1/96) Scaling a blockchain exclusively with L2s is a terrible idea:

Horrible UX due to fragmentation, terrible economics & worse trust trade-offs!

Pushing users into centralization & ultimately into scalable L1 competitors!

That is what makes "L2 scaling" a losing strategy:🧵

Horrible UX due to fragmentation, terrible economics & worse trust trade-offs!

Pushing users into centralization & ultimately into scalable L1 competitors!

That is what makes "L2 scaling" a losing strategy:🧵

2/96) L2 Centralization:

Arbitrum, Optimism, Base, Blast, Mantle, Starknet & ZkSync all have admin keys!

This means they can steal all users' funds right now; this is true for all of the top L2s...

If this is considered safe, then we might as well go back to legacy banking!

Arbitrum, Optimism, Base, Blast, Mantle, Starknet & ZkSync all have admin keys!

This means they can steal all users' funds right now; this is true for all of the top L2s...

If this is considered safe, then we might as well go back to legacy banking!

3/96) "L2 scaling" advocates depend on the claim that these L2s will decentralize one day

In this thread, we explain why that will never happen

As decentralizing requires powerful parties to surrender their power

Historically this rarely happens as it goes against incentives!

In this thread, we explain why that will never happen

As decentralizing requires powerful parties to surrender their power

Historically this rarely happens as it goes against incentives!

4/96) Coinbase's L2; BASE is the perfect example to illustrate this

Coinbase made over $40M of revenue off BASE this year

"Decentralizing" BASE would require Coinbase to entirely give up on that revenue

It is unrealistic to expect the board of a for-profit company to do that!

Coinbase made over $40M of revenue off BASE this year

"Decentralizing" BASE would require Coinbase to entirely give up on that revenue

It is unrealistic to expect the board of a for-profit company to do that!

5/96) Decentralizing BASE means losing the ability to censor

Sometimes exceptional people do the right thing, going against incentives

But on average, especially when looking at large groups of people

We should always bet on incentives, as that far better predicts the masses!

Sometimes exceptional people do the right thing, going against incentives

But on average, especially when looking at large groups of people

We should always bet on incentives, as that far better predicts the masses!

6/96) A centralized sequencer cannot steal user funds, but it can censor & front-run, which is unacceptable

As it defeats the whole point of using crypto!

L2 SC admin keys can steal user funds, as they can change the SCs rules!

All major L2s have admin keys right now...

As it defeats the whole point of using crypto!

L2 SC admin keys can steal user funds, as they can change the SCs rules!

All major L2s have admin keys right now...

7/96) L2 SCs require admin keys for upgrades, even if through a DAO

L2s could burn their admin keys instead, but in the real world, that is rarely the case

This is why L2 sequencers & admin keys end up facing the same challenges as L1s but without an L1s security & scale!

L2s could burn their admin keys instead, but in the real world, that is rarely the case

This is why L2 sequencers & admin keys end up facing the same challenges as L1s but without an L1s security & scale!

8/96) Explaining why L2s do not fully inherit L1 security!

Even after "decentralizing," L2s only get a fraction of L1 security, as it relies on a separate consensus layer:

Ironically, the only way to remove centralized sequencers & admin keys is by adding a consensus mechanism!

Even after "decentralizing," L2s only get a fraction of L1 security, as it relies on a separate consensus layer:

Ironically, the only way to remove centralized sequencers & admin keys is by adding a consensus mechanism!

9/96) Bringing us full circle & ending up in a worse position

As it divides PoS capital between hundreds of L2s instead of combining it all under a single L1

As stake = security

L2s are not solving the problem; only shifting it over to a weaker model instead, making it worse!

As it divides PoS capital between hundreds of L2s instead of combining it all under a single L1

As stake = security

L2s are not solving the problem; only shifting it over to a weaker model instead, making it worse!

10/96) L2s will always have a lower validator set (security) compared to L1

If that were not the case, the L2 might as well become its own L1

This will start happening as the "L2 scaling" narrative destroys the underlying L1!

If L2 lobbies also restrict L1; it is parasitical!

If that were not the case, the L2 might as well become its own L1

This will start happening as the "L2 scaling" narrative destroys the underlying L1!

If L2 lobbies also restrict L1; it is parasitical!

11/96) There is no way around this problem for L2 decentralization

They have to become "blockchains" in their own right! The solution has always been L1 scaling

Off-loading this to L2s avoids the real issue

This is why it makes sense for most L2s to remain centralized forever

They have to become "blockchains" in their own right! The solution has always been L1 scaling

Off-loading this to L2s avoids the real issue

This is why it makes sense for most L2s to remain centralized forever

12/96) L2 Fragmentation:

At the end of the day, L2s are competing with each other & the L1 itself

Forming into competing ecosystems instead of a single ecosystem, unlike L1 scaling

This is because full seamless interoperability between L2s is a social coordination problem

At the end of the day, L2s are competing with each other & the L1 itself

Forming into competing ecosystems instead of a single ecosystem, unlike L1 scaling

This is because full seamless interoperability between L2s is a social coordination problem

13/96) The free market will continue to create a wide diversity of competing L2s

Representing various power blocks who do not always get along

This dynamic is good in most cases, but for blockchain scaling; it only guarantees massive fragmentation!

Destroying UX in the process

Representing various power blocks who do not always get along

This dynamic is good in most cases, but for blockchain scaling; it only guarantees massive fragmentation!

Destroying UX in the process

14/96) As L2s will not all agree on the same interoperability protocols for competitive reasons

"L2 scaling" advocates are failing to account for human nature!

There are good reasons not to make onboarding to direct competitors seamless from an L2s perspective

This breaks UX!

"L2 scaling" advocates are failing to account for human nature!

There are good reasons not to make onboarding to direct competitors seamless from an L2s perspective

This breaks UX!

15/96) Thinking everyone will use the same seamless interoperability protocol

While custodians pack up shop in favor of superior technology... Is a fantasy & does not represent how free markets actually work!

There will always be custodian & centralized L2s in that environment

While custodians pack up shop in favor of superior technology... Is a fantasy & does not represent how free markets actually work!

There will always be custodian & centralized L2s in that environment

16/96) In that environment, a seamless & interoperable UX would also put too many at risk

For example; a decentralized L2 should not be seamlessly interoperable with a centralized L2!

As it would have to inform the user of the change first, as it comes with additional risk!

For example; a decentralized L2 should not be seamlessly interoperable with a centralized L2!

As it would have to inform the user of the change first, as it comes with additional risk!

17/96) Demanding far more steps & understanding from the user is what ruins UX!

This is what makes L2 UX unsolvable!

While the solution stares us in the face; a scalable L1 can provide a single source of truth

When the trust model differs; more user choice is introduced!

This is what makes L2 UX unsolvable!

While the solution stares us in the face; a scalable L1 can provide a single source of truth

When the trust model differs; more user choice is introduced!

18/96) These different rule sets are what break composability

Forcing liquidity to fragment across these different L2 ecosystems

Significantly weakening the value proposition of ETH in the process

As you are now either an Arbitrum, Optimism, or ETH user, they are competing!

Forcing liquidity to fragment across these different L2 ecosystems

Significantly weakening the value proposition of ETH in the process

As you are now either an Arbitrum, Optimism, or ETH user, they are competing!

19/96) We can observe the same effect between L1s

That is why seamless interoperability between all L1s & L2s is impossible

The difference with L1 scaling is that it does not arbitrarily limit how much will fit within a single composable state

As that is anti-competitive!

That is why seamless interoperability between all L1s & L2s is impossible

The difference with L1 scaling is that it does not arbitrarily limit how much will fit within a single composable state

As that is anti-competitive!

20/96) Terrible UX:

As we covered; the UX issues are completely unsolvable in the context of a competitive market due to fragmentation

The best way to demonstrate this is by using a simple real-world example;

Two users exchanging value in an L1 world compared to an L2 world:

As we covered; the UX issues are completely unsolvable in the context of a competitive market due to fragmentation

The best way to demonstrate this is by using a simple real-world example;

Two users exchanging value in an L1 world compared to an L2 world:

21/96) The case of two users exchanging value within an L1 it is simple:

Simply scan a QR or NFC & press send & you are done! As long as you are both using ETH

This was always a good UX, as long as the L1 managed to keep up with demand!

That is how it always should be!

Simply scan a QR or NFC & press send & you are done! As long as you are both using ETH

This was always a good UX, as long as the L1 managed to keep up with demand!

That is how it always should be!

22/96) In the case of L2s this is not as simple

As the user now needs to know what L2 their friend is on & how to bridge between

As we inherently add complexity by layering solutions above what was supposed to be the main solution; the L1!

More clicks, more choices, more risk

As the user now needs to know what L2 their friend is on & how to bridge between

As we inherently add complexity by layering solutions above what was supposed to be the main solution; the L1!

More clicks, more choices, more risk

23/96) To make it even worse

The user now needs to find out whether these specific L2 are even secure or decentralized

Adding difficulty is that L2s are not all compatible with each other

While even displaying different versions of assets based on the L2... Too much to ask!

The user now needs to find out whether these specific L2 are even secure or decentralized

Adding difficulty is that L2s are not all compatible with each other

While even displaying different versions of assets based on the L2... Too much to ask!

24/96) Compare this to simply using a scalable L1!

Whether parallelization, enshrined roll-ups, or execution sharding

Using ETH would just be using ETH without requiring a user to think about extra steps

ETHs roll-up-centric roadmap is a dead end unless the L2s are enshrined!

Whether parallelization, enshrined roll-ups, or execution sharding

Using ETH would just be using ETH without requiring a user to think about extra steps

ETHs roll-up-centric roadmap is a dead end unless the L2s are enshrined!

25/96) As we expect there to always be a wide range of L2s; fragmentation

The free market guarantees competing interests will not coalesce on the same interoperability protocols

Nor should they, as we discussed earlier

This is what leaves cross-L2 UX in an untenable position

The free market guarantees competing interests will not coalesce on the same interoperability protocols

Nor should they, as we discussed earlier

This is what leaves cross-L2 UX in an untenable position

26/96) This inevitably ends up in most users choosing custodians, who can simplify the process for them

This is also what happened to BTC's Lighting Network

As BTC drove people away from L1s empowering features by arbitrarily restricting capacity, pushing them into custodians!

This is also what happened to BTC's Lighting Network

As BTC drove people away from L1s empowering features by arbitrarily restricting capacity, pushing them into custodians!

27/96) A classic case of engineers over estimating user's tolerance for complexity

While also failing to take free market dynamics into account

Because that is why interoperability will never be seamless between all L2s

As it is not a technological problem but a human problem!

While also failing to take free market dynamics into account

Because that is why interoperability will never be seamless between all L2s

As it is not a technological problem but a human problem!

28/96) The same is happening to ETH now, a deep betrayal of the cypherpunk dream

That is why L1 scaling matters, as without it, not even the original vision for Bitcoin can come true

L1 empowers, while L2s disempower users

We cannot expect users to navigate that UX nightmare!

That is why L1 scaling matters, as without it, not even the original vision for Bitcoin can come true

L1 empowers, while L2s disempower users

We cannot expect users to navigate that UX nightmare!

29/96) Shared Sequencing:

ETH core has finally acknowledged the problem of fragmentation with "L2 scaling"!

Proposing "shared sequencing" as a solution

It will not work, as it relies on L2s agreeing to use the same sequencer

A coordination problem only L1 scaling can solve:

ETH core has finally acknowledged the problem of fragmentation with "L2 scaling"!

Proposing "shared sequencing" as a solution

It will not work, as it relies on L2s agreeing to use the same sequencer

A coordination problem only L1 scaling can solve:

30/96) It goes against human nature to cede power & profit to a shared sequencer

Especially when the starting point, as in ETHs case: Includes multi-billion dollar ecosystems such as Optimism & Arbitrum!

Who were built on the promise of "L2 scaling"; adding resistance to change

Especially when the starting point, as in ETHs case: Includes multi-billion dollar ecosystems such as Optimism & Arbitrum!

Who were built on the promise of "L2 scaling"; adding resistance to change

31/96) Even if MEV is mitigated with techniques such as PBS or TX randomization

The ability to censor, monitor & privately order TXs still has sufficient value, real or perceived

That many L2s will choose not to surrender that power to a shared sequencer, making it unsolvable!

The ability to censor, monitor & privately order TXs still has sufficient value, real or perceived

That many L2s will choose not to surrender that power to a shared sequencer, making it unsolvable!

32/96) The problem is that L2s compete with each other ver network effects already

That is why L2s will not want to be fully interoperable with their competitors

As they are building their own "shared sequencers" that compete with each other

Putting us back to square one!

That is why L2s will not want to be fully interoperable with their competitors

As they are building their own "shared sequencers" that compete with each other

Putting us back to square one!

33/96) Ironically, as ETH core pushes for an enshrined L1 sequencer

The L2s are pushing their own "shared sequencers"

Such as Arbitrum's Superchain, Polygon's Agglayer & more

The only way "shared sequencing" works is if we all use the same one, this is what makes it non-viable

The L2s are pushing their own "shared sequencers"

Such as Arbitrum's Superchain, Polygon's Agglayer & more

The only way "shared sequencing" works is if we all use the same one, this is what makes it non-viable

34/96) It is unrealistic to expect these major L2s to abandon their efforts at "solving interoperability"

The same is also true for Eigenlayer & other restaking platforms, as they also fulfill sequencer-like functions

This all makes a true shared sequencer a non-starter!

The same is also true for Eigenlayer & other restaking platforms, as they also fulfill sequencer-like functions

This all makes a true shared sequencer a non-starter!

35/96) These are mostly greed-inspired fantasies

Driven by the thought that if everyone used the same L2 (their L2), it would solve the UX problems!

Technically true, but practically false

I would put that in the same bracket as BTC maximalists thinking there will only be one

Driven by the thought that if everyone used the same L2 (their L2), it would solve the UX problems!

Technically true, but practically false

I would put that in the same bracket as BTC maximalists thinking there will only be one

36/96) That is not how free markets work

As there are plenty of others who believe the same thing about their favorite asset

The idea is also ironic; if it was possible for a single L2 ecosystem to scale for global demand

Then it implies we could have done it on an L1 instead!

As there are plenty of others who believe the same thing about their favorite asset

The idea is also ironic; if it was possible for a single L2 ecosystem to scale for global demand

Then it implies we could have done it on an L1 instead!

37/96) In principle, "shared sequencing" is a step in the right direction

As "Enshrining" more functions as part of the L1 is a move toward "L1 scaling"

Since if ETH deployed enshrined roll-ups, that would be closer to a sharded L1 approach to scaling than an L2 approach!

As "Enshrining" more functions as part of the L1 is a move toward "L1 scaling"

Since if ETH deployed enshrined roll-ups, that would be closer to a sharded L1 approach to scaling than an L2 approach!

38/96) My criticism is that I do not think this coordination problem can be overcome with a shared sequencer alone

Whereas if ETH scaled its L1 either with enshrined roll-ups or sharding

Natural market forces would gravitate toward direct L1 usage, making L2s much less relevant

Whereas if ETH scaled its L1 either with enshrined roll-ups or sharding

Natural market forces would gravitate toward direct L1 usage, making L2s much less relevant

39/96) That is also where the conflict of interest lies

As these two outcomes are diametrically opposed to each other, if the ETH community would rally around this idea, hard

By refusing to use non-enshrined sequencers

Then I admit there is a possibility of this working out

As these two outcomes are diametrically opposed to each other, if the ETH community would rally around this idea, hard

By refusing to use non-enshrined sequencers

Then I admit there is a possibility of this working out

40/96) This would be a case where a small community pivots against incentives in favor of ideology

The odds of this succeeding are not good, in my view

Due to the shear weight of the L2 ecosystem, who have every reason to push counter-narratives

As L2 tokens & equity corrupts!

The odds of this succeeding are not good, in my view

Due to the shear weight of the L2 ecosystem, who have every reason to push counter-narratives

As L2 tokens & equity corrupts!

41/96) Even if ETH succeeds in making a shared sequencer a shelling point for L2s, which I am doubtful off

It still does not solve the problem of there being varied trust trade-offs between L2s

As there will always still be custodian L2s & admin keys, adding friction to the UX

It still does not solve the problem of there being varied trust trade-offs between L2s

As there will always still be custodian L2s & admin keys, adding friction to the UX

42/96) This is why I consider monolithic scaling to be far superior

As all shards/threads remain identical to each other without additional trade-offs

What ETH is attempting to do here is closer to something like DOT or ATOM (modular)

Not NEAR, EGLD & TON (monolithic sharding)

As all shards/threads remain identical to each other without additional trade-offs

What ETH is attempting to do here is closer to something like DOT or ATOM (modular)

Not NEAR, EGLD & TON (monolithic sharding)

43/96) Perverse Incentives/Corruption:

Now we get to the elephant in the room;

There are several orders of magnitude more funding for L2s compared to the L1 in ETH & BTC

Billions are being created around L2 tokens & VC funding, compared to mere millions for L1 development…

Now we get to the elephant in the room;

There are several orders of magnitude more funding for L2s compared to the L1 in ETH & BTC

Billions are being created around L2 tokens & VC funding, compared to mere millions for L1 development…

44/96) This creates clear conflicts of interests, possibly even straight-up corruption!

The incentives are so perverse that it can lead to devs arbitrarily restricting L1 capacity in favor of L2s!

All they would have to do is not pursue or support L1 scaling technologies

The incentives are so perverse that it can lead to devs arbitrarily restricting L1 capacity in favor of L2s!

All they would have to do is not pursue or support L1 scaling technologies

45/96) Describing perfectly what happened in BTC & what is happening in ETH right now

Since BTC also went against its own original vision for Bitcoin by arbitrarily restricting the block size limit in favor of "L2 scaling"

Much how ETH devs refuse to raise the gas limit now

Since BTC also went against its own original vision for Bitcoin by arbitrarily restricting the block size limit in favor of "L2 scaling"

Much how ETH devs refuse to raise the gas limit now

46/96) The incentives are so terribly misaligned in favor of L2 development

That major L2 companies such as Arbitrum have straight up bought out major clients such as Prysm

History is repeating; as this is what happened to BTC through companies like Blockstream & Chaincodelabs!

That major L2 companies such as Arbitrum have straight up bought out major clients such as Prysm

History is repeating; as this is what happened to BTC through companies like Blockstream & Chaincodelabs!

47/96) This is how L2s have become the greatest corrupting force in this industry

As they benefit from not scaling the L1 in the short-term

Turning developers into multi-millionaires through L2 tokens & VCs

Certainly does add a strong bias towards L2 scaling over L1 scaling!

As they benefit from not scaling the L1 in the short-term

Turning developers into multi-millionaires through L2 tokens & VCs

Certainly does add a strong bias towards L2 scaling over L1 scaling!

48/96) All systems with such perverted incentives will trend toward corruption given enough time

Blockchains are no different at scale; as they can still be controlled at the center

History is repeating itself; a real tragedy for humanity, as it means ETH & BTC will not scale

Blockchains are no different at scale; as they can still be controlled at the center

History is repeating itself; a real tragedy for humanity, as it means ETH & BTC will not scale

49/96) It is natural; we should now expect this for any system with this design at scale

The problem is that it causes ETH to take a bad path

That is what makes it a perverse incentive

Developers, influencers & leaders earn more by following an L2 narrative in the short-term

The problem is that it causes ETH to take a bad path

That is what makes it a perverse incentive

Developers, influencers & leaders earn more by following an L2 narrative in the short-term

50/96) While L2s earn far more by supporting a narrative that restricts L1 capacity, in favor of exclusively scaling through L2s

This creates a clear conflict of interest between the long-term success of the L1 (ETH & BTC) & the short-term profit of L2-focused companies

This creates a clear conflict of interest between the long-term success of the L1 (ETH & BTC) & the short-term profit of L2-focused companies

51/96) This is because VCs can rent seek with "L2 scaling" as these are usually for-profit enterprises

Whereas L1 scaling is a public good

There is no way VCs can skim a percentage of the fee over a well-designed L1

However, that is the norm in the L2 world right now...

Whereas L1 scaling is a public good

There is no way VCs can skim a percentage of the fee over a well-designed L1

However, that is the norm in the L2 world right now...

52/96) Scaling the L1 does not benefit these VCs in the short term

Whereas an "L2 scaling" roadmap does, even if that lays the seeds of ETH's self-destruction in the long run

Cui Bono (follow the money)

This is a clear case of misaligned incentives causing deep corruption

Whereas an "L2 scaling" roadmap does, even if that lays the seeds of ETH's self-destruction in the long run

Cui Bono (follow the money)

This is a clear case of misaligned incentives causing deep corruption

53/96) Driven by L2s pouring money into this ecosystem, overshadowing L1 funding

The difference between a few million & tens of billions is why ETH abandoned L1 scaling

This can not be ignored as a systemic explanation for how large chains end up making such terrible decisions

The difference between a few million & tens of billions is why ETH abandoned L1 scaling

This can not be ignored as a systemic explanation for how large chains end up making such terrible decisions

54/96) Economics:

Instead of ETH capturing all of that usage: L2s are earning fees that otherwise would have benefitted the L1!

Only a fraction of fees are paid back to ETH, severely weakening the overall economic design

Compared to L1 scaling, "L2 scaling" economics are weak!

Instead of ETH capturing all of that usage: L2s are earning fees that otherwise would have benefitted the L1!

Only a fraction of fees are paid back to ETH, severely weakening the overall economic design

Compared to L1 scaling, "L2 scaling" economics are weak!

55/96) This is why the ETH burn significantly decreased after the Dencun upgrade

As data availability gives L2s arbitrarily cheap access compared to L1 usage

This is comparable to what happened in BTC with SegWit, as it gave an arbitrary discount to its L2; Lightning Network

As data availability gives L2s arbitrarily cheap access compared to L1 usage

This is comparable to what happened in BTC with SegWit, as it gave an arbitrary discount to its L2; Lightning Network

56/96) BTC & ETH aim to collect fees from a small amount TXs, each paying a high fee

Whereas L1 scaling aims to collect fees from a large amount of TXs; paying a low fee

The L1 scaling approach is superior as low fees provide utility for users, while high fees destroy utility!

Whereas L1 scaling aims to collect fees from a large amount of TXs; paying a low fee

The L1 scaling approach is superior as low fees provide utility for users, while high fees destroy utility!

57/96) Driving away all real usage is so damm uncompetitive compared to low-fee networks

This is assuming BTC & ETH will even be able to sustain high fees in a competitive environment long-term

Something I am skeptical of in the long run as more & more usage moves away

This is assuming BTC & ETH will even be able to sustain high fees in a competitive environment long-term

Something I am skeptical of in the long run as more & more usage moves away

58/96) In BTC's case, it threatens the long-term security as there is no tail inflation to pay for security!

This is not the case in ETH, though it does severely weaken the economics!

As fee burning was meant to be a counterweight to tail inflation, less so with "L2 scaling"

This is not the case in ETH, though it does severely weaken the economics!

As fee burning was meant to be a counterweight to tail inflation, less so with "L2 scaling"

59/96) ETHs low capacity pushes up individual TX fees, leading to a greater burn rate

However, over the long run, scalable chains will host so much more activity that they will far eclipse ETHs current burn rate!

It is silly that I even need to explain this; it is so obvious!

However, over the long run, scalable chains will host so much more activity that they will far eclipse ETHs current burn rate!

It is silly that I even need to explain this; it is so obvious!

60/96) As high-capacity/low-fee blockchains are clearly far superior!

It takes very smart people to justify the position that BTC & ETH are in today

Requiring extreme rationalization of contradicting concepts

Exposing a high degree of tribalism & irrationality in our ecosystem

It takes very smart people to justify the position that BTC & ETH are in today

Requiring extreme rationalization of contradicting concepts

Exposing a high degree of tribalism & irrationality in our ecosystem

61/96) The bottom line is that a modular chain like ETH has no capacity

Forcing usage to move to L2s which take the lion's share of fees

Comparing this to a monolithic chain; which keeps all of the fees for itself

It should be beyond obvous which has stronger economics!

Forcing usage to move to L2s which take the lion's share of fees

Comparing this to a monolithic chain; which keeps all of the fees for itself

It should be beyond obvous which has stronger economics!

62/96) In reality, ETH is setting itself up for failure

By restricting the L1 in favor of L2 scaling; it is allowing the competition to walk all over it

Including L2s, who are also ETH competitors!

In so far as they influence the roadmap, this relationship becomes parasitical!

By restricting the L1 in favor of L2 scaling; it is allowing the competition to walk all over it

Including L2s, who are also ETH competitors!

In so far as they influence the roadmap, this relationship becomes parasitical!

63/96) ZkEVM:

Does allow ETH to scale massively!

The problem is that, according to core devs, this will take at least 5 years!

This means it might never happen, as it is too far out & goes against the current status quo of L2s

Because a zkEVM obsoletes all contemporary L2s!

Does allow ETH to scale massively!

The problem is that, according to core devs, this will take at least 5 years!

This means it might never happen, as it is too far out & goes against the current status quo of L2s

Because a zkEVM obsoletes all contemporary L2s!

64/96) Since if the L1 can scale with a zkEVM, there would be no point to Arbitrum & Optimism!

Enshrined roll-ups do not require admin keys, tokens, sequencers, or mega-corporations

Devs often fail to account for politics; L2s as a stopgap solution prevent the final solution!

Enshrined roll-ups do not require admin keys, tokens, sequencers, or mega-corporations

Devs often fail to account for politics; L2s as a stopgap solution prevent the final solution!

65/96) I cannot take such timelines seriously, especially coming from software engineers

In my experience, a five-year-plus timeline is the equivalent of saying they do not have a clue!

In the meantime, L2s continue to gain power & influence as they will push against this!

In my experience, a five-year-plus timeline is the equivalent of saying they do not have a clue!

In the meantime, L2s continue to gain power & influence as they will push against this!

66/96) I am not against the zkEVM; it definitely has some compelling attributes

It is essentially a form of sharding, as multiple enshrined roll-ups can shard the state into multiple EVMs

Which can be seamlessly interoperable with each other, as it is all part of the L1 now

It is essentially a form of sharding, as multiple enshrined roll-ups can shard the state into multiple EVMs

Which can be seamlessly interoperable with each other, as it is all part of the L1 now

67/96) Combine this with the magic of zero-knowledge proofs & you can run this on your smartwatch!

It does come with the trade-off of potentially losing historical state, though that also makes it more private

The zkEVM makes perfect sense as a form of monolithic (L1) scaling

It does come with the trade-off of potentially losing historical state, though that also makes it more private

The zkEVM makes perfect sense as a form of monolithic (L1) scaling

68/96) Relying on "L2 scaling" in the meantime is ETHs Achilles heel

We only have to scale to meet L1 demand to remain competitive

Implementing a basic form of sharding in the meantime would make a massive difference & stop L2 entrenchment!

Perfection is the enemy of good

We only have to scale to meet L1 demand to remain competitive

Implementing a basic form of sharding in the meantime would make a massive difference & stop L2 entrenchment!

Perfection is the enemy of good

69/96) ZERO on-chain scaling:

ETH is still stuck at a meager capacity of 100 TPS!

Core devs could easily raise the limit within a month

Instead, they removed "increase L1 gas limit" from the roadmap

Saying it can be raised "at any time"; this is false, deceptive & misleading:

ETH is still stuck at a meager capacity of 100 TPS!

Core devs could easily raise the limit within a month

Instead, they removed "increase L1 gas limit" from the roadmap

Saying it can be raised "at any time"; this is false, deceptive & misleading:

70/96) The ETH core devs are choosing not to raise the limit

All while claiming it is not up to them…

A false abdication of responsibility as they conveniently shift the blame to the validators

The truth is that the politics & dynamics of ETHs gas limit are far more complex:

All while claiming it is not up to them…

A false abdication of responsibility as they conveniently shift the blame to the validators

The truth is that the politics & dynamics of ETHs gas limit are far more complex:

71/96) They are using decentralization as a shield!

To cover up their own centralized control of ETH governance;

The gas limit is a perfect example of this

As the limit can be changed by validators within pre-defined increments

However, this has a high coordination threshold

To cover up their own centralized control of ETH governance;

The gas limit is a perfect example of this

As the limit can be changed by validators within pre-defined increments

However, this has a high coordination threshold

72/96) As this requires a majority of validators to continuously vote on higher limits

We have to question how realistic this really is: Especially when most core devs are against on-chain governance & many oppose increasing limits

That creates a lot of friction against change

We have to question how realistic this really is: Especially when most core devs are against on-chain governance & many oppose increasing limits

That creates a lot of friction against change

73/96) As coordinating validators to increase gas limits is very difficult without dev support

Especially considering the prominence of "L2 scaling" narratives that oppose L1 scaling entirely

Without input from the core devs, we cannot expect the gas limit to ever be changed!

Especially considering the prominence of "L2 scaling" narratives that oppose L1 scaling entirely

Without input from the core devs, we cannot expect the gas limit to ever be changed!

74/96) Especially when the gas limit has not been raised for 3+ years!

It is clearly not working ever since EIP-1559 introduced this new gas-limiting mechanism

Combine that with the fact that core devs can raise gas limits overnight!

It starts to look like wilful ignorance

It is clearly not working ever since EIP-1559 introduced this new gas-limiting mechanism

Combine that with the fact that core devs can raise gas limits overnight!

It starts to look like wilful ignorance

75/96) BTC is even worse, where the blocksize limit is determined by the "reference client"

Basically, the Core developers act as gatekeepers to all change

While being able to push controversial code changes themselves

Far from the decentralized dream, people are being sold

Basically, the Core developers act as gatekeepers to all change

While being able to push controversial code changes themselves

Far from the decentralized dream, people are being sold

76/96) False dichotomy:

Modular scaling advocates believe that the L1 cannot scale while preserving decentralization

This is the key false assumption that this entire house of cards is built upon

The truth is that the blockchain scaling trilemma has been solved!

Modular scaling advocates believe that the L1 cannot scale while preserving decentralization

This is the key false assumption that this entire house of cards is built upon

The truth is that the blockchain scaling trilemma has been solved!

77/96) When Vitalik first invented the scaling trilemma, he said it only applied to "conventional" blockchain designs

That is why ETH pursued sharding for years, as they aimed to solve it

Unfortunately, somewhere along the way, they gave up, opting for "L2 scaling" instead

That is why ETH pursued sharding for years, as they aimed to solve it

Unfortunately, somewhere along the way, they gave up, opting for "L2 scaling" instead

78/96) However, here comes the twist;

In the meantime, blockchains such as NEAR, EGLD, XTZ, TON & more have proven that execution sharding is possible!

Some of these chains are capable of exceeding 100k TPS, all while keeping node requirements low

Sharding splits the workload!

In the meantime, blockchains such as NEAR, EGLD, XTZ, TON & more have proven that execution sharding is possible!

Some of these chains are capable of exceeding 100k TPS, all while keeping node requirements low

Sharding splits the workload!

79/96) This means we can scale on-chain without sacrificing decentralization

Or pushing the majority of users onto custodian & possibly even insecure solutions

That has become an unnecessary compromise, so why make it?

This is why SOL is eating ETHs lunch now, as it does scale

Or pushing the majority of users onto custodian & possibly even insecure solutions

That has become an unnecessary compromise, so why make it?

This is why SOL is eating ETHs lunch now, as it does scale

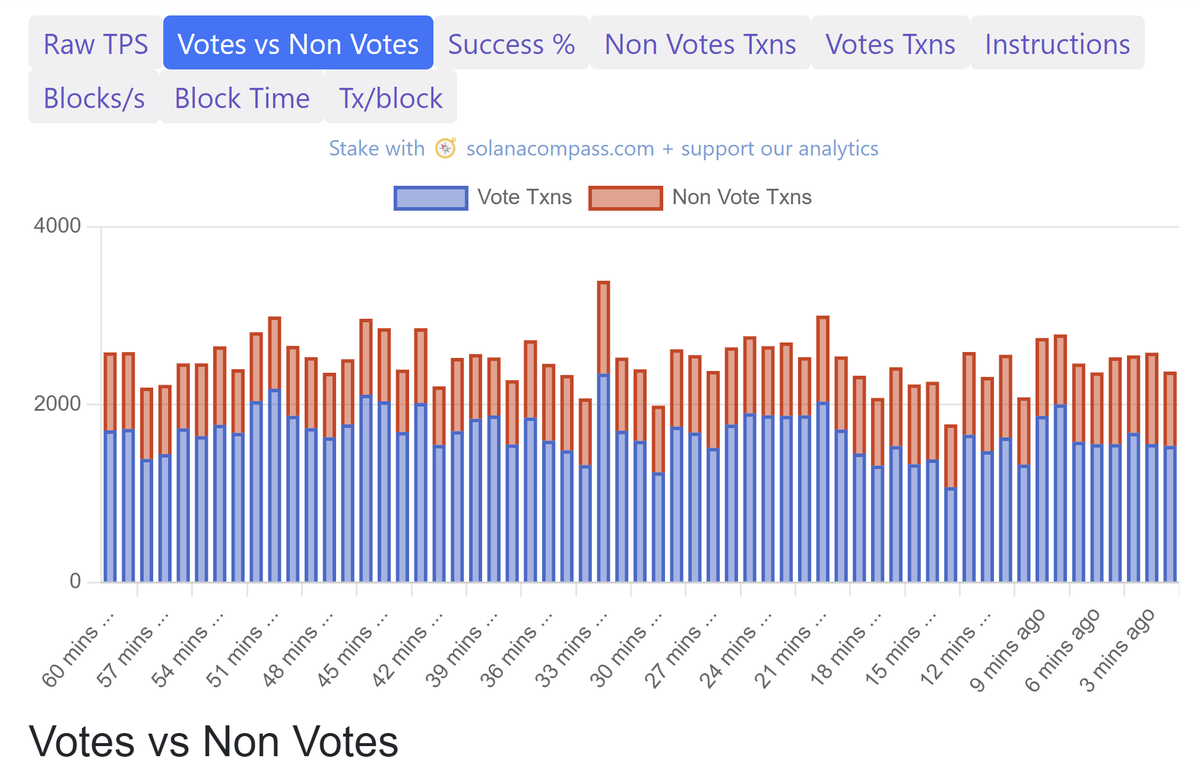

80/96) We now see that many chains fully utilizing parallelization, like SOL, are overtaking ETH in key metrics

Explaining how SOL does more TPS than ETH & all of the L2s combined now!

As SOL has become the anti-ETH vote, for better or worse, ETH is feeling the consequences now

Explaining how SOL does more TPS than ETH & all of the L2s combined now!

As SOL has become the anti-ETH vote, for better or worse, ETH is feeling the consequences now

81/96) Enshrined roll-ups, such as those in XTZ, are also a fine L1 monolithic scalability solution

As you do not have to wait & have faith in ETH devs for 5+ years, enshrined rollups are a reality today!

These are only some of my favorite scalability solutions; there is more!

As you do not have to wait & have faith in ETH devs for 5+ years, enshrined rollups are a reality today!

These are only some of my favorite scalability solutions; there is more!

82/96) Therefore, the argument that "L2 scaling" is the "only way" is a strawman

An "L2 scaling" roadmap can only be justified in a world where L1 scaling is impossible while preserving decentralization

This is the deception "L2 scaling" is built upon, explaining the denial!

An "L2 scaling" roadmap can only be justified in a world where L1 scaling is impossible while preserving decentralization

This is the deception "L2 scaling" is built upon, explaining the denial!

83/96) Solution; Governance:

The obvious solution is to scale both BTC & ETH on-chain, using some of the technologies I already covered earlier

However, the deeper problem here is governance; that is what prevents such positive change from occurring

There lies the challenge!

The obvious solution is to scale both BTC & ETH on-chain, using some of the technologies I already covered earlier

However, the deeper problem here is governance; that is what prevents such positive change from occurring

There lies the challenge!

84/96) What is needed is an L1-biased funding instead of rent-seeking L2-biased funding

This can be achieved by taking part of the block reward & dedicating it to a treasury

Through on-chain governance, stakeholders would vote for proposals that allocate funds for development

This can be achieved by taking part of the block reward & dedicating it to a treasury

Through on-chain governance, stakeholders would vote for proposals that allocate funds for development

85/96) Thereby providing an indefinite source of L1-biased funding

This is not a new idea, having been pioneered by cryptocurrencies such as DASH, DCR & XTZ

Running live for years before the experiments in DAOs occurred in ETH

The mixed results; are due to a lack of scale

This is not a new idea, having been pioneered by cryptocurrencies such as DASH, DCR & XTZ

Running live for years before the experiments in DAOs occurred in ETH

The mixed results; are due to a lack of scale

86/96) However, even with all the flaws of on-chain governance; there is no better alternative

In that sense, it is like a democracy

Flawed, inefficient, corruptible & susceptible to mob rule

Yet still, it is the best form of government we have, just like on-chain governance!

In that sense, it is like a democracy

Flawed, inefficient, corruptible & susceptible to mob rule

Yet still, it is the best form of government we have, just like on-chain governance!

87/96) Especially when you contrast this to "off-chain governance"

The status quo in both BTC & ETH

Were decision-making is effectively highly centralized & capturable

GitHub governance is a wholly inadequate form of governance for a blockchain!

Whether by naivety or malice

The status quo in both BTC & ETH

Were decision-making is effectively highly centralized & capturable

GitHub governance is a wholly inadequate form of governance for a blockchain!

Whether by naivety or malice

88/96) Such centralized governance is vulnerable to capture & corruption

As it Lacks all basic checks & balances

Flying in the face of thousands of years of political philosophy & history

Off-chain governance is just old-school politics without any democratic protections!

As it Lacks all basic checks & balances

Flying in the face of thousands of years of political philosophy & history

Off-chain governance is just old-school politics without any democratic protections!

89/96) We should, therefore, not be surprised when that results in dysfunction

A shame, as blockchains hold the potential to solve these age-old political problems

On-chain stakeholder voting provides stronger positive incentives & transparency

Off-chain governance is worse!

A shame, as blockchains hold the potential to solve these age-old political problems

On-chain stakeholder voting provides stronger positive incentives & transparency

Off-chain governance is worse!

90/96) To ETHs credit; there are multiple clients

This improves the situation considerably compared to most chains without client diversity (like BTC)

However, it is not enough but does provide the hope & possibility of change

It has to come from the community, not status quo

This improves the situation considerably compared to most chains without client diversity (like BTC)

However, it is not enough but does provide the hope & possibility of change

It has to come from the community, not status quo

91/96) Centralization in cryptocurrency is a perversion, a corruption of the ethos

While acknowledging a reasonable spectrum, ETH is taking it too far

Salvation lies in L1 scaling & on-chain governance; BTC & ETH are nowhere near pivoting

But it is still worth fighting for

While acknowledging a reasonable spectrum, ETH is taking it too far

Salvation lies in L1 scaling & on-chain governance; BTC & ETH are nowhere near pivoting

But it is still worth fighting for

92/96) Conclusion:

I am not against L2 solutions; they do have their own niche use case

However, I disagree with arbitrarily restricting L1 capacity in favor of L2 scaling

Allow both to scale within the bounds of decentralization & let the market decide which is better!

I am not against L2 solutions; they do have their own niche use case

However, I disagree with arbitrarily restricting L1 capacity in favor of L2 scaling

Allow both to scale within the bounds of decentralization & let the market decide which is better!

93/96) Scaling the base layer allows both L1 & L2 scaling to occur

Favoring L2 scaling by restricting the L1 removes the option for users to choose L1

The goal of this restriction is to "force" users onto L2s

In reality, this will lead to users moving to scalable L1s instead!

Favoring L2 scaling by restricting the L1 removes the option for users to choose L1

The goal of this restriction is to "force" users onto L2s

In reality, this will lead to users moving to scalable L1s instead!

94/96) I was a Bitcoin supporter from 2013 to 2016

I even supported ETH from the first day of launch, mining it with several rigs in 2015

It makes me incredibly sad to see history repeating itself in this way

ETH is a huge improvement over BTC, but it too can be superseded

I even supported ETH from the first day of launch, mining it with several rigs in 2015

It makes me incredibly sad to see history repeating itself in this way

ETH is a huge improvement over BTC, but it too can be superseded

95/96) I do still have hope that ETH can pivot back to its original roadmap of execution sharding

Or pursue enshrined roll-ups instead

However, that would cause billions worth of L2 tokens & VC investments to be wiped out

Whether ETH leadership would do that remains to be seen

Or pursue enshrined roll-ups instead

However, that would cause billions worth of L2 tokens & VC investments to be wiped out

Whether ETH leadership would do that remains to be seen

96/96) I believe in the utility/value cryptocurrency can offer

So this critique comes from a deep place of optimism; as we can solve the scaling trilemma!

I hope the ETH & BTC communities take this as constructive criticism

So that we can build a truly better future together!

So this critique comes from a deep place of optimism; as we can solve the scaling trilemma!

I hope the ETH & BTC communities take this as constructive criticism

So that we can build a truly better future together!

• • •

Missing some Tweet in this thread? You can try to

force a refresh