Learn about the 3 financial statements, and how they are all connected

In just a few minutes, I'm going to teach you the most important concepts behind the Financial Statements...

and we're going to have a TON of fun along the way...

In just a few minutes, I'm going to teach you the most important concepts behind the Financial Statements...

and we're going to have a TON of fun along the way...

The 3 financial statements are:

1. The Profit & Loss

2. The Balance Sheet

3. The Statement of Cash Flows

You may also hear of the Statement of Changes in Equity, and Notes to the financial statements, but those aren't as commonly included

1. The Profit & Loss

2. The Balance Sheet

3. The Statement of Cash Flows

You may also hear of the Statement of Changes in Equity, and Notes to the financial statements, but those aren't as commonly included

Before we dive into each statement...

It's important to understand the difference between:

the CASH basis

→ treats money in as income

→ money out as expenses

the ACCRUAL basis

→ treats amounts EARNED as income

→ amounts INCURRED as expenses

It's important to understand the difference between:

the CASH basis

→ treats money in as income

→ money out as expenses

the ACCRUAL basis

→ treats amounts EARNED as income

→ amounts INCURRED as expenses

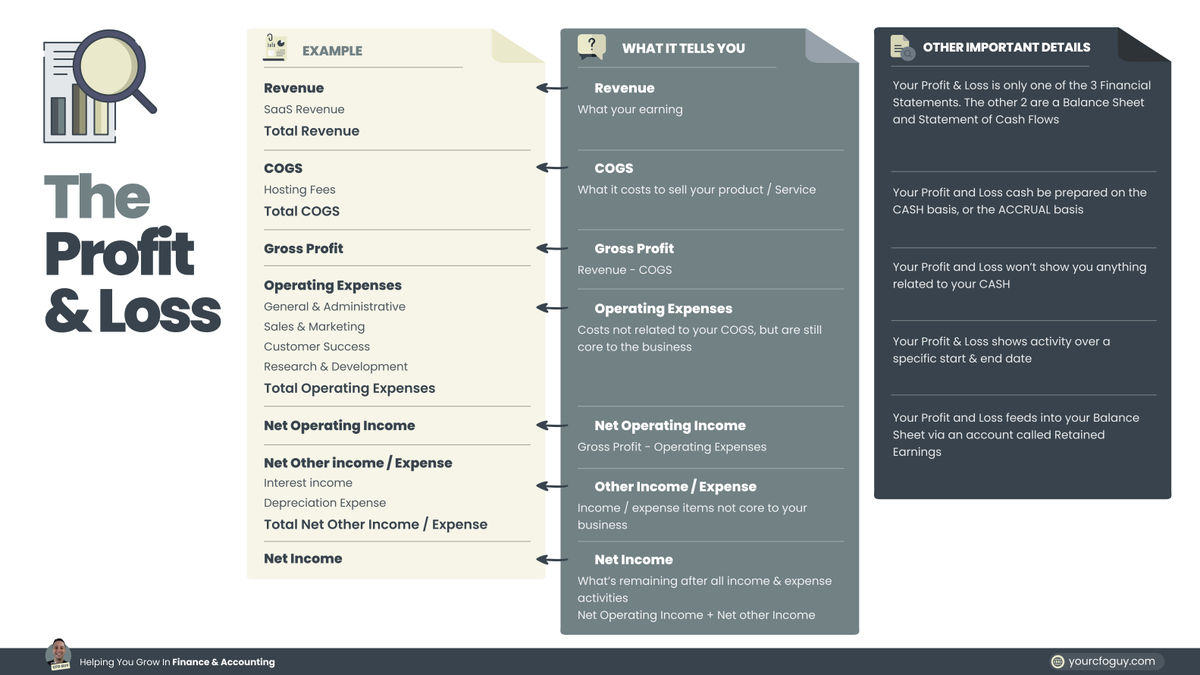

Statement #1: The Profit & Loss

Also referred to as the Income Statement

This tells you what you about your

INCOME

EXPENSES

and PROFITS

it sums up the data from the start & end date selected

Let's do a deep dive on each section 👇

Also referred to as the Income Statement

This tells you what you about your

INCOME

EXPENSES

and PROFITS

it sums up the data from the start & end date selected

Let's do a deep dive on each section 👇

Revenue

This is how much you are generating in income from your customers

Under the accrual basis of accounting, this reflects the amounts EARNED by delivering your product or service

Under the cash basis, this would reflect amounts RECEIVED from customers

This is how much you are generating in income from your customers

Under the accrual basis of accounting, this reflects the amounts EARNED by delivering your product or service

Under the cash basis, this would reflect amounts RECEIVED from customers

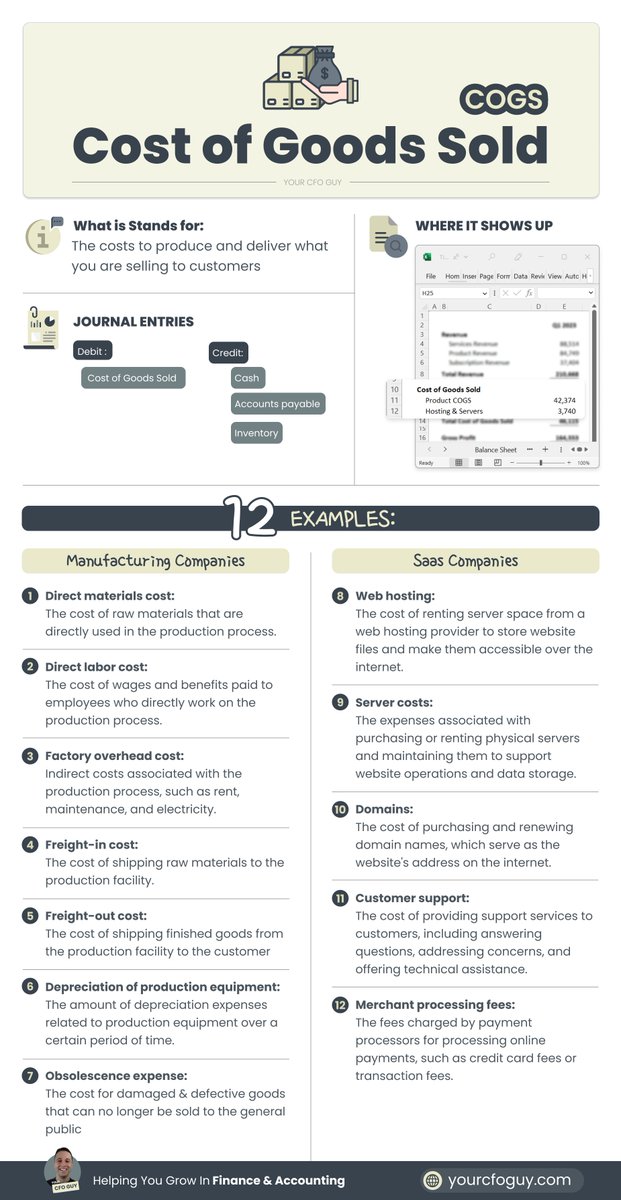

Cost of Goods Sold (COGS)

This represents the cost to produce & deliver your product or service

If you sell widgets, this would be the cost associated with producing the widget

If you sell software, this would include the cost to host your tech

This represents the cost to produce & deliver your product or service

If you sell widgets, this would be the cost associated with producing the widget

If you sell software, this would include the cost to host your tech

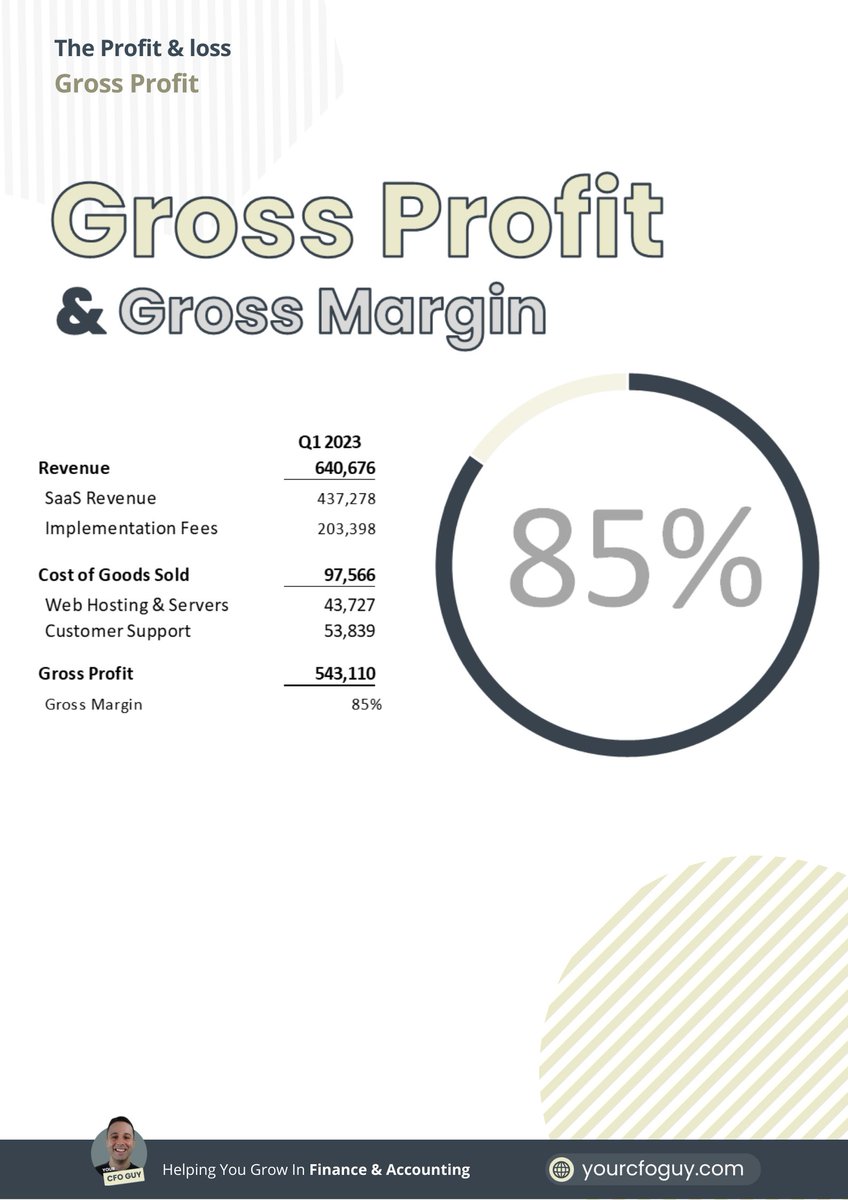

Gross Profit

Now we get to our first profitability metric...Gross profit

Formula → Revenue - COGS

This tells you how much you are netting after each sale

The higher the gross profit, the more you can invest into all other areas of your business

Now we get to our first profitability metric...Gross profit

Formula → Revenue - COGS

This tells you how much you are netting after each sale

The higher the gross profit, the more you can invest into all other areas of your business

Operating Expenses (opex)

These represent the cost to operate your business

Most common ones are payroll, rent, and sales & marketing

These represent the cost to operate your business

Most common ones are payroll, rent, and sales & marketing

Net Operating Income

Here comes our 2nd profitability metric

Formula → Gross Profit - Opex

This shows how much is left over from your sales after subtracting out the costs to operate your business

Here comes our 2nd profitability metric

Formula → Gross Profit - Opex

This shows how much is left over from your sales after subtracting out the costs to operate your business

Other Income / Other Expense

Now we get to our "other" items

These are income & expense items that don't relate to your core business, but still are part of your business activity

Together, they make up your net operating income

Formula → Other Income - Other Expense

Now we get to our "other" items

These are income & expense items that don't relate to your core business, but still are part of your business activity

Together, they make up your net operating income

Formula → Other Income - Other Expense

Net Income

Here comes the grand daddy profitability metric

This shows you your total income - your total expenses

it can be shown before tax, or after tax

and this feeds into your retained earnings (more on that soon)

