We are proposing major upgrades and expansions, including the groundbreaking Aave V4, Aave Network, Cross-Chain Liquidity Layer, non-EVM L1 deployments and a fresh new visual identity, all leading the future of DeFi innovation.

Read more: governance.aave.com/t/temp-check-a…

Read more: governance.aave.com/t/temp-check-a…

Introducing Aave V4 👻

Aave V4 marks a significant advancement in DeFi, engineered to establish new frontiers in capital efficiency, risk management, and scalability.

Aave V4 marks a significant advancement in DeFi, engineered to establish new frontiers in capital efficiency, risk management, and scalability.

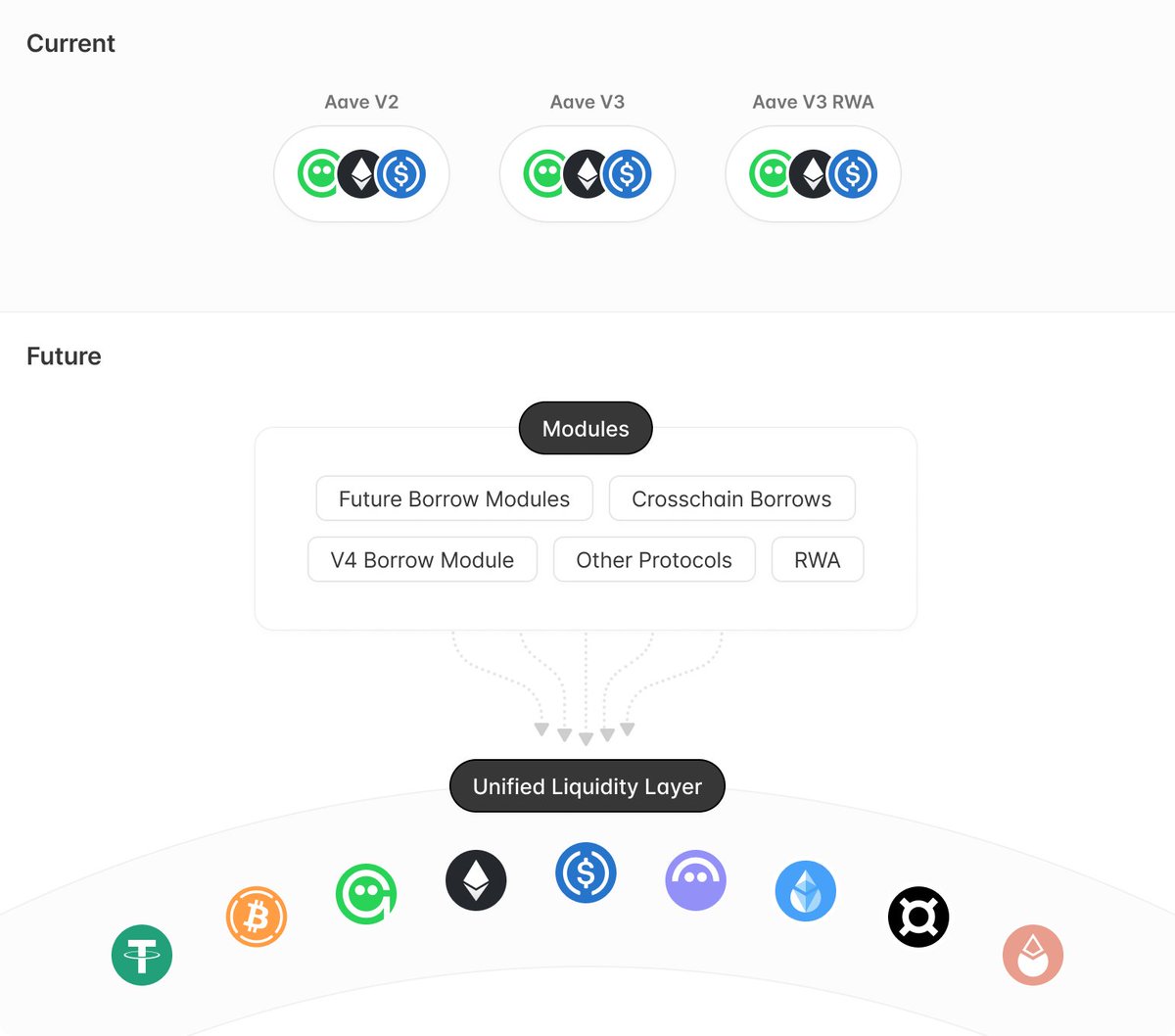

Aave V4 proposes the Unified Liquidity Layer, a more flexible and efficient approach to liquidity management. This design enables the modification of various modules without the need to migrate liquidity or disrupt existing integrations.

Aave V4's Fuzzy-controlled Interest Rates automate rate adjustments based on market conditions, optimising for both suppliers and borrowers. Using @Chainlink to enhance the precision of data feeds, setting new standards in capital efficiency.

Aave V4's Liquidity Premiums adjust borrowing costs in the same market based on collateral risk, ensuring fairer pricing for all. Higher risks incur higher premiums, while lower risks reduce costs.

Discover the full range of innovative features in Aave V4 by exploring the detailed proposal: governance.aave.com/t/temp-check-a…

Cross-Chain Liquidity Layer ⛓️

Aave 2030 is incrementally gearing towards becoming a chain-agnostic liquidity protocol. With CCIP, Superchains, and V4's Unified Liquidity Layer, Aave can enable secure infrastructure for cross-chain liquidity.

Aave 2030 is incrementally gearing towards becoming a chain-agnostic liquidity protocol. With CCIP, Superchains, and V4's Unified Liquidity Layer, Aave can enable secure infrastructure for cross-chain liquidity.

GHO 🤝 RWAs

Subject to the release of Aave V4, we in collaboration with DAO contributors, will focus on Real World Assets products built around GHO. This move will help scale GHO further as an infrastructure.

Subject to the release of Aave V4, we in collaboration with DAO contributors, will focus on Real World Assets products built around GHO. This move will help scale GHO further as an infrastructure.

Aave Network 🛜

A primary hub for GHO and the Aave Protocol with a network-agnostic, multichain approach, this expansion aims to create new opportunities for GHO's use cases.

A primary hub for GHO and the Aave Protocol with a network-agnostic, multichain approach, this expansion aims to create new opportunities for GHO's use cases.

Alongside these technical enhancements, we propose to future-proof the Aave visual identity, cementing our forward-thinking and innovative ethos. Read more about the proposed updates: governance.aave.com/t/temp-check-a…

Your feedback is crucial. We are committed to building in public together with the Aave community and the Aave DAO service providers. Join us to refine and realise the Aave 2030 vision, keeping the protocol at the forefront of DeFi innovation. governance.aave.com/t/temp-check-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh