Jeff Bezos, Mark Zuckerberg, and Peter Thiel all sold their stocks

Just before the market erased $2 trillion

Is this the start of something bigger?

A thread 🧵

Just before the market erased $2 trillion

Is this the start of something bigger?

A thread 🧵

2/ We highlighted this in early 2024 showing a big rise in insider selling

Following insider transaction proved helpful once again

Following insider transaction proved helpful once again

https://x.com/GameofTrades_/status/1760001437814436092

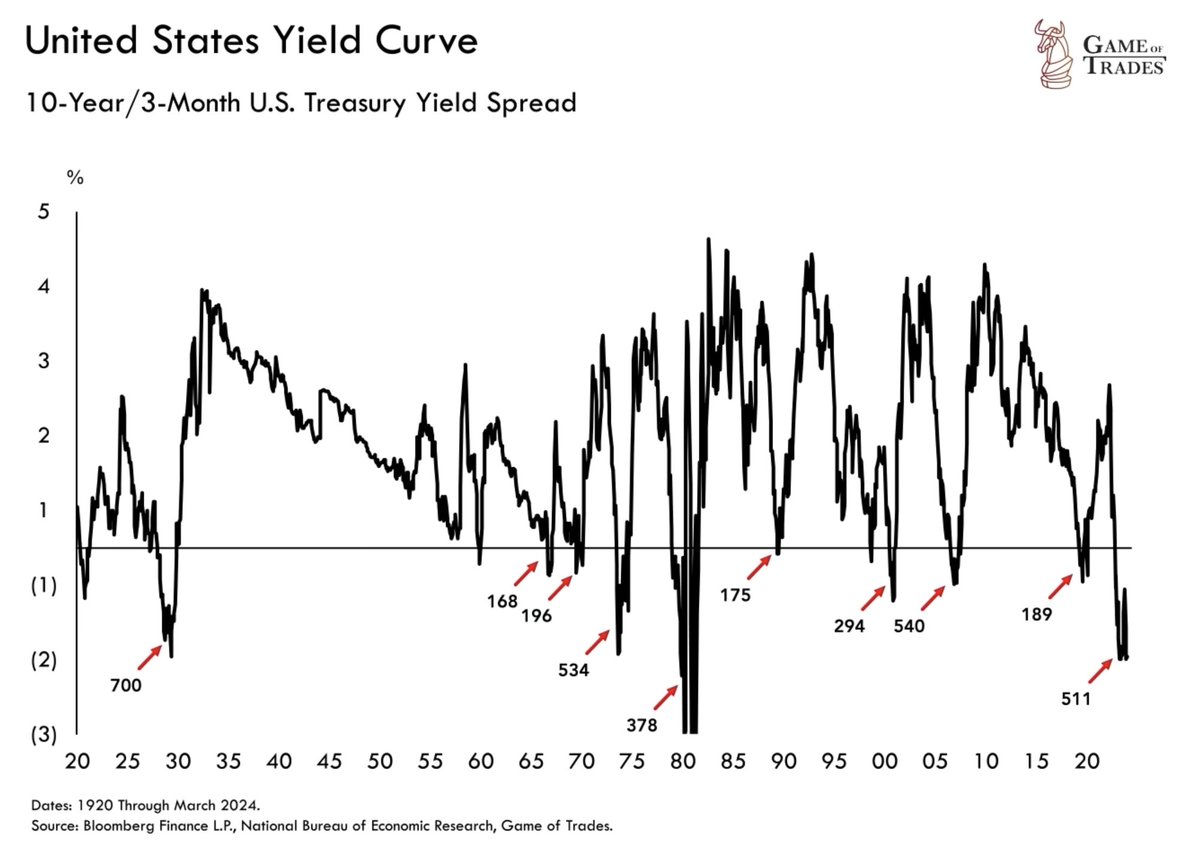

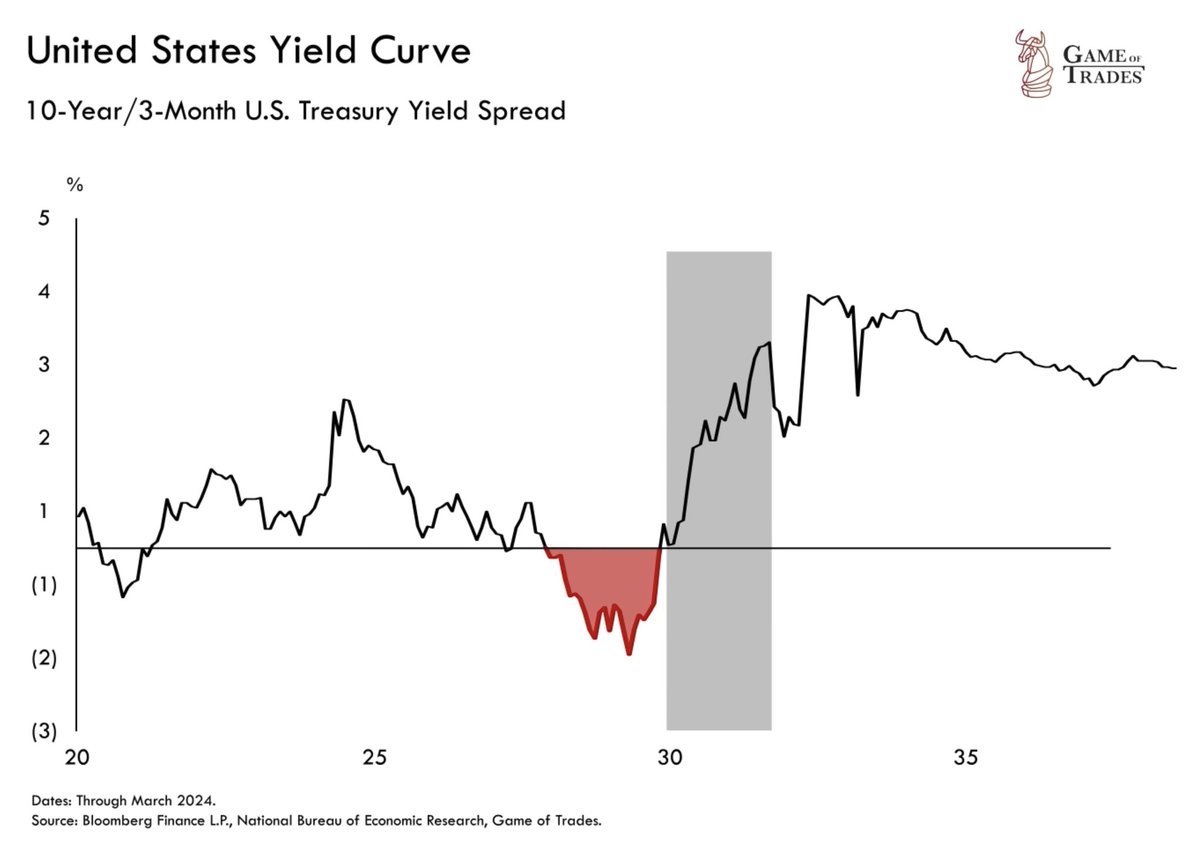

3/ This raises the question:

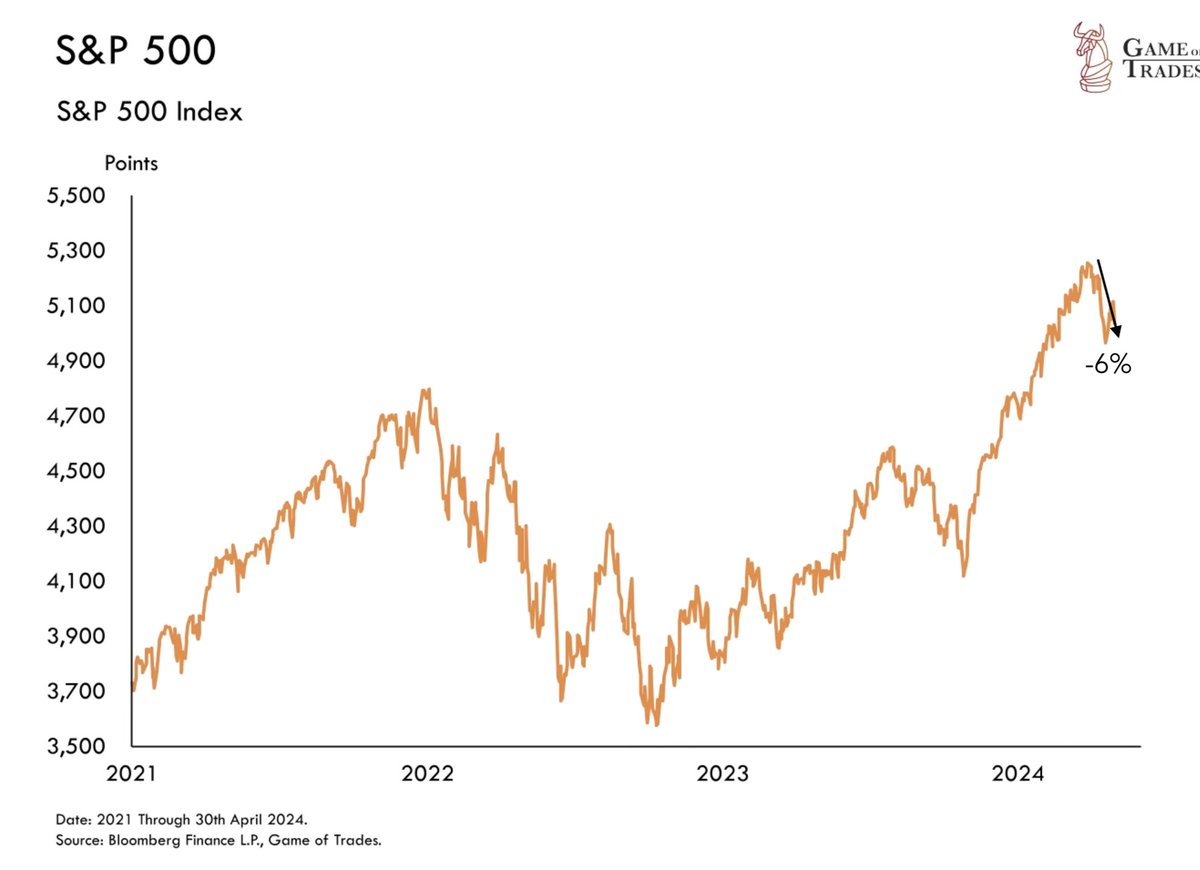

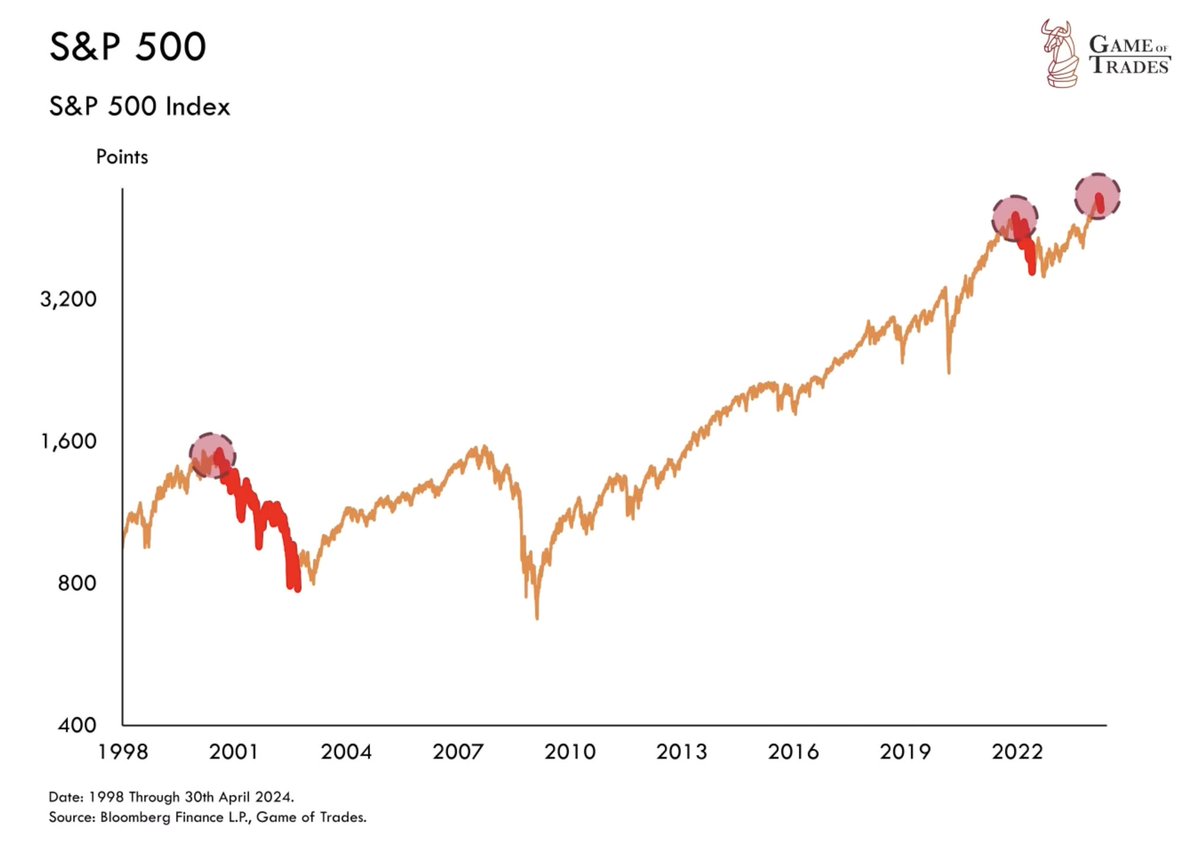

Did they time the top of a small 6% correction or much a larger sell off like in 2021 or 1999?

Did they time the top of a small 6% correction or much a larger sell off like in 2021 or 1999?

4/ Before we address this question, it’s important to note that this correction was predictable

The S&P 500 hadn't touched its 50-day moving average in 154 days

Which is a rare and extended streak, historically signaling an upcoming pullback

The S&P 500 hadn't touched its 50-day moving average in 154 days

Which is a rare and extended streak, historically signaling an upcoming pullback

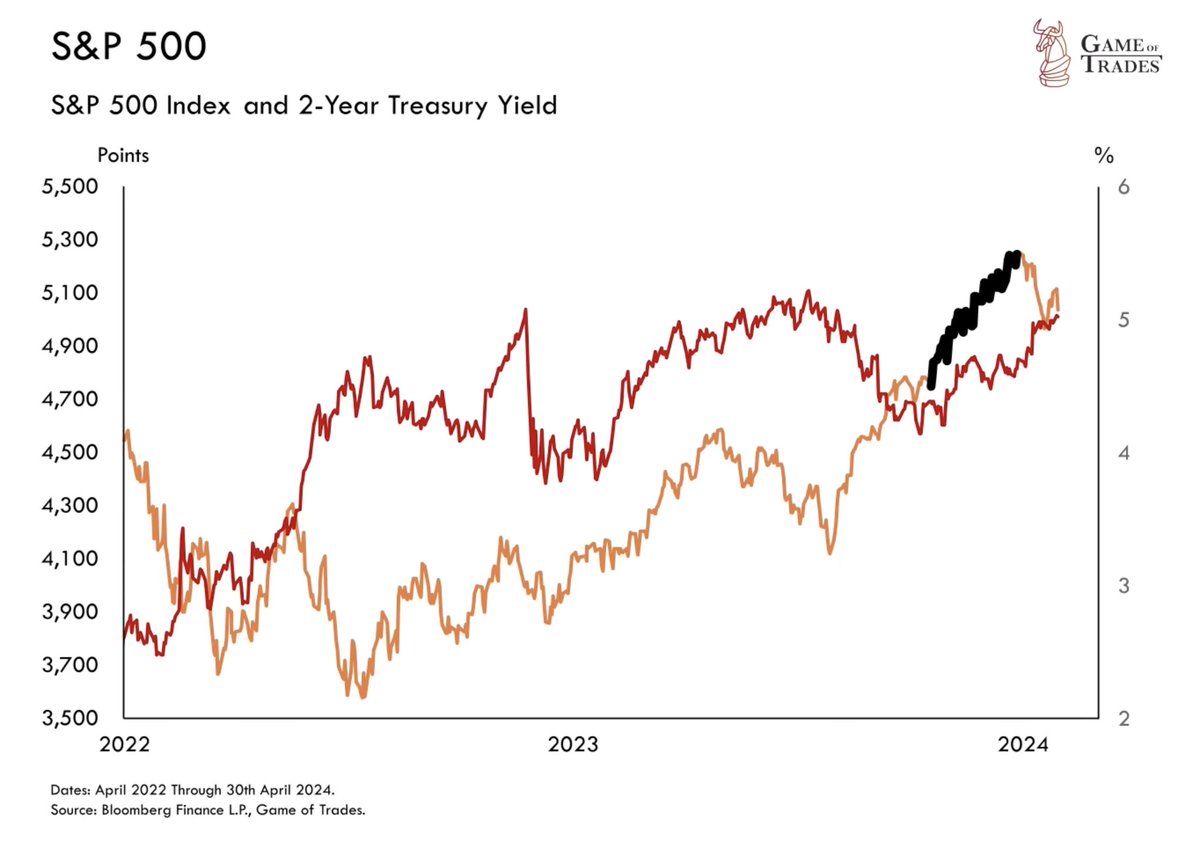

5/ During this period, interest rates were climbing, with the 2-year yield rising from 4% in Jan to 4.7% by March

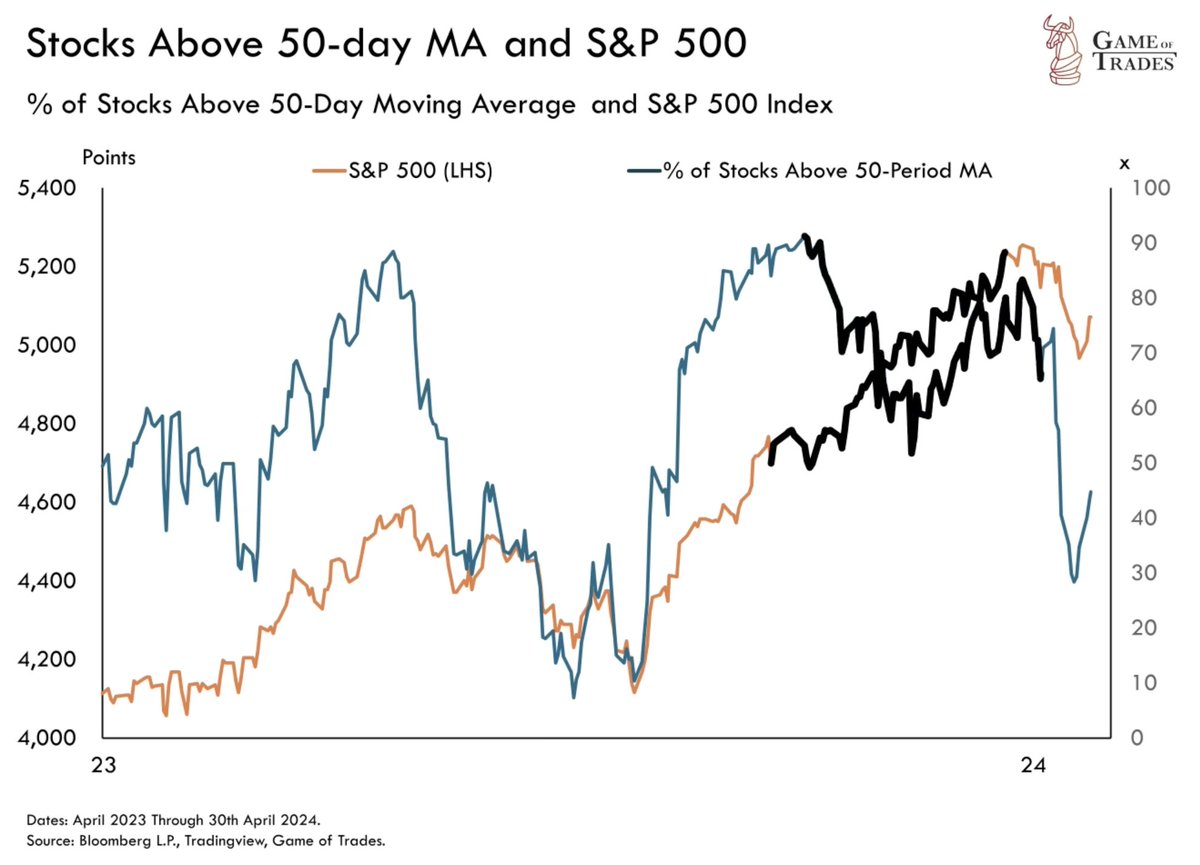

6/ Moreover, market breadth was also sending a warning signal

Late 2023 saw 90% of stocks above their 50-day average

By March 2024, this dropped to 75%

Even as the market rose, fewer stocks participated in the rally

Indicating weakening momentum

Late 2023 saw 90% of stocks above their 50-day average

By March 2024, this dropped to 75%

Even as the market rose, fewer stocks participated in the rally

Indicating weakening momentum

7/ Now, circling back to insider selling, why do insiders sell?

1. Overvaluation

2. Anticipation of weak performance

3. Overly optimistic market expectations

1. Overvaluation

2. Anticipation of weak performance

3. Overly optimistic market expectations

8/ In March 2024, insiders likely saw the 30% surge in the S&P 500 did not match the real world revenue

Many of those stocks are now down 10-15%, with insiders buying back at lower prices

Many of those stocks are now down 10-15%, with insiders buying back at lower prices

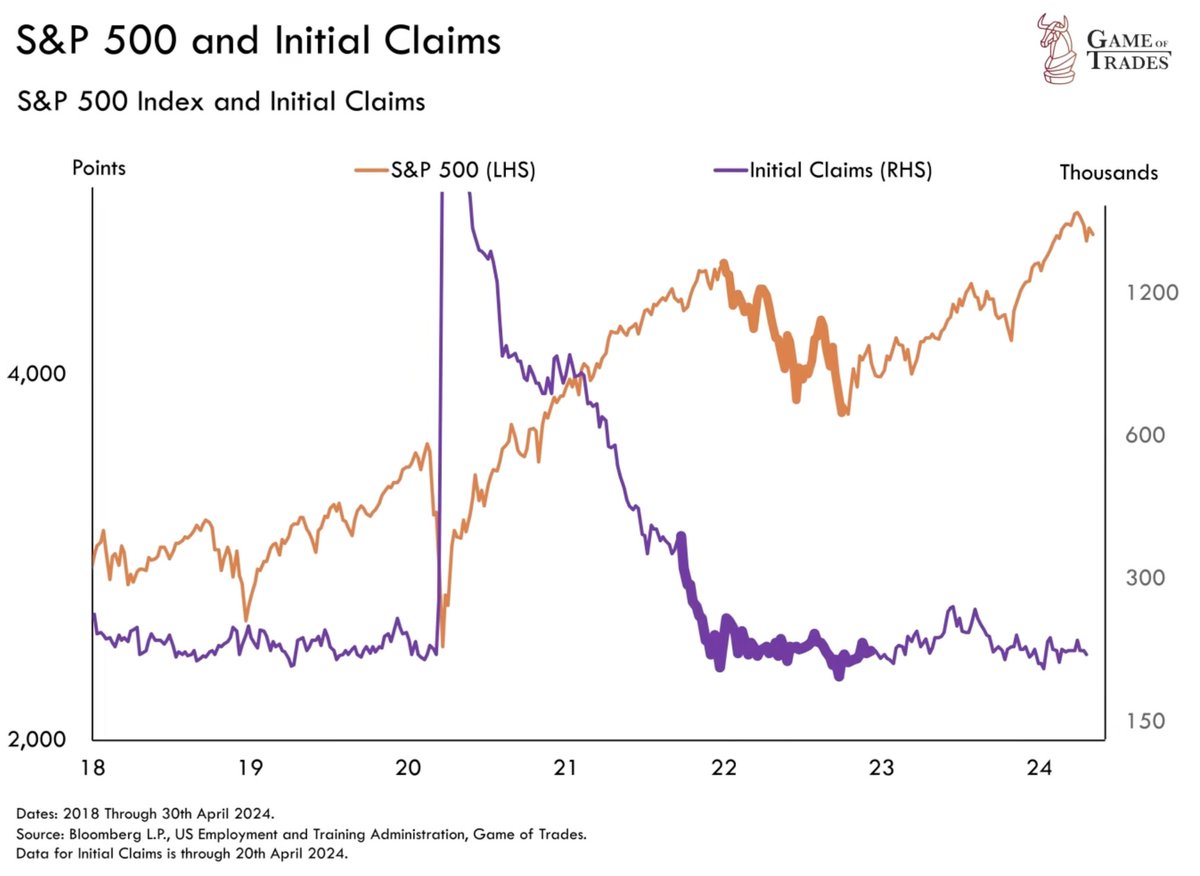

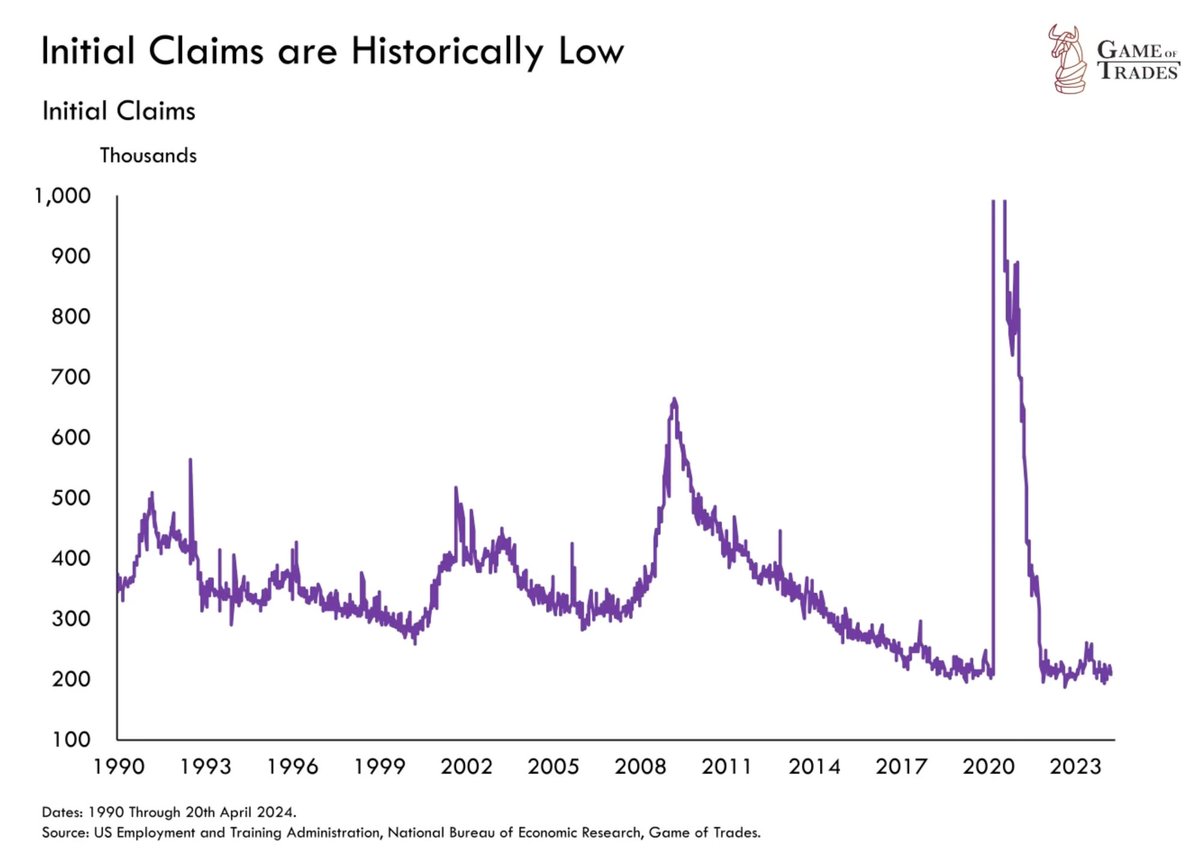

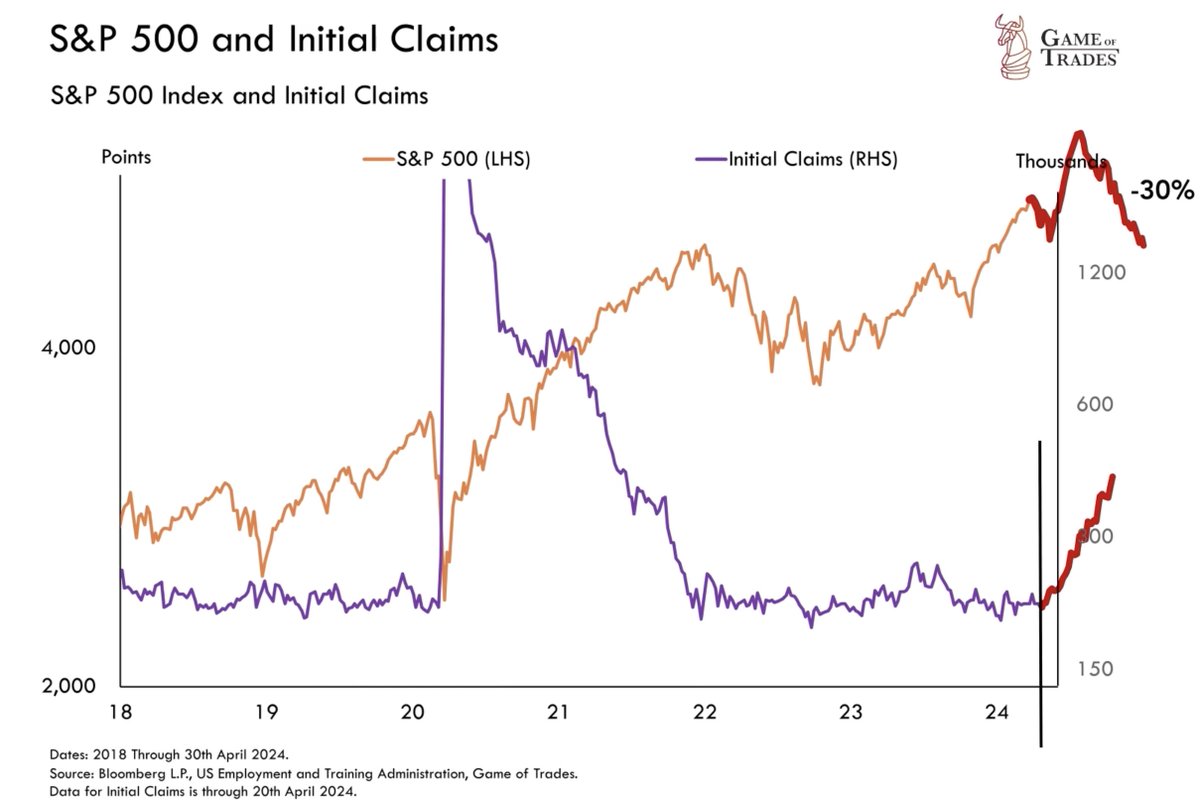

9/ After this pullback, we’ve closed our short on the S&P 500

Part of the reasoning is based on jobless claims

Which continue trending lower

Low unemployment levels typically fuel market growth

Suggesting this correction might be brief with more upside incoming

Part of the reasoning is based on jobless claims

Which continue trending lower

Low unemployment levels typically fuel market growth

Suggesting this correction might be brief with more upside incoming

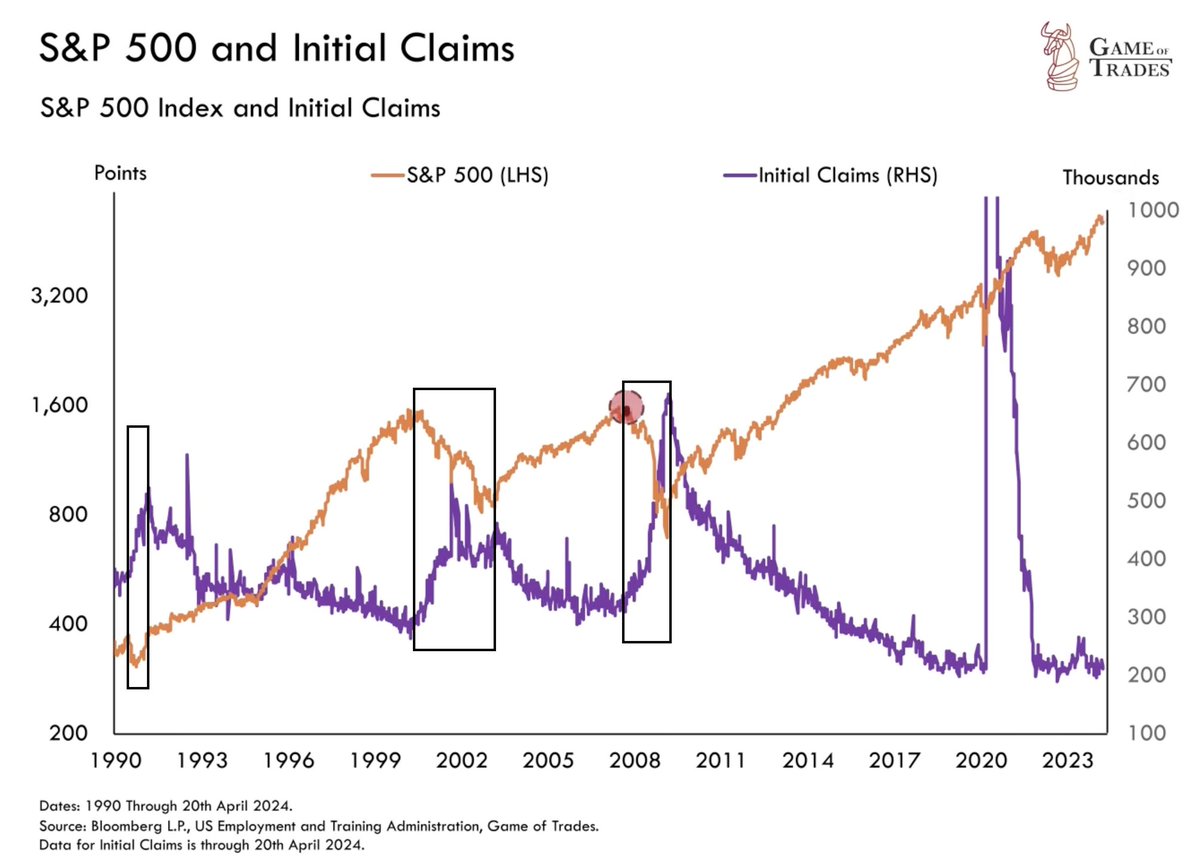

10/ Historical trends show that bear markets often start with rising jobless claims

As seen in 2008, 2000, and 1990

As seen in 2008, 2000, and 1990

12/ With jobless claims still low today, we anticipate the current S&P 500 correction to be shallow

Likely leading to new highs until a significant rise in jobless claims triggers a deeper correction

At which point, we think the markets are likely to decline by at least 30%

Likely leading to new highs until a significant rise in jobless claims triggers a deeper correction

At which point, we think the markets are likely to decline by at least 30%

13/ Today, the S&P 500 shows a very bullish technical structure

It recently retested a key support level after breaking out its rising channel

We're gradually increasing equity exposure, betting that the market holds this support

IF this support gets broken, then all bets are off in the near-term

It recently retested a key support level after breaking out its rising channel

We're gradually increasing equity exposure, betting that the market holds this support

IF this support gets broken, then all bets are off in the near-term

14/ We're watching these technicals very closely at Game of Trades

Get access to our latest Watchlist, Premium Video, and Quant Models with a 7-day free trial at:

gameoftrades.net/?rfsn=7910058.…

Get access to our latest Watchlist, Premium Video, and Quant Models with a 7-day free trial at:

gameoftrades.net/?rfsn=7910058.…

15/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @gameoftrades_ for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @gameoftrades_ for more market insights, finance and investment strategies

https://twitter.com/GameofTrades_/status/1790411626409239014

• • •

Missing some Tweet in this thread? You can try to

force a refresh