Every ICT trader knows the FVG

But few traders know the secrets behind using them correctly

Often overcomplicated, rarely practically taught - here's a full guide on FVGs

[🧵 thread]

But few traders know the secrets behind using them correctly

Often overcomplicated, rarely practically taught - here's a full guide on FVGs

[🧵 thread]

I want to be CLEAR...

Learning FVGs alone will not make you profitable overnight

Only experience and implementing what you learn in a live setting teaches you how to trade

It's not easy

It takes time

Now that we've got that out of the way, let's get started

Learning FVGs alone will not make you profitable overnight

Only experience and implementing what you learn in a live setting teaches you how to trade

It's not easy

It takes time

Now that we've got that out of the way, let's get started

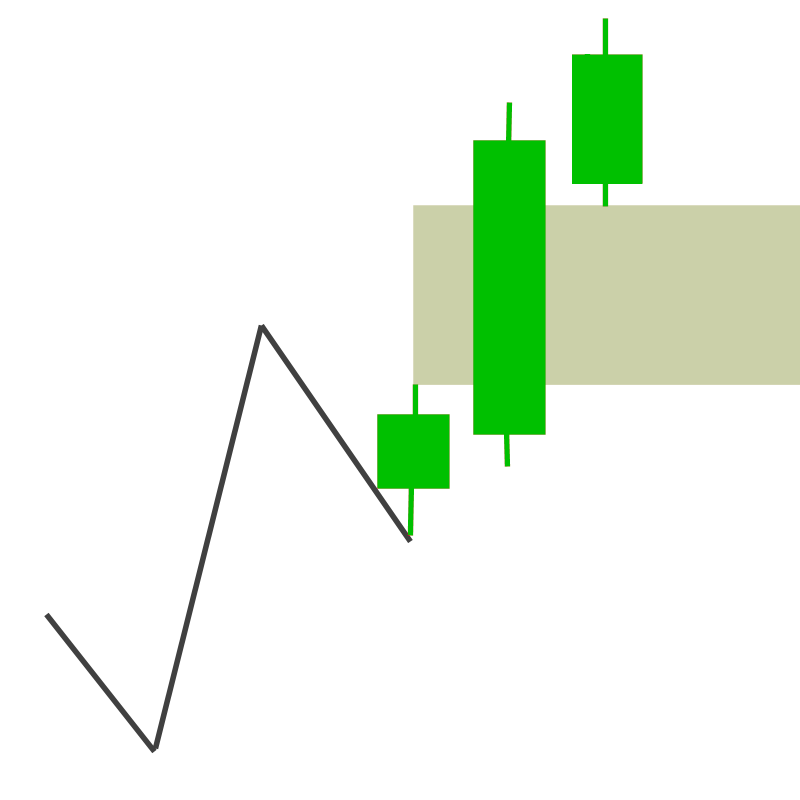

First things first, what is a FVG?

FVG = 3 candle formation with an expansive middle candle

So that's a FVG in the picture right?

Wrong - well not completely

It's a FVG, but a LOW PROBABILITY FVG

Now let's uncover why your FVGs fail

FVG = 3 candle formation with an expansive middle candle

So that's a FVG in the picture right?

Wrong - well not completely

It's a FVG, but a LOW PROBABILITY FVG

Now let's uncover why your FVGs fail

Make sure to follow + bookmark this tweet so you'll have it for later (I'll be going private soon)

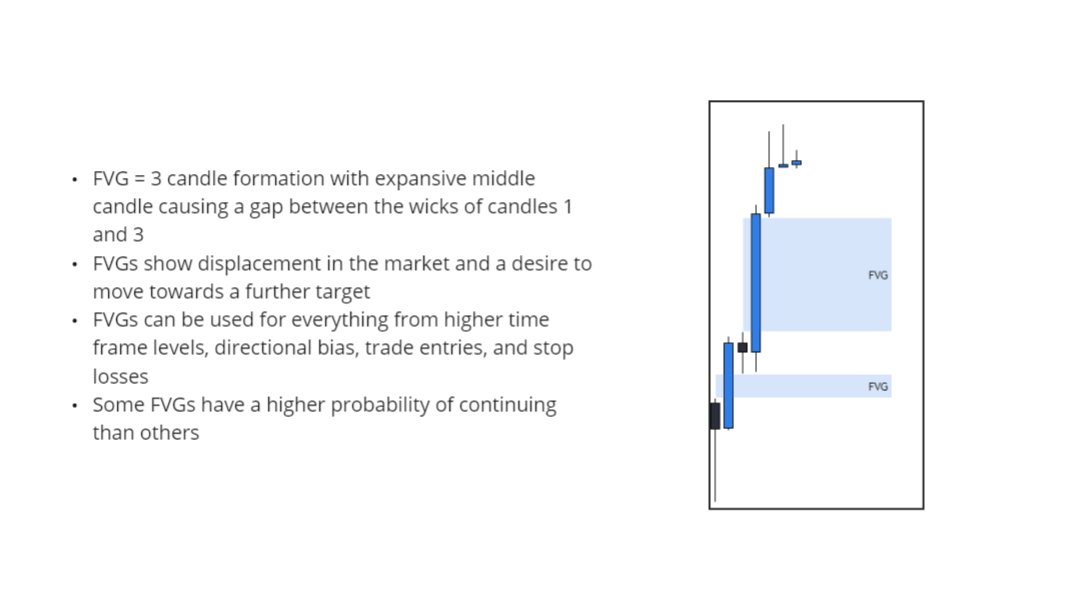

Before I teach you how to stop using the wrong FVGs

You need to understand why they're even important in the first place

FVGs show one thing - Displacement.

Displacement = continuation

Manipulation (lack of displacement) = reversal

How the market reacts to highs/lows tells you everything.

You need to understand why they're even important in the first place

FVGs show one thing - Displacement.

Displacement = continuation

Manipulation (lack of displacement) = reversal

How the market reacts to highs/lows tells you everything.

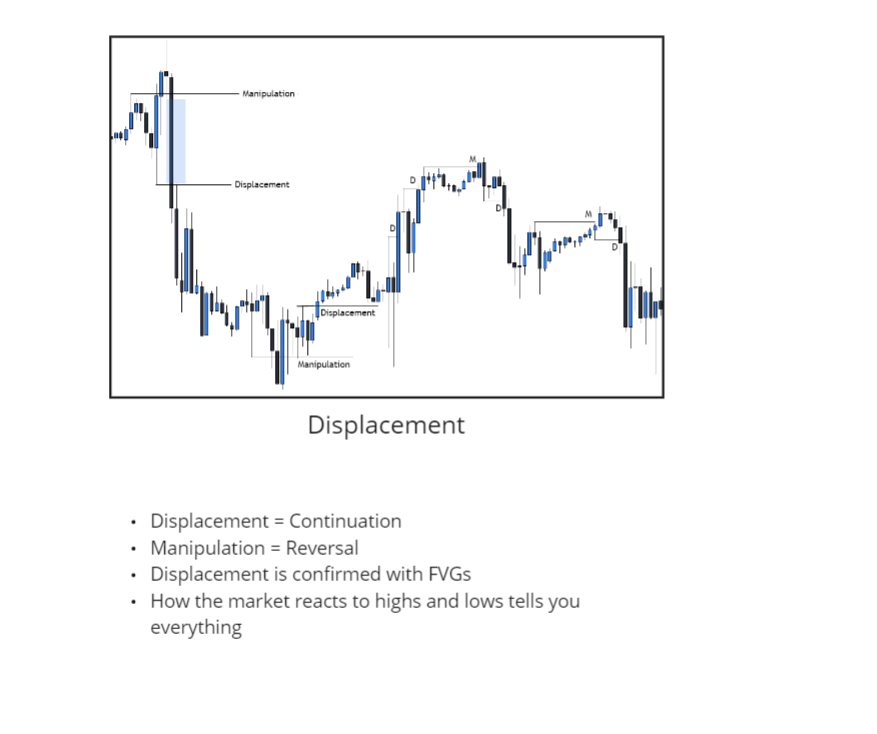

Another reason FVGs are important, is that you can find daily bias using them alone.

The market is always moving to 1 of 2 things:

A high or a low (external range liquidity)

Or a FVG (internal range liquidity)

In each of these moves a market maker model is present

The market is always moving to 1 of 2 things:

A high or a low (external range liquidity)

Or a FVG (internal range liquidity)

In each of these moves a market maker model is present

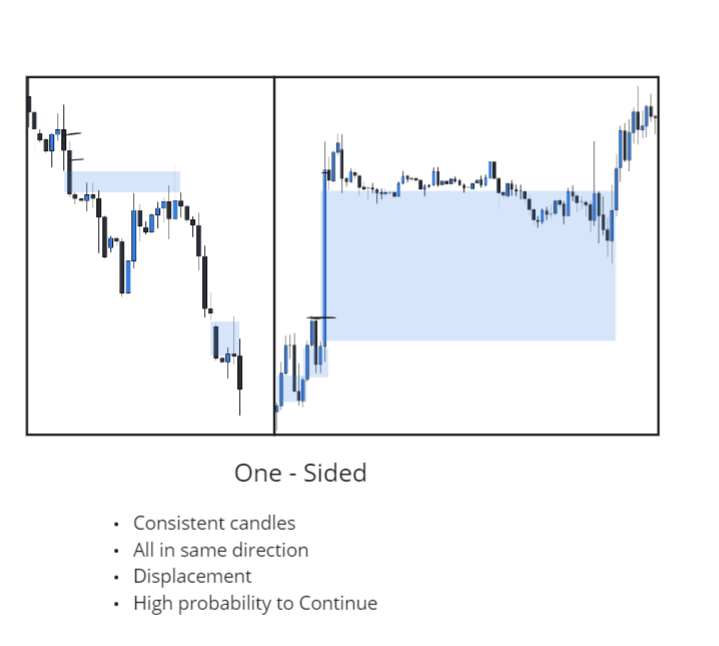

Now - how to select high probability FVGs

Remember, FVGs are valuable because they show displacement

If REAL displacement is occurring, all candles will be moving in the same direction

This is called a one-sided gap, and is likely to give a reaction

Remember, FVGs are valuable because they show displacement

If REAL displacement is occurring, all candles will be moving in the same direction

This is called a one-sided gap, and is likely to give a reaction

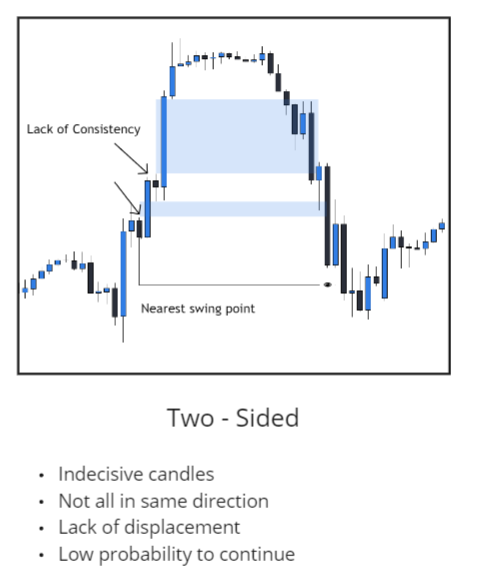

On the other hand, we have two-sided gaps

These gaps LACK displacement, and are likely to fail

See how displacement tells you everything?

Now let's explore another way to stop picking the wrong FVGs

These gaps LACK displacement, and are likely to fail

See how displacement tells you everything?

Now let's explore another way to stop picking the wrong FVGs

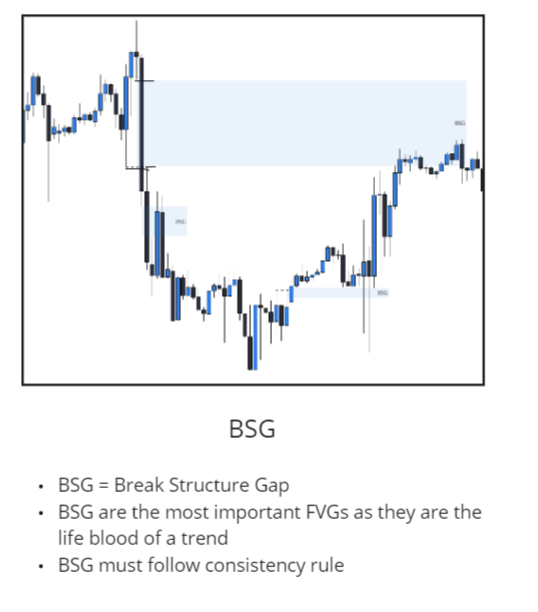

BSG = Break in Structure Gap

Gaps that break through structure, show displacement through structure

These FVGs must follow the consistency rule and be one-sided in order to be the highest probability

Gaps that break through structure, show displacement through structure

These FVGs must follow the consistency rule and be one-sided in order to be the highest probability

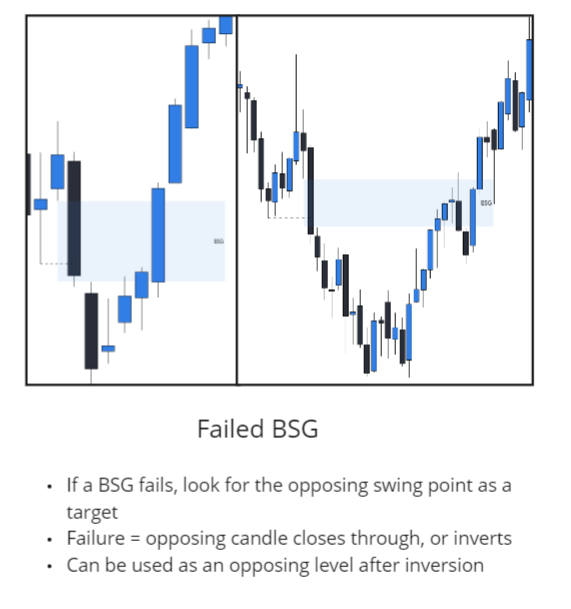

On the contrary, we have failed BSG

This gives an immediate shift in bias, and gives you a draw on liquidity of an opposing high or low

All FVGs beyond the BSG will likely fail

See how displacement and FVG is all you really need?

