🔸Some thoughts on the memecoin narrative

In 20/21 bull, if you were into memes, your options were limited, DOGE, SHIB, FLOKI and maybe few others, most of which were on Ethereum. And most did extremely well.

Enormous inflow of retail/liquidity + few memecoin options = parabolic moves

Things have changed quite a lot since.

1/ Tooling

Back then, deploying an erc20 token wasn't something that the average Joe could easily do. But today, anybody can do it.

Result?

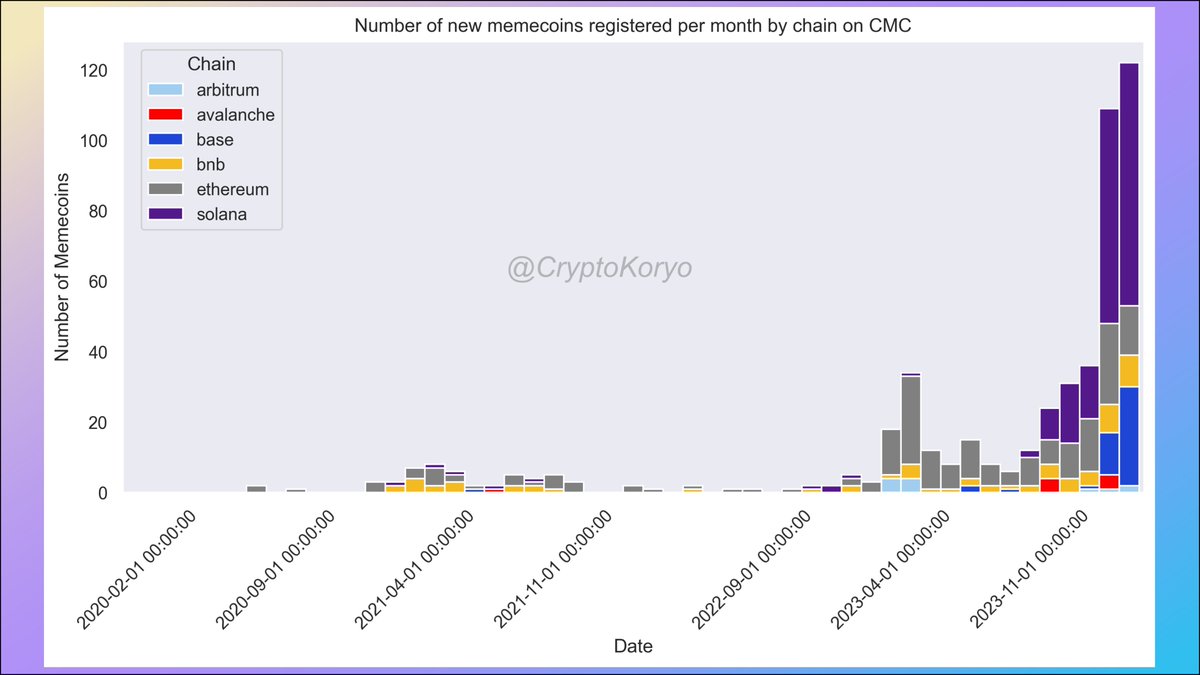

Number of memecoin erc-20 tokens going parabolic in 2024.

138 new memecoins registered on CoinMarketCap last month vs 18 in April 2023.

In reality, CMC captures less than 10% of all tokens so real numbers are much higher.

2/ Chain competition

Due to high gas fees, degen activity has moved (partially) away from Ethereum. We've seen it with Bonk on Solana and Bald on Base. But Solana is now the home of memecoins. Look at distribution of memecoins over time per chain.

Some chains are even launching meme grants/funds.

3/ Standards:

Up until 2023, erc20 was the only established standard for fungible tokens.

But then we saw BRC-20, followed by inscriptions on different EVM chains (SRC-20, DRC-20, ASC-20, etc. )

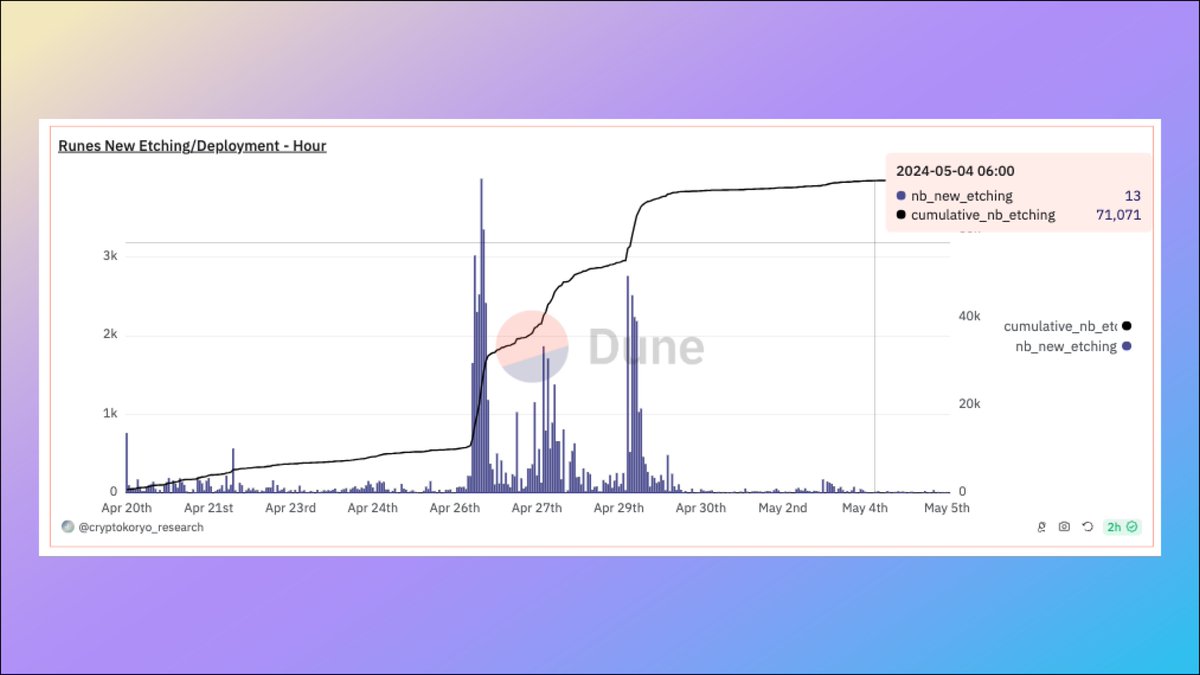

New standards continued to emerge: brc-721, DN404, ... and the most recent one Runes on Bitcoin.

In fact, only 3 weeks after their launch, there are already 70k rune collections on bitcoin.

Etching (deploying) a rune is extremely easy, just pick a name, supply, premine and you are good to go.

Finally, new tools @pumpdotfun make the whole process even easier (and more fair)?

🔸What does it mean?

In 2021, there were a handful of memecoins on ethereum and thousands of new retail users, millions in liquidity were joining crypto every day.

Today, there are thousands of memecoins launching on dozens of different chains and different standards.

How to possible find the next $PEPE , $WIF?

Will we even see a new >$1b memecoin in this cycle?

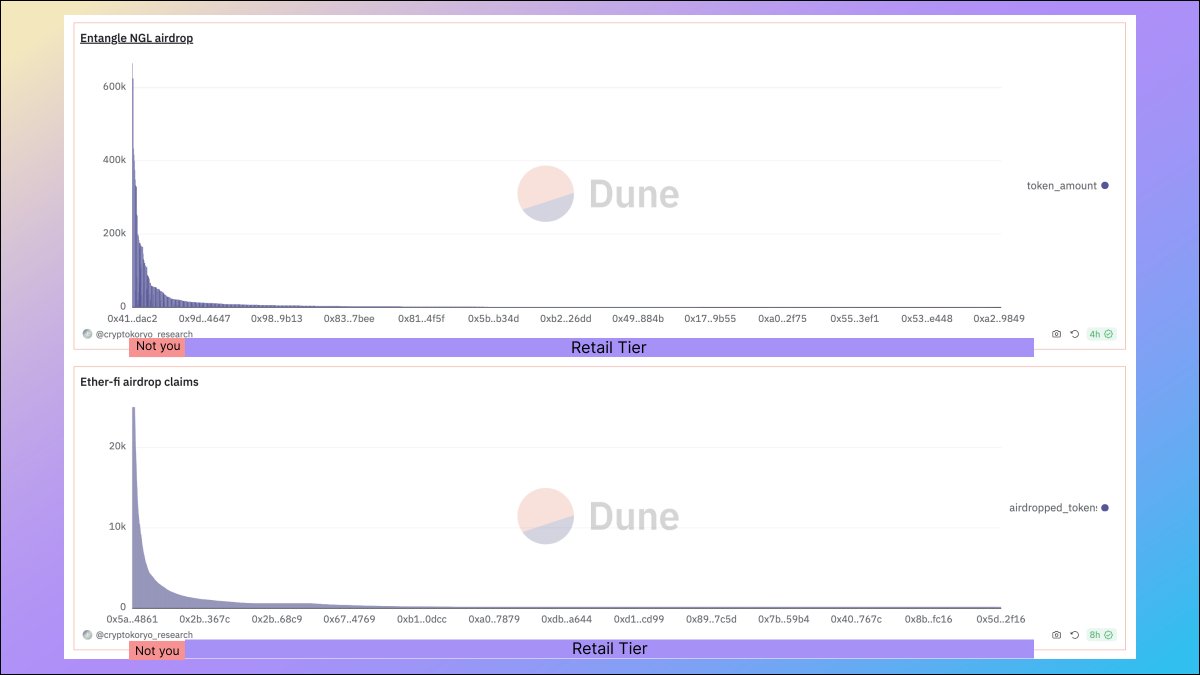

Considering the vast majority of these new memecoins will go to 0, you need a lot of diversification if you want to play that game (except for insiders).

