I read some of the VC blogs about memecoins.

There are some interesting takes and genuine respect to all writers.

But imho the existence of these blog posts is EXACTLY why people trade meme coins.

No, memecoins are not a trojan horse for culture (yet), and I would argue they are not even a particularly effective GTM strategy.

I understand the need to frame memecoins in these lights to make them palatable to LPs - I had LPs once too.

But let's be real.

You and I trade memecoins for one thing:

Because "Fuck it"

Let me explain.

This is merely continuation of a bigger trend you see across the world in developed countries: the future that was promised to older generations is no longer available to the young.

My parents' generation's dream was to have a good stable job, buy a house, raise 2 kids.

The most common dream when I was a college student?Be a billionaire tech founder.

Why?

Well, one because everyone watched The Social Network, missed the entire fucking point of the movie, and idolized Zuck. (Just like they did with the Wolf of Wall Street, but that's for another rant)

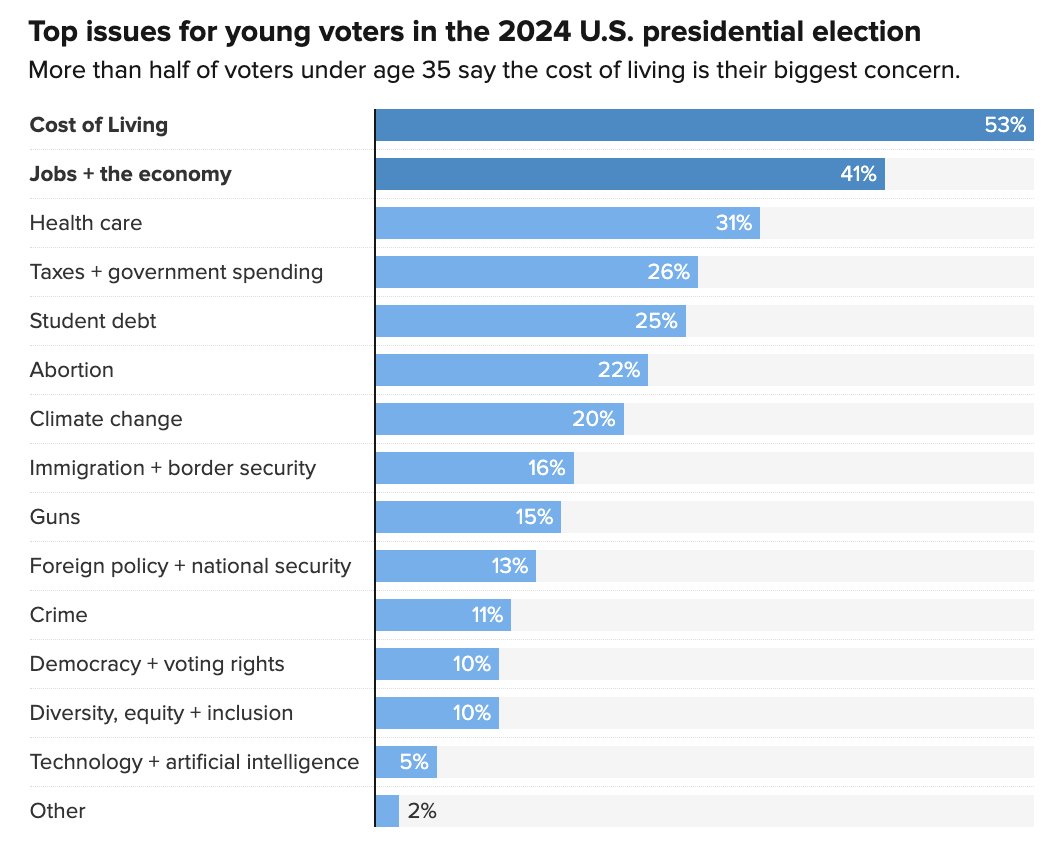

But also maybe because median home price since 1985 is up 80% after adjusting for inflation, and household price-to-income is more than 2x compared to our grandparents'?

Or maybe because 50% of people make less than their parents did at 30 today, compare to 90%+ in 1940.

Or maybe because the world seems richer than it's ever been, but somehow the young is inheriting less than half of what they did before.

Or maybe because simply working hard and being a good employee no longer offers you the same opportunities that were offered to your parents.

So if there's no way to ascend the social ladder and it's going to be a lifetime of wage-cucking anyway, why not flip the coin and see if you can be the next college dropout billionaire entrepreneur?

Then along came crypto as an extension of this on Trenbolone.

Today, nearly 2/3 of young adults believe the stock market is a great way to build wealth...

But 90% of young people are too broke paying for rising living costs to invest their capital at 7% average returns a year.

So, crypto's massive volatility, where you hear stories of people magically becoming millionaires overnight, emerged as an unsolved game - where if you're early and smart, maybe a bit ballsy, you could have a shot at a good life.

To the outside world, it's *slightly* more respectable than the casino, and infinitely more intellectually stimulating for the smart boys and girls among us.

You may say , "well acktually...since the Dutch tulip bulb peddlers in the 1600s humans have been enticed by "make money fast" speculative games! You should read 'Devil Takes the Hindmost!'"

Yes - but the point I'm making is that what has been historically driven by greed is now more and more driven by desperation.

Want to get a whiff of this? Talk to anyone in their 20s in Hong Kong, in Korea, in the US etc. etc.

For a shot at a comfortable life, young people must make life decisions further and further out the risk curve.

And they think - correction - they KNOW that much of this was due to the financial decisions made by the past generation.

And now the boomers also want to take the crypto game away from them through regulatory labyrinths.

They took away ICOs for your protection, so you get to buy coins at 500x the seed price when they finally get listed.

They call it "rat poison", while pocketing fat fees from clients who are buying crypto from them.

Oh and these clients? Yup, same cabal - pumping billions into VC funds that seek to privatize more and more of the game.

THIS why people are trading meme coins.

Yes it's greed, it's "buy coins with no massive supply overhang from VCs", its craps for the ADHD generation that grew up with brain rot from smart phones.

But it's also a "fuck it - nothing else works"

But more importantly, it's a "fuck you" - to the generation they feel has failed them.

The same generation that now seeks to take away the one thing that seems to offer them a way out - through incomprehensible regulations and increasingly privatized opportunities.

Or maybe I'm wrong.

Maybe meme coins really are the next great GTM strategy for startups.

GM.

There are some interesting takes and genuine respect to all writers.

But imho the existence of these blog posts is EXACTLY why people trade meme coins.

No, memecoins are not a trojan horse for culture (yet), and I would argue they are not even a particularly effective GTM strategy.

I understand the need to frame memecoins in these lights to make them palatable to LPs - I had LPs once too.

But let's be real.

You and I trade memecoins for one thing:

Because "Fuck it"

Let me explain.

This is merely continuation of a bigger trend you see across the world in developed countries: the future that was promised to older generations is no longer available to the young.

My parents' generation's dream was to have a good stable job, buy a house, raise 2 kids.

The most common dream when I was a college student?Be a billionaire tech founder.

Why?

Well, one because everyone watched The Social Network, missed the entire fucking point of the movie, and idolized Zuck. (Just like they did with the Wolf of Wall Street, but that's for another rant)

But also maybe because median home price since 1985 is up 80% after adjusting for inflation, and household price-to-income is more than 2x compared to our grandparents'?

Or maybe because 50% of people make less than their parents did at 30 today, compare to 90%+ in 1940.

Or maybe because the world seems richer than it's ever been, but somehow the young is inheriting less than half of what they did before.

Or maybe because simply working hard and being a good employee no longer offers you the same opportunities that were offered to your parents.

So if there's no way to ascend the social ladder and it's going to be a lifetime of wage-cucking anyway, why not flip the coin and see if you can be the next college dropout billionaire entrepreneur?

Then along came crypto as an extension of this on Trenbolone.

Today, nearly 2/3 of young adults believe the stock market is a great way to build wealth...

But 90% of young people are too broke paying for rising living costs to invest their capital at 7% average returns a year.

So, crypto's massive volatility, where you hear stories of people magically becoming millionaires overnight, emerged as an unsolved game - where if you're early and smart, maybe a bit ballsy, you could have a shot at a good life.

To the outside world, it's *slightly* more respectable than the casino, and infinitely more intellectually stimulating for the smart boys and girls among us.

You may say , "well acktually...since the Dutch tulip bulb peddlers in the 1600s humans have been enticed by "make money fast" speculative games! You should read 'Devil Takes the Hindmost!'"

Yes - but the point I'm making is that what has been historically driven by greed is now more and more driven by desperation.

Want to get a whiff of this? Talk to anyone in their 20s in Hong Kong, in Korea, in the US etc. etc.

For a shot at a comfortable life, young people must make life decisions further and further out the risk curve.

And they think - correction - they KNOW that much of this was due to the financial decisions made by the past generation.

And now the boomers also want to take the crypto game away from them through regulatory labyrinths.

They took away ICOs for your protection, so you get to buy coins at 500x the seed price when they finally get listed.

They call it "rat poison", while pocketing fat fees from clients who are buying crypto from them.

Oh and these clients? Yup, same cabal - pumping billions into VC funds that seek to privatize more and more of the game.

THIS why people are trading meme coins.

Yes it's greed, it's "buy coins with no massive supply overhang from VCs", its craps for the ADHD generation that grew up with brain rot from smart phones.

But it's also a "fuck it - nothing else works"

But more importantly, it's a "fuck you" - to the generation they feel has failed them.

The same generation that now seeks to take away the one thing that seems to offer them a way out - through incomprehensible regulations and increasingly privatized opportunities.

Or maybe I'm wrong.

Maybe meme coins really are the next great GTM strategy for startups.

GM.

As always @GwartyGwart , my spiritual guiding light/ what’s left of my conscience, paints a picture of what the status quo is like

My thread is about the why

My thread is about the why

https://twitter.com/gwartygwart/status/1784352365648171312

• • •

Missing some Tweet in this thread? You can try to

force a refresh