Let's talk about the last tool we'll use

This gives an immediate shift in bias, and gives you a draw on liquidity of an opposing high or low

All FVGs beyond the BSG will likely fail

See how displacement and FVG is all you really need?

Let's talk about the last tool we'll use

iFVG = Inverted Fair Value Gap

When a FVG is inverted, we can use this as a trade entry or a reason to shift bias

The HIGHEST probability iFVGs occur at FVGs that were already low probability, like failed BSGs or two-sided gaps

Full video on this + free course in tweet below

When a FVG is inverted, we can use this as a trade entry or a reason to shift bias

The HIGHEST probability iFVGs occur at FVGs that were already low probability, like failed BSGs or two-sided gaps

Full video on this + free course in tweet below

Picture this:

You’re sitting in front of your screen

Anxiously watching the chart

All of the education you’ve learned is not as clear as it once was…

And you chop your account to pieces

Build bad habits

And then try the same thing over and over again, wondering why it doesn’t work…

Insanity

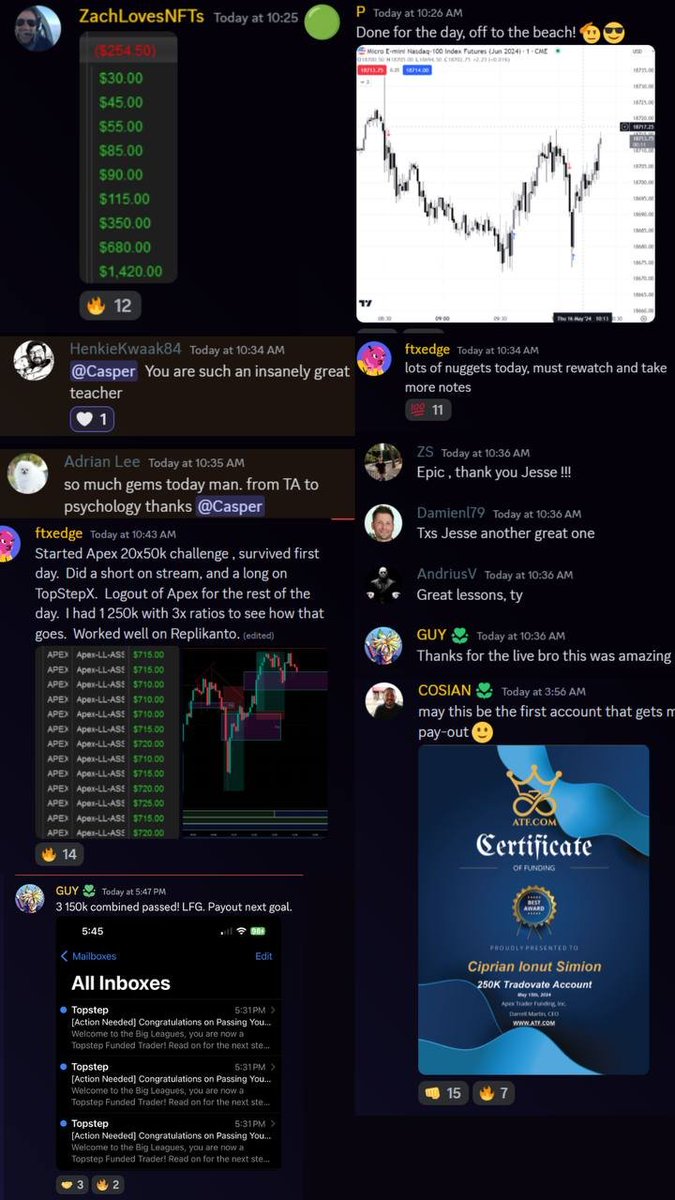

Now imagine you have someone who’s been where you’re at now

And then made it out and became consistent

Trading right in front of you

Guiding you and calling out trades so you stay consistent

Teaching you by DOING…not just videos alone

Then reviewing your trades to make sure you understand

That is education.

2 spots left this week.

DM me "blueprint" to become one of the traders I take under my wing.

You’re sitting in front of your screen

Anxiously watching the chart

All of the education you’ve learned is not as clear as it once was…

And you chop your account to pieces

Build bad habits

And then try the same thing over and over again, wondering why it doesn’t work…

Insanity

Now imagine you have someone who’s been where you’re at now

And then made it out and became consistent

Trading right in front of you

Guiding you and calling out trades so you stay consistent

Teaching you by DOING…not just videos alone

Then reviewing your trades to make sure you understand

That is education.

2 spots left this week.

DM me "blueprint" to become one of the traders I take under my wing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh