1/ Introducing 3Jane — a path forward for EigenLayer growth through financialization.

3jane.xyz/whitepaper

3jane.xyz/whitepaper

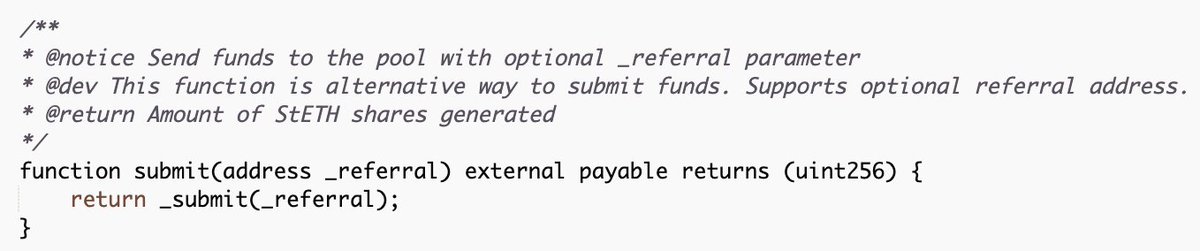

2/ 3Jane is a crypto-native derivatives protocol built on restaking. 3Jane unlocks a novel derivatives yield layer by enabling the collateralization of all exotic yield-bearing ETH variants in *options contracts*.

3/ Users can wrap natively restaked ETH, restaked LST's, eETH, and ezETH on 3Jane & earn *options premiums* yield on top of staking + restaking yield, enhancing overall ETH APY. Under the hood, 3Jane vaults sell deep out-of-the-money options & accrue premiums to depositors.

4/ 3Jane yield is denominated in cold hard ultra-sound money ETH. This makes 3Jane a unique, resilient, acyclic, and reliable on-chain ETH yield pond (via options exposure).

5/ 3Jane revolutionizes the way Ethereum is utilized by collateralizing the cryptoeconomic security of any PoS system in derivatives contracts, allowing users to generate options yield whilst contributing to the overarching security and robustness of the crypto economy.

6/ How is this *a* path forward for EigenLayer?

Earlier I made a claim that EigenLayer is facing a major yield crisis due to the disparity between the amount of security deposited into EL (~$15B) and how much security AVS's *actually* need to pay for.

Earlier I made a claim that EigenLayer is facing a major yield crisis due to the disparity between the amount of security deposited into EL (~$15B) and how much security AVS's *actually* need to pay for.

https://twitter.com/1345846939359744000/status/1782253746615177568

7/ 3Jane unironically solves this. In a best-case scenario, restaked ETH holders have the means to earn 10-15% APY in *ETH* terms from ETH staking (~3% APY) + 3Jane selling vol (~10-15% APY). This does *not* include yield from AVS / EigenLayer inflationary tokenomic intervention.

8/ By sourcing yield within DeFi derivatives (top-down), 3Jane mitigates the opportunity costs of holding restaked ETH and proudly alleviates the burden off of AVS security budgets (bottom-up).

9/ This allows AVS teams to continue focusing on doing what they do best: building DA layers, new VM's, keeper networks, oracle networks, bridges, threshold cryptography schemes, FHE, TEE, etc. and ushering in a new age for crypto.

10/ 3Jane is proof-of-concept of the power of tokenizing / settling cryptoeconomic security and derivatives all on a shared ledger, and a major step towards the financialization of EigenLayer.

Mainnet *very* Soon

Follow @3janexyz

Mainnet *very* Soon

Follow @3janexyz

11/ Disclosure: 3Jane will *not* be offered to persons or entities who are U.S. Persons, Restricted Persons, or Sanctioned Persons. Access and use by such persons is expressly prohibited.

12/ fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh