I lost for years before I mastered daily bias

Most traders NEVER find a consistent way to find bias and ultimately fail

Today I'll teach you a daily bias strategy that anyone can learn

[🧵 thread]

Most traders NEVER find a consistent way to find bias and ultimately fail

Today I'll teach you a daily bias strategy that anyone can learn

[🧵 thread]

Before we get started

You need to understand that daily bias alone will not turn you into a profitable trader

You need bias + a consistent entry strategy to be able to make money

I have multiple threads teaching entry strategies and will be posting more

Now let's get started

You need to understand that daily bias alone will not turn you into a profitable trader

You need bias + a consistent entry strategy to be able to make money

I have multiple threads teaching entry strategies and will be posting more

Now let's get started

So what is "Daily Bias"

Simply put, it's your directional bias for the current day

However, many traders aren't trying to catch the move of the entire day

In fact most of you aren't, specifically if you trade the one-minute chart

So most of you get this wrong before you even start

Simply put, it's your directional bias for the current day

However, many traders aren't trying to catch the move of the entire day

In fact most of you aren't, specifically if you trade the one-minute chart

So most of you get this wrong before you even start

Why does everyone rant over daily bias?

Because it makes trading easy.

Spotting a lower time frame entry model, is EASY.

Knowing which will work, that's the hard part.\

Daily bias solves that for good.

So how do we find daily bias?

Because it makes trading easy.

Spotting a lower time frame entry model, is EASY.

Knowing which will work, that's the hard part.\

Daily bias solves that for good.

So how do we find daily bias?

First off, let's be clear:

BIAS CAN BE FOUND FOR ANY TIME FRAME

You can find bias for the current candle on any time frame

The strategy to do this is ALL the same

Let's break this down into 3 core concepts

1. Liquidity

2. Market Maker Models

3. Alignment

BIAS CAN BE FOUND FOR ANY TIME FRAME

You can find bias for the current candle on any time frame

The strategy to do this is ALL the same

Let's break this down into 3 core concepts

1. Liquidity

2. Market Maker Models

3. Alignment

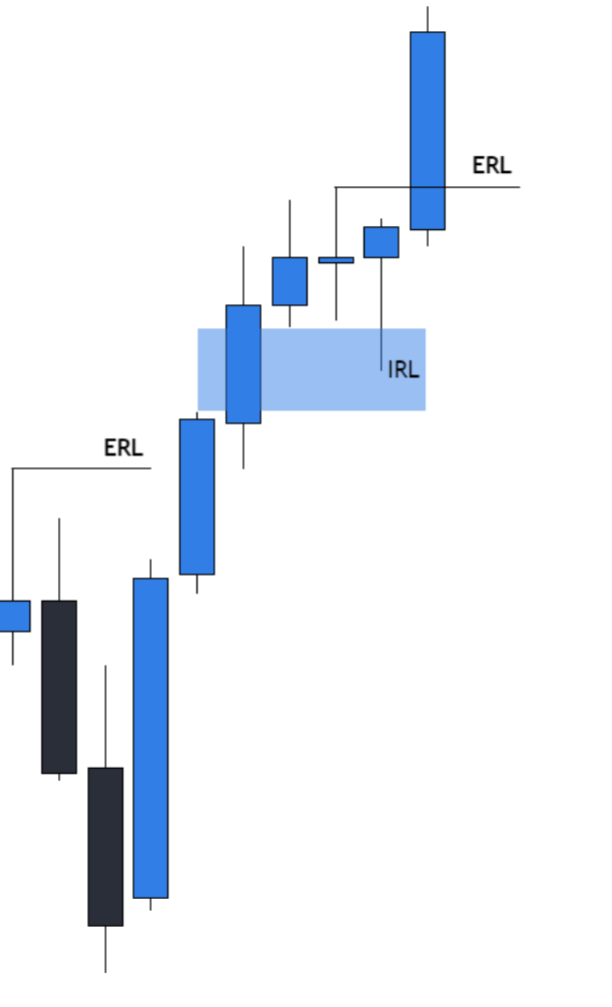

Price is always moving from one area of liquidity to the next

From internal (FVG) to external (highs/lows)

From external (highs/lows) to internal (FVG)

The market is always doing one of these 2 things on your HTF

To confirm this movement, you use LTF market maker models

From internal (FVG) to external (highs/lows)

From external (highs/lows) to internal (FVG)

The market is always doing one of these 2 things on your HTF

To confirm this movement, you use LTF market maker models

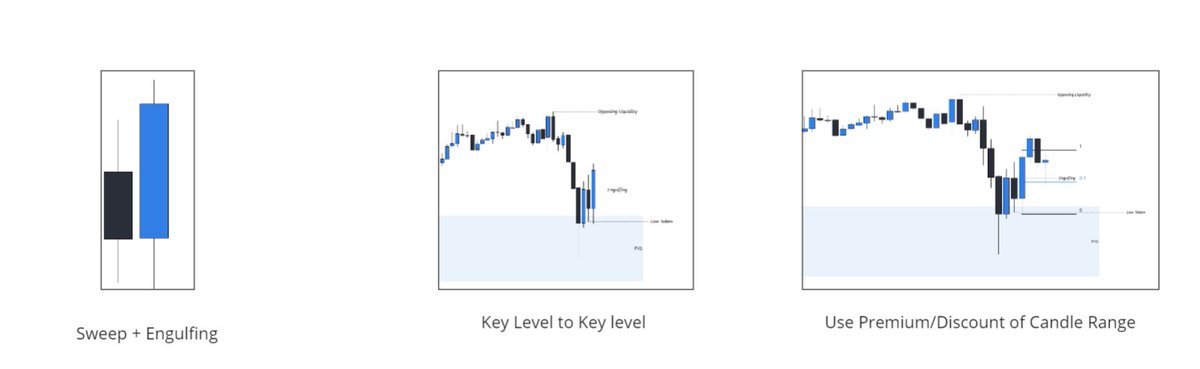

Before I teach you how to trade market maker models, you must understand what they are

Simply put, a market maker model (mmxm) is a strategy to visualize HTF retracements and expansions on a LTF

I could bore you with the algorithmic bullshit, but I'm here to make money - not fantasize about conspiracy theories

Simply put, a market maker model (mmxm) is a strategy to visualize HTF retracements and expansions on a LTF

I could bore you with the algorithmic bullshit, but I'm here to make money - not fantasize about conspiracy theories

Now you may be thinking "ok, but why does this matter"

When you know which way the river is flowing, all you need is a FVG on your lower time frame to get in

You have your draw on liquidity (target) and a clear path to it

That's what trading is all about

Now let's look at some examples

When you know which way the river is flowing, all you need is a FVG on your lower time frame to get in

You have your draw on liquidity (target) and a clear path to it

That's what trading is all about

Now let's look at some examples

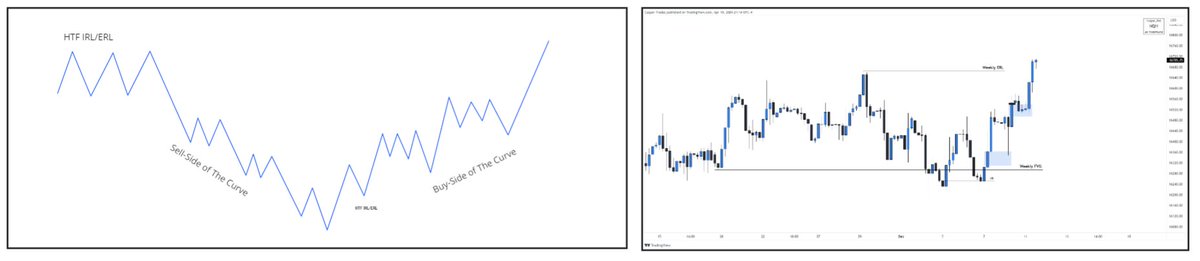

Theory + Price example

When price is moving from internal to external or vice versa on a HTF, scale into the LTF to look for a market maker model

2+ consolidations on the way to IRL/ERL

The first one is your target after the shift

A market structure shift confirms this move

After the shift, any FVG on the right side of the curve can be traded from towards the target

You can even go a step further and go into the LTF again and confirm a new cycle of this same process

So what timeframes to use?

When price is moving from internal to external or vice versa on a HTF, scale into the LTF to look for a market maker model

2+ consolidations on the way to IRL/ERL

The first one is your target after the shift

A market structure shift confirms this move

After the shift, any FVG on the right side of the curve can be traded from towards the target

You can even go a step further and go into the LTF again and confirm a new cycle of this same process

So what timeframes to use?

Alignment is key

The HTF, where you look for IRL > ERL moves, is on the left

The LTF, where you look for market maker models, is on the right

Price is fractal, which is why the term "daily" bias is a misnomer

The HTF, where you look for IRL > ERL moves, is on the left

The LTF, where you look for market maker models, is on the right

Price is fractal, which is why the term "daily" bias is a misnomer

Another strategy you can use for bias is mapping candle by candle

This explanation goes far beyond the ability of a tweet, so I'll leave a video from my YouTube below

This explanation goes far beyond the ability of a tweet, so I'll leave a video from my YouTube below

Full free course:

Make sure to follow me and bookmark these tweets

I'm going private on twitter soon and you'll lose access to this if you don't

Make sure to follow me and bookmark these tweets

I'm going private on twitter soon and you'll lose access to this if you don't

If you want to trade these concepts with me live 3 days per week

With me watching over your shoulder calling out trades

Reviewing your trade journal

Giving you the strategies my students and I have used to generate multiple 7 figures

DM me "blueprint" and we'll get to work

With me watching over your shoulder calling out trades

Reviewing your trade journal

Giving you the strategies my students and I have used to generate multiple 7 figures

DM me "blueprint" and we'll get to work

• • •

Missing some Tweet in this thread? You can try to

force a refresh