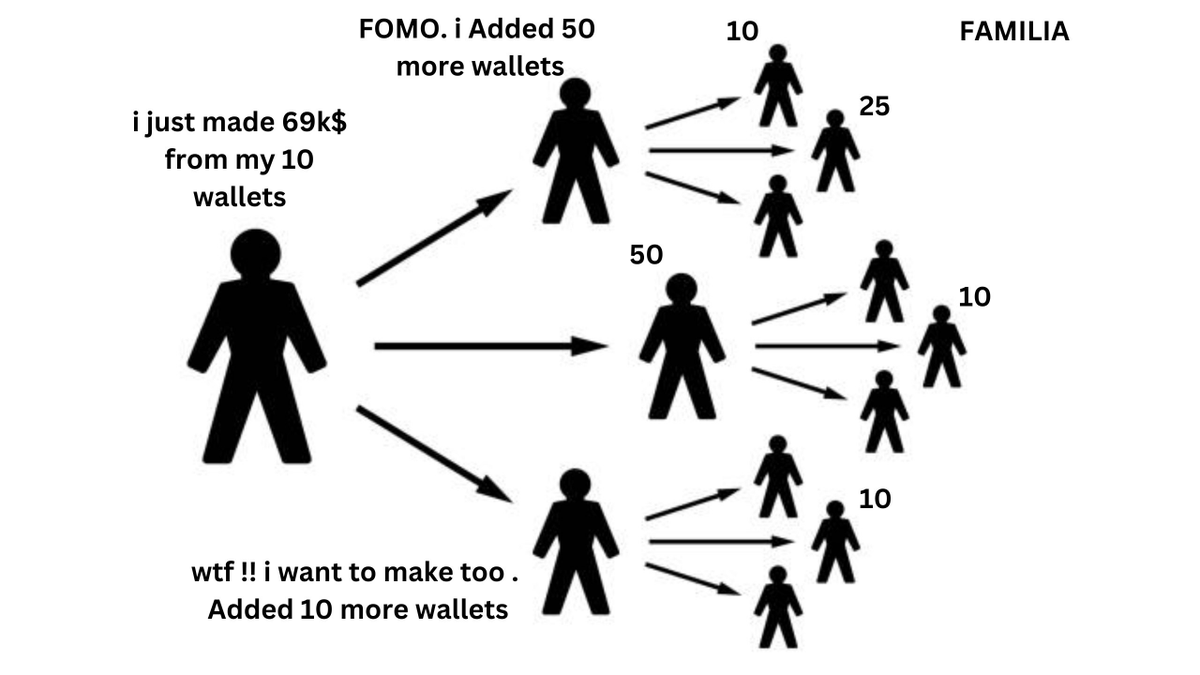

➜ And here comes the infinite never-ending Sybil Cycles:

Now, people already got this that sybiling a lower tier allocation is such a win-win scenario in terms of Cost to farm.

You literally pay less amount of gas/money to get the bare minimum tiered airdrop in 100s of wallets.

➜ And here comes the infinite never-ending Sybil Cycles:

Now, people already got this that sybiling a lower tier allocation is such a win-win scenario in terms of Cost to farm.

You literally pay less amount of gas/money to get the bare minimum tiered airdrop in 100s of wallets.

41/44

How this cycle perpetuates is, someone saw that, "Wow, this guy made so much money sybiling wallets."

FOMO kicks and what an angry farmer will do ? Proceeds to copy that and add 10 more wallets .

This raises the Farmer size exponentially !!

▹ Eg : L0 and zksync farmoors

How this cycle perpetuates is, someone saw that, "Wow, this guy made so much money sybiling wallets."

FOMO kicks and what an angry farmer will do ? Proceeds to copy that and add 10 more wallets .

This raises the Farmer size exponentially !!

▹ Eg : L0 and zksync farmoors

42/44

➔ Final Thoughts: Are Airdrops Dead?

No, airdrops will never be completely dead.

There will always be lucrative opportunities. But the strategy is shifting:

- Farm less of the overly hyped "airdrop airdrop!!" projects

➔ Final Thoughts: Are Airdrops Dead?

No, airdrops will never be completely dead.