Too little diversification (n<10) and your portfolio could go to 0 at anytime.

Too much diversification (n>10) and even a 20x on one of them wouldn't impact the PnL by much, plus the effort required to play the game is so much that you'd either burn out at some point or do some stupid mistakes (or both).

As I said, the number of possibilities is growing rapidly and for the vast majority of people, it's just not possible to consistently have a high win rate in this game.

N is large.

Win rate is low.

Average RR is so so.

Risk is extremely high.

Effort required is very high.

So, maybe in 21, we could say memes were a high risk high reward game. But I'm not sure that's much true anymore. It's more like high risk low reward for most.

Tldr:

In 2021, demand >> supply

In 2024, demand << supply

This is not just a bull market thing. Number of memecoins is just too high now and continues to go higher with a rapid pace.

And even In terms of strategies, if you go with the fully on-chain approach and try to be early, RR is great when it works but win rate is low. Conversely, if you go with the social approach of waiting for it to take over CT, the win rate would be higher but you would miss most of the RR.

Imo the best way to play the memecoin game is combining these two approaches.

There is no doubt that, among the thousands of memecoins launching each year, few of them will print good numbers.

The question is:

- How would you perform playing this game in 2024?

- How does it compare to holding bitcoin or some bluechip (memecoins)?

- Is it worth the effort?

- Do you have an edge?

I'm thinking of recording a video to share some data-driven tips on how to trade memecoins in 2024. Let me know if that is of interest.

In 20/21 bull, if you were into memes, your options were limited, DOGE, SHIB, FLOKI and maybe few others, most of which were on Ethereum. And most did extremely well.

Enormous inflow of retail/liquidity + few memecoin options = parabolic moves

Things have changed quite a lot since.

1/ Tooling

Back then, deploying an erc20 token wasn't something that the average Joe could easily do. But today, anybody can do it.

Result?

Number of memecoin erc-20 tokens going parabolic in 2024.

138 new memecoins registered on CoinMarketCap last month vs 18 in April 2023.

In reality, CMC captures less than 10% of all tokens so real numbers are much higher.

2/ Chain competition

Due to high gas fees, degen activity has moved (partially) away from Ethereum. We've seen it with Bonk on Solana and Bald on Base. But Solana is now the home of memecoins. Look at distribution of memecoins over time per chain.

Some chains are even launching meme grants/funds.

3/ Standards:

Up until 2023, erc20 was the only established standard for fungible tokens.

But then we saw BRC-20, followed by inscriptions on different EVM chains (SRC-20, DRC-20, ASC-20, etc. )

New standards continued to emerge: brc-721, DN404, ... and the most recent one Runes on Bitcoin.

In fact, only 3 weeks after their launch, there are already 70k rune collections on bitcoin.

Etching (deploying) a rune is extremely easy, just pick a name, supply, premine and you are good to go.

Finally, new tools @pumpdotfun make the whole process even easier (and more fair)?

🔸What does it mean?

In 2021, there were a handful of memecoins on ethereum and thousands of new retail users, millions in liquidity were joining crypto every day.

Today, there are thousands of memecoins launching on dozens of different chains and different standards.

How to possible find the next $PEPE , $WIF?

Will we even see a new >$1b memecoin in this cycle?

Considering the vast majority of these new memecoins will go to 0, you need a lot of diversification if you want to play that game (except for insiders).

Too little diversification (n<10) and your portfolio could go to 0 at anytime.

Too much diversification (n>10) and even a 20x on one of them wouldn't impact the PnL by much, plus the effort required to play the game is so much that you'd either burn out at some point or do some stupid mistakes (or both).

As I said, the number of possibilities is growing rapidly and for the vast majority of people, it's just not possible to consistently have a high win rate in this game.

N is large.

Win rate is low.

Average RR is so so.

Risk is extremely high.

Effort required is very high.

So, maybe in 21, we could say memes were a high risk high reward game. But I'm not sure that's much true anymore. It's more like high risk low reward for most.

Tldr:

In 2021, demand >> supply

In 2024, demand << supply

This is not just a bull market thing. Number of memecoins is just too high now and continues to go higher with a rapid pace.

And even In terms of strategies, if you go with the fully on-chain approach and try to be early, RR is great when it works but win rate is low. Conversely, if you go with the social approach of waiting for it to take over CT, the win rate would be higher but you would miss most of the RR.

Imo the best way to play the memecoin game is combining these two approaches.

There is no doubt that, among the thousands of memecoins launching each year, few of them will print good numbers.

The question is:

- How would you perform playing this game in 2024?

- How does it compare to holding bitcoin or some bluechip (memecoins)?

- Is it worth the effort?

- Do you have an edge?

I'm thinking of recording a video to share some data-driven tips on how to trade memecoins in 2024. Let me know if that is of interest.

• • •

Missing some Tweet in this thread? You can try to

force a refresh