Here comes the grand daddy profitability metric

This shows you your total income - your total expenses

it can be shown before tax, or after tax

and this feeds into your retained earnings (more on that soon)

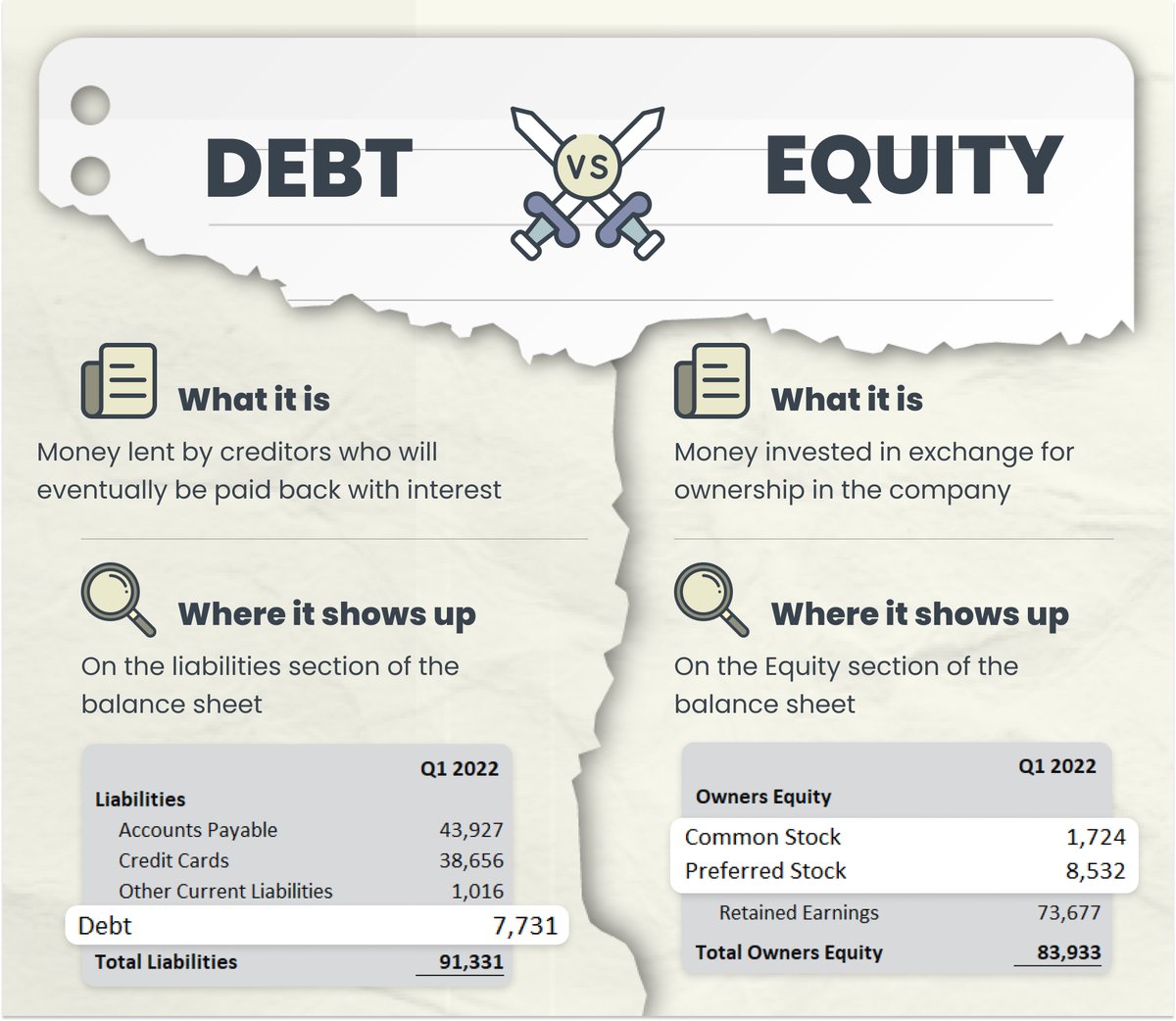

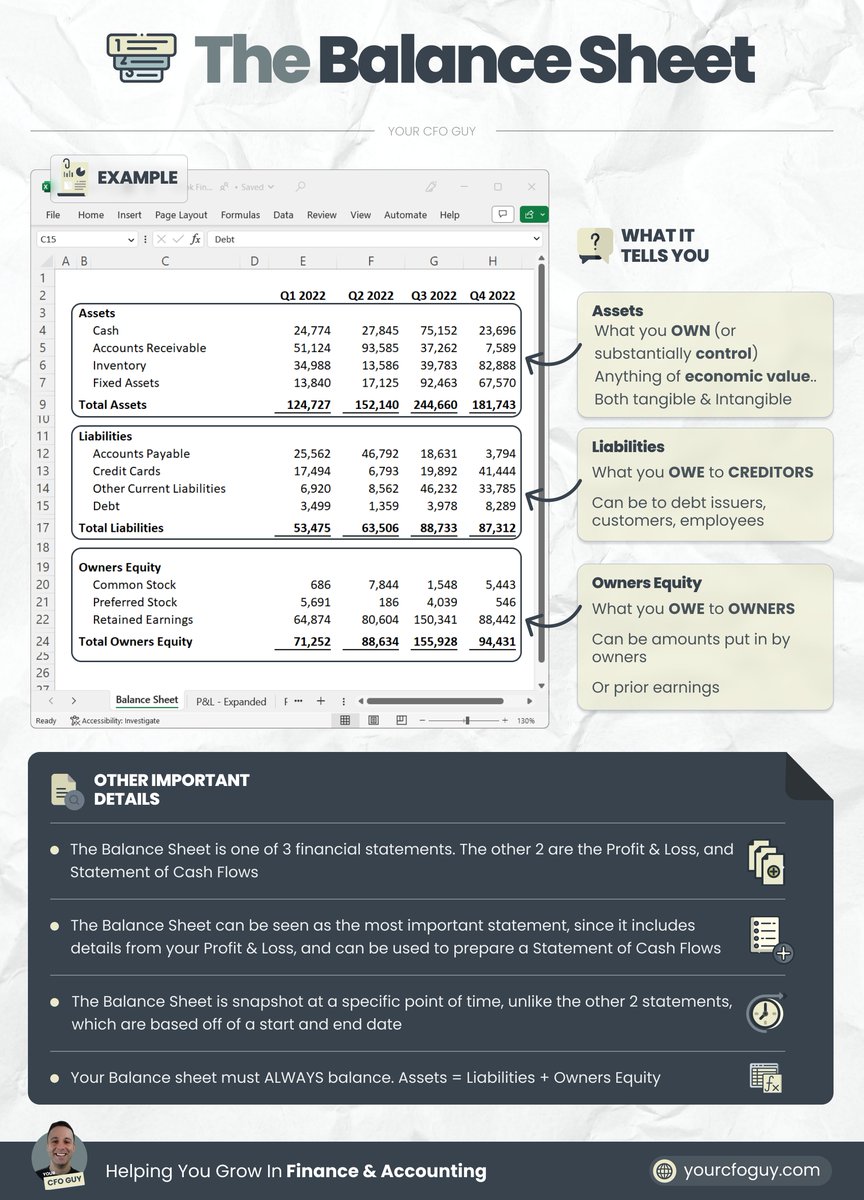

Statement #2: The Balance Sheet

Also referred to as the Statement of Financial Position

this shows you a SNAPSHOT of your business, and it's net worth

It is shown on a CUMULATIVE basis...

and is separated by:

Assets

Liabilities

Owners Equity

Let's dive into each 👇

Also referred to as the Statement of Financial Position

this shows you a SNAPSHOT of your business, and it's net worth

It is shown on a CUMULATIVE basis...

and is separated by:

Assets

Liabilities

Owners Equity

Let's dive into each 👇

Assets

These are items of ECONOMIC VALUE (physical and intangible)

that the business OWNS

or substantially CONTROLS

These are items of ECONOMIC VALUE (physical and intangible)

that the business OWNS

or substantially CONTROLS

Liabilities

These are amounts owed to CREDITORS

These creditors can be:

→ vendors (IE, you purchased something)

→ customers (IE, you owe them your product / service)

→ employees (IE, payroll)

→ owners (IE, if it's a loan)

These are amounts owed to CREDITORS

These creditors can be:

→ vendors (IE, you purchased something)

→ customers (IE, you owe them your product / service)

→ employees (IE, payroll)

→ owners (IE, if it's a loan)

Owners Equity

The final section of the balance sheet

Shows you what you owe to the OWNERS of the business based off of:

→ amounts contributed

→ prior earnings & losses not yet distributed

the key thing is that Owners Equity is UNCAPPED....

while Liabilities are CAPPED

The final section of the balance sheet

Shows you what you owe to the OWNERS of the business based off of:

→ amounts contributed

→ prior earnings & losses not yet distributed

the key thing is that Owners Equity is UNCAPPED....

while Liabilities are CAPPED

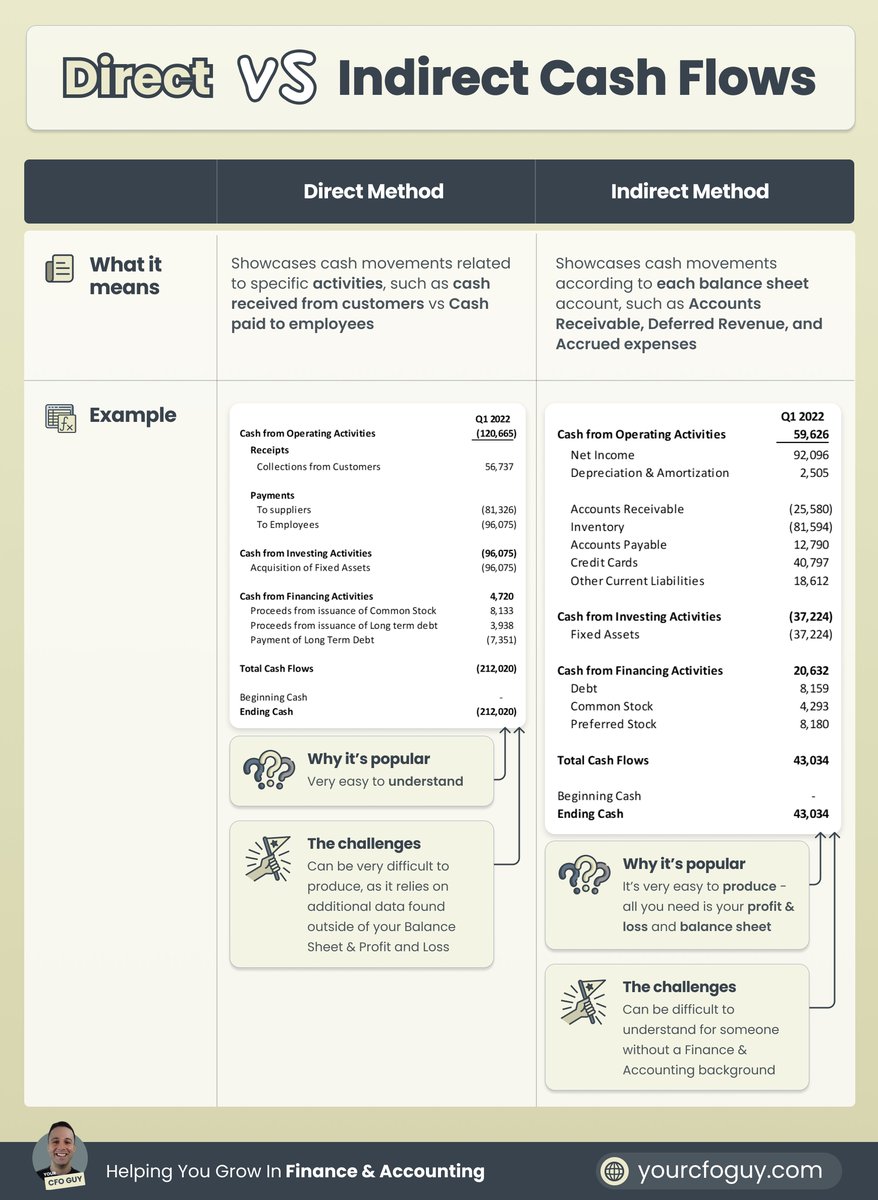

3rd statement: Statement of Cash Flows

This statement has one purpose:

To tell you where your cash went

It can be presented based off of:

the DIRECT method

and the INDIRECT method

and is split between cash from:

OPERATING activities

INVESTING activities

FINANCE activities

This statement has one purpose:

To tell you where your cash went

It can be presented based off of:

the DIRECT method

and the INDIRECT method

and is split between cash from:

OPERATING activities

INVESTING activities

FINANCE activities

Direct method vs Indirect Method

DIRECT method → easy to understand format, but is very difficult to produce

INDIRECT method → less intuitive format, but way easier to produce

Indirect method is most commonly used, and just requires your P&L and BS to produce

DIRECT method → easy to understand format, but is very difficult to produce

INDIRECT method → less intuitive format, but way easier to produce

Indirect method is most commonly used, and just requires your P&L and BS to produce

Sections of the Statement of Cash Flows

Operating → cash movements related to operating your business

Investing → cash movements from assets you've invested in long term

Financing → cash movements from debt or fundraises

Operating → cash movements related to operating your business

Investing → cash movements from assets you've invested in long term

Financing → cash movements from debt or fundraises

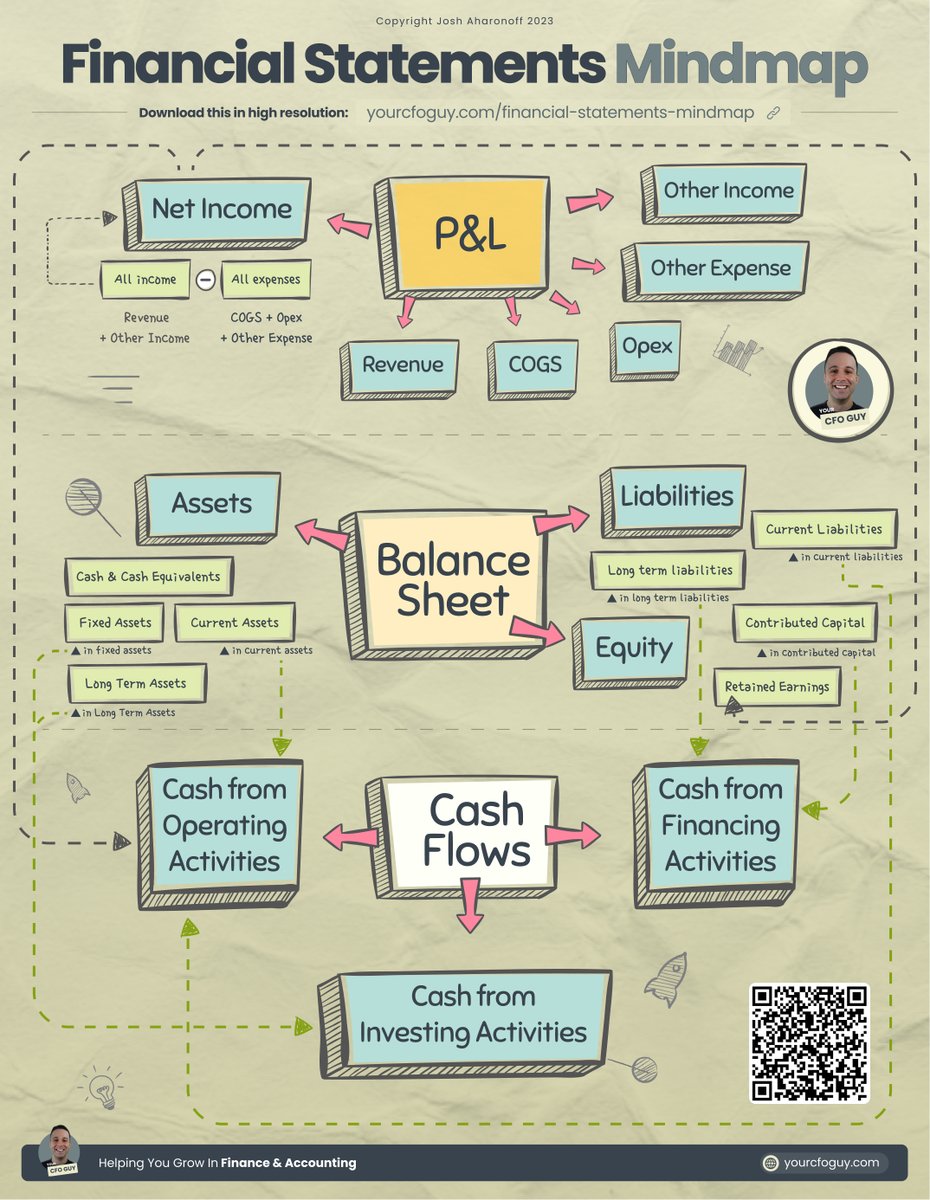

How all 3 statements are connected

The Balance Sheet PULLS from the P&L

Net Income from P&L → goes to Retained Earnings on Balance Sheet

There are also a number of shared journal entries...

such as depreciation / accumulated depreciation (more in the infographic below)

The Balance Sheet PULLS from the P&L

Net Income from P&L → goes to Retained Earnings on Balance Sheet

There are also a number of shared journal entries...

such as depreciation / accumulated depreciation (more in the infographic below)

The Statement of Cash Flows PULLS from both the

Balance Sheet → all accounts other than cash, accumulated depreciation / amortization, and retained earnings

Income Statement → Net Income, Depreciation, and Amortization

More details in the infographic below

Balance Sheet → all accounts other than cash, accumulated depreciation / amortization, and retained earnings

Income Statement → Net Income, Depreciation, and Amortization

More details in the infographic below

TL;DR

The 3 statements are the:

Profit & Loss → shows your income / expenses / net profits

Balance Sheet → shows your cumulative net worth

Statement of Cash flows → shows where your cash is going

See infographic below on how they are all connected

The 3 statements are the:

Profit & Loss → shows your income / expenses / net profits

Balance Sheet → shows your cumulative net worth

Statement of Cash flows → shows where your cash is going

See infographic below on how they are all connected

𝗔𝗻𝗱 𝘁𝗵𝗮𝘁'𝘀 𝗮 𝘄𝗿𝗮𝗽! 🚩🚩

𝗠𝗮𝗻...𝘁𝗵𝗮𝘁 𝘁𝗼𝗼𝗸 𝗮 𝗟𝗢𝗡𝗚 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗽𝗿𝗼𝗱𝘂𝗰𝗲

𝗜𝗳 𝘆𝗼𝘂 𝗲𝗻𝗷𝗼𝘆𝗲𝗱 𝘁𝗵𝗶𝘀, 𝗰𝗼𝗻𝘀𝗶𝗱𝗲𝗿 j𝗼𝗶𝗻𝗶𝗻𝗴 𝗺𝘆 𝗻𝗲𝘄𝘀𝗹𝗲𝘁𝘁𝗲𝗿 yourcfoguy.com/newsletter

𝗠𝗮𝗻...𝘁𝗵𝗮𝘁 𝘁𝗼𝗼𝗸 𝗮 𝗟𝗢𝗡𝗚 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗽𝗿𝗼𝗱𝘂𝗰𝗲

𝗜𝗳 𝘆𝗼𝘂 𝗲𝗻𝗷𝗼𝘆𝗲𝗱 𝘁𝗵𝗶𝘀, 𝗰𝗼𝗻𝘀𝗶𝗱𝗲𝗿 j𝗼𝗶𝗻𝗶𝗻𝗴 𝗺𝘆 𝗻𝗲𝘄𝘀𝗹𝗲𝘁𝘁𝗲𝗿 yourcfoguy.com/newsletter

• • •

Missing some Tweet in this thread? You can try to

force a refresh