Woah.

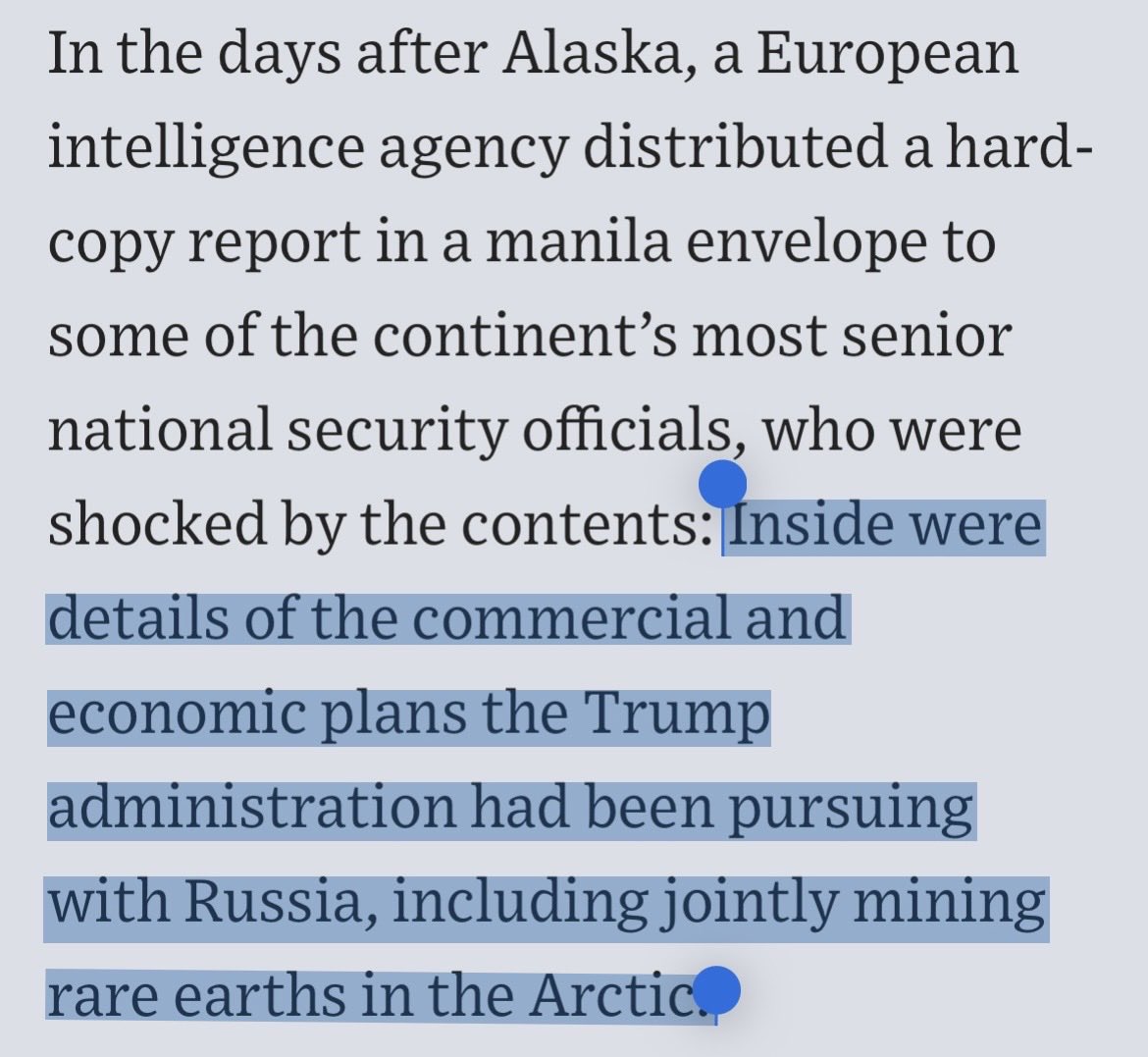

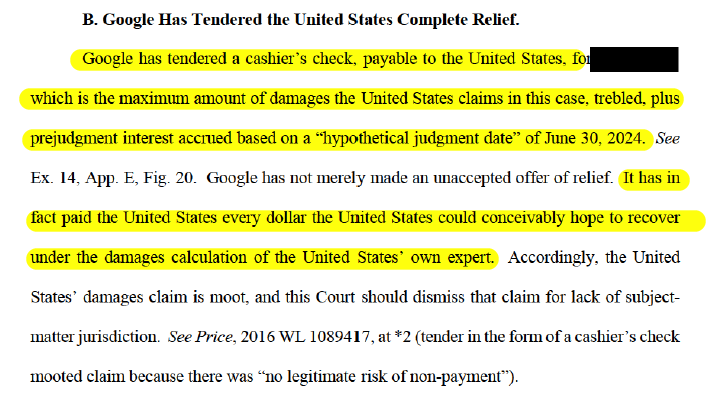

Google is effectively trying to buy out the United States by tendering a cashier's check for the claimed max damages from screwing industry with adtech market power abuses. US DOJ's adtech antitrust trial seeking to break them up is months away. 1/4

Google is effectively trying to buy out the United States by tendering a cashier's check for the claimed max damages from screwing industry with adtech market power abuses. US DOJ's adtech antitrust trial seeking to break them up is months away. 1/4

And then with google's payment, they're trying to get it switched from jury to bench trial. The money is an after thought, what they clearly don't want is a jury of Americans reviewing damning evidence (see Bernanke) which may be harder to appeal leading to structural remedy. 2/4

lol, G. The lawsuit is smart for jury as U.S. explained Google's alleged abuse so Americans understand it by comparing G's market power on all sides to wall street. Hell, Google's own executive made this analogy "if Goldman or Citibank owned the NYSE."

A jury will get this. 3/4

A jury will get this. 3/4

So yeah, good luck with this one, Google. The point of the lawsuit is to break you up. Parallel adtech suits in EDTX and SDNY plus you lost app store suit (to a jury!), a search decision coming late summer and E.U. closing in on adtech, too. Walls closing in. You feel it? 4/4

Here is a link to the motion () they just filed. And then a thread on this lawsuit from when it was originally filed in January, 2023. 5/4 storage.courtlistener.com/recap/gov.usco…

https://x.com/jason_kint/status/1618029720599408643

ha ha, Google dug up a British constitutional law scholar as their expert on why the Seventh Amendment doesn't allow a jury of Americans to decide if Google screwed over the rest of the advertising industry. 6/4 storage.courtlistener.com/recap/gov.usco…

• • •

Missing some Tweet in this thread? You can try to

force a refresh