There will always be lucrative opportunities. But the strategy is shifting:

- Farm less of the overly hyped "airdrop airdrop!!" projects

43/44

- Be bullish on teams explicitly saying "No plans for airdrop/token" but says hey yes here a Galxe campiagn which gives you some OATS and points if you want

Because every damn project will still tokenize during bull markets - they can't miss the opportunity.

- Be bullish on teams explicitly saying "No plans for airdrop/token" but says hey yes here a Galxe campiagn which gives you some OATS and points if you want

Because every damn project will still tokenize during bull markets - they can't miss the opportunity.

44/44

The ones denying it now will inevitably drop a token too, they just don't want rampant farmer exploitation pre-launch.

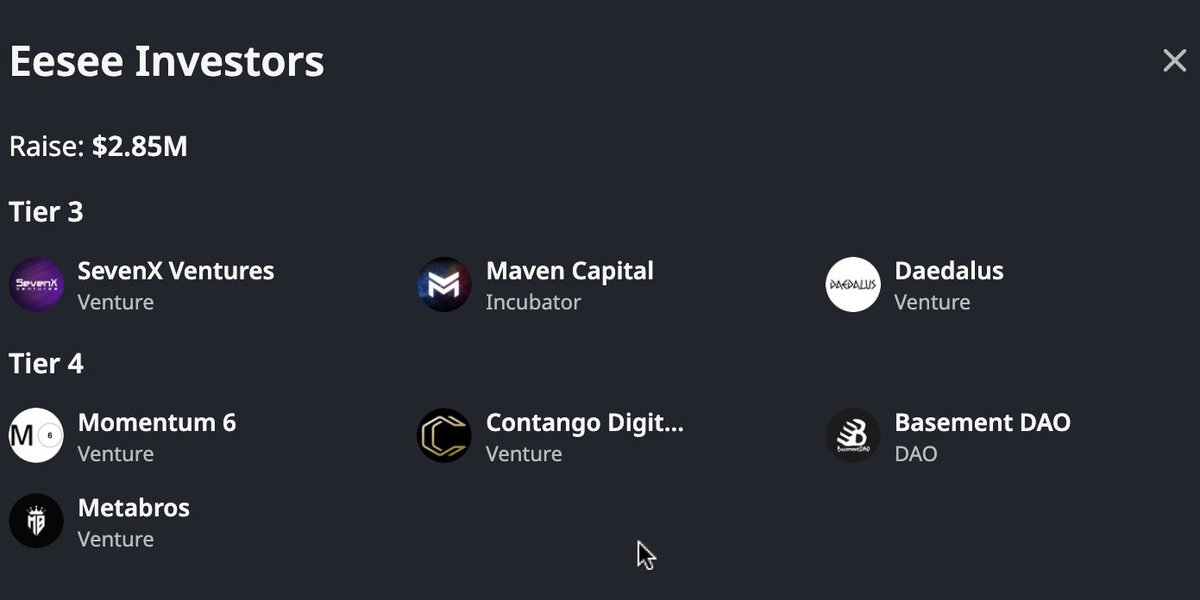

Also, study VCs like JUMP VC. They invest for tokens and not Tech, lol.

So if they are throwing money into something, that project is most likely to get tokenized in 90% of the cases.

VC Pressure > Community Pressure as always.

The ones denying it now will inevitably drop a token too, they just don't want rampant farmer exploitation pre-launch.

Also, study VCs like JUMP VC. They invest for tokens and not Tech, lol.

So if they are throwing money into something, that project is most likely to get tokenized in 90% of the cases.

VC Pressure > Community Pressure as always.

I hope you've found this thread helpful.

Follow me @Axel_bitblaze69 to:

• Learn more valuable crypto related stuff

• Stay up to date with the latest crypto alpha & airdrops

Like/Retweet the first tweet below if you find it useful:

Follow me @Axel_bitblaze69 to:

• Learn more valuable crypto related stuff

• Stay up to date with the latest crypto alpha & airdrops

Like/Retweet the first tweet below if you find it useful:

https://twitter.com/axel_bitblaze69/status/1785279464982942061

• • •

Missing some Tweet in this thread? You can try to

force a refresh