Good morning! I’m so excited to share an update to FREOPP’s analysis of college return on investment (ROI).

We calculate the financial value of 53,000 college degrees & certificates, which can help students and other stakeholders better navigate the college decision.

We calculate the financial value of 53,000 college degrees & certificates, which can help students and other stakeholders better navigate the college decision.

First of all, a link to the full report: freopp.org/does-college-p…

ROI is defined as the increase in lifetime earnings from having a particular college degree, accounting for the cost of tuition and fees, time spent out of the labor force, and the risk of not finishing.

Details of the calculation in the screenshots.

Details of the calculation in the screenshots.

FREOPP’s ROI report builds on existing measures in a few ways.

1) We look at ROI for each major, not just each school

2) We look at lifetime earnings, not just the first few years after college

3) We account for each degree program’s unique demographics & selection bias

1) We look at ROI for each major, not just each school

2) We look at lifetime earnings, not just the first few years after college

3) We account for each degree program’s unique demographics & selection bias

This report updates our 2021 ROI analysis. So what’s new?

- More years of earnings data

- Better counterfactual that accounts for the socioeconomic status of students who enroll in different schools

- New data on federal funding for negative-ROI programs

- More years of earnings data

- Better counterfactual that accounts for the socioeconomic status of students who enroll in different schools

- New data on federal funding for negative-ROI programs

We also have a BRAND NEW dashboard you can use to view and download all estimates of ROI for a particular state, institution, or major.

freopp.wpengine.com/roi-undergradu…

freopp.wpengine.com/roi-undergradu…

Now, on to the results!

Topline finding: 31% of higher ed programs (weighted by enrollment) have a negative ROI.

College is a good bet most of the time. But there are big exceptions!

Topline finding: 31% of higher ed programs (weighted by enrollment) have a negative ROI.

College is a good bet most of the time. But there are big exceptions!

Field of study is a critical factor. Engineering, computer science, nursing, and economics have a far higher payoff than other majors.

But your college major isn’t everything. Business, for instance, has a disproportionate number of programs with ROI > $1 million. It also has a bunch of programs in negative-ROI territory.

Completion rate is also critical. Schools with a high on-time graduation rate are far more likely to pay off, even for traditionally lower-paying majors.

We also look at ROI for non-four year degrees. Overall, these have a lower payoff than BAs.

But there are BIG exceptions. Certificates in the technical trades have a higher payoff than the median BA.

But there are BIG exceptions. Certificates in the technical trades have a higher payoff than the median BA.

So, which programs do the best?

Since you asked, the top program is computer engineering at Princeton. ROI = $7.1 million.

But Princeton is ultra-selective so that stat isn’t useful for most folks.

Since you asked, the top program is computer engineering at Princeton. ROI = $7.1 million.

But Princeton is ultra-selective so that stat isn’t useful for most folks.

Instead, we create a measure called the “mobility index” which multiplies each program’s ROI by its enrollment count.

This metric measures both financial return AND inclusivity.

This metric measures both financial return AND inclusivity.

The best program anywhere in the US is the nursing degree at Chamberlain University, which has an ROI of $842,000 and enrolls 36,000 students.

Nursing and business programs at big schools dominate this list.

Nursing and business programs at big schools dominate this list.

What about grad school? It’s complicated.

Med school & law school have huge payoffs.

But nearly half of master’s degree programs leave students in the red.

Med school & law school have huge payoffs.

But nearly half of master’s degree programs leave students in the red.

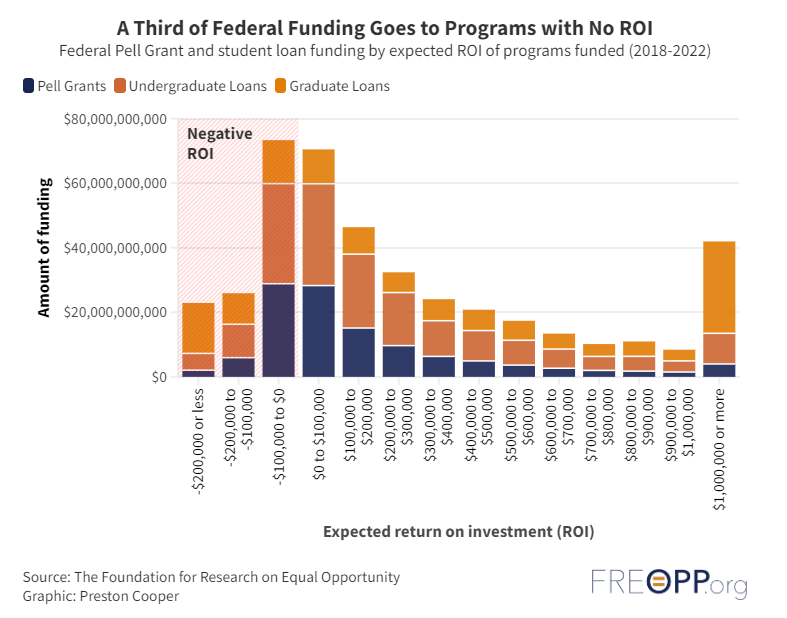

How much government funding goes to programs with no return? We can answer that thanks to new data.

Programs in the ROI database received $418bn in funding from 2018 to 2022.

Of that, $122bn (29%) flowed to negative-ROI programs.

Programs in the ROI database received $418bn in funding from 2018 to 2022.

Of that, $122bn (29%) flowed to negative-ROI programs.

I’ll wrap things up with a few broad takeaways.

1. Field of study is critical at every level. The value of “college” is next to a meaningless concept – “college” is actually lots of different programs/paths.

1. Field of study is critical at every level. The value of “college” is next to a meaningless concept – “college” is actually lots of different programs/paths.

2. Many degrees aren’t good investments. This is especially true for two-year degrees and master’s degrees, where nearly half of programs don’t pay off.

Schools need to take negative ROI more seriously and implement reforms to turn this around.

Schools need to take negative ROI more seriously and implement reforms to turn this around.

3. ROI isn’t everything. I don’t mean to suggest here that ROI should be the only factor we care about in higher ed. We don’t all need to be engineers. The “joy factor” matters too when choosing a major.

But ROI is important and we can’t neglect it.

But ROI is important and we can’t neglect it.

That’s all for now! I’ll try to do some deeper dives into the results over the coming days.

Here’s the report again:

And here’s the data dashboard: freopp.org/does-college-p…

freopp.wpengine.com/roi-undergradu…

Here’s the report again:

And here’s the data dashboard: freopp.org/does-college-p…

freopp.wpengine.com/roi-undergradu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh