Every trader knows the Turtle Soup is the highest risk to reward strategy you can use

The best traders know how to execute using a simple strategy

Often overcomplicated, rarely practically taught - I give you a full approach to the Turtle Soup

[🧵 thread]

The best traders know how to execute using a simple strategy

Often overcomplicated, rarely practically taught - I give you a full approach to the Turtle Soup

[🧵 thread]

Before we get started, let me be clear

Yes, this can change your trading forever

No, it will not make you rich overnight

It will take practice and time to master

Now that we've got that out of the way, let's get started...

Yes, this can change your trading forever

No, it will not make you rich overnight

It will take practice and time to master

Now that we've got that out of the way, let's get started...

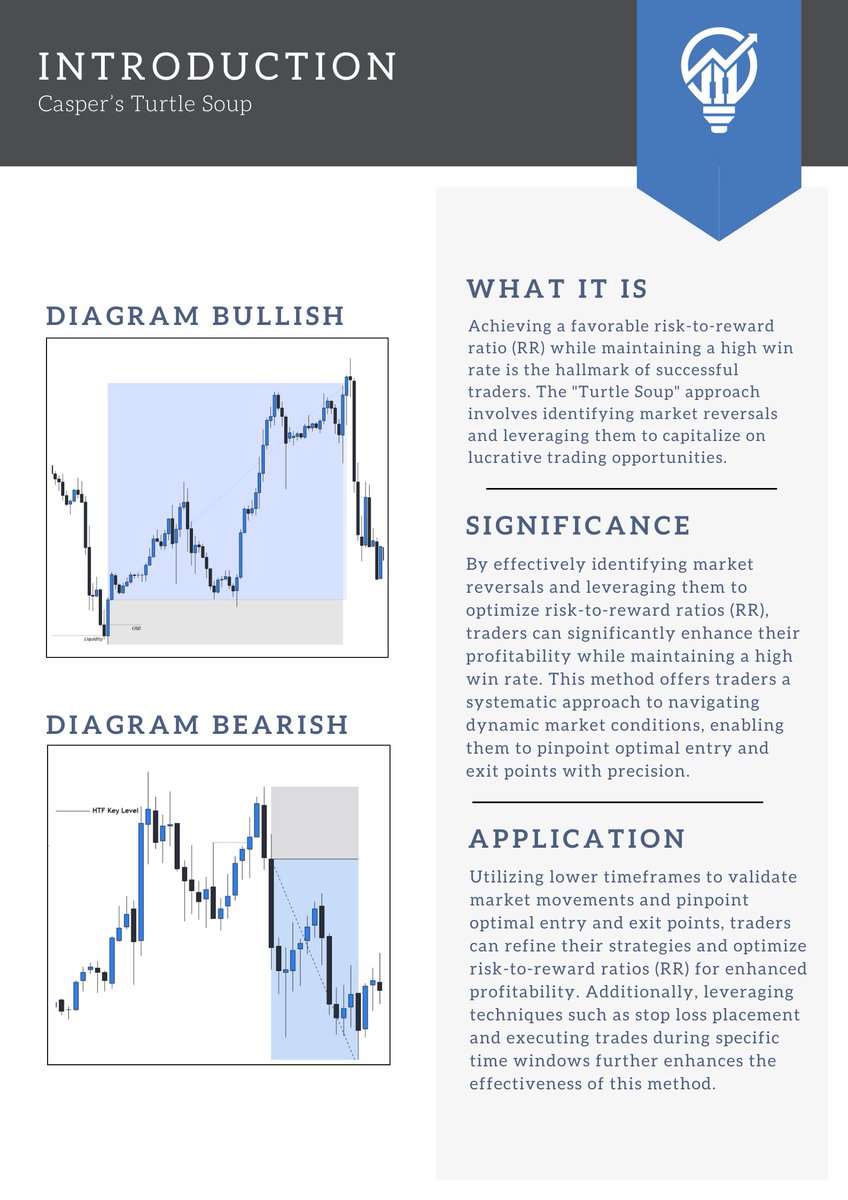

Turtle soup = catching the run on stops

Often overcomplicated, rarely understood

Before market structure shifts or any other signature in price, turtle soup occurs

I've simplified this into a full entry strategy that anyone can use

No mystery, no bullshit

👇

Often overcomplicated, rarely understood

Before market structure shifts or any other signature in price, turtle soup occurs

I've simplified this into a full entry strategy that anyone can use

No mystery, no bullshit

👇

To understand WHEN and WHERE to look for turtle soup

You must understand the context of the market

You do this by pairing moves from IRL to ERL or vice versa on a higher time frame

With market maker models on a lower time frame

You must understand the context of the market

You do this by pairing moves from IRL to ERL or vice versa on a higher time frame

With market maker models on a lower time frame

In every reversal lies a change in the state of delivery

Change in state of delivery = price going from bullish to bearish or vice versa

This can be visualized when the liquidity raid candle is immediately engulfed by the very next candle

This is a confirmation of the turtle soup

Change in state of delivery = price going from bullish to bearish or vice versa

This can be visualized when the liquidity raid candle is immediately engulfed by the very next candle

This is a confirmation of the turtle soup

High time frame IRL to ERL

+

Lower time frame market maker model

+

Change in the state of delivery during kill zone

=

Turtle soup entry

Stops can be placed at near by structure

If you pair with other concepts, such as inverted FVGs

The setup is higher probability

+

Lower time frame market maker model

+

Change in the state of delivery during kill zone

=

Turtle soup entry

Stops can be placed at near by structure

If you pair with other concepts, such as inverted FVGs

The setup is higher probability

Full video on this strategy:

If you want to trade these concepts with me live 3 days per week

With me watching over your shoulder calling out trades

Reviewing your trade journal

Giving you the strategies my students and I have used to generate multiple 7 figures

DM me "blueprint" and we'll get to work

With me watching over your shoulder calling out trades

Reviewing your trade journal

Giving you the strategies my students and I have used to generate multiple 7 figures

DM me "blueprint" and we'll get to work

• • •

Missing some Tweet in this thread? You can try to

force a refresh